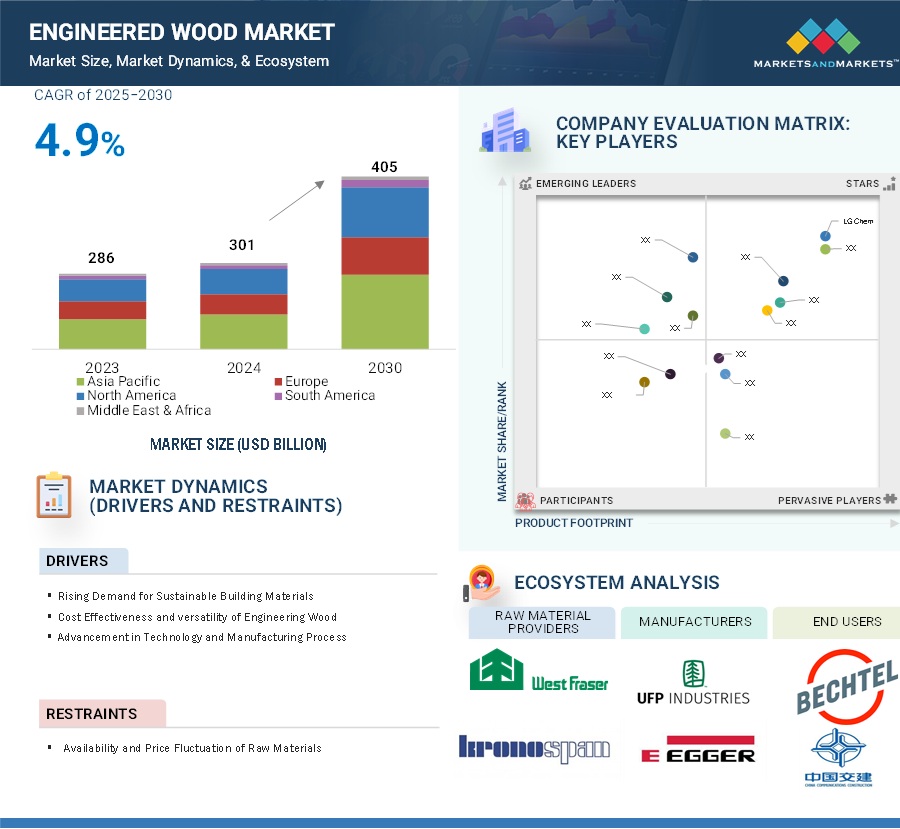

Engineered Wood Market by Type (Structural (CLT, GLULAM, OSB), Non - Structural (Plywood, Fibreboard, Particleboard)), Application (Construction, Furniture, Packaging), End-use Industry (Residential, Non - Residential), and Region (2025-2030)

The engineered wood market is projected to grow from USD 301 billion in 2024 to USD 405 billion by 2030, at a CAGR of 4.9% between 2025 and 2030. The engineered wood market segment applies as much for use in construction, furniture, and packaging. These sectors grow with the effect of urbanization and sustainability trends driven by increasing demand for engineered wood products. In construction, engineered wood products such as plywood and LVL offer strength and sustainability at an affordable cost, which would make them particularly suitable for residential and commercial projects. The versatility, as well as aesthetic appeal and compliance, meets quality standards for lower costs in the furniture sector. In packaging, engineered wood also provides lightness, durability, and eco-friendliness against improved traditional materials in that they are the sustainable alternatives that are gaining traction in demand.

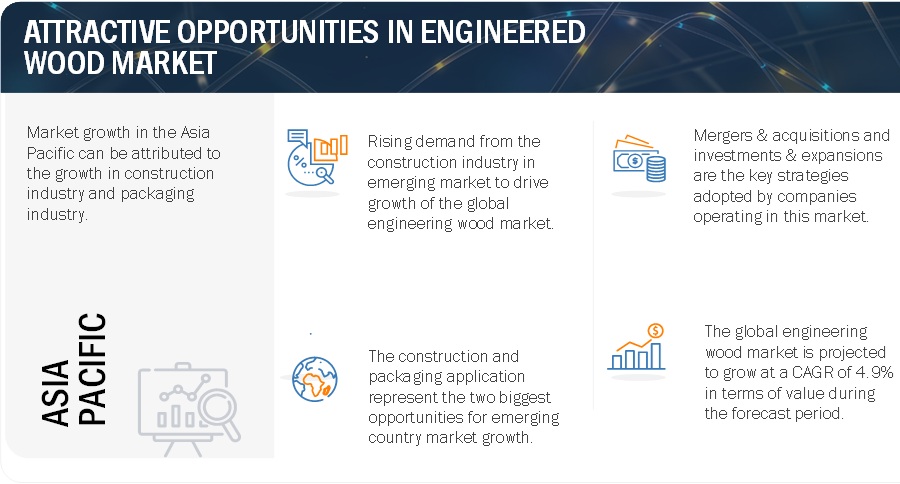

Attractive Opportunities in the Engineered Wood Market

To know about the assumptions considered for the study, Request for Free Sample Report

