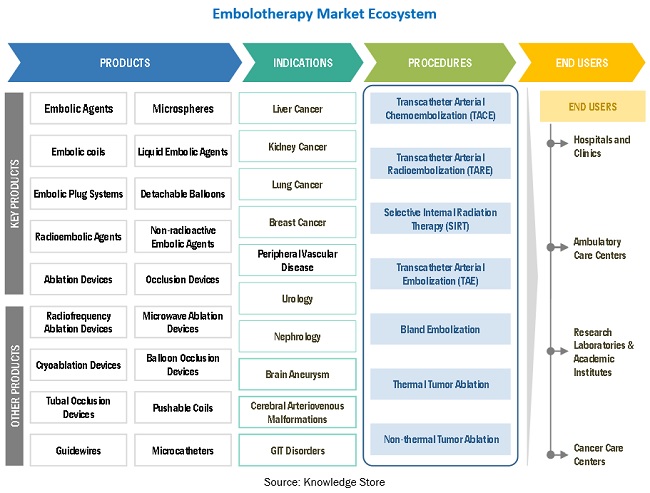

Embolotherapy Market by Product (Embolic Agents (Microspheres, Liquid Embolic Agents, Coil), Microcatheters), Indication (Oncology, Vascular, Aneurysm, Urology, Nephrology), Procedure (TACE, TARE), Enduser (Hospital, Clinics, ASC) - Global Forecast to 2026

The global embolotherapy market boasts a total value of $3.4 billion in 2021 and is projected to register a growth rate of 8.0% to reach a value of $5.0 billion by 2026. Increasing incidences of peripheral vascular diseases, liver cancer, strokes, and uterine fibroids coupled with rising preference for minimally invasive procedures; increasing investments, funds, and grants by public-private organizations for research; and technological advancements in the market will fuel the market growth over the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Embolotherapy Market Dynamics

Drivers: Growing target population

The embolotherapy devices market has experienced steady growth over the last decade, owing to the growing target patient population base, which has increased the number of target surgeries performed. CVD is a key target disease; its importance and high prevalence have made it a focus for research on successful and effective therapies. As of 2017, more than 200 million people are suffering from peripheral vascular diseases globally (Source: Elsevier, 2018). According to the same source, the prevalence of these diseases rises with age, with the above-80 age group displaying a prevalence rate of greater than 20%.

The high success rate and less post-operative complication rate associated with embolotherapy procedures coupled with the rising incidences of liver cancer and hepatocellular cancer will further boost the demand for embolotherapy devices in the near future. Liver cancer is fifth-most-common cancer in men and the ninth-most-common in women. Globally, there were over 840,000 new cases diagnosed in 2018. (Source: World Cancer Research Fund). Furthermore, over the last decade, kidney cancer incidence rates increased by 42% in the UK. In females, the incidence rates increased by 44%, while there was a 38% incidence rate in males. (Source: Cancer Research UK).

Restraints: Strong market positioning of alternative therapies

The availability of effective conventional first-level therapies for the treatment of liver cancer, uterine fibroids, hemorrhagic stroke, and other hemorrhagic conditions is a key restraint to market growth. For instance, therapies such as surgery, chemotherapy, and radiation therapy are preferred options in cancer treatment due to the high awareness among individuals about traditional cancer treatments, low adoption of advanced treatment options (especially in developing countries), and the reluctance among oncologists to shift from conventional treatment options.

Opportunities: Expanding applications of embolotherapy devices

The applications of embolotherapy continue to expand. Initially, embolotherapy was applied for uncontrolled gastrointestinal bleeding; in recent years, embolotherapy is being increasingly adopted for various indications such as non-operative management of solid tumors of the liver, spleen, and kidney; visceral and solid organ aneurysm; vascular malformations in the central nervous systems, pulmonary circulation, head & neck, trunk, and extremities; uterine fibroids; and benign prostatic tumors.

Challenges: Dearth of skilled surgeons

Healthcare markets are witnessing a dearth of well-trained surgeons (including neurosurgeons and radiologists). The Association of American Medical Colleges (US) has estimated a deficit of 41,000 general surgeons in the US by 2025 (Source: Association of American Medical Colleges US, 2017). A shortage of more than 2,300 medical oncologists is expected in the US by 2025 (Source: Journal of Global Oncology). Similarly, India is also facing an acute shortage of oncologists, radiotherapists, and surgical oncologists. With 1.8 million cancer patients in the country, there is only one oncologist to treat every 2,000 patients. The shortage of oncologists and radiologists in several countries worldwide is expected to affect the adoption of embolotherapy procedures.

To know about the assumptions considered for the study, download the pdf brochure

The microspheres segment accounted for the largest share of the embolotherapy market, by product, in 2020

Based on product, the embolotherapy market is broadly segmented into embolization coils (detachable coils and pushable coils), embolic agents (liquid embolic agents and microspheres), detachable balloons, embolic plug systems, and support devices (microcatheters and guidewires). The microspheres segment under embolic agents held the largest share of the market in 2020. The market growth of this segment is majorly driven by the surge in the prevalence of hepatocellular carcinoma (microspheres are widely used to treat this disease), coupled with favorable reimbursement criteria in developed economies. Moreover, new product launches and approvals are further supporting the growth of this segment.

The application segment, by cancer, to register significant growth over the forecast period

In terms of application, embolotherapy market is classified into cancer, peripheral vascular diseases, neurological diseases, urological & nephrological disorders, and gastrointestinal disorders. The cancer segment commanded the largest share of the market in 2020, and the same segment will grow at the highest CAGR over the forecast period between 2021 and 2026. Rising incidences of liver cancer & kidney cancer coupled with respective adoption of TACE and TARE procedures will support the market growth.

