Enterprise Application Integration Market by Deployment type(Hosted, On-Premise, Hybrid), Organization size(Small, Medium, Enterprises, Large Enterprises), Industry Verticals - Global Advancements, Worldwide Forecasts & Analysis (2014-2019)

[160 Pages Report] The enterprise application integration market in 2014 is estimated to be $7.85 billion. This market is expected to reach $13.35 billion by 2019, at a CAGR of 11.2% between 2014 and 2019.

In order to propel business activities, various technologies emerged out with the passage of time. For seamless business functions, it is important to link various data, applications, processes, and business partners. Hence, to achieve this various technologies have emerged out since past. Started from point to point integration, it has now reached to the adoption of Enterprise Service Bus (ESB) in which plethora of adapters and middleware involved within a single framework. It gained traction because of its ability to reduce IT complexity, and smoothen business functional areas such as SCM, CRM, business intelligence and analytics, e-commerce. The enterprise application integration market report is concentrated on the booming area of application integration and also focuses on technologies & standards and analyzes market drivers, restraints, trends and opportunities, along with a study on key players, and the competitive outlook. It focuses on estimating and forecasting the market potential of the major sub-segments of integration.

The enterprise application integration market is also segmented based on regions such as North America, Europe, Asia-Pacific (APAC), and Middle East and Africa (MEA), and Latin America. The market forecasts are provided for each region from 2014 to 2019. The market report profiles leading companies such as Fujitsu, Hewlett Packard, IBM, Microsoft, Mulesoft, Oracle, Redhat, SAP, Software AG, and TIBCO Software. Furthermore, the report gives detailed analysis on global trends and forecasts, competitive landscape, and analysis on Venture Capital (VC) and Mergers and Acquisitions (M&A) related to the market.

Scope of the Report

The enterprise application integration market is segmented based on deployment types, organization size, verticals and regions.

Based on deployment types, the market is segmented into the following three categories:

- On premise

- Hosted

- Hybrid

Based on organization size, the market is segmented into the following four categories:

- Small businesses

- Medium businesses

- Enterprises

- Large enterprises

Based on verticals, market is segmented into the following categories:

- Banking, financial services and insurance(BFSI)

- Business services

- IT and telecom

- Manufacturing

- Retail and wholesale

- Healthcare

- Government

- Other verticals( education, entertainment and media, power and utilities)

Based on regions, market is segmented into the following five categories:

- North America

- Europe

- Asia pacific

- Middle east and Africa (MEA)

- Latin America

With the proliferation of increasing volume of data, need to analyze, monitor, transform and interpretation of data is utmost required in order to facilitate various business operations. With the large number of software, complexities within the IT infrastructure increases, hence to avoid such convolution, enterprise application integration (EAI) was introduced to produce a cost effective solution for transforming various heterogeneous applications into a common and recognizable platform. In order to propel business activities, proper coordination with customers, suppliers and other business concerned people across the globe needed to be connected through real time information. For this, integration platform is required to link various enterprise systems with web and wireless applications.

In large enterprises, application integration has already upped the ante in global market by the adoption of latest integration technologies, whereas market for small and mid size companies still need cost effective tools for enjoying these time effective integration techniques and processes. Hybrid integration technologies gain major traction in the enterprise application integration market and is expected to gain momentum in future with the adoption of more cloud based technologies. Verticals such as business services and BFSI are the booming sectors with maximum market size whereas its use is expected to be more prominent in near times to come.

Need for cost reduction integration platforms, growing demand for real time data access, increasing data across enterprises, technological advancements and modern age business dynamics are the major drivers for EAI market.

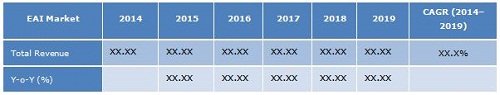

MarketsandMarkets forecasts Enterprise Application Integration market to grow from $7.85 billion in 2014 to $13.35 billion in 2019. This represents a compound annual growth rate (CAGR) of 11.2% from 2015 to 2019. The table given below highlights the overall market opportunity, in terms of absolute dollar value and year-on-year (Y-o-Y) growth.

