Digital Printing for Tableware Market by Application (Ceramic & Porcelain, Glass, Plastic, Bone China, Earthenware, Stoneware), Ink type (Ceramic ink, UV ink, Solvent-based ink) and Region (North America, Europe, APAC, RoW) - Global Forecast to 2029

Updated on : Oct 22, 2024

Digital Printing for Tableware Market Size & Share

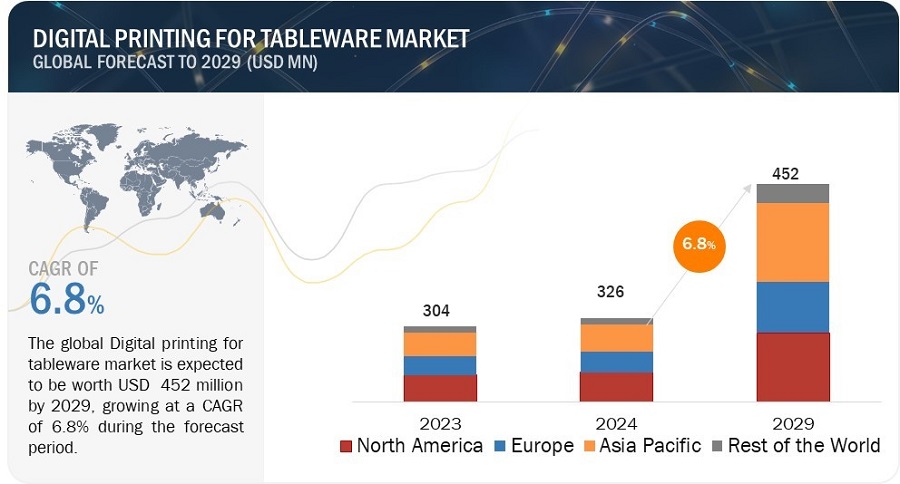

The global digital printing for tableware market size is projected to reach USD 452 million by 2029 from USD 326 million in 2024; it is expected to grow at a CAGR of 6.8% during the forecast period from 2024 to 2029.

The Digital Printing for Tableware market is being propelled by several key factors, including increased demand for sustainable printing, growing demand from the foodservice industry, rapid technological advancement in digital printers, and rapid prototyping and testing of new designs.

Digital Printing for Tableware Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Printing for Tableware Market Trends

Driver: Rapid technological advancements in digital printers

Rapid advancements in digital printing technology are making it more efficient and cost-effective and offer higher quality printing options for tableware. This is driving the growth of the digital printing for tableware market. Specifically, new printer technologies can print on a wider range of substrates, including ceramics and glass.

This allows for more diversified tableware products. New inkjet inks are more durable and resistant to fading, making digital prints last longer on tableware. New printing software makes it easier to design and print complex tableware designs, enabling businesses to create more customized and personalized products for their customers.

As these advancements continue, digital printing becomes a more attractive option for tableware manufacturers. It offers advantages over traditional printing methods, such as screen printing and decaling, including efficiency, cost-effectiveness, and higher-quality prints. As a result, the digital printing for tableware industry is expected to continue to grow. Businesses that adopt new digital printing technologies will be well-positioned to capitalize on this growth. Overall, rapid technological advancements in digital printing are making it more attractive for tableware manufacturers, leading to growth in the digital printing for tableware market.

Restraint: High initial investment costs

The initial investment cost of digital printers is quite high. Moreover, installation and maintenance also incur higher costs. One of the main factors responsible for this high cost is the complexity of the design of digital printers. The requirement of an inkjet varies according to applications. Moreover, the cost of ink used in the inkjet technology is very high. Thus, all these factors lead to the increased overall investment cost of digital printers. Digital printing equipment can be expensive, costing tens of thousands of dollars or more.

This can be a significant investment for small businesses and startups, which may not have the capital to purchase their own equipment. The high upfront cost of digital printing equipment can also make it difficult for businesses to scale their operations. If a business wants to increase its production capacity, it will need to invest in additional equipment. This can be a challenge for businesses that are operating on a tight budget. The high initial cost of digital printing equipment can also make it difficult for businesses to experiment with new designs and technologies. Businesses may be hesitant to invest in new equipment if they are not sure if it will be profitable. As a result of the high initial cost of digital printing equipment, the digital printing for tableware market is dominated by large businesses with deep pockets. This can make it difficult for small businesses and startups to compete.

Opportunity: Increasing demand from the in-plant market

An in-plant refers to an internal document reproduction unit that caters to the requirements of its parent entity, whether it be a corporation, government agency, university, or another sector. The in-plant printing sector offers a diverse range of printing and associated services. While its primary role is to meet the needs of the parent organization, over 50% of in-plants also take on external print projects to generate funds for acquiring equipment.

Due to intense competition within the printing industry and the rising demands from their parent organizations, in-plant printing departments are compelled to broaden their range of services. There is a notable market demand for printing various items, including tableware, from customers within the in-plant industry. As a result, the in-plant market presents substantial opportunities for the expansion of the digital printer market.

