Enhanced Oil Recovery Market by Technology (Thermal (In-Situ Combustion, Steam, Others), Chemical (Polymer, Surfactant, Alkaline Surfactant Polymer), Gas (CO2, Other Gas), Other EOR), Application (Onshore, Offshore), and Region - Global Forecast to 2025

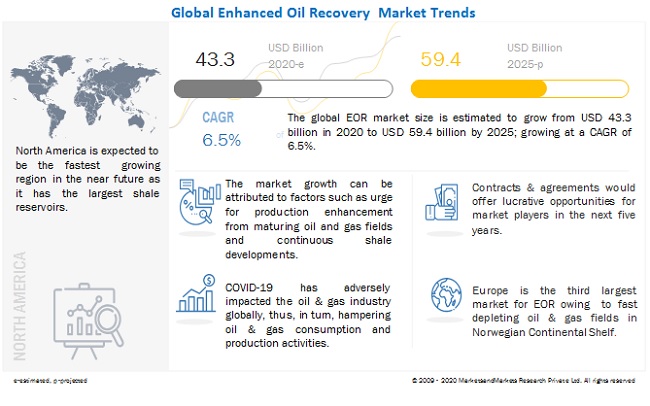

The global enhanced oil recovery market was valued at an estimated $43.3 billion in 2020 and is projected to reach $59.4 billion by 2025, at a CAGR of 6.5 % during forecast period. Increasing efforts by upstream companies to enhance the production from the mature fields is driving the enhanced oil recovery market.

To know about the assumptions considered for the study, Request for Free Sample Report

Enhanced Oil Recovery Market Dynamics

Driver: Increasing production from maturing oilfields

There is an increasing demand for oil & gas owing to which the companies are determined to increase the production from the mature fields. According to a survey by Halliburton, mature fields account for about 70% of the global oil & gas production. Hence, these companies are currently focused on increasing recovery and extending the life of mature fields by using EOR technologies, hence exceeding the production levels; this will drive the demand for enhanced oil recovery market.

Restraints: Increasing adoption of renewable energy in Europe

Europe is one of the major oils & gas production and consumption, the shift toward renewable energy in the European region, which has resulted in the decline of oil consumption in Europe. According to the IEA Oil Demand Report for 2018, the European oil demand remained stagnant due to the slowing economic activity. This decline has resulted in the fall of oil consumption in Europe, also results in the reduction of oil & gas production and drilling activities, thus reducing the demand for enhanced oil recovery services.

Opportunities: Focus on heavy oil production

The decline of conventional light oil & gas reserves provides an opportunity for the exploration of heavy oil reserves on a large commercial scale. Significant heavy oil reserves are present in Canada, Venezuela, Mexico, China, and Colombia. Canada and Venezuela are key countries involved in the production of heavy oil globally. Thus, to increase heavy oil production, EOR technologies are used. Thermal EOR is used to increase the production of heavy oil. Thus, production activities to enhance oil production create opportunities for the enhanced oil recovery market.

Challenges: Impact of COVID-19 on oil and gas production activities

The ongoing COVID pandemic has declined the exploration and production activities in the oil & gas sector. Owing to the lockdown in various countries has further declined the transportation and related activities, and are facing supply chain issues. Furthermore, Oil companies such as Shell and Exxon are taking measures to counteract oversupply issues by delaying LNG project constructions. This creates a challenging environment for the enhanced oil recovery market.

To know about the assumptions considered for the study, download the pdf brochure

By technology, the thermal EOR segment is expected to make the largest contribution to the enhanced oil recovery market during the forecast period.

In thermal EOR, steam is injected to lower the viscosity and improve the mobility of oil through the reservoir. It is mainly used in heavy oil reservoirs to recover several billion barrels of heavy crude oil. The thermal EOR is further categorized further based on the type as in-situ combustion, steam, and others. The steam segment is expected to grow at a faster CAGR. Owing to the development of shale gas discoveries and the development of mature oilfields in the Gulf of Mexico are likely to drive the steam market.

By application, the onshore segment is expected to grow at the fastest rate during the forecast period.

The onshore segment is expected to grow at the fastest rate during the forecast period owing to a larger number of mature oil fields located in North America, the Middle East & Africa. The onshore oilfields in these regions are mature and are on the verge of depletion containing billion barrels of additional oil trapped. Such an amount of oil can be recovered through EOR services. Thus, increasing production activities in the onshore are driving the enhanced oil recovery market.

