Embedded AI Market by Offering (Hardware, Software, Services), Data Type (Numerical Data, Categorical Data, Image & Video Data), Vertical (Automotive, Manufacturing, Healthcare & Life Sciences, Telecom), and Region - Global Forecast to 2028

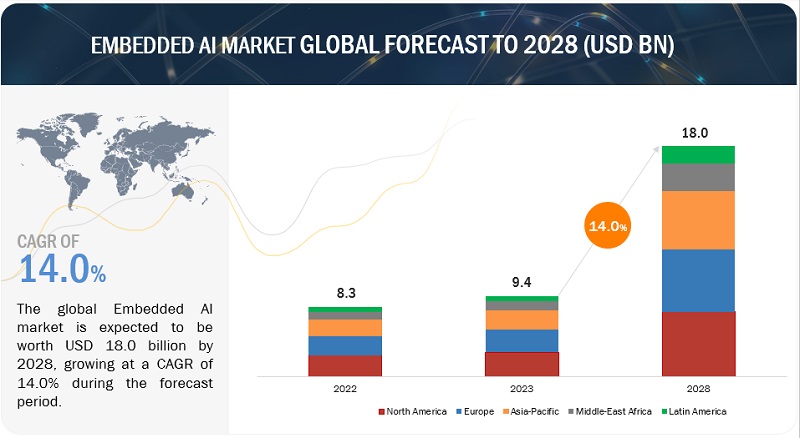

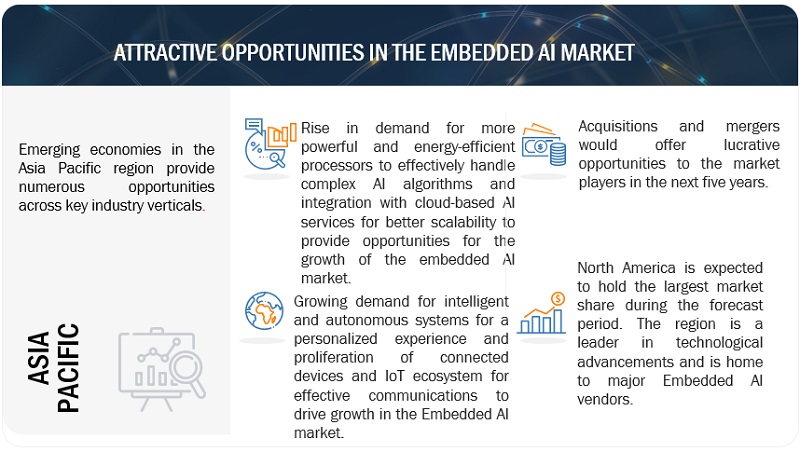

[328 Pages Report] The embedded AI market is estimated to grow from USD 9.4 billion in 2023 to USD 18.0 billion by 2028, at a CAGR of 14.0% during the forecast period. Rise in demand for more powerful and energy-efficient processors to effectively handle complex AI algorithms and integration with cloud-based AI services for better scalability to offer opportunities to the end users to leverage embedded AI solutions. Moreover, the growing demand for intelligent and autonomous systems for a personalized experience and the proliferation of connected devices and IoT ecosystems for effective communications will boost market growth worldwide.

Embedded AI Market Technology Roadmap till 2030

The embedded AI market report covers the embedded AI technology roadmap till 2030, with insights around the initiation, development, and commercialization of technologies across AI-driven autonomous systems, AI-driven intelligent devices, and next-gen embedded AI systems. Some of the key findings from the technology roadmap include:

Embedded AI Market Short-term Technology Roadmap (2023-2025)

- Advancements in edge AI platforms to provide enhanced processing power, reduce latency, and flexibility

- Commercialization of Embedded AI enhancing human intelligence in a wide range of applications

Embedded AI Market Mid-term Technology Roadmap (2026-2028)

- Development in hardware accelerators empowers embedded AI solutions by improving performance, energy efficiency, compactness, real-time responsiveness, and cost-effectiveness

- Next-gen embedded AI systems will continue to push the boundaries of what is possible at the edge to enable intelligent, autonomous, and context-aware applications across various industries

Embedded AI Market Long-term Technology Roadmap (2029-2030)

- Advanced AI-driven autonomous systems heavily rely on embedded AI for advanced sensing and perception capabilities

- AI-driven intelligent devices continue to evolve and become more pervasive in homes, workplaces, and other environments, embedded AI will play a vital role in enabling their intelligent and context-aware capabilities

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Growing demand for intelligent and autonomous systems for a personalized experience

The increasing need for advanced technologies that can provide personalized and adaptive experiences to users to boost the adoption of embedded AI solutions in the market. The demand for personalized experiences has led to the integration of AI capabilities into various embedded systems. By leveraging embedded AI solutions, devices and applications can analyze user data, preferences, and behavior to provide tailored recommendations, suggestions, and responses. This enhances user satisfaction and engagement. Moreover, embedded AI solutions can enable autonomous behavior in devices and systems, reducing the need for constant user interference. This is particularly relevant in applications such as autonomous vehicles, smart home automation, and industrial automation, where embedded AI algorithms can enable intelligent decision-making and automated actions. Embedded AI solutions can leverage machine learning algorithms to analyze data patterns and make predictions about user preferences, behavior, or system performance. This helps in anticipating user needs, optimizing resource allocation, and enhancing the overall efficiency of embedded systems. Nowadays, the demand for voice-controlled and natural language interfaces is soaring. Embedded AI solutions can incorporate natural language processing (NLP) and voice recognition capabilities, allowing users to interact with devices and applications using voice commands, making the experience more intuitive and user-friendly. Overall, the growing demand for intelligent and autonomous systems for personalized experience is driving the development and adoption of embedded AI solutions. These solutions enable devices and systems to understand user preferences, adapt to changing contexts, make intelligent decisions, and provide personalized experiences, ultimately enhancing user satisfaction and driving market growth.

Restraint: Concerns related to data privacy and security

Data privacy and security concerns can erode trust between users and embedded AI solutions. Users may hesitate to share their data or engage with AI-powered systems if they are not confident in the security measures. Lack of transparency about how embedded AI solutions collect, store, and use data can further contribute to mistrust and hinder adoption. Embedded AI solutions may have access to a wide range of data, including personal information and user behavior. Concerns arise regarding the ethical use of this data and the potential for misuse or biased decision-making. Ensuring fairness, transparency, and accountability in AI algorithms and data processing becomes crucial to address these concerns. Failure to address ethical considerations can result in resistance to adopting embedded AI solutions. To overcome these challenges and boost the adoption of embedded AI solutions, vendors and organizations need to prioritize data privacy and security. This includes implementing robust security measures, complying with data protection regulations, ensuring transparency and accountability in data handling, and promoting ethical use of data. Building trust among users by addressing privacy concerns and communicating the steps to secure data can help alleviate barriers to adoption and drive wider acceptance of embedded AI solutions.

