Digital Circular Economy Market by Offering (Software (Circular Design & Prototyping Software, Blockchain & Traceability Software), Services), Application (Digital Resale & Reuse), Technology (IoT, AI & ML), Vertical and Region - Global Forecast to 2028

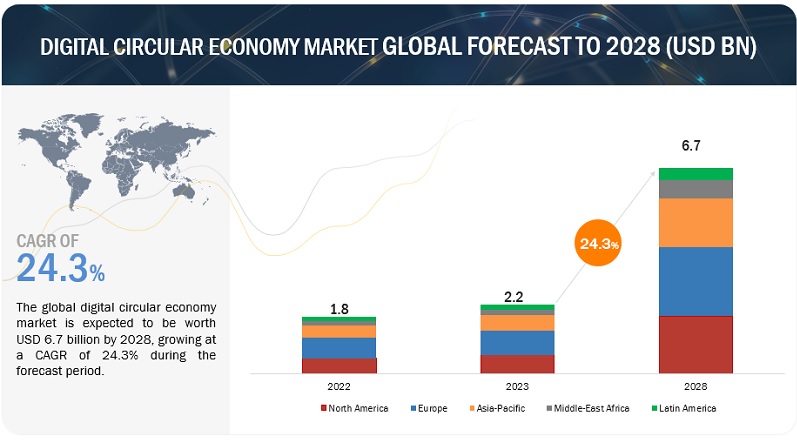

[464 Pages Report] The digital circular economy market is experiencing exponential growth, with projections indicating a substantial expansion in market size from USD 2.2 billion in 2023 to USD 6.7 billion by 2028. This significant growth is expected to occur at a CAGR of 24.3% over the forecast period (2023–2028). The market shift is driven by a confluence of factors, such as technological advancements, particularly in the areas of IoT, blockchain, and data analytics, which play a pivotal role in optimizing resource usage and promoting sustainability. Rising environmental consciousness among consumers and stringent regulatory frameworks further propel the market's expansion, as businesses seek sustainable solutions to meet evolving demands. The shift towards digital platforms for product lifecycle management and the increasing collaboration between businesses to create closed-loop systems are also driving forces, fostering a dynamic landscape where economic growth aligns seamlessly with environmental stewardship.

Technology Roadmap of Digital Circular Economy Market

The digital circular economy market report covers the technology roadmap, with insights into the short-term and long-term developments.

-

Short-term (1–5 years):

- Circular Economy Software Adoption: Adopting specialized software for resource management, including resource tracking, product lifecycle analysis, and waste stream optimization.

- IoT Integration: Incorporating IoT devices and sensors for real-time resource monitoring and data collection.

- AI and Machine Learning for Resource Optimization: Utilizing AI and machine learning for predictive analytics, demand forecasting, and resource efficiency improvement.

- Blockchain for Transparency: Implementing blockchain technology to enhance transparency and traceability in supply chains and circular material flows.

- Circular Material Tracking: Using technology to track the lifecycle of materials, including recyclability and remanufacturing potential.

- Sustainable Packaging Design Software: Adopting software for designing environmentally friendly packaging and reducing single-use plastics.

-

Long-term (5+ years):

- Circular Design Tools: Integrating circular design software for the creation of products and systems with circular economy principles.

- Autonomous Circular Systems: Developing autonomous systems and robotics for resource recovery, recycling, and remanufacturing with minimal human intervention.

- Circular Economy Certification: Establishing global standards and certifications for circular economy practices to ensure compliance and consumer trust.

- Sustainable Product Lifecycle Management: Implementing software for managing product lifecycles with a focus on sustainability and end-of-life considerations.

- Renewable Energy Integration: Advancing renewable energy integration into operations and supply chains to reduce environmental impact.

- Carbon Capture and Utilization Technologies: Employing technologies to capture and utilize carbon emissions, contributing to circularity and sustainability.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Surge in E-waste awareness is fueling the digital circular economy market growth

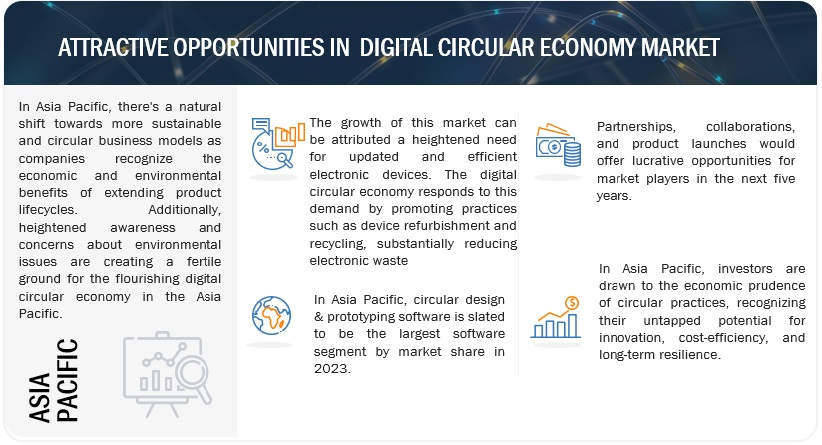

The surge in e-waste awareness is propelling significant growth in the digital circular economy market. As individuals and businesses become increasingly conscious of the environmental impact of electronic waste, there is a growing shift towards sustainable practices. This heightened awareness not only fosters responsible disposal of electronic devices but also drives the demand for innovative solutions within the digital circular economy. Companies that embrace eco-friendly practices and contribute to the recycling and refurbishing of electronic products are positioned to thrive in this evolving market, creating a win-win scenario for both the environment and the economy.

Restraint: Legacy linear thinking is hindering the growth of digital circular economy evolution

The evolution of circular business models is encountering a roadblock in the form of legacy linear thinking. As industries grapple with the imperative to embrace sustainability, traditional linear approaches are proving to be hindrances. The inertia of ingrained practices often resists the paradigm shift towards circularity, impeding the adoption of eco-friendly and resource-efficient business models. Overcoming this hurdle requires a fundamental mindset shift, acknowledging that the linear take-make-dispose model is no longer tenable. Businesses that break free from legacy thinking and embrace circularity not only contribute to a more sustainable future but also position themselves as leaders in a rapidly evolving economic landscape.

Opportunity: The flourishing market for refurbished electronics presents a compelling business opportunity

In the ever-evolving landscape of consumer electronics, the flourishing market for refurbished devices presents a compelling business opportunity. As sustainability gains prominence in consumer choices, the demand for high-quality, pre-owned electronics is on the rise. The refurbished electronics market not only offers budget-friendly alternatives to consumers but also contributes significantly to reducing electronic waste. Entrepreneurs entering this space have the chance to tap into a growing circular economy market, providing eco-conscious consumers with reliable and affordable electronic options. Embracing the trend of refurbished electronics aligns not only with economic considerations but also with the broader ethos of environmental responsibility, making it a win-win scenario for both businesses and conscientious consumers alike.

Challenge: Navigating volatile consumer preferences in a rapidly shifting market

A significant challenge impeding the growth of the digital circular economy market revolves around the intricacies of consumer behavior and awareness. Despite the increasing global emphasis on sustainability, a substantial portion of consumers remains uninformed or hesitant about adopting circular practices. The lack of awareness regarding the benefits of circular economy models, including the potential cost savings and environmental advantages, poses a considerable hurdle. Additionally, there exists a perception challenge, with some consumers associating refurbished or recycled products with lower quality. Overcoming these barriers requires a multifaceted approach, involving targeted educational campaigns, transparent communication about product quality, and collaborative efforts from industry stakeholders to establish and promote the credibility of circular practices. Addressing these challenges is paramount for fostering widespread acceptance of circular economy principles and unlocking the full potential of the digital circular economy market.

