Duckweed Protein Market

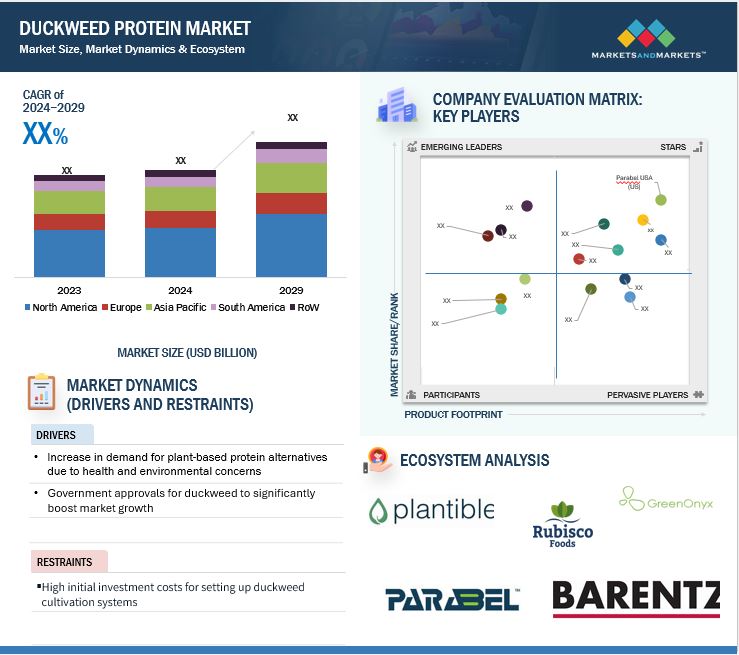

The market for duckweed protein is estimated at USD XX million in 2024; it is projected to grow at a CAGR of XX% to reach USD XX million by 2029. The duckweed protein market is emerging as a promising segment within the plant-based protein industry, driven by its potential as a sustainable and nutrient-rich protein source. Duckweed, a fast-growing aquatic plant, is recognized for its high protein content and ability to thrive in diverse environments with minimal resource input. Its applications span food, animal feed, and bioenergy industries, making it an attractive option for addressing global protein demand while reducing environmental impact.

Global Duckweed Protein Market Trends

Drivers:

Increase in demand for plant-based protein alternatives due to health and environmental concerns

The rising demand for plant-based foods is set to drive the adoption of innovative protein sources such as duckweed protein, a sustainable and nutrient-rich alternative. The Good Food Institute Europe analysed retail sales data from six European countries, revealing that plant-based food sales reached USD 5.84 billion in 2023, marking a 5.5% increase from 2022. Volume sales grew by 3.5% despite economic challenges and inflation. Germany led with strong growth driven by private-label products, while sales volumes rose in Spain and France but declined in the UK and the Netherlands. Plant-based drinks dominated the market (41% share), followed by meat (37%). Emerging categories like plant-based cheese and cream showed rapid growth due to improvements in taste and price parity. This growing interest in plant-based alternatives highlights a clear opportunity for duckweed protein to gain traction, particularly as policymakers and manufacturers invest in innovation to make plant-based options tastier, more affordable, and competitive with animal-based products, fostering a sustainable food system. Duckweed’s high protein content, rapid growth cycle, and minimal environmental footprint align perfectly with the evolving consumer preferences in Europe and beyond.

Restraints:

High initial investment costs for setting up duckweed cultivation systems

The current global landscape of duckweed protein production is characterized by significant technological and scalability hurdles. Existing cultivation technologies are still in nascent stages, making it difficult to achieve consistent, large-scale production. The primary challenges include developing sophisticated controlled environment technologies that can maintain stable growth conditions throughout varying seasonal and climatic conditions globally.

