Digital Water Market By Technology (Smart Water Meters, Internet Of Things, Artificial Intelligence & Machine Learning, Digital Twin, Geographic Information Systems, Others), By Solutions, By End-User (Municipal Water Industries, Industrial), By Region – Global Forecast To 2029

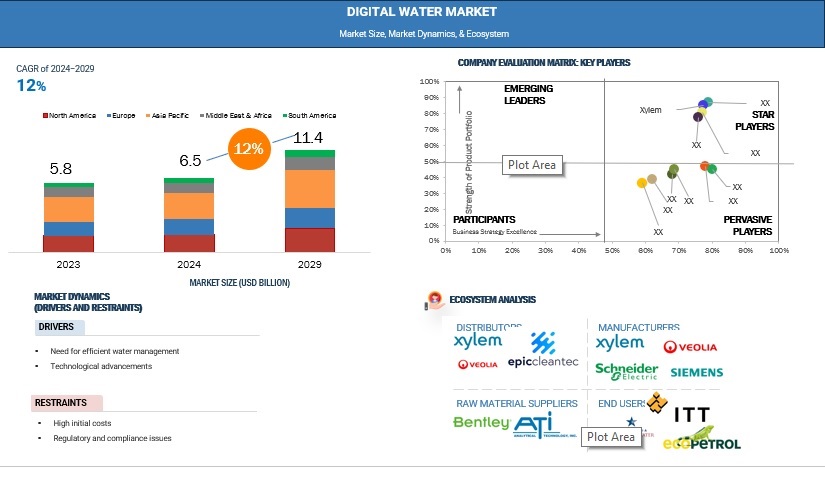

The global digital water market is projected to reach USD 11.4 billion by 2029 from USD 6.5 billion in 2024, at a CAGR of 12% during the forecast period. The digital water market is growing at a high rate due to the urgent need for efficient water management and ongoing technological advancements. The market in North America is anticipated to grow as a result of growing reliance on digital solutions to address challenges such as aging infrastructure and regulatory compliance. The technologies such as Internet of Things, artificial intelligence and smart meters are improving the operational efficiency and thus fueling the market growth.

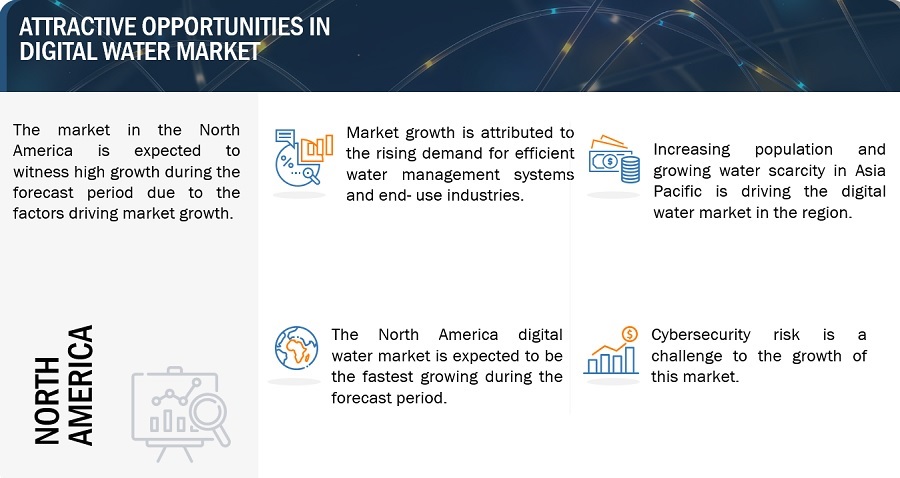

Attractive Opportunities in the Digital Water Market

Source: Interviews with Experts, Secondary Sources, and MarketsandMarkets Analysis

Source: Interviews with Experts, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Digital Water Market Dynamics

Driver: Need for efficient water management

The digital water market integrates technologies and solutions, making use of artificial intelligence along with advanced analytics to facilitate efficiency and sustainability in managing water utilities. The increasing speed of population and urbanization is resulting into water management systems becoming ineffective to cater the demand. For instance, with the new digital water technologies such as IoT sensors, smart meters, and data analytics, utilities and organizations get instant insights into water usage by optimizing resource use and diminishing wastage either from a leak or an over consumption. These technologies help in predictive maintenance. This implies that the aging infrastructure will be repaired and updated in required time, ensuring reliable supply. Moreover, regulatory pressure on water quality and conservation practices forces these organizations to make digital innovations in improving the transparency and accountability of the management of water. This makes it possible for stakeholders to make informed decisions regarding not only the conservation of water but also operational efficiencies as well as costs through the utilization of advanced technologies in digitalization in water management.