Enterprise Application Integration Market Size, 2014 – 2019 ($Billion), Market Growth, 2015–2019 (Y-O-Y %)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives

1.2 Report Description

1.3 Markets Covered

1.4 Research Methodology

1.4.1 Secondary & Primary Research

1.4.2 Data Triangulation & Market Forecasting

1.5 Forecast Assumptions

2 Executive Summary (Page No. - 23)

2.1 Overall Market Size

3 Enterprise Application Integration Market Overview (Page No. - 25)

3.1 Market Definition

3.2 Market Segmentation

3.3 Market Evolution

3.4 Market Dynamics

3.4.1 Drivers

3.4.1.1 Need for Cost Reduction

3.4.1.2 Increased Spending on Application Integration

3.4.1.3 Growing Demand for Real-Time Data Access

3.4.1.4 Increasing Data Across Enterprises

3.4.1.5 Technological Advancements and Modern-Age Business Dynamics

3.4.2 Restraints

3.4.2.1 Limited EAI Knowledge Or Resources Within Organizations

3.4.2.2 Absence of Governance Model to Conceptualize and Sustain EAI Projects

3.4.2.3 Challenges From Hosted Or Cloud-Based Integrations

3.4.3 Opportunities

3.4.3.1 Increasing Demand for Business-to-Business (B2B) Integration

3.4.3.2 Growing Integration Platform-As-A-Service (IPASS) Market

3.4.4 Time-Impact Analysis of Dynamics

3.5 Value Chain Analysis

3.5.1 Overview

4 Enterprise Application Integration Market Size & Forecast By Deployment Type (Page No. - 38)

4.1 Introduction

4.2 Hosted

4.2.1 Overview

4.2.2 Market Size & Forecast By Company Size

4.3 on-Premises

4.3.1 Overview

4.3.2 Market Size & Forecast By Company Size

4.4 Hybrid

4.4.1 Overview

4.4.2 Market Size & Forecast By Company Size

5 Enterprise Application Integration Market Size & Forecast Bycompany Size (Page No. - 48)

5.1 Introduction

5.2 Small Businesses

5.2.1 Overview

5.2.2 Market Size & Forecast By Vertical

5.2.3 Market Size & Forecast By Region

5.3 Medium Businesses

5.3.1 Overview

5.3.2 Market Size & Forecast By Vertical

5.3.3 Market Size & Forecast, By Region

5.4 Enterprises

5.4.1 Overview

5.4.2 Market Size & Forecast, By Vertical

5.4.3 Market Size & Forecast, By Region

5.5 Large Enterprises

5.5.1 Overview

5.5.2 Market Size & Forecast By Vertical

5.5.3 Market Size & Forecast ,By Region

6 Enterprise Application Integration Market Size & Forecast By Vertical (Page No. - 70)

6.1 Introduction

6.2 Banking, Financial Services, & Insurance (BFSI)

6.2.1 Overview

6.2.2 Market Size & Forecast By Deployment

6.3 Business Services

6.3.1 Overview

6.3.2 Market Size & Forecast, By Deployment

6.4 IT & Telecom

6.4.1 Overview

6.4.2 Market Size & Forecast By Deployment

6.5 Manufacturing

6.5.1 Overview

6.5.2 Market Size & Forecast By Deployment

6.6 Retail & Wholesale

6.6.1 Overview

6.6.2 Market Size & Forecast By Deployment

6.7 Healthcare

6.7.1 Overview

6.7.2 Market Size & Forecast By Deployment

6.8 Government

6.8.1 Overview

6.8.2 Market Size & Forecast By Deployment

6.9 Others Vertical

6.9.1 Overview

6.9.2 Market Size & Forecast By Deployment

7 Enterprise Application Integration Market Size & Forecast By Region (Page No. - 90)

7.1 Introduction

7.2 North America (NA)

7.2.1 Overview

7.2.2 Market Size & Forecast By Vertical

7.2.3 Market Size & Forecast By Deployment

7.3 Asia-Pacific (APAC)

7.3.1 Overview

7.3.2 Market Size & Forecast By Vertical

7.3.3 Market Size & Forecast By Deployment

7.4 Europe

7.4.1 Overview

7.4.2 Market Size & Forecast By Vertical

7.4.3 Market Size & Forecast By Deployment

7.5 Middle East & Africa (MEA)

7.5.1 Overview

7.5.2 Market Size & Forecast By Vertical

7.5.3 Market Size & Forecast By Deployment

7.6 Latin America (LA)

7.6.1 Overview

7.6.2 Market Size & Forecast By Vertical

7.6.3 Market Size & Forecast By Deployment

8 Enterprise Application Integration Market Landscape (Page No. - 116)

8.1 Competitive Landscape

8.1.1 Ecosystem & Roles

8.1.2 Vendor Landscape & Market Cap

8.2 End User Landscape

8.2.1 End User Analysis

9 Company Profiles (Page No. - 120)

(Overview, Products & Services, Strategies & Insights, Developments and Mnm View)*