Challenge: Compatibility with limited materials

A notable challenge in the digital printing for tableware market is the limited compatibility of materials. The inherent characteristics of digital printing technologies mean that not all tableware materials can effectively serve as substrates for printing. This limitation significantly restricts the range of products that can be manufactured through digital printing methods.

For businesses striving to present a diverse and comprehensive tableware catalog, this constraint becomes a significant hurdle. It necessitates manufacturers to meticulously choose the materials they work with, potentially excluding certain popular or unique tableware materials from their offerings. Consequently, this limitation can impede their ability to cater to a broad customer base with diverse preferences and needs. Thus, it becomes crucial for companies to strike a balance between material choices and design possibilities in this competitive market.

Digital printing for tableware Market Ecosystem

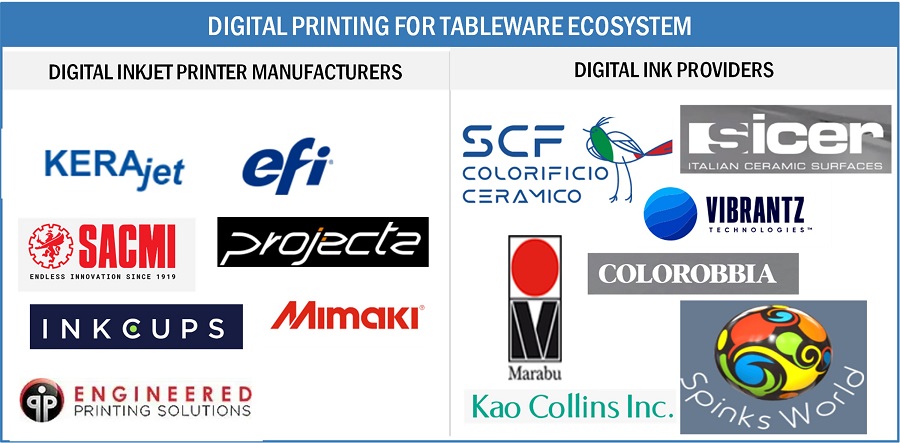

The prominent market players in the Digital printing for tableware market include SACMI (Italy), Electronics for Imaging, Inc. (US), Inkcups Now (US), and Mimaki Engineering Co., ltd. (Japan), Boston Industrial Solutions, Inc. (US), PROJECTA ENGINEERING S.R.L. (Italy), Engineered Printing Solutions (US), INX International Ink Co. (US), KERAjet (Spain), Dip-Tech Digital Printing Technologies Ltd. (Israel).

Digital Printing for Tableware Market Ecosystem

In the ink type segment, the UV ink sub-segment is expected to hold the largest market share during the forecast period.

The utilization of UV ink in digital printing for the tableware market is propelled by its distinctive characteristics and advantages that align with the specific requirements of embellishing and personalizing a variety of tableware items, such as ceramics and porcelain. UV ink incorporates photoinitiators that, when subjected to ultraviolet light, trigger a rapid curing or drying process.

This swift curing period is critical for maintaining high-speed production in digital printing for tableware. UV inks demonstrate robust adhesion properties, guaranteeing that the ink adheres firmly to the surface of ceramic and porcelain materials. This adhesion results in durable and long-lasting prints that can endure washing and everyday use.

In application segment, the Ceramic and porcelain segment is expected to hold the largest market share during the forecast period.

Ceramics and porcelain are two of the most popular substrates for digital printing in the tableware market. These materials are known for their durability, scratch resistance, and ability to withstand high temperatures, making them ideal for use in food service applications.

Additionally, ceramic and porcelain have a smooth, glossy surface that provides excellent printability, allowing for high-quality, detailed designs to be printed. Digital printing for ceramic and porcelain tableware empowers manufacturers to adorn their products with intricate, high-quality designs using cutting-edge printing technology.

This modern printing method has gained substantial traction in the tableware industry due to its ability to deliver customization, detailed graphics, and streamlined production processes. Leveraging inkjet printing technology, digital printing for ceramic and porcelain tableware enables the precise and meticulous transfer of images directly onto the surface of the tableware items. Specially formulated inks, often UV-curable, are employed in the digital printing process. These inks exhibit rapid curing properties when exposed to ultraviolet light, ensuring efficiency throughout the production line.

