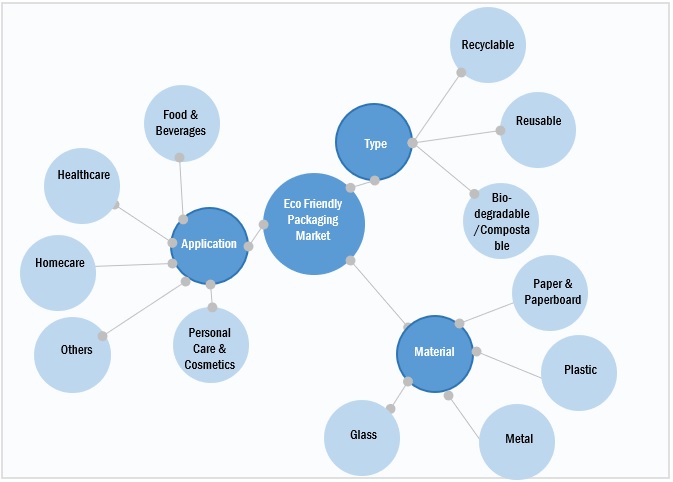

Eco Friendly Packaging Market by Type (Recyclable, Reusable, Biodegradable/Compostable), Material (Paper & Paperboard, Plastic, Metal, Glass, Others), Application (Food & Beverages, Personal Care & Cosmetics, Healthcare, Homecare, Others) and Region – Global Forecast to 2027

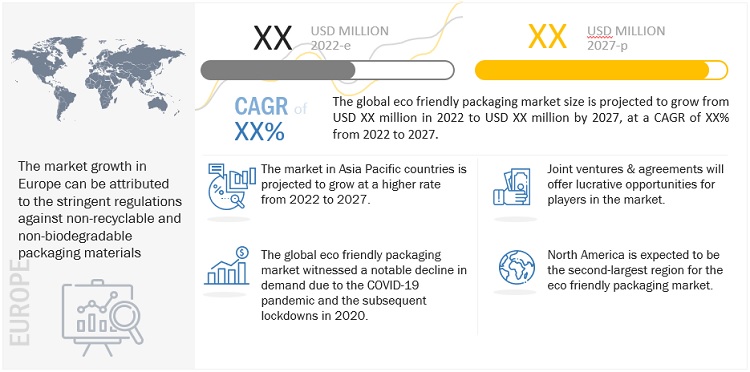

The Eco Friendly Packaging market size is estimated to be close to USD xx Billion in 2022 and is projected to grow at a CAGR of xx%. till 2027. The market is witnessing considerable growth due to the increase in awareness for the need of sustainable materials and the negative effects of disposing non-recyclable and non-biodegradable materials. The demand for eco friendly packaging is increasing from manufacturers of goods as well as their customers.

Attractive Opportunities In The Eco Friendly Packaging Market

e- Estimated, p- Projected

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Government initiatives towards sustainable packaging

Governments all over the world are encouraging the use of sustainable packaging in order to minimize waste. In 2018, UK strode forward to become a world leader in sustainable packaging. With an investment of USD 80 million (£60 million), the government called on innovators to develop packaging which will reduce the impact harmful plastics are having on the environment.The Packaging and Packaging Waste Directive has been established in Europe, which has two main objectives: to help prevent obstacles to trade and reduce the impact of packaging waste on the environment. According to this directive, the EU States shall ensure that recovery and recycling of packaging is done effectively, and that the uses of hazardous constituents in packaging are kept to a minimal level.

The Japanese government implemented a variety of measures to reduce plastic litter. One of these is the formulation of the Plastic Resource Recycling Strategy. The basic principles of this Strategy, which was formulated in May, 2019 are promoting the 3Rs (reduce, reuse, recycle) for plastic as well as encouraging the use of recycled materials and bioplastics. Along with this, measures such as eradicating illegal dumping, curtailing the outflow of microplastics, and retrieving and disposing of ocean litter will be implemented to deal with marine plastic litter.

In the United States, some states and local jurisdictions have adopted laws and regulations affecting the production, use, and disposal of packaging. These provisions include standards for environmentally acceptable packaging, minimum requirements for recycled content, restrictions on the use of certain substances in packaging, and even outright bans on certain types of plastic packaging. Numerous other countries have also adopted such initiatives to drive sustainability in the environment.

Such initiatives have helped provide the necessary boost to the sustainable packaging industry as more and more companies are looking to adhere to these regulations by adopting sustainable and eco-friendly materials in packaging.

