Enterprise Architecture Tools Market by Component (Solutions and Services (Managed Services and Professional Services)), Deployment Type, Organization Size, Vertical (BFSI, IT, Manufacturing), and Region - Global Forecast to 2026

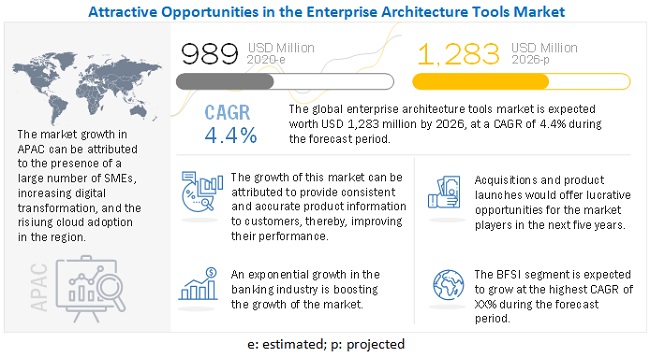

The global enterprise architecture tools market in terms of revenue was estimated to be worth $989 million in 2020 and is poised to reach $1,283 million by 2026, growing at a CAGR of 4.4% from 2020 to 2026. Key factors that are expected to drive the growth of the market are the increasing adoption of the business-driven enterprise architecture approach for strategic business transformation and the increasing need to align enterprise information technology architecture with business strategy. However, increasing data theft activities and data security concerns are expected to limit market growth. Apart from drivers and restraints, there are a few lucrative opportunities for enterprise architecture tool providers. Adding big data capabilities to enterprise architecture tools and an increasing need to adopt application rationalization practices are some of the opportunities for vendors in the enterprise architecture tools market. These opportunities are expected to present new market growth prospects for enterprise architecture tool vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

Enterprise Architecture Tools Market Dynamics

Driver: Increasing adoption of a business-driven enterprise architecture approach for strategic business transformation

Enterprise architecture provides an overall picture of an entire IT strategy. It helps in optimizing long-term decision-making and also guides in selecting the best deployment option out of multiple existing routes. A business-driven enterprise architecture approach can help address completely different actions that are important for an organization, indicating which one is the best to follow. To stay competitive in a new business and economic environment, organizations require new strategies and practices.

A business-driven enterprise architecture approach also results in saving time and working on pipeline projects more quickly. Enterprises are focusing on their business needs in order to align the business needs with the IT department as a whole and manage the application portfolio efficiently in order to advance the organisation as a whole. Hence, the increasing adoption of a business-driven enterprise architecture approach for strategic business transformation is expected to act as a driver for the global enterprise architecture tools market.

Restraint: Increasing data thief activities and data security concerns

Enterprise architecture tools have access to enterprise data, which is stored in databases. This data contains decade-old information about an enterprise and also helps in modelling business architecture. Given the importance of data, attackers will target access to the data. For instance, the 2017 Equifax data breach in which the personal details of 143 million customers were leaked along with the credit card data of 209,000 customers.

It is a top priority of an enterprise architecture tool to secure the data. It needs to be focused on the way the data is stored, accessed, and used. Regulations, such as the General Data Protection Regulation (GDPR) and the Electronic Communications Privacy Act (ECPA), also hold the enterprise architecture tool market accountable for data privacy. Enterprises are sensitive when it comes to data sharing and accessibility. Therefore, enterprise architecture tool providers need to maintain the highest level of privacy and security. Cybersecurity is one of the most important factors for smooth business operations. In recent times, there has been a huge rise in the number of data breaches and cyberattacks. Cyberattacks increased by 600% from 2016 to 2017. Hence, increasing data theft activities and data security concerns are expected to restrain the growth of the global enterprise architecture tools market.

Opportunity: Adding big data capabilities to enterprise architecture tools

Big data is impacting the way organizations understand and make use of the growing volume, velocity, variety, and value of enterprise data. Companies are taking steps to analyse and utilise the disparate data they have in order to accelerate and increase their focus on initiatives that help drive and grow the company. The enterprise architecture tools using big data capabilities would help the business target the right market activities and fine-tune marketing, sales, and business operations, resulting in business transformation and a maximum return on investment. Big data can assist architects in following ideas where the outcome is unclear. Organizations expect enterprise architecture tools to enable them to react and respond where needed in order to capitalise on opportunities as they arise. Hence, adding big data capabilities to enterprise architecture tools will offer ample opportunities for enterprise architecture tool providers.