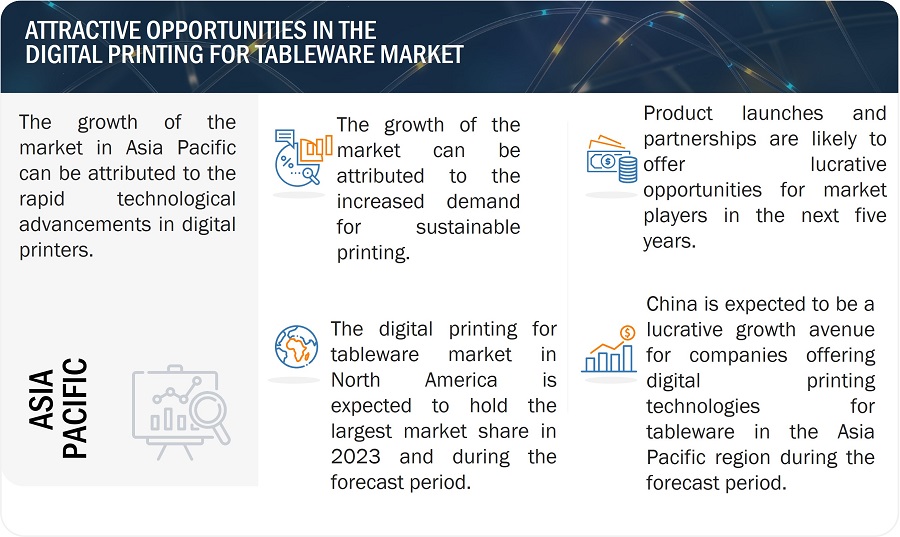

Asia Pacific region to witness the highest growth rate during the forecast period (2024-2029).

The Asia Pacific region harbors significant growth potential within the digital printing for tableware market. This anticipated expansion is fueled by a confluence of factors, including burgeoning industrialization, a rising population with increasing disposable income, and a growing appreciation for customized and aesthetically pleasing tableware. Countries like China, Japan, India, and South Korea are experiencing heightened adoption of digital printing technologies across various industries, including tableware production.

Moreover, the region's robust manufacturing infrastructure and technological advancements position it favorably for further innovation and adoption of digital printing methods. The cultural significance of tableware in Asia Pacific societies, combined with the demand for unique and personalized designs, fuels the market's growth prospects. Additionally, the region's focus on eco-friendly practices aligns well with the sustainable aspects often associated with digital printing technologies. This convergence of factors suggests a promising trajectory for the Asia Pacific digital printing for tableware market, presenting opportunities for manufacturers and stakeholders to capitalize on this burgeoning market segment.

Digital Printing for Tableware Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Digital Printing for Tableware Companies - Key Market Players

- SACMI (Italy),

- Electronics for Imaging, Inc. (US),

- Inkcups Now (US),

- Mimaki Engineering Co., ltd. (Japan),

- Boston Industrial Solutions, Inc. (US),

- PROJECTA ENGINEERING S.R.L. (Italy),

- Engineered Printing Solutions (US),

- INX International Ink Co. (US),

- KERAjet (Spain),

- Dip-Tech Digital Printing Technologies Ltd. (Israel). are some of the key players in the global digital printing for tableware companies.

These players increasingly undertake product launches and development strategies, expansions, partnerships, contracts, and acquisitions to increase their market share.

Digital Printing for Tableware Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 326 million in 2024 |

| Projected Market Size | USD 452 million by 2029 |

| Growth Rate | CAGR of 6.8% |

|

Market Size Available for Years |

2020–2029 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Ink Type, Application, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Rest of the World (Middle East, Africa, and South America) |

|

Key Companies Covered |

SACMI (Italy), Electronics for Imaging, Inc. (US), Inkcups Now (US), Mimaki Engineering Co., ltd. (Japan), Boston Industrial Solutions, Inc. (US), PROJECTA ENGINEERING S.R.L. (Italy), Engineered Printing Solutions (US), INX International Ink Co. (US), KERAjet (Spain), Dip-Tech Digital Printing Technologies Ltd. (Israel). |

Digital Printing for Tableware Market Highlights

In this report, the digital printing for the tableware market has been segmented into the following categories:

|

Segment |

Subsegment |

|

By Ink Type: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments in Digital Printing for Tableware Industry

- In April 2023, Inkcups Now launched the Helix ONE benchtop digital cylinder printer for cylinder printer printing with full CMYKW and varnish onto straight walled and tapered cylindrical objects including plastic bottles, drinkware etc.

- In February 2023, The newly designed Helix 2.0 is similar to the Helix machine but with improved features and upgrades for faster, highly superior printing. It is equipped with ColorBoost and two additional safety features.

- In February 2022, Mimaki Engineering Co., Ltd. (Japan), which specializes in industrial inkjet printers, cutting plotters and 3D printers, announced the worldwide launch of large format inkjet printers 330 Series. The TS-330-1600 printers are used in digital printing for tableware products such as mugs.

- In September 2021, Apulum S. A.- a European tableware manufacturer purchased an isostatic press from SACMI. The product is expected to be used in the manufacturing of different types of dishes - both flatware and holloware.

- In September 2021, Mimaki Engineering Co., Ltd. (Japan), which specializes in industrial inkjet printers, cutting plotters and 3D printers, announced the worldwide launch of a new printer- UJF-7151 plus II. The printer is expected to be used in the digital printing of tableware products such as bottles and thermos.

- In February 2021, Mimaki Engineering Co., Ltd. (Japan), which specializes in industrial inkjet printers, cutting plotters and 3D printers, announced the worldwide launch of a new printer- TS100-1600. The printer is expected to be used in the digital printing of tableware products such as mugs and glass coasters.

