Digital Escrow Market - Global Forecast to 2029

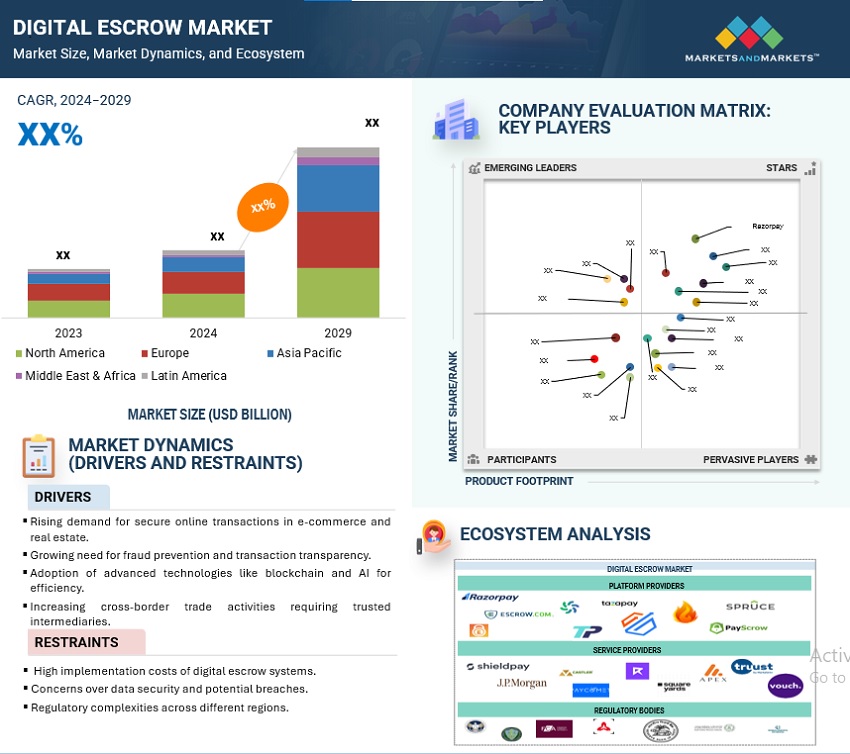

The Digital Escrow Market is projected to grow from USD XX billion in 2024 to USD XX billion by 2029 at a compound annual growth rate (CAGR) of XX % from 2024 to 2029.

The application of escrow mechanisms in share issuance and stock-based compensation plans significantly fuels digital escrow solutions. Companies issuing shares to the public in India are required to maintain an escrow account that handles subscription funds, with the requirement that at least 90% of the shares be subscribed for the issuance to be valid. In cases of under-subscription, the funds are returned to investors in a secure manner, which is evidence of the importance of escrow in reducing financial risks and establishing trust among stakeholders. Apart from public offerings, escrow accounts are being used in employee compensation plans where shares or bonuses are held until certain conditions are met, such as performance milestones or tenure requirements. Digital escrow platforms streamline the process by offering automation, transparency, and robust security, making them an indispensable tool for handling complex financial transactions. As businesses focus on compliance and operational efficiency, digital escrow solutions become a cornerstone for managing funds in high-stakes scenarios, further driving their adoption across diverse financial operations.

ATTRACTIVE OPPORTUNITIES IN THE DIGITAL ESCROW MARKET

To know about the assumptions considered for the study, Request for Free Sample Report