Opportunity : Rise in demand for more powerful and energy-efficient processors to effectively handle complex AI algorithms

The rise in demand for more powerful and energy-efficient processors to effectively handle complex AI algorithms provides more significant opportunities for embedded AI solution providers in the market. As AI algorithms become increasingly complex and resource-intensive, there is a growing need for processors that can handle computational demands efficiently. The demand for more powerful processors, such as high-performance CPUs, GPUs, and specialized AI accelerators, opens opportunities for embedded AI solution providers to offer advanced hardware solutions. By developing and offering processors specifically optimized for AI workloads, providers can cater to the increasing demand for enhanced performance and enable more sophisticated embedded AI applications. Furthermore, traditional processors may need help to handle the computational requirements of AI algorithms while maintaining energy efficiency. Energy-efficient processors, including low-power CPUs, specialized AI chips, and edge computing solutions, are in high demand to enable embedded AI solutions in resource-constrained environments. Embedded AI solution providers can capitalize on this opportunity by developing energy-efficient processors that deliver high-performance computing while minimizing power consumption. These processors can be integrated into various devices and systems, enabling AI capabilities without compromising energy efficiency. Henceforth, the rise in demand for more powerful and energy-efficient processors to handle complex AI algorithms offers significant opportunities for embedded AI solution providers. By focusing on developing advanced processors, energy-efficient solutions, edge computing capabilities, and fostering partnerships, providers can capitalize on the growing market demand and deliver high-performance embedded AI solutions that meet customers’ evolving needs.

Challenge: Inadequate computational resources and model optimization

Embedded AI solutions often operate on resource-constrained devices with limited processing power, memory, and energy. Inadequate computational resources can limit the performance of AI algorithms, leading to slower inference times, reduced accuracy, and compromised user experience. When AI models cannot be efficiently executed on embedded devices due to computational limitations, it hinders the adoption of embedded AI solutions as they may not meet the performance requirements of the intended applications. Model optimization involves techniques like quantization, pruning, and model compression to reduce the model size and computational requirements without significant loss of accuracy. However, optimizing models for embedded devices can be complex and time-consuming. Inadequate computational resources can limit the ability to optimize models effectively, resulting in suboptimal performance and hindering the widespread adoption of embedded AI solutions. Addressing the challenge of inadequate computational resources and model optimization requires a combination of hardware advancements, algorithmic optimizations, and software frameworks tailored for embedded AI. As the industry continues to innovate in these areas, overcoming these challenges will help accelerate the adoption of embedded AI solutions in various domains and enable deploying more powerful and efficient AI applications on resource-constrained devices.

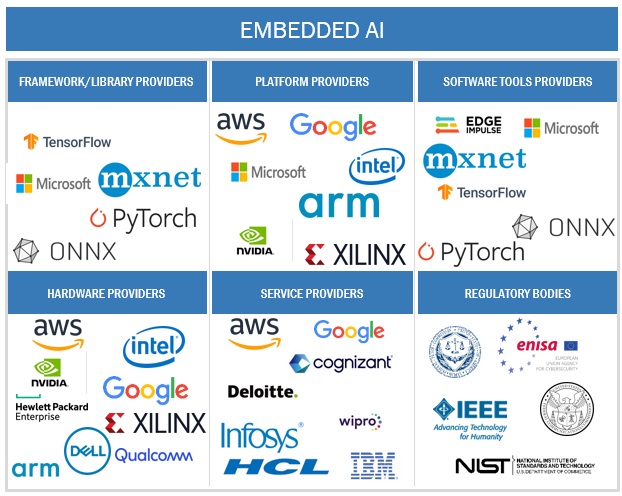

Embedded AI Market Ecosystem

By offering software to register at the highest CAGR during the forecast period

Embedded AI software plays a crucial role in the market by providing the necessary algorithms, frameworks, and libraries to enable AI capabilities on embedded systems. Embedded AI software unlocks the potential of AI on embedded systems, enabling intelligent decision-making, real-time data analysis, and enhanced functionality across various industries. Embedded AI software allows embedded devices to process and interpret data locally, leading to increased autonomy, improved performance, and enhanced user experiences.

By data type, numeric data to account for the largest market size during the forecast period

Numeric data forms the foundation for training, optimizing, and deploying AI models on embedded systems. Embedded AI systems can leverage numeric data to optimize operations and resource utilization. By analyzing historical data and patterns, AI models embedded in the system can make data-driven decisions to optimize energy consumption, scheduling, routing, or resource allocation. This data-driven optimization can improve efficiency, and cost savings, to enhance performance across various sectors such as energy & utilities, transportation & logistics, manufacturing, and many more.

By Services, training and consulting to register at the highest CAGR during the forecast period

Training and consulting services play a significant role in the market for embedded AI solutions by providing expertise, guidance, and support to organizations adopting embedded AI technologies. Training and consulting services assist organizations in developing and optimizing AI models for embedded systems. They offer guidance in selecting appropriate algorithms, data preprocessing techniques, and well-suited model architectures for the embedded environment. By leveraging their expertise, these services ensure that AI models are efficiently trained, optimized, and fine-tuned to achieve optimal performance on embedded devices.

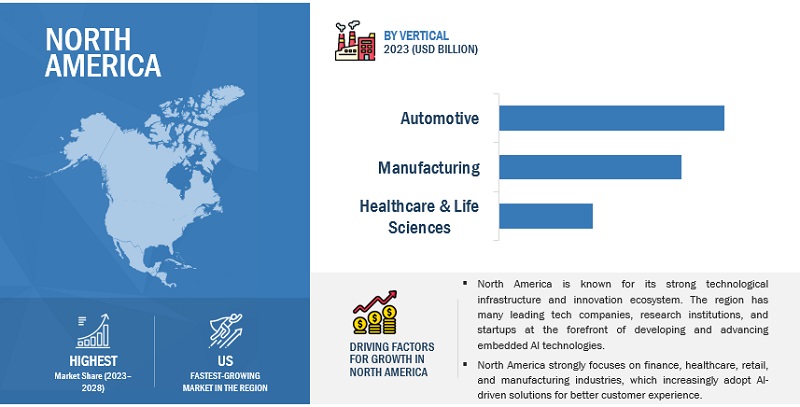

North America to account for the largest market size during the forecast period

North America is a leading region in adopting and growing embedded AI solutions. The presence of advanced AI technology companies, robust R&D capabilities, and a mature market ecosystem contribute to the rapid growth of embedded AI solutions in this region. Embedded AI adoption in North America has been growing steadily in recent years, driven by advancements in AI technologies, increasing demand for intelligent edge devices, and the proliferation of IoT applications. Overall, embedded AI adoption in North America is gaining momentum across industries, driven by technological advancements, the rise of IoT, a supportive ecosystem, and increasing awareness of its benefits.