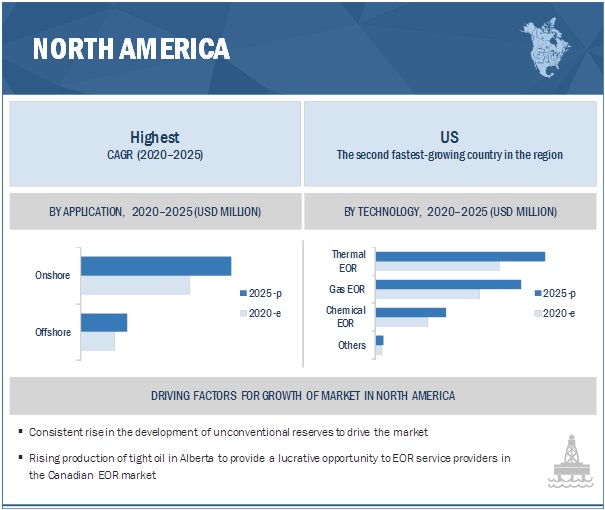

North America is expected to be the largest market during the forecast period.

North America, Europe, South America, Asia Pacific, Middle East, and Africa are the major regions considered for the study of the enhanced oil recovery market. North America is estimated to be the largest market from 2020 to 2025, driven by the growth in unconventional resources in the Gulf of Mexico. Additionally, continuous development in shale reserves in the US is expected to drive market growth for enhanced oil recovery.

Key Market Players

The major players in the global enhanced oil recovery market are Halliburton (US), Schlumberger (US), Baker Hughes Company (US), Royal Dutch Shell Plc (Netherlands), BP Plc(UK), BASF SE(Germany), Linde Plc (Ireland), Air Liquide (France), TechnipFMC(UK), ChampionX(US).

Recent Developments

- In September 2019, TechnipFMC opened a surface international facility in ICAD II. The scope of the investment was to assist ADNOC to enhance its operations in Abu Dhabi. The new facility offered a broad range of TechnipFMC portfolio with its high technology equipment in drilling, completion, production, and pressure control segments.

- In November 2018, BP announced its first offshore deployment LoSal enhanced oil recovery technology to its Clair Ridge project in the West of Shetland region, offshore of the UK. BP owns 28.6% of the interest in the Clair field.

- In September 2018, BASF and Letter One recently signed an agreement to merge their respective oil and gas businesses in a joint venture, which will operate under the name Wintershall DEA.

- In August 2018, Baker Hughes Company was awarded a contract by Cairn Oil & Gas, Vedanta Limited to construct ~300 new wells and deploy a chemical EOR program aimed at increasing production from the Rajasthan area.

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Technology, application, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Halliburton (US), Schlumberger (US), Baker Hughes Company (US), Royal Dutch Shell Plc (Netherlands), BP Plc(UK), BASF SE(Germany), Linde Plc (Ireland), Air Liquide (France), TechnipFMC(UK), ChampionX(US), Suncor Energy Inc.(Canada), Secure Energy Services (Canada), Exterran Corporation(US), Clariant(Switzerland), Croda International(UK), RCS Group of Companies(Canada), Ultimate EOR Services(US), Titan Oil Recovery(US), XYTEL Corporation(US), Premier Energy(US), Chevron Phillips Chemical Company(US), Audubon Companies (US), Kappa Oil Services(France), Core Laboratories(Netherlands), and Clean Energy Systems(US). |

This research report categorizes the enhanced oil recovery market-based technology, application, and region

Based on technology:

-

Thermal EOR

- Steam

- In-situ Combustion

- Others(Hot water and Solar)

-

Chemical EOR

- Polymer

- Surfactant

- Alkaline Surfactant Polymer

-

Gas EOR

- CO2

- Other Gas(Nitrogen and Natural gas)

- Others (microbial, seismic, simultaneous water alternating gas, and water alternating gas.

Based on application:

- Onshore

- Offshore

Based on the region:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Frequently Asked Questions (FAQ):

What is the current size of the enhanced oil recovery market?

The current market size of the global enhanced oil recovery market is USD 82.8 billion in 2019.

