Smart Elevator Market Size, Share & Industry Growth Analysis Report by Component (Control System, Maintenance System, Communication System), Application (Residential, Commercial, Institutional), Services, and Region - Global Forecast

Updated on : October 22, 2024

The Smart Elevator Market is experiencing significant growth, driven by the rising demand for advanced building management solutions and energy-efficient systems. Key trends influencing this market include the integration of IoT technology, which allows for real-time monitoring and predictive maintenance, thereby enhancing operational efficiency and user experience. Furthermore, the push for sustainable infrastructure has led to innovations in smart elevators that reduce energy consumption and optimize space usage in high-rise buildings. As urbanization continues to accelerate and smart city initiatives gain momentum, the future of the smart elevator market looks promising, with an anticipated increase in investments and advancements that will transform vertical transportation in residential, commercial, and industrial sectors.

Smart Elevator Market Market Size

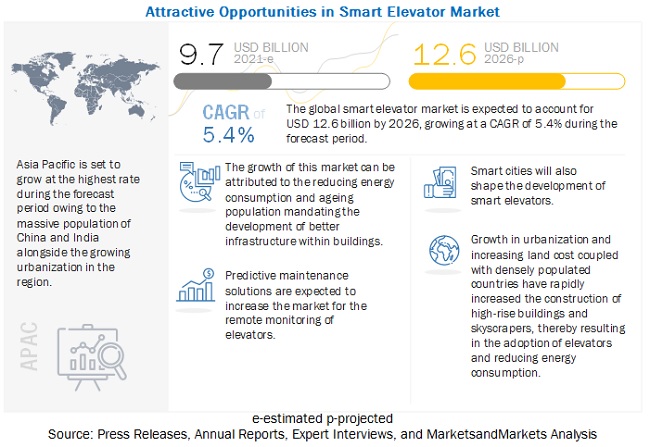

The Global Smart Elevator Market size is projected to reach USD 12.6 billion by 2026, growing at a CAGR of 5.4% . The growth of the smart elevator market is majorly driven by the enhanced spending capabilities of customers in emerging markets.

The market is further driven by the growing need for reducing energy consumption in buildings; modernation of old buildings; and increased construction of high-rise buildings equipped with smart vertical transportation systems due to rapid urbanization. In addition, the advent of smart cities is also expected to boost the installation of smart elevator industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the smart elevator market

COVID-19 has had a devastating impact on the construction sector. On the development side, the construction of new buildings has been halted since lockdowns were imposed worldwide. Laborers have returned to their hometowns. Consumers are also unwilling to invest in infrastructure properties due to economic uncertainty and the growing financial crisis of smart elevator market. This directly hit the growth of new installations in 2020 and will continue to do so till mid 2021 across several countries. However, the adoption of smart elevators for repair and maintenance is anticipated to remain strong.

Smart Elevator Market Dynamics

Driver: Increased construction of high-rise buildings equipped with smart vertical transportation systems due to rapid urbanization

The increasing migration of a large population base from rural areas toward cities has consequently surged the need for infrastructure development, such as constructing high-rise buildings, to cater to the accommodation needs. According to the UN Department of Economic and Social Affairs, by the end of 2030, the urban population will comprise 60% of the world population, and the number is expected to reach 68% by the end of 2050. This is set to result in rapid urbanization in the coming years of smart elevator market. The level of urbanization is increasing primarily in Asia, Africa, and the Middle East as a large number of people in these regions are moving toward cities, which has increased the requirement for eco-efficient and sustainable societies. For instance, in Asia, more than 50% population resides in cities, and this trend is set to increase in the coming years as the working population is swiftly shifting from the agriculture sector toward service-based sectors.

Restraint: High cost to install smart elevators

The high cost of installation of control systems in an elevator is likely to hinder the growth of the smart elevator market. Customers are not willing to pay this amount for high-end access control systems. Additionally, the cost of installation and integration of access control systems is also high due to the requirement of skilled technical consultants.

Opportunity: Inclination toward green technologies in construction industry

Green engineering is to deliver optimal performance by capturing excessive energy, which is often wasted in the form of heat. The system transfers the captured energy back into the building’s electric grid for reuse in smart elevator market.

Building projects consume nearly 40% of the global energy, with elevators consuming between 2% and 10%. By modernizing the building with smart solutions, this number can be brought down to 1–5%. The green engineering concept offers the opportunity for the players to supply energy-efficient solutions to reduce the operational cost through automation and modernization of the existing elevators.

Orona (Spain) has developed elevators that have achieved zero net energy consumption. The structure of the elevator is designed with energy storage systems and photovoltaic panels for the generation of renewable energy in smart elevator market.

Challenge: Economic Slowdown

The growth of the construction industry is directly interlinked with the economic indicators. Any slowdown, recession, or a sudden outbreak of pandemic can severely impact the growth of the construction industry and consequently affect the demand for elevators. In 2020, the global economic slowdown adversely affected the growth of the smart elevator market as it has lowered the investing potentials of various countries in key areas such as infrastructure and construction. However, the market is projected to grow by the mid of 2021 and will continue to have a modest rise in the next 5 years. Further, this expected growth is subject to various macroeconomic factors that can restrict investments in several technologies, e.g., smart elevators. Therefore, the slowdown in the growth of the global economy is expected to be the key challenge for the players operating in the smart elevator market.