Transcatheter Arterial Embolization (TAE) procedure attributes to rising preference for minimally invasive surgeries

On the basis of procedure, the embolotherapy market is segmented into transcatheter arterial embolization (TAE), transcatheter arterial chemoembolization (TACE), and transcatheter arterial radioembolization (TARE)/selective internal radiation therapy (SIRT). The increasing demand for minimally invasive procedures, growing prevalence of chronic diseases, and rapid growth in the geriatric population are some of the key factors contributing to the large share of the transcatheter arterial embolization segment.

The Hospitals and Clinics end user segment garnered the highest revenue in the embolotherapy market in 2020

Based on end user, the embolotherapy market is segmented into hospitals and clinics, ambulatory surgery centers (ASCs) , and other end users. Hospitals and clinics are the key end users of embolotherapy devices. This segment covers the market for embolotherapy devices used in big hospitals, small clinics, and critical care units. The growing adoption of minimally invasive surgical procedures (including vascular, urological, and neurological), increasing purchasing power of major healthcare providers across developed countries (owing to the consolidation of healthcare providers), and the greater availability of reimbursements for target procedures in the US and major European countries are the major factors that are expected to drive the demand for embolization devices in hospitals and clinics.

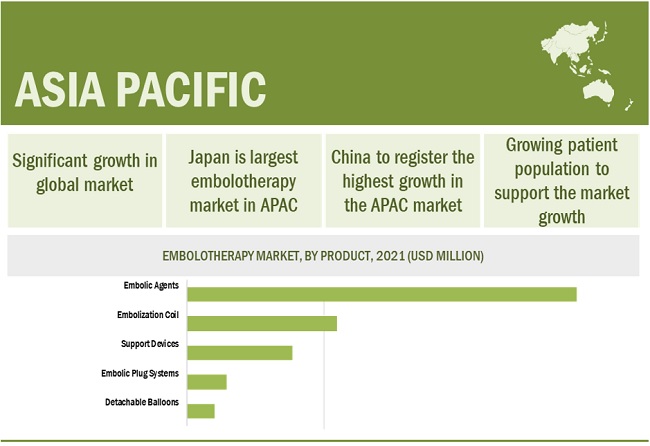

The Asia Pacific market is expected to grow at the highest CAGR during the forecast period

The embolotherapy market is segmented into five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Improving healthcare infrastructure in the region, the large patient population for target diseases, and expanding presence of key market players in the region to grab elevating opportunities offered by these countries are the key factors supporting the market growth in this region.

The major players in the embolotherapy market are Boston Medical Corporation (US), Terumo Medical Systems (Japan), Medtronic (US), Johnson & Johnson (US), and Stryker Corporation (US). Other key players in the embolization therapy market include Sirtex Medical Limited (US), Abbott Laboratories (US), Acandis GmbH (Germany), Balt (France), Cook Medical (US), Kaneka Corporation (Japan), Penumbra, Inc. (US), Merit Medical Systems (US), Meril Life Sciences Pvt. Ltd. (India), Cardiva (US), Shape Memory Medical Inc. (US), Artio Medical Inc. (US), Rapid Medical (US), Emboline, Inc. (US), and IMbiotechnologies Ltd. (Canada), among others.

Boston Scientific Corporation (US) holds a significant share in the embolotherapy market. The company majorly focuses on growth strategies such as acquisitions and expansions to increase its market presence and product offerings. In addition, the company’s acquisition of BTG has driven its sales and increased market share in the market. This is a major factor, which will help Boston Scientific to expand its product offerings in chemoembolization, radioembolization, and ablation therapies from BTG. Boston Scientific constantly strives to gain regulatory and reimbursement approvals. As a part of its long-term growth strategy, the company invests in fast-growing markets as well as new markets by strengthening its position in the global healthcare market.

Scope of the Embolotherapy Market Report

|

Report Metrics |

Details |

|

Market Size value 2026 |

USD 5.0 billion |

|

Growth Rate |

8.0% Compound Annual Growth Rate (CAGR) |

|

Largest Market |

Asia Pacific |

|

Market Dynamics |

Drivers, Opportunities, Restraints & Challenges |

|

Largest Share Segments |

|

|

Table of Content |

|

|

Market Segmentation |

Product, Application, Technology, End User And Regional. |

|

Embolotherapy Market Growth Drivers |

Growing target population |

|

Embolotherapy Market Growth Opportunities |

Expanding applications of embolotherapy devices |

|

Report Highlights |

|

|

Geographies Covered |

North America, Europe, APAC, MEA, and Latin America |

This report has segmented the global embolotherapy market based on product, application, procedure, end user, and region.

By Product

-

Embolization Coil

- Detachable Coils

- Pushable Coils

-

Embolic Agents

- Liquid Embolic Agents

- Microspheres

- Detachable Balloons

- Embolic Plug Systems

-

Support Devices

- Guidewires

- Microcatheters

By Application

-

Oncology

- Liver Cancer

- Kidney Cancer

- Lung Cancer

- Breast Cancer

- Other Cancers

- Peripheral Vascular Diseases

-

Urology and Nephrology

- Benign Prostatic Hyperplasia

- Uterine Fibroids

- Other Urology and Nephrology Applications

-

Neurology

- Brain Aneurysm

- Cerebral Arteriovenous Malformations

- GIT Disorders

By Procedure

- Transcatheter Arterial Embolization

- Transcatheter Arterial Radioembolization/Selective Internal Radiation Therapy

- Transarterial Chemoembolization

By End User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments

- In 2021, Boston Scientific has received U.S. Food and Drug Administration (FDA) approval of the TheraSphere Y-90 Glass Microspheres.

- In 2021, Terumo Corporation has the FDA Approval of the PMA Supplement for the WEB 17 System, a new addition to the WEB Aneurysm Embolization System for the treatment of intracranial wide-neck bifurcation aneurysms

- In 2020, Kaneka has Received FDA approval of the TheraSphere Y-90 Glass Microspheres, developed for the treatment of patients with hepatocellular carcinoma (HCC).

