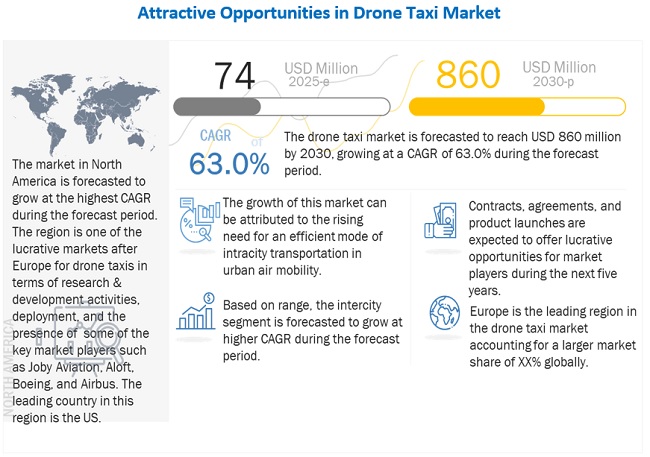

Drone Taxi Market Size, Share & Industry Growth Analysis Report by Range (Intercity, Intracity), Propulsion (Fully Electric, Hybrid, Electric Hydrogen), Autonomy (Fully Autonomous, Remotely Piloted), Passenger Capacity (Up to 2, 3 to 5, More than 5), System, End Use & Geography- Global Growth Driver and Industry Forecast to 2030

Update: 10/23/2024

A Drone Taxi can be used to carry passengers for intracity or intracity transportation. They will be equipped with cutting-edge technology that is silent, safe, and environmentally friendly. Drone taxis are designed to fly remotely piloted or autonomously, avoid obstacles, and take-off, fly, and land precisely every time. Drone taxi propulsion can be fully electric or hybrid electric. Some of the advantages of drone taxis include reduction in traffic congestion, sustainability, increased transportation efficiency, and noise reduction. The growth of the Drone Taxi Industry is majorly attributed to the need for an efficient mode of intracity transportation in urban cities.

DroneTaxi Market Size and Growth

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Drone Taxi Market

Pre-COVID-19, the drone taxi industry experienced an impressive growth trajectory. In the first few months of 2020 alone, over USD 1 billion was invested in the sector, with Toyota leading a USD 590 million investment in Joby Aviation (US) and EHang’s (China) USD 650 million IPO valuation. In 2019, the Federal Aviation Administration (FAA) in the US announced that it was engaged with manufacturers of more than 15 eVTOL aircraft. Uber Air, EHang, Volocopter, Joby Aviation, and Lilium are among those who have signaled their intent to launch commercial passenger operations within the next three to five years.

Since the COVID-19 outbreak, however, there have been some observable signs of slowing down. Engineering by nature is a collaborative endeavor where co-location has been one of the key drivers of innovation. Uber Air disclosed that remote working had impacted the ability of its vehicle partners to conduct research & development activities. Labor and supply chain disruptions were noted by EHang in terms of overseas market development. Moreover, the pandemic may impact opportunities for relationship building and face-to-face conversations, which are key to building trust and alignment to get the first pilots and commercial services off the ground. The COVID-19 pandemic has also brought about some uncommon causalities, affecting companies at a small as well as large scale. One such uncommon casualty has been Voom, an Airbus (US) backed app-based helicopter booking platform. Voom ceased operations in April 2020, citing the impact of COVID-19, although Airbus has reasserted its commitment to its City Airbus drone taxi program

DroneTaxi Market Trends

Drone Taxi Market Driver: Smart City Initiatives

Smart city models have spurred tremendous development opportunities for technology vendors and associated service providers. With increasing government initiatives and environmental campaigns taking center stage, technology providers and consultants have aggressively started simulating innovative solutions based on conceptual modules for urban infrastructure design and development. For instance: In May 2021, Osaka city will undertake the development of vertiports and infrastructure for drone delivery services, including urban air mobility. Skyports, a leading UK-based vertiport company, will assist in the delivery of eVTOL technology. The initiative will enhance tourism, sustainability, and the economic performance of the Osaka Prefecture

Drone Taxi Market Opportunity: Intracity Transportation: Short-Term Opportunity

The key purpose of a drone taxi is to facilitate intracity transportation to reduce the strain on existing urban mobility solutions. Currently, with the limited availability of high-powered, lightweight lithium-ion batteries and the infrastructure required for the setting up of charging points for these batteries, the majority of autonomous aircraft manufacturers are in the research & development phase, leaving only a handful of players to deploy their autonomous aircraft for intracity transportation. Lilium (Germany) has developed the Lilium Jet, an electric vertical take-off and landing jet with a cruising speed of 300 km/h and a range of 300 km. The company plans to deploy this jet for intracity transportation initially and for intercity transportation soon. Lift Aircraft (US), on the other hand, publicly launched Hexa, a manned multirotor ultralight intracity eVTOL at a market price of USD 49,500, in December 2018.

Drone Taxi Market Challenge: Cybersecurity Concerns

Since drone taxis are dependent on software, cybersecurity will be a potentially critical vulnerability. Advanced aerial mobility faces several cybersecurity concerns such as threats to onboard networks and code; attacks on vehicle/air traffic control (ATC) datalinks; and the introduction of adversarial or incorrect data for safety-critical decisions and/or machine learning. In terms of vulnerability, advanced aerial mobility will depend on the operation of other complex software-intensive systems such as ATC, GPS, and various types of shared communication systems. As with modeling and designing in safety, new approaches to cybersecurity are required to make drone taxis a success. The paradigm changes that have been proposed for ensuring safety are also applicable to cybersecurity, but research & development are required to develop new techniques to safeguard automated aerial vehicles from cyber threats.

