Enterprise SSD Market by Type (Server Attached, Storage Attached), Interface Type (SATA, SAS, PCIe), By Form Factor (U.2, M.2, EDSFF), Technology (Single-level Cell, Multi-level Cell, Triple-level Cell), Storage, Application, Enterprise Size, and Region – Global Forecast 2030

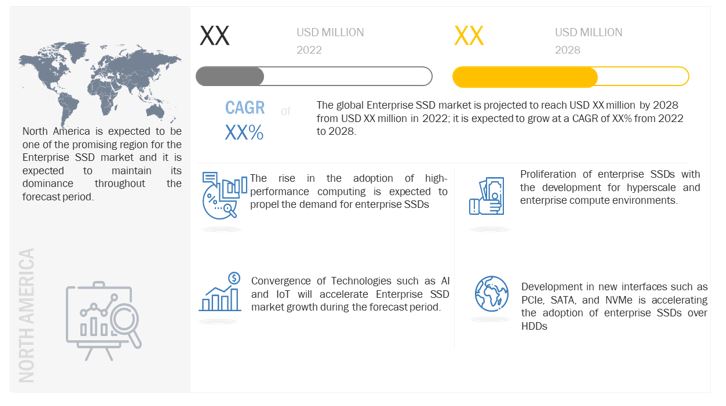

The Enterprise SSD market is projected to grow from USD xx million in 2024 to USD xx million by 2030; it is expected to grow at a CAGR of xx% from 2024 to 2030. The growth of the Enterprise SSD market is driven by its high-power efficiency, supercomputing, and high throughput capabilities. Surging high-end cloud computing, scaling data centers, and replacement of HDDs with SSDs are creating market opportunities for Enterprise SSDs across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

By Type, Storage Attached Enterprise SSD segment is projected to grow at higher rate in the market from 2022 to 2028

Storage Attached SSDs are externally connected to storage arrays. Storage attached SSDs reside between each storage cluster and the host. These SSDs are used to decrease the retrieval time of data stored in storage arrays. Storage-attached SSDs market growth is attributed to usefulness in applications such as intensive searching and mining of data bases, Internet and networking, video applications, and others. Moreover, it offers high performance at low power consumption.

High Performance Computing Segment is stipulated to witness high growth rate

In recent times, with the emergence of cloud computing, the demand for high performance computing storage has been rapidly increasing. Large amounts of processing power are offered to areas such as engineering, research, and think-tank applications via high-performance computing (HPC). The performance of the high-performance computing environment increases when information and computational tasking exchange information more quickly. Moreover, the acceleration of IoT adoption in enterprises and the convergence various technologies, such as artificial intelligence (AI), machine learning (ML), Natural language processing NPL, and blockchain are expected to shape the growth of HPC segment.

North America region is expected to hold largest share in the market during the projected period

North America has been in forefront in evolution and development of the memory storage market since decades as it is the hub of most major players such as Western Digital Technologies, Inc., Micron Technology, Inc., and Microchip Technology Inc. It is anticipated to maintain its dominance in coming years as well majorly owing to the shift from traditional HDDs to SSDs. Enterprises in the region are increasing their spending on IT infrastructure to gain competitive edge and enhance their business productivity, which in turn, is driving the market share in the region.

Key Players in the Market

The key players operating in the Enterprise SSD market are SAMSUNG (South Korea), Western Digital Technologies, Inc. (US), KIOXIA Holdings Corporation (Japan), Micron Technology, Inc. (US), SK HYNIX INC. (South Korea), and Microchip Technology Inc. (US) among others.

- In August 2022, Samsung unveiled an array of next-gen flash memory solutions - Petabyte Storage, Memory-semantic SSD, and two enterprise SSDs.

- In July 2022, Kioxia announced the availability of KIOXIA CM7 Series SSDs in new EDSFF E3.S and Industry Standard 2.5-Inch Form Factors.