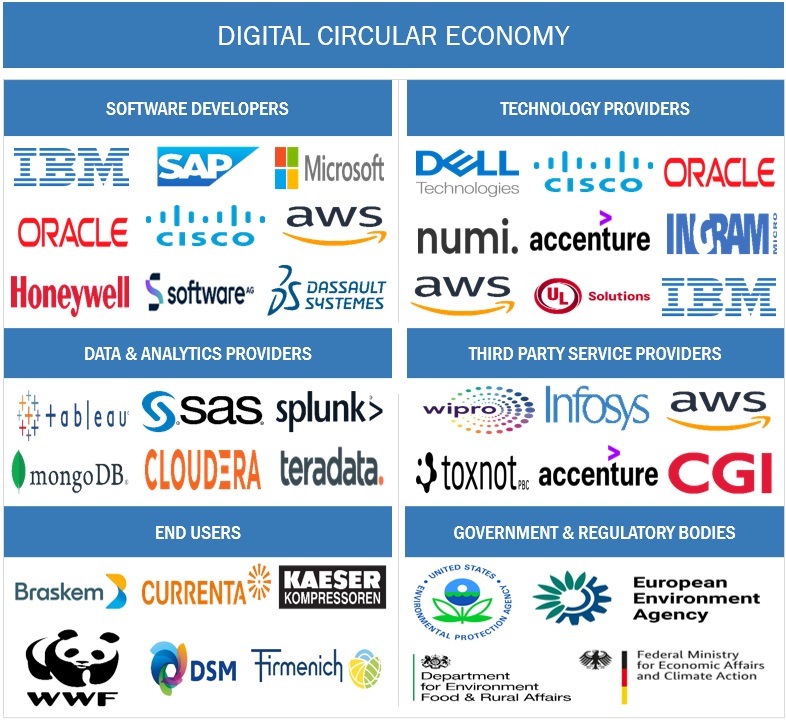

Digital Circular Economy Market Ecosystem

By offering, Product Lifecycle Management (PLM) software segment to account for a larger market size during forecast period

PLM software plays a pivotal role in the digital circular economy market by optimizing and streamlining the various stages of a product's life cycle. PLM software facilitates the seamless integration of circular economy principles into product development, production, and end-of-life processes. It allows businesses to track and manage product information, collaborate across different departments, and make informed decisions throughout the entire product life cycle. This is particularly crucial in the digital circular economy, where the emphasis is on designing products that are durable, easily repairable, and recyclable. Another key aspect of PLM in the digital circular economy is the ability to manage and optimize the use of materials. PLM systems enable companies to make informed decisions about the selection and sourcing of materials, ensuring that they align with circular economy goals such as recyclability and reduced environmental impact.

By technology, IoT segment to hold the largest market share during the forecast period

In the digital circular economy, IoT facilitates the creation of "smart" and interconnected products that contribute to circular principles. Smart sensors embedded in products enable continuous monitoring of usage patterns, performance metrics, and maintenance needs. This data-driven approach allows for predictive maintenance, reducing the likelihood of unexpected failures and extending the lifespan of products. Furthermore, IoT enables the concept of product-as-a-service (PaaS) models within the circular economy. Instead of traditional ownership, businesses can provide services based on the actual usage of products. This shift encourages longevity, repairability, and upgradability, aligning with circular economy principles by promoting the idea of access over ownership.

In waste management, IoT technologies enhance recycling processes by enabling smart sorting and tracking of materials. This not only improves the efficiency of recycling operations but also enhances the quality of recycled materials, contributing to a closed-loop system.

By application, digital resale & reuse segment to register the fastest growth rate during the forecast period

Digital resale platforms have gained immense popularity, offering consumers the opportunity to extend the life cycle of their possessions by selling or exchanging them. These platforms provide a convenient and accessible way for individuals to find new homes for their used items, reducing the overall demand for new products and minimizing the environmental impact associated with manufacturing. Key features of digital resale and reuse platforms include user-friendly interfaces, secure payment systems, and mechanisms for verifying the condition of pre-owned items. These platforms often leverage advanced algorithms to match buyers and sellers efficiently, enhancing the overall user experience and promoting widespread adoption.

Moreover, the concept of digital reuse goes beyond traditional resale. It includes platforms and applications that enable consumers to rent or lease products for temporary use, emphasizing access over ownership. This shift towards a "sharing economy" model promotes the efficient utilization of resources, as multiple users can benefit from the same product throughout its life cycle.

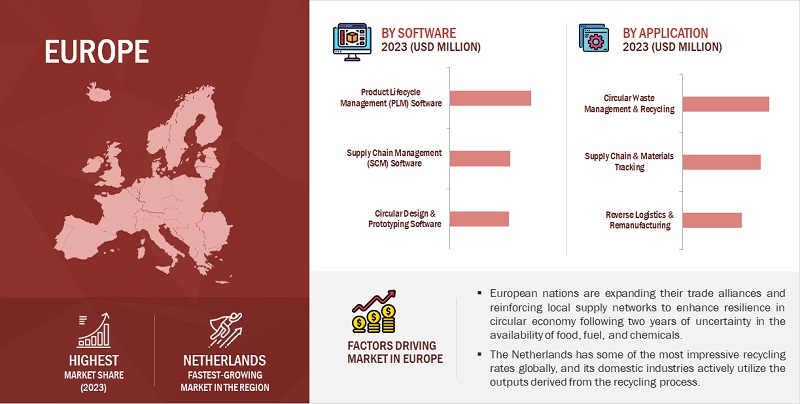

By region, Europe to hold the largest market size during the forecast period

Europe has emerged as the leading region in the digital circular economy market due to a combination of proactive regulatory initiatives, a strong commitment to sustainability, and a robust technological infrastructure. The European Union (EU) has been at the forefront of implementing policies that promote circular economy principles, encouraging the efficient use of resources and the reduction of environmental impact. One of the key drivers of Europe's leadership in the digital circular economy is the Circular Economy Action Plan, introduced by the European Commission. This ambitious strategy sets clear targets for waste reduction, recycling, and resource efficiency, creating a conducive environment for businesses to embrace circular practices. The regulatory framework encourages innovation and the adoption of digital technologies to optimize resource use and minimize waste.

Furthermore, European consumers exhibit a heightened awareness and commitment to sustainable living, driving demand for products and services aligned with circular economy principles. This demand has spurred the growth of digital platforms facilitating product resale, sharing, and reuse, contributing to the region's leadership in the digital circular economy market.

Europe's well-established technological infrastructure also plays a crucial role. The region boasts advanced digital capabilities, facilitating the integration of technologies such as the Internet of Things (IoT), artificial intelligence, and blockchain into circular economy practices. These technologies enhance transparency in supply chains, enable efficient recycling processes, and support the development of smart, connected products that align with circular principles.