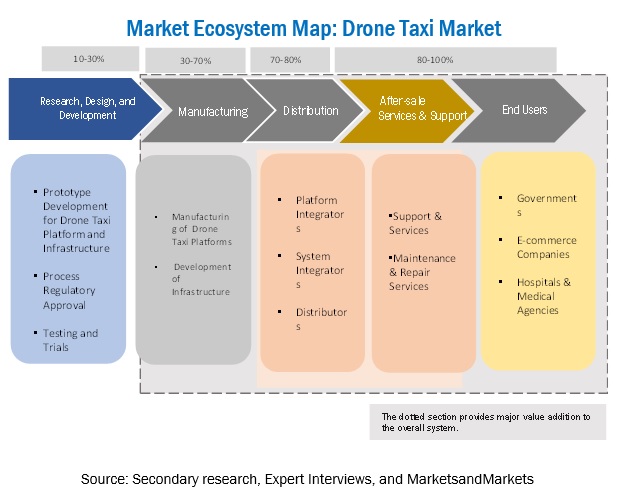

Drone Taxi Market Ecosystem

Prominent companies providing Drone Taxi systems, private and small enterprises, distributors/suppliers/retailers, and end customers are the key stakeholders in Drone Taxi market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries also serve as major influencers in the market.

To know about the assumptions considered for the study, download the pdf brochure

DroneTaxi Market Segmentation

The Ride Sharing Segment Accounts for the Largest Market Size During the Forecast Period

Based on End Use, Ride Sharing segment is projected to have a larger drone taxi market share during the forecast period. This growth is attributed to congested cities and need for faster transport with defined travel routes to enable reaching from one destination to another. While ride sharing companies are expected to account for the largest market share during the forecast period owing to a large number of air taxi operators and the expected increase in the adoption of ride sharing taxis post 2025.

The Fully Electric Segment is Projected for the Largest Market Size During the Forecast Period

Based on Propulsion type, Fully Electric segment is projected for the largest market size during the forecast period. This growth is attributed to the increase in demand for fuel-efficient, high-performance, and low-emission vehicles along with increased endurance over other propulsion systems, thereby enabling eVTOLs to fly for long durations. Fully electric drone taxi manufacturers are expected to account for the largest market share during the forecast period owing to the increase in the demand for high-performance and zero-emission vehicles.

Based on Passenger Capacity, Dronetaxis Having Passenger Capacity of 3 to 5 is Expected to Grow at the Highest CAGR During the Forecast Period

Drone taxis with a passenger carrying capacity of 3 to 5 will lead the market as they will be more cost-efficient when it comes to paying for regular commute and can reduce the possibility of air traffic. Also, the segment has promising investments and developments by companies like Lilium (Germany), Uber Elevate (US), and Ehang (China).

Based on the Range, the Intracity Segment to Account for the Largest Share of Drone Taxi Industry During the Forecast Period

Intracity transportation will lead the market, as the service will be helpful for on-demand air transportation within core urban areas and residential suburban destinations outside cities or around city centers. Manufacturers like Volocopter (Germany), Airbus (US), Aloft(US), Lift Aircraft(US), Ehang (China), and Boeing (US), among others, are heavily investing in the development of next-generation intracity transportation.

DroneTaxi Market Regional Analysis

“North America is Projected to Grow at the Highest CAGR During the Forecast Period.”

North America is estimated to grow at the highest CAGR during the period from 2025-2030. The market growth in this region can be attributed to strategic partnerships and funding related to the use of drone taxis by concerned authorities in North American countries. For instance, in January 2020, Joby Aviation entered into a strategic partnership with Toyoto and Uber. Joby Aviation plans to go public in a reverse merger with Reinvent Technology Partners, a USD 690 million publicly listed blank check company. Air taxis are likely to witness heightened demand for urban transportation in this region.

In North America, the market growth can be attributed to increasing investments to develop drone taxi infrastructure by various key players to reduce the strain on the existing transportation system in the region. Significant carbon emissions caused by traditional aircraft and helicopters used at airports and around the cities are of major concern worldwide. Hence, several international regulatory bodies, such as the International Civil Aviation Organization (ICAO), have initiated green, clean, and energy-efficient programs to achieve zero carbon emission at airports. These programs have led drone taxi platform manufacturers to invest in innovating eVTOL and hybrid variants.

Top Drone Taxi Companies - Key Market Players

The Drone Taxi Companies are dominated by globally established players such as:

- Airbus (Netherlands)

- Boeing (US)

- Joby Aviation (US)

- Lilium (Germany)

- Volocopter (Germany)

- Ehang (China)

These key players offers Drone taxi platforms and strong distribution networks across North America, Europe, Asia Pacific, Middle East and Latin America.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 74 million in 2025 |

|

Projected Market Size |

USD 860 million by 2030 |

|

Growth Rate (CAGR) |

63.0% |

|

Forecast Period |

2025-2030 |

|

Segments Covered |

|

|

Region Covered |

|

| Top Market Companies |

|

| Top Companies in North America |

|

| Key Market Driver |

Smart City Initiatives |

| Key Market Opportunity |

Intracity Transportation: Short-Term Opportunity |

| Largest Growing Region |

North America |

| Largest Market Share Segment |

Fully Electric Segment |

| Highest CAGR Segment |

Passenger Capacity 3 to 5 |

| Largest Application Market Share |

Ride Sharing Segment |

This research report categorizes the Drone Taxi Market based on industry, forecasting type, purpose, organization size, and region.

Drone Taxi Market, By System.

- Structure

- Avionics

- Interior

- Propulsion

- Other

Drone Taxi Market, By Propulsion Type

- Fully Electric

- Hybrid

- Electric Hydrogen

Drone Taxi Market, By Passenger Capacity

- Up to 2

- 3 to 5

- More than 5

Drone Taxi Market, By End use

- Ride Sharing Companies

- Scheduled Operators

- Hospital and Medical Agencies.

- Private Operators

Drone Taxi Market, By Range

- Intracity

- Intercity

Drone Taxi Market, By Autonomy

- Remotely Piloted

- Fully Autonomous

Drone Taxi Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

Recent Developments

- In March 2021, Lilium signed a definitive agreement with Qell Acquisition Corp, an acquisition company that invests in high-growth businesses. The agreement will boost the market for the 7-seater Lilium jet and help Lilium position itself as a leader in regional electric air mobility

- In December 2020, Joby announced that Uber Technologies Inc. agreed to invest a further USD 75 million in Joby as part of a broader transaction involving the acquisition of Uber Elevate by Joby and an expanded partnership between the two parent companies. This investment is an addition to a previously made USD 50 million investment as part of Joby’s Series C financing round in January 2020.