Restraint: Poor infrastructure facilities for recycling

Recycling of packaging waste is a process that requires state-of-the-art infrastructural facilities. It is a time-consuming process that needs personnel expertise. However, some parts of the world lack these facilities for recycling. Even in developed countries such as the U.S., the problem of sub-standard infrastructure for recycling persists. Every year in the U.S. itself, recyclable containers worth more than USD 11 billion are thrown away due to lack of recycling facilities. According to the UN Environment Programme, the world produces around 300 million tonnes of plastic waste each year. To date, only 9 per cent of the plastic waste ever generated has been recycled, and only 14 per cent is collected for recycling now.

As most recycling facilities are outdated, they are incapable of handling changes in waste streams. For instance, even though the amount of paper waste has declined and plastic waste has increased, the existing machinery is ill-equipped to handle such changes in the trends of packaging waste.

Opportunities: Growth of the e-commerce industry

The e-commerce industry is one of the fastest growing industries throughout the world as more and more people are opting to shop online due to the convenience and a large variety of options that are offered. According to the U.S. Department of Commerce, the e-commerce industry was valued at USD 220 billion in the U.S. in 2014, growing at a rate of 17% every year reaching USD 601.75 billion in 2019. Most e-commerce companies such as Amazon, Alibaba, and Flipkart use sustainable packaging materials for packing and shipping their products.

These companies make a conscious effort to ensure that the packaging material used for packing their products is recycled and reused. They aim at reducing and consolidating orders by delivering more products in fewer packaging and reusing packaging materials

Challenges: Fluctuations in raw material prices

The increasing prices of sustainable raw materials adversely affect operations in the packaging industry. In addition to key raw materials, the prices of other raw materials, such as water and fuel are also constantly fluctuating due to weather conditions, market fluctuations, exchange rates, currency control, and government control. Fluctuations in prices increase the operating cost, which in turn can result in an expensive end product.

Majority of the demand is expected to come from developing regions. Sustained interruption in the supply of raw materials leads to a significant increase in prices and can also delay the production cycle. This disruption in demand and supply cycle can result in immense damage caused to the packaging industry.

Sustained interruptions in the supply of raw materials leads to a significant increase in prices and can also delay production. This disruption in the demand and supply cycle can result in immense damage to the packaging industry.

Ecosystem Diagram

By Material, Paper & Paperboard accounted for the largest share in 2022

The demand for paper & paperboard packaging dominated the market in 2022 due to it being highly recyclable and bio-degradable. The global market is primarily driven by increasing environmental issues of landfills and degradation of packaging material. A shift has been seen from plastic to more usage of paper & paperboard in the packaging industry. It has a high demand from the e-commerce industry as majority of the secondary and tertiary packaging use are made of paperboard. The rising demand for sustainable and recycled packaging for food, healthcare, and personal & homecare applications will further drive the paper & paperboard packaging market.

By type, recyclable packaging accounted for the largest share in 2022

Most packaging materials currently in use such as paper, plastic, glass, and metal are recyclable. Hence recycling is a major part of the packaging industry. Recently many companies have been incorporating post-consumer recycled plastic resins in their products to enhance sustainability. According to the New Plastic Economy Global Commitment report 60% of the plastics in use today are recyclable. But the problem in recycling arises in the collection and infrastructure to recycle these products. Packaging companies have been partnering with governments, NGOs and third party businesses to improve the recycling infrastructure and recycling rates. The signatories of the Global Commitment are planning to make a 100% of their packaging products recyclable by 2025.

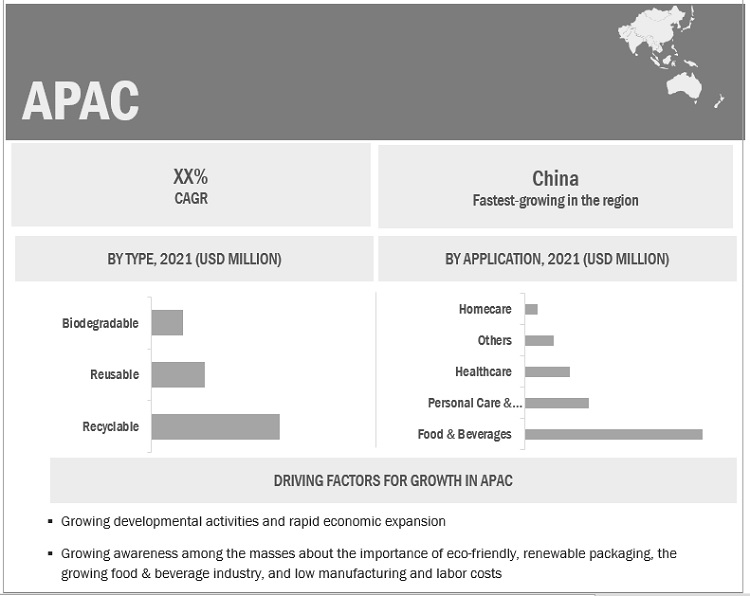

APAC account for the largest share of the eco friendly packaging market during the forecast period

The Asia Pacific region is projected to lead the eco-friendly packaging market, in terms of both value and volume, from 2022 to 2027. According to the World Bank, in 2021, APAC was the fastest-growing region in terms of both population and economic growth. Countries such as India and China are expected to post high growth in the eco friendly packaging market due to growing developmental activities and rapid economic expansion. The growing population in these countries presents a huge customer base for FMCG products and consumer durables.

