Epigenetic Drugs & Diagnostics Market - Global Forecast to 2030

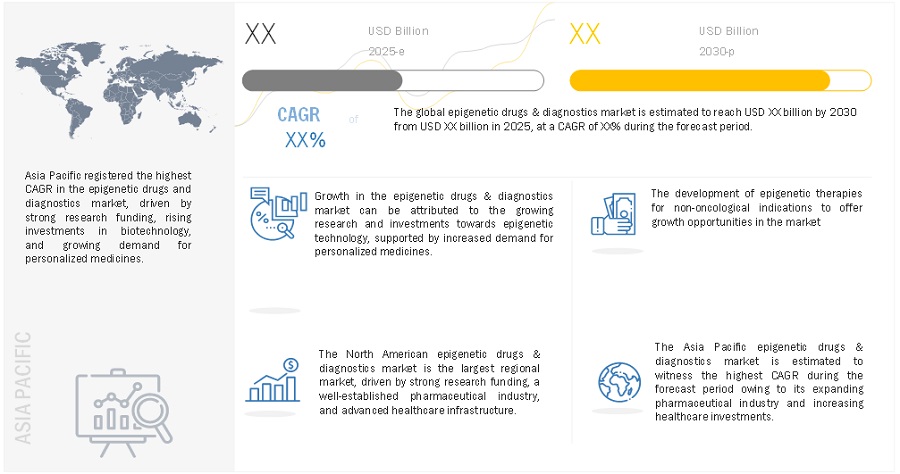

The epigenetic drugs and diagnostics market includes treatments and diagnostic tools that target changes in gene expression without altering DNA sequences. This market covers DNA methylation inhibitors (e.g., azacitidine, decitabine), histone deacetylase (HDAC) inhibitors (e.g., vorinostat, romidepsin), and other emerging therapies used in cancer, neurological disorders, and autoimmune diseases. Increasing R&D investments, a focus on precision medicine, and growing funding are key factors driving market growth. Advances in next-generation sequencing (NGS) and biomarker-based diagnostics are also improving disease detection and personalized treatment approaches. There are opportunities in developing new epigenetic drugs that target enzymes like SETD2 (EZH2), LSD1, and BET proteins, expanding treatment options beyond cancer. However, market growth is limited by the off-target effects of epigenetic drugs, as their complex mechanisms are not yet fully understood. Despite these challenges, ongoing research and technological progress continue to advance this field.

Epigenetic Drugs & Diagnostics Market- Global Forecast to 2030

Global Epigenetics Drugs & Diagnostics Market Dynamics

Driver: Increasing research & investments supported by rising focus on precision medicines to drive growth

Increasing investments in epigenetics research, driven by the demand for personalized medicine, are key factors supporting the growth of the epigenetic drugs and diagnostics market. Initiatives such as the November 2024, partnership of Oxford Nanopore Technologies with UK Biobank aim to improve disease detection and treatment through large-scale epigenomic mapping. This project, sequencing 50,000 participant samples, will help identify key methylation markers linked to various diseases. Similarly, in January 2025, researchers at the Johns Hopkins Kimmel Cancer Center and the Chinese Academy of Sciences explored a potential epigenetic therapy for colorectal cancer by targeting the UHRF1 protein using mRNA-based lipid nanoparticle technology.

Moreover, companies like Chroma Medicine are also advancing the field, securing USD 135 million in Series B financing to develop single-dose epigenetic editing therapies. Additionally, studies on DNA methyltransferase inhibitors (DNMTis) and EZH2 inhibitors (EZH2is) suggest that combining these therapies can improve treatment response in solid tumors by modifying the epigenomic landscape. Institutions like the University of Texas MD Anderson Cancer Center publish a high volume of studies relating to epigenetic therapies. Key research areas include drug resistance, immunotherapy, and combination therapies, emphasizing the need for optimized treatment strategies. With ongoing funding, research advancements, and new therapeutic approaches, the epigenetics market is expected to grow further.

Challenge: Limited understanding of epigenetic mechanism and off-target effects of epigenetic drugs, a major challenge to adoption

A key challenge in the epigenetic drugs and diagnostics market is the limited understanding of epigenetic mechanisms. There are gaps in knowledge about DNA and RNA modifications, reader domains, and protein interactions, making it difficult to identify effective drug targets. More research is needed to understand how these modifications influence diseases and treatment responses. Another challenge is the off-target effects of epigenetic drugs. Many of these drugs lack specificity and affect multiple enzymes, which can cause unintended side effects. To improve safety and effectiveness, precise drug delivery is essential. Advanced delivery systems like lipid nanoparticles are being explored to enhance targeting. Overcoming these challenges will require further research, better drug design, and improved delivery technologies.

Recent Developments in the Epigenetic Drugs and Diagnostics Market:

- In January 2025, Tune Therapeutics raised USD 175 million in a Series B funding round to advance epigenetic editing therapies, which modify gene expression without DNA alteration. The therapy aims to silence viral DNA, preventing further virus production.

- In January 2024, MoonWalk Biosciences, raised USD 57 million in seed and Series A funding from Alpha Wave Ventures, ARCH Venture Partners, Future Ventures, GV, Khosla Ventures, and YK Bioventures. The funding will support the advancement of Moonwalk’s epigenetic profiling and engineering platform and its therapeutic pipeline. The company aims to develop precision epigenetic medicines by targeting the epigenetic code.

- In January 2024, Novo Nordisk entered into a partnership with Omega Therapeutics to develop novel treatments for cardiometabolic diseases. Omega’s epigenomic controller technology will enhance thermogenesis and metabolic activity for obesity management.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Epigenetic Drugs & Diagnostics Market

Growth opportunities and latent adjacency in Epigenetic Drugs & Diagnostics Market