- In March 2020, Volocopter partnered with German company, Autoflug to develop passenger seats for its production air taxi. Autoflug will develop its modular Flyweight seat family for Volocopter’s two-seat VoloCity multicopter, which is being developed for commercial air taxi services in inner cities.

Frequently Asked Questions (FAQ):

What is the Current Size of the Drone Taxi Market?

The Drone Taxi market size is forecasted to grow from an estimated USD 74 million in 2025 to USD 860 million by 2030, at a CAGR of 63% during the forecast period.

Who Are the Winners in the Drone Taxi Market?

Airbus (Netherlands), Boeing (US), Joby Aviation (US), Lilium (Germany), Volocopter (Germany) and Ehang (China) are some of the winners in the market.

What is the COVID-19 Impact on Drone Taxi Market?

Being a futuristic market, the supply side of the drone taxi market has not been significantly impacted by the COVID-19 outbreak. A majority of the platform providing companies are either engaged in developing prototype vehicles or have started flight testing of developed prototypes, while companies engaged in providing infrastructure have shown continuous progress in making drone taxi a reality. When compared to the demand-side impact, the supply-side impact on the market is expected to remain low since funds for deliveries were already allocated prior to the pandemic

What Are Some of the Technological Advancements in the Market?

Technological advancements are paving the way for the development and introduction of autonomous and remotely piloted drone taxis. Artificial intelligence, blockchain, hybrid gears, IoT, and wireless charging are disruptive technologies in the drone taxi market. Utilizing these, drone taxis are expected to be well-equipped with the latest technological advancements and also gain increasing public acceptance, thereby making intercity and intracity rides safe and highly efficient.

What Are the Factors Driving the Growth of the Market?

Expected Increasing demand for commercial use of eVTOLs for intracity transport, replacement of business jets with drone taxis, an alternative to traditional ground transport, rapid increase in urban demographics, and increasing traffic congestion are some of the key factors driving the growth in the Drone Taxi market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 DRONE TAXI MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

1.5 USD EXCHANGE RATES

1.6 INCLUSIONS & EXCLUSIONS

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 4 KEY PRIMARY INSIGHTS

2.1.2.2 Breakdown of primaries

TABLE 1 INFORMATION ABOUT PRIMARY INTERVIEWEES

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increasing demand for alternative transportation in urban mobility and autonomous air ambulances

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.3.1 Advancements in technology

2.3 MARKET SIZE ESTIMATION

2.4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.5 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.6 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.7 ASSUMPTIONS

2.7.1 ASSUMPTIONS FOR THE RESEARCH STUDY

2.8 IMPACT OF COVID-19

2.9 RISK IMPACT ASSESSMENT

2.1 LIMITATIONS/GREY AREAS

2.10.1 PRICING

2.10.2 MARKET SIZE

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 8 RIDE SHARING COMPANIES TO HOLD LARGEST SHARE DURING FORECAST PERIOD

FIGURE 9 PROPULSION SYSTEM SEGMENT PROJECTED TO LEAD

FIGURE 10 REMOTELY PILOTED SEGMENT PROJECTED TO DOMINATE

FIGURE 11 3 TO 5 PASSENGER CAPACITY SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 FULLY ELECTRIC SEGMENT TO COMMAND LARGEST SHARE OF MARKET

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET, 2025–2030

FIGURE 13 NEED FOR ALTERNATIVE MODE OF TRANSPORT IN URBAN AREAS DRIVES MARKET GROWTH

4.2 DRONE TAXI MARKET, BY END USE

FIGURE 14 RIDE SHARING SEGMENT PROJECTED TO LEAD

4.3 MARKET, BY COUNTRY

FIGURE 15 US MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 URBAN AIR MOBILITY MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing demand for alternative mode of transportation in urban mobility

5.2.1.2 Smart city initiatives

TABLE 2 SMART CITY INITIATIVES, BY COUNTRY

5.2.1.3 Improved regulatory framework

5.2.2 RESTRAINTS

5.2.2.1 Safety concerns during drone taxi operations

5.2.2.2 Limited adoption due to political, economic, social, technological, and legal factors

5.2.3 OPPORTUNITIES

5.2.3.1 Intracity transportation: Short-term opportunity

5.2.3.2 Increasing demand for autonomous air ambulance vehicles

5.2.3.3 Technological advancements in sector

TABLE 3 TECHNOLOGY ADVANCEMENT, BY PLATFORM

5.2.3.4 Zero emission initiatives

5.2.4 CHALLENGES

5.2.4.1 Concerns related to lithium batteries

5.2.4.2 Restrictions on commercial use of drones

TABLE 4 RESTRICTIONS ON USE OF DRONES, BY COUNTRY

5.2.4.3 Implementation of required ground infrastructure

5.2.4.4 Cybersecurity concerns

5.2.4.5 Lack of skilled and trained operators

5.3 COVID-19 IMPACT: RANGES AND SCENARIOS

5.4 IMPACT OF COVID-19

5.4.1 DEMAND-SIDE IMPACTS

5.4.1.1 Key developments from January 2020 to November 2020

TABLE 5 KEY DEVELOPMENTS IN DRONE TAXI MARKET

5.4.2 SUPPLY-SIDE IMPACT

5.4.2.1 Key developments from January 2020 to November 2020

TABLE 6 KEY DEVELOPMENTS IN DRONE TAXI MARKET, JANUARY 2020 TO NOVEMBER 2020

5.5 DRONE TAXI MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

TABLE 7 MARKET ECOSYSTEM

5.6 TRENDS/DISRUPTION IMPACTING CUSTOMERS’ BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DRONE TAXI MARKET

5.7 VALUE CHAIN ANALYSIS

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 DRONE TAXI MARKET: PORTER’S FIVE FORCES.