The growing awareness among the masses about the importance of eco-friendly, renewable packaging, the growing food & beverage industry, and low manufacturing and labor costs are driving the eco friendly packaging market in APAC.

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2019-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Tons); Value (USD Million) |

|

Segments |

Type, Material, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

The key players in this market are Sealed Air Corporation (U.S.), Amcor plc (Australia), Berry Global, Inc., (U.S.), DS Smith (UK) and Mondi plc (UK) |

This report categorizes the global eco friendly packaging market based on type, material, application, and region.

On the basis of type, the eco friendly packaging market has been segmented as follows:

- Recyclable

- Reusable

- Biodegradable/Compostable

On the basis of material, the eco friendly packaging market has been segmented as follows:

- Plastics

- Paper & paperboard

- Metal

- Glass

- Others

On the basis of application, the eco friendly packaging market has been segmented as follows:

- Food & Beverages

- Personal Care & Cosmetics

- Healthcare

- Homecare

- Others

On the basis of region, the eco friendly packaging market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is the market size and growth of eco friendly packaging?

The eco friendly packaging market size is estimated to be close to USD xx Billion in 2022 and is projected to grow at a CAGR of xx% till 2027

What are the major drivers driving the demand for Eco Friendly Packaging Market?

The major drivers influencing the demand for eco friendly packaging market is the growing awareness regarding environmental degradation and increading government regulations supporting sustainable packaging materials

What are the restraining factors in Eco Firendly Packaging Market?

The major restraining factor faced by the eco friendly packaging market includes the lack of collection and recycling infrastructure in both developed and developing countries

What are the key players in the eco friendly packaging market?

Some of the key players in the eco friendly packaging market include Amcor plc (Australia), Berry Global, Inc., (U.S.), Sealed Air Corporation (U.S.), DS Smith (UK) and Mondi plc (UK). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATION

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF RIVALRY

5.4 YC, YCC SHIFT

5.5 ECOSYSTEM

5.6 REGULATORY LANDSCAPE

5.7 SUPPLY CHAIN ANALYSIS

5.8 TECHNOLOGY ANALYSIS

5.9 AVERAGE PRICING ANALYSIS

5.10 PATENT ANALYSIS

5.11 FACTORS IMPACTING MARKET GROWTH

5.12 MACRO-ECONOMIC ANALYSIS

6 ECO FRIENDLY PACKAGING MARKET, BY MATERIAL– FORECAST TILL 2027

6.1 INTRODUCTION

6.2 PAPER

6.3 PLASTIC

6.4 METAL

6.5 GLASS

6.6 OTHERS

7 ECO FRIENDLY PACKAGING MARKET, BY TYPE– FORECAST TILL 2027

7.1 INTRODUCTION

7.2 RECYCLABLE

7.3 REUSABLE

7.4 DEGRADABLE/COMPSTABLE

8 ECO FRIENDLY PACKAGING MARKET, BY APPLICATION– FORECAST TILL 2027

8.1 INTRODUCTION

8.2 FOOD & BEVERAGES

8.3 PERSONAL CARE & COSMETICS

8.4 HEALTHCARE

8.5 HOMECARE

8.6 OTHERS

9 ECO FRIENDLY PACKAGING MARKET, BY REGION – FORECAST TILL 2027

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 USA

9.2.2 CANADA

9.2.3 MEXICO

9.3 ASIA-PACIFIC

9.3.1 CHINA

9.3.2 INDIA

9.3.3 JAPAN

9.3.4 SOUTH KOREA

9.3.5 REST OF APAC

9.4 EUROPE

9.4.1 GERMANY

9.4.2 UK

9.4.3 FRANCE

9.4.4 RUSSIA

9.4.5 SPAIN

9.4.6 ITALY

9.4.7 REST OF EUROPE

9.5 MIDDLE EAST & AFRICA

9.5.1 SAUDI ARABIA

9.5.2 UAE

9.5.3 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE

10.1 OVERVIEW

10.2 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

10.2.1 STARS

10.2.2 PERVASIVE PLAYERS

10.2.3 EMERGING LEADERS

10.2.4 PARTICIPANTS

10.3 COMPETITIVE BENCHMARKING OF OVERALL MARKET

10.4 STRENGTH OF PRODUCT PORTFOLIO

10.5 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)

