Enterprise Imaging Software Market - Global Forecast 2030

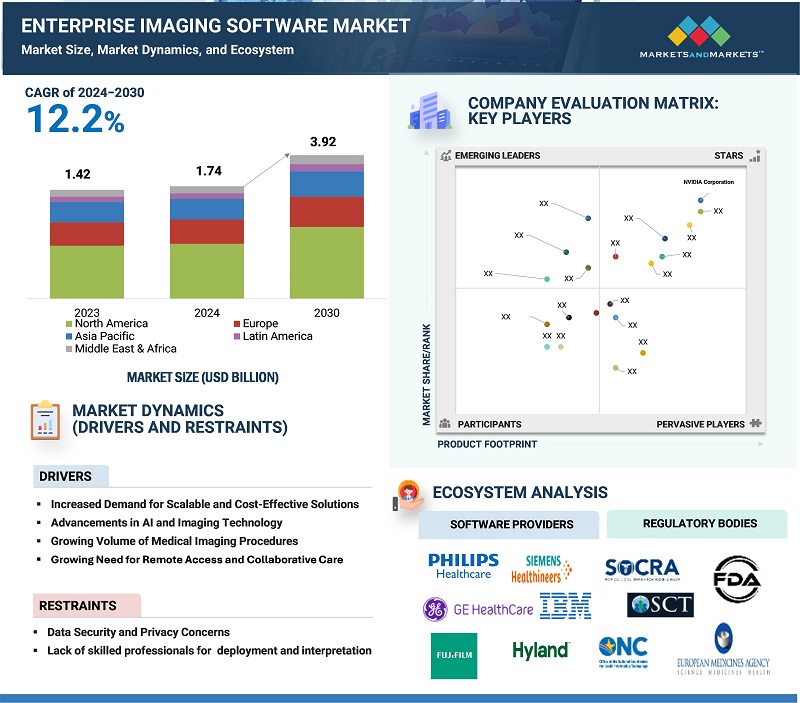

The global enterprise imaging software market, valued at US$1.42 billion in 2023, is forecasted to grow at a robust CAGR of 12.2%, reaching US$1.74 billion in 2024 and an impressive US$3.92 billion by 2030. The healthcare industry is undergoing a shift from fragmented, department-specific imaging systems to enterprise-wide imaging platforms. The need for an integrated system that facilitates holistic patient management, seamless data exchange, and offers cross-departmental association is a major factor driving the market growth. Enterprise imaging software helps healthcare providers retrieve and share imaging data from cardiology, radiology, oncology, pathology, and other specialties, advancing clinical decision-management and patient outcomes.

Global Enterprise Imaging Software Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Global Enterprise Imaging Software Market Dynamics

Driver: Growing Volume of Medical Imaging Procedures

The increasing prevalence of major chronic diseases including neurological conditions, cardiovascular diseases and cancer remains as a significant global burden which drive the need for advanced diagnostic imaging procedures. Further, the significant increase in diagnostic tests using X-rays, CT scans, MRI, PET scans, and ultrasound imaging generates an enormous volume of imaging data. This large amount of data remains difficult for storing and retrieving by traditional systems. Hence, to address such challenges, advance solution such as enterprise imaging software are launched which provide scalable storage, efficient retrieval, and enhance image management systems. As imaging procedures become more frequent in hospitals, diagnostic centers, and ambulatory surgical centers, the demand for enterprise imaging software is expected to grow substantially.

For instance, in November 2024, Konica Minolta Healthcare Americas, Inc. launched Exa Enterprise, a scalable imaging solution powered by AWS HealthImaging. Designed for hospitals and imaging centers, it features integrated PACS/RIS, VNA, AI-powered workflow, and advanced visualization. The platform ensures fast data access, strong cybersecurity, and third-party integration, addressing the rising demand for efficient imaging storage amid increasing diagnostic procedures.

Restraint: Data Security and Privacy Concerns

Data security and privacy are major factors hindering the growth of the market due to the consolidation of sensitive patient records from several medical departments into a unified system. This process increases the chances of illegal access into one's records, ransomware, and cyberattacks, making healthcare system prime targets for hackers. Moreover, cybersecurity threats interrupt patient care, disrupt healthcare operations, and further add to additional operational costs. Regulatory bodies such as General Data Protection and Health Insurance Portability and Accountability Act reign strict compliance to safeguard patient records and data and organization which fail to comply with these regulations are bound to face damage to their reputation, loss in patients trust, along with substantial fines.