What are the major drivers for the enhanced oil recovery market?

Increasing oil & gas production of mature oil fields, continuous shale developments are some of the major drivers driving the market of enhanced oil recovery.

Which is the fastest-growing region during the forecasted period in the enhanced oil recovery market?

North America is the fastest-growing region during the forecasted period owing to a rise in shale gas & tight oil production and development of mature fields.

Which is the fastest-growing segment, by technology during the forecasted period in the enhanced oil recovery market?

The Gas EOR segment, by technology, is the fastest-growing segment during the forecasted period due to the low-cost availability of CO2.

Who are the leading players in the global EOR market?

The major players in the global enhanced oil recovery market are Halliburton (US), Schlumberger (US), Baker Hughes Company (US), Royal Dutch Shell Plc (Netherlands), BP Plc(UK), BASF SE(Germany), Linde Plc (Ireland), Air Liquide (France), TechnipFMC(UK), ChampionX(US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 ENHANCED OIL RECOVERY MARKET, BY TECHNOLOGY: INCLUSIONS VS. EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATION

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 1 ENHANCED OIL RECOVERY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

TABLE 1 ENHANCED OIL RECOVERY MARKET: PLAYERS/COMPANIES CONNECTED

2.2 SCOPE

2.3 KEY INFLUENCING FACTORS/DRIVERS

2.3.1 WELL COUNT

2.3.2 PRODUCTION TRENDS

FIGURE 2 OPERATIONAL WELL COUNT VS. CRUDE OIL PRODUCTION (2013–2019)

2.3.3 CRUDE OIL PRICES

FIGURE 3 CRUDE OIL PRICE TREND

2.3.4 IMPACT OF COVID-19 ON OIL & GAS ACTIVITIES

2.4 MARKET SIZE ESTIMATION

2.4.1 IDEAL DEMAND-SIDE ANALYSIS

2.4.1.1 Assumptions

2.4.1.2 Calculation

2.4.2 SUPPLY-SIDE ANALYSIS

2.4.2.1 Assumptions

2.4.2.2 Calculation

FIGURE 4 RESEARCH METHODOLOGY: ILLUSTRATION OF ENHANCED OIL RECOVERY COMPANY REVENUE ESTIMATION (2019)

FIGURE 5 INDUSTRY CONCENTRATION, 2019

2.4.3 FORECAST

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.6 PRIMARY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 35)

3.1 SCENARIO ANALYSIS

FIGURE 7 SCENARIO ANALYSIS: ENHANCED OIL RECOVERY MARKET, 2017–2025

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 2 MARKET SNAPSHOT

FIGURE 8 NORTH AMERICA DOMINATED MARKET IN 2019

FIGURE 9 MARKET FOR GAS EOR SEGMENT TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 10 ONSHORE SEGMENT IS EXPECTED TO DOMINATE MARKET, BY APPLICATION, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN ENHANCED OIL RECOVERY MARKET

FIGURE 11 INCREASING PRODUCTION FROM MATURING OILFIELDS AND CONTINUOUS SHALE DEVELOPMENT ACTIVITIES TO DRIVE MARKET, 2020–2025

4.2 MARKET, BY TECHNOLOGY

FIGURE 12 THERMAL EOR SEGMENT IS EXPECTED TO DOMINATE MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

4.3 MARKET, BY APPLICATION

FIGURE 13 ONSHORE SEGMENT DOMINATED MARKET, BY APPLICATION, IN 2019

4.4 MARKET, BY REGION

FIGURE 14 NORTH AMERICAN MARKET IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.5 NORTH AMERICAN MARKET, BY APPLICATION & COUNTRY

FIGURE 15 ONSHORE SEGMENT AND US DOMINATED NORTH AMERICAN MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

FIGURE 16 OIL RECOVERY MECHANISM

5.2 YC SHIFT

FIGURE 17 YC SHIFT

5.3 COVID-19 HEALTH ASSESSMENT

FIGURE 18 COVID-19 GLOBAL PROPAGATION

FIGURE 19 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.4 ROAD TO RECOVERY

FIGURE 20 RECOVERY ROAD FOR 2020

5.5 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.6 MARKET DYNAMICS

FIGURE 22 EOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.6.1 DRIVERS

5.6.1.1 Increasing production from maturing oilfields

FIGURE 23 DECLINING RATES OF MATURE NON-OPEC OILFIELDS (2000–2019)