Embedded AI Companies

The embedded AI market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Key players operating in the embedded AI market include Google (US), IBM (US), Microsoft (US), AWS (US), NVIDIA (US), Intel (US), Qualcomm (US), Arm (UK), AMD (US), MediaTek (Taiwan), Oracle (US), Salesforce (US), NXP (The Netherlands), Lattice (US), Octonion (Switzerland), NeuroPace (US), Siemens (Germany), HPE (US), LUIS Technology (Germany), Code Time Technologies (Canada), HiSilicon (China), VectorBlox (Canada), AU-Zone Technologies (Canada), STMicroelectronics (Switzerland), SenseTime (Hong Kong), Edge Impulse (US), Perceive (US), Eta Compute (US), SensiML (US), Syntiant (US), Graphcore (UK), and SiMa.ai (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD (Billion) |

|

Segments covered |

Offering, Data Type, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

|

List of Companies in Embedded AI |

Google (US), IBM (US), Microsoft (US), AWS (US), NVIDIA (US), Intel (US), Qualcomm (US), Arm (UK), AMD (US), MediaTek (Taiwan), Oracle (US), Salesforce (US), NXP (Netherlands), Lattice (Oregon), Octonion (Switzerland), NeuroPace (US), Siemens (Germany), HPE (US), LUIS Technology (Germany), Code Time Technologies (Canada), HiSilicon (China), VectorBlox (Canada), Au-Zone Technologies (Canada), STMicroelectronics (Switzerland), SenseTime (Hong Kong), Edge Impulse (US), Perceive (US), Eta Compute (US), SensiML (US), Syntiant (US), Graphcore (UK), and SiMa.ai (US). |

This research report categorizes the Embedded AI market based on offering, data type, vertical, and region.

By Offering:

- Hardware

- Software

- Services

By Data Type:

- Sensor Data

- Image and Video Data

- Numeric Data

- Categorial Data

- Other Data Types (iris & facial data, text data, time series data, and audio data)

By Vertical:

- BFSI

- IT & ITES

- Retail & Ecommerce

- Manufacturing

- Energy & Utilities

- Transportation & Logistics

- Healthcare & Life Sciences

- Media & Entertainment

- Telecom

- Automotive

- Other Verticals (government, aerospace and defense, construction & real estate, agriculture, education, and travel & hospitality)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand (ANZ)

- South Korea

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Rest of the Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In April 2023, IBM announced the launch of Watson Edge for Financial Services, a solution that helps financial institutions deploy AI at the edge to improve customer service, fraud detection, and risk management.

- In April 2023, Qualcomm Technologies partnered with eInfochips, an Arrow company, to launch Edge Labs. Edge Labs is a program that will help developers and innovators accelerate the development and deployment of AI applications for embedded devices. This partnership will help developers and innovators accelerate developing and deploying AI applications for embedded devices. Edge Labs will provide developers with access to Qualcomm’s expertise in AI and eInfochips' development and deployment services.

- In March 2023, Arm partnered with Google Cloud to bring Arm-based solutions to the Google Cloud Platform (GCP). The partnership is expected to help Arm customers take advantage of GCP's AI and machine learning capabilities and to help Google Cloud customers deploy Arm-based solutions.

- In March 2023, IBM acquired Instana, an application performance monitoring software provider. The acquisition will help IBM to expand its edge AI capabilities and provide customers with a more comprehensive view of their applications.

- In March 2023, the AI-powered tool has been designed to assist Microsoft 365 users in performing various tasks, such as troubleshooting, training, and onboarding. Microsoft 365 Copilot, as an embedded AI technology, is integrated within a broader software ecosystem and has been created to function seamlessly with other Microsoft 365 products and services.

- In October 2022, Intel partnered with Amazon Web Services (AWS) to bring Intel-based solutions to AWS. The partnership is expected to help Intel customers use AWS’s AI and machine learning capabilities to help AWS customers deploy Intel-based solutions.

- In June 2022, Microsoft announced a partnership with NVIDIA to accelerate the development and deployment of edge AI applications. The partnership will combine Microsoft’s Azure platform with NVIDIA’s AI hardware and software to create a more comprehensive solution for edge computing.

- In Jan 2022, IBM partnered with Google Cloud to accelerate the development and deployment of edge AI applications. The partnership will combine IBM’s AI and ML expertise with Google Cloud’s infrastructure and AI capabilities.

Frequently Asked Questions (FAQ):

What is Embedded AI?

Embedded AI integrates artificial intelligence (AI) technologies into embedded systems, computer systems designed for specific tasks or functions. It involves deploying AI algorithms, models, and software directly on embedded devices, such as microcontrollers, system-on-chips (SoCs), and other hardware platforms.

Which countries are considered in the European region?

The countries such as the UK, Germany, France, Spain, and Italy are the major economies in the region that leverage embedded AI solutions.

Which vertical is expected to witness a higher market share in the embedded AI market?

Automotive is the leading sector that leverages embedded AI solutions for applications like advanced driver assistance systems (ADAS), autonomous driving, vehicle control, and infotainment systems. AI algorithms embedded in vehicles help improve safety, efficiency, and user experience.

Which are key verticals adopting Embedded AI solutions and services?

Some key verticals such as automotive, manufacturing, retail & eCommerce, healthcare & life sciences, and Telecom are leveraging embedded AI solutions to provide personalized customer experiences.

Who are the key vendors in the Embedded AI market?