Frequently Asked Questions (FAQs):

What is the size of Embolotherapy Market ?

The global embolotherapy market boasts a total value of $3.4 billion in 2021 and is projected to register a growth rate of 8.0% to reach a value of $5.0 billion by 2026.

What are the major growth factors of Embolotherapy Market ?

The growing adoption of minimally invasive surgical procedures (including vascular, urological, and neurological), increasing purchasing power of major healthcare providers across developed countries (owing to the consolidation of healthcare providers), and the greater availability of reimbursements for target procedures in the US and major European countries are the major factors that are expected to drive the demand for embolization devices in hospitals and clinics.

Who all are the prominent players of Embolotherapy Market ?

The major players in the embolotherapy market are Boston Medical Corporation (US), Terumo Medical Systems (Japan), Medtronic (US), Johnson & Johnson (US), and Stryker Corporation (US). Other key players in the embolization therapy market include Sirtex Medical Limited (US), Abbott Laboratories (US), Acandis GmbH (Germany), Balt (France), Cook Medical (US), Kaneka Corporation (Japan), Penumbra, Inc. (US), Merit Medical Systems (US), Meril Life Sciences Pvt. Ltd. (India), Cardiva (US), Shape Memory Medical Inc. (US), Artio Medical Inc. (US), Rapid Medical (US), Emboline, Inc. (US), and IMbiotechnologies Ltd. (Canada), among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 An indicative list of secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 BREAKDOWN OF PRIMARIES: EMBOLOTHERAPY MARKET

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

2.2.2 PRODUCT-BASED MARKET ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: EMBOLOTHERAPY MARKET

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 6 EMBOLOTHERAPY MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 7 EMBOLOTHERAPY MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 8 EMBOLOTHERAPY MARKET, BY PROCEDURE, 2021 VS. 2026 (USD MILLION)

FIGURE 9 EMBOLOTHERAPY MARKET SHARE, BY END USER, 2021 VS. 2026

FIGURE 10 GEOGRAPHICAL SNAPSHOT OF THE EMBOLOTHERAPY MARKET

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 EMBOLOTHERAPY: MARKET OVERVIEW

FIGURE 11 THE RISING INCIDENCE OF CHRONIC DISEASES IS A KEY FACTOR DRIVING MARKET GROWTH

4.2 GEOGRAPHIC ANALYSIS: NORTH AMERICA EMBOLOTHERAPY MARKET, BY PRODUCT, 2021 VS 2026, (USD MILLION)

FIGURE 12 THE EMBOLIC AGENTS SEGMENT WILL WITNESS HIGH GROWTH IN THE NORTH AMERICA MARKET IN 2026

4.3 EMBOLOTHERAPY MARKET, BY APPLICATION, 2021 VS 2026, (USD MILLION)

FIGURE 13 THE LIVER CANCER SUBSEGMENT OF THE ONCOLOGY APPLICATION IS EXPECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 EMBOLOTHERAPY MARKET, BY REGION AND PROCEDURE

FIGURE 14 TRANSARTERIAL EMBOLIZATION (TAE) PROCEDURE SEGMENT TO HOLD A MAJOR SHARE OF THE ASIA PACIFIC MARKET

4.5 GEOGRAPHIC ANALYSIS: EMBOLOTHERAPY MARKET, BY END USER AND REGION, 2021 VS. 2026 (USD MILLION)

FIGURE 15 AMBULATORY SURGICAL CENTERS SEGMENT TO WITNESS HIGH GROWTH IN EUROPE DURING THE FORECAST PERIOD

4.6 GEOGRAPHIC SNAPSHOT OF THE EMBOLOTHERAPY MARKET

FIGURE 16 CHINA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 EMBOLOTHERAPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing target patient population

TABLE 1 PRIMARY INCIDENCE OF LIVER CANCER AMONG MEN AND WOMEN (2005 VS. 2030)

TABLE 2 GERIATRIC POPULATION, BY REGION (2015 VS. 2030)

5.2.1.2 Rising patient preference for minimally invasive procedures

5.2.1.3 Funding & investments by government and private organizations

5.2.1.4 Technological advancements in embolotherapy devices

5.2.1.5 Favorable reimbursement scenario for minimally invasive surgeries

TABLE 3 MEDICAL REIMBURSEMENT CPT CODES FOR EMBOLIZATION PROCEDURES IN THE US (EFFECTIVE FROM JANUARY 2021)

TABLE 4 MEDICAL REIMBURSEMENT MS-DRG CODES FOR EMBOLIZATION PROCEDURES IN THE US (EFFECTIVE FROM JANUARY 2019)

5.2.2 RESTRAINTS

5.2.2.1 Lack of sufficient evidence & unfavorable regulatory scenario

5.2.2.2 Strong market positioning of alternative therapies

5.2.3 OPPORTUNITIES

5.2.3.1 Growth opportunities offered by emerging markets

5.2.3.2 Expanding applications of embolization devices

5.2.4 CHALLENGES

5.2.4.1 A dearth of skilled surgeons

5.2.4.2 High cost of embolization devices

5.3 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM: EMBOLOTHERAPY MARKET

5.5 REGULATORY ANALYSIS

5.5.1 NORTH AMERICA

5.5.1.1 US

TABLE 5 US FDA: MEDICAL DEVICE CLASSIFICATION

TABLE 6 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.5.1.2 Canada

TABLE 7 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

FIGURE 19 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

5.5.2 EUROPE

FIGURE 20 EUROPE: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES (MDR)

5.5.3 ASIA PACIFIC

5.5.3.1 Japan

TABLE 8 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PHARMACEUTICAL AND MEDICAL DEVICE AGENCY (PMDA)

