Diving Equipment Market by Type (Rebreather, Exposure Suit, Decompression Chamber), Application (Commercial, Defense, Civil), End-User (Oil & Gas, Naval, Aquaculture), Depth (Recreational, Clearance, Saturation) & by Geography – Global Forecasts to 2021

The diving equipment market is expected to grow from USD 2.72 Billion in 2016 to USD 3.21 Billion by 2021, at a CAGR of 4.05% from 2016 to 2021. The objective of this study is to analyze, define, describe, and forecast the diving equipment market on the basis of type, application, depth, end-user, and geography. 2015 was considered as the base year and 2016 to 2021 was considered as the forecast period for this market study.

The diving equipment market is expected to grow from USD 2.72 Billion in 2016 to USD 3.21 Billion by 2021, at a CAGR of 4.05% from 2016 to 2021. This growth can be attributed to the rise in the average income of the people, especially in emerging economies, such as India and Vietnam. The dive tourism, particularly in the European region, is also a key factor fueling the growth of the diving equipment market.

On the basis of type, the diving equipment market has been segmented into rebreather, cylinder and propulsion vehicle, decompression chamber, exposure suit, and accessories. The rebreather segment is estimated to lead the diving equipment market in 2016. This growth can be attributed to the usage of this equipment in two major application areas, namely, commercial and defense; and the fact that it can provide air under high pressure underwater. The exposure suit segment is expected to lead the diving equipment market during the forecast period, owing to need of changing these suits frequently as these suits have short life cycle. Moreover, damages caused by harsh environments underwater also result in frequent replacement of these suits.

On the basis of end user, the oil & gas industry is expected to lead the diving equipment market during the forecast period. It is estimated to hold the largest share due to the expansion of oil rigs and search for new refineries, which require skilled divers for challenging underwater tasks.

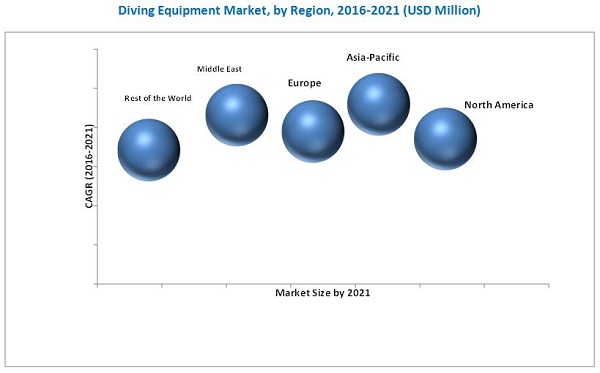

The diving equipment market in North America is estimated to hold the largest market share in 2016, followed by Asia-Pacific. The European market is a mature market for diving equipment, since diving activity is being carried out in this region since the early 1900’s. However, the growth of diving equipment market in North America and Europe is expected to be considerably low during the forecast period, owing to decreased demand of diving equipment in these regions. On the other hand, Asia-Pacific diving equipment market is expected to witness the highest growth rate. This growth can be attributed to the expansion of oilfields in China and Australia, and abundant underwater marine life for exploration, coupled with expected government-funded research and development activities.

Numerous diving accidents in last few years and limited platforms for the diving equipment are the two factors which have restrained the growth of diving equipment market. For instance, the number of fatalities was 292 in North America and 95 in Europe in 2015. In addition, the market for diving equipment is limited to three application areas, namely, defense, commercial, and civil and cannot be served to multiple platforms.

The diving equipment market is a diversified and competitive market with the presence of a large number of players. The market is led by companies based on their core competencies. The key players in diving equipment market include Cobham plc (U.K.), Dragerwerk AG & Co. KGaA (Germany), Divex Ltd. (U.K.), and Aqua Lung International (U.S.), among others. Cobham plc is a leading player in the diving equipment market globally. The company has a strong distribution network, with its centers across 70 countries, worldwide. Cobham has been a market leader in the diving equipment market with a robust product portfolio and wide customer base since the 1990’s.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objective of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Covered

1.3.2 Geographical Coverage

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Shareholders

2 Research Methodology (Page No. - 19)

2.1 Introduction

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.3.1.1 Key Industry Insights

