Ecommerce Platform Market

Ecommerce Platform Market by Solutions (Payment & Billing Solutions, Ecommerce Management Platform, End-To-End Platform), Ecommerce Model (B2B, B2C), By Industry (Beauty & Personal Care, Consumer Electronics, Fashion & Apparel) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

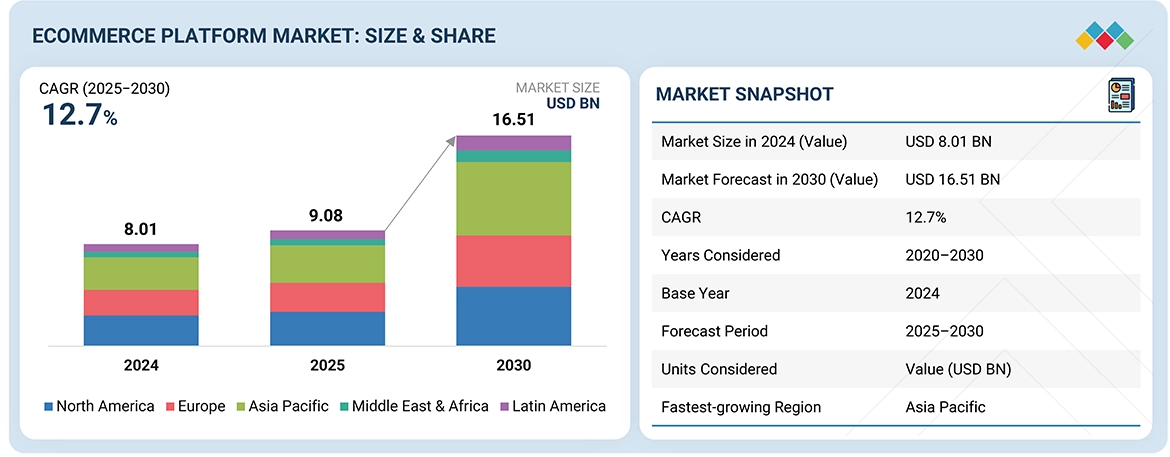

The eCommerce platform market is projected to grow from USD 9.08 billion in 2025 to USD 16.51 billion by 2030 at a CAGR of 12.7% from 2025 to 2030. The eCommerce platform market is being rapidly reshaped by the convergence of digitalization, evolving consumer behavior, and technological innovation. Businesses across industries are shifting toward digital commerce models to meet rising demand for convenience, personalization, and 24/7 availability. Key operational challenges such as fragmented customer journeys, inefficient inventory management, and limited scalability are being addressed through unified commerce platforms that support end-to-end selling, fulfillment, and engagement.

KEY TAKEAWAYS

- The North America eCommerce platform market accounted for a 28.2% revenue share in 2030.

