Digital Twin in Finance Market by Offering (Platforms & Solutions and Services), End-use Industry (BFSI (Banking, Financial Services, and Insurance), Manufacturing, Transportation & Logistics, Healthcare), Application and Region - Global Forecast to 2028

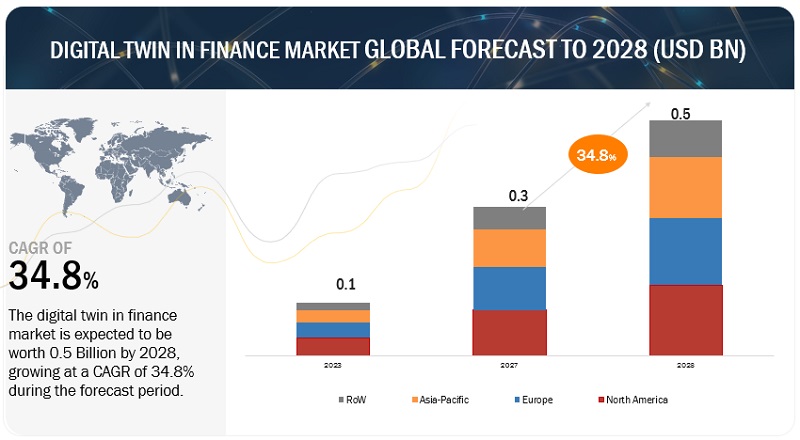

[163 Pages Report] The digital twin in finance market size is projected to grow from USD 0.1 billion in 2023 to USD 0.5 billion by 2028, at a CAGR of 34.8% during the forecast period. The primary factor driving the growth of digital twin in finance market is the growing need to meet compliance requirements in financial institutions. Digital twin platforms help financial institutions in meeting their regulatory requirements, engaging with customers, and optimizing business operations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Digital Twin in Finance Market Dynamics

Driver: Growing adoption of industry 4.0

In the banking sector, Industry 4.0 technologies have unlocked new dimensions. With Industry 4.0, new banking services and opportunities can be launched to improve business performance and end customer experiences. In the finance sector, digital twins can be used to simulate financial scenarios and analyze the impact of different market conditions on financial performance. For example, a digital twin of a portfolio on investments can be used to test different investment strategies and assess the potential risks and rewards.

Restraint: High cost of digital twin deployment

The high investments required for the deployment of digital twin solutions act as a restraint for the growth of the market. The high installation costs of information and enabling technology systems are due to the requirement for consultation, acquisition, and implementation of these systems and services. The implementation of digital twins requires the adoption of advanced smart sensors, IoT, IIoT devices, and several software solutions. The communication between these technologies can be done with the help of more advanced and latest functions such as voice recognition, gesture recognition, or multitouch responsive screens. These technologies are still quite expensive and may lead to an additional financial burden on companies operating in price-sensitive economies.

Opportunity: Growing demand for open banking

The increasing use of open banking systems globally provides opportunities for innovation and implementation of digital twin technologies. Open banking provides open access to third-party financial service providers for consumer banking, transactions, and other financial data from banks and non-bank financial institutions. To add more security layers and minimize risks related to open banking, the need for digital twins has increased in this sector. Digital twins ensure the elimination of unauthorized access such as fake cards or any other object that can be duplicated. Using a virtual environment will also help to develop quick incident response plans.

