Electrical Conduit Market by Type (Rigid & Flexible), Material (Metallic & Non-Metallic), End-use Industry (Building & Construction, Industrial Manufacturing, IT & Telecommunication, Oil & Gas, Energy & Utility, Others) and Region - Global Forecast to 2026

Updated on : September 03, 2025

Electrical Conduit Market

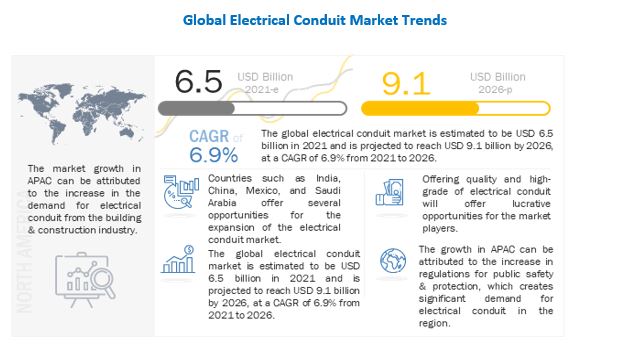

The global electrical conduit market was valued at USD 6.5 billion in 2021 and is projected to reach USD 9.1 billion by 2026, growing at 6.9% cagr from 2021 to 2026. The driving factors for the market is rapid pace of industrialization and urbanization, and rise in demand for electricity or power generation across the globe. The growth of the electrical conduit market is supported by increasing awareness regarding public safety and the implementation of safety regulations by governments.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Global Electrical Conduit Market

In 2020, the electrical conduit market was largely impacted by the COVID-19 pandemic with a substantial decline in its CAGR. Though recovery is expected owing to the impact of the construction sector on the economy. Although the activity might continue, delays and halts are expected owing to supply chain disruptions, shortage of labours and materials. Safety and government orders issued at the federal, state, and local levels, significantly affected electrical conduit manufacturers and suppliers in 2020. The COVID-19 pandemic has affected every business across the world. The federal government’s (US) guidance to prevent the spread of the virus, as well as Shelter-in-Place Orders issued at the state and local levels, have forced companies to modify or change their daily business operations. Electrical conduit manufacturers were affected in 2020 due to business shutdown mandates, social distancing norms, and limited local and state government office activities. However, the demand for electrical conduit was hampered by the pandemic, majorly due to the decline in the demand for these electrical conduits from the construction industry.

Electrical Conduit Market Dynamics

Driver: High demand for electrical conduit due to their beneficial properties

Electrical conduit is an electrical piping system used for the protection and routing of electrical wiring. It is used for protecting cables, wires, and data links against heat, cold, tensile stress, pressure stress, and other external influences in the mechanical and electrical engineering industry. Many different brands/manufacturers offer various types of conduits for diverse applications with various technical requirements.

These electrical conduit systems have been one of the reliable & popular wiring systems in the market and are primarily used for safety purposes. Electrical conduit is one of the safest wiring systems and offers an aesthetic view of electrical wiring. These conduit systems are experiencing a boost in demand as it protects the enclosed conductors from impact, moisture, and chemical vapors. Furthermore, it offers durability and can be used for many years. In addition to this, electrical conduit prevents accidental damage to the insulation. When installed with proper sealing fittings, a conduit will not permit the flow of flammable gases and vapors, which protects from fire and explosion hazards in areas handling volatile substances. These properties of electrical conduit make it a preferred wiring system.

Restraint: Volatility in raw material prices

Raw material and energy used for the production of electrical conduit have volatile prices and are expected to continue so during the forecast period. The prices of these materials directly affect the units of the value chain, which includes procurement and operation costs. Sudden increase or decrease in price affects the profit margin of manufacturers. The main raw materials used for the manufacturing of electrical conduit includes plastic (HDPE, PP, PVC, and others), stainless steel, and aluminum, among others. Volatility in the prices of energy and crude oil, which are used for manufacturing and transporting these materials, is the main cause of fluctuations of prices of these raw materials. These fluctuations, in turn, result in volatility of prices of the finished products.

The instability of energy and crude oil costs may cause the price of raw materials to rise and, in turn, increase the cost of raw materials used in electrical conduit. Hence, the prices of these materials have a direct impact on the cost of electrical conduit. Furthermore, with an increase in the cost of raw materials, vendors increase the price of their products or reduce their profit margins, which will have an adverse effect on the market growth.

Opportunity: Increasing demand for electrical conduit for electricity/power generation

The energy industry offers significant growth opportunities to the electrical conduit market, owing to their extensive use in power transmission. Rapidly growing world population along with economic development and urbanization has resulted in significant increase in energy demand in the past years. The rise in global energy generation has not been able to keep its pace with rising electricity demand for several years. In 2018, the global electricity demand has increased by 4% year-on-year, which is growing about twice as fast as the overall energy generation capability.