9.1 Fujitsu

9.2 Hewlett-Packard (HP)

9.3 IBM

9.4 Microsoft

9.5 Mulesoft

9.6 Oracle

9.7 Red Hat

9.8 SAP

9.9 Software AG

9.10 Tibco Software

*Details on Overview, Products & Services, Strategies & Insights, Developments and Mnm View Might Not Be Captured in Case of Unlisted Companies.

Appendix (Page No. - 157)

Mergers & Acquisitions (M&A)

Venture Capital (VC) Trends

List of Tables (71 Tables)

Table 1 Enterprise Application Integration Market: Forecast Assumptions

Table 2 EAI: Overall Market Size, 2014–2019 ($Million)

Table 3 EAI: Market Size, By Deployment, 2014–2019 ($Million)

Table 4 EAI: Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 5 EAI: Hosted, Market Size, By Company Size, 2014–2019 ($Million)

Table 6 EAI: Hosted, Market Growth, By Company Size, 2014–2019 (Y-O-Y %)

Table 7 EAI: on-Premises, Market Size, By Company Size, 2014–2019 ($Million)

Table 8 EAI: On-Premises, Market Growth, By Company Size, 2014–2019 (Y-O-Y %)

Table 9 EAI: Hybrid, Market Size, By Company Size, 2014–2019 ($Million)

Table 10 EAI: Hybrid, Market Growth, By Company Size, 2014–2019 (Y-O-Y %)

Table 11 Enterprise Application Integration Market Size, By Company Size, 2014–2019 ($Million)

Table 12 EAI: Market Growth, By Company Size, 2014–2019 (Y-O-Y %)

Table 13 EAI: Small Businesses, Market Size, By Vertical, 2014–2019 ($Million)

Table 14 EAI: Small Businesses, Market Growth, By Vertical, 2014–2019 (Y-O-Y %)

Table 15 EAI: Small Businesses, Market Size, By Region, 2014–2019 ($Million)

Table 16 EAI: Small Businesses, Market Growth, By Region, 2014–2019 (Y-O-Y %)

Table 17 EAI: Medium Businesses, Market Size, By Vertical, 2014–2019 ($Million)

Table 18 EAI: Medium Businesses, Market Growth, By Vertical, 2014–2019 (Y-O-Y %)

Table 19 EAI: Medium Businesses, Market Size, By Region, 2014–2019 ($Million)

Table 20 EAI: Medium Businesses, Market Growth, By Region, 2014–2019 (Y-O-Y %)

Table 21 EAI: Enterprises, Market Size, By Vertical, 2014–2019 ($Million)

Table 22 EAI: Enterprises, Market Growth, By Vertical, 2014–2019 (Y-O-Y %)

Table 23 EAI: Enterprises, Market Size, By Region, 2014–2019 ($Million)

Table 24 EAI: Enterprises, Market Growth, By Region, 2014–2019 (Y-O-Y %)

Table 25 EAI: Large Enterprises, Market Size, By Vertical, 2014–2019 ($Million)

Table 26 EAI: Large Enterprises, Market Growth, By Vertical, 2014–2019 (Y-O-Y %)

Table 27 EAI: Large Enterprises, Market Size, By Region, 2014–2019 ($Million)

Table 28 EAI: Large Enterprises, Market Growth, By Region, 2014–2019 (Y-O-Y %)

Table 29 EAI: Market Size, By Vertical, 2014–2019 ($Million)

Table 30 EAI: Market Growth, By Vertical, 2014–2019 (Y-O-Y %)

Table 31 EAI: BFSI, Market Size, By Deployment, 2014–2019 ($Million)

Table 32 EAI: BFSI, Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 33 EAI: Business Services, Market Size, By Deployment, 2014–2019 ($Million)

Table 34 EAI: Business Services, Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 35 EAI: IT & Telecom, Market Size, By Deployment, 2014–2019 ($Million)

Table 36 EAI: IT & Telecom, Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 37 EAI: Manufacturing, Market Size, By Deployment, 2014–2019 ($Million)