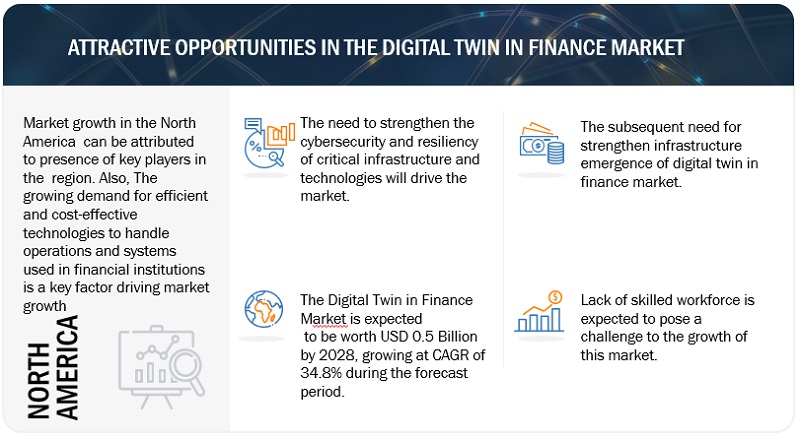

Challenge: Growing threat of cyberattacks

The implementation of digital technologies, such as the cloud, big data, IoT, and artificial intelligence, has increased in various industries and businesses. Digital twins integrate various IoT sensors and other digital technologies in order to create a virtual copy of the physical twin. However, increasing occurrences of viruses and cyberattacks have raised concerns regarding data security. Digital twins gather sensitive data related to banking customers. With the growing number of cyberattacks on critical infrastructure over the past decade, cybersecurity has become a major concern among financial institutions. Thus, the increasing threat pertaining to data security is expected to be a major challenge for the growth of the digital twin in finance market.

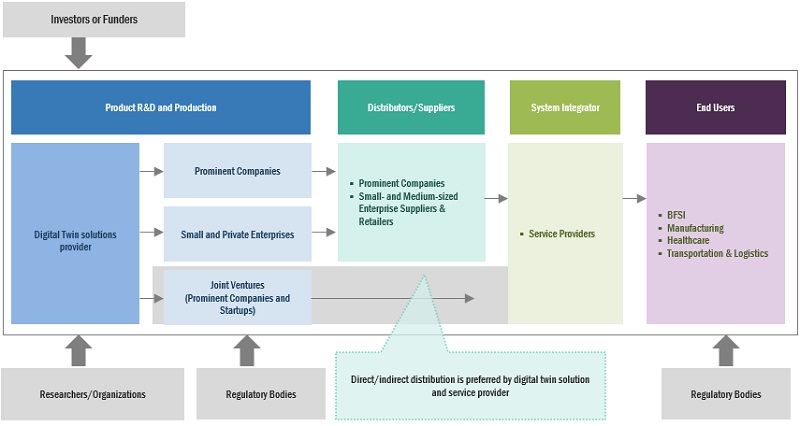

Digital Twin in Finance Market Ecosystem

Prominent companies in this market include well-established, financially stable provider of digital twin solutions and services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include IBM (US), Microsoft (US), Capgemini (France), SAP (Germany), and Ansys (US).

By BFSI, the insurance segment to hold the largest market size during the forecast period

With the advent of new technologies such as AI, IoT, and ML, modern insurance companies are seeking to adopt new technological solutions to visualize and conceptualize the data obtained from physical assets and apply digital twin tools to analyze more favorable outcomes. Digital twins can benefit insurers by estimating the risk involved in specific situations before giving insurance policies to customers. These solutions also help insurance companies calculate dynamic premiums based on risk factors. Insurance companies are adopting digital twin technologies at a rapid pace so as to enhance their abilities to assess and manage risks

Based on offering segment, the platforms & solutions segment to hold the largest market size during the forecast period

The rising adoption of Industry 4.0 technologies and the need for digital transformation in several industries have increased the demand for digital twin platforms in various verticals. With the integration of IoT, artificial intelligence, and other advanced technologies, companies can create virtual replicas of their physical assets and processes, providing insights into the performance and behavior of these assets. In the finance sector, digital twin platforms & solutions are becoming increasingly important as financial institutions seek to leverage digital technologies to improve efficiency, reduce costs, and provide better services to customers.

Based on end-use industries segment, the healthcare segment is expected to grow with the highest CAGR during the forecast period

The use of digital twins in the healthcare industry will reduce the complexities and costs associated with handling and operating medical devices, such as MRI and X-ray instruments as well as CT scanners. Digital twins have the capability to simulate and enhance clinical workflows, which includes the movement of patients in and out of hospitals or outpatient clinics. This technology can pinpoint areas of congestion and inefficiency in the process, allowing healthcare institutions to minimize waiting times and enhance patient contentment, while simultaneously reducing expenses.