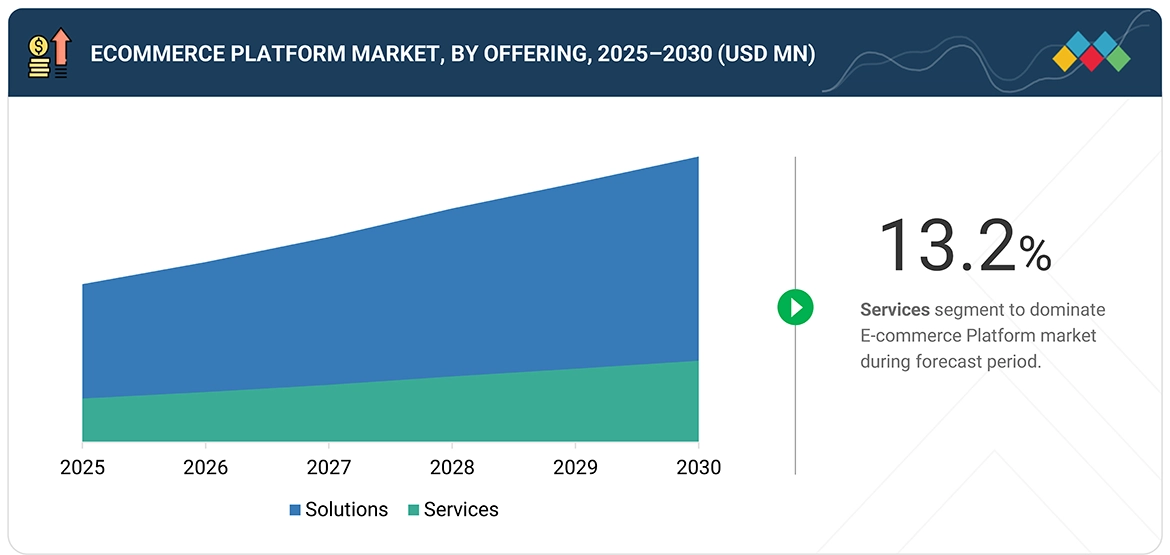

- By offering, the services segment is expected to register the highest CAGR of 13.2%.

- By eCommerce Model, the B2C segment is expected to dominate the market.

- Shopify, Adobe Commerce, and Square were identified as Star players because they offer scalable, omnichannel commerce stacks, rich customization, integrated payments and POS, extensive third-party marketplaces and developer ecosystems, enterprise-grade features, and SME-friendly turnkey tools that accelerate merchant growth and conversions.

- WooCommerce, Lightspeed, and OpenCart have distinguished themselves among startups and SMEs by offering extensible, open-source or cloud-native platforms that unite content/POS-commerce, rapid store setup, and developer-friendly APIs for scalable merchant growth.

The eCommerce platform market is revolutionizing the global retail landscape by enabling businesses to efficiently manage their digital operations, from product listings to order fulfillment. Driven by technologies such as cloud-based hosting, AI-powered personalization, content management systems, CRM integration, and secure payment gateways, these platforms deliver scalable and unified solutions for online commerce. Market expansion is fueled by increasing smartphone adoption, growing internet access, and rising demand for personalized, omnichannel shopping experiences. Industries such as fashion, electronics, and health and wellness are leveraging eCommerce platforms to boost customer engagement, optimize workflows, and strengthen their digital presence. Offering capabilities like real-time analytics, loyalty management, social commerce, and cross-border functionality, these platforms have become essential for both SMEs and large enterprises. As organizations accelerate their digital transformation, eCommerce platforms are evolving into foundational infrastructure that enables sustainable growth, global reach, and data-driven commerce. They are reshaping the future of online retail through innovation, efficiency, and customer-centricity.