Challenge: High cost and lack of technical expertise

The cost of a license for enterprise architecture tools is determined by the modules and features chosen, as well as the number of users. The users are generally categorised into power users, content contributors, and content consumers. It is a complex pricing mechanism that results in higher licence fees. Due to the high cost of enterprise architecture tools, SMEs cannot afford these tools. As a result, many users limit their use of enterprise architecture tools. Furthermore, the lack of technical expertise will result in the underutilization of all the features and applications of the tools for business planning and the implantation of strategies. Hence, high costs and a lack of technical expertise are expected to challenge enterprise architecture tool providers.

During the forecast period, the solutions segment will have a larger share of the enterprise architecture tools market.

The solution enables the creation of a systematic reporting functionality model, which helps improve the coherence or alignment of the entities on it. This again will result in complexity reduction, standardization, vendor independence, and cost reduction. Due to the benefits offered by enterprise architecture tool solutions, their demand across verticals is expected to increase during the forecast period. Application architecture solutions enable organisations to understand the mapping and collation of their software applications as part of their overall enterprise architecture. The solution also offers the effectiveness of the applications' interactions with each other to meet business or user requirements. An application architecture helps ensure that applications are scalable and reliable and assists enterprises in identifying gaps in functionality.

On-premises deployment type to hold a larger size of enterprise architecture tools market

On-premises delivery models involve the installation and operation of software or solutions on the customer's own server and computing infrastructure. The cost of installing on-premises solutions is included in the capital expenditures (CAPEX) of companies. This approach is mostly adopted for applications that involve the processing of sensitive and confidential data. Nowadays, every organisation generates vast amounts of data due to the use of machine learning, IT devices, sensors, clickstreams, and many other devices. The on-premises deployment type enables organisations to ingest data into their own databases, thereby maintaining data security.

Large enterprises to hold a majority of the share for enterprise architecture tools market during the forecast period

Large enterprises have a large corporate network and many revenue streams. Large enterprises are keen to invest in the latest technologies to effectively run their businesses. The enterprise architecture tools market has a stronghold in large enterprises, as IT infrastructure in large enterprises becomes more complex than in SMEs. The existing system integration with advanced enterprise architecture tools is a challenge faced by large enterprises, which now can be easily resolved due to the robust integration, training, and support services provided by enterprise architecture tool providers.

Telecommunications industry vertical to hold a significant share of the enterprise architecture tools market during the forecast period

Digital transformation is a must to survive in a globally connected and competitive environment. Telecommunications companies are investing in new technologies, such as smart computing products, IoT, cloud computing, mobility, and analytics, to gain efficiency, innovate, and attract consumers. The introduction of 5G technology in the near future is expected to further put pressure on players to handle their businesses efficiently. This vertical faces challenges in maintaining IP copyrights, and it deals with cross-border data privacy and security challenges by regulators and anti-trust inquiries. Over the past few years, leading telecommunications companies have been adopting new strategies for effective management of their IT architecture to attain maximum value and have proper maintenance of their architecture through integrations to enhance their business performance. To deliver maximum value, the transformation of the enterprise architecture of telecommunications companies is essential, but it is a difficult task that takes multi-year efforts.

To know about the assumptions considered for the study, download the pdf brochure

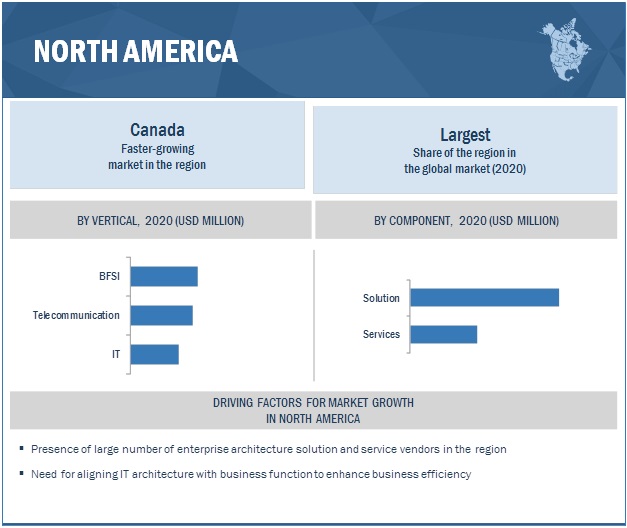

North America accounted for the largest share of the enterprise architecture tools market during the forecast period.