Although cloud-based solutions provide remote access and scalability, but they also result in introduction of new weaknesses. For instance, if providers fail to realize the shared responsibility model with cloud service providers. Interoperability requirements add to the complexity, as enterprise imaging systems must integrate with electronic health records (EHRs), radiology information systems (RIS), and third-party tools, exposing imaging data to more external risks. Furthermore, most of the time, employees or IT staff unintentionally misconfigure servers, share unencrypted files, or compromise passwords resulting in insider threats or a human error which persist as the leading security risks.

Thus, addressing these challenges remain as a major concern hampering the market growth.

Opportunity: Growth of Vendor-Neutral Archives (VNA) and Interoperability in Enterprise Imaging Software

The growth of Vendor-Neutral Archives (VNA) and interoperability in enterprise imaging software represents a lucrative opportunity for imaging centers, healthcare providers, and software providers. The adoption of vendor-neutral, interoperable platforms is increasing as healthcare organizations are striving to streamline the exchange of imaging data across departments, facilities, and health networks. The traditional picture archiving and communication systems (PACS) are often department-specific and vendor-dependent, making cross-departmental data sharing complex and costly. In contrast, VNAs consolidate imaging data from multiple sources, allowing healthcare providers to store, manage, and access images through a single, centralized repository. This shift is driving demand for VNA-integrated enterprise imaging software, offering opportunities for market growth and technological innovation.

For instance, in March 2022, the launch of Intelerad's Enterprise Imaging and Informatics Suite at HIMSS 2022. This platform creates a vendor-neutral information hub that enables healthcare providers to manage and exchange imaging data across the healthcare ecosystem. The suite incorporates multiple software components, including Clario SmartWorklist, IntelePACS, Enterprise VNA, Ambra Image Exchange, and others, supporting seamless integration with third-party health IT systems like Electronic Health Records (EHRs) and Radiology Information Systems (RIS). This development underscores the growing need for vendor-neutral solutions that support interoperability and streamline the flow of imaging data across healthcare networks.

Challenge: Limited Adoption of Enterprise Imaging Software in Developing Regions

The restricted budgets in healthcare, inadequate IT infrastructure, and lack of trained staff in developing regions hamper the adoption of enterprise imaging software. High implementation costs and insufficient funding prevent hospitals from investing in modern imaging platforms. Many facilities lack strong internet connectivity, cloud storage, and cybersecurity measures required for enterprise imaging.

Another restricting factor is the shortage of skilled healthcare professionals and IT experts qualified to manage and maintain advanced software system, affecting the adoption process and increasing the dependence on external consultants, adding to the overall cost of implementation.

Moreover, less awareness and education among healthcare providers about the full capabilities and benefits of enterprise imaging software in some of the developing regions is the key factor hindering the market growth. Therefore, various healthcare facility depend on manual paper-based record systems or department-specific PACS for the management of the patient imaging data, limiting the incorporation and availability of imaging information across various healthcare sectors.