2.3.1.2 Breakdown of Primaries

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Indicators

2.4.2.1 Upcoming Underwater Projects

2.4.2.2 Increasing Underwater War Activities

2.4.2.3 Expansion of Oil & Gas Refineries

2.4.3 Supply-Side Indicators

2.4.3.1 Digitization of Diving Equipment

2.5 Market Size Estimation

2.5.1 Top-Down Approach

2.6 Market Breakdown & Data Triangulation

2.7 Research Assumptions

3 Executive Summary (Page No. - 29)

3.1 Market Drivers for Diving Equipment, By Geography

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in Diving Equipment Market

4.2 Diving Equipment Market, By Type

4.3 Diving Equipment Market, By Application

4.4 Diving Equipment Market, By End User

4.5 Diving Equipment Market, By Geography

4.6 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Levels of Diving

5.3 Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Growth of Tourism Industry in Coastal Countries

5.4.1.2 Increasing Demand for Divers in Oil & Gas Industry Globally

5.4.1.3 Rise in Disposable Income in Emerging Nations

5.4.1.4 Rise in Demand for Divers for Large HydRoElectric Projects

5.4.2 Restraints

5.4.2.1 Numerous Diving Accidents in Past Few Years

5.4.2.2 Selected Range of Platforms for Equipment

5.4.3 Opportunities

5.4.3.1 Underwater Filming and Documentaries

5.4.3.2 Mine Clearance and Special Operations By Military

5.4.4 Restraints

5.4.4.1 Health Challenges to Divers

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Key Influencers

6.3 Key Trends in Diving Equipment Market

6.3.1 REC/TEC Buoyancy Compensator

6.3.2 Bulletproof Drysuits

6.3.3 Led Light Torches

6.4 Key Patents in Diving Equipment Market

7 Diving Equipment Market, By Type (Page No. - 48)

7.1 Introduction

7.2 Rebreather

7.3 Cylinder and Propulsion Vehicle

7.4 Exposure Suit

7.5 Decompression Chamber

7.6 Accessories

8 Diving Equipment Market, By Application (Page No. - 55)

8.1 Introduction

8.2 Defense

8.3 Commercial

8.4 Civil

9 Diving Equipment Market, By Depth (Page No. - 62)

9.1 Introduction

9.2 Recreational Diving

9.3 Clearance Diving

9.4 Saturation Diving

10 Diving Equipment Market, By End User (Page No. - 66)

10.1 Introduction

10.2 Oil & Gas

10.3 Naval

10.4 Aquaculture

11 Geographical Analysis (Page No. - 73)

11.1 Introduction

11.2 North America

11.2.1 By Type

11.2.2 By Application

11.2.3 By End User

11.2.4 By Country

11.2.4.1 U.S.

11.2.4.1.1 By Type

11.2.4.1.2 By Application

11.2.4.1.3 By End User

11.2.4.2 Canada

11.2.4.2.1 By Type

11.2.4.2.2 By Application

11.2.4.2.3 By End User

11.3 Europe

11.3.1 By Type

11.3.2 By Application

11.3.3 By End User

11.3.4 By Country

11.3.4.1 Germany

11.3.4.1.1 By Type

11.3.4.1.2 By Application

11.3.4.1.3 By End User

11.3.4.2 U.K.

11.3.4.2.1 By Type

11.3.4.2.2 By Application

11.3.4.2.3 By End User

11.3.4.3 France

11.3.4.3.1 By Type

11.3.4.3.2 By Application

11.3.4.3.3 By End User

11.3.4.4 Spain

11.3.4.4.1 By Type

11.3.4.4.2 By Application

11.3.4.4.3 By End User

11.4 Asia-Pacific

11.4.1 By Type

11.4.2 By Application

11.4.3 By End User

11.4.4 By Country

11.4.4.1 China

11.4.4.1.1 By Type

11.4.4.1.2 By Application

11.4.4.1.3 By End User

11.4.4.2 India

11.4.4.2.1 By Type

11.4.4.2.2 By Application

11.4.4.2.3 By End User

11.4.4.3 Australia

11.4.4.3.1 By Type

11.4.4.3.2 By Application

11.4.4.3.3 By End User

11.5 The Middle East

11.5.1 By Type

11.5.2 By Application

11.5.3 By End User

11.5.4 By Country

11.5.4.1 Saudi Arabia

11.5.4.1.1 By Type

11.5.4.1.2 By Application

11.5.4.1.3 By End User

11.5.4.2 UAE

11.5.4.2.1 By Type

11.5.4.2.2 By Application

11.5.4.2.3 By End User

11.5.4.3 Iran

11.5.4.3.1 By Type

11.5.4.3.2 By Application

11.5.4.3.3 By End User

11.6 Rest of the World

11.6.1 By Type

11.6.2 By Application

11.6.3 By End User

11.6.4 By Country

11.6.4.1 Brazil

11.6.4.1.1 By Type

11.6.4.1.2 By Application

11.6.4.1.3 By End User

11.6.4.2 South Africa

11.6.4.2.1 By Type

11.6.4.2.2 By Application

11.6.4.2.3 By End User

12 Competitive Landscape (Page No. - 110)