The market is segmented into five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, the Middle East and Africa (MEA), and Latin America. North America is expected to be the most promising region for major verticals such as IT, BFSI, and telecommunications. The enterprise architecture tools market size in North America is expected to grow steadily during the forecast period. North America is further segmented into the US and Canada. The US is expected to be one of the major revenue contributors towards the growth of the market in North America. Canada is also expected to present significant growth opportunities for providers of enterprise architecture solutions and services.

The enterprise architecture tools vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering enterprise architecture tools solutions and services globally are Software AG (Germany), Avolution (Australia), BiZZdesign (Netherlands), MEGA International (France), BOC Group (US), Orbus Software (UK), QualiWare (Denmark), Leanix (Germany), erwin (US), Sparx Systems (Australia), ValueBlue (Netherlands), UNICOM Global (US), Clausmark (Germany), Enterprise Architecture Solutions (UK), Planview (US), MonoFor (US), Valispace (Portugal), FIOS Insight (US), Aplas (Australia), NinjaRMM (US), CodeLogic (US), BetterCloud (US), Ardoq (Norway), Facility Planning Arts (US), and Keboola (US).

The study includes an in-depth competitive analysis of key players in the enterprise architecture tools market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Enterprise Architecture Tools Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$989 million |

|

Estimated Value by 2026 |

$1,283 million |

|

Growth Rate |

Poised to grow at a CAGR of 4.4% |

|

Segments covered |

Component (Solutions & Services), Deployment Type, Organization Size, Vertical, and Region |

|

Market Driver |

Increasing adoption of business-driven enterprise architecture approach for strategic business transformation |

|

Market Opportunity |

Adding big data capabilities to enterprise architecture tools |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

This research report categorizes the enterprise architecture tools market based on component, deployment type, organization size, vertical, and region.

Based on the component

-

Solutions

- Infrastructure Architecture

- Application Architecture

- Data Architecture

- Security Architecture

- Others

-

Services

- Managed Services

- Professional

Based on the deployment type

- On-premises

- Cloud

Based on the organization size

- Large Enterprises

- SMEs

Based on the vertical

- BFSI

- Consumer Goods and Retail

- Telecommunication

- IT

- Manufacturing

- Healthcare and Life Sciences

- Others

Based on the region

-

North America

- US

- Canada

-

Europe

- UK

- Rest of Europe

-

APAC

- China

- Rest of APAC

-

MEA

- UAE

- Rest of MEA

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In January 2021, erwin acquired Quest Software, the aim of this acquisition is to add new capabilities to Quest Software, which may help drive significant data initiatives and the deployment of modern applications while ensuring regulatory compliance.

- In November 2020, BOC Group formed a partnership with ATD Solution, an APAC-based digital enterprise architecture consulting firm. The aim of the partnership is to expand BOC Group’s presence in the APAC and offer better enterprise architecture solutions in the region.

- In January 2020, Avolution added Multi-Factor Authentication (MFA) feature in its ABACUS solution. After MFA is enabled on ABACUS, the cloud account, a user can enroll an authentication application on a smartphone or by using the QR code presented during login.

Frequently Asked Questions (FAQs):

What is the projected market value of the global enterprise architecture tools market?

The global market of enterprise architecture tools is projected to reach USD 1,283 million.

What is the estimated growth rate (CAGR) of the global enterprise architecture tools market for the next five years?

The global enterprise architecture tools market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.4% from 2020 to 2026.

What are the major revenue pockets in the enterprise architecture tools market currently?

