EV Platform Market by EV Type (BEV, PHEV), Electric Passenger Car (Hatchback, Sedan, Utility Vehicles), Electric CV (Bus, Truck, Van/Pick-up Truck), Component (Suspension, Steering, Motor, Brake, Chassis, ECU, Battery) and Region - Global Forecast to 2030

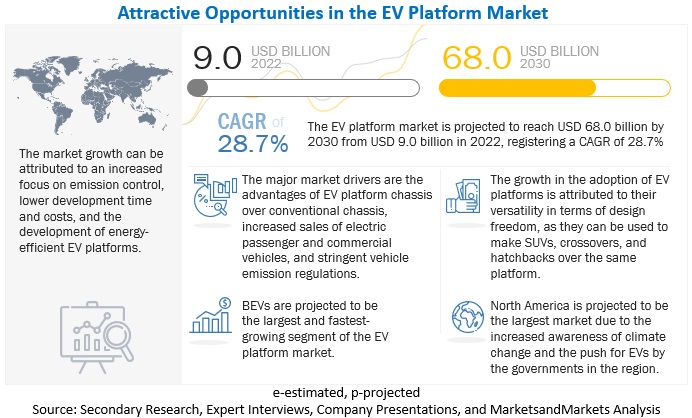

[233 Pages Report] The EV platform market is estimated to grow from USD 9.0 billion in 2022 to USD 68.0 billion by 2030 at a CAGR of 28.7% over the forecast period. Increase in demand for electric vehicles globally, a shift from conventional ICE vehicles to electric vehicles, continuously declining prices of Li-ion batteries, and ease of development and use the EV platforms compared to electric vehicle models. Strict vehicular emission regulations and a rise in sales of electric vehicles drive the development of the EV platform market during the forecast period.

High cost is required to develop an electric vehicle modular platform; the excessive flexibility this platform offers will offset this investment through economies of scale. Moreover, the initial investment, effort, and amount of time required to develop and manufacture different battery electric vehicles on an EV platform are comparatively less compared to other platforms.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVER: Benefits of modular EV platform over conventional chassis

EV platform and electric vehicle prices depend on the prices of batteries; battery cost is around 40% of the electric vehicle cost. This cost is directly proportional to battery capacity. Initially, the prices for large-capacity batteries were high. However, prices have reduced over time, making high-capacity batteries more affordable for end-users. Various policies and economies have led to a reduction in the battery cost/kWh. As the production of batteries increases, there are more opportunities and government incentives to achieve innovations. Therefore, prices often fall when battery technologies begin to scale. In 2020, Niti Aayog sought approval to build up to 10 large factories that would get subsidies to produce lithium-ion batteries for electric vehicles. This would help in the overall price reduction of batteries in India. Research is underway to increase the pack size of batteries to support EV platforms and reduce costs.

A high cost is required to develop an electric vehicle modular platform. This platform's excessive flexibility will offset this investment through economies of scale. Moreover, the initial investment, effort, and time required to develop and manufacture battery electric vehicles on an EV platform are comparatively less than other platforms. According to Honda Motor, developing one EV model requires about USD 455 million, with batteries alone accounting for about 40–50% of the production cost. Converting production lines to cater to EVs costs about USD 73 million to USD 110 million per factory.

According to industry experts, electric vehicle manufacturing companies are not making more profit by manufacturing electric vehicles; each car costs USD 12,000 more than an ICE vehicle. Furthermore, a purpose-built EV platform is simpler to assemble and could deliver up to USD 600 in savings per vehicle in lower fixed-cost allocation. Therefore, the EV platform helps reduce the cost of manufacturing each model, and hatchbacks, sedans, and utility vehicles can be built on a single modular platform. However, high initial investment is required to develop a scalable and modular EV platform. The flexibility offered by the platform is expected to offset the initial investment through economies of scale.

With the billion-dollar requirement for factories to build electric vehicles, customers can take the chassis and assemble the body close to the customer site. Manufacturing electric vehicles from modular EV platforms instead of conventional ones is expected to open different ways to build and service EVs. The modular EV platform design allows different elements to be easily and quickly replaced. Few modules can be kept for store servicing, simplifying the inventory and supply chain requirements.

The advantage of converting the conventional chassis to EV platforms is the availability of x-by-wire technology. The electronic control of steering, suspension, motors, and braking allows these components to be separated, opening up the platform's flexibility. These platforms are helpful for the development of passenger cars and commercial vehicles during the forecast period.

RESTRAINT: High initial investment for developing EV platforms

In electric vehicles, the size of a battery pack depends on the driving range, and the battery size influences the cost of the battery. The big battery size complicates the body and chassis design of the electric vehicle platform. Consequently, electric vehicles are more expensive than their ICE counterparts. Battery replacement cost is another critical factor in determining the total cost. The service life of a battery is much lesser than that of an electric vehicle platform. Therefore, the battery needs to be replaced at least once or twice in the electric vehicle platform's working life depending on the operating conditions. Battery life depends on parameters such as distance traveled per day, annual distance, operating temperature, charging level, and charging rate.

The cathode price largely affects the price of the batteries because raw materials such as cobalt, nickel, lithium, and magnesium are expensive. The cost of developing higher-range EVs is significantly higher due to the requirement of higher specification batteries, advanced technology used for production, and highly expensive components used in the vehicles.

The development cost of infrastructure for EVs is also high. The battery of an EV needs frequent and fast charging through additional equipment, such as electric chargers, which are only available at EV charging stations. The battery, charger, and installation costs add to the cost of the EV platform, making them costlier than traditional ICE vehicles. Despite several benefits of electric vehicle platforms, such as environmental friendliness and low fuel expenses compared with diesel vehicles, the high initial cost of EV platforms has emerged as one of the major barriers to their mass adoption.

OPPORTUNITY Preference for high-voltage and long-distance range EV platforms

The major development area in EV platforms is the driving range on a single charge. With improvements in EV battery technology, OEMs are working on developing long-range EV platforms. This will make EV platforms more viable as part of the commercial vehicle sector in the coming years. The development of solid-state battery technology will further increase the range of electric vehicles by 2028. The mass production of solid-state batteries will begin by 2028, reducing their price and making them suitable for electric vehicles.