12.1 Overview

12.2 Market Share Analysis, By Company

12.3 Brand Analysis

12.4 Competitive Situation & Trends

12.4.1 Contracts

12.4.2 New Product Launches

12.4.3 Agreements & Partnerships

12.4.4 Acquisitions

13 Company Profiles (Page No. - 117)

13.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

13.2 Honeywell International, Inc.

13.3 Drägerwerk AG & Co. KGAA

13.4 Cobham PLC.

13.5 Divex Ltd.

13.6 Aqua Lung International

13.7 Submarine Manufacturing & Products Ltd

13.8 Underwater Kinetics

13.9 Apollo Military

13.10 Henderson Aquatics

13.11 Atlantis Dive

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 137)

14.1 Discussion Guide

14.2 Introducing RT: Real Time Market Intelligence

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

List of Tables (100 Tables)

Table 1 Underwater War Exercises

Table 2 Market Drivers: Geographical Mapping

Table 3 Increase in Oil & Gas Rigs, 2015-2016

Table 4 Diving Equipment Fatalities, 2015, By Geography

Table 5 Key Trend Analysis for REC/TEC Buoyancy Compensator

Table 6 Key Trend Analysis for Bulletproof Drysuits

Table 7 Key Trend Analysis for Led Light Torches

Table 8 List of Key Patents, 2008-2013

Table 9 Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 10 Rebreather Market Size, By Type, 2014-2021 (USD Million)

Table 11 Rebreather Market Size, By Application, 2014-2021 (USD Million)

Table 12 Rebreather Market Size, By Geography, 2014-2021 (USD Million)

Table 13 Cylinder and Propulsion Vehicle Market Size, By Application, 2014-2021 (USD Million)

Table 14 Cylinder and Propulsion Vehicle Market Size, By Geography, 2014-2021 (USD Million)

Table 15 Exposure Suit Market Size, By Type, 2014-2021 (USD Million)

Table 16 Exposure Suit Market Size, By Geography, 2014-2021 (USD Million)

Table 17 Decompression Chamber Market Size, By Geography, 2014-2021 (USD Million)

Table 18 Accessories Market Size, By Type, 2014-2021 (USD Million)

Table 19 Accessories Market Size, By Application, 2014-2021 (USD Million)

Table 20 Accessories Market Size, By Geography, 2014-2021 (USD Million)

Table 21 Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 22 Diving Equipment Market Size, By Geography, 2014-2021 (USD Million)

Table 23 Diving Equipment Market Size in Defense, By Geography, 2014-2021 (USD Million)

Table 24 Diving Equipment Market Size in Commercial, By Geography, 2014-2021 (USD Million)

Table 25 Diving Equipment Market Size in Civil, By Geography, 2014-2021 (USD Million)

Table 26 Recreational Diving Overview

Table 27 Clearance Diving Overview

Table 28 Saturation Diving Overview

Table 29 Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 30 Diving Equipment End User Market Size, By Geography, 2014-2021 (USD Million)

Table 31 Diving Equipment Market Size for Oil & Gas, By Geography, 2014-2021 (USD Million)

Table 32 Top 10 Countries in Terms of Defense Budget (USD Billion ), 2015

Table 33 Diving Equipment Market Size for Naval, By Geography, 2014-2021 (USD Million)

Table 34 Diving Equipment Market Size for Aquaculture, By Geography, 2014-2021 (USD Million)

Table 35 North America: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 36 North America: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 37 North America: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 38 North America: Diving Equipment Market Size, By Country, 2014-2021 (USD Million)

Table 39 U.S.: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 40 U.S.: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 41 U.S.: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 42 Canada: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 43 Canada: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 44 Canada: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 45 Europe: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 46 Europe: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 47 Europe: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 48 Europe: Diving Equipment Market Size, By Country, 2014-2021 (USD Million)