According to the International Energy Agency, “The global electricity demand in 2021 has increased by 4.5% or over 1 000 TWh. Almost 80% of the projected increase in demand in 2021 is in emerging market and developing economies, with the People's Republic China (China) alone accounting for half of the global growth.” According to the US Energy Information Administration, the global energy demand is likely to increase to 736 quadrillions Btu by 2040. A major part of the demand for energy would come from the non-OECD countries, particularly India and China, and would account for more than half of the global energy consumption during this period. The demand is likely to be fulfilled by new generation capacity additions, which would require new transmission and distribution infrastructure, thus creating opportunities for the electrical conduit market.

Challenge: Difficulty in finding defects & managing/adding additional connections in the future

Electrical conduit system is difficult to install, and more time is required for the installation of this wiring system. The installation process of this conduit is not easy & simple and further takes more time to get installed. The fault-finding process is very difficult for these electrical conduit systems and is very hard to find any defects/ faults in the wiring. Once electrical conduits are developed, then it is challenging to identify defects and repair of those wiring. In addition to this, if once the location of switches is fixed, then it is difficult to change the position of switches as well. Furthermore, it is very complicated to manage additional connections in the future. These difficulties associated with electrical conduits are a major challenge.

Flexible electrical conduit is expected to be the fastest-growing type in the electrical conduit market during the forecast period.

The flexible segment is projected to be the fastest-growing segment in the electrical conduit market. This electrical conduit is lightweight, typically less expensive than other options, and versatile & easy to install. Flexible electrical conduit is much easier to work with than rigid metal or plastic conduit. This is because there is no bending involved. However, flexible electrical conduit will not offer quite as much protection as rigid electrical conduit. It is flexible and can snake through walls and other structures. This electrical conduit is used owing to its advantages such as lightweight conduit, typically less expensive than other options, and versatile & easy to install.

Non-metallic segment is expected to grow at higher CAGR in the electrical conduit market during the forecast period.

Non-metallic conduit is common both in rigid and flexible conduits. These conduits are easy to install, lightweight, and hand bendable. Furthermore, non-metallic conduit also offers resistance to corrosion and good protection from moisture ingress. Non-metallic materials used for electrical conduit include PVC, PP, HDPE, and other materials. For use above ground, non-metallic conduit must be flame retardant, tough, and resistant to heat, sunlight, and low-temperature effects.

Building & construction segment accounted for the largest in the electrical conduit market during the forecast period.

The building & construction segment accounted for the largest share of 54.6% of the overall electrical conduit market in 2020. Building & construction is the dominant end-use industry in the electrical conduit market. The building & construction industry can be divided into residential and commercial segments. Commercial buildings include shops, shopping malls, restaurants, banks, hotels, warehouses, offices, and so on. According to the National Fire Protection Association, “Electrical failures were considered to be the second-leading cause for fires, and it resulted in around 13% of the US homes catching fire due to unattended equipment and wires. Also, 18% of the civilian deaths with around 20% of property damage are due to electrical failures.”

Wiring systems in buildings may be subject to frequent alterations. Frequent wiring changes are made simpler and safer through the use of electrical conduit, as existing conductors can be withdrawn and new conductors installed, with little disruption along the path of the conduit. Furthermore, an electrical conduit is used to protect and route electrical wiring in a building or structure. For workshops and public buildings, conduit wiring is the best and most desirable system of wiring and also provides protection and safety against fire.

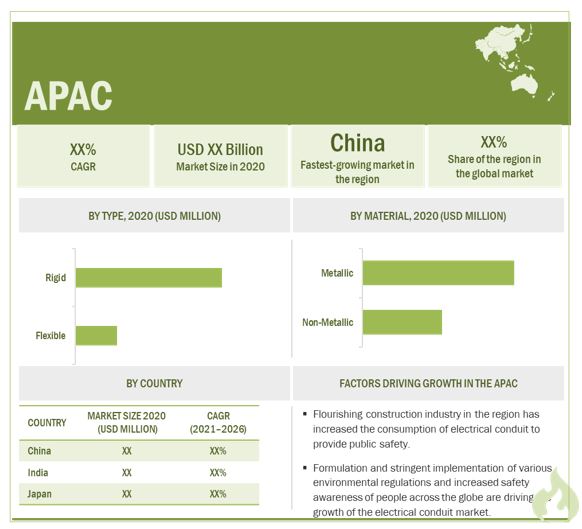

APAC region to lead the global Electrical Conduit market by 2026

APAC led the global electrical conduit market, accounting for a share of 37.8% in 2020. APAC is segmented into China, Japan, India, South Korea, and the Rest of APAC. Factors such as ready availability of raw materials and manpower, along with sophisticated technologies and innovations, have driven economic growth in the APAC region. Emerging economies in APAC are expected to have significant demand for electrical conduit due to the growth of the construction industry led by the rapid economic development and government initiatives in infrastructural developments. In addition, the rising population in these countries represents a strong customer base.