Various companies are also working on the development of long-range EV platforms. In September 2021, BYD Company Ltd. (China) launched a new e-platform 3.0 for electric vehicles. The company also developed a new Ocean-X concept, a mid-sized sedan built upon the company’s new EV platform. The new e-platform 3.0 is expected to enable a range of more than 1000 kilometers, boast acceleration of 0–100 km/h in only 2.9 seconds and a 20% increase in the thermal efficiency of the batteries. In December 2022, Volkswagen Group (Germany) launched the MEB+ platform with development in charging, digital infrastructure, and storage technology. The MEB+ platform consists of unit cell batteries enabling improved charging times with charging speeds of 175 to 200 kW and an EV range of up to 700 km.

According to industry experts, the automotive OEMs and tier 1 suppliers in the automotive industry are adopting the 800V standard around 2025. Hyundai (South Korea) launched its E-GMP platform, which can charge up to 80% in 18 min. Power electronic companies are developing onboard chargers, DC-DC converters, and investors to enhance powertrain efficiency, improve range, and reduce battery pack capacity. The greater efficiencies are achieved using transition silicon carbide MOSFETs and high voltage vehicle platforms. General Motors, Hyundai, BYD Company Ltd., and Nissan announced 800V EV platforms that are expected to adopt silicon carbide MOSFETs in their power electronics by 2025. Recently, STMicroelectronics launched new high-power silicon carbide (SiC) modules for EV platforms, boosting the performance and driving range. Therefore, developments in range and voltage offer lucrative opportunities for EV platform manufacturers during the forecast period.

CHALLENGE: Long charging time compared with other fuels

An EV charging time is much higher than the fuelling time of fuel alternatives. Level 1 and 2 charging can take 8–16 hours, whereas level 3 charging can take ~20 mins to charge an EV. This is much higher than diesel or CNG fuelling, which takes less than 5 mins. The prolonged charging time is a primary reason for the slow growth of electric vehicle platforms. In the coming years, technological breakthroughs will reduce charging time, but the battery will need to be developed for fast, high-voltage charging. Commercial electric vehicles take longer to charge than other EVs due to the presence of more/larger battery packs to increase their range and payload capacity. This is because the per-mile electricity consumption of commercial electric vehicles is higher than that of electric cars. However, companies are now working toward developing commercial vehicles with faster charging. Tesla’s upcoming Semi was announced to take around 40 mins to charge using superchargers by 2021 fully.

The amount of time spent charging EV batteries proves to be a deterrent to market growth. EV battery chargers range from 3.7 KW slow chargers to 50 KW rapid chargers, with a few EV cars being compatible with chargers up to 150 KW. However, the charging time varies across batteries due to other factors, such as battery capacity and energy density. Long-range and high-power vehicles need more charging time than small-range and low-power vehicles. For example, a 75-kWh battery might take as long as 21 hours to charge from empty to full on a 3.7 KW slow charger. The charging rate must also be limited due to the risk of overheating and fire. Such issues pose a big disadvantage to EVs compared to traditional ICE vehicles.

Batteries segment is projected to dominate the EV platform market in 2030

Batteries is expected to be the largest market by value due to EV batteries accounting for a major part of EV platform cost. Companies like Samsung SDI, LG Chem, CATL, SK Innovation, BYD, and Panasonic have been providing batteries for use in EVs over the years. They account for a major part of the EV battery demand in the market. Tesla and BYD use in-house build EV batteries for their electric vehicles. The demand for EV batteries will be the highest in the Asia Pacific due to China being the world’s largest EV market. Thus, with the rise in the adoption of advanced integrated technologies for EV platforms, the demand for EV batteries would also rise. CATL unveiled its Qilin Battery, the third generation of its CTP (cell-to-pack) technology. It delivers a range of 1,000 km and has an energy density of up to 255 Wh/kg. The Qilin Battery is expected to be mass-produced in 2023. Such developments are responsible for the growth of the EV platform during the forecast period.

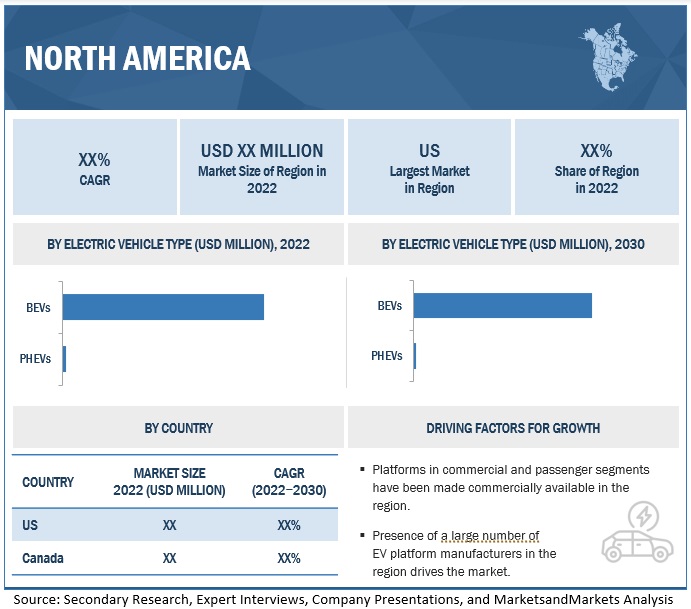

North America is estimated to have the largest market in 2030

The leading countries, such as the US and Canada, are considered under the North American region. North America is a regional hub for renowned OEMs that deliver quality and high-performance vehicles. For instance, Tesla and General Motors focus on developing faster, cleaner, and high-performance electric vehicles. The electric vehicle market in this region is also growing rapidly, with many automakers investing in developing electric vehicles and related technologies. The North American automaker, Ford, announced plans to develop EV platforms. It has already launched one and invested in research and development to improve its electric vehicle technology.

The region is also home to many top EV Platform manufacturers, such as General Motors (US), Ford Motor Company (US), and Rivian Automotive Inc. (US). These companies and other foreign players have worked together to provide for the EV platform demand in the region.

The US is projected to dominate the North American EV platform market by 2030. The US automotive industry is highly inclined towards innovation, technology, and the development of safe and comfortable automobiles. The EV market in the US has been vibrant as not just major automakers are coming into the market, but also many new-age startups have contributed significantly to the market. The US gives USD 7,500 tax credits that reduce the cost of EVs in the region. Around 45 of its states have varying policies for increasing EV demand and setting up EV charging stations across their region. The country encourages electric vehicles for fleet services in many of its states.