5.6.1.2 Growing shale activities

TABLE 3 TOP COUNTRIES WITH RECOVERABLE SHALE RESOURCES, 2018

5.6.1.3 Rising primary energy consumption from Asia Pacific

FIGURE 24 WORLD OIL DEMAND GROWTH (2018–2024)

5.6.2 RESTRAINTS

5.6.2.1 Increasing adoption of renewable energy in Europe

FIGURE 25 OIL CONSUMPTION TREND IN EUROPE (2014–2040)

5.6.2.2 Strict government regulations on E&P activities

5.6.3 OPPORTUNITIES

5.6.3.1 Focus on heavy oil production

5.6.3.2 New offshore oilfield discoveries

FIGURE 26 NEW OFFSHORE OILFIELDS, BY OPERATOR, 2018

5.6.4 CHALLENGES

5.6.4.1 Impact of COVID-19 on oil and gas production activities

5.7 SUPPLY CHAIN OVERVIEW

FIGURE 27 EOR SUPPLY CHAIN

5.7.1 KEY INFLUENCERS

5.7.1.1 Consulting companies

5.7.1.2 Manufacturers

5.7.1.3 Service providers

5.7.1.4 Oilfield operators

5.8 IMPACT OF CRUDE OIL PRICE

FIGURE 28 CRUDE PRICE VS. DRILLING AND PRODUCTION OPERATIONS

TABLE 4 RIG COUNT & OIL PRODUCTION

5.9 CASE STUDY ANALYSIS

5.9.1 IMPROVED MOBILITY CONTROL IN CO2 ENHANCED RECOVERY USING SPI GELS

TABLE 5 PROJECT STATISTICS

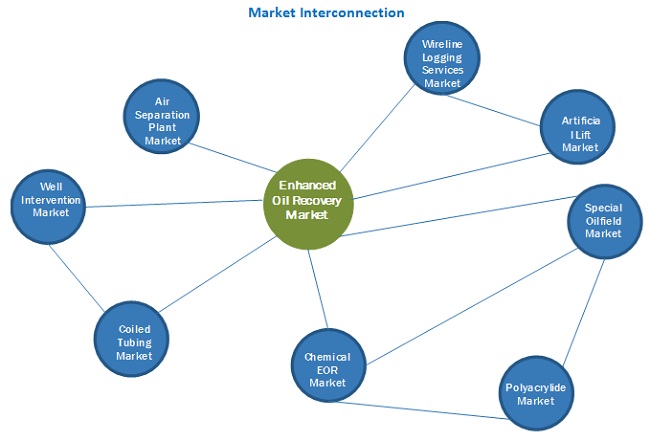

5.10 MARKET MAP

FIGURE 29 ENHANCED OIL RECOVERY: MARKET MAP

5.11 REGULATORY LANDSCAPE

TABLE 6 REGULATIONS ON E&P ACTIVITIES

6 IMPACT OF COVID-19 ON ENHANCED OIL RECOVERY MARKET, SCENARIO ANALYSIS, BY REGION (Page No. - 64)

6.1 INTRODUCTION

6.1.1 IMPACT OF COVID-19 ON GDP

TABLE 7 GDP ANALYSIS (IN PERCENTAGE)

6.1.2 SCENARIO ANALYSIS OF OIL & GAS INDUSTRY

FIGURE 30 CRUDE OIL PRICE VS CRUDE OIL PRODUCTION (2018–2025)

6.1.3 OPTIMISTIC SCENARIO

TABLE 8 OPTIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.4 REALISTIC SCENARIO

TABLE 9 REALISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.5 PESSIMISTIC SCENARIO

TABLE 10 PESSIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

7 ENHANCED OIL RECOVERY MARKET, BY TECHNOLOGY (Page No. - 68)

7.1 INTRODUCTION

FIGURE 31 THERMAL EOR SEGMENT ACCOUNTED FOR LARGEST SHARE OF ENHANCED OIL RECOVERY MARKET IN 2019

TABLE 11 MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

7.2 THERMAL EOR

TABLE 12 THERMAL EOR: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 13 THERMAL EOR: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 14 THERMAL EOR: MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.1 IN-SITU COMBUSTION