Frequently Asked Questions (FAQs):

Which are the major companies in the digital printing of tableware market? What are their major strategies to strengthen their market presence?

The major companies in digital printing of tableware market are – SACMI (Italy), Electronics for Imaging, Inc. (US), Inkcups Now (US), Mimaki Engineering Co., ltd. (Japan), Boston Industrial Solutions, Inc (US), PROJECTA ENGINEERING S.R.L. (Italy), Engineered Printing Solutions (US), INX International Ink Co. (US), KERAjet (Spain), Dip-Tech Digital Printing Technologies Ltd. (Israel). The major strategies adopted by these players are product launches, collaborations, agreements and acquisitions.

Which is the potential market for digital printing of tableware in terms of region?

North America is the largest market for digital printing of tableware. North America, being one of the fastest-growing markets for technology solutions, provides attractive opportunities for players offering digital printers; as a result, many companies are expanding their footprint in this region. US, Canada and Mexico are among the key hubs in North America that occupy the maximum share of the market of the region.

Which application segment is expected to drive the growth of the digital printing of tableware market in the next five years?

The Ceramic & porcelain application segment among all others is expected to grow at the highest CAGR in coming years.

What is the current size of the global digital printing tableware market?

The digital printing tableware market is expected to grow from USD 326 million in 2024 to USD 452 million by 2029, at a CAGR of 6.8%.

What are the opportunities for the existing players and for those who are planning to enter various stages of the digital printing of the tableware value chain?

Numerous avenues are open for current participants to become part of the digital printing of the tableware industry's value chain. Among these are possibilities like conducting R&D in digital printing technologies and applications in numerous ceramic and porcelain tableware products.

Which ink type of digital printing in the tableware market is expected to drive the market's growth in the next five years?

The UV ink type of digital printing of tableware market is expected to hold the largest market share in the forecasted duration.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing trend of sustainable printing practices in tableware industry- High demand for digitally printed tableware from food service industry- Significant advancements in digital printing technology- Faster product development cycle due to rapid prototyping and quick testing of new designsRESTRAINTS- Substantial upfront investment- Limited color gamut, susceptibility to fading, and lack of standardizationOPPORTUNITIES- Rising focus of tableware industry on in-plant printing- Increasing investments in R&D of newer digital printing technologies- Potential of digital printers to reduce per unit cost of printingCHALLENGES- Compatibility with limited materials- Competition from traditional printing methods and hesitance to adopt digital transformation- Difficulties in regulatory compliance management

- 5.3 VALUE/SUPPLY CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) TRENDINDICATIVE PRICE OF DIGITAL INKJET PRINTERS PROVIDED BY MAJOR COMPANIES, BY APPLICATIONAVERAGE SELLING PRICE TREND FOR DIGITAL INKJET PRINTERS, BY REGION

-

5.7 TECHNOLOGY TRENDSRELEASE OF ADVANCED PRINTING TECHNOLOGIESDEVELOPMENT OF NEW PRINTING HEADSELEVATED USE OF FOOD-SAFE INKSINCREASED SUSTAINABILITY INITIATIVESUSE OF AI IN DIGITAL PRINTING FOR TABLEWARE

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISAPULUM PARTNERED WITH SACMI TO PRODUCE PORCELAIN/STONEWARE TABLEWARE USING RECYCLED MATERIALBOTTLED GOOSE COLLABORATED WITH INKCUPS NOW TO DEVELOP PERSONALIZED MODULE FOR CUSTOMIZED OFFERINGSMITEC ENGINY ADOPTED INKJET PRINTING SOLUTION TO PRINT HIGH-QUALITY DESIGNS AND REDUCE PRODUCTION TIME AND COSTSEFI VUTEK Q5R ROLL-TO-ROLL LED PRINTER HELPED DÉCOADER ACHIEVE FASTER TURNAROUND TIMES

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSISTOP PATENT OWNERSGLOBAL PATENT TRENDS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY LANDSCAPE AND STANDARDSISO STANDARDS- Multicolor testing- Color richness testingREGION-WISE REGULATORY ANALYSISNORTH AMERICA- US- Canada- MexicoEUROPEASIA PACIFIC- China- Japan- South KoreaROW- Middle East- Africa- South America

- 6.1 INTRODUCTION

-

6.2 CERAMIC INKINCREASING USE IN PRINTING INTRICATE DESIGNS ON CERAMIC SURFACES TO FUEL SEGMENTAL GROWTH

-

6.3 UV INKSURGING DEMAND FOR UV INK TO PRODUCE VIVID AND HIGH-RESOLUTION PRINTS TO DRIVE MARKET

-

6.4 SOLVENT-BASED INKCOMPATIBILITY WITH NUMEROUS SUBSTRATES AND EXCEPTIONAL DURABILITY TO BOOST DEMAND

- 6.5 OTHER INK TYPES

- 7.1 INTRODUCTION

-

7.2 CERAMIC & PORCELAINGROWING TREND TO PRINT INTRICATE AND COLORFUL DESIGNS ON CERAMIC AND PORCELAIN TABLEWARE TO DRIVE MARKET