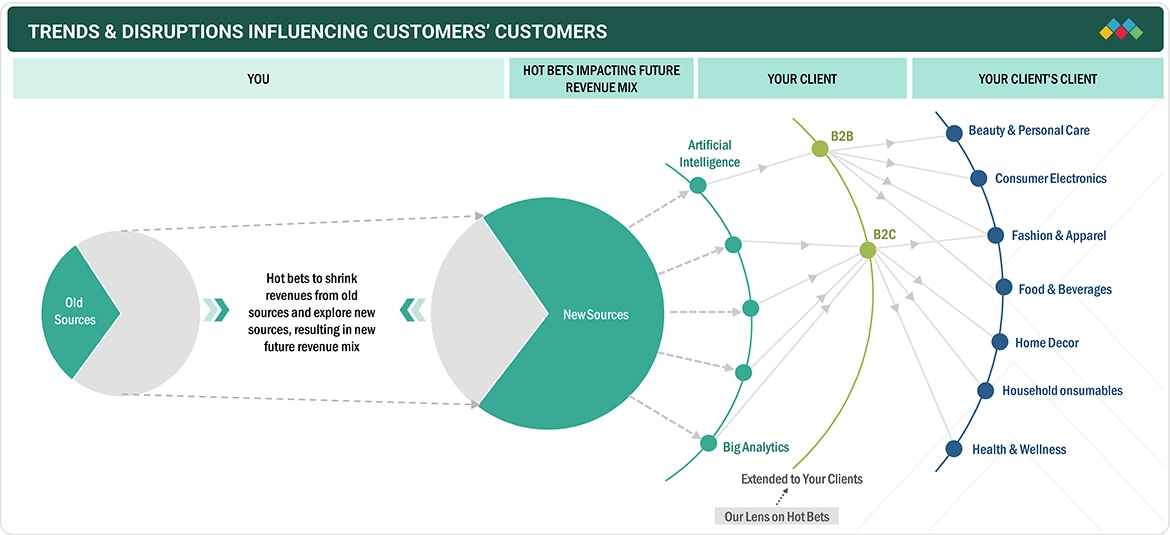

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The ecommerce platform market is shifting from traditional revenue streams to new ecosystems, technologies, and partnerships, with leading players focusing on scaling sellers, AI-driven personalization, embedded finance, logistics, and omnichannel integration to deliver faster fulfillment, broader access, personalized shopping, secure payments, and trusted experiences for end customers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing online consumer base with growing adoption of smartphones to fuel demand for eCommerce platforms

-

Omnichannel retailing to drive demand for eCommerce platforms

Level

-

Cybersecurity threats and online scams

-

Delivering real-time, personalized customer experiences at scale

Level

-

Development of super apps to offer more simple and convenient shopping options

-

Rising investments in eCommerce sector

Level

-

Handling logistics and managing inventory to pose substantial challenges for businesses

-

Customer acquisition and retention to be expensive in competitive era

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising use of internet and smartphones

Over the past two decades, the internet has fundamentally transformed global consumer behaviors, redefining communication, retail, and entertainment consumption patterns. The substantial increase in internet penetration, coupled with the swift adoption of smartphones and digital technologies, has disrupted traditional business paradigms and accelerated the growth of the eCommerce sector. Enhanced connectivity and mobile optimization have facilitated smoother, more secure, and efficient online transactions, empowering organizations to tap into wider markets while minimizing operational costs. As a result, businesses are better positioned to leverage digital channels for scalable growth and competitive advantage in an increasingly dynamic marketplace. The digital transformation has fundamentally altered consumer behavior, leading to a significant shift towards convenience-driven, real-time purchasing experiences. This change underlines the importance of increased internet penetration as a crucial enabler of eCommerce platform adoption, thereby fostering growth in digital commerce across both developed and emerging markets. The continued integration of high-speed broadband and 5G networks is anticipated to further accelerate market expansion by improving platform performance, transaction speed, and user engagement. This evolution positions eCommerce as a pivotal component of the contemporary digital economy, influencing business strategies and consumer interactions on a global scale.

Restraint: Cybersecurity threats and online scams

The proliferation of digital technologies has significantly empowered consumers to streamline their purchasing processes, enabling direct access to a diverse range of products and services from the convenience of their homes. This digital transformation continues to reshape multiple industry verticals, including eCommerce, financial services, travel, and hospitality, by optimizing business operations via integrated online platforms. The increasing implementation of digitalization initiatives, particularly in emerging markets, has prompted public and private sector entities to leverage cloud computing and mobile applications, thereby enhancing operational efficiency and fostering improved customer engagement. This paradigm shift underscores the critical importance of digital strategy in driving competitive advantage and business sustainability. The ongoing transition to digital ecosystems has significantly heightened the vulnerability of business data and infrastructure to cyber threats. As enterprises increasingly rely on digital platforms for real-time service delivery, the necessity for robust cybersecurity frameworks and comprehensive data protection solutions has become paramount. Consequently, data security and risk mitigation strategies are emerging as essential components of the digital transformation journey, particularly in the eCommerce platform market. Additionally, fostering a culture of security awareness among employees and stakeholders is vital for ensuring compliance and resilience against potential breaches. By integrating these practices into their digital strategies, businesses can enhance their security posture and protect their critical assets in an increasingly interconnected landscape.

Opportunity: Rising investment in the eCommerce sector

The recent surge in digital literacy has catalyzed substantial capital inflows into the global eCommerce sector, creating a favorable landscape for emerging enterprises to penetrate the market and deploy disruptive innovations. This increase in investment presents eCommerce platform providers with a numerous strategic opportunities. Enhanced access to capital empowers these platforms to strengthen their research and development capabilities, integrate cutting-edge technologies such as artificial intelligence and machine learning, and scale their operations into untapped regional markets. This dynamic environment not only supports the evolution of existing platforms but also paves the way for new entrants to challenge the status quo and drive transformative change within the industry. Moreover, increased funding supports diversification of service offerings, improved infrastructure scalability, and optimized user experiences. It also allows for robust marketing strategies, strategic collaborations with complementary businesses, and the creation of employment opportunities across the digital economy. As a result, investment growth is not only driving market expansion but also reinforcing the competitive landscape of the eCommerce platform market by enabling continuous innovation, improved service delivery, and long-term value creation for stakeholders.