5.5.3.2 China

TABLE 9 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.5.3.3 India

5.6 IMPACT OF COVID-19 ON EMBOLOTHERAPY MARKET

TABLE 10 COVID-19 GUIDELINES FOR TRIAGE OF VASCULAR SURGERY PATIENTS

6 EMBOLOTHERAPY MARKET, BY PRODUCT (Page No. - 72)

6.1 INTRODUCTION

TABLE 11 EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 EMBOLIC AGENTS

TABLE 12 EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 13 EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY REGION, 2019–2026 (USD MILLION)

TABLE 14 EMBOLIC AGENTS, BY TYPE

6.2.1 LIQUID EMBOLIC AGENTS

6.2.1.1 Significant adoption of embolic coils due to their procedural benefits over liquid embolic agents is expected to restrict the market growth

TABLE 15 EMBOLOTHERAPY MARKET FOR LIQUID EMBOLIC AGENTS, BY REGION, 2019–2026 (USD MILLION)

6.2.1.2 Embolotherapy market for liquid embolic agents, by application

TABLE 16 EMBOLOTHERAPY MARKET FOR LIQUID EMBOLIC AGENTS, BY APPLICATION, 2019–2026 (USD MILLION)

6.2.1.3 Embolotherapy market for liquid embolic agents, by Procedure

TABLE 17 EMBOLOTHERAPY MARKET FOR LIQUID EMBOLIC AGENTS, BY PROCEDURE, 2019–2026 (USD MILLION)

6.2.1.4 Embolotherapy market for liquid embolic agents, by end user

TABLE 18 EMBOLOTHERAPY MARKET FOR LIQUID EMBOLIC AGENTS, BY END USER, 2019–2026 (USD MILLION)

6.2.2 MICROSPHERES

6.2.2.1 Preference for alternative procedures limits the growth of this market segment

TABLE 19 EMBOLOTHERAPY MARKET FOR MICROSPHERES, BY REGION, 2019–2026 (USD MILLION)

6.2.2.2 Embolotherapy market for microspheres, by application

TABLE 20 EMBOLOTHERAPY MARKET FOR MICROSPHERES, BY APPLICATION, 2019–2026 (USD MILLION)

6.2.2.3 Embolotherapy market for microspheres, by Procedure

TABLE 21 EMBOLOTHERAPY MARKET FOR MICROSPHERES, BY PROCEDURE, 2019–2026 (USD MILLION)

6.2.2.4 Embolotherapy market for microspheres, by end user

TABLE 22 EMBOLOTHERAPY MARKET FOR MICROSPHERES, BY END USER, 2019–2026 (USD MILLION)

6.3 EMBOLIZATION COILS

TABLE 23 EMBOLIC COILS OFFERED BY MAJOR MARKET PLAYERS

TABLE 24 EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 25 EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY REGION, 2019–2026 (USD MILLION)

6.3.1 DETACHABLE COILS

6.3.1.1 Detachable coils can be retracted and redeployed a number of times until satisfactory placement is reached, which is a key advantage of this product segment

TABLE 26 EMBOLOTHERAPY MARKET FOR DETACHABLE COILS, BY REGION, 2019–2026 (USD MILLION)

6.3.1.2 Embolotherapy market for detachable coils, by application

TABLE 27 EMBOLOTHERAPY MARKET FOR DETACHABLE COILS, BY APPLICATION, 2019–2026 (USD MILLION)

6.3.1.3 Embolotherapy market for detachable coils, by Procedure

TABLE 28 EMBOLOTHERAPY MARKET FOR DETACHABLE COILS, BY PROCEDURE, 2019–2026 (USD MILLION)

6.3.1.4 Embolotherapy market for detachable coils, by end user

TABLE 29 EMBOLOTHERAPY MARKET FOR DETACHABLE COILS, BY END USER, 2019–2026 (USD MILLION)

6.3.2 PUSHABLE COILS

6.3.2.1 The use of pushable coils increases the risk of non-target vascular blockages, thus restricting their use in various applications

TABLE 30 EMBOLOTHERAPY MARKET FOR PUSHABLE COILS, BY REGION, 2019–2026 (USD MILLION)

6.3.2.2 Embolotherapy market for pushable coils, by application

TABLE 31 EMBOLOTHERAPY MARKET FOR PUSHABLE COILS, BY APPLICATION, 2019–2026 (USD MILLION)

6.3.2.3 Embolotherapy market for pushable coils, by Procedure

TABLE 32 EMBOLOTHERAPY MARKET FOR PUSHABLE COILS, BY PROCEDURE, 2019–2026 (USD MILLION)

6.3.2.4 Embolotherapy market for pushable coils, by end user

TABLE 33 EMBOLOTHERAPY MARKET FOR PUSHABLE COILS, BY END USER, 2019–2026 (USD MILLION)

6.4 EMBOLIC PLUG SYSTEMS

TABLE 34 EMBOLOTHERAPY MARKET FOR EMBOLIC PLUG SYSTEMS, BY REGION, 2019–2026 (USD MILLION)

6.4.1 EMBOLOTHERAPY MARKET FOR EMBOLIC PLUG SYSTEMS, BY APPLICATION

TABLE 35 EMBOLOTHERAPY MARKET FOR EMBOLIC PLUG SYSTEMS, BY APPLICATION, 2019–2026 (USD MILLION)

6.4.2 EMBOLOTHERAPY MARKET FOR EMBOLIC PLUG SYSTEMS, BY PROCEDURE

TABLE 36 EMBOLOTHERAPY MARKET FOR EMBOLIC PLUG SYSTEMS, BY PROCEDURE, 2019–2026 (USD MILLION)

6.4.3 EMBOLOTHERAPY MARKET FOR EMBOLIC PLUG SYSTEMS, BY END USER

TABLE 37 EMBOLOTHERAPY MARKET FOR EMBOLIC PLUG SYSTEMS, BY END USER, 2019–2026 (USD MILLION)