Additionally, high initial investment costs for setting up duckweed cultivation systems pose a significant restraint on the growth of the duckweed protein market. Establishing these systems requires advanced infrastructure, such as controlled environment facilities, nutrient management setups, and water recycling mechanisms, which demand substantial capital outlay. This financial barrier can deter small-scale producers and startups from entering the market, limiting the expansion of production capacity and innovation. Additionally, the long payback period associated with these investments further discourages potential investors, especially in regions where government subsidies or financial incentives for alternative protein sources are limited. Consequently, these high costs impede market penetration, particularly in developing economies, thereby slowing the adoption of duckweed protein despite its nutritional and environmental benefits.

Opportunities:

Rising investment in duckweed protein market

The surge in global investments in the duckweed protein market opens numerous opportunities for Europe, a region already experiencing heightened demand for plant-based, sustainable proteins. The advancements in infrastructure, scaling capabilities, and research, driven by investments like those in Planted Foods’ US facilities, can act as a blueprint for European companies. For instance, Plantible Foods (US) has raised substantial capital in multiple funding rounds, including USD 21.5 million in Series A in September 2021 and USD 30 million in Series B in November 2024. These investments, from prominent firms such as Piva Capital, Siddhi Capital, and Astanor Ventures, allow Plantible to scale its operations and expand its manufacturing capabilities. These developments pave the way for regional players to adopt similar practices and build efficient, large-scale production systems within Europe, enhancing their ability to meet the rising consumer demand.

Furthermore, the focus on Rubi Protein, which boasts high protein efficiency and environmental sustainability, aligns perfectly with growing consumer preference for sustainable, low-carbon-footprint foods. The introduction of innovative, nutrient-dense products like duckweed protein into the global market may create an opportunity to complement other plant-based protein sources like soy and peas. Moreover, increased funding provides opportunities for partnerships with agricultural and biotech companies, fostering localized production while reducing reliance on imports.

Challenges:

Difficulty in achieving consistent product quality and protein yield

The difficulty in achieving consistent product quality and protein yield poses a significant challenge for the duckweed protein market, as it directly impacts the scalability and reliability of its applications in food, feed, and industrial sectors. Variations in protein content can arise due to environmental factors like water quality, temperature, and nutrient availability, which can affect the growth conditions of duckweed. These inconsistencies make it challenging for manufacturers to standardize production processes and meet regulatory and consumer quality standards. Furthermore, fluctuations in protein yield can hinder cost-effectiveness, as lower yields may increase production costs and reduce profitability. Addressing these challenges requires advancements in cultivation techniques, controlled farming environments, and robust quality control systems to ensure the market's growth and competitiveness.

Duckweed Protein Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of duckweed protein. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Plantible Foods (US), Rubisco Foods (Netherlands), GreenOnyx (Israel), Lemnapro (Israel), SETA Organic Inc (Canada).

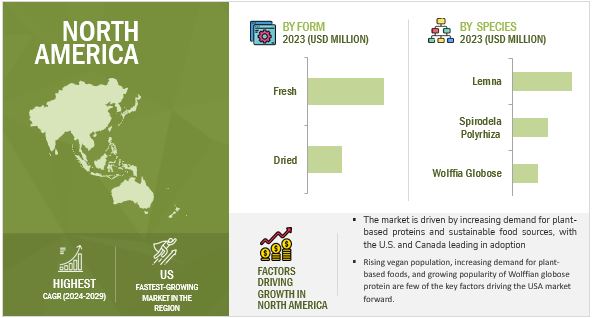

Based on form, the fresh sub-segment is projected to have a significant share in the market.

The global duckweed protein market exhibits a clear segmentation based on form, with fresh duckweed protein currently leading the market segment. This dominance stems from several key factors:

Companies are increasingly preferring fresh duckweed protein extraction due to its superior nutritional profile and processing advantages. The fresh form has become particularly attractive across multiple industries, including animal feed, aquaculture, and health supplements.

The development of future food products is increasingly centred on fresh duckweed species as a sustainable protein alternative. These innovative protein sources offer compelling advantages: they are potentially more nutritious, environmentally friendly, and economically viable compared to traditional animal-based proteins. The ability of fresh duckweed to potentially replace animal meat has sparked significant interest among food technologists and nutritional researchers.

The lemna is the fastest growing segment in the duckweed protein market and is projected to have a significant share.