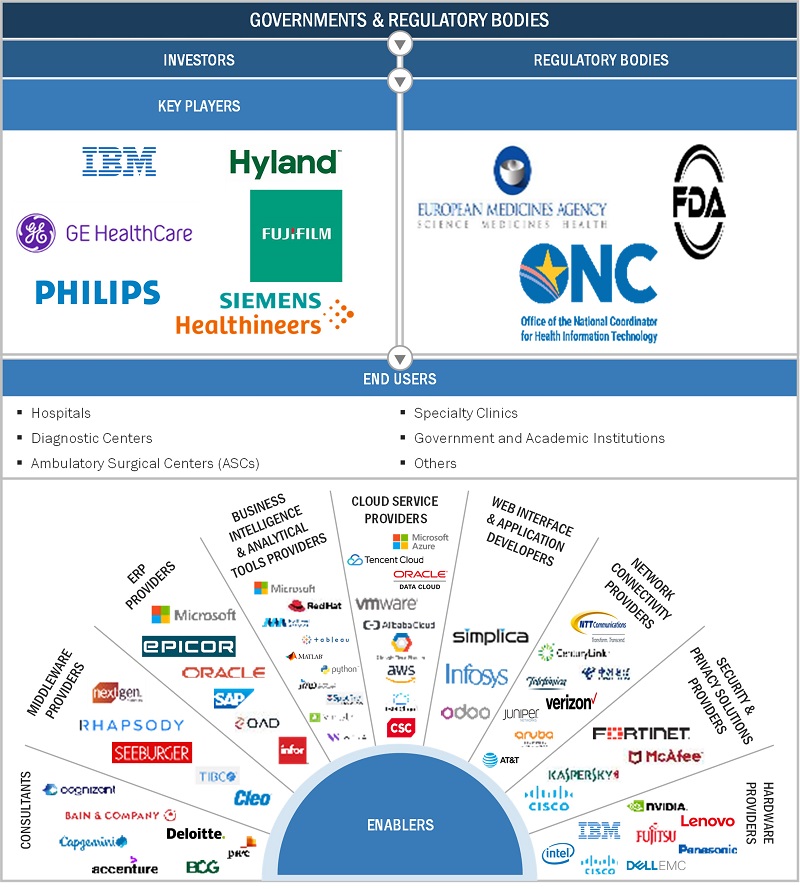

Global Enterprise Imaging Software Market Ecosystem Analysis

The “Enterprise Imaging Software Market Ecosystem” is a comprehensive framework that provide seamless imaging data management across healthcare systems by connecting several stakeholders, cutting-edge technologies, and regulatory guidelines/standards. Major functions such as storage, retrieval, and analysis of medical imaging data from various clinical departments, such as oncology, cardiology, radiology and pathology are facilitated by this ecosystem. The objective is to establish a unified, vendor-neutral environment for healthcare providers to develop clinical decision-making, lower operational costs, and improve patient outcomes. Below is a detailed analysis of the key components, stakeholders, and technological factors that shape the enterprise imaging software market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

By type, the picture archiving and communication system (PACS) model accounted for the largest share of the market for enterprise imaging software in 2023.

Based on type, the market for enterprise imaging software is segmented into vendor neutral archive (VNA), picture archiving and communication system (PACS), image exchange, and universal viewer. The picture archiving and communication system (PACS) segment holds the largest market share in the enterprise imaging software market.

PACS offers centralized system to healthcare providers for storing, retrieving, managing, and distributing medical images. PACS has ability to handle diverse imaging modalities, including X-rays, CT scans, MRIs, and ultrasound images due to which it is widely adopted across hospitals, diagnostic imaging centers, and healthcare networks. It plays a critical role in enhancing clinical efficiency and supporting rapid diagnostic decision-making. The dominance of PACS can be attributed to its well-established infrastructure, comprehensive image management capabilities, and regulatory compliance with standards like DICOM and HIPAA.

Additionally, the increasing demand for interoperability with EHRs and the ability to scale with growing imaging volumes has further solidified PACS' leadership position in the market. While Vendor Neutral Archives (VNA), image exchange platforms, and universal viewers are becoming more prominent due to their support for cross-departmental collaboration and data sharing, PACS remains the preferred choice due to its familiarity, widespread use, and efficiency in managing departmental imaging workflows.

By imaging modality, the MRI segment accounted for the largest share of the market for enterprise imaging software in 2023.

Based on imaging modality, the market for enterprise imaging software is segmented X-ray, magnetic resonance imaging (MRI), computed tomography (CT), ultrasound, mammography, and others. The MRI segment holds the largest market share in the enterprise imaging software market due to high volume of MRI scans, advanced imaging requirements, and integration with AI.

The pathology application is set to register the highest CAGR during the forecast period.

Based on application, the market for enterprise imaging software is segmented into radiology, cardiology, pathology, oncology, orthopedics, and others. The pathology segment registered the highest growth rate during the forecast period. This growth is fueled by the inclination toward digital pathology, the incorporation of AI-driven analytics, advancements in multiple technological, and the rising need for remote data access. These developments are transforming pathology systems, expanding diagnostic accuracy, and aiding faster and enhanced clinical decision-making. Below are some of the key drivers of growth for the pathology segment. For instance, in November 2023, Merge by Merative partnered with Indica Labs to integrate AI-powered digital pathology into the Merge Imaging Suite. This partnership enables seamless access to HALO AP tools for primary diagnosis, AI-driven decision support, and clinical trial management.