-

7.3 GLASSUNPARALLELED CUSTOMIZATION, DURABILITY, AND COST-EFFECTIVENESS OF DIGITAL PRINTING ON GLASS TABLEWARE TO DRIVE MARKET

- 7.4 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICAUS- Significant demand for personalized tableware products to drive marketCANADA- Increasing adoption of sustainable technology to fuel market growthMEXICO- Rising focus on creation of tableware featuring popular festivals to accelerate market growthIMPACT OF RECESSION ON MARKET IN NORTH AMERICA

-

8.3 EUROPEUK- Growing use of digital inkjet printers by ceramic plate manufacturers to support market growthGERMANY- Significant presence of premium and craft beverage providers to stimulate market growthFRANCE- Wine and dine culture and booming tourism market to boost demandREST OF EUROPEIMPACT OF RECESSION ON MARKET IN EUROPE

-

8.4 ASIA PACIFICJAPAN- Rising demand for theme- and festive-based tableware to drive marketCHINA- Surging demand for personalized and visually distinctive tableware products to create opportunitiesSOUTH KOREA- Growing preference for customized and aesthetically unique tableware to foster market growthREST OF ASIA PACIFICIMPACT OF RECESSION ON MARKET IN ASIA PACIFIC

-

8.5 ROWSOUTH AMERICA- Increasing demand for contemporary and innovative tableware designs to fuel market growthMIDDLE EAST- Rising demand for customized tableware from hospitality sector to foster market growth- GCC countries- Rest of Middle EastAFRICA- Regional arts and traditional craftsmanship to boost demandIMPACT OF RECESSION ON MARKET IN ROW

- 9.1 INTRODUCTION

-

9.2 STRATEGIES ADOPTED BY KEY PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC GROWTH STRATEGIES

- 9.3 MARKET SHARE ANALYSIS, 2022

- 9.4 FIVE-YEAR COMPANY REVENUE ANALYSIS, 2018–2022

-

9.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

9.6 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

10.1 DIGITAL INKJET PRINTER PROVIDERSSACMI- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewELECTRONICS FOR IMAGING, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMIMAKI ENGINEERING CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKERAJET- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINX INTERNATIONAL INK CO.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINKCUPS NOW- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBOSTON INDUSTRIAL SOLUTIONS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPROJECTA ENGINEERING S.R.L.- Business overview- Products/Solutions/Services offered- MnM viewENGINEERED PRINTING SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDIP-TECH DIGITAL PRINTING TECHNOLOGIES LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

10.2 DIGITAL INK PROVIDERSVIBRANTZSICER S.P.A.SCF COLORIFICIO CERAMICOMARABU GMBH & CO. KGCOLOROBBIA HOLDING S.P.ASPINKS WORLDRUCOINX DRUCKFARBENKAO COLLINS CORPORATIONSIEGWERK DRUCKFARBEN AG & CO. KGAASUN CHEMICALENCRES DUBUITNEEDHAM INKS LTD.SILPOT&K TOKA CORPORATIONTECGLASS

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 2 INDICATIVE PRICE RANGE OF DIGITAL INKJET PRINTERS OFFERED BY KEY PLAYERS, BY APPLICATION (USD THOUSAND)

- TABLE 3 IMPACT OF PORTER’S FIVE FORCES ON DIGITAL PRINTING FOR TABLEWARE MARKET

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 5 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 6 IMPORT DATA FOR HS CODE 844339-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 844339-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 8 NUMBER OF PATENTS GRANTED IN DIGITAL PRINTING FOR TABLEWARE MARKET IN LAST 10 YEARS

- TABLE 9 LIST OF KEY PATENTS IN DIGITAL PRINTING FOR TABLEWARE MARKET, 2022–2023

- TABLE 10 LIST OF KEY CONFERENCES AND EVENTS IN DIGITAL PRINTING FOR TABLEWARE MARKET, 2023–2024

- TABLE 11 DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 12 DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 13 CERAMIC INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 14 CERAMIC INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 15 UV INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 16 UV INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 17 SOLVENT-BASED INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 18 SOLVENT-BASED INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 19 OTHER INK TYPES: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 20 OTHER INK TYPES: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 21 DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 22 DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 23 CERAMIC & PORCELAIN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 24 CERAMIC & PORCELAIN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 25 GLASS: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 26 GLASS: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 27 OTHER APPLICATIONS: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 28 OTHER APPLICATIONS: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 29 DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 30 DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 31 DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020–2023 (UNITS)

- TABLE 32 DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024–2029 (UNITS)