6.5 DETACHABLE BALLOONS

6.5.1 ADVERSE EVENTS ASSOCIATED WITH THE USE OF DETACHABLE BALLOONS SUCH AS BALLOON RUPTURE, FAILURE, OR SHRINKAGE MAY LIMIT THE UTILIZATION OF THIS EMBOLIC DEVICE

TABLE 38 EMBOLOTHERAPY MARKET FOR DETACHABLE BALLOONS, BY REGION, 2019–2026 (USD MILLION)

6.5.2 EMBOLOTHERAPY MARKET FOR DETACHABLE BALLOONS, BY APPLICATION

TABLE 39 EMBOLOTHERAPY MARKET FOR DETACHABLE BALLOONS, BY APPLICATION, 2019–2026 (USD MILLION)

6.5.3 EMBOLOTHERAPY MARKET FOR DETACHABLE BALLOONS, BY PROCEDURE

TABLE 40 EMBOLOTHERAPY MARKET FOR DETACHABLE BALLOONS, BY PROCEDURE, 2019–2026 (USD MILLION)

6.5.4 EMBOLOTHERAPY MARKET FOR DETACHABLE BALLOONS, BY END USER

TABLE 41 EMBOLOTHERAPY MARKET FOR DETACHABLE BALLOONS, BY END USER, 2019–2026 (USD MILLION)

6.6 SUPPORT DEVICES

TABLE 42 EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY REGION, 2019–2026 (USD MILLION)

6.6.1 MICROCATHETERS

6.6.1.1 Advancements and regulatory approvals in microcatheter technologies are expected to result in their wider adoption

TABLE 44 EMBOLOTHERAPY MARKET FOR MICROCATHETERS, BY REGION, 2019–2026 (USD MILLION)

6.6.1.2 Embolotherapy market for microcatheters, by application

TABLE 45 EMBOLOTHERAPY MARKET FOR MICROCATHETERS, BY APPLICATION, 2019–2026 (USD MILLION)

6.6.1.3 Embolotherapy market for microcatheters, by Procedure

TABLE 46 EMBOLOTHERAPY MARKET FOR MICROCATHETERS, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 47 EMBOLOTHERAPY MARKET FOR MICROCATHETERS, BY END USER, 2019–2026 (USD MILLION)

6.6.2 GUIDEWIRES

6.6.2.1 Rising adoption of guidewires among medical professionals owing to their procedural benefits is expected to drive market growth

TABLE 48 EMBOLOTHERAPY MARKET FOR GUIDEWIRES, BY REGION, 2019–2026 (USD MILLION)

6.6.2.2 Embolotherapy market for guidewires, by application

TABLE 49 EMBOLOTHERAPY MARKET FOR GUIDEWIRES, BY APPLICATION, 2019–2026 (USD MILLION)

6.6.2.3 Embolotherapy market for guidewires, by Procedure

TABLE 50 EMBOLOTHERAPY MARKET FOR GUIDEWIRES, BY PROCEDURE, 2019–2026 (USD MILLION)

6.6.2.4 Embolotherapy market for guidewires, by end user

TABLE 51 EMBOLOTHERAPY MARKET FOR GUIDEWIRES, BY END USER, 2019–2026 (USD MILLION)

7 EMBOLOTHERAPY MARKET, BY APPLICATION (Page No. - 96)

7.1 INTRODUCTION

TABLE 52 EMBOLOTHERAPY MARKET, BY APPLICATION, 2019–2026

7.2 ONCOLOGY

TABLE 53 EMBOLOTHERAPY MARKET FOR ONCOLOGY, BY TYPE, 2019–2026

TABLE 54 EMBOLOTHERAPY MARKET FOR CANCER, BY REGION, 2019–2026

7.2.1 LIVER CANCER

7.2.1.1 The rising prevalence of liver cancer is expected to drive segment growth

TABLE 55 EMBOLOTHERAPY MARKET FOR LIVER CANCER, BY REGION, 2019–2026 (USD MILLION)

7.2.2 KIDNEY CANCER

7.2.2.1 Preoperative kidney tumor embolization in the treatment of kidney cancer drives the segment growth

TABLE 56 EMBOLOTHERAPY MARKET FOR KIDNEY CANCER, BY REGION, 2019–2026 (USD MILLION)

7.2.3 LUNG CANCER

7.2.3.1 Use of arterial embolotherapy in patients with primary lung cancer to drive the segment growth

TABLE 57 EMBOLOTHERAPY MARKET FOR LUNG CANCER, BY REGION, 2019–2026 (USD MILLION)

7.2.3.2 The increasing prevalence of breast cancer is a key factor in the higher adoption of embolotherapy among surgeons

TABLE 58 EMBOLOTHERAPY MARKET FOR BREAST CANCER, BY REGION, 2019–2026 (USD MILLION)

7.2.4 OTHER CANCERS

TABLE 59 EMBOLOTHERAPY MARKET FOR OTHER CANCERS, BY REGION, 2019–2026 (USD MILLION)

7.3 PERIPHERAL VASCULAR DISEASES

7.3.1 RISING ADOPTION OF VASCULAR PLUGS IS A KEY FACTOR DRIVING MARKET GROWTH

TABLE 60 EMBOLOTHERAPY MARKET FOR PERIPHERAL VASCULAR DISEASES, BY REGION, 2019–2026 (USD MILLION)

7.4 NEUROLOGY

TABLE 61 EMBOLOTHERAPY MARKET FOR NEUROLOGY, BY TYPE, 2019–2026

TABLE 62 EMBOLOTHERAPY MARKET FOR NEUROLOGY, BY REGION, 2019–2026 (USD MILLION)

7.4.1 BRAIN ANEURYSM

7.4.1.1 Limited availability of reimbursements across major markets may hinder the market growth

TABLE 63 EMBOLOTHERAPY MARKET FOR BRAIN ANEURYSM, BY REGION, 2019–2026 (USD MILLION)

