European Crop Protection Chemicals Market by Types (Herbicides, Fungicides, Insecticides, Bio-pesticides and Adjuvants), by Crop Types, by Geography: Trends and Forecast to 2018

[407 Pages Report] Crop protection chemicals are widely used across the globe, and are very useful to safeguard crops against various insects, diseases, and pests. Pesticides are very important as they improve the quality and yield of agricultural produce. Based on applications, crop protection chemicals market can be bifurcated into three types, herbicides, insecticides, and fungicides.

Herbicides are used in the agriculture land to control or kill weeds. Insecticides are applied to provide plants with protection against various insects and fungicides safeguards plants from various diseases. Effective pest management significantly reduces pre and post damage of the crops.

Though the mode of action of biopesticides is very slow but they are not harmful to environment and human health. Increasing regulatory requirements have been proved to be one the beneficial factor affecting biopesticides market. Adoption of bio-pesticides is growing as an effective alternative for crop protection with less or no hazard to the environment. To capitalize on the growth trend in the global bio-pesticide market, several leading crop protection chemical companies are rushing in to the development and manufacturing of bio-pesticides

Growth in the demand for crop protection chemicals is expected to come from Eastern and Central Europe, especially countries such as Russia, Ukraine, and Poland. Grains, cereals, and potatoes are key segments in the German crop protection chemicals market as Germany is a major producer and supplier of beer in the world

The European market for crop protection chemicals, in terms of active ingredient volume was estimated at 639.4 KT in 2011 and is expected to reach 741.9.5KT by 2018. Europe is the second largest market for herbicides. Coming out of slow growth in 2008 and 2009 owing to economic downturn and bad weather conditions, herbicide market in Europe started recovery and expected $15,848.5 million by revenue by 2018. Growers in these regions are more educated and aware about the important role of fungicides to drive quality and yield. Further, this region is experiencing the emergence of rapidly growing growers segment that eyeing to optimize their yield profitably and have high-quality crops. This has turned into increased adoption of fungicides. This trend is expected to continue in the near future to increase per acre yield and quality of cereals in Europe.

This report estimates the market size of the global and European crop protection chemicals market both in terms of active ingredient volume as well as revenue. The market has been further segmented on the basis of crop types such as cereals, grains, oilseeds, and vegetables as well as by sub-segmentation of insecticides, fungicides, and herbicides such as glyphosate, atrazine, and 2,4-D. This segmentation is given for major regions and key countries in those regions. Market drivers, restraints and challenges, raw material, and product price trends are discussed in detail. Market share by participants for the overall market is discussed in detail in the report. We have also profiled leading players of this industry including Bayer CropScience (Germany), BASF (Germany), Monsanto (U.S.), and Dow Agrosciences (U.S.).

Customer Interested in this report also can view

-

Crop Protection Chemicals Market By Types (Herbicides, Fungicides, Insecticides, Bio-Pesticides and Adjuvants), By Crop Types, By Geography: Global Trends and Forecast To 2018

-

Asia-Pacific Crop Protection Chemicals Market by Types (Herbicides, Fungicides, Insecticides, Bio-pesticides and Adjuvants), by Crop Types, by Geography: Trends and Forecast to 2018

-

North and Latin American Crop Protection Chemicals Market by Types (Herbicides, Fungicides, Insecticides, Bio-pesticides and Adjuvants), by Crop Types, by Geography: Trends and Forecast to 2018

European Crop protection chemicals: $15,848.5 million market by 2018, signifies a firm CAGR of 4.3%

Europe is one of the largest consumers of pesticides globally, owing to large cultivated land area. Till 2003, Europe accounted for over 30% of the global demand for crop protection chemicals. However, owing to a stringent regulatory framework adopted by REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) has seen a steady decline in the use of conventional or synthetic crop protection chemicals.

Although the European market is dominated by Western Europe, which accounted for over 70% of the total market, growth from this region is expected to be little slow in the near future. Germany, France, Italy, and U.K. are the largest consumers of crop protection chemicals, accounting for over 50% of the total demand in Western Europe.