Control systems segment expected to lead the smart elevator market during forecast period

The control system is expected to account for the largest segment of the overall revenue of market throughout the forecast period. The integration of destination-oriented technology within elevators minimizes the rising congestion that further boosts the demand for control systems. Control systems include elevator control systems, security control systems, access control systems, sensors, and microcontrollers. Elevator control systems comprise destination systems that are opted for the purpose of reducing traffic flow in elevators. Security control systems are driven by growing security concerns with regard to properties and data. Elevator access control systems help handle and monitor traffic, manage car calls, and save power, energy, and time. Diverse types of sensors, such as photoelectric sensors, current sensors, and position sensors, are being deployed in smart elevator market.

New installation services for commercial application to dominate the smart elevator market during forecast period

New installation services for commercial application is expected to hold the largest size of smart elevator market during forecast period. It is further expected to grow at highest CAGR between 2021 and 2026. The commercial sector includes offices, retail establishments, airports, hotels, and leisure parks. The construction of hotels, retail outlets, and entertainment units is anticipated to rise after the COVID-19 pandemic. Achieving energy efficiency in buildings and optimizing the traffic flow in elevators are major objectives of building owners in the commercial space. Thus, the new installation smart elevators are becoming increasingly popular in such new commercial spaces. For instance, in Europe, several new airport projects are in the pipeline, especially in the Nordic countries. Likewise, various African countries are also planning to build new airports to cater to the growing needs of the developing countries.

Commercial application for renovation services to dominate the smart elevator market during forecast period

Commercil application for renovation services is expected to hold the largest size of smart elevator market during forecast period. It is further expected to grow at significant CAGR between 2021 and 2026. The implementation of safety regulations for elevators and escalators generally triggers the demand for modernization services in commercial buildings. Renovation refers to the upgrading or replacing of elevator control systems and cabins with new products and technologies. It enhances the elevator life, saves energy, ensures a comfortable and safe ride for commuters, and improves usability for people.

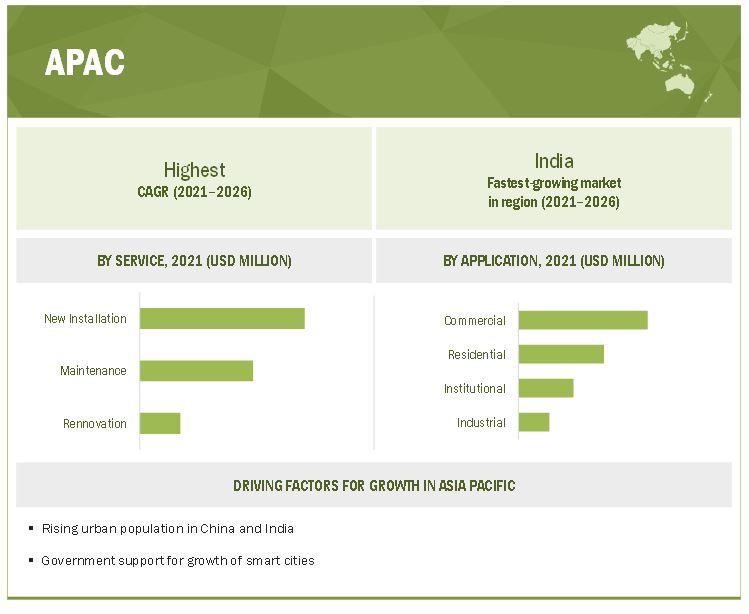

Smart Elevator market in APAC is expected to maintain the highest share during 2022–2027

APAC is anticipated to remain dominant throughout the forecast period as emerging countries such as Indonesia, Vietnam, and Bangladesh are steadily improving living standards that will lead to more urbanization and construction of building with smart technologies. Further, the presence of the most populous countries such as India and China make APAC a prominent region for smart elevators as rapid urbanization and infrastructure in this region would pave new growth avenues for companies. In addition, the renovation initiatives in APAC region backed by government support are the major factor contributing to the growth of the smart elevator market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Top Smart Elevator Companies - Key Market Players:

The smart elevator companies have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, parnerships, acquisitions, and agreements to strengthen their offerings in the market. The major players are OTIS Elevator (US), Kone Corporation (Finland), Schindler Group (Switzerland), Thyssenkrupp AG (Germany), Hitachi Ltd. (Japan), Hyundai Elevators Co., Ltd. (South Korea), Mitsubishi Electric (Japan), Fujitec Co., Ltd. (Japan), Toshiba Elevators and Building Systems Corporation (Japan), and Honeywell (US). Few other players covered in the report includes Motion Control engineering (US), Thames Valley Control (UK), Rimrock Corporation (US), Robustel (China), IBM (US), Robert Bosch (Germany), Liftimsight (Netherlands), Kisi (US), Sick AG (Germany), Perrerl+Fuchs (Germany), Kintronics (US), Openpath Security (US), Brivo (US), Sigma Elevator Company (South Korea), and Emerald Elevators (UK).