Key Market Players

The digital circular economy solution and service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships, and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the digital circular economy market include SAP (Germany), Oracle (US), Landbell Group (Germany), Anthesis Group (UK), and IBM (US) along with other key players such as iPoint Systems (Germany), Rheaply (US), One Click LCA (Finland), and Lenzing (Austria).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD (Billion) |

|

Segments covered |

Offering, Technology, Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

SAP (Germany), Capgemini (France), Dassault Systemes (France), Cisco (US), IBM (US), Oracle (US), KPMG (Netherlands), Software AG (Germany), Siemens-Advanta (Germany), Ingram Micro (US), AWS (US), PwC (UK), Honeywell (US), Accenture (Ireland), Lenzing (Austria), Hitachi (Japan), Landbell Group (Germany), iPoint Systems (Germany), One Click LCA (Finland), TUV SUD (Germany), Suez Group (France), numi.circular (Germany), Treeni (India), UL Solutions (US), Anthesis Group (UK), Circular in Motion (Netherlands), Rheaply (US), proSense Consulting (Austria), geoFluxus (Netherlands), Circulor (UK), and Reflaunt (Singapore). |

This research report categorizes the digital circular economy market based on offering, technology, application, vertical, and region

By Offering:

-

Software

-

Supply Chain Management (SCM) Software

- Sustainable Sourcing Software

- IoT & Sensor Integration Software

- Compliance & Reporting Software

-

Product Lifecycle Management (PLM) Software

- Eco-Design & Prototyping Software

- Circular Manufacturing Software

- Sustainable Material Selection Software

-

Blockchain And Traceability Software

- Product Traceability Software

- Sustainability Certification Software

- Supply Chain Transparency Software

-

Circular Design And Prototyping Software

- Circular Design & Lifecycle Assessment Software

- Digital Prototyping & Simulation Software

- Sustainable Material Modeling Software

-

3D Printing Software

- 3D Printing Process Optimization Software

- Customized Product Design Software

-

Sharing & Machining Software

- Resource Sharing Software

- Digital Marketplaces

- Product Life Extension Software

- Recovery & Recycling Software

- Other Software

-

Supply Chain Management (SCM) Software

-

Services

- Circular Economy Strategy Consulting Services

- Sustainability & Environmental Consulting Services

- Supply Chain Optimization Services

- Product-as-a-Service

- Recycling & Regulatory Compliance Services

- Other Services

By Technology:

-

Blockchain And Distributed Ledger Technology (DLT)

-

Blockchain-Based Supply Chain

- Supply Chain Transparency

- Provenance Tracking

- Smart Contracts For Resource Transactions

-

Dlt-Enabled Asset Tokenization

- Tokenized Asset Management

- Digital Tokens For Circular Economy Products

- Token Exchange Platforms

-

Blockchain-Based Supply Chain

-

IoT

-

IoT-Enabled Product Monitoring

- Remote Product Health Monitoring

- Condition-Based Maintenance

- Product Usage Analytics

-

Smart Recycling Bins & Waste Management

- Smart Waste Collection Scheduling

- Recycling Sorting Automation

- Iot-Enhanced Recycling Centers

-

IoT-Enabled Product Monitoring

-

AI & ML

-

Predictive Maintenance And Quality Control

- Predictive Equipment Maintenance

- Quality Assurance Algorithms

- Anomaly Detection

-

Demand Forecasting

- Predictive Demand Models

- Inventory Optimization

- Production Planning

-

Predictive Maintenance And Quality Control

-

AR & VR

- AR For Design And Prototyping

- Augmented Product Design

- Virtual Prototyping

- Interactive Design Collaboration

-

VR-Based Training

- Virtual Employee Training

- Safety Training Simulations

- Remote Expert Assistance

-

Cloud Computing

- Cloud-Based Resource Planning

- Cloud-Based Circular Supply Chain Platforms

-

Big Data Analytics

- Resource Utilization Analytics

- Circular Economy Performance Metrics

- Circular Economy Data Platforms

- Data Integration And Management

- Advanced Circular Analytics

- Other Technologies

By Application:

-

Supply Chain And Materials Tracking

- Product Lifecycle Traceability

- Circular Supply Chain Optimization

- Eco-Friendly Transportation Management

-

Resource Optimization And Efficiency

- Resource Allocation And Utilization

- Energy And Water Management

- Waste Reduction And Recycling Efficiency

-

Digital Resale And Reuse

- Online Resale Marketplaces

- Product Exchange Networks

- Circular Product Certification

-

Reverse Logistics And Remanufacturing

- Collection And Sorting Services

- Remanufacturing And Refurbishment

- Waste-To-Resource Conversion

-

Circular Economy Reporting And Compliance

- Circular Economy Performance Reporting

- Sustainability Certifications Management

- Regulatory Compliance

-

Circular Waste Management And Recycling

- Waste Sorting And Recycling Apps

- Circular Waste-To-Energy Solutions

- Advanced Recycling Technologies

-

Smart Material Selection & Testing

- Material Analytics & Selection

- Material Performance Testing

- Circular Materials R&D

- Other Applications

By Vertical:

-

Consumer Electronics

- Circular Electronics Design

- Electronics Reuse And Refurbishment

- E-Waste Recycling And Recovery

- Others

-

IT & Telecom

- Circular IT Equipment Management

- Data Center Efficiency

- Telecom Network Sustainability

- Others

-

Automotive

- Circular Auto Manufacturing

- Remanufacturing And Auto Parts Reuse

- End-Of-Life Vehicle Recycling

- Others

-

Manufacturing

- Circular Manufacturing Processes

- Material And Resource Efficiency

- Sustainable Supply Chain Management

- Others

-

Construction And Building

- Sustainable Building Design

- Construction Materials Recycling

- Building Demolition And Deconstruction

- Others

-

Healthcare And Medical Devices

- Medical Device Life Extension

- Hospital Waste Management

- Circular Healthcare Equipment

- Others

-

Energy & Utilities

- Renewable Energy Integration

- Efficient Utility Operations

- Grid Management And Sustainability

- Others

-

Chemicals And Materials

- Circular Materials R&D

- Chemical Recycling

- Material Reuse And Upcycling

- Others

-

Fashion & Apparel

- Sustainable Fashion Design

- Clothing Rental And Resale

- Textile Recycling And Upcycling

- Others

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Singapore

- Australia & New Zealand (ANZ)

- Rest of Asia Pacific

-

Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Turkey

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In October 2023, SAP upgraded its SAP Responsible Design and Production Suite. The latest version of SAP Responsible Design and Production includes updated EPR reporting capability to support the enhanced reporting and integration with multiple ERP with non-harmonized identifiers, augmenting its digital circular economy capabilities.

- In October 2023, Honeywell and GranBio Technologies partnered together to co-produce carbon-neutral sustainable aviation fuel (SAF) from biomass residues at a US-based demonstration plant. Honeywell aims to leverage its renewable energy expertise in generating SAF for strengthening its position as a major circular economy vendor across aerospace and aviation sector.

- In September 2023, Capgemini acquired HDL Design House, a leading silicon design and verification services provider. The synergy between silicon services and digital circular economy is profound, as advanced silicon design plays a pivotal role in optimizing resource usage and fostering sustainability. This acquisition equips Capgemini to offer innovative solutions that align seamlessly with circular economy practices, reinforcing its commitment to driving sustainable digital transformations in the evolving business landscape.

- In June 2023, SAP and Versuni announced a global partnership focused on sustainability and circular economy. With the SAP Sustainability Control Tower software, a digital tool for ESG management based on real-time data, Versuni will be able to promote holistic management by setting goals, monitoring progress, and gaining insights from data, generating robust and auditable ESG reports, as well as improvement actions.

- In April 2023, Cisco and Leonardo entered into a strategic MoU, aimed at boosting cooperation between Cisco and Leonardo in various areas. Both entities will be co-developing solutions in sustainable technology fields such as the green transition and sustainable solutions for logistics and transportation markets.

Frequently Asked Questions (FAQ):

What is digital circular economy?

