Disposable Protective Clothing Market by Material Type (PE, PP, Polyester), Application (Thermal, Chemical, Biological/Radiation, Visibility), End-Use Industry (Manufacturing, Construction, Healthcare/Medical) - Global Forecast to 2024

[148 Pages Report] The disposable protective clothing market size is projected to reach USD 3.6 billion by 2024 from USD 2.6 billion in 2019, at a CAGR of 6.5%. Government initiatives in developed economies regarding the safety of personnel are expected to support the disposable protective clothing market. The rising concern of both the employers and employees regarding the safety at the workplace is expected to drive the disposable protective clothing market.

North America is the key market for disposable protective clothing, globally, followed by Europe and APAC. Innovation in product development is an opportunity to offer advanced disposable protective clothing with superior features. For instance, the development of microporous films which provides an excellent barrier against bacterium, virus, protozoan, and parasite, among others, to be widely used for disease prevention. The nonwoven fiber with microporous films offers a soft feeling and provides an excellent wearing experience.

Polyethylene is expected to be the fastest-growing segment of the global disposable protective clothing market during the forecast period.

Based on material type, the disposable protective clothing market has been segmented into polyethylene, polyurethane, polyester, and others (includes polyurethane, and others). The polyethylene segment is estimated to register the highest CAGR in terms of value, of the global disposable protective clothing market. The use of polyethylene in producing disposable protective clothing has increased as it offers a good line of defense for the workers and helps to prevent injuries or accidents at a relatively lower cost

The manufacturing segment is projected to be the largest end-use industry of disposable protective clothing during the forecast period.

The manufacturing segment is projected to dominate the disposable protective clothing market during the forecast period. Governments of various countries have introduced safety regulations for the manufacturing industry. These regulatory policies include the use of safety equipment to reduce accidents and uncertainties in the industry. This sole factor is expected to augment the demand for disposable protective clothing significantly over the next few years.

North America is expected to account for the largest share of the disposable protective clothing market during the forecast period.

North America is expected to account for the largest market share in disposable protective clothing during the forecast period, in terms of value. The regulations in the region mandate the use of durable and high-performance clothing that can protect the wearer from various threats. The rising awareness among medical professionals regarding healthy medical practices and rising demand for non-woven based clothing, offering better protection from contamination are expected to drive the demand for disposable protective clothing in the healthcare/medical industry.

Key Market Players

The key market players profiled in the report include as 3M Company (US), Du Pont de Nemours and Company (US), Kimberly Clark Corp (US), International Enviroguard (US), Derekduck Industries Corp. (Taiwan), and Lakeland Industries, Inc. (US).

3M Company (US) is developing its disposable protective clothing segment by launching new products and expanding its global presence through acquisition. 3M acquired Scott Safety (US) from Johnson Controls (US) in October 2017. The acquisition helped the company widen its product portfolio of safety products & solutions. The company also acquired Ivera Medical Corp. (US) in March 2015, thereby expanding its business in the healthcare sector. It has the opportunity to develop more efficient and durable products for global sale.

Du Pont de Nemours and Company (US) focuses on R&D to produce protective fabrics and clothing for defense, law enforcement, chemical, and industrial applications. The reliable supply chain and distribution network of the company helps it to have a competitive edge over its competitors. The company is continually innovating to develop improved disposable protective clothing that will enable the company to cater to a wide range of industries.

Scope Of The Report

|

Report Metric |

Details |

| Years considered for the study | 2017–2024 |

| Base year considered | 2018 |

| Forecast period | 2019–2024 |

| Units considered | Value (USD Billion) |

| Segments covered | Material type, application, end-use industry, and region |

| Regions covered | APAC, North America, Europe, Middle East & Africa, and South America |

| Companies profiled |

as 3M Company (US), Du Pont de Nemours and Company (US), Kimberly Clark Corp (US), International Enviroguard (US), Derekduck Industries (Taiwan), and Lakeland Industries, Inc. (US) Top 25 major players covered |

This report categorizes the global disposable protective clothing market based on material type, application, end-use industry, and region.