Table 49 Germany: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 50 Germany: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 51 Germany: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 52 U.K.: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 53 U.K.: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 54 U.K.: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 55 France: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 56 France: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 57 France: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 58 Spain: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 59 Spain: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 60 Spain: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 61 Asia-Pacific: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 62 Asia-Pacific: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 63 Asia-Pacific: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 64 Asia-Pacific: Diving Equipment Market Size, By Country, 2014-2021 (USD Million)

Table 65 China: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 66 China: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 67 China: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 68 India: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 69 India: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 70 India: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 71 Australia: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 72 Australia: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 73 Australia: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 74 Middle East: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 75 Middle East: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 76 Middle East: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 77 Middle East: Diving Equipment Market Size, By Country, 2014-2021 (USD Million)

Table 78 Saudi Arabia: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 79 Saudi Arabia: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 80 Saudi Arabia: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 81 UAE: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 82 UAE: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 83 UAE: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 84 Iran: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 85 Iran: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 86 Iran: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 87 Rest of the World: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 88 Rest of the World: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 89 Rest of the World: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 90 Rest of the World: Diving Equipment Market Size, By Country, 2014-2021 (USD Million)

Table 91 Brazil: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 92 Brazil: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 93 Brazil: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 94 South Africa: Diving Equipment Market Size, By Type, 2014-2021 (USD Million)

Table 95 South Africa: Diving Equipment Market Size, By Application, 2014-2021 (USD Million)

Table 96 South Africa: Diving Equipment Market Size, By End User, 2014-2021 (USD Million)

Table 97 Contracts, September 2011- March 2016

Table 98 New Product Launches, January 2011-June 2016

Table 99 Agreements & Partnerships, January 2013- May 2015

Table 100 Acquisitions, 2014

List of Figures (47 Figures)

Figure 1 Markets Covered: Diving Equipment Market

Figure 2 Research Approach

Figure 3 Research Design:Diving Equiment Market

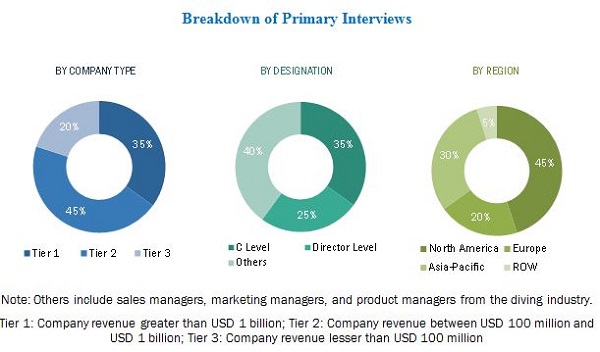

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Geography

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Bottom Technology

Figure 7 Diving Equipment Market, By Geography, 2016 & 2021

Figure 8 Rebreather Segment Estimated to Dominate the Diving Equipment Market in 2016

Figure 9 Commercial Segment Expected to Be the Fastest-Growing Application Segment During Forecast Period

Figure 10 New Product Launches Was the Key Strategy for Companies in the Diving Equipment Market From September 2011 to June 2016

Figure 11 Increasing Global Demand for Diving Equipment Market

Figure 12 The Rebreather Segment Expected to Have Highest Market Share During the Forecast Period

Figure 13 The Commercial Segment Dominated the Diving Equipment Market in 2015

Figure 14 Oil & Gas Industry Estimated to Dominate Diving Equipment During Forecast Period

Figure 15 Asia-Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 16 Middle East Estimated to Witness Significant Growth By 2021

Figure 17 Depth Levels for Diving, By Application

Figure 18 Diving Equipment Market

Figure 19 Market Dynamics of the Diving Equipment Market

Figure 20 Revenue From Tourism in Key Coastal Countries of the World, 2015-2021

Figure 21 Rise in Per Capita Income, USD Thousand, 2005-2015

Figure 22 New Variants in Diving Equipment

Figure 23 Defense Application Segment Estimated to Lead the Diving Equipment Market in 2016

Figure 24 Asia-Pacific Estimated to Witness Highest Growth During the Forecast Period

Figure 25 North America Estimated to Dominate the Diving Equipment Market in Defense Segment in 2016

Figure 26 North America Estimated to Contribute the Largest Share in Commercial Diving Market in 2016

Figure 27 North America Estimated to Contribute the Largest Share in Civil Diving Market in 2016