California has the largest EVs in the country due to its mass popularization and large tax for ICE vehicles in the state. Some other major states that have popularized EVs include New York, Florida, Texas, Washington, Georgia, Colorado, Massachusetts, Maryland, Oklahoma, South Dakota, Oregon, Vermont, Iowa, Maine, and North Carolina. The growing EV demand and the adoption of integrated EV components will propel the electric vehicle platform market in the US. Companies such as General Motors (US), Ford Motor Company (US), Rivian Automotive inc. (US), Canoo (US), and others have come up with their EV platform solutions in commercial and passenger segments. Considering the same, the US will have a good growth rate in the future.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The EV platform market is dominated by a few globally established companies such as Volkswagen Group (Germany), Ford Motor Company (US), General Motors (US), Hyundai Motor Group (South Korea), and Renault (France).

These companies adopted new product launches, partnerships, and joint ventures to gain traction in the EV platform market

Scope of the Report

|

Report Attribute |

Details |

|

Base year for estimation |

2021 |

|

Forecast period |

2022–2030 |

|

Market Growth and Revenue forecast |

USD 9.0 Billion in 2022 to USD 68.0 Billion by 2030 and CAGR of 28.7% during the forecast period 2022 to 2030 |

|

Top Players |

Group (Germany), Ford Motor Company (US), General Motors (US), Hyundai Motor Group (South Korea), and Renault (France) |

|

Fastest Growing Market |

Asia Pacific |

|

Largest Market |

North America |

|

Segments covered |

|

|

By Electric Vehicle Type |

BEV and PHEV |

|

By Vehicle Type |

Hatchback, Sedans, and Utility Vehicles |

|

By Component |

Suspension Systems, Steering Systems, Motor Systems, Batteries, Brake Systems, Chassis, Electronic Control Units |

|

Electric Commercial Vehicle Platform Market, By Vehicle Type |

Electric Trucks, Electric Buses, and Electric Vans/Pickup Trucks |

|

By Region |

Asia Pacific, North America, and Europe |

|

Additional Customization to be offered |

EV platform Market, by Electric Vehicle Type, |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs

The study segments the EV platform market:

By Electric Vehicle Type

- BEV

- PHEV

By Vehicle Type

- Hatchback

- Sedans

- Utility Vehicles

By Component

- Suspension Systems

- Steering Systems

- Motor Systems

- Batteries

- Brake Systems

- Chassis

- Electronic Control Units

Electric Commercial Vehicle Platform Market, By Vehicle Type

- Electric Trucks

- Electric Buses

- Electric Vans/Pickup Trucks

By Region

- Asia Pacific

- North America

- Europe

Recent Developments

- In January 2023, BYD announced the launch of its new e4 quad-motor platform for performance vehicles; the first vehicles on this platform are supposed to be a 5-meter electric offroad SUV and a fast hypercar that will be launched under the newly formed Yangwang brand.

- In December 2022, Volkswagen Group is upgrading its MEB electric platform to become more competitive. The company’s upgraded electric vehicle architecture will retain the 400-volt setup it currently uses instead of adopting an 800-volt system like the Hyundai-Kia platform. However, alterations to the updated platform will see charging speeds rise from 135–170 kWh to 175–200 kWh. In addition to faster charging, the MEB+ architecture will allow a maximum range of 435 miles (700 km), a significant jump from the peak of 342 miles (550 km) achievable with the current MEB setup. The updated EV platform will also use unified battery cells sourced from a battery factory in Salzgitter, Germany, and the Swedish plant operated by Northvolt. These unified cells can support different chemistries and reduce battery costs by 50%.

- In December 2022, General Motors revealed a new Chevy EV sedan concept, the FNR-XE, during its China Tech Vision Day 2022 event based on General Motors’s Ultium platform.

- In August 2022, Volkswagen Group and Mahindra and Mahindra signed a term sheet on the supply of MEB Electric Components for Mahindra’s new Electric SUV. Both companies will explore potential opportunities for collaboration in India in the field of e-mobility, including vehicle projects, charging and energy solutions, and cell manufacturing.

- In August 2022, Mahindra and Mahindra unveiled a new ‘INGLO EV platform’ and plans to launch five e-SUVs under new brands in 2–4 years. Mahindra and Mahindra’s new INGLO EV platform is based on a modular electric skateboard that will underpin the homegrown manufacturer’s new range of EVs, which are set to arrive by the end of 2024. Mahindra’s new INGLO EV platform will build SUVs between 4,368 mm and 4,735 mm and have a flexible wheelbase. The e-SUVs battery sizes would be between 60-80kWh and support a fast charge of 175kW, charging the battery from 0–80% in less than 30 minutes.

- In July 2022, Hyundai officially debuted the new IONIQ 6 with a 379-mile range, teasing the upcoming IONIQ N performance EV. It shares the same 800 V E-General Motors P platform as the IONIQ 5, and the IONIQ 6 makes its debut with the same features.

- In March 2022, The BEV-3 EV platform-based Cadillac Lyriq was launched commercially for the public in March 2022. The BEV3-based SUV has a larger length, lower height, greater energy density, and faster charging rate than BEV2. The rear-wheel-drive vehicle has a 102-kWh battery pack and a single electric motor delivering an estimated 340 hp and 325 lb-ft of torque and an estimated 312-mile range.

- In January 2022, Renault and Nissan have formed a joint venture by investing USD 26 billion in future electric vehicles. Both companies plan on developing battery and platform technology to make their future EVs more customizable and less dependent on supply shortages due to supply chain disruptions.

- In January 2022, REE Automotive unveiled a new electric platform for delivery vehicles. The P7 electric Chassis is flat from end-to-end, and electric and autonomous vehicles based on this platform can achieve ranges of up to 600 km (370 miles) on a charge, given the 120-kWh battery. These vehicles can reach a top speed of 130 kph (80 mph).

- In January 2022, REE Automotive launched its new components product line and platforms, REEcorners. These proprietary systems combined the vital parts of an EV between the Chassis and wheel.

Frequently Asked Questions (FAQ):

What is the current size of the global EV platform market?

The EV platform market is estimated to grow from USD 9.0 billion in 2022 to USD 68.0 billion by 2030 at a CAGR of 28.7% over the forecast period.