Engineered Wood Market Dynamics

Drivers: Urbanization & Construction Growth Boosting the Demand for Engineered Wood

The global trend of urbanization and construction expansion is dramatically increasing demand for engineered wood. As cities grow and more residential and commercial structures are required, engineered wood products such as plywood, LVL, and MDF provide affordable, long-lasting, and environmentally friendly alternatives to traditional materials. These items are utilized in both structural and aesthetic applications, including as beams, flooring, and furniture, making them suitable for a wide range of building projects. Engineered wood's strength, lightweight nature, and eco-friendliness combine with the expanding need for green building materials, establishing it as a critical answer in the thriving construction industry.

Restraints: Competition from the alternative materials

The engineered wood industry competes strongly against numerous such rival substitutes. Steel, concrete, and plastic composites are becoming more favourable even in some applications for their greater strength, durability, and performance. Steel and concrete completely dominate the construction of heavy-load-bearing and high-rise buildings, taking into account fire-prevention features and structural integrity, which restricts the overall usage of engineered wood in megaprojects. In addition, plastic composites have been rapidly gaining ground in other applications, especially in decking and furniture, because of their moisture resistance and minimal maintenance requirement. As all these alternatives are improving in terms of their strength, sustainability, and cost-effectiveness, their threat becomes more serious to the engineered-wood requirement, especially among those industries where performance and longevity matter.

Opportunities: Growth in green building projects promote engineered wood

The engineered wood segment has an excellent opportunity emerging under the Green Building Trends. It is now gaining significant momentum considering that sustainability in construction is the talk of the day, championing an increasing thirst for eco-friendly materials. Happily, engineered wood products like plywood, MDF, and LVL are very much in demand not only for renewable sourcing but also for their lower carbon footprint and resource-efficient utilization. These add up to the green building certifications under LEED for environmentally-conscious construction in today's setting. With more and more architects, builders, and developers going sustainable, engineered wood will have a guaranteed gain from this trend. Engineered wood will, further, enjoy extensive market opportunities since its recycling and biodegradability continue to correspond to the rising demands from both consumers and the industry for environmentally friendly building solutions.

Challenges: Maintaining quality and reducing processing cost

Meeting the norms and requirements is a challenge for engineered wood manufacturers due to the high cost of complying with the demanding environmental and quality standards connected with them. The process of obtaining certification, such as Forest Stewardship Council certification for the requirement that timber be supplied sustainably, entails traceable supply chains and high environmental standards, requires extensive administrative work and audits, and follows local and international regulations, all of which increase operational costs. Smaller firms struggle to manage these expenses, significantly limiting their competitiveness. ongoing improvement and investments in sustainable practices are critical because complying with ever-changing rules on emissions, chemical applications, and waste management necessitates ongoing improvement and investment in long-term operations. Certification may avail distinctive market advantage in niche eco-conscious sectors, but the corresponding expense and complexity make it an exercise in futility for those simply not resource endowed.

Engineered Wood Market Ecosystem

The ecosystem of an engineered wood market includes various product types, applications, and end-user industries. The market is classified as structural and non-structural engineered wood products. A few major structural products are CLT, Glulam, and OSB, which are the prime engineered wood products mainly used in construction for load-bearing applications like beams, trusses, and framing. The non-structural products are Plywood, Medium Density Fiberboard (MDF), and Particle Board used in interior finishes, furniture, and packaging applications that are cost-effective, multi-functional, and ease of manufacturing. Hence in applications, engineered wood is especially important in construction; products are structural and non-structural and used for framing, walls, and flooring in furniture cabinets, tables, and shelves and are even packaged with it. It has also heavily used engineered wood by considering plywood and particle board as creating pallets, crates, and containers in packaged products. This ecosystem depends on the influx of raw material suppliers, manufacturers, and end-users, where sustainability and eco-certifications such as FSC become more and more vital. Therefore, as the demographics of the population exert demand on materials that are sustainable, multi-functional, and cost-effective, so does engineered wood foray into these diverse sectors even more.