Google (US), IBM (US), Microsoft (US), AWS (US), NVIDIA (US), Intel (US), Qualcomm (US), Arm (UK), AMD (US), MediaTek (Taiwan), and Oracle (US) are the key vendors that offer embedded AI solutions for improved operational efficiency, enhanced customer experiences, better decision-making, and the optimization of various processes across different sectors.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for intelligent and autonomous systems- Increasing advancements in AI and ML technologies for better and smart decisions- Proliferation of connected devices and IoT ecosystem for effective communications- Rising use of embedded AI for industry-specific applicationsRESTRAINTS- Data privacy and security concerns- Shortage of skilled and talented workforceOPPORTUNITIES- Rising demand for more powerful and energy-efficient processors- Integration with cloud-based AI services for better scalabilityCHALLENGES- Inadequate computational resources and model optimization- High infrastructure costs with lower ROI

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: EDGE IMPULSE HELPED OURA RING PROVIDE ENHANCED ANALYSIS OF SLEEP PATTERNS AND USER READINESSCASE STUDY 2: NVIDIA JETSON TX2 NX OFFERED ACCURATE FALL DETECTION BY DEPLOYING NOVI SMART LAMPCASE STUDY 3: ROLLOOS ACTIVELY MONITORED RED ZONES IN REAL TIME BY DEPLOYING NVIDIA'S ACCELERATION TOOLKITSCASE STUDY 4: MERCEDES-BENZ CONSULTING OPTIMIZED DEALERSHIP LAYOUT USING MODCAM STORE ANALYTICSCASE STUDY 5: TVGH ACHIEVED REAL-TIME AI INFERENCE BY UTILIZING AETINA EDGE AI STARTER PACKAGE

-

5.4 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST & AFRICALATIN AMERICA

-

5.5 ECOSYSTEM

-

5.6 PATENT ANALYSISMETHODOLOGYPATENTS FILED, BY DOCUMENT TYPE, 2013–2023INNOVATION AND PATENT APPLICATIONS- Top applicants

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 FUTURE DIRECTIONS OF EMBEDDED AI MARKET LANDSCAPETECHNOLOGY ROADMAP FOR EMBEDDED AI MARKET UNTIL 2030

- 5.9 PRICING ANALYSIS

-

5.10 KEY COMPONENTS OF EMBEDDED AI ARCHITECTUREMODEL MODULEDATA MODULECOMPUTING POWER MODULE

- 5.11 BRIEF HISTORY OF EMBEDDED AI/EVOLUTION

- 5.12 TRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTS’ BUSINESSES

-

5.13 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.16 TECHNOLOGY ANALYSISKEY TECHNOLOGY- ML and Deep Learning- Data Science- Edge Computing- IoT- Computer Vision- Neural Networks- TensorFlow LiteADJACENT TECHNOLOGY- Signal Processing- Data Mining and Predictive Analysis- Blockchain- 5G

-

5.17 IMPACT OF EMBEDDED AI ON BUSINESS MODERNIZATIONBUSINESS PROCESS AND TASK AUTOMATIONADVANCED PREDICTIVE ANALYTICSINTELLIGENT DECISION-MAKINGSTREAMLINED CUSTOMER EXPERIENCE

-

5.18 BUSINESS MODEL ANALYSISBUSINESS MODELS FOR HARDWARE VENDORSBUSINESS MODELS FOR SOFTWARE PROVIDERSBUSINESS MODELS FOR SERVICE PROVIDERS

-

6.1 INTRODUCTIONOFFERING: EMBEDDED AI MARKET DRIVERS

-

6.2 HARDWAREPROCESSORS- GPUs- FPGAs- NPUs- Other processorsMEMORY UNITS- Random Access Memory (RAM)- Flash Memory- ROM- Other memory unitsAI ACCELERATORS- Tensor Processing Units (TPUs)- Neural Network AcceleratorsOTHER HARDWARE

-

6.3 SOFTWAREAI MIDDLEWARE- AI Middleware to offer tools and frameworks for efficient model management and inference at edgeAI & ML FRAMEWORKS- Need for model optimization and integration of AI frameworks with edge computing architectures to drive marketEDGE COMPUTING PLATFORMS- Edge computing platforms to support edge AI applications, simplify data processing and analytics, and seamlessly integrate with edge devicesOTHER SOFTWARE

-

6.4 SERVICESTRAINING & CONSULTING- Training & consulting services to play vital role in managing operations and technological updatesSYSTEM INTEGRATION & IMPLEMENTATION- System integration & implementation services to gain traction to ensure effective system communicationSUPPORT & MAINTENANCE- Rising demand for support & maintenance services to ensure optimal performance

-

7.1 INTRODUCTIONDATA TYPE: EMBEDDED AI MARKET DRIVERS

-

7.2 SENSOR DATACOMBINATION OF EMBEDDED AI AND EDGE AI TO FUEL GROWTH OF SENSOR DATA

-

7.3 IMAGE & VIDEO DATAINCREASING AVAILABILITY AND AFFORDABILITY OF CAMERAS AND CONSUMPTION OF VISUAL CONTENT TO DRIVE MARKET

-

7.4 NUMERIC DATAPROLIFERATION OF SENSORS AND CONNECTED DEVICES TO DRIVE DEMAND FOR NUMERIC DATA

-

7.5 CATEGORICAL DATANEED TO DETECT AND CLASSIFY OBJECTS, RECOGNIZE GESTURES, AND IDENTIFY SPECIFIC PATTERNS TO DRIVE MARKET

- 7.6 OTHER DATA TYPES

-

8.1 INTRODUCTIONVERTICAL: EMBEDDED AI MARKET DRIVERS

-

8.2 BANKING, FINANCIAL SERVICES, AND INSURANCEFRAUD DETECTION & PREVENTION- Need to detect and mitigate fraudulent activities and safeguard financial institutions to drive marketRISK MANAGEMENT- Embedded AI to analyze transactional data in real time, enabling accurate risk identification and fraud preventionCUSTOMER SERVICE- Embedded AI to create virtual assistants or chatbots for automated customer supportCOMPLIANCE & REGULATORY REPORTING- Embedded AI to streamline reporting process, reduce human error, and ensure accurate and timely submission of reportsOTHER BANKING, FINANCIAL SERVICES, AND INSURANCE TYPES

-

8.3 IT & ITESINTELLIGENT AUTOMATION- Intelligent automation to provide automated responses by utilizing pre-defined templates or accessing knowledge baseCYBERSECURITY- Incorporation of embedded AI into cybersecurity measures to help IT companies detect and respond to cyber threats effectivelyCUSTOMER SERVICE- Embedded AI to analyze customer sentiment by assessing tone and context of customer interactionsPREDICTIVE ANALYTICS- Need to monitor and analyze data points and raise alerts and notifications to drive demand for embedded AI in proactive analyticsSUPPLY CHAIN MANAGEMENT- Need to manage inventory, reduce excess stock, and ensure timely replenishment to drive demand for embedded AI in supply chain management