7.4.2 CEREBRAL ARTERIOVENOUS MALFORMATION

7.4.2.1 Side effects associated with AVM embolization procedures may restrict market growth to a certain extent

TABLE 64 EMBOLOTHERAPY MARKET FOR CEREBRAL ARTERIOVENOUS MALFORMATION, BY REGION, 2019–2026 (USD MILLION)

7.5 UROLOGY & NEPHROLOGY

TABLE 65 EMBOLOTHERAPY MARKET FOR UROLOGY & NEPHROLOGY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 EMBOLOTHERAPY MARKET FOR UROLOGY & NEPHROLOGY, BY REGION, 2019–2026 (USD MILLION)

7.5.1 BENIGN PROSTATIC HYPERPLASIA

7.5.1.1 Risks associated with traditional surgery will make patients opt for PAE treatment

TABLE 67 EMBOLOTHERAPY MARKET FOR BENIGN PROSTATIC HYPERPLASIA, BY REGION, 2019–2026 (USD MILLION)

7.5.1.2 Advantages offered by the UFE over other techniques is a key factor driving market growth

TABLE 68 EMBOLOTHERAPY MARKET FOR UTERINE FIBROIDS, BY REGION, 2019–2026 (USD MILLION)

7.5.2 OTHER UROLOGY & NEPHROLOGY APPLICATIONS

7.5.2.1 Safety and minimal complication with the use of TAE in this segment will drive the market growth

TABLE 69 EMBOLOTHERAPY MARKET FOR OTHER UROLOGY & NEPHROLOGY APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

7.6 GASTROINTESTINAL DISORDERS

7.6.1 EMBOLIZATION IS A WIDELY ADOPTED PROCEDURE USED TO TREAT LGIB AND UGIB

TABLE 70 EMBOLOTHERAPY MARKET FOR GASTROINTESTINAL DISORDERS, BY REGION, 2019–2026 (USD MILLION)

8 EMBOLOTHERAPY MARKET, BY PROCEDURE (Page No. - 111)

8.1 INTRODUCTION

TABLE 71 EMBOLOTHERAPY MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

8.2 TRANSCATHETER ARTERIAL EMBOLIZATION (TAE)

8.2.1 THE GROWTH OF THIS SEGMENT IS LARGELY DRIVEN DUE TO THE INCREASING INCIDENCE OF UTERINE FIBROIDS & VASCULAR LESIONS

TABLE 72 TRANSCATHETER ARTERIAL EMBOLIZATION MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3 TRANSCATHETER ARTERIAL RADIOEMBOLIZATION (TARE)/SELECTIVE INTERNAL RADIATION THERAPY (SIRT)

8.3.1 BETTER CLINICAL OUTCOMES & INCREASED CANCER SURVIVAL RATE SUPPORTS THE GROWTH OF THIS SEGMENT

TABLE 73 TRANSCATHETER ARTERIAL RADIOEMBOLIZATION MARKET, BY REGION, 2019–2026 (USD MILLION)

8.4 TRANSARTERIAL CHEMOEMBOLIZATION (TACE)

8.4.1 TACE CAN BE USED TO TREAT TUMORS THAT ARE RELATIVELY LARGER IN SIZE, WHICH CANNOT BE EASILY TREATED BY TUMOR ABLATION

TABLE 74 TRANSARTERIAL CHEMOEMBOLIZATION MARKET, BY REGION, 2019–2026

9 EMBOLOTHERAPY MARKET, BY END USER (Page No. - 117)

9.1 INTRODUCTION

TABLE 75 EMBOLOTHERAPY MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2 HOSPITALS AND CLINICS

9.2.1 RISING INCIDENCE OF TARGET DISEASES TO PROPEL MARKET GROWTH

TABLE 76 EMBOLOTHERAPY MARKET FOR HOSPITALS AND CLINICS, BY REGION, 2019–2026 (USD MILLION)

9.3 AMBULATORY SURGERY CENTERS

9.3.1 INCREASING AVAILABILITY OF REIMBURSEMENTS TO DRIVE THE ADOPTION OF EMBOLOTHERAPY PRODUCTS IN ASCS

TABLE 77 EMBOLOTHERAPY MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2019–2026 (USD MILLION)

9.4 OTHER END USERS

TABLE 78 EMBOLOTHERAPY MARKET FOR OTHER END USERS, BY REGION, 2019–2026 (USD MILLION)

10 EMBOLOTHERAPY MARKET, BY REGION (Page No. - 121)

10.1 INTRODUCTION

TABLE 79 EMBOLOTHERAPY MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 21 NORTH AMERICA: EMBOLOTHERAPY MARKET SNAPSHOT

TABLE 80 NORTH AMERICA: EMBOLOTHERAPY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: EMBOLOTHERAPY MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: EMBOLOTHERAPY MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: EMBOLOTHERAPY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Increasing R&D investments in the country drives the market growth

TABLE 88 US: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 89 US: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 US: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 US: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 The rising prevalence of cancer supports market growth in Canada

TABLE 92 CANADA: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 93 CANADA: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 CANADA: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 CANADA: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 96 EUROPE: EMBOLOTHERAPY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 97 EUROPE: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 98 EUROPE: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 EUROPE: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 EUROPE: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 EUROPE: EMBOLOTHERAPY MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 102 EUROPE: EMBOLOTHERAPY MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 103 EUROPE: EMBOLOTHERAPY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany is the fastest growing market in Europe

TABLE 104 GERMANY: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 105 GERMANY: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 GERMANY: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 GERMANY: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 The rising geriatric population and the high incidence of chronic diseases support market growth in the UK

TABLE 108 UK: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 109 UK: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 UK: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 UK: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 The growing geriatric population coupled with the increasing number of target surgeries to support market growth in France

TABLE 112 FRANCE: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 113 FRANCE: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 FRANCE: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 FRANCE: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Increasing government funding for research to support market growth