Based on material type, the protective clothing market has been segmented as follows:

- Polyethylene

- Polypropylene

- Polyester

- Others (Includes polyurethane, and polylactic acids)

Based on application, the disposable protective clothing market has been segmented as follows:

- Thermal

- Chemical

- Mechanical

- Biological/Radiation

- Visibility

- Others (Includes paints & coatings, transportation, cleanroom clothing, and antistatic protective clothing)

Based on end-use industry, the protective clothing market has been segmented as follows:

- Oil & gas

- Construction

- Manufacturing

- Healthcare/Medical

- Mining

- Defense & Public Safety

- Others (Includes agriculture, aerospace, automobile, sports, packaging, and food & beverages)

On the basis of region, the protective clothing market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In June 2018, DuPont launched Tyvek® 500 HV, which protects from chemical, biological, and antistatic exposure with high visibility functionality. SNCF collaborates with DuPont to innovative Tyvek® 500 HV coverall. This helps DuPont to increase its portfolio.

- In June 2018, DuPont invested USD 400 million to expand its production capacity of Tyvek in Europe. The new operating line at the site is scheduled to start up in 2021.

- In April 2016, Honeywell launched Hapichem. Hapichem is the new ventilated suit for protection against both dangerous chemical agents and electrostatic risks. The new product launched by the company is suitable for use in industries such as chemical and pharmaceutical.

- In December 2015, Honeywell launched Ne-Hon TM 6. Ne-Hon TM 6 is the industry’s first single-use High Visibility coverall with certified protection. The new product launched by the company is suitable for use in industries such as rail, aerospace, construction and oil and gas.

Key Questions addressed by the report

- What are the major developments impacting the market?

- Where will all the developments take the industry in the mid to long term?

- What are the upcoming material types of protective clothing?

- What are the emerging applications of disposable protective clothing?

- What are the emerging end-use industries of disposable protective clothing?

- What are the major factors impacting market growth during the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Market Definition and Scope

2.2 Base Number Calculation

2.2.1 Primary and Secondary Research

2.2.2 Market Calculation, By End-Use Industry

2.3 Forecast Number Calculation

2.4 Market Engineering Process

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Assumptions

2.6 Secondary Data

2.7 Primary Data

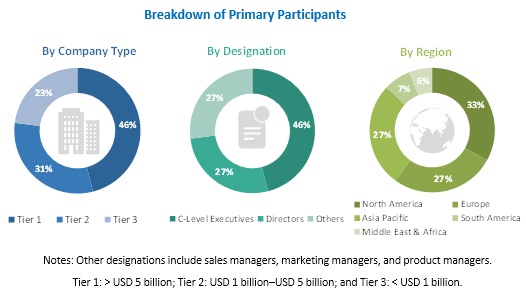

2.7.1 Breakdown of Primary Interviews

2.7.2 Key Industry Insights

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Disposable Protective Clothing Market

4.2 Disposable Protective Clothing Market in North America, By Application and Country, 2018

4.3 Disposable Protective Clothing Market, By Region

4.4 Disposable Protective Clothing Market, By Material Type

4.5 Disposable Protective Clothing Market Attractiveness, By Key Countries

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Strict Regulations Pertaining to Workers’ and Employees’ Safety in Developed Economies

5.2.1.1.1 Protective Clothing Standards

5.2.1.2 Rising Demand From the Healthcare/Medical Industry

5.2.2 Restraints

5.2.2.1 Requirement of Massive Investment for R&D

5.2.3 Opportunities

5.2.3.1 Innovation in Product Development

5.3 Technology

5.3.1 Nanotechnology

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of Substitutes

5.4.2 Threat of New Entrants

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

5.5 Macroeconomic Indicators

5.5.1 GDP Trends and Forecast of Major Economies

5.5.2 Construction Industry

6 Disposable Protective Clothing Market, By Material Type (Page No. - 43)

6.1 Introduction

6.2 Polyethylene

6.2.1 Polyethylene-Based Disposable Protective Clothing Offers Excellent Mechanical and Chemical Resistance

6.3 Polypropylene

6.3.1 Polypropylene Can Be Used in A Variety of Fibrous Forms

6.4 Polyester

6.4.1 Polyester-Based Fabrics have High Tensile Strength and Offer Structural Stability

6.5 Others

7 Disposable Protective Clothing Market, By Application (Page No. - 47)

7.1 Introduction

7.2 Thermal

7.2.1 Thermal Protective Clothing is Made of Three Layers of Clothing - Thermal Liner, Moisture Barrier, and Outer Shell

7.3 Visibility

7.3.1 Innovations By Major Players are Promising for the Market Growth in This Segment

7.4 Mechanical

7.4.1 The Market in This Application Segment has Growth Potential in the Future Due to the Development of the Manufacturing Sector in the Emerging Economies