The market is segmented into five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, the Middle East and Africa (MEA), and Latin America. North America is expected to be the most promising region for major verticals such as IT, BFSI, and telecommunications. The enterprise architecture tools market size in North America is expected to grow steadily during the forecast period. North America is further segmented into the US and Canada. The US is expected to be one of the major revenue contributors towards the growth of the market in North America.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 6 ENTERPRISE ARCHITECTURE TOOLS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.1 Key industry insights

2.1.2.2 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 ENTERPRISE ARCHITECTURE TOOLS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING ENTERPRISE ARCHITECTURE TOOLS SOLUTIONS AND SERVICES (1/2)

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING ENTERPRISE ARCHITECTURE TOOLS SOLUTIONS AND SERVICES (2/2)

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (BOTTOM-UP): REVENUE OF VENDORS FROM SOLUTIONS AND SERVICES

FIGURE 11 MARKET SIZE RESEARCH APPROACH 2: DEMAND-SIDE MARKET ESTIMATIONS THROUGH VERTICALS

2.4 MARKET REVENUE ESTIMATION

FIGURE 12 ILLUSTRATION OF COMPANY ENTERPRISE ARCHITECTURE TOOLS REVENUE ESTIMATION

2.5 GROWTH FORECAST ASSUMPTIONS

2.6 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.7 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.8 RESEARCH ASSUMPTIONS

TABLE 4 ASSUMPTIONS FOR THE STUDY

2.9 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 14 ON-PREMISES, LARGE ENTERPRISES, AND MANAGED SERVICES TO HOLD HIGH SHARES IN THE ENTERPRISE ARCHITECTURE TOOLS MARKET IN 2020

FIGURE 15 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST SHARE IN THE MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ENTERPRISE ARCHITECTURE TOOLS MARKET

FIGURE 16 INCREASING DEMAND FOR ENTERPRISE ARCHITECTURE TOOLS TO TACKLE HIGH DEMAND FROM BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY TO DRIVE THE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY VERTICAL AND COUNTRY

FIGURE 17 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT AND UNITED STATES TO ACCOUNT FOR HIGH SHARES IN THE NORTH AMERICAN MARKET IN 2020

4.3 ASIA PACIFIC: MARKET, BY COMPONENT AND COUNTRY

FIGURE 18 SOLUTIONS AND REST OF ASIA PACIFIC TO ACCOUNT FOR HIGH SHARES IN THE ASIA PACIFIC MARKET IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ENTERPRISE ARCHITECTURE TOOLS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of business-driven enterprise architecture approach for strategic business transformation

FIGURE 20 DIGITAL TECHNOLOGIES FOR SUCCESSFUL BUSINESS TRANSFORMATION

5.2.1.2 Increasing need to align enterprise information technology architecture with business strategy

5.2.2 RESTRAINTS

5.2.2.1 Increasing data thief activities and data security concerns

FIGURE 21 MALWARE INFECTION, 2009 TO 2018 (MILLION)

5.2.3 OPPORTUNITIES

5.2.3.1 Adding big data capabilities to enterprise architecture tools

5.2.3.2 Increasing need to adopt application rationalization practice

5.2.4 CHALLENGES

5.2.4.1 High cost and lack of technical expertise

5.2.4.2 Structuring the repository with usable information

5.3 INDUSTRY TRENDS

5.3.1 CASE STUDY ANALYSIS

5.3.1.1 Use Case 1: Banking, Financial Services, and Insurance

5.3.1.2 Use Case 2: Healthcare

5.3.1.3 Use Case 3: Information Technology

5.4 COVID-19 IMPACT: ENTERPRISE ARCHITECTURE TOOLS MARKET

FIGURE 22 PRE AND POST-COVID-19 SCENARIO DURING THE FORECAST PERIOD

5.4.1 ASSUMPTIONS: COVID-19 IMPACT ON THE MARKET

5.4.2 DRIVERS AND OPPORTUNITIES

5.4.3 RESTRAINTS AND CHALLENGES

5.5 PATENT ANALYSIS

FIGURE 23 NUMBER OF PATENTS PUBLISHED IN LAST 10 YEARS

FIGURE 24 TOP FIVE COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 5 TOP 10 APPLICANTS (US)