Digital circular economy refers to the application of digital technologies and data-driven strategies to enhance the sustainability and efficiency of material and resource flows within the framework of a circular economy. This approach aims to create a closed-loop system where products and materials are designed, produced, consumed, and recycled with minimal waste and maximum reuse. Digital circular economy leverages technologies such as IoT, blockchain, AI, and data analytics to enable transparent, traceable, and optimized resource management, reducing environmental impact and promoting the longevity of products throughout their lifecycles.

What is the total CAGR expected to be recorded for the digital circular economy market during 2023-2028?

The market is expected to record a CAGR of 24.3% from 2023-2028.

Which are the major growth enablers catalyzing the digital circular economy market?

The digital circular economy market is being majorly driven by factors such Increasing awareness among consumers about environmental sustainability, growing demand for products and services that align with circular principles, and government regulations that establish clear standards and targets for sustainable practices and resource efficiency.

Which are the top three digital circular economy software prevailing in the digital circular economy market?

Supply Chain Management (SCM) software, Product Lifecycle Management (PLM) software, and Circular Design & Prototyping Software are among the top-3 digital circular economy software in terms of adoption. Together, these software solutions empower businesses to integrate circular economy principles into their operations, fostering environmentally conscious and economically viable practices.

Who are the key vendors in the digital circular economy market?

Some major players in the digital circular economy market include SAP (Germany), Capgemini (France), Dassault Systemes (France), Cisco (US), IBM (US), Oracle (US), KPMG (Netherlands), Software AG (Germany), Siemens-Advanta (Germany), Ingram Micro (US), AWS (US), PwC (UK), Honeywell (US), Accenture (Ireland), Lenzing (Austria), Hitachi (Japan), Landbell Group (Germany), iPoint Systems (Germany), One Click LCA (Finland), TUV SUD (Germany), Suez Group (France), numi.circular (Germany), Treeni (India), UL Solutions (US), Anthesis Group (UK), Circular in Motion (Netherlands), Rheaply (US), proSense Consulting (Austria), geoFluxus (Netherlands), Circulor (UK), Reflaunt (Singapore).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Surge in eWaste awareness- AI-driven recycling tech to catalyze resource reutilization- Stringent government mandates to propel circularity adoption- Eco-conscious consumers to drive demand for sustainable digital productsRESTRAINTS- High upfront costs to hamper circular economy startups- Legacy linear thinking to hinder circular business evolution- Lack of standardized circularity metrics to confound progressOPPORTUNITIES- Unlocking new revenue streams by capitalizing on market for upcycled tech gadgets- Cross-industry alliances foster circular innovation waves- Flourishing market for refurbished electronics to present compelling business opportunity- Cost efficiencies through optimized resource utilizationCHALLENGES- Managing intricate supply chain and reverse logistics- Balancing durability and quality in circular tech design- Navigating volatile consumer preferences in shifting market

- 5.3 EVOLUTION OF DIGITAL CIRCULAR ECONOMY

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM/MARKET MAPDIGITAL CIRCULAR ECONOMY SOFTWARE DEVELOPERSDIGITAL CIRCULAR ECONOMY TECHNOLOGY PROVIDERSDIGITAL CIRCULAR ECONOMY DATA & ANALYTIC PROVIDERSTHIRD-PARTY SERVICE PROVIDERSEND USERSGOVERNMENT & REGULATORY BODIES

- 5.6 INVESTMENT LANDSCAPE

- 5.7 BEST PRACTICES IN DIGITAL CIRCULAR ECONOMY MARKET

-

5.8 CASE STUDY ANALYSISBRASKEM POWERED ACTIONABLE CLIMATE ROADMAP FOR SUSTAINABLE GROWTH WITH HELP OF ACCENTUREWWF IDENTIFIED OPPORTUNITIES FOR IMPROVEMENT IN MANAGEMENT OF PLASTIC WASTE WITH HELP OF ANTHESIS GROUPEARLY LEAKAGE DETECTION WITH USE OF TRENDMINER BY SOFTWARE AGKAESER KOMPRESSOREN AUTOMATED COMPLIANCE PROCESSES USING IPOINT’S SYSTEMSTREENI ALLOWED DSM TO COLLECT AND MANAGE DATA EFFICIENTLYESTABLISHING PROCESS THINKING IN RESEARCH AND EDUCATION FOR MUNICH UNIVERSITY WITH IGRAFX SOLUTIONS

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- IoT- Big data analytics- Blockchain- AI & ML- AR/VR- Cloud computingADJACENT TECHNOLOGIES- Robotics- Nanotechnology- Sustainable manufacturing- Digital twinCOMPLIMENTARY TECHNOLOGIES- 3D printing- Smart sensor technologies- Renewable energy storage

-

5.10 TARIFF AND REGULATORY LANDSCAPETARIFF RELATED TO DIGITAL CIRCULAR ECONOMY SOFTWAREREGULATORY LANDSCAPE- Regulatory bodies, government agencies, and other organizationsREGULATIONS: DIGITAL CIRCULAR ECONOMY MARKET- North America- Europe- Asia Pacific- Middle East & Africa- Latin America

-

5.11 PATENT ANALYSISMETHODOLOGYPATENTS FILED, BY DOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top 10 applicants in digital circular economy market

-

5.12 PRICING ANALYSISAVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY SOFTWARE TYPEINDICATIVE PRICING ANALYSIS, BY DIGITAL CIRCULAR ECONOMY VENDORS

-

5.13 TRADE ANALYSISIMPORT SCENARIO OF COMPUTER SOFTWAREEXPORT SCENARIO OF COMPUTER SOFTWARE

- 5.14 KEY CONFERENCES AND EVENTS

-

5.15 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITION RIVALRY

- 5.16 DIGITAL CIRCULAR ECONOMY TECHNOLOGY ROADMAP

-

5.17 DIGITAL CIRCULAR ECONOMY BUSINESS MODELSDIGITAL MARKETPLACES MODELSHARING ECONOMY MODELPRODUCT-AS-A-SERVICE MODELREUSE AND RECYCLING SERVICES MODELENVIRONMENTAL CREDITS & CARBON MARKETS MODEL

-

5.18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

5.19 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONAPPLICATION: DIGITAL CIRCULAR ECONOMY MARKET DRIVERS

-

6.2 SUPPLY CHAIN & MATERIAL TRACKINGFOSTERING RESPONSIBLE PRODUCTION AND EFFICIENT RESOURCE USE ACROSS PRODUCT LIFECYCLEPRODUCT LIFECYCLE TRACEABILITYCIRCULAR SUPPLY CHAIN OPTIMIZATIONECO-FRIENDLY TRANSPORTATION MANAGEMENT

-

6.3 RESOURCE OPTIMIZATION & EFFICIENCYHARNESSING DIGITAL TECHNOLOGIES TO MAXIMIZE RESOURCE UTILIZATION AND MINIMIZE ECOLOGICAL FOOTPRINTRESOURCE ALLOCATION & UTILIZATIONENERGY & WATER MANAGEMENTWASTE REDUCTION & RECYCLING EFFICIENCY

-

6.4 DIGITAL RESALE & REUSECREATING CULTURE OF SUSTAINABLE CONSUMPTION AND REDUCING DEMAND FOR NEW PRODUCTS WITH DIGITAL RESALE & REUSEONLINE RESALE MARKETPLACESPRODUCT EXCHANGE NETWORKSCIRCULAR PRODUCT CERTIFICATION

-

6.5 REVERSE LOGISTICS & REMANUFACTURINGEFFICIENT TRACKING AND MANAGEMENT OF REVERSE LOGISTICS TO ENCOURAGE RECYCLING AND UPCYCLINGCOLLECTION & SORTING SERVICESREMANUFACTURING & REFURBISHMENTWASTE-TO-RESOURCE CONVERSION