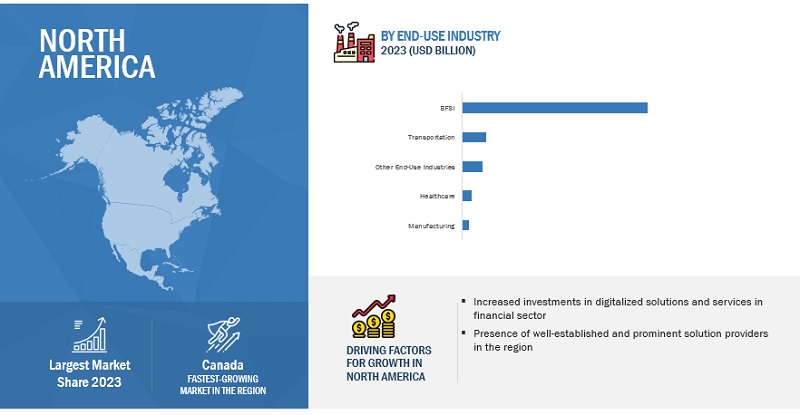

Based on region North America is expected to hold the largest market size during the forecast period.

North America, being an early adopter of digital twin solutions, is a major revenue-generating region in the global digital twin in finance market. Increasing adoption of cloud-based solutions in financial institutions is responsible for the growing demand for digital twins in the finance market in this region. The increasing number of internet subscribers, expanding mobile data traffic, and growing government emphasis on the enhancement of digital infrastructures to meet the demand for seamless connectivity are expected drive growth in the overall digital twin in finance market.

Market Players:

The major players in the digital twin in finance market are IBM (US), Microsoft (US), Capgemini (France), SAP (Germany), Ansys (US), Altair (US), NVIDIA (US), NTT Data (Japan), Oracle (US), Deloitte (UK), Verisk (US), Cosmo Tech (France), NayaOne (UK), VSOptima (US), Merlynn (US), Piprate (Ireland), and TADA (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the digital twin in finance market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2023-2028 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments covered |

Offering, Applications, and End-Use Industry |

|

Region covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies covered |

IBM (US), Microsoft (US), Capgemini (France), SAP (Germany), Ansys (US), Altair (US), NVIDIA (US), NTT Data (Japan), Oracle (US), Deloitte (UK), Verisk (US), Cosmo Tech (France), NayaOne (UK), VSOptima (US), Merlynn (US), Piprate (Ireland), and TADA (US). |

This research report categorizes the digital twin in finance market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Platforms & Solutions

-

Services

- Professional Services

- Managed Services

Based on Application:

- Risk Assessment & Compliance

- Process Optimization

- Insurance Claims Management

- Testing & Simulation

- Other Applications

Based on End-Use Industry:

-

BFSI

- Banking

- Financial Services

- Insurance

- Manufacturing

- Transportation & Logistics

- Healthcare

- Other End-Use Industries

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Singapore

- Rest of Asia Pacific

- Rest of the World

Recent Developments

- In April 2023, IBM and Cosmo Tech announced their integration. The Cosmo Tech platform connects to asset information from the IBM Maximo Application Suite. Through this integration, asset managers can simulate the complete physical and financial life cycle of their asset network, even under conditions that have never occurred before.

- In July 2022, Microsoft and Cosmo Tech collaborated to merge their digital twin platforms to deliver practical insights for organizations to achieve net-zero carbon emissions. This partnership brings together Microsoft Azure Digital Twins and the 360° Simulation Digital Twin platform from Cosmo Tech. By integrating these platforms, the enterprise customers of Microsoft Azure can track emissions from their systems almost instantly and model future outcomes of various sustainability initiatives.

- In September 2022, Altair announced the completion of the acquisition of RapidMiner.

- In September 2022, NVIDIA and Deloitte announced an expansion of their cooperation to make it easier for businesses all over the world to develop, integrate, and deploy hybrid-cloud solutions.

- In February 2022, Ansys upgraded the ANSYS Twin Builder 2022 R1. By merging physical and virtual sensors, ANSYS Twin Builder 2022 R1 provides predictive analytics with unrivaled accuracy. New features enable faster deployment of users’ digital twins, easier workflows, and web applications for online interaction with the user model.

Frequently Asked Questions (FAQ):

What is the definition of digital twin in finance market?

Digital twins are computerized models or virtual replicas (simulations) of physical objects such as devices, assets, products, or processes. The biggest advantage of digital twins is that they operate in real-time, taking cues from updated data. This holds immense potential for the BFSI industry, which heavily relies on data insights to make critical business decisions. Processes can be replicated using digital twin technology in order to gather data necessary for future predictions.