Which electric vehicle type is currently leading the global EV platform market?

BEVs segment is leading in the global EV platform market. Most EV platforms developed by manufacturers are mostly used for BEVs as they allow molding the system into different configurations such as SUVs, sedans, and others. Due to the decreasing cost of EV batteries, increasing EV range, and a growing EV charging network worldwide, the demand for BEVs has been rising significantly.

What are the trends in EV platforms?

The development of the EV platform is expected to provide growth opportunities for participants such as battery and motor manufacturers, EV services based companies, automotive software providers, big data companies, and cloud service.

Many companies are operating in the global EV platform market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

The EV platform market is dominated by a few globally established companies such as Volkswagen Group (Germany), Ford Motor Company (US), General Motors (US), Hyundai Motor Group (South Korea), and Renault (France). These companies adopted new product launches, partnership, and joint venture to gain traction in the EV platform market

What are the new technologies and its impact on platform designs?

The EV platform is charging station and manufacturers are developing the EV platform according to OEM requirements. The OEM requirements and design requirements are differ according to model of the vehicle. The platform manufacturers need to update the EV platform depending on the new technologies such as ADAS, software defined vehicle platforms, body, chassis, telematics, connectivity, power line communications, plus safety and cybersecurity in the physical computer unit. The addition of these features is expected to impact the design of EV platforms during the forecast period.

How is the demand for global EV platform market varies by region?

With the high electrification trend in developed countries and high demand for EV platform in electric vehicles, North America region is predicted to lead the EV platform market. The stringent emission norms from this region, rising number of EV platform manufacturers, increase in preference for electric vehicles are some of the key reasons for this region also to have the largest market for EV platform.

What are the growth opportunities for the global EV platform market supplier?

Developing lightweight and high voltage EV platform, growing demand for end-to-end software-defined vehicle platforms, use of electric vehicles for fleet and commercial applications and rising demand for solid state batteries would create growth opportunities for the EV platform market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Benefits of modular EV platforms over conventional chassisRESTRAINTS- High initial investment to develop EV platforms- Soaring energy costs- Limited range of EV platformsOPPORTUNITIES- Preference for high-voltage and long-range EV platforms- High demand for solid-state batteries to deploy in EV platforms- Growing demand for end-to-end software-defined vehicle platforms- Development of lightweight EV platforms- Use of electric vehicles in fleet and commercial applicationsCHALLENGES- Shortage of lithium- Long charging time

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 TRADE ANALYSISEXPORT TRADE DATA- US- China- Germany- Switzerland- NetherlandsIMPORT TRADE DATA- Germany- China- US- Switzerland- Netherlands

- 5.5 TRENDS AND DISRUPTIONS IN MARKET

-

5.6 CASE STUDY ANALYSISEV PLATFORMS: COMPANY PRODUCT PORTFOLIORENAULT, NISSAN, AND MITSUBISHI MOTORS ANNOUNCE COMMON ROADMAPCANOO DELIVERS LIGHT TACTICAL VEHICLES TO ARMY FOR ANALYSIS AND DEMONSTRATIONVOLKSWAGEN SOLVES MASSIVE SOFTWARE PROBLEMS FOR NEW ELECTRIC CARSNOISE REDUCTION IN ELECTRIC VEHICLE INTERFACES

-

5.7 PATENT ANALYSIS

- 5.8 SUPPLY CHAIN ANALYSIS

-

5.9 ECOSYSTEM MAP

-

5.10 REGULATORY AUTHORITIES, BY REGIONNORTH AMERICAEUROPEASIA PACIFIC

-

5.11 INCENTIVES FOR ELECTRIC VEHICLES AND EV CHARGING STATIONS, BY COUNTRYNETHERLANDSGERMANYFRANCEUKCHINAUS

-

5.12 PRICING ANALYSISASP ANALYSIS, 2022 (USD)

-

5.13 TECHNOLOGY TRENDSSOLID-STATE BATTERIESIOTOPEN EV PLATFORMS FOR SOFTWARE-DEFINED VEHICLES

- 5.14 CONFERENCES AND EVENTS, 2022–2023

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONKEY PRIMARY INSIGHTS

- 6.2 P0

- 6.3 P1

- 6.4 P2

- 6.5 P3

- 6.6 P4

-

7.1 INTRODUCTIONRESEARCH METHODOLOGYKEY PRIMARY INSIGHTSASSUMPTIONS

-

7.2 BATTERY ELECTRIC VEHICLESGOVERNMENT PROVISION OF TAX BENEFITS AND INCENTIVES

-

7.3 PLUG-IN HYBRID ELECTRIC VEHICLESHIGH PERFORMANCE DUE TO LARGE BATTERY PACKS AND LESS DEPENDENCE ON ICE

-

8.1 INTRODUCTIONRESEARCH METHODOLOGYKEY PRIMARY INSIGHTSASSUMPTIONS

- 8.2 HATCHBACKS

- 8.3 SEDANS

- 8.4 UTILITY VEHICLES (SUVS/MUVS)

-

9.1 INTRODUCTIONRESEARCH METHODOLOGYKEY PRIMARY INSIGHTSASSUMPTIONS

-

9.2 SUSPENSION SYSTEMSPREFERENCE FOR BETTER RIDE LUXURY AND DRIVING EXPERIENCE

-

9.3 STEERING SYSTEMSINCREASED ENERGY EFFICIENCY AND LOW MAINTENANCE

-

9.4 MOTOR SYSTEMSHIGH TORQUE, LOW NOISE, AND FUEL EFFICIENCY FEATURES

-

9.5 BATTERIESINCREASED DEMAND FOR HIGH-VOLTAGE AND HIGH-CAPACITY BATTERIES

-

9.6 BRAKE SYSTEMSSAFETY AND REGENERATIVE CHARGING FEATURES

-

9.7 CHASSISHIGH DEMAND FOR CRASH-IMPACTING ZONES IN CHASSIS

-

9.8 ELECTRONIC CONTROL UNITSGROWING MODULARITY AND COMPLEXITY OF EV ARCHITECTURE

-

10.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONS

-

10.2 ELECTRIC TRUCKSFAVORABLE GOVERNMENT INCENTIVES

-

10.3 ELECTRIC BUSESPREFERENCE FOR EMISSION-FREE PUBLIC TRANSPORT

-

10.4 ELECTRIC VANS/PICKUP TRUCKSHIGH DEMAND FROM LOGISTICS PROVIDERS

-

11.1 INTRODUCTIONRESEARCH METHODOLOGYINDUSTRY INSIGHTSASSUMPTIONS

-

11.2 NORTH AMERICAUS- Investments in research and production capacity of electric vehiclesCANADA- Developments in electric vehicle infrastructure