APAC is expected to be the fastest-growing market for electrical conduit globally during the forecast period. Significant consumer base, rising urban population, low labor costs, and easy availability of raw materials are attracting international companies to shift their production facilities to the region, thus creating a high demand for electrical conduits in these industries. The increase in demand for electrical conduit can be largely attributed to the growing infrastructure and building & construction industries. The demand for electrical conduits is rising rapidly in the region owing to the high demand from the infrastructural sector.

Electrical Conduit Market Players

The electrical conduit market is dominated by a few globally established players, such Atkore International Group Inc. (US), Hubbell Incorporated (US), Legrand S.A. (France), Schneider Electric SE (France), and Sekisui Chemical Co., Ltd. (Japan) among others.

Electrical Conduit Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 6.5 billion |

|

Revenue Forecast in 2026 |

USD 9.1 billion |

|

CAGR |

6.9% |

|

Market Size Available for Years |

2019-2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD million) |

|

Segments Covered |

Type, Material, End-Use Industry, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, |

|

Companies Covered |

Some of the leading players operating in the electrical conduit market include Atkore International Group Inc. (US), Hubbell Incorporated (US), Legrand S.A. (France), Schneider Electric SE (France), and Sekisui Chemical Co., Ltd. (Japan) |

This research report categorizes the electrical conduit market based on type, material, end-use industry, and region.

Electrical Conduit Market, By Type

- Rigid

- Flexible

Electrical Conduit Market, By Material

-

Metallic

- Stainless steel

- Aluminum

-

Non-metallic

- PVC

- HDPE

- PP

- Others

Electrical Conduit Market, By End-Use Industry

-

Building & Construction

- Residential

- Commercial

- Industrial Manufacturing

- IT & Telecommunication

- Oil & Gas

- Energy & Utility

-

Others

- Healthcare

- Marine

Electrical Conduit Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East

- South America

Recent Developments

- In February 2021, Atkore International Group Inc. acquired FRE Composites Group, a leading manufacturer of fiberglass conduit solutions for the electrical, transportation, telecommunication, and infrastructure markets. This acquisition helped in expanding Atkore’s conduit product portfolio.

- In October 2020, Atkore International Group Inc. acquired the assets of Queen City Plastics, Inc., a manufacturer of PVC conduit, elbows, and fittings for the electrical market. This acquisition strengthened Atkore’s existing product portfolio and enabled to serve customers in the Southeast and mid-Atlantic regions of the US.

- In August 2019, Atkore International Group Inc. acquired the assets of Rocky Mountain Colby Pipe Company, a leader in PVC conduit and duct products. The acquisition contributes to its focus on strategic growth by expanding its product portfolio and improving geographic coverage for the West Coast.

Frequently Asked Questions (FAQ):

What is the current size of global electrical conduit market?

The global electrical conduit market is estimated to be USD 6.5 billion in 2021 and is projected to reach USD 9.1 billion by 2026, at a CAGR of 6.9% from 2021 to 2026.

How is the electrical conduit market aligned?

The electrical conduit market is highly fragmented in terms of market share, with small and medium-scale manufacturers competing with each other and the big players.

Who are the key players in the global electrical conduit market?

The key players operating in the electrical conduit market are Atkore International Group Inc. (US), Hubbell Incorporated (US), Legrand S.A. (France), Schneider Electric SE (France), and Sekisui Chemical Co., Ltd. (Japan), amongst others.

What are the latest ongoing trends in the electrical conduit market?

Recent trends accelerating the growth of the market are the adoption of new materials and emphasis on health and hygiene to maintain safety in various end-use industries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSION AND EXCLUSION

TABLE 1 INCLUSION AND EXCLUSION

1.4 MARKET SCOPE

FIGURE 1 ELECTRICAL CONDUIT MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.4.2 REGIONAL SCOPE

FIGURE 2 ELECTRICAL CONDUIT MARKET, BY REGION

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 3 ELECTRICAL CONDUIT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary insights

FIGURE 4 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

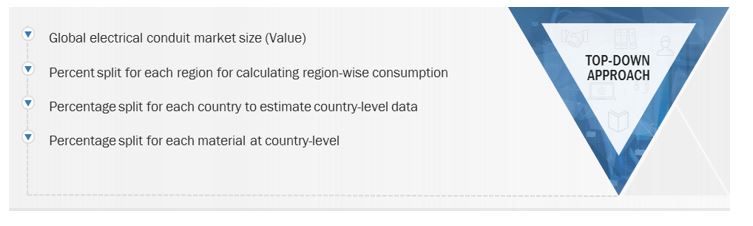

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: SUPPLY-SIDE

2.3 DATA TRIANGULATION

FIGURE 8 ELECTRICAL CONDUIT MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 9 RIGID SEGMENT TO DOMINATE OVERALL ELECTRICAL CONDUIT MARKET