In the duckweed protein market, species segmentation reveals three primary types: Wolffiella, Spiro Dela, and Lemna. Notably, the Lemna species currently dominates the market, a position expected to be maintained throughout the forecast period. This prominence is primarily attributed to Lemna's exceptional cultivation and processing characteristics.

Lemna, recognized as the world's smallest flowering plant, offers remarkable advantages in protein production. Its rapid growth and high protein concentration make it an extraordinarily promising solution to global protein scarcity challenges. The plant's versatility is particularly striking - it can be cultivated in diverse environments including basins, greenhouses, and even vertical farming systems, without requiring traditional agricultural land.

Innovative companies like Plantible Foods are actively exploring and developing various Lemna varieties, focusing on advanced protein extraction techniques. The species' ability to thrive in controlled environments, combined with its impressive protein yield, positions Lemna as a sustainable and scalable protein source for future nutritional needs.

The market's increasing interest in Lemna is driven by its unique characteristics: minimal land requirements, rapid growth cycle, high protein content, and adaptability to different cultivation methods. These attributes make Lemna an attractive option for companies seeking alternative, environmentally friendly protein sources in an increasingly resource-constrained world.

The North America region is anticipated to experience rapid growth between 2024 and 2029.

North America is emerging as a pivotal market for duckweed protein, driven by a confluence of consumer consciousness, technological innovation, and sustainability imperatives. The region's robust plant-based food ecosystem creates a fertile ground for duckweed protein's market penetration, with consumers increasingly prioritizing health, environmental sustainability, and functional nutrition.

Consumer dynamics in the United States are particularly transformative, with the duckweed protein market estimated at approximately USD 18.1 million in 2024. This growth is propelled by the expanding vegan and flexitarian populations seeking alternative protein sources that align with their dietary and environmental values. The rising demand is underpinned by a growing awareness of the ecological footprint of traditional protein production. The convergence of consumer trends, technological innovation, and sustainability goals positions North America, particularly the United States, as a critical market for duckweed protein's future growth and mainstream adoption.

Key Market Players

Plantible Foods (US)

Rubisco Foods (Netherlands)

GreenOnyx (Israel)

Parabel USA (US)

Sustainable Planet (UK)

Barentz (Netherlands)

Hinoman (Israel)

Lemnapro (Germany)

SETA Organic Inc. (Canada)

The Green Farmer Co-operative Society Limited (Ireland)

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, South America and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In October 2022, Viachem, Ltd, a specialty distributor of life science ingredients and specialty chemicals was acquired by Barentz International, a global life science ingredients distributor.

- In December 2022, Crop One Holdings and Cold Spring Harbor Laboratory secured a USD 1.5 million FFAR grant to advance research on plant-based proteins. Focused on Lemna aquatic plants, the project aims to develop efficient methods for high-quality protein production in controlled environments.

- In October 2023, Plantible Foods and ICL Food Specialties introduced ROVITARIS, a clean-label binding solution for plant-based meat and seafood, featuring RuBisCO protein extracted from Lemna (duckweed). It was touted as a revolutionary alternative to methylcellulose, advancing sustainability in food production.

Frequently Asked Questions (FAQ):

What is the current size of the duckweed protein market?

The duckweed protein market is estimated at USD xx million in 2024 and is projected to reach USD xx million by 2029, at a CAGR of xx% during the same period.

Which are the key players in the market, and how intense is the competition?

Plantible Foods (US), Rubisco Foods (Netherlands), GreenOnyx (Israel), Lemnapro (Israel), SETA Organic Inc (Canada).

Which region is projected to account for the largest share of the duckweed protein market?

The North American region market is expected to dominate during the forecast period. The region currently stands as a formidable force in the duckweed protein market, boasting dominance fueled by a convergence of factors, including robust research and development initiatives and the presence of major key players with advanced manufacturing capabilities.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the duckweed protein market?

Increase in demand for plant-based protein alternatives due to health and environmental concerns. Innovations in extraction technologies for improving yields are driving the market.

Growth opportunities and latent adjacency in Duckweed Protein Market