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 USE CASE ANALYSIS: DRONE TAXI MARKET

5.9.1 PASSENGER FLIGHT TESTING

5.9.2 AIR AMBULANCE

5.9.3 RIDE SHARING

5.9.4 AIR HUB

5.10 TARIFF AND REGULATORY LANDSCAPE, UK

TABLE 9 DRONE REGULATORY BODIES, BY COUNTRY

TABLE 10 DRONE REGULATIONS, BY COUNTRY

5.11 TECHNOLOGY ANALYSIS

5.11.1 COMPACT FLY-BY-WIRE

5.12 TREND ANALYSIS

5.13 SELLING PRICE ANALYSIS

TABLE 11 ESTIMATED VEHICLE COST

TABLE 12 ESTIMATED COST PER TRIP

6 INDUSTRY TRENDS (Page No. - 68)

6.1 INTRODUCTION

6.2 CHALLENGES OF DRONE TAXI ECOSYSTEM

FIGURE 17 CHALLENGES OF DRONE TAXI ECOSYSTEM

6.3 EMERGING TECHNOLOGY TRENDS

FIGURE 18 KEY TECHNOLOGY ENABLERS FOR DRONE TAXI

6.3.1 BLOCKCHAIN

6.3.2 ARTIFICIAL INTELLIGENCE

6.3.3 SENSE & AVOID SYSTEMS

6.3.4 CLOUD COMPUTING

6.3.5 AUTOMATED GROUND CONTROL STATIONS

6.3.6 INTERNET OF THINGS (IOT)

6.3.7 HYDROGEN PROPULSION

6.3.8 REDUCTION IN PROPULSION NOISE

6.3.9 COMPOSITE MATERIAL

6.4 IMPACT OF MEGATREND

6.5 INNOVATION & PATENT ANALYSIS

TABLE 13 INNOVATION & PATENT ANALYSIS OF DRONE TAXI MARKET

7 DRONE TAXI MARKET, BY END USE (Page No. - 75)

7.1 INTRODUCTION

FIGURE 19 RIDE SHARING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 14 DRONE TAXI MARKET, BY END USE, 2023–2030 (USD MILLION)

7.2 RIDE SHARING COMPANIES

7.2.1 STRATEGIES OF EXPANSION AND PARTNERSHIP WITH RIDE SHARING COMPANIES WILL BOOST SEGMENT

7.3 SCHEDULED OPERATORS

7.3.1 CONGESTED CITIES AND NEED FOR FASTER TRANSPORT WILL BOOST SEGMENT

7.4 HOSPITALS & MEDICAL AGENCIES

7.4.1 SPECIAL EMERGENCY MEDICAL SERVICE PERMITS FOR CRITICAL PATIENTS CAN FUEL SEGMENT GROWTH

7.5 PRIVATE OPERATORS

7.5.1 EMERGING SEGMENT FOR ON-DEMAND AIR TRAVEL

8 DRONE TAXI MARKET, BY AUTONOMY (Page No. - 79)

8.1 INTRODUCTION

FIGURE 20 FULLY AUTONOMOUS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 DRONE TAXI MARKET, BY AUTONOMY, 2023–2030 (USD MILLION)

8.2 FULLY AUTONOMOUS

8.2.1 INCREASING COMMERCIAL USE OF EVTOL AIRCRAFT FOR INTRACITY TRAVEL WILL DRIVE SEGMENT

8.3 REMOTELY PILOTED

8.3.1 BETTER AIR TRAFFIC MANAGEMENT WILL INCREASE DEMAND FOR REMOTELY PILOTED AIRCRAFT

9 DRONE TAXI MARKET, BY PASSENGER CAPACITY (Page No. - 82)

9.1 INTRODUCTION

FIGURE 21 DRONE TAXIS WITH PASSENGER CAPACITY OF 3 TO 5 TO COMMAND LARGEST MARKET SHARE

TABLE 16 DRONE TAXI MARKET, BY PASSENGER CAPACITY, 2023–2030 (USD MILLION)

9.2 UP TO 2 PASSENGERS

9.2.1 INCREASING DISPOSAL INCOME IN URBAN AREAS WILL DRIVE SEGMENT

9.3 3 TO 5 PASSENGERS

9.3.1 INCREASING INVESTMENTS AND DEVELOPMENTS BOOST SEGMENT

9.4 MORE THAN 5 PASSENGERS

9.4.1 FUNDING FOR MINI AIRBUS DRONE TAXIS WILL FUEL SEGMENT

10 DRONE TAXI MARKET, BY PROPULSION TYPE (Page No. - 85)

10.1 INTRODUCTION

FIGURE 22 FULLY ELECTRIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 17 DRONE TAXI MARKET, BY PROPULSION SYSTEM, 2023–2030 (USD MILLION)

10.2 FULLY ELECTRIC

10.2.1 REDUCTION OF OVERALL WEIGHT WITH ELIMINATION OF PISTON ENGINE DRIVEN GENERATOR WILL INCREASE DEMAND.

10.3 HYBRID

10.3.1 ELIMINATION OF GROUND BATTERY CHARGING INFRASTRUCTURE WILL INCREASE DEMAND FOR HYBRID ELECTRIC DRONE TAXIS

10.4 ELECTRIC HYDROGEN

10.4.1 INCREASED ENDURANCE OVER OTHER PROPULSION SYSTEMS WILL BOOST MARKET FOR ELECTRIC HYDROGEN POWERED EVTOL DRONES

11 DRONE TAXI MARKET, BY RANGE (Page No. - 88)

11.1 INTRODUCTION

FIGURE 23 INTRACITY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 18 DRONE TAXI MARKET, BY RANGE, 2023–2030 (USD MILLION)

11.2 INTERCITY

11.2.1 RAPID INCREASE IN URBAN DEMOGRAPHICS WILL DRIVE MARKET FOR INTERCITY DRONE TAXIS

11.3 INTRACITY

11.3.1 INCREASING TRAFFIC CONGESTION WILL INCREASE DEMAND FOR INTRACITY DRONE TAXI SERVICES.

12 DRONE TAXI MARKET, BY SYSTEM (Page No. - 91)

12.1 INTRODUCTION

FIGURE 24 PROPULSION SYSTEM EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 19 DRONE TAXI MARKET SIZE, BY SYSTEM, 2023–2030 (USD MILLION)

