Energy Harvesting System for Wireless Sensor Network Market by Sensor (Temperature, Pressure, Flow, Level, Humidity, Position, Motion & IR), Technology (Light, Vibration, & Thermal), Application, and by Geography - Global Forecast to 2022

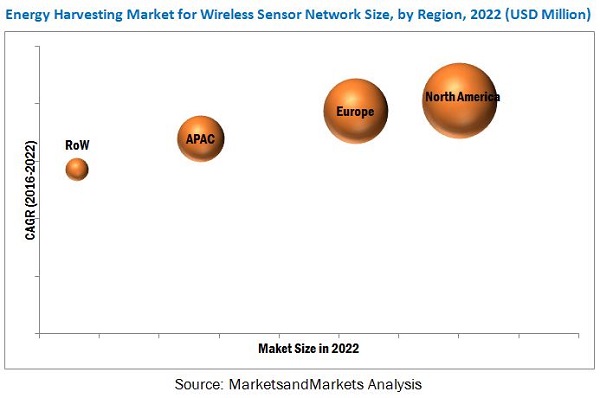

The energy harvesting for wireless sensor network market was valued at USD 429.6 Million in 2015 and is expected to reach USD 1576.9 Million by 2022, at a CAGR of 19.1% between 2016 and 2022. The base year considered for the study is 2015 and forecast period is between 2016 and 2022. This report analyzes the energy harvesting system for the wireless sensor network market on the basis of sensors, technologies, applications, and geography. North America is estimated to hold the largest market share in 2016. The objective of the study is to analyze the market share on the bases of sensor, battery, component, application and region and identify the market opportunities for stakeholders in the ecosystem of wireless sensor network and energy harvesting system.

The market for energy harvesting system for wireless sensor network is expected to grow from USD 429.6 Million in 2015 to USD 1576.9 Million by 2022, at a CAGR of 19.1% between 2016 and 2022. The increasing implementation of IoT for building and home automation in the North American region, widespread usage of various wireless sensors in industrial applications for pressure pump health monitoring, tank level monitoring, and flow control are the major drivers for the growth of the energy harvesting for wireless sensor network market.

The industrial application currently leads the market majorly owing to the high rate of installation of industrial wireless sensors for machine health monitoring, pressure pump health monitoring, tank level monitoring, flow control, temperature measurement and to control lighting systems, and for environment monitoring. The market for the building and home automation is expected to exhibit high growth potential till 2022 Owing to the increasing demand for energy-efficient lighting systems, integration of IoT and lighting, and acceptance of standard protocols for lighting control.

Vibration energy harvesting is expected to lead the global market for energy harvesting for wireless sensor network. In the industrial application, vibration energy harvesting holds the largest share as it is used to power the wireless sensor network for machine health monitoring, pressure pump health monitoring, tank level monitoring, and flow control. Moreover, vibration energy harvesting holds the largest share for most of the applications such as aerospace, automotive, transportation, and industrial application for powering wireless sensors.

Temperature sensor is expected to hold the largest share of the energy harvesting system for wireless sensor network market by 2022 owing to its increasing applications such as temperature monitoring in buildings, HVAC, cold storage, greenhouse, refrigerated trucks, second homes, data centers, industrial boilers, furnaces, and forest fire monitoring.

North America holds the largest market share and is expected to grow at the highest CAGR during the forecast period. This growth of the market in North America can be attributed to the increasing industrial wireless sensor networking, smart home system in new constructions, government initiatives, and increasing green energy awareness. The U.S. and Canada are the major regions deploying wireless sensor network powered by energy harvesting system. These regions also offer opportunities in the field of transportation, railway, aviation, and automobile. Europe held the second-largest share of the energy harvesting for wireless sensor network market in 2015.

The factors restraining the market growth are the limitations of remotely installed network modules and the low adoption in developing countries due to high initial cost. The players in the wireless sensor and energy harvesting ecosystem are also facing challenges in terms of standardizing the communication protocol, which limits the interoperability of the wireless sensor and energy harvesting system.

Major players in the wireless sensor and energy harvesting ecosystem are ABB Limited (Switzerland), Convergence Wireless (U.S.), Cymbet Corporation (U.S.), EnOcean GmbH (Germany), Fujitsu Limited (Japan), Honeywell International Inc. (U.S.), Microchip Technology Inc. (U.S.), STMicroelectronics N.V. (Switzerland), Cypress Semiconductor Corporation (U.S.), EnOcean GmbH (Germany), Linear Technology (California), and Lord Microstrain (U.S.). EnOcean GmbH (Germany) is one of the major players in the energy harvesting system market. The company has a broad product portfolio in the field of energy harvesting for wireless sensor networking. The company’s core strategy is based on continuous product development, majorly in the field of building and home automation. The company also offers energy harvesting products for industrial, transportation, and consumer electronics applications.