Restraints: High Initial Costs

One of the major restraints to the digital water market is the significant amount of initial capital investment required to adopt advanced technologies. The adoption of advanced technologies such as smart water meters, IoT-capable sensors, cloud-based analytics platforms, and AI applications need a high number of upfront investments. This discourages many utilities from embracing digitization. The costs include the purchase of the high-end hardware and software along with the integration of legacy systems. Many of these systems were not designed with digital technologies in mind. Such integration may be complex and costly, leading to a cycle of additional infrastructure improvements that tend to stretch the budget further. For many smaller water utilities, especially those within developing regions or underserved cities, the challenge is to manage scarce budgets. Financial constraints that these organizations have prevent them from investing in such technologies expected to improve efficiency and use of resources. Moreover, training employees should be streamlined to ensure that employees are as proficient in using any new introduced digital tools or systems. Costs of these training contributes to the increase in the total spending and capital expenditure. Therefore, supporting these kinds of additional high initial costs regarding integration and training is crucial in encouraging the broader adoption of advanced technologies in water management practices.

Opportunity: Artificial intelligence, cloud solutions, and federal funding is transforming water utilities

The digital water market is expected to grow at a high rate. The artificial intelligence and machine learning technologies fuel the market growth through predictive maintenance, analytics improvement, and operational efficiency. Scalable, cost-effective solutions are provided by cloud-based platforms such as software as a service (SaaS), data as a service (DaaS), and network as a service (Naas) especially for smaller utilities with limited resources. In addition, this market is characterized by strong competition driven by innovative start-ups offering affordable solutions, which challenges the established players. Moreover, companies like AWS, Microsoft, and Oracle are integrating their experience into the water industry, proposing modern solutions and stimulating inter-industry collaboration. Increasing use of real-time data gathering and monitoring technologies improves compliance, operations efficiency, and resource utilization, further increasing the adoption. All these trends underscore the high market potential, placing the market at the forefront of transforming water utilities and meeting important challenges in water management.

Challenges: Workforce challenges and cybersecurity risks

The digital water market faces enormous challenges regarding the workforce gap in regions like the U.S. and Canada. Retirement of experienced professionals along with increasing utility workforce vacancy rates between 2015 and 2023, has contributed to the issued of knowledge transfer. The aged infrastructure makes the job tougher since such water systems require rejuvenation and digitalization in solutions for their improved efficiency. Quality standards, leak management, and sustainability constitute a few advanced technologies which become essential by generating the requirement for this transformation to go digital. But the growing more reliance on these systems results into increased vulnerability to the threat of ransomware and phishing attacks, with spending on cybersecurity anticipated to grow at a 7.5% CAGR, creating the need to implement robust protection. Smaller utilities have limited resources including technical and financial constraints, which hampers their ability to implement advanced solutions. Moreover, the implementation of new technologies faces challenges such as lack of skilled workers and high initial costs. At the same time, the traditional systems like SCADA, GIS, and metering continue to support the growth. These interrelated challenges require innovative, scalable, and secure solutions, customized to the diverse needs of utilities, to transcend financial and operational constraints towards sustainable progress within the digital water market.

DIGITAL WATER MARKET ECOSYSTEM

The raw material suppliers, manufacturers, distributors, and end users form a digital water market ecosystem. The raw material suppliers here provide essential components like sensors, software, and hardware necessary for creating digital solutions in water. These materials integrate into the advanced technologies such as smart meters and IoT devices for ensuring efficiency in water management. The distributors increase the accessibility of these products to utilities and municipalities, thereby ensuring that the solutions reach end users who are entrusted with managing water systems. End users are majorly water utilities and municipalities which implement these digital solutions to achieve high operational efficiency, compliance with regulatory requirements, and a drive toward sustainability in managing their water resources. The interconnected system fosters innovation and fuels growth in the digital water market.

Internet of Things to account for largest market share in the digital water by technology

The IoT dominates the technology segment of the digital water market because of its ability to modify water and wastewater management systems. It allows the real-time collection of data with the help of smart meters and strategically placed sensors and monitors the continuous performance and resource usage of the system, including the quality of the water. The data is then transmitted to central platforms for processing into actionable insights. This helps utilities to improve their operational efficiency, optimize resource allocation, and improve the decision-making. IoT technology extends the monitoring capabilities of traditional plant operations beyond WWTPs upstream and downstream. IoT devices can identify illegal discharges into water systems and monitor downstream water basins for contaminants. It helps utilities to take preventive measures and reduce the environmental damage along with complying to the regulations. Increasing use of wireless IoT solutions is enabling utilities to manage their operations and integrate with other technologies such as cloud-based platforms and big data analytics. This integration brings a holistic approach in the management of water as it fights the challenge of scarcity and a growing operational demand. This will make IoT more dominant in its market, which will be driving the digital transformation of the water industry with the possibilities of creating smarter, more sustainable solutions, and paving the way for more efficient and resilient futures.