-

6.6 CIRCULAR ECONOMY REPORTING & COMPLIANCEFACILITATING TRANSPARENT COMMUNICATION AND EFFICIENT CERTIFICATION MANAGEMENT, CONTRIBUTING TO CIRCULAR ECONOMYCIRCULAR ECONOMY PERFORMANCE REPORTINGSUSTAINABILITY CERTIFICATIONS MANAGEMENTREGULATORY COMPLIANCE

-

6.7 CIRCULAR WASTE MANAGEMENT & RECYCLINGINTEGRATING DIGITAL SOLUTIONS TO ENHANCE WASTE MANAGEMENT AND OPTIMIZE RESOURCE RECOVERYWASTE SORTING & RECYCLING APPSCIRCULAR WASTE-TO-ENERGY SOLUTIONSADVANCED RECYCLING TECHNOLOGIES

-

6.8 SMART MATERIAL SELECTION & TESTINGNEED FOR DEVELOPMENT AND ADOPTION OF MORE SUSTAINABLE AND CIRCULAR MATERIALSMATERIAL ANALYTICS & SELECTIONMATERIAL PERFORMANCE TESTINGCIRCULAR MATERIALS R&D

- 6.9 OTHER APPLICATIONS

-

7.1 INTRODUCTIONTECHNOLOGY: DIGITAL CIRCULAR ECONOMY MARKET DRIVERS

-

7.2 BLOCKCHAIN & DISTRIBUTED LEDGER TECHNOLOGY (DLT)BLOCKCHAIN & DISTRIBUTED LEDGER TO HELP BUSINESSES SECURE SUPPLY CHAIN TO ENABLE ASSET TOKENIZATIONBLOCKCHAIN-BASED SUPPLY CHAIN- Supply chain transparency- Provenance tracking- Smart contracts for resource transactionsDLT-ENABLED ASSET TOKENIZATION- Tokenized asset management- Digital tokens for circular economy products- Token exchange platforms

-

7.3 IOTSUSTAINABLE AND RESPONSIVE APPROACH TO RESOURCE UTILIZATION AND ENVIRONMENTAL SUPERVISIONIOT-ENABLED PRODUCT MONITORING- Remote product health monitoring- Condition-based maintenance- Product usage analyticsSMART RECYCLING BINS & WASTE MANAGEMENT- Smart waste collection scheduling- Recycling sorting automation- IoT-enhanced recycling centers

-

7.4 AI & MLAI & ML IN DIGITAL CIRCULAR ECONOMY ENHANCE OPERATIONAL EFFICIENCY AND CONTRIBUTE TO OVERARCHING GOALS OF SUSTAINABILITYPREDICTIVE MAINTENANCE & QUALITY CONTROL- Predictive equipment maintenance- Quality assurance algorithms- Anomaly detectionDEMAND FORECASTING- Predictive demand models- Inventory optimization- Production planning

-

7.5 AR & VRINTEGRATION OF AR & VR TECHNOLOGIES TO ENABLE REAL-TIME DATA VISUALIZATION AND BETTER DECISION-MAKINGAR FOR DESIGN & PROTOTYPING- Augmented Product Design- Virtual prototyping- Interactive design collaborationVR-BASED TRAINING- Virtual employee training- Safety training simulations- Remote expert assistance

-

7.6 CLOUD COMPUTINGOPTIMIZATION OF ENERGY CONSUMPTION, TRACKING OF SUSTAINABLE PRACTICES, AND OVERALL RESOURCE UTILIZATIONCLOUD-BASED RESOURCE PLANNINGCLOUD-BASED CIRCULAR SUPPLY CHAIN PLATFORMS

-

7.7 BIG DATA ANALYTICSBIG DATA ANALYTICS HELPS TO IDENTIFY AREAS FOR IMPROVEMENT AND IMPLEMENTING MORE SUSTAINABLE PRACTICESRESOURCE UTILIZATION ANALYTICSCIRCULAR ECONOMY PERFORMANCE METRICSCIRCULAR ECONOMY DATA PLATFORMSDATA INTEGRATION & MANAGEMENTADVANCED CIRCULAR ANALYTICS

- 7.8 OTHER TECHNOLOGIES

-

8.1 INTRODUCTIONVERTICAL: DIGITAL CIRCULAR ECONOMY MARKET DRIVERS

-

8.2 CONSUMER ELECTRONICSTRANSFORMING CONSUMER ELECTRONICS LANDSCAPE WITH LONGEVITY AND REUSABILITYCIRCULAR ELECTRONICS DESIGNELECTRONICS REUSE & REFURBISHMENTEWASTE RECYCLING & RECOVERYOTHER CONSUMER ELECTRONICS APPLICATIONS

-

8.3 IT & TELECOMEXTENDING LIFE OF IT & TELECOM EQUIPMENT WITH HELP OF DIGITAL CIRCULAR ECONOMYCIRCULAR IT EQUIPMENT MANAGEMENTDATA CENTER EFFICIENCYTELECOM NETWORK SUSTAINABILITYOTHER IT & TELECOM APPLICATIONS

-

8.4 AUTOMOTIVEADOPTING PRINCIPLES OF CIRCULAR DESIGN AND SUSTAINABLE MATERIALS IN AUTOMOTIVE APPLICATIONSCIRCULAR AUTO MANUFACTURINGREMANUFACTURING & AUTO PARTS REUSEEND-OF-LIFE VEHICLE RECYCLINGOTHER AUTOMOTIVE APPLICATIONS

-

8.5 MANUFACTURINGDIGITAL TECHNOLOGIES FACILITATE TRANSPARENCY AND TRACEABILITY, ALLOWING MANUFACTURERS TO MAKE INFORMED DECISIONSCIRCULAR MANUFACTURING PROCESSESMATERIAL & RESOURCE EFFICIENCYSUSTAINABLE SUPPLY CHAIN MANAGEMENTOTHER MANUFACTURING APPLICATIONS

-

8.6 CONSTRUCTION & BUILDINGTECHNOLOGY-DRIVEN SOLUTIONS TO CREATE SUSTAINABLE AND RESOURCE-EFFICIENT STRUCTURESSUSTAINABLE BUILDING DESIGNCONSTRUCTION MATERIALS RECYCLINGBUILDING DEMOLITION & DECONSTRUCTIONOTHER BUILDING & CONSTRUCTION APPLICATIONS

-

8.7 HEALTHCARE & MEDICAL DEVICESENVIRONMENTALLY FRIENDLY PROCESSES FOR DISPOSAL AND RECYCLING OF MEDICAL WASTEMEDICAL DEVICE LIFE EXTENSIONHOSPITAL WASTE MANAGEMENTCIRCULAR HEALTHCARE EQUIPMENTOTHER HEALTHCARE APPLICATIONS AND MEDICAL DEVICES

-

8.8 ENERGY & UTILITIESINCREASING USE OF DIGITAL TECHNOLOGIES IN SMART GRID MANAGEMENT AND RENEWABLE ENERGY INTEGRATION IS BOOSTING CIRCULAR ECONOMY PRACTICESRENEWABLE ENERGY INTEGRATIONEFFICIENT UTILITY OPERATIONSGRID MANAGEMENT & SUSTAINABILITYOTHER ENERGY & UTILITY APPLICATIONS

-

8.9 CHEMICALS & MATERIALSAIM TO REPLACE TRADITIONAL MODELS WITH MORE SUSTAINABLE ALTERNATIVES, PROMOTING RESOURCE EFFICIENCYCIRCULAR CHEMICALS R&DCHEMICAL RECYCLINGMATERIAL REUSE & UPCYCLINGOTHER CHEMICAL & MATERIAL APPLICATIONS