Frequently Asked Questions (FAQ):

Why there is increasing need of energy harvesting in building automation and industries? Which technologies are expected to drive the growth of the market in the next 5 years?

The growth of the energy harvesting system market is driven by the growing demand for safe, energy-efficient, and long-lasting systems that require minimum or no maintenance, extensive implementation of IoT devices in automation and energy harvesting technology in building and home automation, rising adoption of wireless sensor networks equipped with energy harvesting system, and increasing trend of green energy and favorable initiatives by governments. Light energy harvesting is majorly used in the building and home automation and industrial applications; this technology currently holds the leading position in the overall energy harvesting system market.

Which are the major companies in the market? What are their major strategies to strengthen their market presence?

EnOcean (Europe), Powercast Corporation (US), Cymbet Corporation (US), Fujitsu (Japan), and Linear Technology (US) are some of the major companies providing energy harvesting solutions. Product launches is one of the key strategies adopted by these players. Apart from launches, these players extend their focus on partnerships and expansions.

Which region is expected to witness significant demand for energy harvesting system market in the coming years?

Americas is expected to have the largest market share in terms of value, as the adoption of energy harvesting systems in the building and home automation is high in the Americas. Moreover, there are an increasing number of government activities for energy harvesting in the Americas.

Which are the major applications of this market?

The building and home automation application is expected to lead the energy harvesting system market. This application involves the use of power harvested through ambient energy to operate devices such as sensors, switches, lighting system, and harvesting energy from various devices such as radiators, refrigerators, and many more.

Which are the major opportunities in the energy harvesting system market?

The use of energy harvesting systems in portable and mobile medical devices, ocean energy harvesting devices, and human energy harvesting technologies are a few key opportunities in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Slide No. - 15)