7.5 Chemical

7.5.1 Rising Demand From Oil & Gas, Construction, and Manufacturing Industries is Expected to Support the Market Growth in Chemical Application

7.6 Biological/Radiation

7.6.1 The Developing Nuclear Industry is Influencing the Market Positively in the Biological/Radiation Application

7.7 Other Applications

8 Disposable Protective Clothing Market, By End-Use Industry (Page No. - 56)

8.1 Introduction

8.2 Construction

8.2.1 Disposable Protective Clothing is Widely Used in the Construction Industry for Visibility and Arc Protection

8.2.1.1 Visibility

8.2.1.2 Arc Protection

8.3 Manufacturing

8.3.1 Infrastructural Development in Emerging Countries is Boosting the Market in This Segment

8.4 Oil & Gas

8.4.1 The Use of Protective Clothing in the Oil & Gas Industry is Driven By the Increased Risk of Encountering Life-Threatening Chemical Hazards

8.5 Healthcare/Medical

8.5.1 The Market in This Industry is Expected to Be Driven By the Introduction of More Advanced Disposable Protective Clothing for Medical Applications

8.5.2 Cleaning Room Protection

8.5.3 Bio-Hazard Protection

8.6 Mining

8.6.1 Rising Focus on Safety Standards for Workers By Local Governments is Driving the Market

8.7 Defense & Public Safety

8.7.1 Increasing Demand From Emerging Countries in APAC and the Middle East & Africa is Likely to Propel the Market

8.8 Energy & Power

8.8.1 Rising Focus on Safety Standards is Expected to Drive the Demand for Disposable Protective Clothing in the Industry

8.9 Others

9 Disposable Protective Clothing Market, By Region (Page No. - 69)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.1.1 Growing Manufacturing Industry, Coupled With Increased Awareness Among the Workers and Employers Regarding Safety, is Driving the Market for Disposable Protective Clothing in China

9.2.2 Japan

9.2.2.1 Rising Awareness Regarding Industrial Safety and Protective Wears is Expected to Drive the Disposable Protective Clothing Market in Japan

9.2.3 India

9.2.3.1 Growing Population and Income Levels, Coupled With A Lack of Stringent Regulatory Intervention, have Enabled the Country to Emerge as One of the Fastest-Growing Disposable Protective Clothing Markets

9.2.4 South Korea

9.2.4.1 Rapid Industrialization and Technological Advancements in the Country are Supporting the Growth of the Disposable Protective Clothing Market

9.2.5 Australia

9.2.5.1 Disposable Protective Clothing Market in Australia is Expected to Grow Owing to the Rising Demand for Thermal Protective Clothing

9.3 North America

9.3.1 US

9.3.1.1 Rising Demand From Construction, Manufacturing, and Healthcare Industries to Drive the Demand for Disposable Protective Clothing

9.3.2 Canada

9.3.2.1 Trade Agreements Undertaken By Canada to Favor the Export of the Canadian Protective Clothing in the Global Market

9.3.3 Mexico

9.3.3.1 Growing Infrastructural Development and Construction Activities to Drive the Demand for Disposable Protective Clothing in the Country

9.4 Europe

9.4.1 Germany

9.4.1.1 Government Emphasis on Safety of Industrial Workers is A Major Factor Contributing to the Growth of the Disposable Protective Clothing Market in the Country

9.4.2 Italy

9.4.2.1 Increased Safety Awareness Among the Employees and Employers is Expected to Drive the Disposable Protective Clothing Market in Italy

9.4.3 France

9.4.3.1 Rising Demand for Disposable Protective Clothing in the Manufacturing Industry is Driving Its Growth in the Country

9.4.4 UK

9.4.4.1 The Rising Number of Accidents in Chemical Laboratories and at Construction Sites is Estimated to Drive the Market for Disposable Protective Clothing in the Country