-

11.3 EUROPEFRANCE- Government incentives to boost demand for EVsGERMANY- Rising sales of EVs by domestic playersNETHERLANDS- Government focus toward greener vehiclesNORWAY- Stringency in government regulationsSWEDEN- Investments by global automotive giants in developing EV platformsUK- Domestic investment in ultra-low-emission vehiclesSPAIN- Increased investments in BEVs

-

11.4 ASIA PACIFICCHINA- Increased development of EVs, EV infrastructure, and battery technologiesINDIA- Mahindra and Tata Motors unveiled EV platforms for their future EVsJAPAN- Advancements in battery technologySOUTH KOREA- Increased investments in electric vehicles

- 12.1 OVERVIEW

- 12.2 MARKET SHARE AND RANKING ANALYSIS

- 12.3 REVENUE ANALYSIS OF TOP PLAYERS

-

12.4 COMPETITIVE LEADERSHIP MAPPINGSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.5 COMPETITIVE SCENARIONEW PRODUCT DEVELOPMENTSDEALSEXPANSIONS

- 12.6 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.7 COMPETITIVE BENCHMARKING

-

13.1 KEY PLAYERSVOLKSWAGEN GROUP- Business overview- Products Offered- Recent developments- MnM viewBYD COMPANY LTD.- Business overview- Products offered- Recent developments- MnM viewHYUNDAI MOTOR GROUP- Business overview- Products offered- Recent developments- MnM viewRENAULT- Business overview- Products offered- Recent developments- MnM viewFORD MOTOR COMPANY- Business overview- Products offered- Recent developments- MnM viewTOYOTA- Business overview- Products offered- Recent developmentsGENERAL MOTORS- Business overview- Products offered- Recent developmentsREE AUTOMOTIVE- Business overview- Products offered- Recent developmentsMAHINDRA & MAHINDRA- Business overview- Products offered- Recent developmentsNIDEC CORPORATION- Business overview- Products offered- Recent developmentsZERO LABS AUTOMOTIVE- Business overview- Products offered- Recent developments

-

13.2 OTHER PLAYERSVIA MOTORSRIVIAN AUTOMOTIVEHON HAI PRECISION INDUSTRY CO., LTD.BENTELER AGCANOO

- 14.1 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR EV PLATFORMS

- 14.2 PARTNERSHIPS TO PLAY CRUCIAL ROLE IN EV PLATFORM MARKET

- 14.3 IMPROVEMENTS IN EV BATTERY TECHNOLOGY TO PROVIDE IMPETUS TO EV PLATFORM MARKET

- 14.4 CONCLUSION

- 15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

-

15.4 CUSTOMIZATION OPTIONSEV PLATFORM MARKET, BY PLATFORM- P0- P1- P2- P3- P4EV PLATFORM MARKET, BY ELECTRIC VEHICLE TYPE- HEV- FCEVEV PLATFORM MARKET, BY DRIVE TYPE- Two-wheel drive- Four-wheel driveELECTRIC COMMERCIAL VEHICLE PLATFORM MARKET, BY REGION- North America- Europe- Asia Pacific- RoW

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 CURRENCY EXCHANGE RATES (PER USD)

- TABLE 2 AVERAGE ELECTRICITY COST, 2020–2021

- TABLE 3 EV BATTERY INNOVATIONS

- TABLE 4 MAJOR EV FLEET TARGETS

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 US: HS CODE: 870240: EV PLATFORM EXPORT SHARE DATA, BY COUNTRY (VALUE %)

- TABLE 7 US: HS CODE: 870380: EV PLATFORM EXPORT SHARE DATA, BY COUNTRY (VALUE %)

- TABLE 8 CHINA: HS CODE: 870240: EV PLATFORM EXPORT SHARE DATA, BY COUNTRY (VALUE %)

- TABLE 9 CHINA: HS CODE: 870380: EV PLATFORM EXPORT SHARE DATA, BY COUNTRY (VALUE %)

- TABLE 10 GERMANY: HS CODE: 870240: EV PLATFORM EXPORT SHARE DATA, BY COUNTRY (VALUE %)

- TABLE 11 GERMANY: HS CODE: 870380: EV PLATFORM EXPORT SHARE DATA, BY COUNTRY (VALUE %)

- TABLE 12 SWITZERLAND: HS CODE: 870240: PLATFORM EXPORT SHARE DATA, BY COUNTRY (VALUE %)

- TABLE 13 SWITZERLAND: HS CODE: 870380: EV PLATFORM EXPORT SHARE DATA, BY COUNTRY (VALUE %)

- TABLE 14 NETHERLANDS: HS CODE: 870240: EV PLATFORM EXPORT SHARE DATA, BY COUNTRY (VALUE %)

- TABLE 15 NETHERLANDS: HS CODE: 870380: EV PLATFORM EXPORT SHARE DATA, BY COUNTRY (VALUE %)

- TABLE 16 GERMANY: HS CODE: 870240: EV PLATFORM IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 17 GERMANY: HS CODE: 870380: EV PLATFORM IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 18 CHINA: HS CODE: 870240: EV PLATFORM IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 19 CHINA: HS CODE: 870380: EV PLATFORM IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 20 US: HS CODE: 870240: EV PLATFORM IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 21 US: HS CODE: 870380: EV PLATFORM IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 22 SWITZERLAND: HS CODE: 870240: EV PLATFORM IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 23 SWITZERLAND: HS CODE: 870380: EV PLATFORM IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 24 NETHERLANDS: HS CODE: 870240: EV PLATFORM IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 25 NETHERLANDS: HS CODE: 870380: EV PLATFORM IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 26 ACTIVE PATENTS