7.2.1.1 Increasing demand from depleting oil fields of North America driving demand for in-situ combustion EOR

TABLE 15 IN-SITU COMBUSTION: THERMAL MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.2 STEAM

7.2.2.1 Redevelopment of mature fields is expected to drive market for steam in North America and Middle East

TABLE 16 STEAM: THERMAL MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.3 OTHERS

TABLE 17 OTHERS: THERMAL MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3 CHEMICAL EOR

TABLE 18 CHEMICAL EOR: ENHANCED OIL RECOVERY MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 19 CHEMICAL EOR: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 20 CHEMICAL EOR: MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3.1 POLYMER

7.3.1.1 High success rates of polymer injection in Europe and Asia Pacific are driving market growth

TABLE 21 POLYMER: CHEMICAL MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3.2 SURFACTANT

7.3.2.1 Growing deepwater explorations and increasing oil & gas production from existing fields drive surfactant market

TABLE 22 SURFACTANT: CHEMICAL MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3.3 ALKALINE SURFACTANT POLYMER

7.3.3.1 High efficiency of alkaline surfactant polymer flooding is driving growth of market

TABLE 23 ALKALINE SURFACTANT POLYMER: CHEMICAL ENHANCED OIL RECOVERY MARKET, BY REGION, 2018–2025 (USD MILLION)

7.4 GAS EOR

TABLE 24 GAS EOR: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 25 GAS EOR: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 26 GAS EOR: MARKET, BY REGION, 2018–2025 (USD MILLION)

7.4.1 CO2

7.4.1.1 Rising focus on carbon capture, utilization, and storage is driving market for CO2 injection for oil recovery

TABLE 27 CO2: GAS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.4.2 OTHER GASES

TABLE 28 OTHER GASES: GAS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.5 OTHERS

TABLE 29 OTHERS: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 30 OTHERS: MARKET, BY REGION, 2018–2025 (USD MILLION)

8 ENHANCED OIL RECOVERY MARKET, BY APPLICATION (Page No. - 82)

8.1 INTRODUCTION

FIGURE 32 ONSHORE SEGMENT IS EXPECTED TO LEAD MARKET FROM 2020 TO 2025

TABLE 31 MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.2 ONSHORE

8.2.1 INCREASING MATURE ONSHORE OILFIELD ACTIVITIES ALONG WITH GROWING SHALE ACTIVITIES TO DRIVE ONSHORE MARKET

8.2.2 ONSHORE, BY TECHNOLOGY

TABLE 32 ONSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

8.2.2.1 Onshore enhanced oil recovery market (technology), by region

TABLE 33 THERMAL EOR: ONSHORE MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 34 CHEMICAL EOR: ONSHORE MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 GAS EOR: ONSHORE MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 36 OTHERS: ONSHORE MARKET, BY REGION, 2018–2025 (USD MILLION)

8.2.3 ONSHORE, BY REGION

TABLE 37 ONSHORE MARKET, BY REGION, 2018–2025 (USD MILLION)

8.3 OFFSHORE

8.3.1 RISING INVESTMENTS IN OFFSHORE PROJECTS ARE DRIVING OFFSHORE MARKET

8.3.2 OFFSHORE, BY TECHNOLOGY

TABLE 38 OFFSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

8.3.2.1 Offshore enhanced oil recovery market (technology), by region

TABLE 39 THERMAL EOR: OFFSHORE MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 40 CHEMICAL EOR: OFFSHORE MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 41 GAS EOR: OFFSHORE MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 42 OTHERS: OFFSHORE MARKET, BY REGION, 2018–2025 (USD MILLION)

8.3.3 OFFSHORE, BY REGION

TABLE 43 OFFSHORE MARKET, BY REGION, 2018–2025 (USD MILLION)

9 ENHANCED OIL RECOVERY MARKET, BY REGION (Page No. - 90)

9.1 INTRODUCTION

FIGURE 33 MARKET IN NORTH AMERICA IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 34 NORTH AMERICA DOMINATED MARKET IN 2019

TABLE 44 MARKET, BY REGION, 2018–2025 (THOUSAND BARRELS DAILY)

TABLE 45 MARKET, BY REGION, 2018–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

9.2.1 AVERAGE PRICE/COST

TABLE 46 NORTH AMERICA: ENHANCED OIL RECOVERY, BY COST, 2018–2025 (USD PER BARREL PER DAY)