Challenge: Customer acquisition and retention

In the competitive eCommerce landscape, customer acquisition has become a complex and costly challenge. Businesses are significantly investing in digital marketing strategies, including pay-per-click advertising, social media engagement, influencer partnerships, and search engine optimization (SEO) to enhance visibility and conversion rates. To stand out, eCommerce platforms must offer compelling value propositions along with strategic incentives such as personalized offers, loyalty programs, and exclusive discounts. These initiatives should be underpinned by advanced data analytics to effectively target consumer personas and optimize user experiences. An agile, data-driven approach that adapts to market trends and customer feedback is crucial for sustaining growth in this dynamic environment. Furthermore, ensuring a seamless and user-centric experience is critical for customer retention. This includes responsive website and mobile app interfaces, intuitive navigation, fast page loading speeds, and a streamlined checkout process. By prioritizing ease of use, visual appeal, and reliability, eCommerce platforms can enhance customer satisfaction and drive conversion rates. As customer expectations continue to evolve, offering a superior digital experience becomes a key driver of sustained growth and long-term success in the eCommerce platform market.

Ecommerce Platform Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Replatformed its digital experience to Shopify in 90 days to build a fast, mobile-first, and flexible flagship site that removes previous tech limitations. | Achieved 45% YoY revenue growth, reduced load times significantly, launched global sites within weeks, saved millions by simplifying tech stack, and enabled rapid product launches without performance issues. |

|

Implemented a global digital commerce platform to scale operations and improve user experience across regions. | Enhanced customer engagement, increased sales through unified scalable platform, reduced checkout friction, supported faster merchandise launches, and grew global e-commerce performance. |

|

Adopted VTEX to create a customer-centric e-commerce solution mapping individual journeys and boosting multichannel engagement. | Delivered higher customer satisfaction, faster checkout with VTEX Personal Shopper, increased sales participation (~25%), quick customer service response times, and improved brand loyalty with continuous engagement. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecommerce platform market ecosystem consists of diverse participants, including solution providers, service providers, system integrators, technology and cloud infrastructure providers, logistics players, and payment gateway providers. Solution providers such as Shopify, Adobe Commerce, and Alibaba supply core platform technologies, while service providers like Amazon and Wix deliver additional tools and marketplaces for business operations. System integrators including SAP, IBM, and Capgemini support platform customization and integration. Technology infrastructure is offered by firms such as AWS, Oracle, and Azure, providing cloud-based deployments. Logistics companies like DHL, UPS, and FedEx manage inbound and outbound supply chains, while payment gateways such as PayPal, Stripe, and Klarna enable efficient financial transactions for e-commerce businesses.?

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Ecommerce Platform Market, By Offering

Based on solutions, the global eCommerce platform market is categorized into billing and subscription management solutions, eCommerce management platforms, and comprehensive end-to-end platforms. Building a customized eCommerce website from scratch typically demands significant time, financial investment, and technical expertise, often requiring dedicated software developers. However, modern eCommerce platforms address these challenges by providing pre-configured, scalable, and user-friendly solutions that enable businesses to launch and manage their online stores efficiently. These platforms are equipped with product catalog management, payment integration, order processing, inventory tracking, and customer support tools, streamlining the entire eCommerce lifecycle. As a result, businesses of all sizes, mainly small and medium-sized enterprises (SMEs), are increasingly turning to turnkey eCommerce platform solutions to accelerate time-to-market, reduce operational costs, and enhance digital presence. This growing preference for ready-to-deploy solutions is significantly driving the demand within the eCommerce platform market.