12.2 STRUCTURE

12.2.1 SUBSTANTIAL GROWTH IN DESIGNING AND MANUFACTURING TECHNOLOGIES WILL DRIVE SEGMENT

12.3 AVIONICS

12.3.1 ADOPTION OF AUTONOMOUS DRONE TAXIS WILL INCREASE DEMAND FOR AVIONICS

12.4 PROPULSION

12.4.1 INCREASING DEMAND FOR HYBRID ELECTRIC DRONE TAXIS WILL DRIVE PROPULSION SEGMENT

12.5 INTERIOR

12.5.1 EXPANDED INTEREST FOR IN-FLIGHT ENTERTAINMENT WILL DRIVE SEGMENT

12.6 OTHERS

12.6.1 NEED FOR REGULAR MAINTENANCE OF DRONE TAXI COMPONENTS DRIVES OTHERS SEGMENT

13 DRONE TAXI MARKET, BY SOLUTION (Page No. - 95)

13.1 INTRODUCTION

13.2 PLATFORM, BY LIFT TECHNOLOGY

13.2.1 VECTOR THRUST

13.2.1.1 Advantage of quieter vertical take-off will increase demand for vector thrust platform

13.2.2 MULTIROTOR

13.2.2.1 Use for personal use, tourism, and entertainment hubs will drive multirotor platform

13.2.3 LIFT PLUS CRUISE

13.2.3.1 Longer range and higher passenger carrying capacity drive market for lift plus cruise technology

13.3 SOFTWARE MARKET BY APPLICATION

13.3.1 ROUTE PLANNING & OPTIMIZING

13.3.1.1 Increasing delivery of drone taxis will drive need for software for route planning and optimizing

13.3.2 SENSE & AVOID SYSTEM

13.3.2.1 Inclusion of more autonomous aerial vehicles will drive the market

13.3.3 LIVE TRACKING

13.3.3.1 Investments and advancements in next-generation eVTOLs will drive market of live tracking software

13.3.4 FLEET MANAGEMENT

13.3.4.1 Managing and scaling drone taxi fleets for commercial use will drive market for fleet management software

13.3.5 COMPUTER VISION

13.3.5.1 Developments in computer vision and machine learning to drive computer vision market

13.4 INFRASTRUCTURE, BY END USE

13.4.1 CHARGING STATIONS

13.4.1.1 Increasing investments will drive market for charging station infrastructure

13.4.2 VERTIPORTS

13.4.2.1 With increasing investments in passenger drones, demand for new vertiports will grow

13.4.3 TRAFFIC MANAGEMENT

13.4.3.1 Evolving technology and increasing availability of LTE and other high capacity networks will drive market for UTM systems

13.4.4 GROUND CONTROL STATION

13.4.4.1 Increasing demand for lightweight and portable ground stations will drive market

14 REGIONAL ANALYSIS (Page No. - 100)

14.1 INTRODUCTION

14.2 COVID-19 IMPACT ON DRONE TAXI MARKET

FIGURE 25 REGIONAL SNAPSHOT (2025)

TABLE 20 MARKET, BY REGION, 2023–2030 (USD MILLION)

14.3 NORTH AMERICA

14.3.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

TABLE 21 NORTH AMERICA: MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 22 NORTH AMERICA: MARKET SIZE, BY END USE, 2025–2030 (USD MILLION)

TABLE 23 NORTH AMERICA: MARKET SIZE, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 24 NORTH AMERICA: MARKET SIZE, BY AUTONOMY, 2025–2030 (USD MILLION)

TABLE 25 NORTH AMERICA: MARKET SIZE, BY PASSENGER CAPACITY, 2025–2030 (USD MILLION)

TABLE 26 NORTH AMERICA: MARKET SIZE, BY RANGE, 2025–2030 (USD MILLION)

14.3.2 US

14.3.2.1 Presence of major e-VTOL aircraft manufacturers to foster adoption of unmanned systems for various civil and commercial applications

TABLE 27 US: MARKET SIZE, BY AUTONOMY, 2025–2030 (USD MILLION)

TABLE 28 US: MARKET SIZE, BY RANGE, 2025–2030 (USD MILLION)

14.3.3 CANADA

14.3.3.1 CAAM consortium to promote commercialization of drones and air taxis in Canada

TABLE 29 CANADA: MARKET SIZE, BY AUTONOMY, 2025–2030 (USD MILLION)

TABLE 30 CANADA: MARKET SIZE, BY RANGE, 2025–2030 (USD MILLION)

14.4 EUROPE

14.4.1 PESTLE ANALYSIS: EUROPE

FIGURE 27 EUROPE: MARKET SNAPSHOT

TABLE 31 EUROPE: MARKET SIZE, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 32 EUROPE: PLATFORM MARKET SIZE, BY END USE, 2023–2030 (USD MILLION)

TABLE 33 EUROPE: MARKET SIZE, BY SYSTEM, 2023–2030 (USD MILLION)

TABLE 34 EUROPE: MARKET SIZE, BY AUTONOMY, 2023–2030 (USD MILLION)

TABLE 35 EUROPE: MARKET SIZE, BY PASSENGER CAPACITY, 2023–2030 (USD MILLION)

TABLE 36 EUROPE: MARKET SIZE, BY RANGE, 2023–2030 (USD MILLION)

14.4.2 FRANCE

14.4.2.1 Government initiatives supporting UAM projects will fuel market growth

TABLE 37 FRANCE: MARKET SIZE, BY AUTONOMY, 2024–2030 (USD MILLION)

TABLE 38 FRANCE: MARKET SIZE, BY RANGE, 2024–2030 (USD MILLION)

14.4.3 UK

14.4.3.1 Consortium cooperative business model with involvement of private sector and local authorities to drive market growth in UK

TABLE 39 UK: MARKET SIZE, BY AUTONOMY, 2023–2030 (USD MILLION)

TABLE 40 UK: MARKET SIZE, BY RANGE, 2023–2030 (USD MILLION)

14.4.4 BELGIUM

14.4.4.1 Initiatives for setting up drone-based emergency services network to drive market growth in Belgium

TABLE 41 BELGIUM: MARKET SIZE, BY AUTONOMY, 2023–2030 (USD MILLION)

TABLE 42 BELGIUM: MARKET SIZE, BY RANGE, 2023–2030 (USD MILLION)

14.4.5 BULGARIA

14.4.5.1 Increasing automobile emissions fueling demand for UAM in Bulgaria

TABLE 43 BULGARIA: MARKET SIZE, BY AUTONOMY, 2025–2030 (USD MILLION)

TABLE 44 BULGARIA: MARKET SIZE, BY RANGE, 2025–2030 (USD MILLION)