- TABLE 33 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 34 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 35 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 36 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 37 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 38 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 39 US: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 40 US: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 41 US: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 42 US: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 43 CANADA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 44 CANADA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 45 CANADA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 46 CANADA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 47 MEXICO: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 48 MEXICO: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 49 MEXICO: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 50 MEXICO: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 51 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 52 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 53 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 54 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 55 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 56 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 57 UK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 58 UK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 59 UK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 60 UK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 61 GERMANY: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 62 GERMANY: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 63 GERMANY: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 64 GERMANY: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 65 FRANCE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 66 FRANCE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 67 FRANCE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 68 FRANCE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 69 REST OF EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 70 REST OF EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 71 REST OF EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 72 REST OF EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 73 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 74 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 75 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 76 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 77 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 78 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 79 JAPAN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 80 JAPAN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 81 JAPAN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 82 JAPAN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 83 CHINA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 84 CHINA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 85 CHINA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 86 CHINA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 87 SOUTH KOREA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 88 SOUTH KOREA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 89 SOUTH KOREA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 90 SOUTH KOREA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 95 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 96 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 97 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 98 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 99 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 100 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 101 SOUTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 102 SOUTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 103 SOUTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 104 SOUTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 105 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 106 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 107 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 108 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 109 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 110 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 111 AFRICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 112 AFRICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 113 AFRICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020–2023 (USD MILLION)

- TABLE 114 AFRICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024–2029 (USD MILLION)

- TABLE 115 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS

- TABLE 116 DIGITAL PRINTING FOR TABLEWARE MARKET: DEGREE OF COMPETITION, 2022

- TABLE 117 OVERALL COMPANY FOOTPRINT (10 COMPANIES)

- TABLE 118 APPLICATION FOOTPRINT (10 COMPANIES)

- TABLE 119 REGION FOOTPRINT (10 COMPANIES)

- TABLE 120 DIGITAL PRINTING FOR TABLEWARE MARKET: PRODUCT LAUNCHES, 2021–2023

- TABLE 121 DIGITAL PRINTING FOR TABLEWARE MARKET: DEALS, 2020–2022

- TABLE 122 SACMI: COMPANY OVERVIEW

- TABLE 123 SACMI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 SACMI: DEALS

- TABLE 125 ELECTRONICS FOR IMAGING, INC.: COMPANY OVERVIEW

- TABLE 126 ELECTRONICS FOR IMAGING, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 ELECTRONICS FOR IMAGING, INC.: DEALS

- TABLE 128 MIMAKI ENGINEERING CO., LTD.: COMPANY OVERVIEW

- TABLE 129 MIMAKI ENGINEERING CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 MIMAKI ENGINEERING CO., LTD.: PRODUCT LAUNCHES

- TABLE 131 MIMAKI ENGINEERING CO., LTD.: DEALS

- TABLE 132 KERAJET: COMPANY OVERVIEW

- TABLE 133 KERAJET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 KERAJET: PRODUCT LAUNCHES

- TABLE 135 KERAJET: DEALS

- TABLE 136 INX INTERNATIONAL INK CO.: COMPANY OVERVIEW

- TABLE 137 INX INTERNATIONAL INK CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 INX INTERNATIONAL INK CO.: DEALS

- TABLE 139 INX INTERNATIONAL INK CO.: OTHERS

- TABLE 140 INKCUPS NOW: COMPANY OVERVIEW

- TABLE 141 INKCUPS NOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 INKCUPS NOW: PRODUCT LAUNCHES

- TABLE 143 INKCUPS NOW: DEALS

- TABLE 144 BOSTON INDUSTRIAL SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 145 BOSTON INDUSTRIAL SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 BOSTON INDUSTRIAL SOLUTIONS, INC.: PRODUCT LAUNCHES

- TABLE 147 PROJECTA ENGINEERING S.R.L.: COMPANY OVERVIEW

- TABLE 148 PROJECTA ENGINEERING S.R.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 ENGINEERED PRINTING SOLUTIONS: COMPANY OVERVIEW

- TABLE 150 ENGINEERED PRINTING SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 ENGINEERED PRINTING SOLUTIONS: PRODUCT LAUNCHES

- TABLE 152 DIP-TECH DIGITAL PRINTING TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 153 DIP-TECH DIGITAL PRINTING TECHNOLOGIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 DIP-TECH DIGITAL PRINTING TECHNOLOGIES LTD.: DEALS

- FIGURE 1 DIGITAL PRINTING FOR TABLEWARE MARKET SEGMENTATION

- FIGURE 2 DIGITAL PRINTING FOR TABLEWARE MARKET: RESEARCH DESIGN

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS IN DIGITAL PRINTING FOR TABLEWARE MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (DEMAND SIDE): BOTTOM-UP APPROACH, BY REGION

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 CERAMIC & PORCELAIN SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 10 UV INK SEGMENT TO ACQUIRE LARGEST MARKET SHARE IN 2029

- FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO EMERGE AS LUCRATIVE MARKET FOR DIGITALLY PRINTED TABLEWARE PRODUCTS

- FIGURE 13 UV INK SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 14 CERAMIC & PORCELAIN SEGMENT TO LEAD DIGITAL PRINTING FOR TABLEWARE MARKET FROM 2024 TO 2029

- FIGURE 15 CERAMIC & PORCELAIN SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2029