- TABLE 27 ROLE OF COMPANIES IN EV PLATFORM MARKET

- TABLE 28 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 NETHERLANDS: ELECTRIC VEHICLE INCENTIVES

- TABLE 32 NETHERLANDS: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 33 GERMANY: ELECTRIC VEHICLE INCENTIVES

- TABLE 34 GERMANY: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 35 FRANCE: ELECTRIC VEHICLE INCENTIVES

- TABLE 36 FRANCE: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 37 UK: ELECTRIC VEHICLE INCENTIVES

- TABLE 38 UK: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 39 CHINA: ELECTRIC VEHICLE INCENTIVES

- TABLE 40 CHINA: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 41 US: ELECTRIC VEHICLE INCENTIVES

- TABLE 42 US: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 43 ASP ANALYSIS, 2022 (USD)

- TABLE 44 ASP ANALYSIS, BY VEHICLE TYPE, 2022 (USD)

- TABLE 45 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR EV PLATFORMS (%)

- TABLE 46 KEY BUYING CRITERIA

- TABLE 47 EV PLATFORM MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 48 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 49 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 50 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 51 BEVS: MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 52 BEVS: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 53 BEVS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 54 BEVS: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 55 PHEVS: MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 56 PHEVS: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 57 PHEVS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 58 PHEVS: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 59 MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 60 MARKET, BY VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 61 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 62 MARKET, BY VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 63 HATCHBACKS: MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 64 HATCHBACKS: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 65 HATCHBACKS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 66 HATCHBACKS: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 67 SEDANS: MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 68 SEDANS: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 69 SEDANS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 70 SEDANS: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 71 UTILITY VEHICLES: EV PLATFORM MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 72 UTILITY VEHICLES: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 73 UTILITY VEHICLES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 74 UTILITY VEHICLES: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 75 MARKET, BY COMPONENT, 2018–2021 (UNITS)

- TABLE 76 MARKET, BY COMPONENT, 2022–2030 (UNITS)

- TABLE 77 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 78 MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 79 SUSPENSION SYSTEMS: MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 80 SUSPENSION SYSTEMS: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 81 SUSPENSION SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 82 SUSPENSION SYSTEMS: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 83 STEERING SYSTEMS: MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 84 STEERING SYSTEMS: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 85 STEERING SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 86 STEERING SYSTEMS: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 87 MOTOR SYSTEMS: MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 88 MOTOR SYSTEMS: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 89 MOTOR SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 90 MOTOR SYSTEMS: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 91 BATTERIES: MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 92 BATTERIES: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 93 BATTERIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 94 BATTERIES: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 95 BRAKE SYSTEMS: MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 96 BRAKE SYSTEMS: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 97 BRAKE SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 98 BRAKE SYSTEMS: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 99 CHASSIS: EV PLATFORM MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 100 CHASSIS: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 101 CHASSIS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 102 CHASSIS: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 103 ECUS: MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 104 ECUS: MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 105 ECUS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 106 ECUS: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 107 ELECTRIC COMMERCIAL VEHICLE PLATFORM MARKET, BY VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 108 ELECTRIC TRUCKS PLATFORM MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 109 ELECTRIC BUSES PLATFORM MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 110 ELECTRIC VANS/PICKUP TRUCKS PLATFORM MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 111 MARKET, BY REGION, 2018–2021 (UNITS)

- TABLE 112 MARKET, BY REGION, 2022–2030 (UNITS)

- TABLE 113 MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 114 MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (UNITS)

- TABLE 116 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2030 (UNITS)

- TABLE 117 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 118 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 119 US: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 120 US: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 121 US: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 122 US: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 123 CANADA: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 124 CANADA: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 125 CANADA: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 126 CANADA: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 127 EUROPE: MARKET, BY COUNTRY, 2018–2021 (UNITS)

- TABLE 128 EUROPE: MARKET, BY COUNTRY, 2022–2030 (UNITS)

- TABLE 129 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 130 EUROPE: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 131 FRANCE: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 132 FRANCE: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 133 FRANCE: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 134 FRANCE: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 135 GERMANY: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 136 GERMANY: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 137 GERMANY: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 138 GERMANY: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 139 NETHERLANDS: MARKET, ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 140 NETHERLANDS: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 141 NETHERLANDS: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 142 NETHERLANDS: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 143 NORWAY: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 144 NORWAY: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 145 NORWAY: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 146 NORWAY: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 147 SWEDEN: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 148 SWEDEN: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 149 SWEDEN: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 150 SWEDEN: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 151 UK: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 152 UK: EV PLATFORM MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 153 UK: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 154 UK: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 155 SPAIN: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 156 SPAIN: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 157 SPAIN: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 158 SPAIN: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (UNITS)

- TABLE 160 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2030 (UNITS)

- TABLE 161 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 162 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 163 CHINA: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 164 CHINA: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 165 CHINA: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 166 CHINA: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 167 INDIA: EV PLATFORM MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 168 INDIA: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 169 INDIA: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 170 INDIA: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 171 JAPAN: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 172 JAPAN: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 173 JAPAN: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 174 JAPAN: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 175 SOUTH KOREA: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (UNITS)

- TABLE 176 SOUTH KOREA: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (UNITS)

- TABLE 177 SOUTH KOREA: MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 178 SOUTH KOREA: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 179 MARKET SHARE ANALYSIS, 2022