The European market for crop protection chemicals, in terms of active ingredient volume was estimated at 639.4 KT in 2011 and is expected to reach 741.9.5 KT by 2018. Growth in revenue is expected to be higher than volume, owing to the increasing cost of pesticides. Development and registration of a pesticide active ingredient is one of the biggest components of cost for a pesticide company. Presently, the cost of innovation and registration of an active ingredient is about $200 million, which is a 25% increase from 2000.

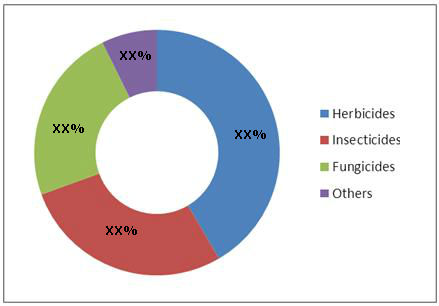

EUROPEAN CROP PROTECTION CHEMICALS MARKET REVENUE, BY TYPES, 2012

Source: MarketsandMarkets Analysis

The European crop protection chemicals market is facing saturation in demand, owing to a strong push for organic farming and reduction of synthetic pesticides. Also, demand in the European Union is particularly poor owing to the strict regulatory framework adopted by REACH. Since 2006, REACH has been constantly reviewing all registered and commercialized active ingredients, which has resulted in the ban of high-usage pesticides such as atrazine.