- FIGURE 16 MEXICO TO RECORD HIGHEST CAGR IN GLOBAL DIGITAL PRINTING FOR TABLEWARE FROM 2024 TO 2029

- FIGURE 17 DIGITAL PRINTING FOR TABLEWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 DRIVERS: IMPACT ANALYSIS

- FIGURE 19 RESTRAINTS: IMPACT ANALYSIS

- FIGURE 20 OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 21 CHALLENGES: IMPACT ANALYSIS

- FIGURE 22 VALUE/SUPPLY CHAIN ANALYSIS: DIGITAL PRINTING FOR TABLEWARE MARKET

- FIGURE 23 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 24 KEY PLAYERS IN DIGITAL PRINTING FOR TABLEWARE MARKET

- FIGURE 25 ASP TREND OF DIGITAL INKJET PRINTERS USED IN TABLEWARE INDUSTRY, 2020–2029

- FIGURE 26 INDICATIVE PRICE OF DIGITAL INKJET PRINTERS OFFERED BY KEY PLAYERS, BY APPLICATION

- FIGURE 27 AVERAGE SELLING PRICE TREND OF DIGITAL INKJET PRINTERS, BY REGION

- FIGURE 28 DIGITAL PRINTING FOR TABLEWARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 30 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 31 COUNTRY-WISE IMPORT DATA FOR HS CODE 844339-COMPLIANT PRODUCTS, 2018–2022 (USD MILLION)

- FIGURE 32 COUNTRY-WISE EXPORT DATA FOR HS CODE 844339-COMPLIANT PRODUCTS, 2018–2022 (USD MILLION)

- FIGURE 33 TOP 10 COMPANIES WITH SUBSTANTIAL PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 34 NUMBER OF PATENTS GRANTED PER YEAR, 2013–2022

- FIGURE 35 UV INK TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 36 CERAMIC & PORCELAIN SEGMENT TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 37 DIGITAL PRINTING FOR TABLEWARE MARKET: REGIONAL SNAPSHOT

- FIGURE 38 DIGITAL PRINTING FOR TABLEWARE MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 39 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET SNAPSHOT

- FIGURE 40 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET SNAPSHOT

- FIGURE 42 MIDDLE EAST TO ACCOUNT FOR LARGEST SHARE OF DIGITAL PRINTING FOR TABLEWARE MARKET IN ROW IN 2029

- FIGURE 43 FIVE-YEAR COMPANY REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2018–2022

- FIGURE 44 DIGITAL PRINTING FOR TABLEWARE MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 45 SACMI: COMPANY SNAPSHOT

- FIGURE 46 MIMAKI ENGINEERING CO., LTD.: COMPANY SNAPSHOT

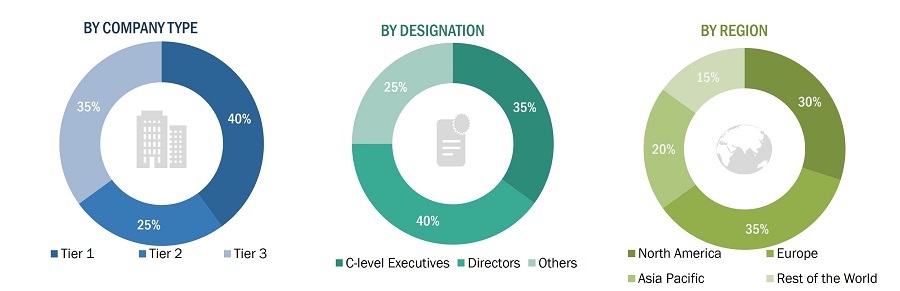

This research elucidates the approach used to compile this report on Digital Printing for the Tableware market. The study employs two fundamental information sources, secondary and primary sources, which collectively provide a comprehensive, technical, and commercial analysis of Digital Printing for the Tableware market. Secondary sources encompass data derived from sources like company websites, publications, industry associations, and databases such as OneSource, Factiva, and Bloomberg. Additionally, primary sources were tapped, including insights from key opinion leaders spanning various sectors, experts from governmental entities and associations, preferred suppliers, digital printer manufacturers, distributors, technology experts, subject matter specialists (SMEs), C-level executives of prominent firms, and industry consultants. These interviews were instrumental in acquiring, validating, and comprehending crucial information and in gauging the future prospects and trends within the Digital Printing for Tableware market. Key market players were identified through secondary research, and their market positioning was assessed via a combination of primary and secondary research methods. Furthermore, this research integrated an examination of the annual reports of market participants to pinpoint the leading players in the Digital Printing for Tableware market.

Secondary Research

In the secondary research phase, we referred to a variety of secondary sources to identify and collect pertinent information for this Digital Printing for Tableware market study. These secondary sources encompassed materials such as companies' annual reports, press releases, and investor presentations, as well as white papers, accredited publications, and articles authored by recognized experts. We also consulted directories and databases. The global size of the Digital Printing for Tableware market was determined through secondary data obtained from both paid and freely available sources. This involved evaluating the product portfolios of leading companies and assessing the quality of their offerings. The secondary research process was instrumental in gathering essential data related to the industry's supply chain, the financial aspects of the market, the total count of major market players, and the segmentation of the market in alignment with industry trends down to the most granular level, including geographic markets. Furthermore, this phase allowed for the identification and examination of industry trends and significant developments from both market and technology perspectives.