9.4.5 Spain

9.4.5.1 Rising Demand From Manufacturing and Construction Industries Will Drive the Demand for Disposable Protective Clothing in the Country

9.4.6 Russia

9.4.6.1 Increase in Exploration Activities in the Oil & Gas Industry is Driving the Market for Protective Clothing in Russia

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.1.1 Rising Awareness for Worker Safety to Drive the Market in the Country

9.5.2 UAE

9.5.2.1 Disposable Protective Clothing Market in the Country is Driven By the Oil & Gas and Manufacturing Industries

9.5.3 Iraq

9.5.3.1 Disposable Protective Clothing in Iraq is Dominated By the Oil & Gas Industry

9.5.4 South Africa

9.5.4.1 Rising Demand for Personal Protective Equipment to Support the Growth of the Disposable Protective Clothing Market in the Country

9.6 South America

9.6.1 Brazil

9.6.1.1 Regulatory Mandates for Ensuring Worker Safety to Drive the Disposable Protective Clothing Demand in the Country

9.6.2 Argentina

9.6.2.1 National and International Regulations Mandating the Use of Protective Clothing in Various Industries to Drive the Disposable Protective Clothing Market

9.6.3 Chile

9.6.3.1 Increasing Industrialization to Result in Rising Demand for Protective Clothing in the Country

10 Competitive Landscape (Page No. - 105)

10.1 Overview

10.2 Competitive Leadership Mapping, 2018

10.2.1 Terminology/Nomenclature

10.2.1.1 Visionary Leaders

10.2.1.2 Innovators

10.2.1.3 Emerging Companies

10.2.2 Strength of Product Portfolio

10.2.3 Business Strategy Excellence

10.3 Competitive Leadership Mapping (Small and Medium-Sized Enterprises)

10.3.1 Terminology/Nomenclature

10.3.1.1 Progressive Companies

10.3.1.2 Starting Blocks

10.3.1.3 Responsive Companies

10.3.1.4 Dynamic Companies

10.3.2 Strength of Product Portfolio

10.3.3 Business Strategy Excellence, 2018

10.4 Market Share Analysis

10.4.1 3M Company

10.4.2 Du Pont De Nemours Inc.

10.4.3 Honeywell International

10.5 Competitive Scenario

10.5.1 New Product Launch

10.5.2 Agreement

10.5.3 Expansion

10.5.4 Acquisition

11 Company Profiles (Page No. - 117)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 3M Company

11.2 Dupont De Nemours Inc.

11.3 Honeywell International, Inc.

11.4 Kimberly Clark Corp

11.5 Lakeland Industries, Inc.

11.6 Derekduck Industries Corp.

11.7 International Enviroguard

11.8 Drager

11.9 Asatex

11.10 UVEX

11.11 Other Players

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 141)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (81 Tables)

Table 1 Safety Standards for Industries

Table 2 Trends and Forecast of GDP, 2019–2024 (USD Billion)

Table 3 Contribution of the Construction Industry to the GDP of APAC, By Key Countries, 2016 (USD Billion)

Table 4 Contribution of the Construction Industry to the GDP of North America, By Key Countries, 2016 (USD Billion)

Table 5 Contribution of the Construction Industry to the GDP of Europe, By Key Countries, 2016 (USD Billion)

Table 6 Contribution of the Construction Industry to the GDP of South America, By Key Countries, 2016 (USD Billion)

Table 7 Contribution of the Construction Industry to the GDP of the Middle East & Africa, By Key Countries, 2016 (USD Billion)

Table 8 Disposable Protective Clothing Market Size, By Material Type, 2017–2024 (USD Million)

Table 9 Disposable Protective Clothing Market Size, By Application, 2017–2024 (USD Million)

Table 10 Disposable Protective Clothing Market Size in Thermal Application, By Region, 2017-2024 (USD Million)

Table 11 Disposable Protective Clothing Market Size in Thermal Application, By End-Use Industry, 2017-2024 (USD Million)

Table 12 Disposable Protective Clothing Market Size in Visibility Application, By Region, 2017-2024 (USD Million)

Table 13 Disposable Protective Clothing Market Size in Visibility Application, By End-Use Industry, 2017-2024 (USD Million)