Smart Elevator Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 9.7 Billion |

| Projected Market Size | USD 12.6 Billion |

| Growth Rate | CAGR of 5.4% |

|

Market size available for years |

2021–2026 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Increased Construction Of High-rise Buildings |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Elevator Control Segment |

| Highest CAGR Segment | Residential Application Segment |

In this report, the overall smart elevator market has been segmented based on Component, Services, Application, and Region

Smart Elevator Market, by Component

- Control System

- Maintenance System

- Communication System

Market, by Application

- Residential

- Commercial

- Institutional

- Industrial

Smart Elevator Market , by Service

- New Installation

- Maintenance

- Renovation

Smart Elevator Market Geographic Analysis

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, Italy, France, and Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, and Rest of APAC)

- Rest of the World (Middle East & Africa and South America)

Recent Developments in Smart Elevator market

- In October 2020, Hitachi Ltd. (Japan) acquired a 9.99% share in Yungtay Engineering (Taiwan) to strengthen its elevator and escalator market. Till date, Hitachi has acquired a ~51% share in Yungtgay.

- In August 2020, OTIS Elevator (US) acquired Bay State Elevator (US) to expand in the northeast US. The acquisition includes the company service portfolio and operations in Massachusetts, Connecticut, Vermont, and upstate New York

- In March 2020, Thyssenkrupp AG (Germany) entered an agreement with Advent, Cinven, and RAG Foundation to sell its Elevator Technology business segment to strengthen its cash flow and lower its structural costs.

FAQs

What is the market size of smart elevator market expected in 2021?

The smart elevator market is expected to be valued USD 9.7 billion by 2021.

Which are the top players in the smart elevator market?

The major vendors operating in the smart elevator market include Otis Elevator (US), Schindler Group (Switzerland), Kone Corporation (Finland), Thyssenkrupp AG (Germany), Hitachi (Japan) among others.

How the industrial application is contributing to the overall market growth by 2026?

In industrial environments, elevators are opted for diverse transport and logistics applications and are integral to various production processes. Key industrial applications include installation in increment works and oil and gas refinery systems and adoption in the cement industry Safety is of utmost importance in industrial environments. The demand for industrial smart elevator products is driven by the incorporation of diverse sensors and smart components in these elevators as per the industry standards.

Which are the major component of smart elevator?

The major components of smart elevators includes control systems, maintenance systems, and communication system.

What are some of the technological advancements in the market?

Various key technologies being adopted by the players in the smart elevator market to enhance performance and safety features. For instance, with the advent of artificial intelligence, elevators have become more intelligent and are connected to the cloud for collecting and analyzing data. Kone, a key market player, is utilizing IBM’s Watson IoT Platform and Predictive Maintenance Insights for offering connected services to its customers. IoT-based monitoring technology helps to predict the maintenance issues in real time and monitors elevators’ performance based on the set parameters .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SMART ELEVATOR MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET VOLUME

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH FLOW

FIGURE 3 SMART ELEVATOR MARKET : RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market share by bottom-up analysis

FIGURE 4 SMART ELEVATOR MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—BOTTOM-UP (SUPPLY SIDE - PART I)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—BOTTOM-UP (SUPPLY SIDE – PART II)

FIGURE 6 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: (DEMAND SIDE)

FIGURE 8 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 10 COVID-19 IMPACT ON SMART ELEVATOR MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

3.4 INITIATIVES BY KEY ELEVATOR PLAYERS DURING PANDEMIC

3.4.1 PURIFICATION SYSTEMS

TABLE 2 INITIATIVES IN PURIFICATION SYSTEMS

3.4.2 TOUCHLESS SOLUTIONS

TABLE 3 INITIATIVES IN TOUCHLESS SOLUTIONS

3.4.3 PASSENGER COMMUNICATIONS

TABLE 4 INITIATIVES IN PASSENGER COMMUNICATIONS

3.4.4 SOCIAL DISTANCING

TABLE 5 INITIATIVES IN SOCIAL DISTANCING

FIGURE 11 SMART ELEVATOR MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

FIGURE 12 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

FIGURE 13 MARKET, BY SERVICE, 2021–2026 (USD MILLION)

FIGURE 14 MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 15 URBANIZATION COUPLED WITH EVOLUTION OF SMART BUILDINGS DRIVING MARKET

4.2 MARKET, BY COMPONENT

FIGURE 16 CONTROL SYSTEM TO GROW AT HIGHEST CAGR IN FORECAST PERIOD

4.3 MARKET, BY APPLICATION

FIGURE 17 COMMERCIAL SEGMENT TO BE DOMINANT APPLICATION FOR SMART ELEVATORS

4.4 MARKET, BY SERVICE

FIGURE 18 NEW INSTALLATION TO HOLD LARGEST SHARE IN MARKET DURING FORECASTED PERIOD

4.5 MARKET FOR APAC, BY SERVICE AND COUNTRY (2021)

FIGURE 19 CHINA TO ACCOUNT FOR LARGEST SHARE OF MARKET

4.6 MARKET, BY REGION

FIGURE 20 APAC TO GROW AT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 MARKET DYNAMICS

FIGURE 21 GLOBAL SMART ELEVATOR MARKET DYNAMICS

5.1.1 DRIVERS

5.1.1.1 Increased construction of high-rise buildings equipped with smart vertical transportation systems due to rapid urbanization

