EPA and DHA Supplements Market by Product Type (Eicosapentaenoic Acid, and Docosahexaenoic Acid), Sources (Fish Oil, Algae Oil, Krill Oil, And Other Sources), Application (Infant Formula, Dietary Supplements, Fortified Food & Beverages, Pharmaceuticals, Pet & Animal Feed, and Other Applications), and Region - Global Forecast to 2029

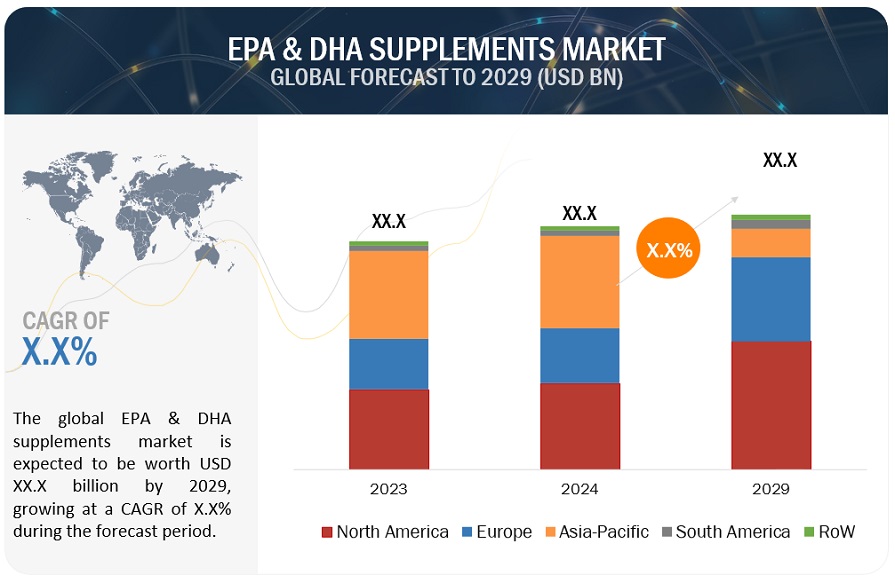

The global EPA and DHA supplements market growth is on a trajectory of significant expansion, with an estimated value projected to reach USD XX.X billion by 2029 from the 2024 valuation of USD XX.X billion, displaying a promising Compound Annual Growth Rate (CAGR) of X.X%. The rapidly growing EPA and DHA supplement market is attributed to the increasing awareness of health benefits from these omega-3 fatty acids. These are crucial for cardiovascular health, cognitive functions, and fetal development. There has been an increasing awareness of the natural way to prevent chronic diseases; thus, people want supplements which support heart health, brain function, and general well-being. There is a growing interest in plant-based diets, which has directed the attention toward algal-derived EPA and DHA supplements appealing to the vegetarian and vegan consumers who want to avoid fish-based products.

More health benefits, including reduced inflammation and enhanced mental health by EPA and DHA, are fueling the growth of the market. Easy access via channels of direct-to-consumer sales through e-commerce has made these supplements easily available. As more and more people realize the significance of omega-3s, the market is growing rapidly.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers: Health benefits of EPA and DHA is driving the market

The major drivers of the EPA and DHA market are linked to health consciousness regarding benefits to fetal and infant development. DHA significantly impacts the maturation process both for the brain and eyes, with significant depositions occurring during the last trimester of pregnancy and within the first two years of life according to the National Center for Biotechnology Information's September 2021 report. This makes the maternal DHA intake important because newborns cannot produce sufficient amounts of DHA independently. It, therefore, translates into impaired development aspects, including cognition, hand-eye coordination, and problem-solving skills. Moreover, EPA is notable for conferring cardiovascular advantages through the reduction of triglycerides as well as improved heart health. Supplementation of n-3 long-chain polyunsaturated fatty acids also reduces the risk of preterm birth and allergies. All these contribute towards the necessity for EPA and DHA supplementation in pregnancy.

Restraints: Increased regulation in fish catching hinders EPA and DHA supplements market

Main restrain facing the EPA and DHA supplement market includes sustainability and environmental impact. According to a report by Oceana in November 2023, the decision taken by over 20 countries and the European Union to ban bottom fishing in the Cabliers Bank area summarises the continuous pressure put on ensuring that the fishing practices are sustainable. It is a vital area for marine biodiversity since it is the only growing cold-water reef in the Mediterranean and serves as an abode for young fish.

Another threat on the part of China's inland seafood production is the reported decrease of 33% on inland water catch with the Yangtze River fishing ban, according to the State of World Fisheries and Aquaculture 2022 article. Other issues also exist pertaining to forced labor on seafood. The above hindrances show that ethical sourcing and responsible production are needed to attain supply security in the context of marine ecosystems protection in the EPA and DHA supplements market.