1.1 Objectives of the Study

1.2 Definition and Scope

1.3 Stakeholders and Major Players in the Market

1.4 Currency & Years Considerate for Study

2 Research Methodology (Slide No. - 21)

2.1 Introduction

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Share Estimation

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.5 Research Assumptions

2.5.1 Assumptions

3 Premium Insight (Slide No. - 29)

3.1 Life-Cycle Analysis, By Geography

3.2 Growth Strategy Matrix (Ansoff Matrix)

3.3 Market Investment Analysis

3.3.1 Pro-Factors for Investment in WSN With Energy Harvesting System

3.3.2 Barriers for Investment in WSN With Energy Harvesting System

4 Market Overview (Slide No. - 33)

4.1 Introduction

4.2 History and Evolution of Wireless Sensor Networking

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.3.4 Challenge

5 Industry Trends (Slide No. - 40)

5.1 Introduction

5.2 Value Chain Analysis

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Bargaining Power of Buyers

5.3.3 Degree of Competetion

5.3.4 Bargaining Power of Suppliers

5.3.5 Threat of Substitute

6 Wireless Sensor Network Market, By Type of Sensors (Slide No. - 50)

6.1 Temperature Sensor

6.2 Pressure Sensor

6.3 Flow Sensor

6.4 Level Sensor

6.5 Humidity Sensor

6.6 Motion & Ir Sensors

6.7 Position Sensors

6.8 Gas Sensors

6.9 Others

7 Wireless Sensor Network Market, By Type of Primary Batteries (Slide No. - 62)

7.1 Lithium Battery

7.2 Alkaline

7.3 Others

8 Transducers Used in Energy Harvesting System (Slide No. - 65)

8.1 Introduction

8.2 Electrodynamic

8.3 Photovoltaic

8.4 Thermoelectric

8.5 Piezoelectric

8.5.1 Sound Energy Harvesting

8.5.2 On-Road(Kinetic) Energy Harvesting

8.5.3 Biomechanical Energy Harvesting

8.6 Radio Frequency (RF) Transducers

8.6.1 Radio Frequency (RF) Energy Harvesting

8.7 Electromagnetic Transducers

8.7.1 Inductive/Magnetic Energy Harvesting

8.8 Case Study

9 Wireless Sensor Network With Energy Harvester Market, By Component (Slide No. - 76)

9.1 Transducers

9.1.1 Photovoltaic

9.1.2 Piezoelectric

9.1.3 Thermoelectric

9.1.4 Others

9.2 Pmic

9.3 Secondary Batteries

9.3.1 Li-Ion Battery

9.3.2 Supercapacitor

9.3.3 Others

10 Wireless Sensor Network With Energy Harvester Market, By Technology (Slide No. - 80)

10.1 Introduction

10.2 Light Energy Harvesting

10.3 Vibration Energy Harvesting

10.4 Radio Frequency (RF) Energy Harvesting

10.5 Thermal Energy Harvesting

11 Wireless Sensor Network With Energy Harvester Market, By Application (Slide No. - 86)

11.1 Introduction

11.2 Building and Home Automation

11.3 Industrial

11.4 Aerospace

11.5 Automotive

11.6 Transportation Infrastructure

11.7 Security

11.8 Railways

11.9 Others

12 Wireless Sensor Networking With Energy Harvester Market, By Geography (Slide No. - 96)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Rest of the World

13 Competitive Landscape (Slide No. - 103)

13.1 Competitive Analysis

13.2 Competitive Situation and Trends

13.3 Key Players in Wireless Sensor Network With Energy Harvesting System Ecosystem

13.4 Competitive Landscape

13.4.1 Competitive Landscape Table

13.4.2 New Product Development

13.4.3 Agreements, Partnerships, Joint Ventures & Collaborations

13.4.4 Expansions, Mergers & Acquisitions

13.4.5 Others

14 Company Profile (Slide No. - 119)

14.1 ABB Limited

14.2 Convergence Wireless

14.3 Cymbet Corporation

14.4 Cypress Semiconductor Corporation

14.5 Enocean GmbH

14.6 Fujitsu Limited

14.7 Honeywell International Inc..

14.8 Linear Technology

14.9 Lord Microstrain

14.10 Microchip Technology Inc..

14.11 Stmicroelectronics N.V.

List of Tables (32 Tables)

Table 1 List of Companies for Wireless Sensor Network With Energy Harvesting

Table 2 Wireless Temperature Sensor Network With Energy Harvesting System Market, By Technology

Table 3 Wireless Flow Sensor Network With Energy Harvesting System Market, By Technology

Table 4 Wireless Pressure Sensor Network With Energy Harvesting System Market, By Technology

Table 5 Wireless Level Sensor Network With Energy Harvesting System Market, By Technology

Table 6 Wireless Humidity Sensor Network With Energy Harvesting System Market, By Technology

Table 7 Wireless Motion & Ir Sensor Network With Energy Harvesting System Market, By Technology

Table 8 Wireless Position Sensor Network With Energy Harvesting System Market, By Technology

Table 9 Wireless Gas Sensor Network With Energy Harvesting System Market, By Technology

Table 10 Other Wireless Sensor Network With Energy Harvesting System Market, By Technology

Table 11 Primary Battery Market for Wireless Sensor Network

Table 12 Major Players Ranking: Transducers Manufacturers

Table 13 Major Players Ranking: Power Management Ic Companies

Table 14 Major Players Ranking: Energy Harvesting Cells Manufacturing Companies

Table 15 Major Players Ranking: Wireless Sensor Network

Table 16 Competitive Landscape Table - 2015

Table 17 Competitive Landscape Table – 2014 & 2013

Table 18 New Product Development

Table 19 Acquisition, Partnership & Collaboration

Table 20 Contracts and Agreements

Table 21 Awards & Recognition

Table 22 ABB Limited: Developments

Table 23 Convergence Wireless Inc.: Developments

Table 24 Cymbet Corporation: Developments

Table 25 Cypress Semiconductor Corporation: Developments

Table 26 Enocean GmbH: Developments

Table 27 Fujitsu Limited: Developments

Table 28 Honeywell International Inc.: Developments

Table 29 Lord Microstrain: Developments

Table 30 Linear Technology Corporation: Developments

Table 31 Microchip Technology Inc..: Developments

Table 32 Stmicroelectronics N.V.: Developments

List of Figures (86 Figures)