14.4.6 ITALY

14.4.6.1 Initiatives for setting up vertiport services network to drive market growth in Italy

TABLE 45 ITALY: MARKET SIZE, BY AUTONOMY, 2025–2030 (USD MILLION)

TABLE 46 ITALY: MARKET SIZE, BY RANGE, 2025–2030 (USD MILLION)

14.4.7 FINLAND

14.4.7.1 Growing adoption of UAM to decrease environmental impacts of aviation and improve flight connections

TABLE 47 FINLAND: MARKET SIZE, BY AUTONOMY, 2024–2030 (USD MILLION)

TABLE 48 FINLAND: MARKET SIZE, BY RANGE, 2024–2030 (USD MILLION)

14.4.8 GERMANY

14.4.8.1 Recognizing urban and regional air mobility as future strategic approach will play an important role in driving market in Germany

TABLE 49 GERMANY: MARKET SIZE, BY AUTONOMY, 2023–2030 (USD MILLION)

TABLE 50 GERMANY: SIZE, BY RANGE, 2023–2030 (USD MILLION)

14.4.9 SPAIN

14.4.9.1 Developing concepts for operating drone taxis will drive market

TABLE 51 SPAIN: MARKET SIZE, BY AUTONOMY, 2024–2030 (USD MILLION)

TABLE 52 SPAIN: MARKET SIZE, BY RANGE, 2024–2030 (USD MILLION)

14.4.10 SWITZERLAND

14.4.10.1 Initiatives for setting up air taxi network to connect places will drive market in Switzerland

TABLE 53 SWITZERLAND: MARKET SIZE, BY AUTONOMY, 2024–2030 (USD MILLION)

TABLE 54 SWITZERLAND: MARKET SIZE, BY RANGE, 2024–2030 (USD MILLION)

14.4.11 NETHERLANDS

14.4.11.1 Establishment of Dutch Drone Delta foundation to boost market growth in Netherlands

TABLE 55 NETHERLANDS: MARKET SIZE, BY AUTONOMY, 2024–2030 (USD MILLION)

TABLE 56 NETHERLANDS: DRONE TAXI MARKET SIZE, BY RANGE, 2024–2030 (USD MILLION)

14.5 ASIA PACIFIC

14.5.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 58 ASIA PACIFIC: DRONE TAXI PLATFORM MARKET SIZE, BY END USE, 2023–2030 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY SYSTEM, 2023–2030 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY AUTONOMY, 2023–2030 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY PASSENGER CAPACITY, 2023–2030 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY RANGE, 2023–2030 (USD MILLION)

14.5.2 JAPAN

14.5.2.1 Air mobility to attain key sustainable development

TABLE 63 JAPAN: MARKET SIZE, BY AUTONOMY, 2025–2030 (USD MILLION)

TABLE 64 JAPAN: MARKET SIZE, BY RANGE, 2025–2030 (USD MILLION)

14.5.3 AUSTRALIA

14.5.3.1 Rapid development and continuous testing of aerial taxi services will boost passenger drone operations

TABLE 65 AUSTRALIA: MARKET SIZE, BY AUTONOMY, 2024–2030 (USD MILLION)

TABLE 66 AUSTRALIA: MARKET SIZE, BY RANGE, 2024–2030 (USD MILLION)

14.5.4 INDIA

14.5.4.1 Increasing population and road traffic congestion in megacities such as Mumbai and Pune demand for UAM as alternate mode of transportation

TABLE 67 INDIA: MARKET SIZE, BY AUTONOMY, 2025–2030 (USD MILLION)

TABLE 68 INDIA: MARKET SIZE, BY RANGE, 2025–2030 (USD MILLION)

14.5.5 CHINA

14.5.5.1 China’s State Council urges acceleration of strategic planning and standards formulation for drone taxi

TABLE 69 CHINA: DRONE TAXI MARKET SIZE, BY AUTONOMY, 2023–2030 (USD MILLION)

TABLE 70 CHINA: DRONE TAXI MARKET SIZE, BY RANGE, 2023–2030 (USD MILLION)

14.5.6 SOUTH KOREA

14.5.6.1 South Korea has plans to launch air taxi services by 2025

TABLE 71 SOUTH KOREA: DRONE TAXI MARKET SIZE, BY AUTONOMY, 2024–2030 (USD MILLION)

TABLE 72 SOUTH KOREA: DRONE TAXI MARKET SIZE, BY RANGE, 2024–2030 (USD MILLION)

14.5.7 NEW ZEALAND

14.5.7.1 Airways New Zealand is a key provider of air traffic service in New Zealand

TABLE 73 NEW ZEALAND: DRONE TAXI MARKET SIZE, BY AUTONOMY, 2025–2030 (USD MILLION)

TABLE 74 NEW ZEALAND: DRONE TAXI MARKET SIZE, BY RANGE, 2025–2030 (USD MILLION)

14.5.8 SINGAPORE

14.5.8.1 Civil Aviation Authority of Singapore signed MOU with Airbus to focus on drone taxi

TABLE 75 SINGAPORE: DRONE TAXI MARKET SIZE, BY AUTONOMY, 2024–2030 (USD MILLION)

TABLE 76 SINGAPORE: DRONE TAXI MARKET SIZE, BY RANGE, 2024–2030 (USD MILLION)

14.6 MIDDLE EAST

14.6.1 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 29 MIDDLE EAST: DRONE TAXI MARKET SNAPSHOT

TABLE 77 MIDDLE EAST: DRONE TAXI MARKET SIZE, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 78 MIDDLE EAST: DRONE TAXI PLATFORM MARKET SIZE, BY END USE, 2023–2030 (USD MILLION)

TABLE 79 MIDDLE EAST: DRONE TAXI MARKET SIZE, BY SYSTEM, 2023–2030 (USD MILLION)

TABLE 80 MIDDLE EAST: DRONE TAXI MARKET SIZE, BY AUTONOMY, 2023–2030 (USD MILLION)

TABLE 81 MIDDLE EAST: DRONE TAXI MARKET SIZE, BY PASSENGER CAPACITY, 2023–2030 (USD MILLION)