FIGURE 10 METALLIC SEGMENT TO DOMINATE ELECTRICAL CONDUIT MARKET DURING FORECAST PERIOD

FIGURE 11 BUILDING & CONSTRUCTION TO BE LARGEST SEGMENT IN ELECTRICAL CONDUIT MARKET DURING THE FORECAST PERIOD

FIGURE 12 APAC LED ELECTRICAL CONDUIT MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 EMERGING ECONOMIES TO WITNESS HIGHER DEMAND FOR ELECTRICAL CONDUIT

FIGURE 13 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES DURING THE FORECAST PERIOD

4.2 APAC: ELECTRICAL CONDUIT MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 14 CHINA WAS LARGEST MARKET FOR ELECTRICAL CONDUIT IN APAC

4.3 ELECTRICAL CONDUIT MARKET, BY TYPE

FIGURE 15 RIGID SEGMENT TO LEAD ELECTRICAL CONDUIT MARKET DURING THE FORECAST PERIOD

4.4 ELECTRICAL CONDUIT MARKET, BY MATERIAL

FIGURE 16 METALLIC SEGMENT TO DOMINATE ELECTRICAL CONDUIT MARKET DURING THE FORECAST PERIOD

4.5 ELECTRICAL CONDUIT MARKET, BY END-USE INDUSTRY

FIGURE 17 BUILDING & CONSTRUCTION PROJECTED TO BE LARGEST END-USE INDUSTRY FOR ELECTRICAL CONDUIT

4.6 ELECTRICAL CONDUIT MARKET, BY COUNTRY

FIGURE 18 ELECTRICAL CONDUIT MARKET IN CHINA PROJECTED TO WITNESS HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 ELECTRICAL CONDUIT MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 High demand for electrical conduit due to their beneficial properties

5.2.1.2 No/less risk of electric shock & fire when using electrical conduits

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

FIGURE 20 CRUDE OIL PRICE TREND

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for electrical conduit for electricity/power generation

FIGURE 21 OECD & NON-OECD NET ELECTRICITY GENERATION, 2012-2040 (TRILLION KILOWATT-HOURS)

5.2.3.2 Population growth and rapid urbanization translating to large number of construction projects

TABLE 2 ASIA PACIFIC URBANIZATION TREND, 1990–2050

5.2.4 CHALLENGES

5.2.4.1 Difficulty in finding defects & managing/adding additional connections in the future

6 INDUSTRY TRENDS (Page No. - 53)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 22 ELECTRICAL CONDUIT MARKET: SUPPLY CHAIN

TABLE 3 ELECTRICAL CONDUIT MARKET: ECOSYSTEM

6.1.1 PROMINENT COMPANIES

6.1.2 SMALL & MEDIUM ENTERPRISES

6.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 PORTER’S FIVE FORCES ANALYSIS: ELECTRICAL CONDUIT MARKET

TABLE 4 ELECTRICAL CONDUIT MARKET: PORTER’S FIVE FORCES ANALYSIS

6.2.1 THREAT OF NEW ENTRANTS

6.2.2 THREAT OF SUBSTITUTES

6.2.3 BARGAINING POWER OF SUPPLIERS

6.2.4 BARGAINING POWER OF BUYERS

6.2.5 INTENSITY OF COMPETITIVE RIVALRY

6.3 YC-YCC DRIVERS

FIGURE 24 YC-YCC DRIVERS

6.4 MARKET MAPPING/ECOSYSTEM MAP

FIGURE 25 ECOSYSTEM MAP: ELECTRICAL CONDUIT MARKET

6.5 PATENT ANALYSIS

6.5.1 INTRODUCTION

6.5.2 METHODOLOGY

6.5.3 DOCUMENT TYPE

TABLE 5 TOTAL NUMBER OF PATENTS FOR ELECTRICAL CONDUIT

FIGURE 26 ELECTRICAL CONDUIT MARKET: GRANTED PATENT, LIMITED PATENT, AND PATENT APPLICATION

FIGURE 27 PUBLICATION TRENDS (2010-2020)

6.5.4 INSIGHT

FIGURE 28 JURISDICTION ANALYSIS

6.5.5 TOP COMPANIES/APPLICANTS

FIGURE 29 TOP APPLICANTS OF ELECTRICAL CONDUIT PATENTS

TABLE 6 LIST OF PATENTS BY BRIDGEPORT FITTINGS INC.