What is the market size of the digital twin in finance market?

The digital twin in finance market size is projected to grow from USD 0.1 billion in 2023 to USD 0.5 billion by 2028, at a CAGR of 34.8% during the forecast period.

What are the major drivers in the digital twin in finance market?

Growing adoption of industry 4.0, along with the growing need to test new market scenarios in real time to reduce risks is expected to drive the digital twin in finance market. Digital twins allow financial institutions, such as banks and insurance companies, to replicate various scenarios and analyze the impact of different events on their portfolios. They help identify potential risks and essential steps to be taken in order to reduce risk. In the banking industry, digital twins provide the ability to assess risk that could be applied to analyze the performance of loans given to customers and businesses. In the banking sector, Industry 4.0 technologies have unlocked new dimensions. With Industry 4.0, new banking services and opportunities can be launched to improve business performance and end customer experiences.

Who are the key players operating in the digital twin in finance market?

The major players in the digital twin in finance market are IBM (US), Microsoft (US), Capgemini (France), SAP (Germany), Ansys (US), Altair (US), NVIDIA (US), NTT Data (Japan), Oracle (US), Deloitte (UK), Verisk (US), Cosmo Tech (France), NayaOne (UK), VSOptima (US), Merlynn (US), Piprate (Ireland), and TADA (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the digital twin in finance market.

What are the opportunities for new market entrants in the digital twin in finance market?

The increasing use of open banking systems globally provides opportunities for innovation and implementation of digital twin technologies. Open banking provides open access to third-party financial service providers for consumer banking, transactions, and other financial data from banks and non-bank financial institutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 MARKET OVERVIEW

-

5.2 MARKET DYNAMICSDRIVERS- Growing adoption of Industry 4.0- Growing need to test new market scenarios in real-time to reduce risks- Increasing demand for secure infrastructure- Growing need to meet compliance requirementsRESTRAINTS- High cost of digital twin deploymentOPPORTUNITIES- Increasing adoption of real-time data analytical tools- Growing demand for open banking- Rising emphasis on financial crime risk alert managementCHALLENGES- Lack of skilled workforce- Growing threat of cyberattacks

- 5.3 EVOLUTION OF DIGITAL TWIN TECHNOLOGY

-

5.4 ECOSYSTEM ANALYSISRESEARCH & DEVELOPMENTPLANNING & DESIGNDIGITAL TWIN ENABLERSSOLUTION/PLATFORM/SERVICE PROVIDERSEND USERS

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE OF KEY PLAYERS, BY OFFERINGAVERAGE SELLING PRICE TREND

-

5.7 TECHNOLOGY ANALYSISRELATED TECHNOLOGIES- Artificial intelligence and machine learning- Big data and analytics- IoT & IIoT- Augmented reality and virtual reality- Blockchain- 5GIMPACT OF DIGITAL TWINS ON ADJACENT TECHNOLOGIES

-

5.8 INDUSTRY USE CASESUSE CASE 1: INSURANCE COMPANIES ARE ADOPTING DIGITAL TWINS TO MANAGE RISKUSE CASE 2: COMPANIES ADOPT DIGITAL TWINS TO ADDRESS LEGAL AND COMPLIANCE RISKS IN FINANCIAL DATA

-

5.9 PATENT ANALYSISDOCUMENT TYPESINNOVATION AND PATENT APPLICATIONS

-

5.10 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSDEGREE OF COMPETITION

-

5.12 REGULATORY LANDSCAPEISO/TC 184/SC 4ISO/TC 184GENERAL PERSONAL DATA PROTECTION LAW (GPDP)AUSTRALIAN DIGITAL CURRENCY COMMERCE ASSOCIATION (ADCCA)DIGITAL SIGNATURE ACTGDPRFINANCIAL SERVICES MODERNIZATION ACTSOX ACTPAYMENT CARD INDUSTRY-DATA SECURITY STANDARDHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACTFEDERAL INFORMATION SECURITY MANAGEMENT ACT