-

8.4 RETAIL & ECOMMERCEPERSONALIZED RECOMMENDATIONS- Utilization of embedded AI in personalized recommendations to improve customer experience and drive salesINVENTORY MANAGEMENT- Embedded AI to automate tasks and provide intelligent insights in inventory managementPRICING OPTIMIZATION- Embedded AI to automate pricing optimization process and predict customer demand and price elasticity accuratelyFRAUD DETECTION & PREVENTION- Embedded AI to detect fraud in real time and provide comprehensive view of customer activitiesOTHER RETAIL & ECOMMERCE TYPES

-

8.5 MANUFACTURINGPREDICTIVE MAINTENANCE- Embedded AI to aid in predictive maintenance by analyzing data and enabling proactive and timely maintenance actionsWASTE MANAGEMENT- Embedded AI to help avoid unplanned downtime and prevent waste generated by faulty machineryAUTOMATION & ROBOTICS- Embedded AI to aid robots in analyzing data, making decisions, executing tasks faster, and reducing human errorQUALITY CONTROL & INSPECTION- AI technology to enhance quality control and inspection processesPRODUCT DESIGN & OPTIMIZATION- Embedded AI to provide intelligent insights and optimize product designs before creating physical prototypesOTHER MANUFACTURING TYPES

-

8.6 ENERGY & UTILITIESENERGY MANAGEMENT- Embedded AI to monitor, analyze, and control energy use in real time and help prevent grid strain and power outagesPREDICTIVE MAINTENANCE- Leveraging AI algorithms in predictive maintenance to help determine optimal time for maintenance activitiesRENEWAL ENERGY OPTIMIZATION- Embedded AI to analyze historical data, weather patterns, and other relevant factors to forecast energy demand accuratelyOTHER ENERGY & UTILITIES TYPES

-

8.7 TRANSPORTATION & LOGISTICSROUTE OPTIMIZATION- Embedded AI to help monitor real-time data and minimize travel time and fuel consumptionINVENTORY MANAGEMENT- Need to improve operational efficiency and analyze historical data and market trends to drive demand for embedded AI in inventory managementAUTONOMOUS VEHICLES- Embedded AI to optimize routes, make real-time adjustments, and reduce fuel consumptionFREIGHT MANAGEMENT- Embedded AI to facilitate real-time monitoring of freight shipments and improve operational efficiencyOTHER TRANSPORTATION & LOGISTICS TYPES

-

8.8 HEALTHCARE & LIFE SCIENCESMEDICAL DIAGNOSIS- Embedded AI to analyze vast amounts of patient data and aid in accurate diagnosis and treatment planningDRUG DISCOVERY- Embedded AI to accelerate and optimize drug discovery and analyze vast amounts of drugs to identify potential drug targetsPERSONALIZED MEDICINE- Embedded AI to interpret genomic data, predict disease risk, and provide personalized diagnostic recommendationsREMOTE PATIENT MONITORING- RPM empowered by embedded AI to monitor patients' health conditions and collect real-time dataOTHER HEALTHCARE & LIFE SCIENCES TYPES

-

8.9 MEDIA & ENTERTAINMENTCONTENT CREATION- Embedded AI to transform content creation, provide innovative tools, and improve quality, efficiency, and personalization of media experiencesCONTENT ANALYTICS- Embedded AI to automate content analytics by analyzing and comprehending extensive volumes of media contentAR & VR- AR and VR technologies to revolutionize Media & Entertainment industry by providing enhanced user experiencesOTHER MEDIA & ENTERTAINMENT TYPES

-

8.10 TELECOMNETWORK OPTIMIZATION- Embedded AI to analyze network traffic patterns in real time, reduce latency, and improve network responsivenessNETWORK SECURITY- Embedded AI to process and understand unstructured data and monitor network traffic and identify abnormal patternsQUERY MANAGEMENT- Telecom providers to leverage AI capabilities to deliver personalized, efficient, and proactive customer supportFRAUD DETECTION & PREVENTION- Embedded AI to help telecom companies proactively update fraud prevention strategies by analyzing vast amounts of dataOTHER TELECOM TYPES

-

8.11 AUTOMOTIVESELF DRIVING CARS- Embedded AI technology to analyze traffic patterns, road rules, and situational factorsFLEET MANAGEMENT- Embedded AI to help in tracking and monitoring vehicles in real time and intelligent decision-makingENERGY EFFICIENCY & EMISSIONS CONTROL- Embedded AI to optimize power distribution and overall energy consumption and improve battery utilizationVEHICLE INFOTAINMENT- Embedded AI incorporated with NLP to enable natural language commands and provide connected servicesOTHER AUTOMOTIVE TYPES

- 8.12 OTHER VERTICALS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: EMBEDDED AI MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Rising technological advancements and deals focusing on AI development to drive marketCANADA- Strong tech ecosystem, presence of numerous startups, and supportive government initiatives to drive market

-

9.3 EUROPEEUROPE: EMBEDDED AI MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Growing demand for interconnected devices and focus on developing cutting-edge technologies to drive marketGERMANY- Acquisitions and partnerships between major companies to develop intelligent devices to propel demand for embedded AIFRANCE- Focus of STMicroelectronics on developing cutting-edge embedded AI solutions to drive marketITALY- Integration of edge computing and AI capabilities and rising demand from healthcare sector to drive marketSPAIN- Establishment of BSC as European AI-on-demand platform to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: EMBEDDED AI MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Deals between technical giants to create intelligent devices and government initiatives to adopt embedded AI to drive marketINDIA- National AI Strategy to focus on R&D, skilling and reskilling, and establishing AI centers of excellenceJAPAN- Deployment of AI in diverse sectors and presence of companies and startups specialized in embedded AI to drive marketANZ- Focus on developing cutting-edge AI solutions and attracting investments to drive demand for embedded AISOUTH KOREA- Significant strides in AI research, development, and deployment and focus of companies on developing AI devices to drive marketASEAN COUNTRIES- Growing digital transformation efforts, expanding technology infrastructure, and increasing demand for AI-enabled applications to drive marketREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: EMBEDDED AI MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTUAE- Government initiatives to promote advancement of technology and innovation to drive demand for embedded AISAUDI ARABIA- Supportive government regulations and investment in technology to boost demand for embedded AISOUTH AFRICA- Need for real-time data analysis, reduced latency, and enhanced data privacy to propel demand for embedded AIISRAEL- Thriving startup ecosystem, robust R&D capabilities, and supportive government initiatives to drive marketREST OF MIDDLE EAST & AFRICA