FIGURE 22 URBAN AND RURAL POPULATION, 1950–2050

5.1.1.2 Growing need for reducing energy consumption in buildings

5.1.1.3 Growing aging population will facilitate development of better infrastructure within buildings

FIGURE 23 NUMBER OF PEOPLE AGED 65 YEARS AND ABOVE, BY REGION, 2019 AND 2050

5.1.1.4 Smart cities to boost installation of smart elevators

5.1.1.5 Modernization of old buildings

5.1.2 DRIVERS IMPACT ON MARKET

FIGURE 24 MARKET DRIVERS AND THEIR IMPACT

5.1.3 RESTRAINTS

5.1.3.1 High cost to install smart elevators

5.1.4 RESTRAINTS IMPACT ON SMART ELEVATOR MARKET

FIGURE 25 MARKET RESTRAINTS AND THEIR IMPACT

5.1.5 OPPORTUNITIES

5.1.5.1 Inclination toward green technologies in construction industry

5.1.5.2 Data analytics for predictive maintenance of elevators

5.1.6 OPPORTUNITIES IMPACT ON MARKET

FIGURE 26 MARKET OPPORTUNITIES AND THEIR IMPACT

5.1.7 CHALLENGES

5.1.7.1 Economic slowdown

5.1.7.2 Integration of smart elevator components in existing elevators

5.1.8 CHALLENGES IMPACT ON MARKET

FIGURE 27 MARKET CHALLENGES AND THEIR IMPACT

5.2 VALUE CHAIN ANALYSIS

FIGURE 28 MARKET VALUE CHAIN

5.2.1 RESEARCH AND DEVELOPMENT

5.2.2 COMPONENT MANUFACTURER

5.2.3 MANUFACTURER

5.2.4 SOFTWARE & SERVICE

5.2.5 INTEGRATOR

5.2.6 END-USE APPLICATION

5.3 ECOSYSTEM ANALYSIS FOR SMART ELEVATORS

FIGURE 29 SMART ELEVATOR MARKET ECOSYSTEM AND ADJACENT ECOSYSTEMS

TABLE 6 ECOSYSTEM COMPANIES

5.4 YC-YCC SHIFT FOR MARKET

5.5 PORTERS FIVE FORCE ANALYSIS

TABLE 7 IMPACT OF PORTERS FIVE FORCES ON MARKET

5.6 SMART ELEVATOR USE CASES

5.6.1 INTRODUCTION

5.6.2 CASE STUDY 1: HONEYWELL: CORPORATE OFFICE RENOVATIONS

TABLE 8 HONEYWELL HELPED CORPORATE OFFICE RENOVATION IN US

5.6.3 CASE STUDY 2: KONE CORPORATION: 180 BRISBANE COMMERCIAL OFFICES, AUSTRALIA

TABLE 9 KONE CORPORATION SUPPORTED COMMERCIAL OFFICES IN AUSTRALIA

5.6.4 CASE STUDY 3: OTIS ELEVATORS: BAHRAIN WORLD TRADE CENTER

TABLE 10 OTIS SUPPORTED BAHRAIN WORLD TRADE CENTER TO INSTALL ELEVATORS

5.7 TECHNOLOGY TRENDS : SMART ELEVATOR MARKET

5.7.1 ADOPTION OF ECO-FRIENDLY PRODUCTS

5.7.2 ARTIFICIAL INTELLIGENCE

5.7.3 INTUITIVE ELEVATOR TECHNOLOGY

5.7.4 INTERNET OF THINGS

5.7.5 CONNECTIVITY 5G TECHNOLOGY

5.8 PRICING ANALYSIS

TABLE 11 ASP OF SMART ELEVATOR PRODUCT TYPES, 2020 (USD)

5.9 TRADE ANALYSIS

FIGURE 30 LIFTING, HANDLING, LOADING, OR UNLOADING MACHINERY IMPORT, BY KEY COUNTRIES, 2016-2019 (USD MILLION)

FIGURE 31 LIFTING, HANDLING, LOADING OR UNLOADING MACHINERY EXPORT, BY KEY COUNTRIES, 2016-2019 (USD MILLION)

TABLE 12 IMPORT OF LIFTING, HANDLING, LOADING, OR UNLOADING MACHINERY, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 EXPORT OF LIFTING, HANDLING, LOADING, OR UNLOADING MACHINERY, BY REGION, 2016–2019 (USD MILLION)

5.10 PATENT ANALYSIS

FIGURE 32 PATENT ANALYSIS RELATED TO MARKET

5.11 STANDARDS AND REGULATORY LANDSCAPE

5.11.1 STANDARDS FOR SAFETY AND ACCESSIBILITY IN EUROPE

5.11.2 LIFT/ELEVATOR STANDARDS IN ASIA-PACIFIC (INDIA)

5.11.3 LIFT/ELEVATOR STANDARDS IN AMERICA

5.11.4 BACNET: COMMUNICATION PROTOCOL

6 SMART ELEVATOR MARKET, BY COMPONENT (Page No. - 73)

6.1 INTRODUCTION

FIGURE 33 MARKET, BY COMPONENT

FIGURE 34 CONTROL SYSTEM TO LEAD MARKET

TABLE 14 MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 15 MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 CONTROL SYSTEMS

6.2.1 INTEGRATION OF DESTINATION-ORIENTED TECHNOLOGY WITHIN ELEVATORS TO MINIMIZE RISING CONGESTION TO BOOST DEMAND FOR CONTROL SYSTEMS

TABLE 16 MARKET FOR CONTROL SYSTEM, BY TYPE, 2017–2020 (USD MILLION)

TABLE 17 MARKET FOR CONTROL SYSTEM, BY TYPE, 2021–2026 (USD MILLION)

6.2.2 ELEVATOR CONTROL SYSTEMS

6.2.3 SECURITY CONTROL SYSTEMS

TABLE 18 MARKET FOR SECURITY CONTROL SYSTEM, BY TYPE, 2017–2020 (USD MILLION)