9.2.2 BY TECHNOLOGY

TABLE 47 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

9.2.2.1 Technology, by type

TABLE 48 NORTH AMERICA: THERMAL EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: CHEMICAL EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: GAS EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.2.3 BY APPLICATION

TABLE 51 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.2.3.1 Application, by technology

TABLE 52 NORTH AMERICA: ONSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: OFFSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

9.2.4 BY COUNTRY

TABLE 54 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (THOUSAND BARRELS DAILY)

TABLE 55 NORTH AMERICA: EOR MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

9.2.4.1 US

9.2.4.1.1 Development of shale gas reserves to drive market

TABLE 56 US: EOR MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.2.4.2 Canada

9.2.4.2.1 Rising production of tight oil and increasing oil sand formations in Alberta propel market growth

TABLE 57 CANADA: EOR MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.2.4.3 Mexico

9.2.4.3.1 Investments for developing unconventional reserves to boost market growth

TABLE 58 MEXICO: EOR MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.3 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

9.3.1 AVERAGE PRICE/COST

TABLE 59 ASIA PACIFIC: ENHANCED OIL RECOVERY, BY COST, 2018–2025 (USD PER BARREL PER DAY)

9.3.2 BY TECHNOLOGY

TABLE 60 ASIA PACIFIC: EOR MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

9.3.2.1 Technology, by type

TABLE 61 ASIA PACIFIC: THERMAL EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 ASIA PACIFIC: CHEMICAL EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 ASIA PACIFIC: GAS EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.3.3 BY APPLICATION

TABLE 64 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.3.3.1 Application, by technology

TABLE 65 ASIA PACIFIC: ONSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 66 ASIA PACIFIC: OFFSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

9.3.4 BY COUNTRY

TABLE 67 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (THOUSAND BARRELS DAILY)

TABLE 68 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

9.3.4.1 China

9.3.4.1.1 Depleting giant oil & gas fields and increasing shale reserves favor implementation of enhanced oil recovery

TABLE 69 CHINA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.3.4.2 India

9.3.4.2.1 Rising investments for offshore exploration & production activities are expected to drive market

TABLE 70 INDIA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.3.4.3 Malaysia

9.3.4.3.1 Rising deepwater explorations and increasing oil & gas production from existing fields boost market growth

TABLE 71 MALAYSIA: EOR MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.3.4.4 Rest of Asia Pacific

TABLE 72 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.4 EUROPE

9.4.1 AVERAGE PRICE/COST

TABLE 73 EUROPE: ENHANCED OIL RECOVERY, BY COST, 2018–2025 (USD PER BARREL PER DAY)

9.4.2 BY TECHNOLOGY

TABLE 74 EUROPE: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

9.4.2.1 Technology, by type

TABLE 75 EUROPE: THERMAL EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 EUROPE: CHEMICAL EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 EUROPE: GAS EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.4.3 BY APPLICATION

TABLE 78 EUROPE: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.3.1 Application, by technology

TABLE 79 EUROPE: ONSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 80 EUROPE: OFFSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

9.4.4 BY COUNTRY

TABLE 81 EUROPE: MARKET, BY COUNTRY, 2018–2025 (THOUSAND BARRELS DAILY)

TABLE 82 EUROPE: ENHANCED OIL RECOVERY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

9.4.4.1 Russia

9.4.4.1.1 Rising exploration & production activities in East Siberia and Caspian region are likely to drive Russian market

TABLE 83 RUSSIA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.4.2 UK

9.4.4.2.1 Increasing investments in offshore EOR projects and redevelopment of brownfields drive market

TABLE 84 UK: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.4.3 Norway

9.4.4.3.1 High maturity rates of oil & gas fields in Norwegian Continental Shelf (NCS) drive market

TABLE 85 NORWAY: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.4.4 Kazakhstan

9.4.4.4.1 Development of offshore oilfields is driving market for enhanced oil recovery

TABLE 86 KAZAKHSTAN: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.4.5 Germany

9.4.4.5.1 Increased onshore crude oil production activities along with discoveries to propel market growth

TABLE 87 GERMANY: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.4.6 Rest of Europe