-

8.10 FASHION & APPARELINTEGRATING SUSTAINABILITY INTO EVERY STAGE OF PRODUCT LIFECYCLESUSTAINABLE FASHION DESIGNCLOTHING RENTAL & RESALETEXTILE RECYCLING & UPCYCLINGOTHER FASHION & APPAREL APPLICATIONS

- 8.11 OTHER VERTICALS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: DIGITAL CIRCULAR ECONOMY MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Government initiatives and regulatory measures contribute to expansion of digital circular economyCANADA- Canada's vibrant startup ecosystem to contribute to digital transformation of circular practices

-

9.3 EUROPEEUROPE: DIGITAL CIRCULAR ECONOMY MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Embracing digital platforms for efficient resource management and adoption of circular practicesGERMANY- Collaboration between industry, government, and research institutions to promote digital circular economy practicesFRANCE- Increased adoption of digital solutions to optimize resource use, reduce waste, and enhance life cycle of productsITALY- Implementation of advanced technologies to create more connected and sustainable economySPAIN- Investments in research and innovation to drive digital transformation in key sectors of SpainNETHERLANDS- Initiatives to promote circular design, product lifecycle management, and collaborative consumptionREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- With companies increasingly focusing on product life extension, circular design principles of China to gain tractionINDIA- Growing penetration of smartphones and internet access to catalyze integration of digital solutions for circular practicesJAPAN- Japan's strong emphasis on research & development led to emergence of innovative solutions in circular economySOUTH KOREA- Increase in incorporation of circular design principles is contributing to waste reduction throughout lifecycle of goodsSINGAPORE- Digital technologies integrated into waste collection systems to improve efficiency and reduce environmental impactAUSTRALIA & NEW ZEALAND- Investments in technology and sustainable practices play pivotal roles in shaping future of digital circular economyREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTGCC- GCC countries to adopt circular economy approach, focusing on sustainable production and consumption patternsSOUTH AFRICA- Initiatives such as smart grids and digital monitoring systems contribute to more sustainable and circular energy landscapeEGYPT- Shift toward circular economy to present opportunity to enhance economic growth and foster employmentTURKEY- Adopting innovative practices such as product life extension and recycling to help transition toward more sustainable economyREST OF MIDDLE EAST & AFRICA

-

9.6 LATIN AMERICALATIN AMERICA: DIGITAL CIRCULAR ECONOMY MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Robust digital infrastructure and thriving technology sector to bolster growth of digital solutions in circular economyMEXICO- Government Initiatives to create an encouraging environment for businesses focused on circular economy practices growthARGENTINA- Growing tech sector and population with high internet penetrationREST OF LATIN AMERICA

- 10.1 OVERVIEW

- 10.2 KEY PLAYERS STRATEGIES

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 BRAND/PRODUCT COMPARATIVE ANALYSISBRAND/PRODUCT COMPARATIVE ANALYSIS, BY SUPPLY CHAIN MANAGEMENT SOFTWARE- IBM- Circulor- Oracle- iPoint-systemsBRAND/PRODUCT COMPARATIVE ANALYSIS, BY PRODUCT LIFECYCLE MANAGEMENT SOFTWARE- Dassault Systèmes- SAP- Hitachi- HoneywellBRAND/PRODUCT COMPARATIVE ANALYSIS, BY SUSTAINABILITY SOFTWARE- One Click LCA- Treeni- Reflaunt- Rheaply

-

10.6 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.7 COMPANY EVALUATION MATRIX, 2022 (OTHER PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT (OTHER PLAYERS)

-

10.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES & ENHANCEMENTSDEALS

- 10.9 VALUATION AND FINANCIAL METRICS OF KEY DIGITAL CIRCULAR ECONOMY VENDORS

- 11.1 INTRODUCTION

-

11.2 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHONEYWELL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewACCENTURE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDASSAULT SYSTÈMES- Business overview- Products/Solutions/Services offered- Recent developmentsCAPGEMINI- Business overview- Products/Solutions/Services offered- Recent developmentsCISCO- Business overview- Products/Solutions/Services offered- Recent developmentsHITACHI- Business overview- Products/Solutions/Services offered- Recent developmentsAWS- Business overview- Products/Solutions/Services offered- Recent developmentsSOFTWARE AGSIEMENS-ADVANTAPWCANTHESIS GROUPKPMGLANDBELL GROUP

-

11.3 OTHER PLAYERSINGRAM MICROLENZINGIPOINT-SYSTEMSONE CLICK LCATÜV SÜDSUEZ GROUPNUMI.CIRCULARTREENIUL SOLUTIONSCIRCULAR IN MOTIONRHEAPLYPROSENSE CONSULTINGGEOFLUXUSCIRCULORREFLAUNT

- 12.1 INTRODUCTION

-

12.2 ESG REPORTING SOFTWARE MARKETMARKET DEFINITIONMARKET OVERVIEWESG REPORTING SOFTWARE MARKET, BY COMPONENTESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT MODEESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZEESG REPORTING SOFTWARE MARKET, BY VERTICALESG REPORTING SOFTWARE MARKET, BY REGION

-

12.3 GREEN TECHNOLOGY & SUSTAINABILITY MARKETMARKET DEFINITIONMARKET OVERVIEWGREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY COMPONENTGREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGYGREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATIONGREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY DEPLOYMENT MODEGREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY ORGANIZATION SIZEGREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY VERTICALGREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 DIGITAL CIRCULAR ECONOMY MARKET DETAILED SEGMENTATION

- TABLE 2 US DOLLAR EXCHANGE RATE, 2018–2022

- TABLE 3 PRIMARY INTERVIEWS

- TABLE 4 FACTOR ANALYSIS

- TABLE 5 IMPACT OF RECESSION ON GLOBAL DIGITAL CIRCULAR ECONOMY MARKET

- TABLE 6 GLOBAL DIGITAL CIRCULAR ECONOMY MARKET SIZE AND GROWTH RATE, 2018–2022 (USD MILLION, Y-O-Y)

- TABLE 7 GLOBAL DIGITAL CIRCULAR ECONOMY MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y)