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

- 5.15 BEST PRACTICES IN DIGITAL TWIN IN FINANCE MARKET

-

5.16 FUTURE OUTLOOK OF DIGITAL TWIN IN FINANCE MARKETDIGITAL TWIN TECHNOLOGY ROADMAP TILL 2030- Short-term roadmap (2023–2025)- Mid-term roadmap (2026–2028)- Long-term roadmap (2029–2030)

-

6.1 INTRODUCTIONDIGITAL TWIN IN FINANCE MARKET, BY OFFERING: MARKET DRIVERS

-

6.2 PLATFORMS & SOLUTIONSBENEFITS SUCH AS REAL-TIME MONITORING AND PREDICTIVE MAINTENANCE TO DRIVE DEMAND FOR DIGITAL TWIN PLATFORMS & SOLUTIONS

-

6.3 SERVICESPROFESSIONAL SERVICES- Growing need for ongoing technical support to boost demand for professional servicesMANAGED SERVICES- Ability of managed services to improve client experiences to drive growth

-

7.1 INTRODUCTIONDIGITAL TWIN IN FINANCE MARKET, BY APPLICATION: MARKET DRIVERS

-

7.2 RISK ASSESSMENT & COMPLIANCEGROWING NEED FOR REAL-TIME ASSET MONITORING FOR RISK ESTIMATION TO DRIVE MARKET GROWTH

-

7.3 PROCESS OPTIMIZATIONABILITY OF DIGITAL TWINS TO CHECK AND REDUCE BOTTLENECKS TO BOOST ADOPTION

-

7.4 INSURANCE CLAIMS MANAGEMENTGROWING USE OF DIGITAL TWINS TO PREVENT DELAYS IN CLAIMS MANAGEMENT PROCESSES TO FAVOR GROWTH

-

7.5 TESTING & SIMULATIONNEED FOR DIGITAL TWINS TO TEST AND ANALYZE SYSTEM BEHAVIOR IN COMPLEX SITUATIONS TO BOOST MARKET

- 7.6 OTHER APPLICATIONS

-

8.1 INTRODUCTIONDIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY: MARKET DRIVERS

-

8.2 BFSIBANKING- Growing need to improve customer experiences to drive use of digital twins in banking sectorFINANCIAL SERVICES- Need for virtual assistants to solve consumer problems through simulated interactions to drive demand for digital twinsINSURANCE- Growing need for risk assessment in insurance sector to boost demand for digital twins

-

8.3 MANUFACTURINGNEED TO CUT TIME AND COST IN MANUFACTURING SECTOR TO DRIVE GROWTH- Use cases

-

8.4 HEALTHCAREGROWING TREND OF DIGITALIZATION IN HEALTHCARE TO BOOST ADOPTION OF DIGITAL TWINS- Use cases

-

8.5 TRANSPORTATION & LOGISTICSNEED FOR TRANSPORTATION COMPANIES TO IMPROVE PERFORMANCE OF ASSETS AND PROCESSES TO FUEL MARKET GROWTH- Use cases

-

8.6 OTHER END-USE INDUSTRIESUSE CASES- To improve energy operations and help companies enhance revenue models- To better understand risk

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: DIGITAL TWIN IN FINANCE MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Rapid adoption of technology in financial sector to drive market growthCANADA- Increasing cyberattacks to drive demand for digital twins

-

9.3 EUROPEEUROPE: DIGITAL TWIN IN FINANCE MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Need to improve efficiency of digital infrastructure to boost market growthGERMANY- Significant adoption of IoT technologies and analytics in financial sector to propel marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: DIGITAL TWIN IN FINANCE MARKET DRIVERSRECESSION IMPACT: ASIA PACIFICCHINA- Increasing government investments to enhance security of digital platforms to contribute to growthSINGAPORE- Rapid adoption of innovative digital technologies across banking sector to fuel growthREST OF ASIA PACIFIC

-

9.5 REST OF THE WORLDREST OF THE WORLD: DIGITAL TWIN IN FINANCE MARKET DRIVERSRECESSION IMPACT: REST OF THE WORLD

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 COMPETITIVE SCENARIO

- 10.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 10.5 COMPETITIVE BENCHMARKING

- 10.6 MARKET RANKING OF KEY PLAYERS IN DIGITAL TWIN IN FINANCE MARKET, 2023

-

10.7 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.8 START-UP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