Figure 28 Diving Equipment Market, By Depth

Figure 29 The Oil & Gas Segment Estimated to Lead the Diving Equipment Market in 2016

Figure 30 North America Estimated to Lead the Diving Equipment Market in 2016

Figure 31 The Diving Equipment Market in Asia-Pacific for Oil & Gas Projected to Grow at the Highest CAGR During the Forecast Period

Figure 32 North America Estimated to Contribute the Largest Share to the Diving Equipment Market for the Naval Segment in 2016

Figure 33 The North America Expected to Lead Aquaculture Diving Equipment Market in 2016

Figure 34 Diving Equipment Market: Geographic Snapshot (2016-2021)

Figure 35 North American Diving Equipment Market Snapshot: the U.S. Estimated to Command the Largest Market Share in 2016

Figure 36 European Diving Equipment Market Snapshot: Germany is Esimated to Command the Largest Market Share in 2016

Figure 37 European Diving Equipment Market Snapshot: China Estimated to Command the Largest Market Share in 2016

Figure 38 Middle East Diving Equipment Market Snapshot: Saudi Arabia Estimated to Command the Largest Market Share in 2016

Figure 39 Companies Adopted New Product Launches as the Key Growth Strategy During September 2011 to June 2016

Figure 40 Market Share Analysis, 2015

Figure 41 Brand Analysis: Diving Equipment Market

Figure 42 Battle for Market Share: New Product Launches has Been A Key Strategy Between September, 2011 and June, 2016

Figure 43 Financial Highlights

Figure 44 Geographical Revenue of Key Players,2015

Figure 45 Honeywell International, Inc.: Company Snapshot

Figure 46 Drägerwerk AG & Co. KGAA : Company Snapshot

Figure 47 Cobham PLC. : Company Snapshot

The research methodology used to estimate and forecast the diving equipment market included the study of data on key diving equipment revenues globally through secondary resources, such as annual reports, yahoo finance, Professional Association of Diving Instructors (PADI), and International Marine Contractors Association (IMCA). This market has also been segmented on the basis of other diving equipment. The bottom-up procedure was employed to arrive at the overall diving equipment market size from the revenue of key players in the market operating globally. After arriving at the overall market size, the total diving equipment market was split into several segments and subsegments which were then verified through primary research by conducting extensive interviews with key industry experts, such as CEOs, VPs, directors, executives, and professional divers. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the diving equipment market comprises type, application, depth, and end user industries. Key players operational in this market include Cobham plc (U.K.), Dragerwerk AG & Co. KGaA (Germany), Divex Ltd. (U.K.), and Aqua Lung International (U.S.), among others. Contracts and new product launches are the major strategies adopted by key players operational in the global diving equipment market. This report will help the diving equipment manufacturers, suppliers, distributers, and sub-component manufacturers to identify hot revenue pockets in this market.

Target Audience for this Report

- Diving equipment Manufacturers

- Original Equipment Manufacturers

- Sub-component Manufacturers

- Technology Support Providers

- Divers

- Diving Associations

“This study answers several questions for the stakeholders, primarily, which market segments to focus on during the next two to five years for prioritizing their efforts and investments”.

Scope of the Report:

Diving Equipment Market, By Type

-

Rebreather

- Military Rebreather

- Commercial Rebreather

- Cylinders and Propulsion Vehicle

- Decompression Chamber

-

Exposure Suits

- Dry Suit

- Wet Suit

-

Accessories

- Headset/Hood

- Watch

- Torch

- Knife

- Others

Diving Equipment Market, By Application

- Defense

- Commercial

- Civil

Diving Equipment Market, By Depth

- Recreational Diving

- Clearance Diving

- Saturation Diving

Diving Equipment Market, By End-User

- Oil & Gas Industry

- Naval Industry

- Aquaculture Industry

- Other Industries

Diving Equipment Market, By Geography

- North America

- Europe

- Asia-Pacific

- Middle East

- Rest of the World

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for this report:

-

Geographic Analysis

- Further breakdown of the Rest of the World market

-

Company Information

- Detailed analysis and profiling of additional market players (up to five)

-

Additional Level Segmentation

- Additional level of segmentation

Growth opportunities and latent adjacency in Diving Equipment Market

OSEL manufacturers rebreathers for the military and commercial markets and your Diving Equipment Market report may be of interest.

We are a new manufacturer of diving life support systems. We are searching for professional dive industry data to support our initial sales projections.