- TABLE 180 MARKET: COMPANY FOOTPRINT, 2022

- TABLE 181 MARKET: TECHNOLOGY FOOTPRINT

- TABLE 182 MARKET: REGIONAL FOOTPRINT

- TABLE 183 MARKET: PRODUCT DEVELOPMENTS, JANUARY 2020– DECEMBER 2022

- TABLE 184 MARKET: DEALS, JANUARY 2020–DECEMBER 2022

- TABLE 185 MARKET: EXPANSIONS, JANUARY 2020–DECEMBER 2022

- TABLE 186 KEY GROWTH STRATEGIES

- TABLE 187 MARKET: KEY STARTUPS/SMES

- TABLE 188 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 189 VOLKSWAGEN GROUP: BUSINESS OVERVIEW

- TABLE 190 VOLKSWAGEN GROUP: PRODUCTS OFFERED

- TABLE 191 VOLKSWAGEN GROUP: NEW PRODUCT DEVELOPMENTS

- TABLE 192 VOLKSWAGEN GROUP: DEALS

- TABLE 193 BYD COMPANY LTD.: BUSINESS OVERVIEW

- TABLE 194 BYD COMPANY LTD.: PRODUCTS OFFERED

- TABLE 195 BYD COMPANY LTD.: NEW PRODUCT DEVELOPMENTS

- TABLE 196 BYD COMPANY LTD.: DEALS

- TABLE 197 BYD COMPANY LTD: OTHERS

- TABLE 198 HYUNDAI MOTOR GROUP: BUSINESS OVERVIEW

- TABLE 199 HYUNDAI MOTOR GROUP: PRODUCTS OFFERED

- TABLE 200 HYUNDAI MOTOR GROUP: NEW PRODUCT DEVELOPMENTS

- TABLE 201 HYUNDAI MOTOR GROUP: DEALS

- TABLE 202 HYUNDAI MOTOR GROUP: OTHERS

- TABLE 203 RENAULT: BUSINESS OVERVIEW

- TABLE 204 RENAULT: PRODUCTS OFFERED

- TABLE 205 RENAULT: NEW PRODUCT DEVELOPMENTS

- TABLE 206 RENAULT: DEALS

- TABLE 207 RENAULT: OTHERS

- TABLE 208 FORD MOTOR COMPANY: BUSINESS OVERVIEW

- TABLE 209 FORD MOTOR COMPANY: PRODUCTS OFFERED

- TABLE 210 FORD MOTOR COMPANY: NEW PRODUCT DEVELOPMENTS

- TABLE 211 FORD MOTOR COMPANY: DEALS

- TABLE 212 TOYOTA: BUSINESS OVERVIEW

- TABLE 213 TOYOTA: PRODUCTS OFFERED

- TABLE 214 TOYOTA: DEALS

- TABLE 215 GENERAL MOTORS: BUSINESS OVERVIEW

- TABLE 216 GENERAL MOTORS: PRODUCTS OFFERED

- TABLE 217 GENERAL MOTORS: NEW PRODUCT DEVELOPMENTS

- TABLE 218 GENERAL MOTORS: DEALS

- TABLE 219 GENERAL MOTORS: OTHERS

- TABLE 220 REE AUTOMOTIVE: BUSINESS OVERVIEW

- TABLE 221 REE AUTOMOTIVE: PRODUCTS OFFERED

- TABLE 222 REE AUTOMOTIVE: NEW PRODUCT DEVELOPMENTS

- TABLE 223 REE AUTOMOTIVE: DEALS

- TABLE 224 REE AUTOMOTIVE: OTHERS

- TABLE 225 MAHINDRA & MAHINDRA: BUSINESS OVERVIEW

- TABLE 226 MAHINDRA & MAHINDRA: PRODUCTS OFFERED

- TABLE 227 MAHINDRA & MAHINDRA: NEW PRODUCT DEVELOPMENTS

- TABLE 228 MAHINDRA & MAHINDRA: DEALS

- TABLE 229 NIDEC CORPORATION: BUSINESS OVERVIEW

- TABLE 230 NIDEC CORPORATION: PRODUCTS OFFERED

- TABLE 231 NIDEC CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 232 NIDEC CORPORATION: DEALS

- TABLE 233 ZERO LABS AUTOMOTIVE: BUSINESS OVERVIEW

- TABLE 234 ZERO LABS AUTOMOTIVE: PRODUCTS OFFERED

- TABLE 235 ZERO LABS AUTOMOTIVE: NEW PRODUCT DEVELOPMENTS

- TABLE 236 VIA MOTORS: COMPANY OVERVIEW

- TABLE 237 RIVIAN AUTOMOTIVE: COMPANY OVERVIEW

- TABLE 238 HON HAI PRECISION INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 239 BENTELER AG: COMPANY OVERVIEW

- TABLE 240 CANOO: COMPANY OVERVIEW

- FIGURE 1 MARKETS COVERED

- FIGURE 2 REGIONS COVERED

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 RESEARCH METHODOLOGY MODEL

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 MARKET ESTIMATION METHODOLOGY

- FIGURE 7 BOTTOM-UP APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 FACTORS INFLUENCING MARKET

- FIGURE 11 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- FIGURE 12 REPORT SUMMARY

- FIGURE 13 MARKET, BY REGION, 2022 VS. 2030 (USD MILLION)

- FIGURE 14 INCREASED FOCUS ON ELECTRIFICATION AND EMISSION CONTROLS

- FIGURE 15 UTILITY VEHICLES TO HOLD LARGEST MARKET SHARE BY 2030

- FIGURE 16 BATTERIES SURPASS OTHER EV PLATFORM COMPONENTS

- FIGURE 17 ELECTRIC VANS/PICKUP TRUCKS TO HOLD DOMINANCE IN MARKET

- FIGURE 18 BEVS HOLD LARGER SHARE OVER PHEVS DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO BE FASTEST-GROWING REGION IN EV PLATFORM MARKET

- FIGURE 20 EV PLATFORM MARKET DYNAMICS

- FIGURE 21 SALES OF ELECTRIC PASSENGER CARS, 2018–2021 (THOUSAND UNITS)

- FIGURE 22 EV CHARGING DEMAND, 2020 VS. 2025 VS. 2030

- FIGURE 23 LITHIUM-ION DEMAND AND SUPPLY, 2016–2030 (KT)

- FIGURE 24 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 25 REVENUE SHIFTS IN EV PLATFORM MARKET

- FIGURE 26 SUPPLY CHAIN ANALYSIS

- FIGURE 27 KEY BUYING CRITERIA

- FIGURE 28 EV PLATFORM MARKET, BY ELECTRIC VEHICLE TYPE, 2022 VS. 2030 (USD MILLION)

- FIGURE 29 MARKET, BY VEHICLE TYPE, 2022 VS. 2030 (USD MILLION)

- FIGURE 30 MARKET, BY COMPONENT, 2022 VS. 2030 (USD MILLION)

- FIGURE 31 ELECTRIC COMMERCIAL VEHICLE PLATFORM MARKET, BY VEHICLE TYPE, 2022 VS. 2030 (USD MILLION)

- FIGURE 32 MARKET, BY REGION, 2022 VS. 2030 (USD MILLION)

- FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 34 EUROPE: MARKET SNAPSHOT