TABLE 116 SPAIN: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 117 SPAIN: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 SPAIN: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 SPAIN: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3.5 ITALY

10.3.5.1 Rising awareness activities to support market growth

TABLE 120 ITALY: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 121 ITALY: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 ITALY: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 ITALY: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 124 REST OF EUROPE: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 125 REST OF EUROPE: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 126 REST OF EUROPE: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 REST OF EUROPE: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 22 ASIA PACIFIC: EMBOLOTHERAPY MARKET SNAPSHOT

TABLE 128 ASIA PACIFIC: EMBOLOTHERAPY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 129 ASIA PACIFIC: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 130 ASIA PACIFIC: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 131 ASIA PACIFIC: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 132 ASIA PACIFIC: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 133 ASIA PACIFIC: EMBOLOTHERAPY MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 134 ASIA PACIFIC: EMBOLOTHERAPY MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 135 ASIA PACIFIC: EMBOLOTHERAPY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Presence of universal healthcare reimbursement scenario and growing geriatric population—key factors driving market growth

TABLE 136 JAPAN: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 137 JAPAN: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 JAPAN: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 139 JAPAN: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Increasing patient pool and government initiatives for healthcare development supports market growth

TABLE 140 CHINA: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 141 CHINA: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 CHINA: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 CHINA: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Ongoing modernization and infrastructure development in India to support the market growth for embolotherapy

TABLE 144 INDIA: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 145 INDIA: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 146 INDIA: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 INDIA: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.4.4 SOUTH KOREA

10.4.4.1 Rising R&D and promising clinical trials in the country to positively impact market growth

TABLE 148 SOUTH KOREA: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 149 SOUTH KOREA: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 SOUTH KOREA: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 SOUTH KOREA: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.4.5 AUSTRALIA

10.4.5.1 Rising research investments and awareness campaigns are the key factors supporting market growth in Australia

TABLE 152 AUSTRALIA: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 153 AUSTRALIA: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 AUSTRALIA: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 155 AUSTRALIA: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 156 REST OF APAC: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 157 REST OF APAC: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 158 REST OF APAC: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 REST OF APAC: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

TABLE 160 LATIN AMERICA: EMBOLOTHERAPY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 161 LATIN AMERICA: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 162 LATIN AMERICA: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 163 LATIN AMERICA: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 LATIN AMERICA: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 LATIN AMERICA: EMBOLOTHERAPY MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 166 LATIN AMERICA: EMBOLOTHERAPY MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 167 LATIN AMERICA: EMBOLOTHERAPY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Brazil is a key market in Latin America owing to the modernization of healthcare facilities

TABLE 168 BRAZIL: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 169 BRAZIL: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 BRAZIL : EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 171 BRAZIL: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Availability of advanced care and increasing awareness programs are driving market growth in Mexico

TABLE 172 MEXICO: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 173 MEXICO: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 174 MEXICO: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 175 MEXICO: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 176 REST OF LATAM: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 177 REST OF LATAM: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 178 REST OF LATAM: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 179 REST OF LATAM: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE AND INCREASING PUBLIC-PRIVATE INVESTMENTS TO DRIVE MARKET GROWTH IN THE MEA

TABLE 180 MIDDLE EAST & AFRICA: EMBOLOTHERAPY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: EMBOLOTHERAPY MARKET FOR EMBOLIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: EMBOLOTHERAPY MARKET FOR EMBOLIC COILS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: EMBOLOTHERAPY MARKET FOR SUPPORT DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: EMBOLOTHERAPY MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: EMBOLOTHERAPY MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: EMBOLOTHERAPY MARKET, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 174)

11.1 OVERVIEW

FIGURE 23 KEY DEVELOPMENTS IN THE EMBOLOTHERAPY MARKET FROM 2017 TO 2020

11.2 GLOBAL MARKET SHARE ANALYSIS

11.2.1 GLOBAL EMBOLOTHERAPY MARKET SHARE ANALYSIS (2019)

FIGURE 24 GLOBAL EMBOLOTHERAPY MARKET SHARE ANALYSIS, BY KEY PLAYER (2020)

11.3 COMPETITIVE LEADERSHIP MAPPING

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE

11.3.4 PARTICIPANTS

FIGURE 25 EMBOLOTHERAPY MARKET: COMPETITIVE LEADERSHIP MAPPING (2020)

FIGURE 26 EMBOLOTHERAPY MARKET: COMPETITIVE LEADERSHIP MAPPING (SME/START-UPS)

11.4 COMPETITIVE SCENARIO

11.4.1 PRODUCT LAUNCHES

TABLE 187 EMBOLOTHERAPY MARKET: PRODUCT LAUNCHES AND APPROVALS, 2017–2020

11.4.2 EXPANSIONS

TABLE 188 EMBOLOTHERAPY MARKET: EXPANSIONS, 2017–2020

11.4.3 ACQUISITIONS

TABLE 189 EMBOLOTHERAPY MARKET: ACQUISITIONS, 2017–2020

12 COMPANY PROFILES (Page No. - 181)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.1 KEY PLAYERS

12.1.1 BOSTON SCIENTIFIC CORPORATION

TABLE 190 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

FIGURE 27 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

12.1.2 MERIT MEDICAL SYSTEMS

TABLE 191 MERIT MEDICAL SYSTEMS: BUSINESS OVERVIEW

FIGURE 28 MERIT MEDICAL SYSTEMS: COMPANY SNAPSHOT

12.1.3 TERUMO CORPORATION

TABLE 192 TERUMO CORPORATION: BUSINESS OVERVIEW

FIGURE 29 TERUMO CORPORATION: COMPANY SNAPSHOT

12.1.4 MEDTRONIC PLC

TABLE 193 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 30 MEDTRONIC PLC: COMPANY SNAPSHOT