-

9.6 LATIN AMERICALATIN AMERICA: EMBEDDED AI MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Favorable government initiatives and focus on implementing AI technologies to drive marketMEXICO- Technological advancements, demand for innovative startups and investments, and rising adoption of AI-powered solutions to drive marketARGENTINA- Focus of startups and companies on developing ML, computer vision, and NLP to drive marketREST OF LATIN AMERICA

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

10.3 REVENUE ANALYSISHISTORIC REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.8 STARTUP/SME COMPETITIVE BENCHMARKING

-

10.9 EMBEDDED AI PRODUCT LANDSCAPECOMPARATIVE ANALYSIS OF EMBEDDED AI PRODUCTS

- 10.10 VALUATION AND FINANCIAL METRICS OF KEY EMBEDDED AI VENDORS

-

10.11 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

- 11.1 INTRODUCTION

-

11.2 KEY PLAYERSGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNVIDIA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTEL- Business overview- Products/Solutions/Services offered- Recent developmentsQUALCOMM- Business overview- Products/Solutions/Services offered- Recent developmentsARM- Business overview- Products/Solutions/Services offered- Recent developmentsAMD- Business overview- Products/Solutions/Services offered- Recent developmentsMEDIATEK- Business overview- Products/Solutions/Services offered- Recent developmentsORACLE- Business overview- Products/Solutions/Services offered- Recent developments

-

11.3 OTHER KEY PLAYERSSALESFORCENXPLATTICE SEMICONDUCTOROCTONIONNEUROPACESIEMENSHPELUIS TECHNOLOGYCODE TIME TECHNOLOGIESHISILICONVECTORBLOXAU-ZONE TECHNOLOGIESSTMICROELECTRONICSSENSETIME

-

11.4 STARTUP/SME PROFILESEDGE IMPULSEPERCEIVEETA COMPUTESENSIMLSYNTIANTGRAPHCORESIMA.AI

- 12.1 INTRODUCTION

-

12.2 EDGE AI SOFTWARE MARKET - GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEW- Edge AI software market, by component- Edge AI software market, by data source- Edge AI software market, by organization size- Edge AI software market, by vertical- Edge AI software market, by region

-

12.3 ARTIFICIAL INTELLIGENCE MARKET - GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEW- Artificial intelligence market, by offering- Artificial intelligence market, by technology- Artificial intelligence market, by deployment mode- Artificial intelligence market, by organization size- Artificial intelligence market, by business function- Artificial intelligence market, by vertical- Artificial intelligence market, by region

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 FACTOR ANALYSIS

- TABLE 2 ASSUMPTIONS

- TABLE 3 IMPACT OF RECESSION ON GLOBAL EMBEDDED AI MARKET

- TABLE 4 GLOBAL EMBEDDED AI MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 5 GLOBAL EMBEDDED AI MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 PATENTS FILED, 2013–2023

- TABLE 12 TOP TWENTY PATENT OWNERS IN EMBEDDED AI MARKET, 2013–2023

- TABLE 13 LIST OF PATENTS IN EMBEDDED AI MARKET, 2023

- TABLE 14 EMBEDDED AI MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 15 AVERAGE SELLING PRICE ANALYSIS, BY OFFERING

- TABLE 16 EMBEDDED AI MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 19 EMBEDDED AI MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 20 EMBEDDED AI MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 21 EMBEDDED AI MARKET, BY HARDWARE, 2017–2022 (USD MILLION)

- TABLE 22 EMBEDDED AI MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 23 PROCESSORS: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 24 PROCESSORS: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 MEMORY UNITS: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 MEMORY UNITS: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 AI ACCELERATORS: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 AI ACCELERATORS: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 OTHER HARDWARE: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 OTHER HARDWARE: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 EMBEDDED AI MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 32 EMBEDDED AI MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 33 AI MIDDLEWARE: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 AI MIDDLEWARE: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 AI & ML FRAMEWORKS: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 AI & ML FRAMEWORKS: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 EDGE COMPUTING PLATFORMS: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 EDGE COMPUTING PLATFORMS: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 OTHER SOFTWARE: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 OTHER SOFTWARE: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 SERVICES: EMBEDDED AI MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 42 SERVICES: EMBEDDED AI MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 TRAINING & CONSULTING: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 TRAINING & CONSULTING: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 SYSTEM INTEGRATION & IMPLEMENTATION: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 SYSTEM INTEGRATION & IMPLEMENTATION: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 SUPPORT & MAINTENANCE: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 SUPPORT & MAINTENANCE: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 EMBEDDED AI MARKET, BY DATA TYPE, 2017–2022 (USD MILLION)

- TABLE 50 EMBEDDED AI MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 51 SENSOR DATA: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 SENSOR DATA: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 IMAGE & VIDEO DATA: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 IMAGE & VIDEO DATA: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 NUMERIC DATA: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 NUMERIC DATA: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 CATEGORICAL DATA: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 CATEGORICAL DATA: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 OTHER DATA TYPES: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 OTHER DATA TYPES: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 EMBEDDED AI MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 62 EMBEDDED AI MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 63 BANKING, FINANCIAL SERVICES, AND INSURANCE: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 64 BANKING, FINANCIAL SERVICES, AND INSURANCE: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 IT & ITES: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 IT & ITES: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 RETAIL & ECOMMERCE: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 68 RETAIL & ECOMMERCE: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 MANUFACTURING: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 70 MANUFACTURING: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 ENERGY & UTILITIES: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 72 ENERGY & UTILITIES: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 TRANSPORTATION & LOGISTICS: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 74 TRANSPORTATION & LOGISTICS: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 HEALTHCARE & LIFE SCIENCES: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 76 HEALTHCARE & LIFE SCIENCES: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 MEDIA & ENTERTAINMENT: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 78 MEDIA & ENTERTAINMENT: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 TELECOM: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 80 TELECOM: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 AUTOMOTIVE: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 82 AUTOMOTIVE: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 OTHER VERTICALS: EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 84 OTHER VERTICALS: EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 EMBEDDED AI MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 86 EMBEDDED AI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: EMBEDDED AI MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: EMBEDDED AI MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: EMBEDDED AI MARKET, BY HARDWARE, 2017–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: EMBEDDED AI MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: EMBEDDED AI MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: EMBEDDED AI MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: EMBEDDED AI MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: EMBEDDED AI MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: EMBEDDED AI MARKET, BY DATA TYPE, 2017–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: EMBEDDED AI MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: EMBEDDED AI MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: EMBEDDED AI MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: EMBEDDED AI MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: EMBEDDED AI MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: EMBEDDED AI MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 102 EUROPE: EMBEDDED AI MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: EMBEDDED AI MARKET, BY HARDWARE, 2017–2022 (USD MILLION)