- FIGURE 35 MARKET SHARE AND RANKING ANALYSIS, 2022

- FIGURE 36 PLAYERS DOMINATING MARKET IN LAST THREE YEARS

- FIGURE 37 COMPANY EVALUATION QUADRANT, 2022

- FIGURE 38 STRATEGIES ADOPTED BY PLAYERS

- FIGURE 39 VOLKSWAGEN GROUP: COMPANY SNAPSHOT

- FIGURE 40 BYD COMPANY LTD.: COMPANY SNAPSHOT

- FIGURE 41 HYUNDAI MOTOR GROUP: COMPANY SNAPSHOT

- FIGURE 42 RENAULT: COMPANY SNAPSHOT

- FIGURE 43 FORD MOTOR COMPANY: COMPANY SNAPSHOT

- FIGURE 44 TOYOTA.: COMPANY SNAPSHOT

- FIGURE 45 GENERAL MOTORS: COMPANY SNAPSHOT

- FIGURE 46 MAHINDRA & MAHINDRA: COMPANY SNAPSHOT

- FIGURE 47 NIDEC CORPORATION: COMPANY SNAPSHOT

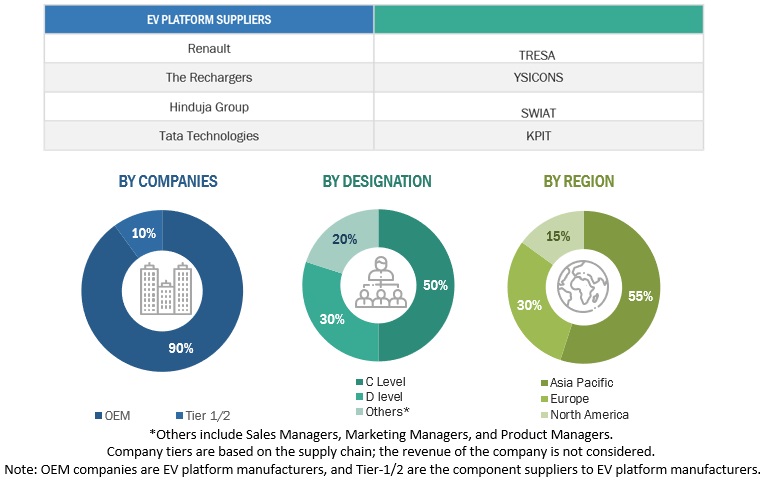

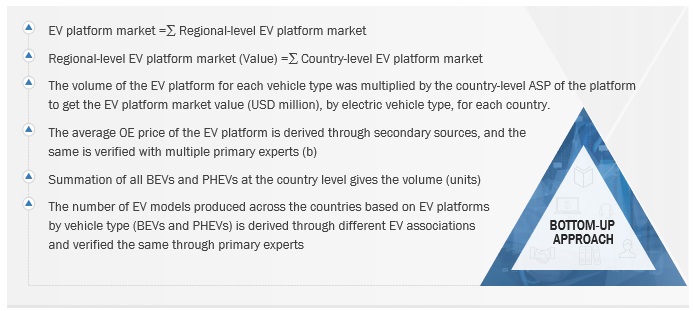

The study involves four main activities to estimate the current size of the EV platform market.

- Exhaustive secondary research was done to collect information on the market, such as EV platform market by electric vehicle type, vehicle type, component, electric commercial vehicle market, by commercial vehicle, and region.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

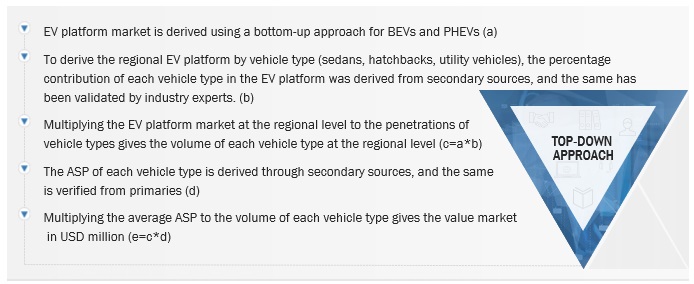

- Top-down approach were employed to estimate the complete market size for different segments considered under this study.

- Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources.

Secondary research was used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the scenario of the EV platform market through secondary research. Several primary interviews were conducted with market experts from both demand and supply sides across three major regions, namely North America, Europe, and Asia Pacific. Approximately 90% of the primary interviews were conducted with OEMs, and 10% were conducted from the demand side. Primary data was collected through questionnaires, emails, and telephonic interviews.

In our canvassing of primaries, we strived to cover various departments within organizations, including sales, operations, and administration, to provide a holistic viewpoint of the EV platform market in our report. After interacting with industry participants, we conducted brief sessions with experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of the in-house subject-matter experts, led us to the findings described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the size of the EV platform market and other dependent submarkets, as mentioned below:

- Key players in the market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of annual and quarterly financial reports, regulatory filings of major market players (public), and interviews with industry experts for detailed market insights.

- All industry-level penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

EV Platform Market Size: Bottom-Up Approach (Region)

To know about the assumptions considered for the study, Request for Free Sample Report

EV Platform Market Size: Top-Down Approach (Vehicle Type)

Report Objectives

-

To define, describe, and forecast the size of the EV platform market in terms value

- By electric vehicle type (BEV and PHEV)

- By vehicle type (hatchback, sedans, and utility vehicles)

- By component (suspension systems, steering systems, motor systems, batteries, brake systems, chassis, electronic control units)

- Electric commercial vehicle platform market, by vehicle type (electric trucks, electric buses, and electric vans/pickup trucks)

- By Region (Asia-Pacific, Europe, North America)

- To qualitatively analyze and assess the market, by Platform (P0, P1, P2, P3, P4)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the share of leading players in the market and evaluate competitive leadership mapping

- To strategically analyze the key player strategies/right to win and company revenue analysis

- To strategically analyze the market with Porter’s Five Forces analysis, supply chain analysis, market ecosystem, trade analysis, case studies, ASP analysis, patent analysis, trends/disruptions impacting buyers, technology trend and regulatory analysis.

- To analyze recent developments, including new product launches, expansions, and other activities, undertaken by key industry participants in the market.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs

EV Platform Market, By Electric Vehicle Type

- HEV

- PHEV

EV Platform Market, By Drive Type

- Two-wheel drive

- Four-wheel drive

Electric Commercial Vehicle Platform Market, By Region

- North America

- Europe

- Asia Pacific

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in EV Platform Market