Opportunities: Growing demand for EPA and DHA supplements in aquafeed

Omega-3s, especially EPA and DHA, play a significant role in promoting the health and development of farmed fish in aquaculture. According to Aqua Culture Asia Pacific, March 2023 article, the omega-3s were found to be very significant for the physiologic aspect of the fish concerning stress tolerance, susceptibility to potential disease, and general well-being of the fish. It has been established that over-accumulation of omega-3s in fish leads to the storage of excess fat in the fish's body or disruption in tissue integrity. In any case, the omega-3s also represent quality of the fish products, not just in relation to the nutritional needs of the humans but also in terms of the efficiency of aquaculture production. Optimizing the use of omega-3s in aquafeeds can greatly reduce waste, improve the utilization of by-products, and lead towards a more sustainable aquaculture industry as demand for sustainable seafood increases.

Challenges: Government regulation in the EPA and DHA supplements hinders market growth

Challenges associated with the EPA and DHA supplement market include regulatory limits and safety issues. According to the FDA, up to 3 grams per day is safe for the consumption of omega-3 fatty acids, while not more than 2 grams should come from dietary supplements. Upwards of these may expose consumers to some form of risk, especially those who are under anticoagulant drugs since DHA increases the risk of bleeding.

Health Canada has outlined a minimum effective intake of 1.5 grams of EPA and DHA daily to significantly reduce the levels of triglyceride in blood, yet it also raises concerns regarding the safety in food products of long-chain fatty acids. For example, Health Canada mandates very strict evidence for safety and for nutritional adequacy for infant formulas containing DHA; this is another layer of regulation. In addition, safety issues aside, these regulatory hurdles have continued to discourage the market of the EPA and DHA supplements.

Market Ecosystem

FISH OIL segment accounted for A HIGHER market SHARE among SOURCE SEGMENT in 2023.

Fish oil accounts for a relatively larger part of the EPA and DHA supplement market than algae oil and krill oil. This is attributed to better bioavailability, an economical offering, and extensive historical research proving the product offers health advantages. Companies specializing in high-quality fish oil products include the Nordic Naturals (US), Omega Protein (US) and GC Rieber VivoMega AS (Norway), which derives primarily from fatty fish like salmon, mackerel, and sardines. These fish are good sources of Omega-3 fatty acids, an essential component for the prevention and maintenance of heart health and regulation of inflammation.

According to a report published by the National Library of Medicine in July 2023, Omega-3 to omega-6 is about 1:20 in industrial countries and largely resulted from increased consumption of high amounts of omega-3 through foods. The report also states that Omega-3 PUFAs are the most prescribed supplements, further leading to dominance in the market for fish oil.

THE DIETARY SUPPLEMENTS SEGMENT IS PROJECTED TO BE THE dominant DURING THE FORECAST PERIOD IN BY APPLICATION SEGMENT.

Dietary supplements are considered the largest market share in the EPA and DHA supplement market as there is a rising life expectancy accompanied by an increasingly prevalent aged-related non-communicable diseases (NCDs) rate. Older patients are indeed those often suffering from multi-morbidities; therefore, good nutrition intervention, including EPA and DHA, plays an essential role in achieving good clinical outcomes and low cost of healthcare services. These long-chain omega-3 polyunsaturated fatty acids have the potential to reduce inflammation, a key factor in the cause of most NCDs, making such factors key in prevention and treatment.

According to a published research report by the National Library of Medicine in September 2020, omega-3 fatty acids are special for older adults as they help in retaining muscle mass and function, preserve immune function, and may improve quality of life while reducing healthcare services-related expenses.