11.1 MAJOR PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCAPGEMINI- Business overview- Products/Solutions/Services offered- MnM viewSAP- Business overview- Products/Solutions/Services offered- MnM viewANSYS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsALTAIR ENGINEERING INC.- Business overview- Products/Solutions/Services offered- Recent developmentsDELOITTE- Business overview- Products/Solutions/Services offered- Recent developmentsNVIDIA CORPORATION- Business overview- Products/Solutions/Services offeredNTT DATAVERISK

-

11.2 SMES/START-UPSCOSMO TECHNAYAONEVSOPTIMAMERLYNN INTELLIGENCE TECHNOLOGIESPIPRATETADA

-

12.1 RISK ANALYTICS MARKETMARKET DEFINITIONMARKET OVERVIEWRISK ANALYTICS MARKET, BY COMPONENT- Software- Services

-

12.2 INSURANCE ANALYTICS MARKETMARKET DEFINITIONMARKET OVERVIEWINSURANCE ANALYTICS MARKET, BY COMPONENTINSURANCE ANALYTICS MARKET, BY APPLICATIONINSURANCE ANALYTICS MARKET, BY DEPLOYMENT MODEINSURANCE ANALYTICS MARKET, BY ORGANIZATION SIZEINSURANCE ANALYTICS MARKET, BY END USERINSURANCE ANALYTICS MARKET, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 FACTOR ANALYSIS

- TABLE 2 DIGITAL TWIN IN FINANCE MARKET: ECOSYSTEM

- TABLE 3 PRICING MODELS AND INDICATIVE PRICE POINTS, 2022–2023

- TABLE 4 PATENTS FILED, 2020–2023

- TABLE 5 TOP TEN PATENT OWNERS IN DIGITAL TWIN IN FINANCE MARKET, 2020–2023

- TABLE 6 LIST OF PATENTS IN DIGITAL TWIN IN FINANCE MARKET, 2020–2022

- TABLE 7 DIGITAL TWIN IN FINANCE MARKET: PORTER’S FIVE FORCES MODEL

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, A ND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 14 KEY BUYING CRITERIA

- TABLE 15 DIGITAL TWIN IN FINANCE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 16 DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 17 DIGITAL TWIN IN FINANCE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 18 PROFESSIONAL SERVICES: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 MANAGED SERVICES: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 21 BFSI: DIGITAL TWIN IN FINANCE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 22 BFSI: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 BANKING: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 FINANCIAL SERVICES: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 INSURANCE: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MANUFACTURING: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 HEALTHCARE: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 TRANSPORTATION & LOGISTICS: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 OTHER END-USE INDUSTRIES: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: DIGITAL TWIN IN FINANCE SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: DIGITAL TWIN IN FINANCE MARKET FOR BFSI SECTOR, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 35 EUROPE: DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 36 EUROPE: DIGITAL TWIN IN FINANCE SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 EUROPE: DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 38 EUROPE: DIGITAL TWIN IN FINANCE MARKET FOR BFSI SECTOR, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: DIGITAL TWIN IN FINANCE SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: DIGITAL TWIN IN FINANCE MARKET FOR BFSI SECTOR, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 REST OF THE WORLD: DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 44 REST OF THE WORLD: DIGITAL TWIN IN FINANCE SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 REST OF THE WORLD: DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 46 REST ON THE WORLD: DIGITAL TWIN IN FINANCE MARKET FOR BFSI SECTOR, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DIGITAL TWIN IN FINANCE MARKET

- TABLE 48 DIGITAL TWIN IN FINANCE MARKET: DEGREE OF COMPETITION

- TABLE 49 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 50 DIGITAL TWIN IN FINANCE MARKET: COMPETITIVE BENCHMARKING OF PLAYERS, BY OFFERING, END-USE INDUSTRY, AND REGION

- TABLE 51 DIGITAL TWIN IN FINANCE MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 52 PRODUCT LAUNCHES, JANUARY 2019–MARCH 2023

- TABLE 53 DEALS, JANUARY 2019–MARCH 2023

- TABLE 54 IBM: BUSINESS OVERVIEW

- TABLE 55 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 56 IBM: DEALS

- TABLE 57 MICROSOFT: BUSINESS OVERVIEW

- TABLE 58 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 59 MICROSOFT: DEALS