- TABLE 8 DIGITAL CIRCULAR ECONOMY MARKET: VALUE CHAIN ANALYSIS

- TABLE 9 ROLE OF PLAYERS IN DIGITAL CIRCULAR ECONOMY MARKET

- TABLE 10 BEST PRACTICES IN DIGITAL CIRCULAR ECONOMY MARKET

- TABLE 11 TARIFF RELATED TO DIGITAL CIRCULAR ECONOMY SOFTWARE, 2022

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 PATENTS FILED, 2013–2023

- TABLE 18 TOP 20 PATENT OWNERS IN DIGITAL CIRCULAR ECONOMY MARKET, 2013–2023

- TABLE 19 LIST OF PATENTS GRANTED IN DIGITAL CIRCULAR ECONOMY MARKET, 2023

- TABLE 20 AVERAGE SELLING PRICE TREND OF KEY PLAYERS: TOP THREE SOFTWARE TYPES

- TABLE 21 INDICATIVE PRICING LEVELS OF DIGITAL CIRCULAR ECONOMY VENDORS

- TABLE 22 DIGITAL CIRCULAR ECONOMY MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 25 DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 26 DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 DIGITAL CIRCULAR ECONOMY MARKET IN SUPPLY CHAIN & MATERIALS TRACKING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 28 DIGITAL CIRCULAR ECONOMY MARKET IN SUPPLY CHAIN & MATERIALS TRACKING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 29 DIGITAL CIRCULAR ECONOMY MARKET IN PRODUCT LIFECYCLE TRACEABILITY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 DIGITAL CIRCULAR ECONOMY MARKET IN PRODUCT LIFECYCLE TRACEABILITY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR SUPPLY CHAIN OPTIMIZATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR SUPPLY CHAIN OPTIMIZATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 DIGITAL CIRCULAR ECONOMY MARKET IN ECO-FRIENDLY TRANSPORTATION MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 DIGITAL CIRCULAR ECONOMY MARKET IN ECO-FRIENDLY TRANSPORTATION MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 DIGITAL CIRCULAR ECONOMY MARKET IN RESOURCE OPTIMIZATION & EFFICIENCY, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 36 DIGITAL CIRCULAR ECONOMY MARKET IN RESOURCE OPTIMIZATION & EFFICIENCY, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 37 DIGITAL CIRCULAR ECONOMY MARKET IN RESOURCE ALLOCATION & UTILIZATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 DIGITAL CIRCULAR ECONOMY MARKET IN RESOURCE ALLOCATION & UTILIZATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 DIGITAL CIRCULAR ECONOMY MARKET IN ENERGY & WATER MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 DIGITAL CIRCULAR ECONOMY MARKET IN ENERGY & WATER MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 DIGITAL CIRCULAR ECONOMY MARKET IN WASTE REDUCTION & RECYCLING EFFICIENCY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 DIGITAL CIRCULAR ECONOMY MARKET IN WASTE REDUCTION & RECYCLING EFFICIENCY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 DIGITAL CIRCULAR ECONOMY MARKET IN DIGITAL RESALE & REUSE, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 44 DIGITAL CIRCULAR ECONOMY MARKET IN DIGITAL RESALE & REUSE, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 45 DIGITAL CIRCULAR ECONOMY MARKET IN ONLINE RESALE MARKETPLACES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 DIGITAL CIRCULAR ECONOMY MARKET IN ONLINE RESALE MARKETPLACES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 DIGITAL CIRCULAR ECONOMY MARKET IN PRODUCT EXCHANGE NETWORKS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 DIGITAL CIRCULAR ECONOMY MARKET IN PRODUCT EXCHANGE NETWORKS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR PRODUCT CERTIFICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR PRODUCT CERTIFICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 DIGITAL CIRCULAR ECONOMY MARKET IN REVERSE LOGISTICS & REMANUFACTURING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 52 DIGITAL CIRCULAR ECONOMY MARKET IN REVERSE LOGISTICS & REMANUFACTURING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 53 DIGITAL CIRCULAR ECONOMY MARKET IN COLLECTION & SORTING SERVICES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 DIGITAL CIRCULAR ECONOMY MARKET IN COLLECTION & SORTING SERVICES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 DIGITAL CIRCULAR ECONOMY MARKET IN REMANUFACTURING & REFURBISHMENT, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 DIGITAL CIRCULAR ECONOMY MARKET IN REMANUFACTURING & REFURBISHMENT, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 DIGITAL CIRCULAR ECONOMY MARKET IN WASTE-TO-RESOURCE CONVERSION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 DIGITAL CIRCULAR ECONOMY MARKET IN WASTE-TO-RESOURCE CONVERSION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR ECONOMY REPORTING & COMPLIANCE, 2018–2022 (USD MILLION)

- TABLE 60 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR ECONOMY REPORTING & COMPLIANCE, 2023–2028 (USD MILLION)

- TABLE 61 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR ECONOMY PERFORMANCE REPORTING, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR ECONOMY PERFORMANCE REPORTING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 DIGITAL CIRCULAR ECONOMY MARKET IN SUSTAINABILITY CERTIFICATIONS MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 DIGITAL CIRCULAR ECONOMY MARKET IN SUSTAINABILITY CERTIFICATIONS MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 DIGITAL CIRCULAR ECONOMY MARKET IN REGULATORY COMPLIANCE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 DIGITAL CIRCULAR ECONOMY MARKET IN REGULATORY COMPLIANCE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR WASTE MANAGEMENT & RECYCLING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 68 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR WASTE MANAGEMENT & RECYCLING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 DIGITAL CIRCULAR ECONOMY MARKET IN WASTE SORTING & RECYCLING APPS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 DIGITAL CIRCULAR ECONOMY MARKET IN WASTE SORTING & RECYCLING APPS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR WASTE-TO-ENERGY SOLUTIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 72 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR WASTE-TO-ENERGY SOLUTIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 DIGITAL CIRCULAR ECONOMY MARKET IN ADVANCED RECYCLING TECHNOLOGIES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 DIGITAL CIRCULAR ECONOMY MARKET IN ADVANCED RECYCLING TECHNOLOGIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 DIGITAL CIRCULAR ECONOMY MARKET IN SMART MATERIAL SELECTION & TESTING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 76 DIGITAL CIRCULAR ECONOMY MARKET IN SMART MATERIAL SELECTION & TESTING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 77 DIGITAL CIRCULAR ECONOMY MARKET IN MATERIAL ANALYTICS & SELECTION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 DIGITAL CIRCULAR ECONOMY MARKET IN MATERIAL ANALYTICS & SELECTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 DIGITAL CIRCULAR ECONOMY MARKET IN MATERIAL PERFORMANCE TESTING, BY REGION, 2018–2022 (USD MILLION)

- TABLE 80 DIGITAL CIRCULAR ECONOMY MARKET IN MATERIAL PERFORMANCE TESTING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR MATERIALS R&D, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR MATERIALS R&D, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 84 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 86 DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 87 BLOCKCHAIN & DISTRIBUTED LEDGER TECHNOLOGY (DLT) MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 88 BLOCKCHAIN & DISTRIBUTED LEDGER TECHNOLOGY (DLT) MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 BLOCKCHAIN-BASED SUPPLY CHAIN MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 90 BLOCKCHAIN-BASED SUPPLY CHAIN MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 91 SUPPLY CHAIN TRANSPARENCY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 92 SUPPLY CHAIN TRANSPARENCY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 PROVENANCE TRACKING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 94 PROVENANCE TRACKING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 SMART CONTRACTS FOR RESOURCE TRANSACTIONS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 96 SMART CONTRACTS FOR RESOURCE TRANSACTIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 DLT-ENABLED ASSET TOKENIZATION MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 98 DIGITAL CIRCULAR ECONOMY MARKET, BY DLT-ENABLED ASSET TOKENIZATION, 2023–2028 (USD MILLION)