Figure 1 Market Segmentation

Figure 2 Life Cycle Analysis

Figure 3 Ansoff Matrix

Figure 4 Market Investment Analysis

Figure 5 Industry Trends

Figure 6 Value Chain Analysis

Figure 7 Poter`S Five Force Model Analysis

Figure 8 Threat of New Enterants

Figure 9 Bargaining Power of Buyer

Figure 10 Degree of Competition

Figure 11 Bargaining Power of Suppliers

Figure 12 Threat of Substitutes

Figure 13 Global Wireless Sensor Network Market

Figure 14 Global WSN With EHS Market

Figure 15 Wireless Sensor Network Market, By Type of Sensor

Figure 16 Wireless Temperature Sensor Network With Energy Harvesting System Market

Figure 17 Wireless Flow Sensor Network With Energy Harvesting System Market

Figure 18 Wireless Pressure Sensor Network With Energy Harvesting System Market

Figure 19 Wireless Level Sensor Network With Energy Harvesting System Market

Figure 20 Wireless Humidity Sensor Network With Energy Harvesting System Market

Figure 21 Wireless Motion & IR Sensor Network With Energy Harvesting System Market

Figure 22 Wireless Position Sensor Network With Energy Harvesting System Market

Figure 23 Wireless Gas Sensor Network With Energy Harvesting System Market

Figure 24 Other Wireless Sensor Network With Energy Harvesting System Market

Figure 25 Primary Battery for Wireless Sensor Networking Market

Figure 26 Transducer Technologies Used in Wireless Sensor Network

Figure 27 Electrodynamic Transducer for Energy Harvesting

Figure 28 Photovoltaic Cell (PV Cell)

Figure 29 Thermoelectric Transducer

Figure 30 Piezoelectric Transducer

Figure 31 Radio Frequency-To-Dc Converter

Figure 32 RF Energy Harvesting System

Figure 33 Electrodynamic Transducer for Energy Harvesting

Figure 34 Energy Harvesting Component for Wireless Sensor Network Market

Figure 35 Transducer Component in Energy Harvesting System for Wireless Sensor Network Market

Figure 36 Battery Component in Energy Harvesting System for Wireless Sensor Network Market

Figure 37 Wireless Sensor Network Market With Energy Harvesting System, By Technology

Figure 38 Wireless Sensor Network Market With Light Energy Harvesting System, By Application

Figure 39 Wireless Sensor Network Market With Vibration Energy Harvesting System, By Application

Figure 40 Wireless Sensor Network Market With Radio Frequency (RF) Energy Harvesting System, By Application

Figure 41 Wireless Sensor Network Market With Thermal Energy Harvesting System, By Application

Figure 42 Wireless Sensor Network With Energy Harvesting Market By Application

Figure 43 Market for Building and Automation By WSN With EHS

Figure 44 Market for Building and Automation By Technology

Figure 45 Market for Industry By WSN With EHS

Figure 46 Market for Industry By Technology

Figure 47 Market for Aerospace By WSN With EHS

Figure 48 Market for Aerospace By Technology

Figure 49 Market for Automotive By WSN With EHS

Figure 50 Market for Automotive By Technology

Figure 51 Market for Transportation By WSN With EHS

Figure 52 Market for Transportation By Technology

Figure 53 Market for Security By WSN With EHS

Figure 54 Market for Security By Technology

Figure 55 Market for Railways By WSN With EHS

Figure 56 Market for Railways By Technology

Figure 57 Market for Others Application By WSN With EHS

Figure 58 Market for Other Application By Technology

Figure 59 Wireless Sensor Network With Energy Harvesting System, Geography Snapshot

Figure 60 Wireless Sensor Network With Energy Harvesting System By Geography

Figure 61 Wireless Sensor Network With Energy Harvesting System in North America

Figure 62 Wireless Sensor Network With Energy Harvesting System in Europe

Figure 63 Wireless Sensor Network With Energy Harvesting System in Asia-Pacific

Figure 64 Wireless Sensor Network With Energy Harvesting System in Rest of the World