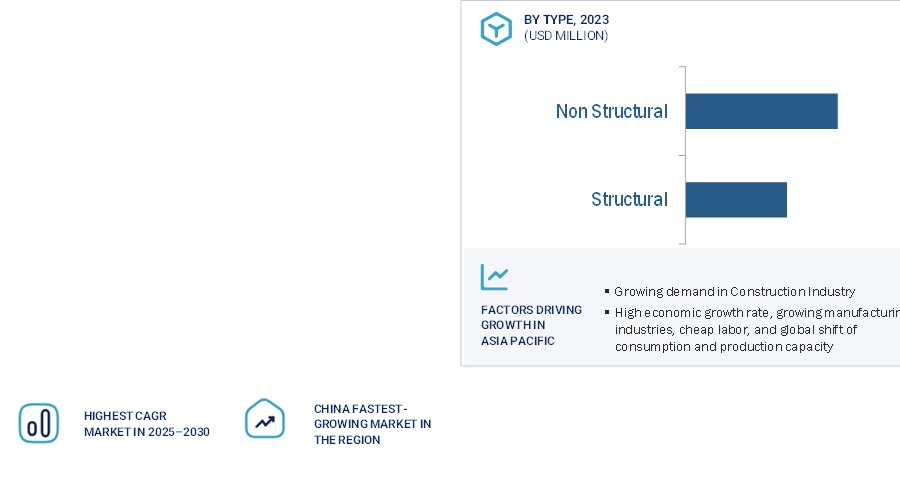

By type, non-structural accounted for the largest share of the Engineered Wood market in terms of value

The non-structural engineered wood segment accounts for the largest market share due to its broad range of applications across industries. Products like plywood, MDF, and particle board are widely used in furniture, interior design, flooring, and packaging because they are cost-effective, versatile, and easy to manufacture. These materials are essential for creating products like cabinets, tables, shelves, and decorative panels, which have high demand in both residential and commercial sectors. Non-structural engineered wood is also favoured for decorative finishes and lightweight solutions, making it ideal for furniture and home improvement. Additionally, the growing DIY culture and sustainability trends have increased the demand for eco-friendly, affordable materials. This widespread usage across various sectors, combined with cost-efficiency, drives the dominance of non-structural engineered wood in the market.

Residential segment accounted for the largest share of the Engineered Wood market by end use industry in terms of value

Residential make up the most significant segment of the engineered wood market. Engineered wood is favoured by homeowners for the construction of spaces where households live because of the cost, flexibility, and sustainability of engineered wood products provided in the formats of plywood and Fibreboard. Engineered wood is popular for residential construction, framing, flooring, roofing, and interior finishes because it costs less than solid wood, which perfectly fits into the residential projects being built at increased costs with affordable housing resulting from urbanization. Additionally, it fuels market access in engineered wood. Further, engineered wood provides superior strength, durability increased sustainability as globally consumers shift to eco-friendly building materials. Cost and quality continue to be the focus of homebuilders and developers, and thus, engineered wood would always be featured in this preference.

Asia Pacific is the fastest-growing Engineered Wood Market

Urbanization, industrialization, and construction activity in the Asia Pacific region have made it the fastest-growing region in terms of engineered wood markets. With more people flocking to cities, the number of people demanding more residential and commercial buildings will rise, and thus, they will all require cheaper, sustainable materials such as plywood, MDF, and LVL. Therefore, engineered wood products will see an incremental preference in construction because they are strength, flexible, and price-efficient, making them easy to construct large projects. In addition, the growing focus of the region towards sustainable construction and green building trend will further increase demand for engineered wood solutions in the region. China, India, and many Southeast Asian countries are heavily investing in infrastructure, which further adds fuel to market expansion. Finally, the fast-growing furniture industry in this region creates a need for engineered wood products, thus making Asia-Pacific the leading region in driving the growth of the market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- Georgia – Pacific LLC (US)

- West Fraser Timber Co. Ltd. (US)

- WeyerHaeuser Company (US)

- LP Building Solutions (US)

- Kronospan (Austria)

- Egger (Austria)

- Sonae Aracuo (Portugal)

Georgia – pacific LLC is among the top manufacturers of engineered wood across the globe. It also operates through its multiple marketing subsidiaries in the Americas, Europe, and Asia. The company has established R&D networks to provide differentiated products to its customers worldwide.

Recent Developments in Engineered Wood Market

- In October 2023, Researchers at the University of California, San Diego, have developed a new type of engineered wood that is stronger and more fire-resistant than traditional wood. This new material could have a wide range of applications in the construction industry.

- In November 2023, Weyerhaeuser Company, another major manufacturer of engineered wood products, announced that it was expanding its production capacity for laminated veneer lumber (LVL) at its facility in Osage, Minnesota. The expansion is expected to be completed by the end of 2024 and will increase Weyerhaeuser's LVL production capacity by 25%.