TABLE 7 LIST OF PATENTS BY AT&T INTELLECTUAL PROPERTY I L.P

TABLE 8 LIST OF PATENTS BY CASCADE MICROTECH INC.

TABLE 9 LIST OF PATENTS BY 1593563 ONTARIO INC.

TABLE 10 LIST OF TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6.5.6 DISCLAIMER

6.6 TECHNOLOGY ANALYSIS

6.7 REGULATORY ANALYSIS

TABLE 11 ELECTRICAL CONDUIT REGULATIONS

6.8 PRICING ANALYSIS

6.8.1 RIGID METAL CONDUIT

6.8.2 FLEXIBLE METAL CONDUIT

6.8.3 RIGID NON-METALLIC CONDUIT

6.8.4 FLEXIBLE NON-METALLIC CONDUIT

6.9 TRADE ANALYSIS

TABLE 12 LIST OF EXPORTERS FOR FLEXIBLE TUBING OF BASE METAL, WITH OR WITHOUT FITTINGS, 2016-2020 (USD THOUSAND)

TABLE 13 LIST OF IMPORTERS FOR FLEXIBLE TUBING OF BASE METAL, WITH OR WITHOUT FITTINGS, 2016-2020 (USD THOUSAND)

TABLE 14 LIST OF EXPORTERS FOR ALUMINIUM TUBES AND PIPES (EXCLUDING HOLLOW PROFILES), 2016-2020 (USD THOUSAND)

TABLE 15 LIST OF IMPORTERS FOR ALUMINIUM TUBES AND PIPES (EXCLUDING HOLLOW PROFILES), 2016-2020 (USD THOUSAND)

TABLE 16 LIST OF EXPORTERS FOR TUBES, PIPES AND HOSES, AND FITTINGS, E.G., JOINTS, ELBOWS, FLANGES, OF PLASTICS, 2016-2020 (USD THOUSAND)

TABLE 17 LIST OF IMPORTERS FOR TUBES, PIPES AND HOSES, AND FITTINGS THEREFOR, E.G., JOINTS, ELBOWS, FLANGES, OF PLASTICS, 2016-2020 (USD THOUSAND)

6.10 CASE STUDY ANALYSIS

TABLE 18 ELECTRICAL CONDUIT FOR FABRIC COVERED BUILDINGS

TABLE 19 ELECTRICAL CONDUIT FOR GREENHOUSE STRUCTURES

TABLE 20 ELECTRICAL CONDUIT FOR TUSCARORA TUNNEL REHABILITATION PROJECT

6.11 IMPACT OF COVID-19

6.11.1 INTRODUCTION

6.11.2 IMPACT OF COVID-19 ON ELECTRICAL CONDUIT MARKET

6.12 END-USE INDUSTRIES

6.12.1 IMPACT OF COVID-19 ON BUILDING & CONSTRUCTION INDUSTRY

6.12.2 IMPACT OF COVID-19 ON OIL & GAS INDUSTRY

6.12.3 IMPACT OF COVID-19 ON ENERGY INDUSTRY

7 ELECTRICAL CONDUIT MARKET, BY TYPE (Page No. - 76)

7.1 INTRODUCTION

FIGURE 30 FLEXIBLE SEGMENT TO WITNESS HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 21 ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 22 ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

7.2 RIGID

7.3 FLEXIBLE

8 ELECTRICAL CONDUIT MARKET, BY MATERIAL (Page No. - 79)

8.1 INTRODUCTION

FIGURE 31 NON-METALLIC SEGMENT TO GROW AT HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 23 ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 24 ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL,2019–2026 (MILLION METER)

8.2 METALLIC

TABLE 25 ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 26 ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (MILLION METER)

8.2.1 STAINLESS STEEL

8.2.2 ALUMINUM

8.3 NON-METALLIC

TABLE 27 ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 28 ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (MILLION METER)

8.3.1 PVC

8.3.2 HDPE

8.3.3 PP

8.3.4 OTHERS

9 ELECTRICAL CONDUIT MARKET, BY END-USE INDUSTRY (Page No. - 84)

9.1 INTRODUCTION

FIGURE 32 INDUSTRIAL MANUFACTURING SEGMENT TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 29 ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 30 ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

9.2 BUILDING & CONSTRUCTION

9.3 IT & TELECOMMUNICATION

9.4 INDUSTRIAL MANUFACTURING

9.5 ENERGY & UTILITY

9.6 OIL & GAS

9.7 OTHERS

10 ELECTRICAL CONDUIT MARKET, BY REGION (Page No. - 88)

10.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: CHINA PROJECTED TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

TABLE 31 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY REGION, 2019–2026 (MILLION METER)

TABLE 33 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 34 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 35 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 36 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