12.1.5 ABBOTT LABORATORIES

TABLE 194 ABBOTT LABORATORIES: BUSINESS OVERVIEW

FIGURE 31 ABBOTT LABORATORIES: COMPANY SNAPSHOT

12.1.6 DEPUY SYNTHES (J&J MEDICAL DEVICES)

TABLE 195 DEPUY SYNTHES: BUSINESS OVERVIEW

FIGURE 32 JOHNSON & JOHNSON: COMPANY SNAPSHOT

12.1.7 COOK MEDICAL

TABLE 196 COOK MEDICAL: BUSINESS OVERVIEW

12.1.8 BALT

TABLE 197 BALT: BUSINESS OVERVIEW

12.1.9 SIRTEX MEDICAL LIMITED (PART OF CDH INVESTMENTS)

TABLE 198 SIRTEX MEDICAL LIMITED: BUSINESS OVERVIEW

12.1.10 KANEKA CORPORATION

TABLE 199 KANEKA CORPORATION: BUSINESS OVERVIEW

FIGURE 33 KANEKA CORPORATION: COMPANY SNAPSHOT

12.1.11 STRYKER CORPORATION

TABLE 200 STRYKER CORPORATION: BUSINESS OVERVIEW

FIGURE 34 STRYKER CORPORATION: COMPANY SNAPSHOT

12.2 OTHER PLAYERS

12.2.1 PENUMBRA, INC.

TABLE 201 PENUMBRA, INC.: BUSINESS OVERVIEW

FIGURE 35 PENUMBRA, INC.: COMPANY SNAPSHOT

12.2.2 MERIL LIFE SCIENCES PVT., LTD.

TABLE 202 MERIL LIFE SCIENCES PVT., LTD.: BUSINESS OVERVIEW

12.2.3 ACANDIS GMBH

TABLE 203 ACANDIS GMBH: BUSINESS OVERVIEW

12.2.4 CARDIVA MEDICAL INC. (PART OF HAEMONETICS)

TABLE 204 CARDIVA MEDICAL INC.: BUSINESS OVERVIEW

12.2.5 SHAPE MEMORY MEDICAL, INC.

TABLE 205 SHAPE MEMORY MEDICAL, INC..: BUSINESS OVERVIEW

12.2.6 ARTIO MEDICAL, INC.

TABLE 206 ARTIO MEDICAL, INC.: BUSINESS OVERVIEW

12.2.7 RAPID MEDICAL

TABLE 207 RAPID MEDICAL: BUSINESS OVERVIEW

12.2.8 IMBIOTECHNOLOGIES LTD.

TABLE 208 IMBIOTECHNOLOGIES LTD.: BUSINESS OVERVIEW

12.2.9 EMBOLINE, INC.

TABLE 209 EMBOLINE, INC.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 222)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

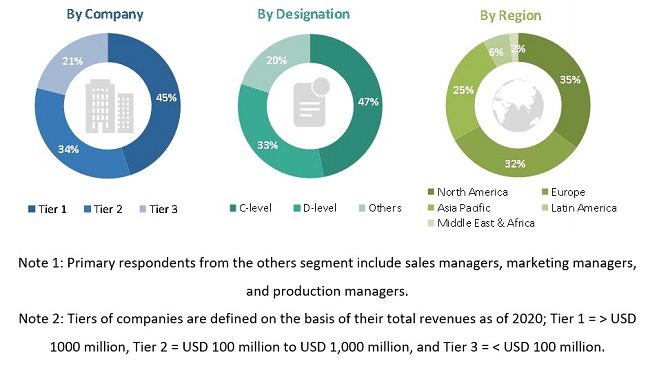

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the embolotherapy market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Primary research was conducted after acquiring extensive knowledge about the global embolotherapy market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as CROs, hospitals, transplant centers, healthcare service providers, commercial service providers, academia, and research organizations) and supply-side respondents (such as presidents, CEOs, vice presidents, directors, general managers, heads of business units, and senior managers) across five major geographies, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East, and Africa. Approximately 60% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 40%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

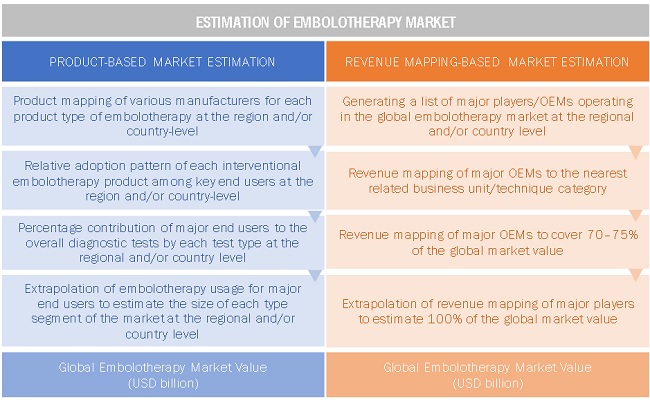

Market Estimation Methodology

A detailed market estimation approach was followed to estimate and validate the size of the global embolotherapy market and other dependent submarkets.

- The key players in the global embolotherapy market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts for key insights on the global embolotherapy market.

- All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

- All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation:

After deriving the overall Embolotherapy market value data from the market size estimation process, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative and quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macro indicators.

Report Objectives:

- To define, describe, and forecast the embolotherapy market on the basis of product, disease indication, procedure, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the embolotherapy market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea, and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as new product launches; agreements, partnerships, and joint ventures; mergers & acquisitions; business expansions and research & development activities in the embolotherapy market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global embolotherapy market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe embolotherapy market into Belgium, Austria, the Czech Republic, Denmark, Greece, Poland, and Russia, among other

- Further breakdown of the Rest of Asia Pacific embolotherapy market into wan, New Zealand, Vietnam, the Philippines, Singapore, Malaysia, Thailand, and Indonesia among other

- Further breakdown of the Latin American embolotherapy market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Embolotherapy Market