Ecommerce Platform Market, By Ecommerce Model

The B2B eCommerce model is projected to experience the fastest growth in the global eCommerce platform market, driven by accelerating digital transformation and the growing need for streamlined procurement and supply chain operations. Enterprises are increasingly adopting B2B eCommerce platforms to manage large-volume transactions, negotiate pricing, process bulk orders, and enable efficient delivery through a centralized digital ecosystem. These platforms provide advanced capabilities such as account-based pricing, bulk order management, ERP integration, and customizable workflows tailored to business buyers. The rising focus on automation, cost optimization, and real-time data insights is further boosting B2B adoption. Additionally, the shift from traditional sales channels to digital procurement is being fueled by greater smartphone penetration, enhanced internet connectivity, and increasing demand for seamless online transactions among corporate buyers. As manufacturers, wholesalers, and distributors modernize operations and strengthen customer engagement, B2B eCommerce platforms are becoming vital for achieving operational efficiency, scalability, and long-term competitiveness.

Ecommerce Platform Market, By End-use Industry

Electronics companies are increasingly leveraging eCommerce platforms to expand their global presence and offer a wide range of products, including devices for entertainment, communication, and leisure. This digital transformation allows brands to connect directly with consumers across diverse markets, improving accessibility and convenience. According to the Consumer Electronics and Appliances Manufacturers Association (CEAMA), India’s consumer electronics sector is expected to witness strong growth over the next three years, supported by rising domestic demand and higher disposable incomes. Moreover, India is rapidly emerging as a major hub for consumer electronics manufacturing and sales, positioned as both a fast-growing market and a competitive alternative to China and other Southeast Asian economies, driven by robust economic growth and favorable government policies.

REGION

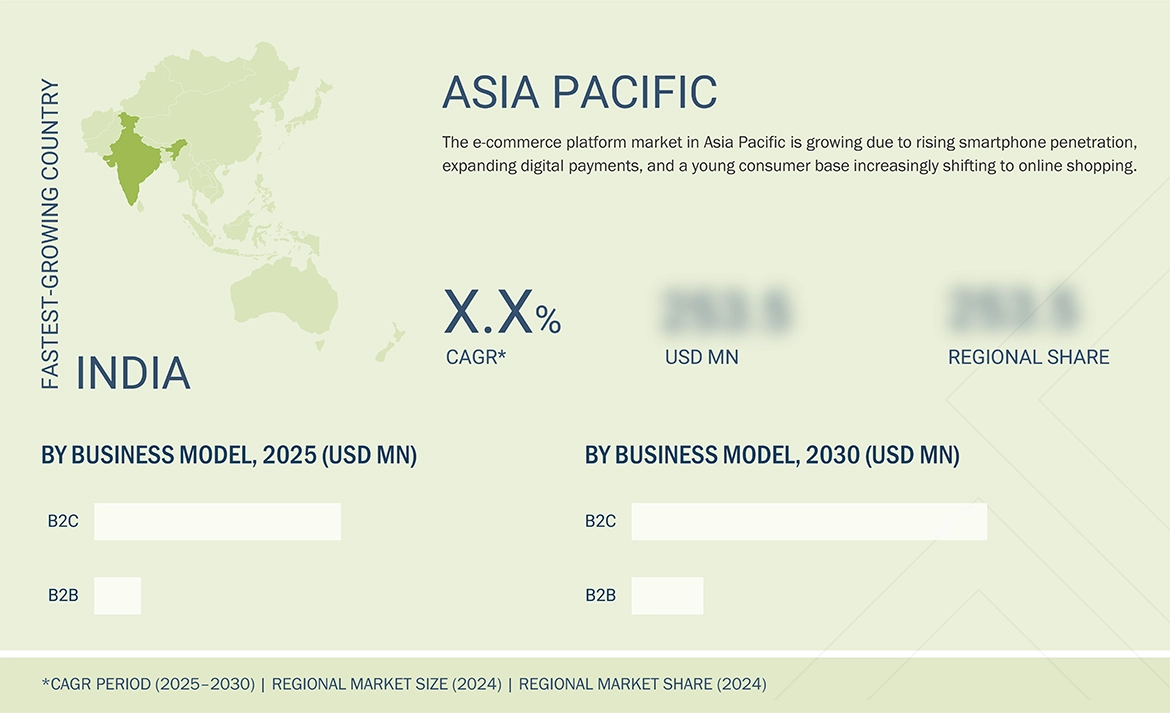

Asia Pacific to be fastest-growing region in global ecommerce platform market during forecast period