- TABLE 104 EUROPE: EMBEDDED AI MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: EMBEDDED AI MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 106 EUROPE: EMBEDDED AI MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: EMBEDDED AI MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 108 EUROPE: EMBEDDED AI MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: EMBEDDED AI MARKET, BY DATA TYPE, 2017–2022 (USD MILLION)

- TABLE 110 EUROPE: EMBEDDED AI MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: EMBEDDED AI MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 112 EUROPE: EMBEDDED AI MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: EMBEDDED AI MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 114 EUROPE: EMBEDDED AI MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: EMBEDDED AI MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: EMBEDDED AI MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: EMBEDDED AI MARKET, BY HARDWARE, 2017–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: EMBEDDED AI MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: EMBEDDED AI MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: EMBEDDED AI MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: EMBEDDED AI MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 122 ASIA PACIFIC: EMBEDDED AI MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: EMBEDDED AI MARKET, BY DATA TYPE, 2017–2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: EMBEDDED AI MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: EMBEDDED AI MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: EMBEDDED AI MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: EMBEDDED AI MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: EMBEDDED AI MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: EMBEDDED AI MARKET, BY ASEAN COUNTRY, 2017–2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: EMBEDDED AI MARKET, BY ASEAN COUNTRY, 2023–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY HARDWARE, 2017–2022 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY DATA TYPE, 2017–2022 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: EMBEDDED AI MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 145 LATIN AMERICA: EMBEDDED AI MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 146 LATIN AMERICA: EMBEDDED AI MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 147 LATIN AMERICA: EMBEDDED AI MARKET, BY HARDWARE, 2017–2022 (USD MILLION)

- TABLE 148 LATIN AMERICA: EMBEDDED AI MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 149 LATIN AMERICA: EMBEDDED AI MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 150 LATIN AMERICA: EMBEDDED AI MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 151 LATIN AMERICA: EMBEDDED AI MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 152 LATIN AMERICA: EMBEDDED AI MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 153 LATIN AMERICA: EMBEDDED AI MARKET, BY DATA TYPE, 2017–2022 (USD MILLION)

- TABLE 154 LATIN AMERICA: EMBEDDED AI MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 155 LATIN AMERICA: EMBEDDED AI MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 156 LATIN AMERICA: EMBEDDED AI MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 157 LATIN AMERICA: EMBEDDED AI MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 158 LATIN AMERICA: EMBEDDED AI MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 159 OVERVIEW OF STRATEGIES ADOPTED BY KEY EMBEDDED AI VENDORS

- TABLE 160 EMBEDDED AI MARKET: DEGREE OF COMPETITION

- TABLE 161 EMBEDDED AI MARKET: OVERALL FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- TABLE 162 EMBEDDED AI MARKET: OVERALL FOOTPRINT ANALYSIS OF OTHER KEY PLAYERS, 2022

- TABLE 163 EMBEDDED AI MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 164 EMBEDDED AI MARKET: PRODUCT FOOTPRINT ANALYSIS OF STARTUPS/SMES, 2022

- TABLE 165 COMPARATIVE ANALYSIS OF TRENDING EMBEDDED AI PRODUCTS

- TABLE 166 COMPARATIVE ANALYSIS OF OTHER EMBEDDED AI PRODUCTS

- TABLE 167 PRODUCT LAUNCHES, 2022–2023

- TABLE 168 DEALS, 2021–2023

- TABLE 169 GOOGLE: BUSINESS OVERVIEW

- TABLE 170 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 172 GOOGLE: DEALS

- TABLE 173 IBM: BUSINESS OVERVIEW

- TABLE 174 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 176 IBM: DEALS

- TABLE 177 MICROSOFT: BUSINESS OVERVIEW

- TABLE 178 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 180 MICROSOFT: DEALS

- TABLE 181 AWS: BUSINESS OVERVIEW

- TABLE 182 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 184 AWS: DEALS

- TABLE 185 NVIDIA: BUSINESS OVERVIEW

- TABLE 186 NVIDIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 NVIDIA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 188 NVIDIA: DEALS

- TABLE 189 INTEL: BUSINESS OVERVIEW

- TABLE 190 INTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 INTEL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 192 INTEL: DEALS

- TABLE 193 QUALCOMM: BUSINESS OVERVIEW

- TABLE 194 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 QUALCOMM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 196 QUALCOMM: DEALS

- TABLE 197 ARM: BUSINESS OVERVIEW

- TABLE 198 ARM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 ARM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 200 ARM: DEALS

- TABLE 201 AMD: BUSINESS OVERVIEW

- TABLE 202 AMD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 AMD: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 204 AMD: DEALS

- TABLE 205 MEDIATEK: BUSINESS OVERVIEW

- TABLE 206 MEDIATEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 MEDIATEK: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 208 MEDIATEK: DEALS

- TABLE 209 ORACLE: BUSINESS OVERVIEW

- TABLE 210 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 212 ORACLE: DEALS

- TABLE 213 EDGE AI SOFTWARE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 214 EDGE AI SOFTWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 215 EDGE AI SOFTWARE MARKET, BY DATA SOURCE, 2018–2021 (USD MILLION)

- TABLE 216 EDGE AI SOFTWARE MARKET, BY DATA SOURCE, 2022–2027 (USD MILLION)

- TABLE 217 EDGE AI SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 219 EDGE AI SOFTWARE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 220 EDGE AI SOFTWARE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 221 EDGE AI SOFTWARE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 222 EDGE AI SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 223 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2016–2021 (USD BILLION)

- TABLE 224 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2022–2027 (USD BILLION)

- TABLE 225 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2016–2021 (USD BILLION)

- TABLE 226 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2022–2027 (USD BILLION)

- TABLE 227 ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD BILLION)

- TABLE 228 ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD BILLION)

- TABLE 229 ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION, 2016–2021 (USD BILLION)

- TABLE 230 ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION, 2022–2027 (USD BILLION)

- TABLE 231 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD BILLION)

- TABLE 232 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD BILLION)

- TABLE 233 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2016–2021 (USD BILLION)

- TABLE 234 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 235 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2016–2021 (USD BILLION)

- TABLE 236 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2022–2027 (USD BILLION)