Industrial accounts largest market share of digital water market by end-user.

These are industrial end users that include oil and gas, food and beverages, chemicals and pharmaceuticals, power generation, and agriculture. These are major volumes of industrial water usage that require high regulation and growing requirements to achieve operational efficiency. Many of these industries majorly rely on water for vital operations such as cooling, cleaning, and production. This leads to increased pressure on the resources in such applications creating a need for advanced digital solutions to manage resources in a sustainable and efficient way. Investment in digital water technologies is increasing in sectors such as oil and gas and chemicals to support water management to address problems like water reuse, treatment of wastewater, and meet the environmental standards. Similarity, food and beverages is relying on the accurate water quality and management for production and food safety, which necessitates monitoring and automation in real-time. Large quantities of water are required in power generation units for their cooling systems, where digital tools optimize the use of water and minimize environmental impacts. The largest consumer of water worldwide is agriculture. Through IoT sensors, weather information, and auto-irrigation mechanism, farming can help end water scarcity and increase yields. Requirements to predict maintenance, energy, and regulatory compliance make industries invest in IoT, big data analytics, and AI so that they may be more efficient in their consumption. These high-tech solutions provide real-time monitoring and early detection of inefficiencies as well as adaptive responses to water-related challenges. High water demand by the industrial sector, coupled with its emphasis on sustainability, regulatory compliance, and cost-effectiveness, places it as the largest market in the digital water sector, spearheading the adoption of innovative technologies to optimize water resource management.

North America to dominate digital water market during forecast period.

North America is likely to hold the largest share of the digital water market. This can be attributed to the improved infrastructure, increased investment, and forward policies, which are opening up the technological aspects of the region. North America has been seriously investing in smart water solutions, wherein the cumulative spend is slated at USD 169.5 billion during 2024-2033. The primary funding sources are government initiatives, such as the U.S. Infrastructure Investment and Jobs Act (IIJA) and Canada's Investing in Canada Infrastructure Plan, for digitization to comply with strict water quality regulations and to maintain the culture of sustainability. This is further increasing the adaption of digital solutions so that utilities can streamline its operations and provide better services. More pressure from climate change has challenged North America, putting increased pressure on utilities' digital tool adoption to enhance better management and sustainability of resources in use. The region through these technologies is setting a global standard regarding efficiency and environmental stewardship in water management. All these factors combined make the North American region the leading region in the digital water market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- Schneider Electric(France)

- Xylem(US)

- Veolia(France)

- Siemens(Germany)

- Copperleaf Technologies Inc.(Canada)

- Atonix Digital(US)

- ABB(Switzerland)

- Innovyze(US)

- Analytical Technology Inc.(US)

- Bentley systems, incorporated

Recent Developments in Smart PPE Market

- In July 2023, SUEZ and Schneider Electric collaborated to speed up the implementation of digital services in the water sector.

- In May 2024, Siemens expanded its software portfolio for the water industry allowing customers to optimize plant operations with artificial intelligence.

- In January 2024, ABB acquired Real Tech to expand its portfolio in the water management sector.

- In August 2024, IFS, one of the leading technology innovators in cloud and Industrial AI software, acquired Copperleaf Technologies Inc

- In December 2020, Innovyze had launched a new Software-as-a-Service (SaaS) platform, Info360.com, which allows water and wastewater utilities to monitor, analyze, and optimize their operations through the power and convenience of the cloud.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQs):

What is the current size of the global digital water market?

The global digital water market is estimated to reach USD 11.4 billion by 2029 from USD 6.5 billion in 2024, at a CAGR of 12% during the forecast period.

Who are the key players in the global digital water market?

Schneider Electric (France), Xylem (US), Veolia (France), Siemens (Germany), Copperleaf Technologies Inc. (Canada), Atonix Digital (US), ABB (Switzerland), Innovyze (US), Analytical Technology Inc. (US), and Bentley Systems, Incorporated (US) are the key players in this market. They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers for the market growth?

Key drivers for the digital water market include the need for efficient water management and advancements in technology.

What are the different technologies in the digital water market?

Smart water meters, internet of things, artificial intelligence and machine learning, digital twin, and geographic information systems are widely used in this market.

What are the major end-use industries of digital waters?

Municipal water industries and industrial sectors are the main end-use industries in this market.

Digital Water Market

Growth opportunities and latent adjacency in Digital Water Market