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PORTER’S FIVE FORCES ANALYSIS: ENTERPRISE ARCHITECTURE TOOLS MARKET

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS: MARKET

TABLE 7 ENTERPRISE ARCHITECTURE TOOLS MARKET: VALUE CHAIN

5.8 PRICING ANALYSIS

TABLE 8 PRICING ANALYSIS: MARKET

5.9 TECHNOLOGY ANALYSIS

5.9.1 CLOUD/SAAS

5.9.2 MACHINE LEARNING

5.9.3 INTERNET OF THINGS

5.10 REGULATORY LANDSCAPE

5.10.1 INTRODUCTION

5.10.2 GENERAL DATA PROTECTION REGULATION

5.10.3 ELECTRONIC COMMUNICATIONS PRIVACY ACT

5.10.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.10.5 DODD-FRANK WALL STREET REFORM AND CONSUMER PROTECTION ACT

5.10.6 CALIFORNIA CONSUMER PRIVACY ACT

5.10.7 SARBANES-OXLEY ACT OF 2002

5.10.8 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

5.10.9 PERSONAL DATA PROTECTION ACT

6 ENTERPRISE ARCHITECTURE TOOLS MARKET, BY COMPONENT (Page No. - 69)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 27 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 9 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 10 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 11 COMPONENTS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 COMPONENTS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2 SOLUTIONS

FIGURE 28 DATA ARCHITECTURE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 13 ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 14 MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 15 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 SOLUTIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.1 INFRASTRUCTURE ARCHITECTURE

TABLE 17 INFRASTRUCTURE ARCHITECTURE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 INFRASTRUCTURE ARCHITECTURE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.2 APPLICATION ARCHITECTURE

TABLE 19 APPLICATION ARCHITECTURE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 APPLICATION ARCHITECTURE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.3 DATA ARCHITECTURE

TABLE 21 DATA ARCHITECTURE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 DATA ARCHITECTURE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.4 SECURITY ARCHITECTURE

TABLE 23 SECURITY ARCHITECTURE: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 SECURITY ARCHITECTURE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.5 OTHERS

TABLE 25 OTHERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 OTHERS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

FIGURE 29 PROFESSIONAL SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 27 MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 28 MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

6.3.1 MANAGED SERVICES

TABLE 29 MANAGED SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 MANAGED SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

TABLE 31 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 ENTERPRISE ARCHITECTURE TOOLS MARKET, BY DEPLOYMENT TYPE (Page No. - 83)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

7.1.2 DEPLOYMENT: COVID-19 IMPACT

FIGURE 30 CLOUD SEGMENT TO GROW AT A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

TABLE 33 MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 34 MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

7.2 ON-PREMISES

TABLE 35 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 CLOUD

TABLE 37 CLOUD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 ENTERPRISE ARCHITECTURE TOOLS MARKET, BY ORGANIZATION SIZE (Page No. - 88)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 31 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 39 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 40 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 41 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 SMALL AND MEDIUM ENTERPRISES

TABLE 43 SMALL AND MEDIUM ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 SMALL AND MEDIUM ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 ENTERPRISE ARCHITECTURE TOOLS MARKET, BY VERTICAL (Page No. - 93)

9.1 INTRODUCTION

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

FIGURE 32 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 45 MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 46 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

9.2 INFORMATION TECHNOLOGY

TABLE 47 INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 48 INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 TELECOMMUNICATION

TABLE 49 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.4 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 51 BANKING, FINANCIAL SERVICES, AND INSURANCE: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 52 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.5 CONSUMER GOODS AND RETAIL

TABLE 53 CONSUMER GOODS AND RETAIL: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 54 CONSUMER GOODS AND RETAIL: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.6 MANUFACTURING

TABLE 55 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 56 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.7 HEALTHCARE AND LIFE SCIENCES

TABLE 57 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 58 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.8 OTHERS

TABLE 59 OTHERS VERTICAL: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 60 OTHERS VERTICAL: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 MARKET, BY REGION (Page No. - 104)

10.1 INTRODUCTION

FIGURE 33 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 61 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 62 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

TABLE 63 NORTH AMERICA: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.4 UNITED STATES

TABLE 77 UNITED STATES: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 78 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 79 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 80 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.2.5 CANADA

TABLE 81 CANADA: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 82 CANADA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 83 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 84 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 85 EUROPE: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 99 UNITED KINGDOM: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 100 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 101 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 102 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3.5 REST OF EUROPE