- TABLE 60 CAPGEMINI: BUSINESS OVERVIEW

- TABLE 61 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 62 SAP: BUSINESS OVERVIEW

- TABLE 63 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 64 ANSYS: BUSINESS OVERVIEW

- TABLE 65 ANSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 66 ANSYS: PRODUCT LAUNCHES

- TABLE 67 ANSYS: DEALS

- TABLE 68 ORACLE CORPORATION: BUSINESS OVERVIEW

- TABLE 69 ORACLE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 70 ORACLE CORPORATION: DEALS

- TABLE 71 ALTAIR ENGINEERING INC.: BUSINESS OVERVIEW

- TABLE 72 ALTAIR ENGINEERING INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 73 ALTAIR ENGINEERING INC.: DEALS

- TABLE 74 DELOITTE: BUSINESS OVERVIEW

- TABLE 75 DELOITTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 76 DELOITTE: DEALS

- TABLE 77 NVIDIA CORPORATION: BUSINESS OVERVIEW

- TABLE 78 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 79 RISK ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 80 RISK ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 81 RISK ANALYTICS SOFTWARE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 82 RISK ANALYTICS SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 83 RISK ANALYTICS SOFTWARE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 84 RISK ANALYTICS SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 85 RISK ANALYTICS SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 86 RISK ANALYTICS SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 87 RISK ANALYTICS SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 88 RISK ANALYTICS SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 89 INSURANCE ANALYTICS MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

- TABLE 90 INSURANCE ANALYTICS MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

- TABLE 91 INSURANCE ANALYTICS SERVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

- TABLE 92 INSURANCE ANALYTICS SERVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

- TABLE 93 INSURANCE ANALYTICS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

- TABLE 94 INSURANCE ANALYTICS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

- TABLE 95 INSURANCE ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

- TABLE 96 INSURANCE ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

- TABLE 97 INSURANCE ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

- TABLE 98 INSURANCE ANALYTICS MARKET, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

- TABLE 99 INSURANCE ANALYTICS MARKET, BY END USER, 2016–2019 (USD MILLION)

- TABLE 100 INSURANCE ANALYTICS MARKET, BY END USER, 2020–2026 (USD MILLION)

- TABLE 101 INSURANCE ANALYTICS MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 102 INSURANCE ANALYTICS MARKET, BY REGION, 2020–2026 (USD MILLION)

- FIGURE 1 GLOBAL DIGITAL TWIN IN FINANCE MARKET: RESEARCH DESIGN

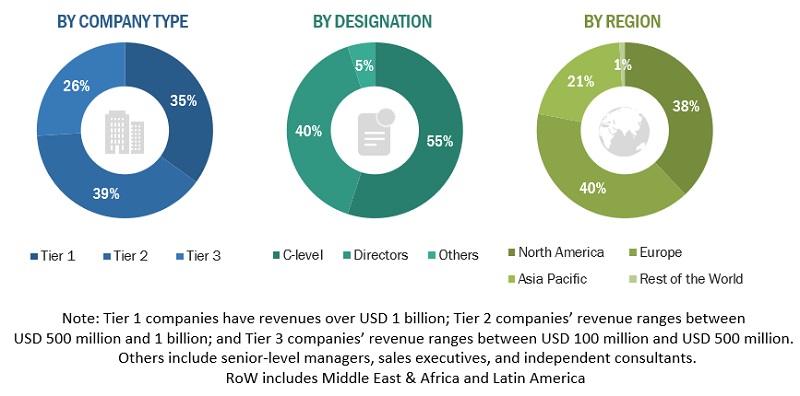

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF PLATFORMS/SOLUTIONS AND SERVICES

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2: TOP-DOWN APPROACH (DEMAND SIDE)

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DIGITAL TWIN IN FINANCE MARKET, 2023–2028 (USD MILLION)

- FIGURE 8 DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 INCREASING USE OF DIGITALIZED PLATFORMS TO DRIVE MARKET GROWTH

- FIGURE 12 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 13 PLATFORMS & SOLUTIONS TO DOMINATE MARKET IN ASIA PACIFIC IN 2023

- FIGURE 14 BFSI SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 DIGITAL TWIN IN FINANCE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 DIGITAL TWIN IN FINANCE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2020–2023