- FIGURE 1 EMBEDDED AI MARKET: RESEARCH DESIGN

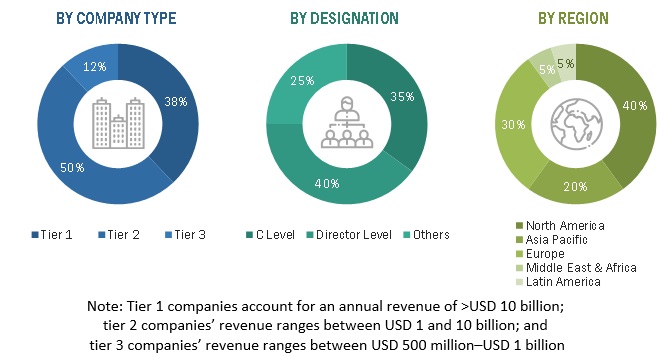

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

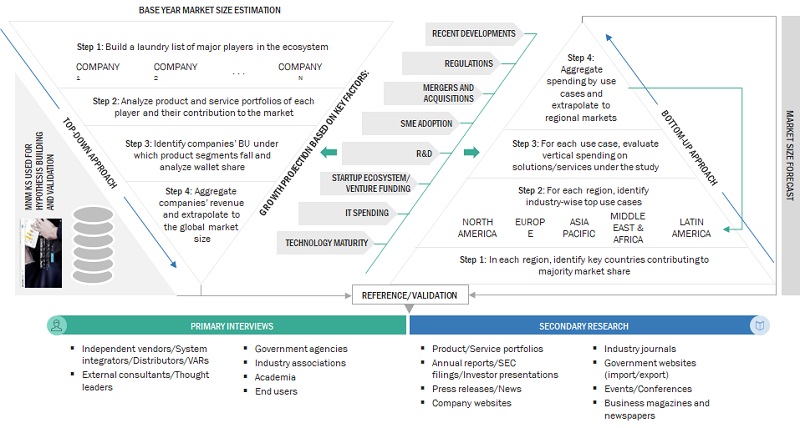

- FIGURE 4 EMBEDDED AI MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF EMBEDDED AI MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF EMBEDDED AI MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF EMBEDDED AI MARKET

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF EMBEDDED AI THROUGH OVERALL EMBEDDED AI SPENDING

- FIGURE 9 HARDWARE SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 10 EDGE COMPUTING PLATFORMS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 11 PROCESSORS SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 12 SYSTEM INTEGRATION & IMPLEMENTATION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 13 NUMERIC DATA SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 14 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA TO HOLD LARGEST MARKET SHARE AND ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 PROLIFERATION OF CONNECTED DEVICES AND IOT ECOSYSTEM FOR EFFECTIVE COMMUNICATIONS TO DRIVE MARKET GROWTH

- FIGURE 17 EMBEDDED AI MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2023

- FIGURE 18 NUMERIC DATA SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 HARDWARE SEGMENT AND AUTOMOTIVE SEGMENT TO HOLD LARGEST MARKET SHARES IN NORTH AMERICA IN 2023

- FIGURE 20 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: EMBEDDED AI MARKET

- FIGURE 22 EMBEDDED AI MARKET: ECOSYSTEM

- FIGURE 23 TOTAL NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 24 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST TEN YEARS, 2013–2023

- FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED FOR EMBEDDED AI MARKET, 2023

- FIGURE 26 EMBEDDED AI MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 EMBEDDED AI ROADMAP UNTIL 2030

- FIGURE 28 EMBEDDED AI ARCHITECTURE

- FIGURE 29 EMBEDDED AI MARKET EVOLUTION

- FIGURE 30 EMBEDDED AI MARKET: TRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTS’ BUSINESSES

- FIGURE 31 EMBEDDED AI MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 34 EMBEDDED AI MARKET: BUSINESS MODELS

- FIGURE 35 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 AI ACCELERATORS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 AI MIDDLEWARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 TRAINING & CONSULTING SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 NUMERIC DATA SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 HEALTHCARE & LIFE SCIENCES VERTICAL TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 45 HISTORIC REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 46 MARKET SHARE ANALYSIS FOR KEY COMPANIES IN 2022

- FIGURE 47 EMBEDDED AI MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 48 EMBEDDED AI PLAYERS: COMPANY EVALUATION MATRIX FOR STARTUPS/ SMES, 2022

- FIGURE 49 FINANCIAL METRICS OF KEY EMBEDDED AI VENDORS

- FIGURE 50 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY EMBEDDED AI VENDORS

- FIGURE 51 GOOGLE: COMPANY SNAPSHOT

- FIGURE 52 IBM: COMPANY SNAPSHOT

- FIGURE 53 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 54 AWS: COMPANY SNAPSHOT

- FIGURE 55 NVIDIA: COMPANY SNAPSHOT

- FIGURE 56 INTEL: COMPANY SNAPSHOT

- FIGURE 57 QUALCOMM: COMPANY SNAPSHOT

- FIGURE 58 AMD: COMPANY SNAPSHOT

- FIGURE 59 MEDIATEK: COMPANY SNAPSHOT

- FIGURE 60 ORACLE: COMPANY SNAPSHOT

The research study for the Embedded AI market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred embedded AI providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, Embedded AI spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to offerings, hardware, software, services, data types, verticals, and regions, and key developments from both markets- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and Embedded AI expertise; related key executives from Embedded AI solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using Embedded AI solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Embedded AI solutions and services, which would impact the overall Embedded AI market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Edge Intelligence |

VP Product |

|

Octonion |

CEO |

|

Litmus |

Regional Director, Asia Pacific Sales |

|

Kneron |

Marketing Director |

Market Size Estimation

In the bottom-up approach, the adoption rate of embedded AI solutions and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of embedded AI solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the embedded AI market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major embedded AI providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall Embedded AI market size and segments’ size were determined and confirmed using the study.

Global Embedded AI Market Size: Bottom-Up and Top-Down Approach:

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the Embedded AI market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major embedded AI providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall Embedded AI market size and segments’ size were determined and confirmed using the study.

Market Definition

Embedded AI solutions combine artificial intelligence (AI) capabilities directly into devices, systems, or products at the network’s edge. These solutions enable devices to perform intelligent tasks locally, such as data processing, decision-making, and inference, without relying on cloud or remote servers. By embedding AI into devices, organizations can enhance functionality, enable real-time and context-aware intelligence, and optimize resource utilization.

Stakeholders

- Embedded AI vendors

- Embedded AI hardware vendors

- Embedded AI service vendors

- Consulting service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Value-Added Resellers (VARs) and distributors

- Distributors and Value-added Resellers (VARs)

- System Integrators (SIs)

- Independent Software Vendors (ISV)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and predict the Embedded AI market by offering (hardware, software, and services), data type, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Embedded AI market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Embedded AI market

- To analyze the impact of recession across all the regions across the Embedded AI market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American Embedded AI market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Embedded AI Market