Primary Research

In the primary research phase, we conducted interviews with a range of primary sources to acquire both qualitative and quantitative data concerning the market in four primary regions: Asia Pacific, North America, Europe, and the Rest of the World (Middle East, Africa, and South America). On the supply side, primary sources included industry experts occupying various roles, such as CEOs, vice presidents, marketing directors, technology directors, and other key executives from major companies and organizations operating within the Digital Printing for Tableware market or closely related sectors. This primary research was instrumental in gathering, verifying, and validating critical data that had been sourced from other channels following the market engineering phase.

Primary research also served to identify various market segments, industry trends, key players, the competitive landscape, and the pivotal market dynamics, encompassing factors such as drivers, constraints, opportunities, and challenges, as well as the key strategies adopted by market players. The majority of the primary interviews focused on engaging with the supply side of the market, and the collection of this primary data was carried out through questionnaires, email correspondence, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used extensively in the market engineering process. This entire research methodology includes the study of annual and financial reports of top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). The key players in the digital printing for tableware market have been identified through secondary research, and their market share in the respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. Several data triangulation methods were also used to perform market forecasting and market estimation for the overall market segments and sub-segments in the report. Multiple qualitative and quantitative analyses were performed on the market engineering process to gain key insights throughout the report. All the possible parameters that affect the markets covered in this research have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figures depict the overall market size estimation process employed for the purpose of this study.

The revenues were identified geographically as well as market segment-wise, using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives were also conducted to gain insights on the key players and the digital printing for tableware market. All the market shares were estimated using secondary and primary research. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Digital Printing for Tableware Market Size: Bottom-Up Approach

Global Digital Printing for Tableware Market Size: Top-down Approach

Data Triangulation

Following the determination of the comprehensive market size through the previously described market size estimation process, the entire market was subsequently divided into multiple segments and sub-segments. To accomplish this and attain precise statistical data for all segments and sub-segments, the market engineering process employed a data triangulation method. This triangulation involved a thorough examination of diverse factors and trends originating from both the demand and supply aspects of the market. In addition to this, the market's accuracy and reliability were substantiated through a combination of both top-down and bottom-up approaches.

Market Definition

The global digital printing for tableware market is defined as the market for the sale of digital printing equipment, inks, and services used to decorate tableware items such as plates, bowls, cups, and mugs. This market encompasses a wide range of technologies, including inkjet printing, as well as a variety of substrates, including ceramics, glass, and plastics. The "Digital Printing for Tableware Market" delineates a specialized sector dedicated to employing cutting-edge digital printing methodologies for the embellishment and customization of tableware products. This market segment revolves around the integration of advanced printing technologies, encompassing inkjet, UV-curable, and other high-resolution printing techniques, to imprint intricate designs, graphics, and patterns onto an array of tableware items, including but not limited to plates, cups, mugs, saucers, and serving bowls. This innovative approach allows for unparalleled customization, enabling personalized and detailed designs that cater to both individual consumer preferences and the burgeoning demands of commercial enterprises seeking unique, branded tableware offerings. The digital printing processes involved in this market ensure superior print quality, vivid color reproduction, and the flexibility to accommodate diverse materials, surfaces, and design intricacies, thereby driving innovation and customization within the tableware industry.

Key Stakeholders

- Manufacturers of digital inkjet printers

- Manufacturers of digital inks

- Manufacturers of printer heads

- Third-party developers

- Suppliers of raw materials

- Vendors of printer solutions

- Original device manufacturers (ODMs)

- Providers of assembly, testing, and packaging services

- Research organizations

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Distributors

- Component providers

- Market research and consulting firms

Study Objectives

- To estimate, segment, and forecast the overall size of the Digital Printing for Tableware market, by application, ink type and region, in terms of value.

- To forecast the market size, in terms of value, for Digital Inkjet Printers with regard to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the value chain of Digital Printing for the Tableware market

- To strategically analyze macro and micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) in the Digital Printing for Tableware market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape

- To study technology analysis, key buying criteria, and key conferences (2023 -2024)

- To strategically profile the key players and comprehensively analyze their market position in terms of their ranking and core competencies2, and to provide detailed information about the competitive landscape of the market

- To analyze the annual revenues generated by key players in Digital Printing for Tableware market

- To analyze competitive developments, such as product launches & developments, collaborations, contracts, partnerships, acquisitions, and expansions, in the Digital Printing for Tableware market

- To analyze the overall, as well as regional impact of the recession on the market

Report Scope

The report covers the demand- and supply-side segmentation of the digital printing for the tableware market. The supply-side market segmentation includes the ink type, whereas the demand-side market segmentation includes application, and region.

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the specific requirements of companies. The following customization options are available for the report:

Company Information

- Market size based on different subsegments of the Digital Printing for Tableware Market

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Digital Printing for Tableware Market