By deployment, the cloud-based model accounted for the largest share of the market for enterprise imaging software in 2023.

Based on deployment, the market for enterprise imaging software is segmented into cloud-based and on-premise models. In 2023, cloud-based deployment dominated the enterprise imaging software market due to its significant advantages over on-premise systems. Cloud platforms provide strong security measures aligned with healthcare regulations like HIPAA and GDPR, lowering data breach risks.

Cloud-based solutions offer scalability, flexibility and a affordable "pay-as-you-go" strategy model, lowering upfront infrastructure costs, making innovative imaging solutions available to small facilities and centers in healthcare sectors. These solutions support collaborative care, telehealth, and teleradiology by enabling remote access to imaging data.

For instance, in November 2023, Philips launched HealthSuite Imaging, a cloud-based next-generation PACS at RSNA 2023. Powered by AWS, the platform offers AI-enabled workflow orchestration, remote access for diagnostic reading, and integrated reporting, enabling faster, more efficient image management. With over 80 healthcare sites in the U.S. and Latin America already migrated, Philips aims to deliver AI-driven clinical workflows and reduce IT management burdens.

As healthcare organizations seek more secure, cost-effective, and scalable solutions, cloud-based deployment has become the preferred choice for enterprise imaging software.

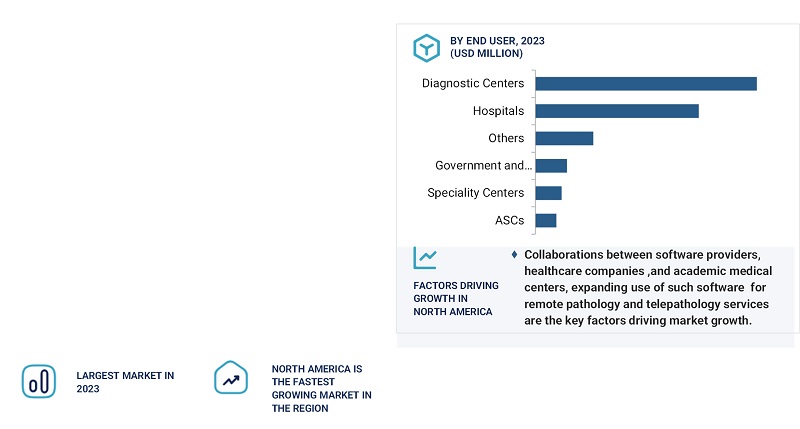

The diagnostic imaging centers is set to register the highest CAGR during the forecast period.

Based on end-user, the market for enterprise imaging software is segmented into hospitals, diagnostic centers, ambulatory surgical centers (ASCs), specialty clinics, government and academic institutions, and others. The diagnostic imaging centers segment registered the highest growth rate during the forecast period. This growth is driven by the increasing utilization of diagnostic imaging, a rise in patient imaging volumes, and the availability of advanced technologies in these centers. Moreover, after COVID, the increased awareness regarding health and related diseases across the world led to significant surge in the advanced diagnostic imaging software, driving the market growth.

Favorable reimbursement policies are also expected to boost the adoption and usage of enterprise imaging solutions in diagnostic imaging centers. These factors collectively contribute to the segment's rapid expansion within the enterprise imaging software market.

North America accounted for the largest share of the market for enterprise imaging software market in 2023.

In 2023, North America dominated the enterprise imaging software market due to key factors such as development of advanced healthcare infrastructure with predominant adoption of advanced and pioneering imaging technologies and major investments in healthcare IT. The region has robust regulatory structure, including HIPAA compliance that promote healthcare providers to adopt the technology by ensuring high data security and interoperability standards.

Further, North America is hub for major players such as GE Healthcare, Konica Minolta, Philips, and AGFA HealthCare which further ensured the region's dominance.