TABLE 82 MIDDLE EAST: DRONE TAXI MARKET SIZE, BY RANGE, 2023–2030 (USD MILLION)

14.6.2 UAE

14.6.2.1 Dubai making progress to meet 2022 target for commercial electric air taxi operations

TABLE 83 UAE: DRONE TAXI MARKET SIZE, BY AUTONOMY, 2023–2030 (USD MILLION)

TABLE 84 UAE: DRONE TAXI MARKET SIZE, BY RANGE, 2023–2030 (USD MILLION)

14.7 LATIN AMERICA

14.7.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 30 LATIN AMERICA: DRONE TAXI MARKET SNAPSHOT

TABLE 85 LATIN AMERICA: DRONE TAXI MARKET SIZE, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 86 LATIN AMERICA: DRONE TAXI PLATFORM MARKET SIZE, BY END USE, 2025–2030 (USD MILLION)

TABLE 87 LATIN AMERICA: DRONE TAXI MARKET SIZE, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 88 LATIN AMERICA: DRONE TAXI MARKET SIZE, BY AUTONOMY, 2025–2030 (USD MILLION)

TABLE 89 LATIN AMERICA: DRONE TAXI MARKET SIZE, BY PASSENGER CAPACITY, 2025–2030 (USD MILLION)

TABLE 90 LATIN AMERICA: DRONE TAXI MARKET SIZE, BY RANGE, 2025–2030 (USD MILLION)

14.7.2 BRAZIL

14.7.2.1 Brazil to witness air taxi services by Airbus for intercity and intracity travel to reduce travel time

TABLE 91 BRAZIL: DRONE TAXI MARKET SIZE, BY AUTONOMY, 2025–2030 (USD MILLION)

TABLE 92 BRAZIL: DRONE TAXI MARKET SIZE, BY RANGE, 2025–2030 (USD MILLION)

14.7.3 MEXICO

14.7.3.1 Airbus, with establishment of its new drone taxi unit, aims to lay foundation for more efficient and sustainable city travel in Mexico

TABLE 93 MEXICO: DRONE TAXI MARKET SIZE, BY AUTONOMY, 2025–2030 (USD MILLION)

TABLE 94 MEXICO: DRONE TAXI MARKET SIZE, BY RANGE, 2025–2030 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 143)

15.1 INTRODUCTION

15.2 RANKING OF LEADING PLAYERS, 2020

FIGURE 31 RANKING OF LEADING PLAYERS IN DRONE TAXI MARKET, 2020

15.3 COMPETITIVE OVERVIEW

TABLE 95 KEY DEVELOPMENTS BY LEADING PLAYERS IN DRONE TAXI MARKET BETWEEN 2016 AND 2020

15.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 96 COMPANY PRODUCT FOOTPRINT

TABLE 97 COMPANY APPLICATION FOOTPRINT

TABLE 98 COMPANY RANGE FOOTPRINT

TABLE 99 COMPANY REGION FOOTPRINT

15.5 COMPANY EVALUATION QUADRANT

15.5.1 STAR

15.5.2 EMERGING LEADER

15.5.3 PERVASIVE

15.5.4 PARTICIPANT

FIGURE 32 DRONE TAXI MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

15.6 COMPETITIVE SCENARIO

15.6.1 DEALS

TABLE 100 DEALS, 2019–2021

TABLE 101 PRODUCT LAUNCHES, 2019–2021

16 COMPANY PROFILES (Page No. - 157)

(Business overview, Products/solutions/services offered, Recent Developments, MNM view)*

16.1 INTRODUCTION

16.2 KEY PLAYERS

16.2.1 AIRBUS SAS

TABLE 102 AIRBUS SAS: BUSINESS OVERVIEW

FIGURE 33 AIRBUS S.A.S.: COMPANY SNAPSHOT

TABLE 103 AIRBUS SAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 104 AIRBUS SAS: PRODUCT DEVELOPMENT

TABLE 105 AIRBUS SAS: DEALS

16.2.2 BOEING

TABLE 106 BOEING: BUSINESS OVERVIEW

FIGURE 34 BOEING: COMPANY SNAPSHOT

TABLE 107 BOEING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 108 BOEING: PRODUCT DEVELOPMENT

TABLE 109 BOEING: DEALS

16.2.3 TEXTRON INC

TABLE 110 TEXTRON INC: BUSINESS OVERVIEW

FIGURE 35 TEXTRON INC: COMPANY SNAPSHOT

TABLE 111 TEXTRON INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 112 TEXTRON INC: PRODUCT LAUNCH

16.2.4 EHANG

TABLE 113 EHANG: BUSINESS OVERVIEW

FIGURE 36 EHANG: COMPANY SNAPSHOT

TABLE 114 EHANG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 115 EHANG: PRODUCT LAUNCH

TABLE 116 EHANG: DEAL

16.2.5 JOBY AVIATION

TABLE 117 JOBY AVIATION: BUSINESS OVERVIEW

TABLE 118 JOBY AVIATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 119 JOBY AVIATION: DEALS

16.2.6 VOLOCOPTER

TABLE 120 VOLOCOPTER: BUSINESS OVERVIEW

TABLE 121 VOLOCOPTER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 122 VOLOCOPTER: PRODUCT LAUNCH

TABLE 123 VOLOCOPTER: DEALS

16.2.7 LILIUM

TABLE 124 LILIUM: BUSINESS OVERVIEWS

TABLE 125 LILIUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 126 LILIUM: PRODUCT LAUNCH

TABLE 127 LILIUM: DEALS

16.3 OTHER PLAYERS

16.3.1 OPENER

TABLE 128 OPENER: BUSINESS OVERVIEW

TABLE 129 OPENER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.3.2 PIPISTREL

TABLE 130 PIPISTREL: BUSINESS OVERVIEW

TABLE 131 PIPISTREL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 132 PIPISTREL: PRODUCT LAUNCH

TABLE 133 PIPISTREL: DEALS

16.3.3 ALOFT

TABLE 134 ALOFT: BUSINESS OVERVIEW

TABLE 135 ALOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 136 ALOFT: DEALS