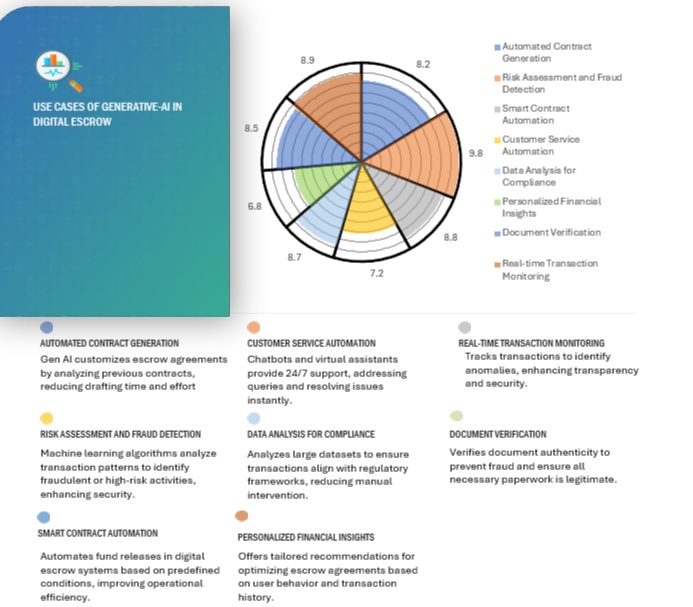

USE CASES OF AI/GEN AI IN DIGITAL ESCROW

Generative AI is transforming the digital escrow market by enabling the automation of key procedures and improving security. These technologies assist in drafting and adjusting escrow agreements to any transaction. Gen AI enhances fraud detection and risk assessment by analysis of real-time transaction data. Smart contracts are automated. There is no human error, and funds are promptly released. The technology helps offer 24/7 customer support through AI-driven chatbots and virtual assistants. Gen AI also supports compliance by reviewing transaction data and ensuring regulatory standards are met. It provides individualized financial insights and automates document verification to avoid fraud. Moreover, it continuously tracks transactions in real time and flags suspicious activities and potential disputes. Using predictive analytics, Gen AI assists escrow providers in tailoring offerings according to market trends. It also enhances auditing through the identification of discrepancies in escrow accounts and automatically allocates funds. Gen AI introduces dynamic pricing, adaptive risk mitigation, and voice-enabled management to provide a safe, efficient, and easy escrow experience.

Digital Escrow Market Dynamics

Driver: Growing need for fraud prevention and transaction transparency

High-value transactions have become a subject of fraud, and the reliance on digital escrow services is on the rise. Such transactions typically involve large sums of money, multiple parties, and complex legal requirements, thus placing them at risk of payment fraud, asset misrepresentation, non-delivery, and cyber threats. Digital escrow services act as a trusted middleman, holding funds securely and only releasing them when all agreed conditions are met, giving both parties peace of mind. They ensure transparency by clearly laying out the terms, so everyone knows what's expected and when. With advanced tools like AI-powered fraud detection, KYC checks, and real-time monitoring, digital escrow platforms help catch red flags early. In addition, secure cybersecurity, like encryption and multi-factor authentication, prevents hackers from accessing sensitive data. These services verify documents and assets which prevent costly blunders, such as accepting counterfeit titles for property or inflated valuations. Legal protections embedded in an escrow agreement also provide an amicable means to a settlement.

Restraint: Regulatory complexities across different regions

The regulatory complexities across regions are a major factor in the adoption and operation of digital escrow services. Each country or region has its own legal frameworks, financial regulations, and compliance requirements, which can vary widely in scope and enforcement. These include licensing requirements for escrow providers, data protection laws like GDPR in Europe, anti-money laundering (AML) mandates, and cross-border transaction rules. Navigating these regulations is particularly difficult for international providers, as they must adjust their services to fit various legal standards while ensuring uniform user experiences. Furthermore, tax policies, reporting requirements, and dispute-resolution procedures vary between regions, which makes the process even more complicated. In some regions, laws related to digital transactions are outdated or unclear, creating uncertainty that discourages businesses and customers from using escrow services. It costs providers to invest heavily in legal expertise and compliance systems to deal with these issues. Often, the cost of running is higher because of this investment, but complying with regional regulations builds trust and ensures legitimacy to encourage more adoption of digital escrow solutions.

Opportunity: Expanding digital platforms in emerging markets

Digital platforms in emerging markets are growing and opening up a large number of opportunities for the digital escrow market. More and more people are shopping online, and businesses are increasingly adopting digital payment methods, thus creating a massive need for secure and trustworthy transaction solutions. These markets, most of which still face issues such as mistrust about online deals and limited access to traditional banks, consider digital escrow services an ideal fit to build confidence and safeguard funds. Booming sectors such as real estate, cross-border trade, and freelancing create ample opportunities for escrow services to step in. Governments are also supporting digital adoption through policies, which makes the environment even more promising. In return, digital escrow providers can play a significant role in helping these economies grow and thrive in the digital age by tailoring their solutions to local needs and teaming up with regional platforms.

Challenge: Managing complexities of multi-currency cross-border transactions

Dealing with cross-border transactions involves fluctuating exchange rates presenting a significant challenge for digital escrow service providers. Fluctuations in currency impact the value of funds held in escrow, leading to a dispute if the value changes before the transaction is completed. Providers must deal with these risks by using tools such as rate locking or real-time conversions and then managing associated costs such as exchange fees. Furthermore, they are exposed to country-specific foreign exchange regulations that add to the complexity of compliance. It is essential to have transparent communication about these risks and fees to maintain client trust. Technologies such as blockchain and AI will help streamline processes and eliminate errors, further strengthening cross-border escrow operations.