Table 38 EAI: Manufacturing, Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 39 EAI: Retail & Wholesale, Market Size, By Deployment, 2014–2019 ($Million)

Table 40 EAI: Retail & Wholesale, Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 41 EAI: Healthcare, Market Size, By Deployment, 2014–2019 ($Million)

Table 42 EAI: Healthcare, Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 43 EAI: Government, Market Size, By Deployment, 2014–2019 ($Million)

Table 44 EAI: Government, Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 45 EAI: Others Vertical, Market Size, By Deployment, 2014–2019 ($Million)

Table 46 EAI: Others Vertical, Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 47 EAI: Market Size, By Region, 2014–2019 ($Million)

Table 48 EAI: Market Growth, By Region, 2014–2019 (Y-O-Y %)

Table 49 NA: Enterprise Application Integration Market Size, By Vertical, 2014–2019 ($Million)

Table 50 NA: EAI Market Growth, By Vertical, 2014–2019 (Y-O-Y %)

Table 51 NA: EAI Market Size, By Deployment, 2014–2019 ($Million)

Table 52 NA: EAI Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 53 APAC: Enterprise Application Integration Market Size, By Vertical, 2014–2019 ($Million)

Table 54 APAC: EAI Market Growth, By Vertical, 2014–2019 (Y-O-Y %)

Table 55 APAC: EAI Market Size, By Deployment, 2014–2019 ($Million)

Table 56 APAC: EAI Market Growth, By Deployment,2014–2019 (Y-O-Y %)

Table 57 Europe: Enterprise Application Integration Market Size, By Vertical, 2014–2019 ($Million)

Table 58 Europe: EAI Market Growth, By Vertical, 2014–2019 (Y-O-Y %)

Table 59 Europe: EAI Market Size, By Deployment, 2014–2019 ($Million)

Table 60 Europe: EAI Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 61 MEA: Enterprise Application Integration Market Size, By Vertical, 2014–2019 ($Million)

Table 62 MEA: EAI Market Growth, By Vertical, 2014–2019 (Y-O-Y %)

Table 63 MEA: EAI Market Size, By Deployment, 2014–2019 ($Million)

Table 64 MEA: EAI Market Growth, By Deployment,2014–2019 (Y-O-Y %)

Table 65 LA: Enterprise Application Integration Market Size, By Vertical, 2014–2019 ($Million)

Table 66 LA: EAI Market Growth, By Vertical, 2014–2019 (Y-O-Y %)

Table 67 LA: EAI Market Size, By Deployment, 2014–2019 ($Million)

Table 68 LA: EAI Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Table 69 EAI: Vendor Market Share, By Region, 2012-2013

Table 70 EAI: Mergers & Acquisitions (M&A)

Table 71 EAI: Venture Capital (VC) Funding

List of Figures (17 Figures)

Figure 1 EAI: Research Methodology

Figure 2 EAI: Top-Down & Bottom-Up Approach

Figure 3 Enterprise Application Integration Market Size, 2014–2019 ($Million), Market Growth, 2014–2019 (Y-O-Y %)

Figure 4 EAI: Market Segmentation

Figure 5 EAI: Market Evolution

Figure 6 EAI : Time-Impact Analysis of Dynamics

Figure 7 EAI: Value Chain

Figure 8 EAI: Market Size, By Deployment Type, 2014–2019 ($Million), Market Growth, 2014–2019 (Y-O-Y %)

Figure 9 Enterprise Application Integration Market Growth, By Deployment, 2014–2019 (Y-O-Y %)

Figure 10 EAI: Company Size, Market Size, 2014–2019 ($Million), Market Growth, 2014–2019 (Y-O-Y %)

Figure 11 EAI: Market Growth, By Company Size, 2014–2019 (Y-O-Y %)

Figure 12 EAI: Verticals, Market Size, 2014–2019 ($Million),Market Growth, 2014–2019 (Y-O-Y %)

Figure 13 EAI: Market Growth, By Vertical, 2014–2019 (Y-O-Y %)

Figure 14 EAI: Regions, Market Size, 2014–2019 ($Million), Market Growth, 2014–2019 (Y-O-Y %)

Figure 15 EAI: Market Growth, By Region, 2014–2019 (Y-O-Y %)

Figure 16 Enterprise Application Integration Market Ecosystem

Figure 17 EAI: End User Analysis

Growth opportunities and latent adjacency in Enterprise Application Integration Market