TABLE 37 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 38 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 39 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 40 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 41 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 42 GLOBAL ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

10.2 APAC

FIGURE 34 APAC: ELECTRICAL CONDUIT MARKET SNAPSHOT

TABLE 43 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 44 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER)

TABLE 45 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 46 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 47 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 48 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

TABLE 49 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 50 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 51 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 52 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 53 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 54 APAC: ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

10.2.1 CHINA

10.2.1.1 China to be fastest-growing market for electrical conduit globally

TABLE 55 CHINA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 CHINA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 57 CHINA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 58 CHINA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.2.2 JAPAN

10.2.2.1 Infrastructure and commercial building projects to offer growth opportunities for the market

TABLE 59 JAPAN: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 JAPAN: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 61 JAPAN: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 62 JAPAN: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.2.3 INDIA

10.2.3.1 Increasing demand for electrical conduit from building & construction and manufacturing sectors

TABLE 63 INDIA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 INDIA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 65 INDIA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 66 INDIA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.2.4 AUSTRALIA

10.2.4.1 Growing construction industry to drive the demand for electrical conduit

TABLE 67 AUSTRALIA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 68 AUSTRALIA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 69 AUSTRALIA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 70 AUSTRALIA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.2.5 SOUTH KOREA

10.2.5.1 Rising construction activities to drive demand for electrical conduit

TABLE 71 SOUTH KOREA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 SOUTH KOREA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 73 SOUTH KOREA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 74 SOUTH KOREA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.2.6 REST OF APAC

TABLE 75 REST OF APAC: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 REST OF APAC: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 77 REST OF APAC: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 78 REST OF APAC: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.3 NORTH AMERICA

TABLE 79 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER)

TABLE 81 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 83 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

TABLE 85 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 87 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 89 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

10.3.1 US

10.3.1.1 US to dominate the market for electrical conduit in North America

TABLE 91 US: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 US: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 93 US: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 94 US: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.3.2 CANADA

10.3.2.1 Growing construction sector to drive the market for electrical conduit

TABLE 95 CANADA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 CANADA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 97 CANADA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 98 CANADA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.3.3 MEXICO

10.3.3.1 Non-metallic electrical conduit is faster-growing segment in the country

TABLE 99 MEXICO: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 MEXICO: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 101 MEXICO: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 102 MEXICO: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.4 EUROPE

TABLE 103 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 104 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER)

TABLE 105 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 107 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 108 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

TABLE 109 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 110 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 111 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 112 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 113 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 114 EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

10.4.1 GERMANY

10.4.1.1 Germany to lead the market for electrical conduit in Europe

TABLE 115 GERMANY: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 GERMANY: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 117 GERMANY: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 118 GERMANY: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.4.2 UK

10.4.2.1 Significant investments in infrastructure to drive the demand for electrical conduit

TABLE 119 UK: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 UK: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 121 UK: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 122 UK: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.4.3 FRANCE

10.4.3.1 Rise in construction of buildings to offer growth opportunities for electrical conduit

TABLE 123 FRANCE: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 FRANCE: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 125 FRANCE: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 126 FRANCE: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.4.4 ITALY

10.4.4.1 Building & construction sector to accelerate demand for electrical conduit

TABLE 127 ITALY: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 ITALY: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 129 ITALY: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 130 ITALY: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.4.5 SPAIN

10.4.5.1 Energy sector to accelerate demand for electrical conduit

TABLE 131 SPAIN: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 132 SPAIN: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 133 SPAIN: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 134 SPAIN: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.4.6 REST OF EUROPE

TABLE 135 REST OF EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 REST OF EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 137 REST OF EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 138 REST OF EUROPE: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.5 MIDDLE EAST & AFRICA

TABLE 139 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER)

TABLE 141 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 143 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

TABLE 145 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 147 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 149 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

10.5.1 UAE

10.5.1.1 UAE to be the fastest-growing market for electrical conduits

TABLE 151 UAE: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 152 UAE: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 153 UAE: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 154 UAE: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.5.2 SAUDI ARABIA

10.5.2.1 Saudi Arabia leads electrical conduit market in the Middle East & Africa region

TABLE 155 SAUDI ARABIA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 156 SAUDI ARABIA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 157 SAUDI ARABIA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 158 SAUDI ARABIA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.5.3 SOUTH AFRICA

10.5.3.1 Growth potential owing to increasing number of construction projects

TABLE 159 SOUTH AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 160 SOUTH AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 161 SOUTH AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 162 SOUTH AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 163 REST OF MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 REST OF MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 165 REST OF MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 166 REST OF MIDDLE EAST & AFRICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.6 SOUTH AMERICA

TABLE 167 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 168 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER)

TABLE 169 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 171 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 172 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