- In April 2022, SK Hynix launched new enterprise solid-state drive (SSD) that uses 128-layer NAND flashes. The new SSD operates on PCIe 4 interface and comes in 1TB, 2TB and 4TB.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 Introduction

1.1. Study Objective

1.2. Definition

1.3. Study Scope

1.4. Stakeholders

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Driver

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Trends

5.3.1. Technology Trend

5.3.2. Market Trend

5.3.3. Industry Trend

5.4. Value Chain Analysis

5.5. Ecosystem

5.6. Trends/Disruptions Impacting Customer’ Business

5.7. Porter’s Five Forces Analysis

5.8. Pricing Analysis

5.9. ASP of Key Players, by Type

5.10. Case Study Analysis

5.11. Trade Analysis

5.12. Patent Analysis

5.13. Key Conferences & events in 2022-23

5.14. Market Standards & Regulations

5.15. Key Stakeholders & Buying Criteria

5.16. Regulatory Bodies, Government Agencies & Other Organizations

6 Global Enterprise SSD Market, By Type

6.1. Introduction

6.2. Server Attached

6.3. Storage Attached

7 Global Enterprise SSD Market, By Interface Type

7.1. Introduction

7.2. SATA

7.3. SAS

7.4. PCIe

8 Global Enterprise SSD Market, By Technology

8.1. Introduction

8.2. Single-level Cell

8.3. Multi-level Cell

8.4. Triple-level Cell

9 Global Enterprise SSD Market, By Storage

9.1. Introduction

9.2. Below 500 GB

9.3. 1TB to 3 TB

9.4. Above 3 TB

10 Global Enterprise SSD Market, By Application

10.1. Introduction

10.2. High Performance Computing

10.3. Datacenter Servers

11 Global Enterprise SSD Market, By Enterprise Size

11.1. Introduction

11.2. Small & Medium Enterprises

11.3. Large Enterprises

12 Global Enterprise SSD Market, By Region

12.1. Introduction

12.2. North America

12.2.1. US

12.2.2. Canada

12.2.3. Mexico

12.3. Europe

12.3.1. UK

12.3.2. Germany

12.3.3. France

12.3.4. Rest of Europe

12.4. APAC

12.4.1. China

12.4.2. Japan

12.4.3. South Korea

12.4.4. Rest of the APAC

12.5. RoW

12.5.1. Middle East

12.5.2. Africa

12.5.3. South America

13 Competitive Landscape

13.1. Introduction

13.2. Key Player Strategies/Right to Win

13.3. Top 5 Company Revenue Analysis

13.4. Market Share Analysis (2021)

13.5. Company Evaluation Quadrant

13.6. SME Quadrant

13.7. Company Footprint

13.8. Startup Matrix

13.9. Competitive Benchmarking

13.10. Competitive Scenario

13.10.1. Deals - Joint Venture, Partnership, and M&A

13.10.2. Product Launch and Development

14 Company Profiles

14.1. Key Players

14.1.1. SAMSUNG

14.1.2. Western Digital Technologies, Inc.

14.1.3. KIOXIA Holdings Corporation

14.1.4. Micron Technology, Inc.

14.1.5. SK HYNIX INC.

14.1.6. Microchip Technology Inc.

14.1.7. ROHM CO., LTD.

14.1.8. Renesas Electronics Corporation

14.1.9. STMicroelectronics

14.1.10. Infineon Technologies AG

14.1.11. Nantero, Inc.

14.1.12. Crossbar Inc.

14.1.13. Winbond

14.1.14. Everspin Technologies

14.2. Other Players

14.2.1. Fujitsu

14.2.2. Viking Technology

14.2.3. NVMdurance

14.2.4. Avalanche Technology

14.2.5. SMART Modular Technologies

14.2.6. YMTC

14.2.7. Flexxon Pte Ltd

15 Appendix

Growth opportunities and latent adjacency in Enterprise SSD Market