TABLE 103 REST OF EUROPE: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 104 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 105 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 106 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 107 ASIA PACIFIC: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.4 CHINA

TABLE 121 CHINA: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 122 CHINA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 123 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 124 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 125 REST OF ASIA PACIFIC: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 126 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 127 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 128 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 129 MIDDLE EAST AND AFRICA: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 136 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 137 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 138 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 139 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 140 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

TABLE 143 UNITED ARAB EMIRATES: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 144 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 145 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 146 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5.5 REST OF MIDDLE EAST AND AFRICA

TABLE 147 REST OF MIDDLE EAST AND AFRICA: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 148 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 149 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 150 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 151 LATIN AMERICA: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 156 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 157 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 158 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.6.4 BRAZIL

TABLE 165 BRAZIL: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 166 BRAZIL: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 167 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 168 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 169 REST OF LATIN AMERICA: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 170 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 171 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 172 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 148)

11.1 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK

11.2 MARKET RANKING

FIGURE 37 MARKET RANKING IN 2020

11.3 MARKET SHARE ANALYSIS

TABLE 173 ENTERPRISE ARCHITECTURE TOOLS MARKET: DEGREE OF COMPETITION

FIGURE 38 MARKET SHARE ANALYSIS OF COMPANIES IN THE MARKET

11.4 KEY MARKET DEVELOPMENTS

FIGURE 39 KEY DEVELOPMENTS IN THE MARKET FOR 2018–2021

11.4.1 NEW PRODUCT LAUNCHES

TABLE 174 MARKET: PRODUCT LAUNCHES, 2018-2021

11.4.2 DEALS

TABLE 175 MARKET: DEALS, 2018-2021

11.5 COMPANY EVALUATION MATRIX

TABLE 176 COMPANY PRODUCT FOOTPRINT

TABLE 177 COMPANY INDUSTRY FOOTPRINT

TABLE 178 COMPANY REGION FOOTPRINT

TABLE 179 COMPANY SOLUTION SCORE

11.5.1 STAR

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE

11.5.4 PARTICIPANTS

FIGURE 40 GLOBAL ENTERPRISE ARCHITECTURE TOOLS MARKET, COMPANY EVALUATION MATRIX

12 COMPANY PROFILES (Page No. - 160)

12.1 INTRODUCTION

(Business overview, Products offered, Recent developments & MnM View)*

12.2 MAJOR PLAYERS

12.2.1 SOFTWARE AG

TABLE 180 SOFTWARE AG: BUSINESS OVERVIEW

FIGURE 41 SOFTWARE AG: COMPANY SNAPSHOT

TABLE 181 SOFTWARE AG: PRODUCTS OFFERED

12.2.2 AVOLUTION

TABLE 182 AVOLUTION: BUSINESS OVERVIEW

TABLE 183 AVOLUTION: PRODUCTS OFFERED

12.2.3 BIZZDESIGN

TABLE 184 BIZZDESIGN: BUSINESS OVERVIEW

TABLE 185 BIZZDESIGN: PRODUCTS OFFERED

12.2.4 MEGA INTERNATIONAL

TABLE 186 MEGA INTERNATIONAL: BUSINESS OVERVIEW

TABLE 187 MEGA INTERNATIONAL: PRODUCTS OFFERED

12.2.5 BOC GROUP

TABLE 188 BOC GROUP: BUSINESS OVERVIEW

TABLE 189 BOC GROUP: PRODUCTS OFFERED

12.2.6 ORBUS SOFTWARE

TABLE 190 ORBUS SOFTWARE: BUSINESS OVERVIEW

TABLE 191 ORBUS SOFTWARE: PRODUCTS OFFERED

12.2.7 QUALIWARE

TABLE 192 QUALIWARE: BUSINESS OVERVIEW

TABLE 193 QUALIWARE: PRODUCTS OFFERED

12.2.8 LEANIX

TABLE 194 LEANIX: BUSINESS OVERVIEW

TABLE 195 LEANIX: PRODUCTS OFFERED

12.2.9 ERWIN

TABLE 196 ERWIN: BUSINESS OVERVIEW

TABLE 197 ERWIN: PRODUCTS OFFERED