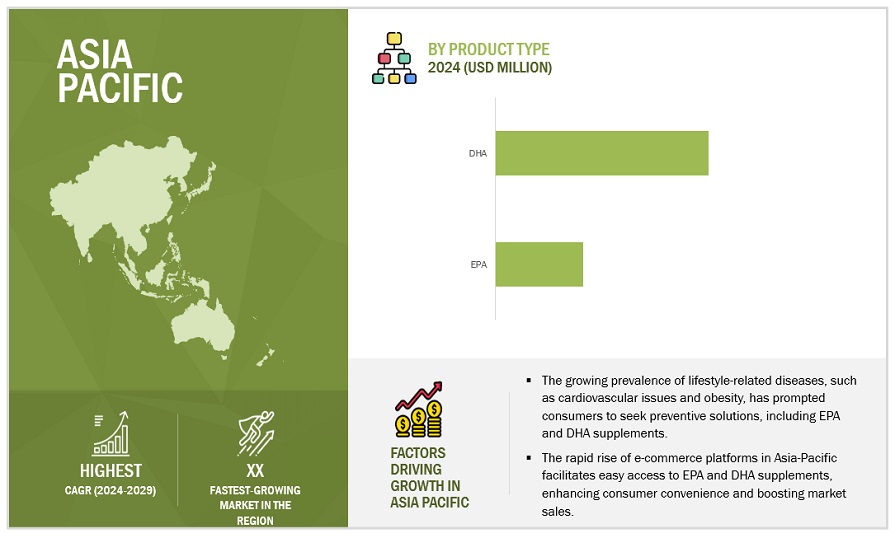

ASIA PACIFIC REGION IS EXPECTED TO DOMINATE FOR EPA AND DHA SUPPLEMENTS MARKET AMONG THE REGIONS.

Asia Pacific is the largest market for EPA and DHA supplements. The immediate cause of this growth in the Asia Pacific region is increased consumer awareness of health benefits as well as increasing demand for functional foods. Some companies that are significantly contributing to this growth curve are HUATAI Biopharm Resource Co.Ltd (Taiwan), KinOmega Biopharm (China), and Golden Omega Biotech (China) while Arjuna Natural (India).

Nu-Mega Ingredients-a subsidiary of Clover Corporations headquartered in Australia, offers ultra-high EPA and DHA microencapsulated powders for sectors such as Foods for Special Medical Purpose (FSMP), sports nutrition, and general nutraceuticals. According to an article published in November 2021 by Clover Corporation, these innovative powders will enable food manufacturers to increase the content of Omega-3 fatty acids without compromising the taste, therefore attracting strong interest from companies active in immunity-boosting products and vegan-growing markets. Increased demand for nutrient-rich formulations thus solidifies its status as the region most prominent in the global EPA and DHA market.

Key Market Players

The key players in this market include Nordic Naturals (US), BASF (Germany), dsm-firmenich (Switzerland), Croda International Plc (UK), Clover Corporation Limited (Australia), KD Pharma Group SA (Switzerland), Novotech Nutraceuticals, Inc. (US), Omega Protein Corporation (US), Corbion (Netherlands), and COPEINCA SAC (Peru).

Recent Developments

- In July 2024, KD Pharma Group SA (Switzerland) launched KD LabServices, an independent omega-3 testing laboratory offering accurate lipid analysis under cGMP conditions. This permitted KD Pharma to further strengthen its hold on the EPA and DHA supplements market with reliable high-precision analytical services that amplified the industry's reliability and established best standards in the overall quality of omega-3 products and compliance.

- In July 2024, Clover Corporation diversified its operations by opening a new fish oil extraction plant in Ecuador-a key fishing port. This addition of vertical integration would help Clover source high-quality fish oil consistently, thereby decreasing the supply chain risk and improving company production efficiency-a strategic step forward for Clover in the market for EPA and DHA supplements.

- In March 2024, dsm-firmenich (Switzerland) partnered with SCN BestCo in developing high-load omega-3 gummies using life'sOMEGA O33-P100, an algal-based powder for an omega-3. The cooperation helped dsm-firmenich establish a strong position in the EPA and DHA supplements market by providing innovative higher-dosage omega-3 solutions combined with improved sensory properties.

Frequently Asked Questions (FAQ):

What is the current size of the EPA and DHA supplements market?

The EPA and DHA supplements market forecast is estimated at USD XX.X billion in 2024 and is projected to reach USD XX.X billion by 2029, at a CAGR of X.X% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

EPA and DHA supplements market players include Nordic Naturals (US), BASF (Germany), dsm-firmenich (Switzerland), Croda International Plc (UK), Clover Corporation Limited (Australia), KD Pharma Group SA (Switzerland), Novotech Nutraceuticals, Inc. (US), Omega Protein Corporation (US), Corbion (Netherlands), and COPEINCA SAC (Peru). These companies boast reliable EPA and DHA Supplements facilities alongside robust distribution networks spanning crucial regions. They possess a well-established portfolio of esteemed services, commanding a sturdy market presence supported by sound business strategies. Additionally, they hold substantial market share, offer services with versatile applications, cater to a diverse geographical clientele, and maintain an extensive service range.

Which region is projected to account for the largest share of the EPA and DHA Supplements market?

The Asia Pacific holds a largest market share in EPA and DHA as consumer awareness of health and rising demand for dietary supplements continue, combined with growing prevalence of heart disease conditions in China, Japan, and India.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What are the growth prospects for the EPA and DHA supplements market in the next five years?

With a high demand for omega-3 supplements from health-conscious consumers and increased awareness of cardiovascular benefits, the EPA and DHA market is expected to increase enormously over the next five years. The applications of EPA and DHA are also likely to expand into functional foods. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in EPA and DHA Supplements Market