- In April 2023, WoodTech Innovations unveiled a breakthrough in engineered wood technology with the introduction of a lightweight yet strong and durable engineered wood beam. The innovative design combines different wood species and engineered materials to create a beam that offers superior load-bearing capacity and structural performance. This advancement in engineered wood beams opens up possibilities for cost-effective and sustainable construction solutions in the residential and commercial sectors.

- In May 2023, Greenwood Corp launched a range of engineered wood products with improved moisture resistance and dimensional stability. The company's advanced treatment process ensures that the engineered wood retains its structural integrity even in high humidity and wet environments, making it suitable for outdoor applications such as decking and siding. This development expands the application scope of engineered wood and provides architects and builders with more versatile options.

- In June 2023, Timetric Solutions introduced a new line of engineered wood flooring with enhanced scratch and wear resistance. The innovative surface treatment technology used in the flooring provides superior durability and longevity, making it ideal for high-traffic areas in residential and commercial settings. The development of highly durable engineered wood flooring offers an attractive alternative to traditional hardwood flooring, combining the aesthetic appeal of wood with enhanced performance characteristics.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

What are the factors driving the growth of the Engineered Wood market?

The growing construction market and green projects

What are the major applications for Engineered Wood?

The major applications of Engineered Wood are construction, packaging, and Furniture.

Who are the major manufacturers of Engineered Wood?

Georgia – Pacific LLC (US), West Fraser Timber Co. Ltd. (US), WeyerHaeuser Company (US), LP Building Solutions (US), Kronospan (Austria), Egger (Austria), Sonae Aracuo (Portugal), are the key players in the global engineered wood market.

What are the reasons behind Engineered Wood gaining market share?

Engineered Wood are gaining market share due to increasing demand from the Asia Pacific region.

Which is the largest region in the Engineered Wood market?

Asia Pacific is the largest region in the Engineered Wood market.

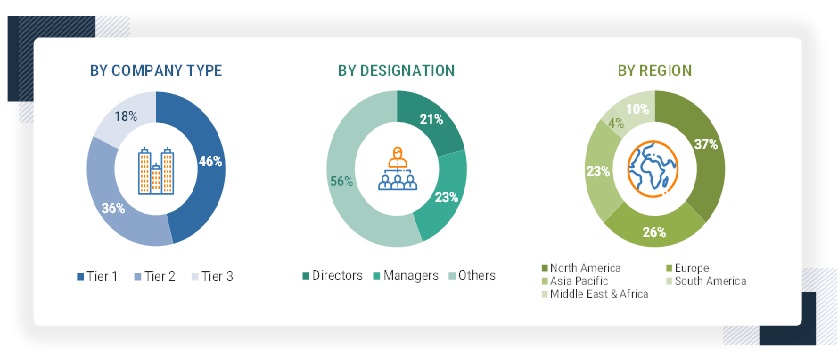

The study involved four major activities in order to estimating the current size of the engineered wood market. Exhaustive secondary research conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, and Factiva; and publications and databases from associations, including The Engineered Wood Association, American Plywood Association, Engineered Wood Products Association of Australasia, Structural Insulated Panel Association (SIPA).

Primary Research

Extensive primary research was carried out after gathering information about engineered wood market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the engineered wood market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, applications, end – use industry, and region.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

ENGINEERED WOOD MANUFACTURERS

|

Engineered Wood Manufacturers |

|

|

Kronospan |

Georgia – Pacific |

|

Egger |

LP Building Solutions |

|

Sonae Arauco |

West Fraser Timber |

|

Garnica |

Metsa Wood |

Engineered Wood Market Size Estimation

The following information is part of the research methodology used to estimate the size of the engineered wood market. The market sizing of the engineered wood market was undertaken from the demand side. The market size was estimated based on market size for engineered wood in various technology.

Global Engineered Wood Market Size: Bottom-Up Approach and Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Engineered Wood manufactured using wood in layer, particle, or fiber form with adhesives or other bonding material to make composite. These engineered products have enhanced performances such as improved strength, stability, and durability when compared to natural wood. Engineered woods are cost – effective, and versatile when it comes to its applications in construction, furniture, among others. Commonly known engineered woods are cross laminated timber, glue laminated timber, fiberboards, particle boards, oriented strand boards, among others.

Key Stakeholder

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives:

- To define, describe, segment, and forecast the size of the Engineered Wood Market based on width, type, end – use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the Engineered Wood Market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Engineered Wood Market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company in the Engineered Wood Market

Growth opportunities and latent adjacency in Engineered Wood Market