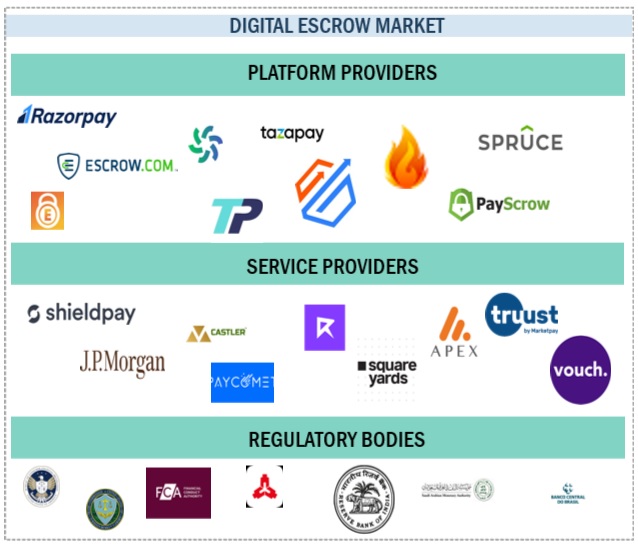

Digital Escrow Market Ecosystem

The Digital Escrow market ecosystem comprises various solutions and service providers along with various regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include are Razorpay (India), Shieldpay (United Kingdom), Escrow.com (US), EscrowPay (India), Castler (India), Transpact (India), Tazapay (Singapore), Truzo (South Africa), J.P. Morgan (US), Paycomet (Spain), Refrens (India), Square Yards (India), Apex Group (Bermuda), EscrowTech (US), Morningstar Escrow (US), Payscrow (US), Spruce (US), Truust (Spain), and Vouch (US).

To know about the assumptions considered for the study, download the pdf brochure

By Offering, Platform segment is expected to hold a higher growth rate during the forecast period.

Digital escrow platforms provide secure, automated solutions in the management of transactions with holding funds or assets in a neutral account until certain terms are met. Enhanced security through blockchain is guaranteed; fraud detection through AI and machine learning capabilities, smart contracts to automatically release funds, and the ability to conduct multi-currency transactions and compliance with regulatory standards for real-time monitoring and reporting. Built-in encryption and biometric authentication protect the sensitive data, and friendly interfaces increase accessibility. Companies such as Razorpay, Shieldpay, Castler, and J.P. Morgan are leading provider of Digital Escrow platforms. Escrow platform by Razorpay specifically designed for online businesses for safe payment processing. Shieldpay specializes in complex B2B transactions, ensuring safe payment handling and escrow services. Castler specializes in the fantasy sports industry with secure fund management and prize payout solutions. Morgan provides a holistic digital treasury platform with capabilities such as an escrow mechanism. They provide easy multicurrency transactions along with full controls over your finance. These and others innovate across all sectors from e-commerce to real estate, then to finance.

By end-use industry, IT & ITeS segment is expected to hold a higher growth rate during the forecast period.

Digital escrow solutions play a critical role in enhancing trust and security in complex transactions for the IT and IT-enabled Services (ITeS) industry. This is especially applicable in software licensing agreements, cloud services, outsourcing contracts, and SaaS subscriptions. This digital escrow platform protects the payments from being released until the service levels are delivered as agreed. They also minimize risks such as non-delivery of services or misuse of intellectual property. With the increased transition to cloud-based infrastructure, digital escrow solutions also support secure data transfers and adherence to regulatory frameworks. Furthermore, they provide transparency by monitoring milestones and deliverables, reducing disputes, and enhancing collaboration between service providers and clients. These also automate the payment release, integrate well with existing IT systems, and enable smooth border transactions that are critical for global IT and ITeS projects. By providing security and certainty, digital escrow solutions promote smoother and more efficient business operations in the IT & ITeS sector.

North America is expected to hold a higher growth rate during the forecast period.