10.5.1 PROGRESSIVE COMPANIES

10.5.2 STARTING BLOCKS

10.5.3 RESPONSIVE COMPANIES

10.5.4 DYNAMIC COMPANIES

10.6 DETAILED LIST OF KEY STARTUP/SMES

10.7 COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

10.8 COMPETITIVE SCENARIO

10.8.1 EXPANSIONS & INVESTMENTS

10.8.2 AGREEMENTS, COLLABORATIONS, AND JOINT VENTURES

10.8.3 NEW PRODUCT LAUNCHES

10.8.4 MERGERS & ACQUISITIONS

11 COMPANY PROFILE

11.1 AMCOR

11.1.1 BUSINESS OVERVIEW

11.1.2 PRODUCTS OFFERED

11.1.3 RECENT DEVELOPMENTS

11.1.4 WINNING IMPERATIVES

11.1.5 CURRENT FOCUS AND STRATEGIES

11.1.6 THREAT FROM COMPETITION

11.2 CONSTANTIA FLEXIBLES

11.2.1 BUSINESS OVERVIEW

11.2.2 PRODUCTS OFFERED

11.2.3 RECENT DEVELOPMENTS

11.2.4 WINNING IMPERATIVES

11.2.5 CURRENT FOCUS AND STRATEGIES

11.2.6 THREAT FROM COMPETITION

11.3 DS SMITH PLC

11.3.1 BUSINESS OVERVIEW

11.3.2 PRODUCTS OFFERED

11.3.3 RECENT DEVELOPMENTS

11.3.4 WINNING IMPERATIVES

11.3.5 CURRENT FOCUS AND STRATEGIES

11.3.6 THREAT FROM COMPETITION

11.4 BERRY PLASTICS

11.4.1 BUSINESS OVERVIEW

11.4.2 PRODUCTS OFFERED

11.4.3 RECENT DEVELOPMENTS

11.4.4 WINNING IMPERATIVES

11.4.5 CURRENT FOCUS AND STRATEGIES

11.4.6 THREAT FROM COMPETITION

11.5 INTERNATIONAL PAPER COMPANY

11.5.1 BUSINESS OVERVIEW

11.5.2 PRODUCTS OFFERED

11.5.3 RECENT DEVELOPMENTS

11.5.4 WINNING IMPERATIVES

11.5.5 CURRENT FOCUS AND STRATEGIES

11.5.6 THREAT FROM COMPETITION

11.6 SMURFIT KAPPA GROUP

11.7 BALL CORPORATION

11.8 STORA ENSO

11.9 REYNOLDS GROUP

11.10 TETRAL LAVAL

11.11 WESTROCK CORPORATION

11.12 PROAMPAC

11.13 SEALED AIR CORPORATION

11.14 COVERIS

11.15 MONDI PLC

11.16 OTHER 5-10 PLAYERS

*Note: This is a tentative list of companies, and it may change during the course of study. Financial will be only provided for listed companies.

12 APPENDIX

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 AVAILABLE CUSTOMIZATIONS

12.4 CONNECTED MARKETS

12.5 RELATED REPORTS

The study involved four major activities to estimate the size of eco friendly packaging market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The eco friendly packaging market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the eco friendly packaging market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the eco friendly packaging industry.

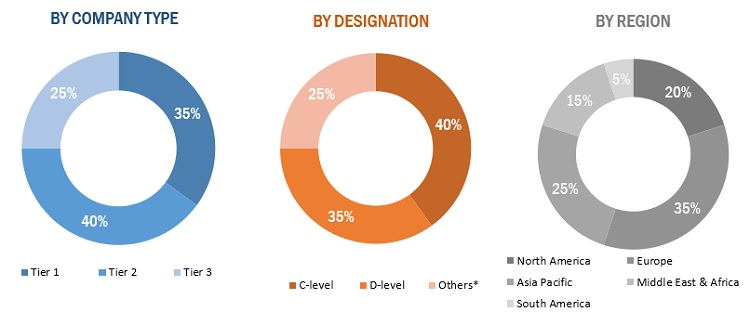

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

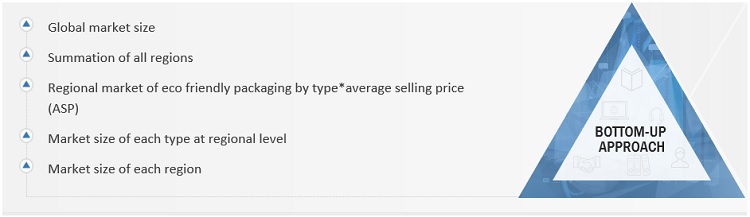

The top-down and bottom-up approaches have been used to estimate and validate the size of the eco friendly packaging market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Eco Friendly Packaging Market: Bottom-Up Approach 1

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the eco friendly packaging market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, material, application, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Middle East & Africa, and South America along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies2

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

Company Information

Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Eco Friendly Packaging Market