TABLE 19 SMART ELEVATOR MARKET FOR SECURITY CONTROL SYSTEM, BY TYPE, 2021–2026 (USD MILLION)

6.2.3.1 Surveillance camera

6.2.3.2 Intruder camera system

6.2.3.3 Fire alarm system

6.2.3.4 Visitor management system

6.2.4 ACCESS CONTROL SYSTEM

TABLE 20 MARKET FOR ACCESS CONTROL SYSTEM, BY TYPE, 2017–2020 (USD MILLION)

TABLE 21 MARKET FOR ACCESS CONTROL SYSTEM, BY TYPE, 2017–2020 (USD MILLION)

TABLE 22 MARKET FOR ACCESS CONTROL SYSTEM, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 23 MARKET FOR ACCESS CONTROL SYSTEM, BY APPLICATION, 2017–2020 (USD MILLION)

6.2.4.1 Biometrics access control systems

TABLE 24 MARKET FOR BIOMETRICS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 25 MARKET FOR BIOMETRICS, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.4.2 Card-based access control systems

TABLE 26 MARKET FOR CARD-BASED ACCESS CONTROL SYSTEM, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 27 SMART ELEVATOR MARKET FOR CARD-BASED ACCESS CONTROL SYSTEM, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.4.3 Touch screen- & keypad-based access control systems

TABLE 28 MARKET FOR TOUCH SCREEN & KEYPAD, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 29 MARKET FOR TOUCH SCREEN & KEYPAD, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.5 SENSORS

TABLE 30 MARKET FOR SENSOR, BY TYPE, 2017–2020 (USD MILLION)

TABLE 31 MARKET FOR SENSOR, BY TYPE, 2021–2026 (USD MILLION)

6.3 MAINTENANCE SYSTEM

6.3.1 PREDICTIVE MAINTENANCE—NEW TREND IN ELEVATOR MARKET

6.4 COMMUNICATION SYSTEM

6.4.1 COMMUNICATION SYSTEMS INTEGRAL FOR DATA TRANSFER

7 SMART ELEVATOR MARKET, BY APPLICATION (Page No. - 83)

7.1 INTRODUCTION

FIGURE 35 MARKET, BY APPLICATION

FIGURE 36 COMMERCIAL SEGMENT TO CONTINUE TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 32 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 33 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 RESIDENTIAL

7.2.1 GROWING HIGH-RISE RESIDENTIAL BUILDING CONSTRUCTION IS FUELING DEMAND FOR ENERGY-EFFICIENT ELEVATORS

TABLE 34 MARKET FOR RESIDENTIAL, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 35 MARKET FOR RESIDENTIAL, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 36 MARKET FOR RESIDENTIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 MARKET FOR RESIDENTIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 MARKET FOR RESIDENTIAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 39 MARKET FOR RESIDENTIAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 40 SMART ELEVATOR MARKET FOR RESIDENTIAL APPLICATION IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 41 MARKET FOR RESIDENTIAL APPLICATION IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 42 MARKET FOR RESIDENTIAL APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 43 MARKET FOR RESIDENTIAL APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 44 MARKET FOR RESIDENTIAL APPLICATION IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 MARKET FOR RESIDENTIAL APPLICATION IN ROW, BY REGION, 2021–2026 (USD MILLION)

7.3 COMMERCIAL

7.3.1 NEED TO OPTIMIZE TRAFFIC FLOW IN ELEVATORS IN COMMERCIAL SPACES TO RAISE DEMAND FOR SMART ELEVATORS

TABLE 46 MARKET FOR COMMERCIAL, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 47 MARKET FOR COMMERCIAL, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 48 MARKET FOR COMMERCIAL, BY END USER, 2017–2020 (USD MILLION)

TABLE 49 MARKET FOR COMMERCIAL, BY END USER, 2021–2026 (USD MILLION)

TABLE 50 MARKET FOR COMMERCIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 MARKET FOR COMMERCIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 52 MARKET FOR COMMERCIAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 53 MARKET FOR COMMERCIAL APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 54 MARKET FOR COMMERCIAL APPLICATION IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 55 MARKET FOR COMMERCIAL, BY EUROPEAN COUNTRY, 2021–2026 (USD MILLION)

TABLE 56 MARKET FOR COMMERCIAL APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 57 MARKET FOR COMMERCIAL APPLICATION IN ASIA PACIFIC BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 58 SMART ELEVATOR MARKET FOR COMMERCIAL APPLICATION IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 MARKET FOR COMMERCIAL APPLICATION IN ROW, BY REGION, 2021–2026 (USD MILLION)

7.4 INSTITUTIONAL

7.4.1 FOCUS ON ENERGY SAVING AND PASSENGER SECURITY ARE BOOSTING DEMAND FOR SMART ELEVATORS FOR INSTITUTIONAL APPLICATIONS

TABLE 60 MARKET FOR INSTITUTIONAL, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 61 MARKET FOR INSTITUTIONAL, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 62 MARKET FOR INSTITUTIONAL, BY END USER, 2017–2020 (USD MILLION)

TABLE 63 MARKET FOR INSTITUTIONAL, BY END USER, 2021–2026 (USD MILLION)