The Asia Pacific region is experiencing a notable surge in the adoption of eCommerce platform solutions, particularly within sectors such as hospitality, consumer electronics, and fashion & apparel. It is expected to record the highest CAGR during the forecast period. This trend is largely attributed to the increasing penetration of the internet and enhanced digital connectivity. Key drivers include a burgeoning population of internet-savvy consumers, rising disposable incomes, the proliferation of mobile commerce, and improvements in last-mile logistics infrastructure. In response to these market dynamics, businesses are channeling investments into sophisticated eCommerce platforms that can handle high traffic volumes, seamlessly integrate a variety of payment gateways, and provide an intuitive and engaging user experience. This regional shift is indicative of a broader movement toward digital transformation, enabling scalable online retail ecosystems in burgeoning Asian markets. Stakeholders must remain agile and adaptive, leveraging these technological advancements to meet the evolving demands of consumers in this vibrant landscape.

Ecommerce Platform Market: COMPANY EVALUATION MATRIX

In the ecommerce platform market matrix, Shopify (Star) leads with a strong market share and extensive product footprint, driven by its user-friendly interface, extensive app ecosystem, scalable solutions for businesses of all sizes, and strong global merchant support. VTEX (Emerging Leader) is gaining visibility with its cloud-native, enterprise-grade solution that enables seamless B2B and B2C commerce, integrated marketplace capabilities, and omnichannel support, driving rapid adoption across Latin America and global markets. Shopify excels with ease of use, a vast app ecosystem, and global reach for SMEs, while VTEX focuses on enterprise-grade B2B/B2C solutions, marketplace integration, and omnichannel capabilities, targeting larger businesses.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.01 Billion |

| Market Forecast in 2030 (Value) | USD 16.51 Billion |

| Growth Rate | CAGR of 12.7% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

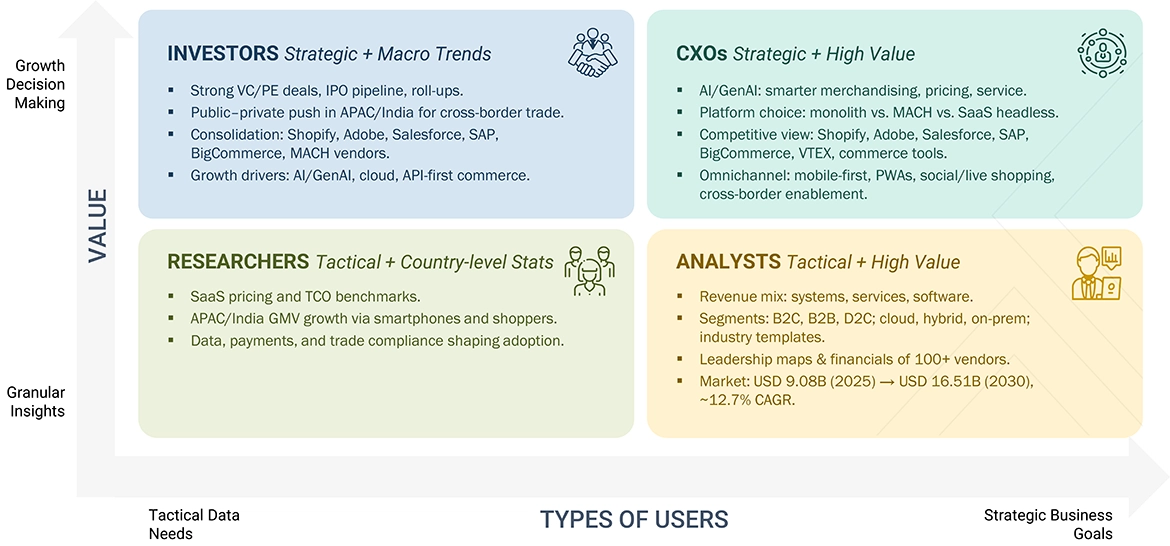

WHAT IS IN IT FOR YOU: Ecommerce Platform Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Ecommerce Platform |

|

|

| Leading Consumer Electronics OEM | Detailed analysis and profiling of additional market players operating in the Consumer Electronics End-use Industry |

|

RECENT DEVELOPMENTS

- May 2025 : Square launched the Square?Handheld, a sleek, pocket-sized POS device designed for restaurants and retailers. Weighing just 11?ounces with IP54 durability, it features a 6.2″ Gorilla Glass touchscreen, barcode scanner, 16?MP camera, and full payment capabilities.