Table Of Contents

1 Introduction (Page No. - 12)

1.1 Key Take-Aways

1.2 Report Description

1.3 Research Methodology

1.3.1 Market Size

1.3.2 Key Data Points Taken From Secondary Sources

1.3.3 Key Data Points Taken From Primary Sources

1.3.4 Assumptions Made For This Report

1.4 Stake Holders

1.5 Key Questions Answered

2 Executive Summary (Page No. - 18)

3 Market Overview (Page No. - 20)

3.1 Introduction

3.1.1 Types Of Pesticides On The Basis Of Mode Of Action

3.1.1.1 Contact Pesticides

3.1.1.2 Residual Pesticides

3.1.1.3 Systemic Pesticides

3.2 Value Chain Analysis

3.3 Winning Imperatives

3.3.1 Successful Introduction Of Pesticides Coming Off-Patents

3.4 Burning Issues

3.4.1 Battle Of Patented Vs Generic Pesticides

3.4.2 Ban On Endosulfan

3.5 Drivers

3.5.1 Crop Protection Key To Food Security Of Ever Growing Population Of The World

3.5.2 Change In Farming Practices & Technology

3.5.3 Shrinking Arable Land

3.5.4 Growing Demand For Crop Protection Chemicals In South &Central America

3.6 Restraints

3.6.1 Use Of Bacillus Thuringiensis (BT), Genetically Modified Seeds/Crops & Advancement In Biotechnology

3.6.2 Growing Environmental Concerns

3.7 Opportunities

3.7.1 Rapid Growth In The Bio-Pesticides Market

3.8 Porters Five Force Analysis

3.8.1 Bargaining Power Of Suppliers

3.8.2 Bargaining Power Of Buyers

3.8.3 Threat Of New Entrants

3.8.4 Threat Of Substitutes

3.8.5 Degree Of Competition

3.9 Patent Analysis

3.9.1 Patent Trends In Europe, 2009 2013

4 European Crop Protection Chemicals Market By Types (Page No. - 48)

4.1 Pesticides

4.2 Synthetic Pesticides

4.3 Europe

4.3.1 Herbicides

4.3.1.1 Glyphosate

4.3.1.2 Atrazine

4.3.1.3 Acetochlor

4.3.1.4 2,4-D

4.3.1.4.1 Metolachlor

4.3.1.4.2 Imazethapyr

4.3.2 Insecticides

4.3.2.1 Chlorpyrifos

4.3.2.2 Malathion

4.3.2.3 Pyrethrins & Pyrethroids

4.3.2.3.1 Types Of Pyrethroids

4.3.2.3.1.1 Bifenthrin

4.3.2.3.1.2 Cypermethrin

4.3.2.3.1.3 Deltamethrin

4.3.2.3.1.4 Lambda-Cyhalothrin

4.3.2.3.1.5 Permethrin

4.3.2.3.1.6 Resmethrin

4.3.2.3.1.7 Tetramethrin

4.3.2.3.1.8 Tralomethrin

4.3.2.4 Carbaryl

4.3.2.5 Others

4.3.2.5.1 Diazinon

4.3.2.5.2 Terbufos

4.3.2.5.3 Methoxychlor

4.3.3 Fungicides

4.3.3.1 Mancozeb

4.3.3.2 Chlorothalonil

4.3.3.3 Metalaxyl

4.3.3.4 Strobilurin

4.4 Biopesticides

4.4.1 Pros & Cons Of Biopesticide

4.5 Adjuvants

5 European Crop Protection Chemicals Market,By Crop Types (Page No. - 92)

5.1 Introduction

5.2 Cereals & Grains

5.3 Oilseeds

5.4 Fruits & Vegetables

5.5 Others

6 Europe Crop Protection Chemicals Market,By Countries (Page No. - 99)

6.1 Germany

6.2 France

6.3 U.K.

7 Competitive Landscape (Page No. - 112)

7.1 Introduction

7.2 New Product Launches: Most Preferred Strategic Approach

7.3 Maximum Developments In 2011

7.4 Syngenta & BASF: Most Active Companies

8 Company Profiles Overview, Financials, Products & Services, Strategy, And Developments)* (Page No. - 145)

8.1 BASF

8.2 Bayer Cropscience AG

8.3 Cheminova AS

8.4 Chemtura Corporation

8.5 Cleary Chemical Corporation

8.6 Isagro SPA

8.7 Syngenta AG

*Details On Overview, Financials, Product & Services, Strategy, And Developments Might Not Be Captured In Case Of Unlisted Companies.

Appendix (Page No. - 194)

Europe Patents

List Of Tables (60 Tables)

Table 1 Types Of Pesticides

Table 2 Active Substances The Patents Of Which Will Expire Between, 2013 2017

Table 3 Endosulfan & Alternatives Cost Comparison,By Products ($)

Table 4 Europe: Agricultural & Arable Land,2007 2011 (Million Hectares)

Table 5 Technology Penetration, By Revenue, 2001 2010

Table 6 GM Crops & Bio-Pesticides: Substitution Potential Of Synthetic Pesticides In Various Crops

Table 7 Major Pesticides & Crops

Table 8 Europe: Crop Protection Chemicals Market Revenue, By Types, 2011 2018 ($Million)

Table 9 Europe: Crop Protection Chemicals Market Volume, By Types, 2011 2018 (KT)

Table 10 Global Glyphosate Market, By Volume (KT) & By Revenue ($Million), 2009 2016

Table 11 Global Atrazine Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 12 Global Acetochlor Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 13 Global 2,4-D Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 14 Global Other Herbicides Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 15 Global Chlorpyrifos Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 16 Global Malathion Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 17 Global Pyrethrins & Pyrethroids Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 18 Global Carbaryl Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 19 Other Insecticides Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 20 Global Mancozeb Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 21 Global Chlorothalonil Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 22 Global Metalaxyl Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 23 Global Strobilurin Market, By Volume (KT) & By Revenue ($Million), 2011 2018

Table 24 New Biopesticide Active Ingredients Approved In 2012

Table 25 Upcoming Biopesticide Active Ingredients, 2012 2013

Table 26 Pros & Cons Of Biopesticide Active Ingredients In Comparison With Conventional Pesticides

Table 27 Europe: Biopesticides Market Revenues, By Countries,2011 2018 ($Million)

Table 28 Adjuvants: Types & Features

Table 29 Popular Oilseeds & Applications

Table 30 Germany: Crop Protection Chemicals Market Revenue,By Types, 2011 2018 ($Million)

Table 31 Germany: Crop Protection Chemicals Market Volume,By Types, 2011 2018 (KT)

Table 32 Germany: Crop Protection Chemicals Market Revenue,By Crop Types, 2011 2018 ($Million)

Table 33 Germany: Crop Protection Chemicals Market Revenue,By Crop Types, 2011 2018 (KT)

Table 34 France: Crop Protection Chemicals Market Revenue, By Types, 2011 2018 ($Million)