TABLE 64 MARKET FOR INSTITUTIONAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 MARKET FOR INSTITUTIONAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 66 MARKET FOR INSTITUTIONAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 67 MARKET FOR INSTITUTIONAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 68 MARKET FOR INSTITUTIONAL APPLICATION IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 69 MARKET FOR INSTITUTIONAL APPLICATION IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 70 MARKET FOR INSTITUTIONAL APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 71 MARKET FOR INSTITUTIONAL APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 72 MARKET FOR INSTITUTIONAL APPLICATION IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 MARKET FOR INSTITUTIONAL APPLICATION IN ROW, BY REGION, 2021–2026 (USD MILLION)

7.5 INDUSTRIAL

7.5.1 NEED TO INCREASE SAFETY QUOTIENT OF INDUSTRIAL OPERATIONS TO DRIVE DEMAND FOR SMART ELEVATORS

TABLE 74 MARKET FOR INDUSTRIAL, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 75 MARKET FOR INDUSTRIAL, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 76 MARKET FOR INDUSTRIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 SMART ELEVATOR MARKET FOR INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 78 MARKET FOR INDUSTRIAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 79 MARKET FOR INDUSTRIAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 80 MARKET FOR INDUSTRIAL APPLICATION IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 81 MARKET FOR INDUSTRIAL APPLICATION IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 82 MARKET FOR INDUSTRIAL APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 83 MARKET FOR INDUSTRIAL APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 84 MARKET FOR INDUSTRIAL APPLICATION IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 MARKET FOR INDUSTRIAL APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

8 SMART ELEVATOR MARKET, BY SERVICE (Page No. - 102)

8.1 INTRODUCTION

FIGURE 37 MARKET, BY SERVICE

FIGURE 38 NEW INSTALLATION DOMINATES MARKET

TABLE 86 MARKET, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 87 MARKET, BY SERVICE, 2021–2026 (USD MILLION)

8.2 NEW INSTALLATION

8.2.1 NEW CONSTRUCTION ACTIVITIES IN EMERGING ECONOMIES TO BOOST MARKET GROWTH

TABLE 88 MARKET FOR NEW INSTALLATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 MARKET FOR NEW INSTALLATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 90 MARKET FOR NEW INSTALLATION, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 91 MARKET FOR NEW INSTALLATION, BY APPLICATION, 2021–2026 (USD MILLION)

8.3 MAINTENANCE

8.3.1 INCORPORATION OF ADVANCED TECHNOLOGIES IN MAINTENANCE SOLUTIONS FOR REMOTE MONITORING OF ELEVATORS

TABLE 92 SMART ELEVATOR MARKET FOR MAINTENANCE, BY REGION, 2017–2020 (USD MILLION)

TABLE 93 MARKET FOR MAINTENANCE, BY REGION, 2021–2026 (USD MILLION)

TABLE 94 MARKET FOR MAINTENANCE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 95 MARKET FOR MAINTENANCE, BY APPLICATION, 2021–2026 (USD MILLION)

8.4 RENOVATION

8.4.1 IMPLEMENTATION OF SAFETY REGULATIONS IN ELEVATORS TO DRIVE MARKET

TABLE 96 MARKET FOR RENOVATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 97 MARKET FOR RENOVATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 98 MARKET FOR RENOVATION, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 99 MARKET FOR RENOVATION, BY APPLICATION, 2021–2026 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 109)

9.1 INTRODUCTION

FIGURE 39 MARKET, BY REGION

FIGURE 40 APAC TO LEAD MARKET

TABLE 100 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 101 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 41 NORTH AMERICA: SNAPSHOT OF MARKET

TABLE 102 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 103 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 104 MARKET IN NORTH AMERICA, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 105 SMART ELEVATOR MARKET IN NORTH AMERICA, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 106 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 107 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 US companies heavily investing in smart building measures

TABLE 108 MARKET IN US, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 109 MARKET IN US, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Investments in residential segment to hold growth opportunities

TABLE 110 MARKET IN CANADA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 111 SMART ELEVATOR MARKET IN CANADA, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Growth of commercial constructions to accelerate market growth

TABLE 112 MARKET IN MEXICO, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 113 MARKET IN MEXICO, BY APPLICATION, 2021–2026 (USD MILLION)

9.3 EUROPE

FIGURE 42 EUROPE: SNAPSHOT OF MARKET

TABLE 114 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 115 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 116 MARKET IN EUROPE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 117 MARKET IN EUROPE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 118 SMART ELEVATOR MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 119 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.1 UK

9.3.1.1 Smart city initiatives to reduce carbon footprint

TABLE 120 MARKET IN UK, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 121 MARKET IN UK, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Germany—dominant market for smart elevators in Europe

TABLE 122 MARKET IN GERMANY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 123 MARKET IN GERMANY, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Renovation projects in residential segment to spur growth

TABLE 124 SMART ELEVATOR MARKET IN FRANCE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 125 MARKET IN FRANCE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Launch of Smart Building Alliance to promote smart buildings

TABLE 126 MARKET IN ITALY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 127 MARKET IN ITALY, BY APPLICATION, 2017–2020 (USD MILLION)

9.3.5 REST OF EUROPE

9.4 APAC

FIGURE 43 APAC: SNAPSHOT OF MARKET

TABLE 128 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 129 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 130 MARKET IN APAC, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 131 MARKET IN APAC, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 132 MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 133 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China to continue remaining dominant in APAC smart elevator market

TABLE 134 MARKET IN CHINA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 135 MARKET IN CHINA, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Surging adoption of smart technologies