- May 2025 : Wix introduced Wixel, a standalone AI-powered visual design platform, democratizing professional-grade design for all users. Integrated with intuitive tools and OpenAI’s image-generation model, Wixel enables effortless background removal, context switching, and style customization within minutes.

- April 2025 : eBay strengthened its global strategic partnership with Klarna, introducing flexible payment methods, including Pay in 4, financing options, and reselling tools to US shoppers. This expansion enhances eBay’s checkout experience by improving affordability across categories such as electronics, fashion, and collectibles. The integration empowers structured payments and circular commerce, reflecting a growing commitment to seamless, customer-centric commerce enabled by Buy Now Pay Later innovation and sustainable shopping practices.

- April 2025 : BigCommerce announced an expanded commercial partnership with Noibu, integrating their eCommerce intelligence directly into BigCommerce’s platform. This collaboration enables one-click activation of Noibu’s enterprise-grade error detection and prioritization tools without separate contracts. The integration accelerates time-to-value, enhances proactive revenue protection by resolving technical and performance issues early, and fosters joint merchant success across growth stages.

- April 2024 : Shopify partnered with Cognizant and Google Cloud to advance the future of enterprise commerce. This strategic collaboration integrates Shopify’s powerful commerce platform with Google Cloud’s AI infrastructure and Cognizant’s implementation expertise. The partnership empowers global retailers to deliver personalized, AI-driven shopping experiences at scale, enhancing digital transformation through cloud-native solutions, real-time customer engagement, and seamless end-to-end commerce journeys tailored for the enterprise segment.

Table of Contents

Methodology

This research study involved extensive secondary sources, directories, and databases, such as Dun & Bradstreet, D&B Hoovers, and Bloomberg BusinessWeek, to identify and collect valuable information for a technical, market-oriented, and commercial study of the eCommerce platform market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews were conducted with primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and associations were also referred to, such as the Journal of Electronic Commerce Research (JECR) and the Journal of Electronic Commerce in Organizations (JECO). Secondary research was used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), chief technology officers (CTOs), chief operating officers (COOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the eCommerce platform market. The primary sources from the demand side included eCommerce platform end users, consultants/specialists, chief information officers (CIOs), and subject-matter experts from enterprises and government associations.

Note: Others include sales managers, marketing managers, and product managers.

Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies ‘revenue ranges between USD 500 million

and USD 1 billion; and Tier 3 companies’ revenue ranges between USD 100 million and USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the eCommerce platform market. The first approach involves estimating market size by summing up the revenue companies generate through selling eCommerce platform solutions.

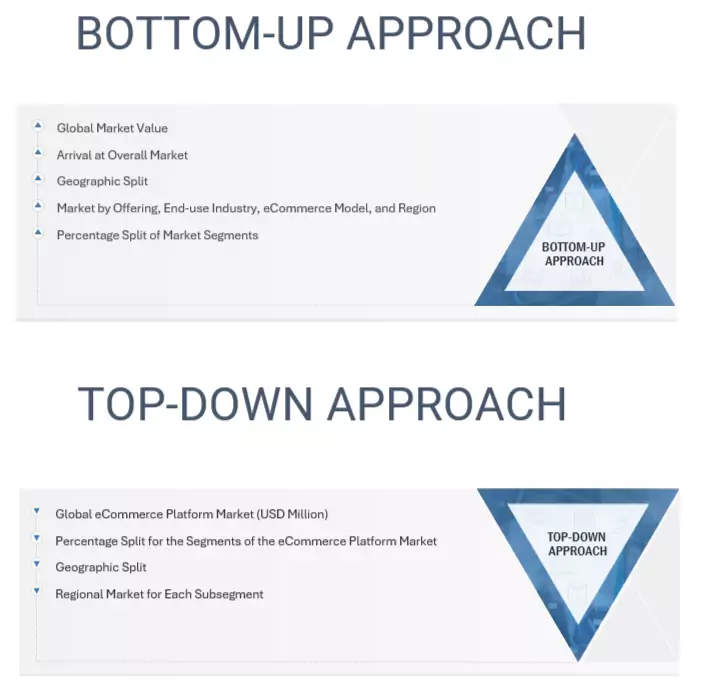

The top-down and bottom-up approaches were used to estimate and validate the total size of the eCommerce platform market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Ecommerce Platform Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the eCommerce platform market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and determine the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