The increasing adoption of secure and efficient digital payment systems, driven by advanced technologies and changing consumer preferences, is shaping the digital escrow landscape in North America. Digital payment options in the U.S., like digital wallets, real-time payments (RTP), and Buy Now, Pay Later (BNPL) services, are becoming increasingly popular because they make transactions faster and more flexible. Companies are integrating blockchain and AI technologies into escrow systems to secure greater transparency and fraud detection. Similarly, in Canada, there’s widespread growth of contactless payments. Cyber security is also emphasized with proper compliance with regulations, coupled with ease of access, as governments and financial institutions look forward to programs that promote electronic funds transfer and mobile payment systems. The U.S. further shows the commitment of the region to innovation in digital payments through the exploration of Central Bank Digital Currencies (CBDCs). This dynamic environment is positioning digital escrow solutions to be very useful tools that can ensure trust, mitigate risks, and facilitate transactions across various industries. The growth of cross-border transactions and e-commerce continues an upward trend, and the North American region is ahead in the advancement of secure, user-centric digital escrow systems.

Key Market Players

The major players in the Digital Escrow market are Razorpay (India), Shieldpay (United Kingdom), Escrow.com (US), EscrowPay (India), Castler (India), Transpact (India), Tazapay (Singapore), Truzo (South Africa), J.P. Morgan (US), Paycomet (Spain), Refrens (India), Square Yards (India), Apex Group (Bermuda), EscrowTech (US), Morningstar Escrow (US), Payscrow (US), Spruce (US), Truust (Spain), and Vouch (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their Digital Escrow market footprint.

Recent Developments:

- In October 2024, The Federation of Indian Fantasy Sports (FIFS) partnered with Castler to strengthen the rapidly growing fantasy sports industry. This partnership aims to tackle key financial challenges in the sector while promoting transparency and trust. Castler’s escrow solution, which securely holds funds in a neutral account until specified conditions are met, ensures the safe management of pooled acknowledgment amounts. These funds are released only after fulfilling all contractual obligations, such as prize payouts, taxes, and operational expenses, providing a robust financial framework for the industry.

- In August 2024, Atlas partnered with J.P. Morgan Payments to implement a comprehensive solution using J.P. Morgan Access, a digital treasury management platform. This solution provides Atlas with full visibility and control over 66 accounts associated with the Vista Alegre project, including escrow and DDA accounts. Features like automated reporting, entitlement security, and direct disbursement capabilities in USD and BRL streamline and enhance their treasury operations.

- In December 2022, Shieldpay partnered with payment service provider Mollie. The partnership will enable Shieldpay clients to have their payment needs fully digitized, from routine payments requiring straight-through processing up to high-value, complex B2B transactions. Businesses will also have access to Mollie’s payment data, bespoke dashboards comprehensive reporting features, and more, alongside the security of Shieldpay’s digital escrow solution.

Frequently Asked Questions (FAQ):

What is the definition of the Digital Escrow market?

Digital escrow is a secure online service that acts as a neutral third party to facilitate transactions by holding funds, assets, or documents until all agreed-upon conditions between the involved parties are met. It ensures trust, mitigates risks, and provides a transparent process for transactions, particularly in high-value or complex deals, by safeguarding payments and releasing them only after fulfilling the contractual obligations.

What is the market size of the Digital Escrow market?

The Digital Escrow market is estimated at USD XX billion in 2024 to USD XX billion by 2029 at a compound annual growth rate (CAGR) of XX% from 2024 to 2029.

What are the major drivers in the Digital Escrow market?

The major drivers in the Digital Escrow market are the rising demand for secure online transactions in e-commerce and real estate, the growing need for fraud prevention and transaction transparency, and the adoption of advanced technologies like blockchain and AI for efficiency.

Who are the key players operating in the Digital Escrow market?

The key market players profiled in the Digital Escrow market include Razorpay (India), Shieldpay (United Kingdom), Escrow.com (US), EscrowPay (India), Castler (India), Transpact (India), Tazapay (Singapore), Truzo (South Africa), J.P. Morgan (US), Paycomet (Spain), Refrens (India), Square Yards (India), Apex Group (Bermuda), EscrowTech (US), Morningstar Escrow (US), Payscrow (US), Spruce (US), Truust (Spain), and Vouch (US).

What are the key technology trends prevailing in the Digital Escrow market?

Key trends prevailing in the Digital Escrow market include Blockchain integration, which enhances security and offers transparency and traceability by offering decentralized and tamper-proof transaction records. AI and machine learning facilitate fraud detection, identity verification, and risk assessment through intelligent pattern recognition and automation. Smart contracts automate escrow agreements, enabling real-time execution while reducing reliance on manual processes.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Digital Escrow Market