TABLE 173 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 174 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 175 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY NON-METALLIC TYPE, 2019–2026 (USD MILLION)

TABLE 176 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, NON-METALLIC TYPE, 2019–2026 (MILLION METER)

TABLE 177 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 178 SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

10.6.1 BRAZIL

10.6.1.1 Brazil to dominate the market for electrical conduit in South America

TABLE 179 BRAZIL: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 180 BRAZIL: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 181 BRAZIL: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 182 BRAZIL: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.6.2 ARGENTINA

10.6.2.1 Increasing demand for electrical conduit from building & construction industry

TABLE 183 ARGENTINA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 184 ARGENTINA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 185 ARGENTINA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 186 ARGENTINA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

10.6.3 REST OF SOUTH AMERICA

TABLE 187 REST OF SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 188 REST OF SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 189 REST OF SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 190 REST OF SOUTH AMERICA: ELECTRICAL CONDUIT MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION METER)

11 COMPETITIVE LANDSCAPE (Page No. - 138)

11.1 OVERVIEW

11.2 COMPANIES ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY BETWEEN 2019 AND 2021

11.3 MARKET RANKING ANALYSIS

11.4 MARKET SHARE ANALYSIS

FIGURE 35 MARKET SHARE OF KEY PLAYERS IN THE ELECTRICAL CONDUIT MARKET, 2020

TABLE 191 ELECTRICAL CONDUIT MARKET: DEGREE OF COMPETITIVENESS

11.5 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 36 TOP FIVE PLAYERS DOMINATED THE MARKET IN THE LAST FIVE YEARS

11.5.1 STAR

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE

FIGURE 37 COMPETITIVE LEADERSHIP MAPPING: ELECTRICAL CONDUIT MARKET, 2020

TABLE 192 COMPANY PRODUCT FOOTPRINT

TABLE 193 COMPANY REGION FOOTPRINT

11.6 SME MATRIX, 2020

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 38 SME MATRIX: ELECTRICAL CONDUIT MARKET, 2020

11.7 COMPETITIVE SCENARIO

11.7.1 RECENT DEVELOPMENTS

TABLE 194 DEALS, 2019–2021

12 COMPANY PROFILES (Page No. - 146)

12.1 MAJOR PLAYERS

(Business and financial overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

12.1.1 ATKORE INTERNATIONAL GROUP INC.

TABLE 195 ATKORE INTERNATIONAL GROUP INC.: BUSINESS OVERVIEW

FIGURE 39 ATKORE INTERNATIONAL GROUP INC.: COMPANY SNAPSHOT

12.1.2 HUBBELL INCORPORATED

TABLE 196 HUBBELL INCORPORATED: BUSINESS OVERVIEW

FIGURE 40 HUBBELL INCORPORATED: COMPANY SNAPSHOT

12.1.3 LEGRAND S.A.

TABLE 197 LEGRAND S.A.: BUSINESS OVERVIEW

FIGURE 41 LEGRAND S.A.: COMPANY SNAPSHOT

12.1.4 SCHNEIDER ELECTRIC SE

TABLE 198 SCHNEIDER ELECTRIC SE: BUSINESS OVERVIEW

FIGURE 42 SCHNEIDER ELECTRIC SE: COMPANY SNAPSHOT

12.1.5 SEKISUI CHEMICAL CO., LTD.

TABLE 199 SEKISUI CHEMICAL CO., LTD.: BUSINESS OVERVIEW

FIGURE 43 SEKISUI CHEMICAL CO., LTD.: COMPANY SNAPSHOT

12.1.6 ALIAXIS SA

TABLE 200 ALIAXIS SA: BUSINESS OVERVIEW

12.1.7 THOMAS AND BETTS

TABLE 201 THOMAS AND BETTS: BUSINESS OVERVIEW

12.1.8 ROBROY INDUSTRIES

TABLE 202 ROBROY INDUSTRIES: BUSINESS OVERVIEW

12.1.9 HELLERMANNTYTON GROUP PLC

TABLE 203 HELLERMANNTYTON GROUP PLC: BUSINESS OVERVIEW

12.1.10 DURA-LINE CORPORATION

TABLE 204 DURA-LINE CORPORATION: BUSINESS OVERVIEW

12.1.11 NATIONAL PIPE & PLASTICS, INC.

12.1.12 CANTEX INC.

12.1.13 ZEKELMAN INDUSTRIES INC.

12.1.14 JM EAGLE INC.

12.1.15 OPW CORPORATION

12.1.16 PREMIER CONDUIT INC.

12.1.17 HELENGE SUL - INDUSTRIAL SUPPLIES CORP.

12.1.18 INTERNATIONAL METAL HOSE COMPANY

12.1.19 ANAMET ELECTRICAL INC.

12.1.20 ASPERBRAS GROUP

12.2 OTHER COMPANY PROFILES

12.2.1 TIGRE GROUP S.A.

12.2.2 DALTCO ELECTRIC

12.2.3 PUHUI INDUSTRY CO., LTD

12.2.4 CONDUIT S.A. DE C.V.

12.2.5 KRONA TUBOS E CONEXOES

*Details on Business and financial overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 172)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORT

13.5 AUTHOR DETAILS

The global electrical conduit market is estimated to be USD 6.5 billion in 2021 and is projected to reach USD 9.1 billion by 2026, at a CAGR of 6.9% from 2021 to 2026. The driving factors for the electrical conduit market is rapid pace of industrialization and urbanization, and rise in demand for electricity or power generation across the globe. The growth of the electrical conduit market is supported by increasing awareness regarding public safety and the implementation of safety regulations by governments.

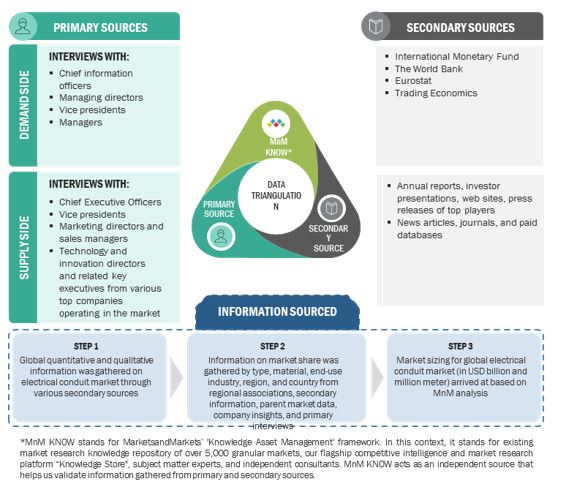

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were used. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

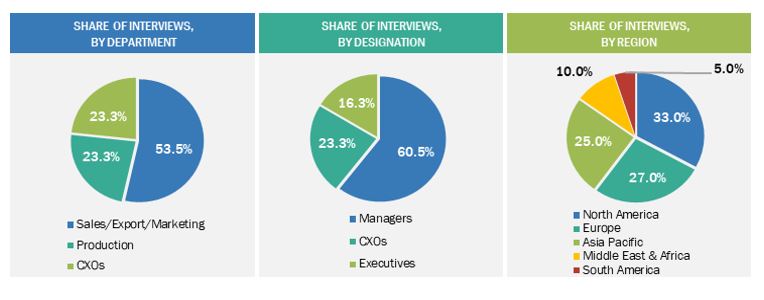

Primary Research

The electrical conduit market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the electrical conduit market characterize the demand side. Market consolidation activities undertaken by manufacturers characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

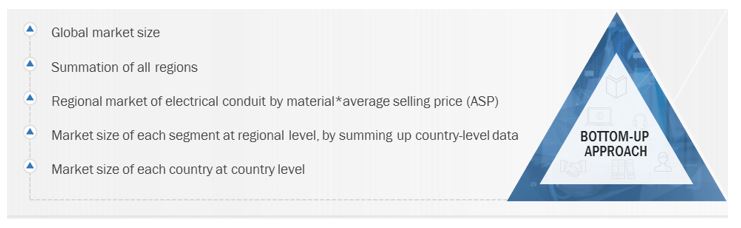

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the electrical conduit market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the electrical conduit market have been identified through secondary research, and their revenues have been determined through primary and secondary research.

- The market size of electrical conduit has been derived from the aggregation of the market shares of the leading players, and the forecast is based on analysis of market trends, such as pricing and consumption of electrical conduits in various end-use industries.

- The market size of electrical conduit, by region, has been calculated by using the market sizes of each material in each application.

- The market size for electrical conduit for each material, in terms of value, has been calculated by multiplying the average price of the products types with their volumes.

Electrical Conduit Market: Bottom-Up Approach

Electrical Conduit Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the overall market has been split into several segments. In order to complete the market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches. It has been then verified through primary interviews. Hence, for every data segment, there are three sources — the top-down approach, the bottom-up approach, and expert interviews. The data is assumed correct only when the values arrived at from these three sources match.

Report Objectives

- To define, describe, and forecast the electrical conduit market in terms of value and volume

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

- To analyze and forecast the market size based on type, material and end-use industry

- To forecast the market size of five main regions, namely, North America, Europe, Asia Pacific (APAC), South America and Middle East and Africa (MEA) (along with the key countries in each region)

- To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze the competitive developments, such as new product launch, expansion, mergers & acquisitions, and partnership & collaboration in the electrical conduit market

- To strategically profile the key players and comprehensively analyze their core competencies.

Available Customizations:

- With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

- The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electrical Conduit Market