Figure 65 ABB Limited: Business Overview

Figure 66 ABB Limited: Product Portfolio

Figure 67 Convergence Wireless Inc.: Business Overview

Figure 68 Convergence Wireless Inc.: Product Portfolio

Figure 69 Cymbet Corp0ration: Business Overview

Figure 70 Cymbet Corporation: Product Portfolio

Figure 71 Cypress Semiconductors Corporation: Business Overview

Figure 72 Cypress Semiconductor Corporation: Product Portfolio

Figure 73 Enocean GmbH: Business Overview

Figure 74 Enocean GmbH: Product Portfolio

Figure 75 Fujitsu Limited: Business Overview

Figure 76 Fujitsu Limited: Product Portfolio

Figure 77 Honeywell International Inc.: Business Overview

Figure 78 Honeywell International Inc.: Product Portfolio

Figure 79 Lord Microstrain: Business Overview

Figure 80 Lord Microstrain: Product Portfolio

Figure 81 Linear Technology Corporation: Business Overview

Figure 82 Linear Technology Corporation: Product Portfolio

Figure 83 Microchio Technology Inc.: Business Overview

Figure 84 Microchip Technology Inc.: Product Portfolio

Figure 85 Stmicroelectronics N.V.: Business Overview

Figure 86 Stmicroelectronics N.V.: Product Protfolio

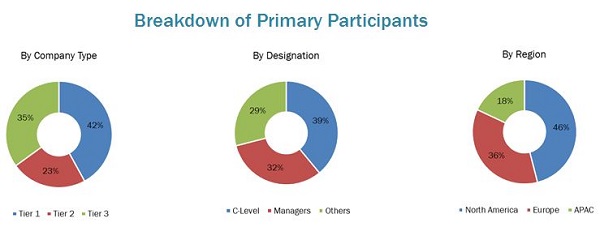

This research study involves the extensive use of secondary sources, directories, and databases (such as annual reports, press releases, journals, company websites, and paid databases) to identify and collect information useful for this study. The entire procedure includes the study of the financial reports of the top market players. After arriving at the overall market size, the total market has been split into several segments and subsegments and confirmed with the key industry experts such as CEOs, VPs, directors, and marketing executives. The figure below shows the breakdown of primaries on the basis of company type, designation, and region conducted during research study.

To know about the assumptions considered for the study, download the pdf brochure

The energy harvesting for wireless sensor network market has a diversified ecosystem that includes different types of transducer providers such as Laird Plc. (U.K.), Mide Technology Corporation (U.S.), Lord Microstrain (U.S.), EnOcean GmbH (Germany), and IXYS Corporation (U.S.); secondary battery and capacitor providers such as Cymbet Corporation (U.S.), Linear Technologies (U.S.), Murata Manufacturing Co., Ltd. (Japan), and Infinite Power Solution Inc. (U.S.); power management IC manufacturers such as Linear Technologies (U.S.), Cypress Semiconductor Corp. (U.S.), STMicroelectronics (Switzerland), Texas Instruments (U.S.), and Fujitsu (Japan); wireless sensors providers such as ABB Limited (Switzerland), EnOcean GmbH (Germany), Episensor (Ireland) and Monnit Corporation (U.S.); semiconductor wafer manufacturers, research institutes and universities, government organizations, low-power electronic product manufacturers, energy harvesting system consultancies, alliances and associations for wireless sensor network with energy harvesting system; and end users from all applications.

Target Audience:

- Technology providers

- Technology investors

- Technology standards organizations

- Forums, alliances, and associations

- Government bodies

- Venture capitalists

- Private equity firms

- Analysts, strategic business planners, and others

- Startup firms

Key Takeaways:

- Analysis of global market for energy harvesting for wireless sensor network

- Market size splits by technology, application, and geography

- Value chain analysis of wireless sensor network with energy harvesting system

- Major market trends, drivers, restraints, and opportunities for global energy harvesting for wireless sensor network market

- Detailed competitive landscape which includes key players, in-depth market analysis, individual revenue, and company strategies

The market in this report has been segmented as follows:

By Sensors:

- Temperature Sensors

- Pressure Sensors

- Flow Sensors

- Level Sensors

- Humidity Sensors

- Motion and IR Sensors

- Position Sensors

- Gas Sensors

- Others (Light Sensors, Contact Sensors)

By Primary Batteries:

- Lithium Batteries

- Alkaline Batteries

- Others

By Component:

-

Transducers

- Photovoltaic

- Piezoelectric

- Thermoelectric

- Others

- PMIC

-

Secondary Batteries

- Li-Ion batteries

- Supercapacitors

- Others

By Technology:

- Light Energy Harvesting

- Vibration Energy Harvesting

- Radio Frequency (RF) Energy Harvesting

- Thermal Energy Harvesting

By Application:

- Building and Home Automation

- Industrial

- Aerospace

- Automotive

- Railways

- Transportation Infrastructure

- Security

- Others (Ships, Water and Wastewater Management, Forestry and Agriculture)

By Geography:

- North America

- Europe

- APAC

- RoW

Growth opportunities and latent adjacency in Energy Harvesting System for Wireless Sensor Network Market