TABLE 136 MARKET IN JAPAN, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 137 MARKET IN JAPAN, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Government initiatives for 100 smart cities to fuel growth

TABLE 138 MARKET IN INDIA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 139 MARKET IN INDIA, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 Growing construction industry to offer opportunities for new installation of smart elevators

TABLE 140 MARKET IN SOUTH KOREA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 141 MARKET IN AUSTRALIA, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.5 REST OF APAC

9.4.5.1 Australian government investments for smart cities to boost demand for smart elevators

9.5 ROW

TABLE 142 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 143 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 144 SMART ELEVATOR MARKET IN ROW, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 145 MARKET IN ROW, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 146 MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 147 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA

TABLE 148 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 149 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2021–2026 (USD MILLION)

9.5.2 SOUTH AMERICA

TABLE 150 MARKET IN SOUTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 151 MARKET IN SOUTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 134)

10.1 INTRODUCTION

10.2 REVENUE ANALYSIS OF TOP 5 COMPANIES

FIGURE 44 MARKET: MARKET SHARE ANALYSIS (2020)

10.3 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2020

TABLE 152 MARKET: DEGREE OF COMPETITION

10.4 COMPETITIVE EVALUATION QUADRANT, 2020

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

10.4.4 PARTICIPANT

FIGURE 45 MARKET, COMPANY EVALUATION MATRIX, 2020

10.5 STARTUP/SME EVALUATION QUADRANT, 2020

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 46 SMART ELEVATOR MARKET, STARTUP/SME EVALUATION QUADRANT, 2020

10.6 MARKET: PRODUCT FOOTPRINT

TABLE 153 COMPANY PRODUCT FOOTPRINT

TABLE 154 COMPANY REGIONAL FOOTPRINT

TABLE 155 COMPANY INDUSTRIAL FOOTPRINT

TABLE 156 COMPANY APPLICATION FOOTPRINT

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT LAUNCHES

TABLE 157 MARKET: PRODUCT LAUNCHES

10.7.2 DEALS

TABLE 158 MARKET: DEALS

11 COMPANY PROFILES (Page No. - 147)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 KEY PLAYERS

11.1.1 OTIS ELEVATOR

TABLE 159 OTIS ELEVATOR: BUSINESS OVERVIEW

FIGURE 47 OTIS ELEVATOR: COMPANY SNAPSHOT

11.1.2 KONE CORPORATION

TABLE 160 KONE CORPORATION: BUSINESS OVERVIEW

FIGURE 48 KONE CORPORATION: COMPANY SNAPSHOT

11.1.3 SCHINDLER GROUP

TABLE 161 SCHINDLER GROUP: BUSINESS OVERVIEW

FIGURE 49 SCHINDLER GROUP: COMPANY SNAPSHOT

11.1.4 THYSSENKRUPP AG

TABLE 162 THYSSENKRUPP AG: BUSINESS OVERVIEW

FIGURE 50 THYSSENKRUPP AG: COMPANY SNAPSHOT

11.1.5 HITACHI LTD.

TABLE 163 HITACHI LTD: BUSINESS OVERVIEW

FIGURE 51 HITACHI LTD.: COMPANY SNAPSHOT

11.1.6 HYUNDAI ELEVATORS CO., LTD.

TABLE 164 HYUNDAI ELEVATORS CO., LTD.: BUSINESS OVERVIEW

FIGURE 52 HYUNDAI ELEVATOR CO, LTD.: COMPANY SNAPSHOT

11.1.7 MITSUBISHI ELECTRIC CORPORATION

TABLE 165 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 53 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

11.1.8 FUJITEC CO., LTD.

TABLE 166 FUJITEC CO.LTD: BUSINESS OVERVIEW

FIGURE 54 FUJITEC CO., LTD.: COMPANY SNAPSHOT

11.1.9 TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION

TABLE 167 TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION: BUSINESS OVERVIEW

FIGURE 55 TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION: COMPANY SNAPSHOT

11.1.10 HONEYWELL

TABLE 168 HONEYWELL: BUSINESS OVERVIEW

FIGURE 56 HONEYWELL: COMPANY SNAPSHOT

11.2 OTHER KEY PLAYERS

11.2.1 MOTION CONTROL ENGINEERING

11.2.2 THAMES VALLEY CONTROLS

11.2.3 RIMROCK CORPORATION

11.2.4 ROBUSTEL

11.2.5 IBM

11.2.6 ROBERT BOSCH GMBH

11.2.7 LIFTINSIGHT

11.2.8 KISI

11.2.9 SICK AG

11.2.10 PEPPERL +FUCHS

11.2.11 KINTRONICS, INC

11.2.12 OPENPATH SECURITY INC

11.2.13 BRIVO

11.2.14 SIGMA ELEVATOR COMPANY

11.2.15 EMERALD ELEVATORS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED REPORT (Page No. - 179)

12.1 BUILDING AUTOMATION SYSTEM

12.2 INTRODUCTION

FIGURE 57 BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION

FIGURE 58 COMMERCIAL APPLICATION SEGMENT TO HOLD LARGEST SIZE OF BUILDING AUTOMATION SYSTEM MARKET FROM 2021 TO 2026

TABLE 169 BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2015–2020 (USD BILLION)