TABLE 88 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.5 SOUTH AMERICA

9.5.1 AVERAGE PRICE/COST

TABLE 89 SOUTH AMERICA: ENHANCED OIL RECOVERY, BY COST, 2018–2025 (USD PER BARREL PER DAY)

9.5.2 BY TECHNOLOGY

TABLE 90 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

9.5.2.1 Technology, by type

TABLE 91 SOUTH AMERICA: THERMAL EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 92 SOUTH AMERICA: CHEMICAL EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 SOUTH AMERICA: GAS EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.5.3 BY APPLICATION

TABLE 94 SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.5.3.1 Application, by technology

TABLE 95 SOUTH AMERICA: ONSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 96 SOUTH AMERICA: OFFSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

9.5.4 BY COUNTRY

TABLE 97 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (THOUSAND BARRELS DAILY)

TABLE 98 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

9.5.4.1 Venezuela

9.5.4.1.1 Production of heavy oil and redevelopment of mature oilfields drive market

TABLE 99 VENEZUELA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.5.4.2 Brazil

9.5.4.2.1 Increasing production in deepwater offshore wells propels market growth

TABLE 100 BRAZIL: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.5.4.3 Colombia

9.5.4.3.1 Increasing exploration & production activities along with high investment reforms drive market

TABLE 101 COLOMBIA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.5.4.4 Rest of South America

TABLE 102 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 AVERAGE PRICE/COST

TABLE 103 MIDDLE EAST & AFRICA: ENHANCED OIL RECOVERY, BY COST, 2018–2025 (USD PER BARREL PER DAY)

9.6.2 BY TECHNOLOGY

TABLE 104 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

9.6.2.1 Technology, by type

TABLE 105 MIDDLE EAST & AFRICA: THERMAL EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 MIDDLE EAST & AFRICA: CHEMICAL EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: GAS EOR MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.6.3 BY APPLICATION

TABLE 108 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.6.3.1 Application, by technology

TABLE 109 MIDDLE EAST & AFRICA: ONSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA: OFFSHORE MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

9.6.4 BY COUNTRY

TABLE 111 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2025 (THOUSAND BARRELS DAILY)

TABLE 112 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

9.6.4.1 Oman

9.6.4.1.1 Increasing production from maturing brownfields owing to government initiative drives market

TABLE 113 OMAN: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.6.4.2 Saudi Arabia

9.6.4.2.1 Increasing crude production from declining reserves and development of pilot EOR projects drive market

TABLE 114 SAUDI ARABIA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.6.4.3 UAE

9.6.4.3.1 Increasing implementation of EOR technology owing to ESP activities at existing mature fields acts as driving force for enhanced oil recovery services in UAE

TABLE 115 UAE: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.6.4.4 Egypt

9.6.4.4.1 Increasing E&P applications at existing mature fields act as driving force for enhanced oil recovery services in Egypt

TABLE 116 EGYPT: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.6.4.5 Rest of Middle East & Africa

TABLE 117 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 130)

10.1 OVERVIEW

FIGURE 37 KEY DEVELOPMENTS IN GLOBAL MARKET, 2017–JUNE 2020

10.2 INDUSTRY CONCENTRATION, 2019

FIGURE 38 INDUSTRY CONCENTRATION, 2019

10.3 COMPETITIVE SCENARIO

TABLE 118 DEVELOPMENTS OF KEY PLAYERS IN MARKET, 2017–2020

10.3.1 CONTRACTS & AGREEMENTS

10.3.2 INVESTMENTS & EXPANSIONS

10.3.3 MERGERS & ACQUISITIONS

10.4 WINNERS VS. TAIL-ENDERS

10.5 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE

10.5.4 EMERGING COMPANIES

FIGURE 39 ENHANCED OIL RECOVERY MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING (2019)

11 COMPANY PROFILES (Page No. - 136)

(Business overview, Products offered, Recent developments, SWOT analysis & MnM View)*