An eCommerce platform comprises various technologies that facilitate buying and selling over the internet. It assists vendors in showcasing their products, providing discounts, and keeping customers engaged. On the buyer’s end, these technologies help consumers search for products they want, create shopping lists, and pay for their purchases online. It is a tool that enables businesses to manage their virtual assets, omnichannel marketing, digital sales, and operations all in one place.

According to Shopify, an eCommerce platform is a software application that facilitates online commerce between merchants and consumers. These platforms can handle web hosting, inventory management, payment processing, marketing, order fulfillment, and more.

Stakeholders

- eCommerce Platform Providers

- eCommerce Software Providers

- Government Organizations

- Regulatory Authorities

- Policymakers and Financial Organizations

- Consulting Firms

- Research Organizations

- Academic Institutions

- Resellers and Distributors

- Training Providers

Report Objectives

- To analyze and forecast the global eCommerce platform market from 2025 to 2030 for the following segments: Offerings: Solutions and Services; eCommerce Models: B2B (Business-to-Business) and B2C (Business-to-Consumer); and End-use Industries: Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Home Décor, Health & Wellness, Household Consumables, and Other Industries

- To examine the various macroeconomic and microeconomic factors that influence market growth

- To forecast the size of the market segments for North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa (MEA)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the eCommerce platform market

- To analyze each submarket concerning individual growth trends, prospects, and contributions to the overall eCommerce platform market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the eCommerce platform market

- To profile the key market players, provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the market’s competitive landscape

- To track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and research and development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report.

Geographic Analysis as per Feasibility

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the definition of the eCommerce platform market?

An eCommerce platform consists of various technologies that facilitate the process of buying and selling over the internet. According to Shopify, an eCommerce platform is a software application that facilitates online commerce between merchants and consumers. These platforms can handle tasks such as web hosting, inventory management, payment processing, marketing, order fulfillment, and more.

What is the market size of the eCommerce platform market?

The eCommerce platform market is estimated at USD 9,078.2 million in 2025 and is expected to reach USD 16,506.9 million by 2030 at a compound annual growth rate (CAGR) of 12.7% from 2025 to 2030.

What are the major drivers in the eCommerce platform market?

The eCommerce platform market is primarily driven by the growing global shift toward digital commerce, accelerated by increasing internet penetration and smartphone adoption. The rising consumer preference for online shopping, coupled with advancements in payment and logistics infrastructure, is fostering platform adoption. The demand for omnichannel retailing, integration of AI-powered tools, and the need for scalable, cloud-based infrastructure are further propelling market growth across diverse industry verticals and geographic regions.

Who are the key players operating in the eCommerce platform market?

The key market players profiled in the eCommerce Platform market include Shopify (Canada), eBay (US), Etsy (US), Square (US), BigCommerce (US), Amazon (US), Adobe (US), Wix (Israel), Oracle (US), Squarespace (US), SAP (Germany), Salesforce (US), VTEX (UK), Trade Me (New Zealand), WooCommerce (US), StoreHippo (India), Lightspeed (US), OpenCart (China), Volusion (US), PrestaShop (France), Shift4Shop (US), FastSpring (US), Nuvemshop (Brazil), Tray.io (US), and Shopware (Germany).

What are the key technological trends in the eCommerce platform market?

Artificial Intelligence (AI) and Machine Learning (ML) are enabling personalized customer experiences through recommendation engines, dynamic pricing, and intelligent chatbots. The integration of Augmented Reality (AR) and Virtual Reality (VR) is enhancing product visualization, allowing consumers to interact with products in immersive environments.

Headless commerce architecture is gaining traction, offering greater flexibility and scalability by decoupling the frontend from the backend. Blockchain technology is also emerging as a secure solution for payments, data transparency, and supply chain traceability.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Ecommerce Platform Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Ecommerce Platform Market