Table 35 France: Crop Protection Chemicals Market Volume, By Types, 2011 2018 (KT)

Table 36 France: Crop Protection Chemicals Market Revenue, By Crop Types, 2011 2018 ($Million)

Table 37 France: Crop Protection Chemicals Market Revenue, By Crop Types, 2011 2018 (KT)

Table 38 U.K.: Crop Protection Chemicals Market Revenue, By Types, 2011 2018 ($Million)

Table 39 U.K.: Crop Protection Chemicals Market Volume, By Types, 2011 2018 (KT)

Table 40 U.K.: Crop Protection Chemicals Market Revenue, By Crop Types, 2011 2018 ($Million)

Table 41 U.K.: Crop Protection Chemicals Market Revenue, By Crop Types, 2011 2018 (KT)

Table 42 Merger & Acquisition, 2009 2013

Table 43 Agreements, Partnerships, Collaborations & Joint Ventures, 2009 2013

Table 44 New Product Launches, January 2009 2013

Table 45 Investment, Expansion & Other Developments, 2009 2013

Table 46 BASF: Total Revenue, By Business Segments,2011 2012 ($Million)

Table 47 BASF SE: Agricultural Solutions Business Segment Revenue, 2010 2011 ($Million)

Table 48 BASF SE: Intermediates Business Division Revenue,By Geography, 2010 2011 ($Million)

Table 49 Bayer: Total Revenue, By Business Segments,2011 2012 ($Million)

Table 50 Bayer: Total Revenue, By Geography, 2011 2012 ($Million)

Table 51 Bayer: Crop Protection/Seeds Segment Revenue,2011 2012 ($Million)

Table 52 Auriga Industries A/S : Total Revenue, By Business Segments, 2011 2012 ($Million)

Table 53 Auriga Industries A/S : Total Revenue, By Geography,2011 2012 ($Million)

Table 54 Cheminova: Crop Protection Chemicals

Table 55 Chemtura: Total Revenue, By Business Segments,2011 2012 ($Million)

Table 56 Chemtura: Total Revenue, By Geography,2011 2012 ($Million)

Table 57 Isagro: Total Revenue, By Segments, 2011 2012 ($Million)

Table 58 Syngenta: Total Revenue, By Business Segments,2011 2012 ($Million)

Table 59 Syngenta: Crop Protection Segment Revenue,2011 2012 ($Million)

Table 60 Syngenta: Crop Protection Business Segment Revenue,By Geography, 2011 2012 ($Million)

List Of Figures (19 Figures)

Figure 1 Research Methodology

Figure 2 Europe: Crop Protection Chemicals Market Revenue,By Types, 2012

Figure 3 Value Chain Analysis Of Crop Protection Chemicals Market

Figure 4 Sales Of Active Ingredients Coming Off-Patents, By Types, 2012 ($Million)

Figure 5 Impact Of Major Drivers And Restrains On Global Crop Protection Chemicals Market, 2011 2018

Figure 6 Arableland, 1950 2020 (Hectares/Person)

Figure 7 Arable Land, By Countries (Hectares/Person)

Figure 8 Porters Five Force Analysis

Figure 9 Patent Trends In Europe, 2009 2013

Figure 10 Patent Analysis, By Companies, 2009 2013

Figure 11 Global Crop Protection Chemicals Market Volume,By Types, 2012

Figure 12 Europe: Adjuvants Market Revenue, By Geography,2011 2018 ($Million)

Figure 13 Europe Crop Protection Chemical Market By Crop Type,2012 ($Million)

Figure 14 Major Cereals & Grains Production In Europe,2011 (000 Tons)

Figure 15 Major Oilseed Production In Europe, 2011, ( 000 Tons)

Figure 16 Major Fruits And Vegetables Production In Europe,2011 (000) Tons

Figure 17 Europe: Crop Protection Chemicals Market, By Growth Strategies, 2009 2013

Figure 18 Europe: Crop Protection Chemicals Market Developments,By Growth Strategies, 2009 2013

Figure 19 Europe: Crop Protection Chemicals Market Growth Strategies, By Companies, 2009 2013

Growth opportunities and latent adjacency in European Crop Protection Chemicals Market