11.1 TECHNOLOGY PROVIDERS

11.1.1 SCHLUMBERGER

FIGURE 40 SCHLUMBERGER: COMPANY SNAPSHOT

FIGURE 41 SCHLUMBERGER: SWOT ANALYSIS

11.1.2 HALLIBURTON

FIGURE 42 HALLIBURTON: COMPANY SNAPSHOT

FIGURE 43 HALLIBURTON: SWOT ANALYSIS

11.1.3 CHAMPIONX

FIGURE 44 CHAMPIONX: COMPANY SNAPSHOT

11.1.4 BAKER HUGHES COMPANY

FIGURE 45 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

FIGURE 46 BAKER HUGHES COMPANY: SWOT ANALYSIS

11.1.5 SECURE ENERGY SERVICES

FIGURE 47 SECURE ENERGY SERVICES: COMPANY SNAPSHOT

11.1.6 TECHNIPFMC

FIGURE 48 TECHNIPFMC: COMPANY SNAPSHOT

11.1.7 XYTEL CORPORATION

11.1.8 EXTERRAN CORPORATION

FIGURE 49 EXTERRAN CORPORATION: COMPANY SNAPSHOT

11.1.9 RCS GROUP OF COMPANIES

11.1.10 ULTIMATE EOR SERVICES

11.1.11 PREMIER ENERGY

11.1.12 TITAN OIL RECOVERY INC.

11.2 CHEMICAL PROVIDERS

11.2.1 BASF SE

FIGURE 50 BASF SE: COMPANY SNAPSHOT

11.2.2 CRODA INTERNATIONAL PLC

FIGURE 51 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

11.2.3 LINDE PLC

FIGURE 52 LINDE PLC: COMPANY SNAPSHOT

11.2.4 CLARIANT

FIGURE 53 CLARIANT: COMPANY SNAPSHOT

11.2.5 AIR LIQUIDE

FIGURE 54 AIR LIQUIDE: COMPANY SNAPSHOT

11.3 OILFIELD OPERATORS

11.3.1 ROYAL DUTCH SHELL PLC

FIGURE 55 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

FIGURE 56 ROYAL DUTCH SHELL PLC: SWOT ANALYSIS

11.3.2 BP PLC

FIGURE 57 BP PLC: COMPANY SNAPSHOT

FIGURE 58 BP SHELL PLC: SWOT ANALYSIS

11.3.3 SUNCOR ENERGY INC.

FIGURE 59 SUNCOR ENERGY, INC.: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 173)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

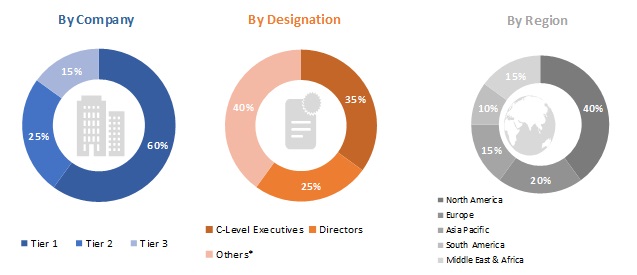

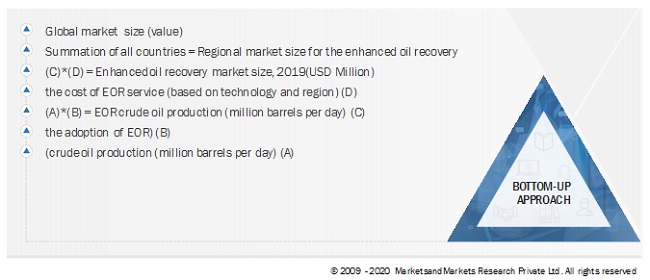

This study involved four major activities in estimating the current size of the enhanced oil recovery market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global enhanced oil recovery market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The enhanced oil recovery market comprises several stakeholders, such as end-product manufacturers, service providers, and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as upstream/oilfield operators, and others. The supply-side is characterized by enhanced oil recovery service providers, tool providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global enhanced oil recovery market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Enhanced oil recovery Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas upstream sector.

Report Objectives

- To define and describe the global enhanced oil recovery market by technology, application, and region.

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges).

- To strategically analyze the global market with respect to individual growth trends, future expansions, and the contribution of each segment to the market.

- The impact of the COVID-19 pandemic on the market has been analyzed for the estimation of the market size.

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders.

- To forecast the growth of the global market with respect to the main regions (North America, Asia Pacific, Europe, South America, and the Middle East & Africa).

- To profile and rank key players and comprehensively analyze their market share.

- To analyze competitive developments such as contracts & agreements, expansions & investments, and mergers & acquisitions in the enhanced oil recovery market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Enhanced Oil Recovery Market