Table 14 Disposable Protective Clothing Market Size in Mechanical Application, By Region, 2017–2024 (USD Million)

Table 15 Disposable Protective Clothing Market Size in Mechanical Application, By End-Use Industry, 2017-2024 (USD Million)

Table 16 Disposable Protective Clothing Market Size in Chemical Application, By Region, 2017-2024 (USD Million)

Table 17 Types of Protective Clothing in Chemical Application

Table 18 Disposable Protective Clothing Market Size in Chemical Application, By End-Use Industry, 2017-2024 (USD Million)

Table 19 Disposable Protective Clothing Market Size in Biological/Radiation Application, By Region, 2017-2024 (USD Million)

Table 20 Disposable Protective Clothing Markt Size in Biological/Radiation Application, By End-Use Industry, 2017-2024 (USD Million)

Table 21 Disposable Protective Clothing Market Size in Other Applications, By Region, 2017-2024 (USD Million)

Table 22 Disposable Protective Clothing Market Size in Other Applications, By End-Use Industry, 2017-2024 (USD Million)

Table 23 Disposable Protective Equipment & Clothing Applications Across End-Use Industries

Table 24 Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 25 Disposable Protective Clothing Market Size in Construction End-Use Industry, By Region, 2017–2024 (USD Million)

Table 26 Disposable Protective Clothing Market Size in Construction End-Use Industry, By Application, 2017-2024 (USD Million)

Table 27 Disposable Protective Clothing Market Size in Manufacturing End-Use Industry, By Region, 2017–2024 (USD Million)

Table 28 Disposable Protective Clothing Market Size in Manufacturing End-Use Industry, By Application, 2017-2024 (USD Million)

Table 29 Disposable Protective Clothing Market Size in Oil & Gas End-Use Industry, By Region, 2017–2024 (USD Million)

Table 30 Disposable Protective Clothing Market Size in Oil & Gas End-Use Industry, By Application, 2017–2024 (USD Million)

Table 31 Disposable Protective Clothing Market Size in Healthcare/Medical End-Use Industry, By Region, 2017–2024 (USD Million)

Table 32 Disposable Protective Clothing Market Size in Healthcare/Medical End-Use Industry, By Application, 2017–2024 (USD Million)

Table 33 Disposable Protective Clothing Market Size in Mining End-Use Industry, By Region, 2017-2024 (USD Million)

Table 34 Disposable Protective Clothing Market Size in Mining End-Use Industry, By Application, 2017-2024 (USD Million)

Table 35 Disposable Protective Clothing Market Size in Defense & Public Safety End-Use Industry, By Region, 2017–2024 (USD Million)

Table 36 Disposable Protective Clothing Market Size in Defense & Public Safety End-Use Industry, By Application, 2017–2024 (USD Million)

Table 37 Disposable Protective Clothing Market Size in Energy & Power End-Use Industry, By Region, 2017-2024 (USD Million)

Table 38 Disposable Protective Clothing Market Size in Energy & Power End-Use Industry, By Application, 2017-2024 (USD Million)

Table 39 Disposable Protective Clothing Market Size in Other End-Use Industries, By Region, 2017–2024 (USD Million)

Table 40 Disposable Protective Clothing Market Size in Other End-Use Industries, By Application, 2017–2024 (USD Million)

Table 41 Disposable Protective Clothing Market Size, By Region, 2017–2024 (USD Million)

Table 42 APAC: Disposable Protective Clothing Market Size, By Country, 2017–2024 (USD Million)

Table 43 APAC: Disposable Protective Clothing Market Size, By Application, 2017–2024 (USD Million)

Table 44 APAC: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 45 China: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 46 Japan: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 47 India: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 48 South Korea: Disposable Protective Clothing Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 49 Australia: Disposable Protective Clothing Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 50 North America: Disposable Protective Clothing Market Size, By Country, 2017–2024 (USD Million)

Table 51 North America: Disposable Protective Clothing Market Size, By Application, 2017–2024 (USD Million)

Table 52 North America: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 53 US: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 54 Canada: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 55 Mexico: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 56 Europe: Disposable Protective Clothing Market Size, By Country, 2017–2024 (USD Million)

Table 57 Europe: Disposable Protective Clothing Market Size, By Application, 2017–2024 (USD Million)