- FIGURE 19 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- FIGURE 20 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN DIGITAL TWIN IN FINANCE MARKET

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 22 KEY BUYING CRITERIA

- FIGURE 23 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 24 HEALTHCARE INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 FINANCIAL SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 DIGITAL TWIN IN FINANCE MARKET: REGIONAL SNAPSHOT (2023)

- FIGURE 27 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 29 EUROPE: MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 31 MARKET RANKING OF KEY PLAYERS, 2023

- FIGURE 32 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 33 DIGITAL TWIN IN FINANCE MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 34 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 35 DIGITAL TWIN IN FINANCE MARKET: START-UP/SME EVALUATION MATRIX, 2023

- FIGURE 36 IBM: COMPANY SNAPSHOT

- FIGURE 37 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 38 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 39 SAP: COMPANY SNAPSHOT

- FIGURE 40 ANSYS: COMPANY SNAPSHOT

- FIGURE 41 ORACLE CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 ALTAIR ENGINEERING INC.: COMPANY SNAPSHOT

- FIGURE 43 DELOITTE: COMPANY SNAPSHOT

- FIGURE 44 NVIDIA CORPORATION: COMPANY SNAPSHOT

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial study of the global smart transportation market. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as assess prospects.

Secondary Research

The market for digital twin in finance solutions and services is arrived at based on the secondary data available through paid and unpaid sources and by analyzing the different solutions and services of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to in order to identify and collect information for this study. Secondary sources included annual reports, the press releases and investor presentations of companies, white papers, journals, and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology & innovation directors, and related key executives from different key companies and organizations operating in the digital twin in finance market.

The breakup of Primary Research :

|

Company Name |

Designation |

|

Altair |

Senior Manager |

|

Merlynn Intelligence Technologies |

Director |

|

Deloitte |

Senior Consultant |

To know about the assumptions considered for the study, download the pdf brochure

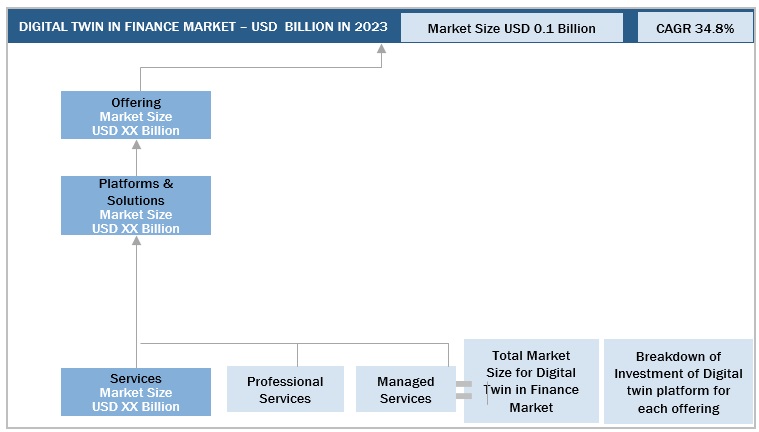

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the digital twin in finance market. The first approach involved estimating the market size through the summation of companies’ revenues generated from digital twin in finance solutions and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the digital twin in finance market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Analyzing the size of the global digital twin market and then identifying revenues generated through this technology in the finance sector

- Estimating the size of the digital twin in finance market

- Estimating the market size of other digital twin technology providers

Digital Twin in Finance Market Size: Botton Up Approach

Digital Twin in Finance Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size, the overall digital twin in finance market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Digital twins are computerized models or virtual replicas (simulations) of physical objects such as devices, assets, products, or processes. The biggest advantage of digital twins is that they operate in real-time, taking cues from updated data. This holds immense potential for the BFSI industry, which heavily relies on data insights to make critical business decisions. Processes can be replicated using digital twin technology in order to gather data necessary for future predictions.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- R&D Department

- IT Department

Report Objectives

- To determine and forecast the global digital twin in finance market, by offering, end-use industry, application, and region from 2023 to 2028

- To analyze the various macroeconomic and microeconomic factors affecting market growth

- To forecast the size of the market segments with respect to four main regions: North America, Europe, Asia Pacific (APAC), Rest of the World (RoW)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the finance market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the digital twin in finance market

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, partnerships & collaborations, and research & development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Twin in Finance Market