16.3.4 LIFT AIRCRAFT

TABLE 137 LIFT AIRCRAFT: BUSINESS OVERVIEW

TABLE 138 LIFT AIRCRAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 139 LIFT AIRCRAFT: PRODUCT LAUNCH

TABLE 140 LIFT AIRCRAFT: DEALS

16.3.5 SKYDRIVE INC

TABLE 141 SKYDRIVE INC: BUSINESS OVERVIEW

TABLE 142 SKYDRIVE INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 143 SKYDRIVE INC: PRODUCT LAUNCH

TABLE 144 SKYDRIVE INC: DEALS

16.3.6 MOOG

TABLE 145 MOOG: BUSINESS OVERVIEW

TABLE 146 WISK AERO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.3.7 KAREM AIRCRAFT

TABLE 147 KAREM AIRCRAFT BUSINESS OVERVIEW

TABLE 148 KAREM AIRCRAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 149 KAREM AIRCRAFT: DEALS

16.3.8 TECNALIA

TABLE 150 TECNALIA: BUSINESS OVERVIEW

TABLE 151 TECNALIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.3.9 XERIANT

TABLE 152 XERIANT: BUSINESS OVERVIEW

TABLE 153 XERIANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 154 XERIANT: DEALS

16.3.10 SCIENEX

TABLE 155 SCIENEX: BUSINESS OVERVIEW

TABLE 156 SCIENEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.3.11 ZHEJIANG GEELY

TABLE 157 ZHEJIANG GEELY: BUSINESS OVERVIEW

TABLE 158 ZHEJIANG GELLY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.3.12 MICOR TECHNOLOGY LLC

TABLE 159 MICOR TECHNOLOGY LLC BUSINESS OVERVIEW

TABLE 160 MICOR TECHNOLOGY LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.3.13 AIRSPACE EXPERIENCE TECHNOLOGY

TABLE 161 AIRSPACE EXPERIENCE TECHNOLOGY: BUSINESS OVERVIEW

TABLE 162 AIRSPACE EXPERIENCE TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 163 AIRSPACE EXPERIENCE TECHNOLOGY: PRODUCT DEVELOPMENT

16.3.14 VARON VEHICLES CORPORATION

TABLE 164 VARON VEHICLES: BUSINESS OVERVIEW

TABLE 165 VARON VEHICLES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.3.15 HOVER

TABLE 166 HOVER: BUSINESS OVERVIEW

TABLE 167 HOVER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 168 HOVER: DEAL

16.3.16 TRANSCEND AIR

TABLE 169 TRANSCEND AIR: BUSINESS OVERVIEW

TABLE 170 TRANSCEND AIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 171 TRANSCEND AIR: DEALS

16.3.17 ALIPTERA

TABLE 172 ALIPTERA: BUSINESS OVERVIEW

TABLE 173 ALIPTERA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

16.3.18 COMAC

TABLE 174 COMAC: BUSINESS OVERVIEW

TABLE 175 COMAC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Details on Business overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

17 APPENDIX (Page No. - 201)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AUTHOR DETAILS

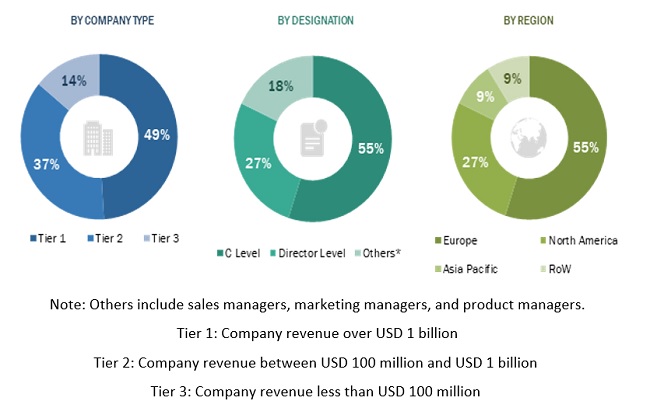

The research study conducted on the Drone Taxi market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the Drone Taxi market. The primary sources considered included industry experts from the Drone Taxi market consisting of Drone Taxi service providers, government agencies, technology vendors, system integrators, research organizations, and original equipment manufacturers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives, have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the Drone Taxi as well as to assess the growth prospects of the market. Drone Consultants, CEOs and CO-Founders, Directors

Secondary Research

Secondary sources referred for this research study included Boeing and Airbus Market Outlook 2019, General Aviation Manufacturers Association (GAMA); International Air Transport Association (IATA) publications; Flight Global World Airforce Fleet; Stockholm International Peace Research Institute, corporate filings (such as annual reports, investor presentations, and financial statements); Federal Aviation Administration (FAA) and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

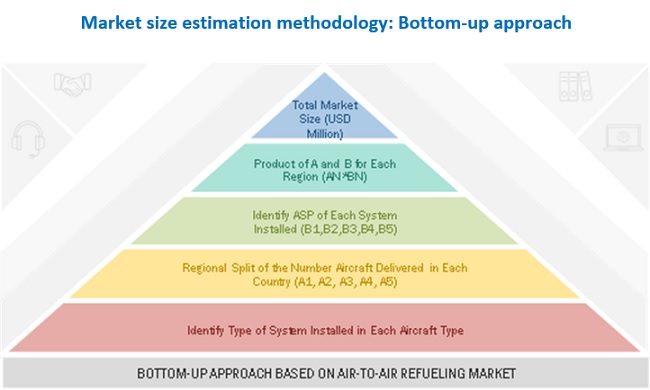

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Drone Taxi market. The research methodology used to estimate the market size also included the following details:

- Key players in the market were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews with industry experts with knowledge on Drone Taxi.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, and analyzed by MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the segments and subsegments of Drone Taxi market. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the Drone Taxi market based on System, Propulsion Type, Passenger Capacity, End use, Range, Autonomy and Region.

- To identify and analyze key drivers, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To forecast the size of different segments of the market with respect to North America, Europe, Asia Pacific, Middle East and Latin America.

- To profile leading market players based on their product portfolios, financial positions, and key growth strategies

- To analyze the degree of competition in the market by identifying key growth strategies, such as mergers & acquisitions, contracts, agreements, collaborations, new product launches, and funding, adopted by leading market players.

- To provide a detailed competitive landscape of the market, along with rank analysis, revenue share analysis, and market share analysis of key players

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Drone Taxi Market