Moreover, the need for AI tools such as EHR - integrated imaging platforms and cloud-based VNAs is speeding up the implementation of imaging software in the US and Canada. For instance, in July 2024, AGFA HealthCare, in collaboration with Corista DP3, launched Enterprise Imaging for Pathology in North America. The platform enables whole slide imaging (WSI), real-time collaboration, and seamless EHR integration, driving efficiency and enhancing diagnostic workflows for pathologists.

Key Market Players

- IBM

- GE HealthCare

- Change Healthcare

- Hyland Software, Inc.

- Merative

- Pure Storage, Inc.

- Agfa-Gevaert Group

- Dicom Systems, Inc.

- Canon Medical Informatics, Inc.

- IMEXHS

- FUJIFILM Holdings America Corporation

- Apollo Enterprise Imaging Corp.

- Koninklijke Philips N.V.

- PaxeraHealth

- Siemens Healthcare GmbH

- Visage Imaging, Inc.

- Sectra AB

- Mach7 Technologies

- Intelerad Medical Systems

- ScImage

- Novarad Corporation

Recent Developments in the Enterprise Imaging Software Market:

- In June 2024, Mach7 Technologies launched its Enterprise Imaging Solution at SIIM24, featuring the enhanced eUnity Enterprise Viewer and Vendor Neutral Archive (VNA). The platform aims to unify patient data, streamline workflows, and improve healthcare synergy.

- In July 2024, Proscia introduced an advanced version of Concentriq AP, featuring multi-AI workflows for pathology. The update enables simultaneous analysis of breast, colon, gastric, lung, and prostate images, supporting global lab digitization and AI-powered precision medicine.

- In November 2023, InsiteOne announced the acquisition of BRIT Systems, integrating its RIS, PACS, and VNA solutions into InsiteOne's portfolio. The move aims to enhance radiology workflows and offer multi-tenant imaging platforms to healthcare providers.

- In March 2022, Philips launched HealthSuite Interoperability, a cloud-enabled health IT platform, and expanded Performance Analytics for cardiology, enhancing efficiency, interoperability, and clinical decision support. These innovations are part of Philips' strategy to offer a comprehensive, scalable data management system for healthcare providers.

- In March 2022, FUJIFILM showcased its Synapse Enterprise Imaging Portfolio, featuring Radiology PACS, Cardiology PACS, and VNA, all recognized at the 2022 Best In KLAS Show. These solutions enable healthcare providers to unify imaging workflows and improve patient care through cross-departmental collaboration and faster access to images.

- In September 2022, Intelerad acquired Life Image, creating one of the largest interoperable image exchange networks and promoting seamless image-sharing across healthcare systems. This move enhances cross-institutional imaging access, supporting multi-site collaboration and enabling healthcare providers to deliver more effective patient care.

- In January 2023, Bayer acquired Blackford Analysis to strengthen its capabilities in AI-driven medical imaging. The acquisition aims to accelerate the adoption of AI-powered clinical decision support tools, supporting faster, more accurate diagnoses and enabling precision healthcare. This strategic move aligns with Bayer's focus on personalized medicine and enhanced diagnostic workflows.

Frequently Asked Questions (FAQ):

1. Who are the major market players covered in the report?

The key players in the enterprise imaging software market include IBM, GE HealthCare, and Canon Medical Informatics, Inc.

2. Define the market for enterprise imaging software.

The enterprise imaging software encompasses robust systems designed to handle the management, storage, retrieval, and analysis of medical imaging data within healthcare organizations. These platforms consolidate imaging data from multiple specialties such as radiology, cardiology, pathology, and dermatology into a single, centralized framework. Their primary objectives are to foster collaboration, enhance diagnostic precision, optimize workflow efficiency, and provide seamless access to imaging information across the organization.

3. Which region is projected to account for the largest market share for enterprise imaging software?

The enterprise imaging software market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is projected to account for the largest share of the market for enterprise imaging software during the forecast period.

4. Which end-user segments have been included in the enterprise imaging software market report?

The report contains the following end-user segments:

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Government and Academic Institutions

- Others

5. How big is the global enterprise imaging software market today?

The global enterprise imaging software market is projected to grow from USD 1.74 billion in 2024 to USD 3.92 billion by 2030, at a CAGR of 12.2%.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Enterprise Imaging Software Market