12.2.10 SPARX SYSTEMS

TABLE 198 SPARX SYSTEMS: BUSINESS OVERVIEW

TABLE 199 SPARX SYSTEMS: PRODUCTS OFFERED

12.2.11 VALUEBLUE

12.2.12 UNICOM GLOBAL

12.2.13 CLAUSMARK

12.2.14 ENTERPRISE ARCHITECTURE SOLUTIONS

12.2.15 PLANVIEW

12.3 STARTUP/SME PLAYERS

12.3.1 MONOFOR

12.3.2 VALISPACE

12.3.3 FIOS INSIGHT

12.3.4 APLAS

12.3.5 NINJARMM

12.3.6 CODELOGIC

12.3.7 BETTERCLOUD

12.3.8 ARDOQ

12.3.9 FACILITY PLANNING ARTS

12.3.10 KEBOOLA

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKET (Page No. - 191)

13.1 INTRODUCTION

13.1.1 RELATED MARKET

13.1.2 LIMITATIONS

13.2 CLOUD ITSM MARKET

TABLE 200 CLOUD ITSM MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 201 CLOUD ITSM MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 202 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD ITSM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 203 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD ITSM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 204 TELECOMMUNICATIONS: CLOUD ITSM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 205 TELECOMMUNICATIONS: CLOUD ITSM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 206 IT AND ITES: CLOUD ITSM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 207 IT AND ITES: CLOUD ITSM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 208 GOVERNMENT AND PUBLIC SECTOR: CLOUD ITSM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 209 GOVERNMENT AND PUBLIC SECTOR: CLOUD ITSM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 210 RETAIL AND CONSUMER GOODS: CLOUD ITSM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 211 RETAIL AND CONSUMER GOODS: CLOUD ITSM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 212 MANUFACTURING: CLOUD ITSM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 213 MANUFACTURING: CLOUD ITSM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 214 ENERGY AND UTILITIES: CLOUD ITSM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 215 ENERGY AND UTILITIES: CLOUD ITSM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 216 MEDIA AND ENTERTAINMENT: CLOUD ITSM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 217 MEDIA AND ENTERTAINMENT: CLOUD ITSM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 218 HEALTHCARE AND LIFE SCIENCES: CLOUD ITSM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 219 HEALTHCARE AND LIFE SCIENCES: CLOUD ITSM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 220 OTHER VERTICALS: CLOUD ITSM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 221 OTHER VERTICALS: CLOUD ITSM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

14 APPENDIX (Page No. - 200)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

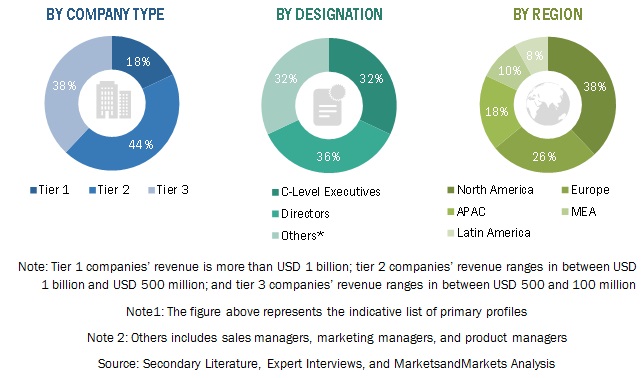

The study involved four major activities in estimating the current size of the global Enterprise architecture tools market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total enterprise architecture tools market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the enterprise architecture tools market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the enterprise architecture tools market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global enterprise architecture tools market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the enterprise architecture tools market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the enterprise architecture tools market based on components, verticals, organization size, deployment types, and regions

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the enterprise architecture tools market

- To analyze the impact of COVID-19 on components, verticals, organization size, deployment types, and regions across the globe

- To analyze the market with respect to individual growth trends, prospects, and contributions to the enterprise architecture tools market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the enterprise architecture tools market

- To profile key players in the enterprise architecture tools market and comprehensively analyze their core competencies in each microsegment

- To analyze key players based on pricing models, technology analysis, and their market shares

- To analyze competitive developments, such as new product launches, product enhancements, partnerships, and mergers and acquisitions, in the enterprise architecture tools market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enterprise Architecture Tools Market