TABLE 170 BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

12.3 RESIDENTIAL APPLICATIONS

12.3.1 PREVALENCE OF SMART HOME AND SMART BUILDING TECHNOLOGIES IN RESIDENTIAL APPLICATIONS

12.3.2 DIY HOME AUTOMATION

TABLE 171 BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL APPLICATION, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 172 BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL APPLICATION, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 173 BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL APPLICATION, BY REGION, 2015–2020 (USD BILLION)

TABLE 174 BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL APPLICATION, BY REGION, 2021–2026 (USD BILLION)

12.4 COMMERCIAL APPLICATIONS

12.4.1 EMERGENCE OF OFFICE BUILDINGS AS PROMINENT COMMERCIAL END USERS OF BUILDING AUTOMATION SYSTEMS

12.4.2 OFFICE BUILDINGS

12.4.3 RETAIL AND PUBLIC ASSEMBLY BUILDINGS

12.4.4 HOSPITALS AND HEALTHCARE FACILITIES

12.4.5 AIRPORTS AND RAILWAY STATIONS

TABLE 175 BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL APPLICATION, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 176 BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL APPLICATION, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 177 BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2015–2020 (USD BILLION)

TABLE 178 BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2021–2026 (USD BILLION)

12.5 INDUSTRIAL APPLICATION

12.5.1 INCREASED ADOPTION OF SMART BUILDING SOLUTIONS IN MANUFACTURING FACILITIES TO ACHIEVE ENERGY AND COST SAVINGS

TABLE 179 BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL APPLICATION, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 180 BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL APPLICATION, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 181 BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2015–2020 (USD BILLION)

TABLE 182 BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2021–2026 (USD BILLION)

13 APPENDIX (Page No. - 188)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involves four major activities for estimating the size of the smart elevator market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size estimations, which have been further validated by primary research.

Primary Research

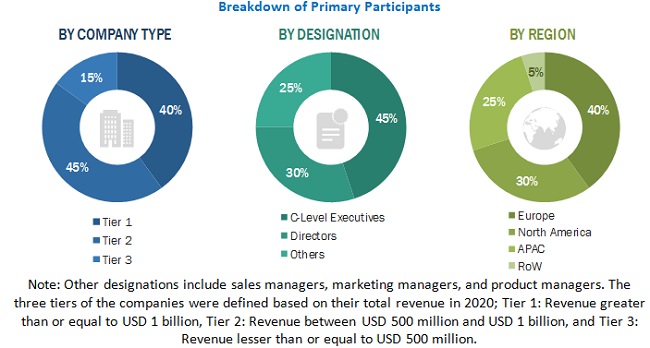

In the primary research process, a number of primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information pertaining to this report. Several primary interviews have been conducted with market experts from both demand and supply sides (smart elevator manufacturers and distributors). This primary data has been collected through questionnaires, emails, and telephonic interviews. Approximately 40% of the primary interviews have been conducted with the demand side and 60% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 70% of the total primary interviews. Additionally, questionnaires and emails were used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the smart elevator market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the smart elevator market by component, application, services, and region, in terms of value

- To forecast the market with respect to 4 main regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the major factors, namely, drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To study and analyze the influence of COVID-19 on market during the forecast period

- To analyze the competitive intelligence of players on the basis of company profiles, key growth strategies, and game-changing developments, such as product launches, product developments, partnership, agreement, and acquisitions

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players, comprehensively analyze their market share and core competencies, and provide the competitive landscape of the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Elevator Market

Interested in Section 5.3.4, "High Demand for Security," and Section 7.1.1 on control systems. Is there any provision to purchase only these two section.

Hello! Working with a client in the elevators space and would like to know if you have market breakdown by i) Customer industry (e.g. 6% of elevator revenues from hotel sector), by age of elevator (e.g. 70% from 10 years or older) and by building height (e.g. 10 floors or more). We would need this data for US, China and Germany - please response ASAP - thanks!

Would like to know about different component supplier/ manufcaturers (Control System, Maintenance System, Communication System) for smart elevator market. Is this kind of information available in this study?

We study escalator handrail sterilization products. So we want to get escalator market size, trend, and related sterilizing apparatus market size and trend

I would like to know more especially about the following topics: The profiles for the major players in the market, along with their SWOT analysis. The market has witnessed a series of new product launches along with investments and collaboration among the industry players across the value chain.

Dear Sir or Madam, I´m gonna write my master thesis about future changes in the global elevator and escalator market in the context of smart cities. During internet research I found your report and would be interested in it. Due to the restrictions of my university and the available money to spend, a first insight into the report could be beneficial. Is it possible, that you send me a sample of the report? Thank you very much. Yours, Andreas Seegmüller

Dear Sir or Madam, I´m gonna write my master thesis about future changes in the global elevator and escalator market. During internet research I found your report and would be interested in it. Due to the restrictions of my university and the available money to spend, a first insight into the report could be beneficial. Is it possible, that you send me a sample of the report? Thank you very much. Yours, Andreas Seegmüller

IN THE PROCESS TO MOVE MY ELEVATOR MANUFACTUR FROM CHICAGO TO Dubai, UAE. I NEED MARKET INFO FOR NEXT 5 YRS TO COMPLETE THE FESIBILITY STUDAY FOR THE GCC COUNTRY.

Hello, I love your Homepage and you have many interesting Reports about smart Sensors and Platform, Cloud service, smart Homes... I am study Business for IT-M2M and I would like to learnt more about smarts Elevators. Thank you so much für your help! :-)