Table 58 Europe: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 59 Germany: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 60 Italy: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 61 France: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 62 UK: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 63 Spain: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 64 Russia: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 65 Middle East & Africa: Disposable Protective Clothing Market Size, By Country, 2017–2024 (USD Million)

Table 66 Middle East & Africa: Disposable Protective Clothing Market Size, By Application, 2017–2024 (USD Million)

Table 67 Middle East & Africa: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 68 Saudi Arabia: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 69 UAE: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 70 Iraq: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 71 South Africa: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 72 South America: Disposable Protective Clothing Market Size, By Country, 2017–2024 (USD Million)

Table 73 South America: Disposable Protective Clothing Market Size, By Application, 2017–2024 (USD Million)

Table 74 South America: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 75 Brazil: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 76 Argentina: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 77 Chile: Disposable Protective Clothing Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 78 New Product Launches, 2014–2019

Table 79 Agreements, 2014–2019

Table 80 Expansions, 2014–2019

Table 81 Acquisitions, 2014–2019

List of Figures (35 Figures)

Figure 1 Disposable Protective Clothing Market Segmentation

Figure 2 Disposable Protective Clothing Market: Bottom-Up Approach

Figure 3 Disposable Protective Clothing Market: Top-Down Approach

Figure 4 Polyethylene Segment to Account for the Largest Share

Figure 5 Biological/Radiation to Be the Fastest-Growing Application in the Overall Disposable Protective Clothing Market

Figure 6 Manufacturing to Be the Largest End-Use Industry of Disposable Protective Clothing

Figure 7 APAC to Register the Highest CAGR During the Forecast Period

Figure 8 Rising Demand From Manufacturing and Healthcare Industries to Drive the Market Between 2019 and 2024

Figure 9 US and Thermal Segment Accounted for the Largest Shares

Figure 10 North America to Account for the Largest Market Share

Figure 11 Polyethylene to Account for the Largest Share

Figure 12 India to Be the Fastest-Growing Market

Figure 13 Drivers, Restraints, and Opportunities in Disposable Protective Clothing Market

Figure 14 Disposable Protective Clothing Market: Porter’s Five Forces Analysis

Figure 15 Polyethylene Segment to Lead the Disposable Protective Clothing Market

Figure 16 Chemical Application to Lead the Disposable Protective Clothing Market

Figure 17 Healthcare/Medical Industry to Register the Highest CAGR

Figure 18 APAC to Register the Highest CAGR in the Disposable Protective Clothing Market

Figure 19 APAC: Disposable Protective Clothing Market Snapshot

Figure 20 North America: Disposable Protective Clothing Market Snapshot

Figure 21 Europe: Disposable Protective Clothing Market Snapshot

Figure 22 Disposable Protective Clothing Market: Competitive Leadership Mapping, 2018

Figure 23 Strength of Product Portfolio, 2018

Figure 24 Business Strategy Excellence, 2018

Figure 25 Small and Medium-Sized Enterprises (SMSE) Mapping, 2018

Figure 26 Strength of Product Portfolio, 2018

Figure 27 Business Strategy Excellence, 2018

Figure 28 Companies Adopted New Product Launch as the Key Growth Strategy Between 2014 and 2018

Figure 29 Global Disposable Protective Clothing Market Share, By Company, 2018

Figure 30 3M Company: Company Snapshot

Figure 31 Dupont De Nemours Inc.: Company Snapshot

Figure 32 Honeywell International, Inc.: Company Snapshot

Figure 33 Kimberly Clark Corp: Company Snapshot

Figure 34 Lakeland Industries Inc.: Company Snapshot

Figure 35 Drager: Company Snapshot

The study involved four major activities in estimating the market size for disposable protective clothing. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The disposable protective clothing market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of oil & gas, construction, manufacturing, healthcare/medical, mining, and other industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the disposable protective clothing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas, construction, manufacturing, healthcare/medical, mining and other industries.

Report Objectives

- To analyze and forecast the size of the disposable protective clothing market in terms of value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the protective clothing market based on material type, application, and end-use industry

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, new product launches, agreements, acquisitions in the disposable protective clothing market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional end-use industry

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Disposable Protective Clothing Market