- TABLE 99 TOKENIZED ASSET MANAGEMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 100 TOKENIZED ASSET MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 DIGITAL TOKENS FOR CIRCULAR ECONOMY PRODUCTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 102 DIGITAL TOKENS FOR CIRCULAR ECONOMY PRODUCTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 TOKEN EXCHANGE PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 104 TOKEN EXCHANGE PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 IOT MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 106 IOT MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 107 IOT-ENABLED PRODUCT MONITORING MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 108 IOT-ENABLED PRODUCT MONITORING MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 109 REMOTE PRODUCT HEALTH MONITORING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 110 REMOTE PRODUCT HEALTH MONITORING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 CONDITION-BASED MAINTENANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 112 CONDITION-BASED MAINTENANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 113 PRODUCT USAGE ANALYTICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 114 PRODUCT USAGE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 SMART RECYCLING BINS & WASTE MANAGEMENT MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 116 SMART RECYCLING BINS & WASTE MANAGEMENT MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 117 SMART WASTE COLLECTION SCHEDULING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 118 SMART WASTE COLLECTION SCHEDULING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 119 RECYCLING SORTING AUTOMATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 120 RECYCLING SORTING AUTOMATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 121 IOT-ENHANCED RECYCLING CENTERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 122 IOT-ENHANCED RECYCLING CENTERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 123 AI & ML MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 124 AI & ML MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 125 PREDICTIVE MAINTENANCE & QUALITY CONTROL MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 126 PREDICTIVE MAINTENANCE & QUALITY CONTROL MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 127 PREDICTIVE EQUIPMENT MAINTENANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 128 PREDICTIVE EQUIPMENT MAINTENANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 129 QUALITY ASSURANCE ALGORITHMS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 130 QUALITY ASSURANCE ALGORITHMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 131 ANOMALY DETECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 132 ANOMALY DETECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 133 DEMAND FORECASTING MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 134 DEMAND FORECASTING MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 135 PREDICTIVE DEMAND MODELS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 136 PREDICTIVE DEMAND MODELS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 137 INVENTORY OPTIMIZATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 138 INVENTORY OPTIMIZATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 139 PRODUCTION PLANNING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 140 PRODUCTION PLANNING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 141 AR & VR MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 142 AR & VR MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 143 AR FOR DESIGN & PROTOTYPING MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 144 AR FOR DESIGN & PROTOTYPING MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 145 AUGMENTED PRODUCT DESIGN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 146 AUGMENTED PRODUCT DESIGN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 147 VIRTUAL PROTOTYPING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 148 VIRTUAL PROTOTYPING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 149 INTERACTIVE DESIGN COLLABORATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 150 INTERACTIVE DESIGN COLLABORATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 151 VR-BASED TRAINING MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 152 VR-BASED TRAINING MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 153 VIRTUAL EMPLOYEE TRAINING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 154 VIRTUAL EMPLOYEE TRAINING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 155 SAFETY TRAINING SIMULATIONS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 156 SAFETY TRAINING SIMULATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 157 REMOTE EXPERT ASSISTANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 158 REMOTE EXPERT ASSISTANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 159 CLOUD COMPUTING MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 160 CLOUD COMPUTING MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 161 CLOUD-BASED RESOURCE PLANNING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 162 CLOUD-BASED RESOURCE PLANNING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 163 CLOUD-BASED CIRCULAR SUPPLY CHAIN PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 164 CLOUD-BASED CIRCULAR SUPPLY CHAIN PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 165 BIG DATA ANALYTICS MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

- TABLE 166 BIG DATA ANALYTICS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 167 RESOURCE UTILIZATION ANALYTICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 168 RESOURCE UTILIZATION ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 169 CIRCULAR ECONOMY PERFORMANCE METRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 170 CIRCULAR ECONOMY PERFORMANCE METRICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 171 CIRCULAR ECONOMY DATA PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 172 CIRCULAR ECONOMY DATA PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 173 DATA INTEGRATION & MANAGEMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 174 DATA INTEGRATION & MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 175 ADVANCED CIRCULAR ANALYTICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 176 ADVANCED CIRCULAR ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 177 OTHER DIGITAL CIRCULAR ECONOMY TECHNOLOGIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 178 OTHER DIGITAL CIRCULAR ECONOMY TECHNOLOGIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 179 DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 180 DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 181 DIGITAL CIRCULAR ECONOMY MARKET IN CONSUMER ELECTRONICS, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 182 DIGITAL CIRCULAR ECONOMY MARKET IN CONSUMER ELECTRONICS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 183 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR ELECTRONICS DESIGN, BY REGION, 2018–2022 (USD MILLION)

- TABLE 184 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR ELECTRONICS DESIGN, BY REGION, 2023–2028 (USD MILLION)

- TABLE 185 DIGITAL CIRCULAR ECONOMY MARKET IN ELECTRONICS REUSE & REFURBISHMENT, BY REGION, 2018–2022 (USD MILLION)

- TABLE 186 DIGITAL CIRCULAR ECONOMY MARKET IN ELECTRONICS REUSE & REFURBISHMENT, BY REGION, 2023–2028 (USD MILLION)

- TABLE 187 DIGITAL CIRCULAR ECONOMY MARKET IN EWASTE RECYCLING & RECOVERY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 188 DIGITAL CIRCULAR ECONOMY MARKET IN EWASTE RECYCLING & RECOVERY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 189 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER CONSUMER ELECTRONICS APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 190 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER CONSUMER ELECTRONICS APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 191 DIGITAL CIRCULAR ECONOMY MARKET IT & TELECOM, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 192 DIGITAL CIRCULAR ECONOMY MARKET IT & TELECOM, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 193 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR IT EQUIPMENT MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

- TABLE 194 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR IT EQUIPMENT MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

- TABLE 195 DIGITAL CIRCULAR ECONOMY MARKET IN DATA CENTER EFFICIENCY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 196 DIGITAL CIRCULAR ECONOMY MARKET IN DATA CENTER EFFICIENCY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 197 DIGITAL CIRCULAR ECONOMY MARKET IN TELECOM NETWORK SUSTAINABILITY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 198 DIGITAL CIRCULAR ECONOMY MARKET IN TELECOM NETWORK SUSTAINABILITY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 199 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER IT & TELECOM APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 200 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER IT & TELECOM APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 201 DIGITAL CIRCULAR ECONOMY MARKET IN AUTOMOTIVE VERTICAL, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 202 DIGITAL CIRCULAR ECONOMY MARKET IN AUTOMOTIVE VERTICAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 203 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR AUTO MANUFACTURING, BY REGION, 2018–2022 (USD MILLION)

- TABLE 204 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR AUTO MANUFACTURING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 205 DIGITAL CIRCULAR ECONOMY MARKET IN REMANUFACTURING & AUTO PARTS REUSE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 206 DIGITAL CIRCULAR ECONOMY MARKET IN REMANUFACTURING & AUTO PARTS REUSE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 207 DIGITAL CIRCULAR ECONOMY MARKET IN END-OF-LIFE VEHICLE RECYCLING, BY REGION, 2018–2022 (USD MILLION)

- TABLE 208 DIGITAL CIRCULAR ECONOMY MARKET IN END-OF-LIFE VEHICLE RECYCLING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 209 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER AUTOMOTIVE APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 210 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER AUTOMOTIVE APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 211 DIGITAL CIRCULAR ECONOMY MARKET IN MANUFACTURING, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 212 DIGITAL CIRCULAR ECONOMY MARKET IN MANUFACTURING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 213 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR MANUFACTURING PROCESSES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 214 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR MANUFACTURING PROCESSES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 215 DIGITAL CIRCULAR ECONOMY MARKET IN MATERIAL & RESOURCE EFFICIENCY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 216 DIGITAL CIRCULAR ECONOMY MARKET IN MATERIAL & RESOURCE EFFICIENCY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 217 DIGITAL CIRCULAR ECONOMY MARKET IN SUSTAINABLE SUPPLY CHAIN MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

- TABLE 218 DIGITAL CIRCULAR ECONOMY MARKET IN SUSTAINABLE SUPPLY CHAIN MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

- TABLE 219 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER MANUFACTURING APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 220 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER MANUFACTURING APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 221 DIGITAL CIRCULAR ECONOMY MARKET IN CONSTRUCTION & BUILDING, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 222 DIGITAL CIRCULAR ECONOMY MARKET IN CONSTRUCTION & BUILDING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 223 DIGITAL CIRCULAR ECONOMY MARKET IN SUSTAINABLE BUILDING DESIGN, BY REGION, 2018–2022 (USD MILLION)

- TABLE 224 DIGITAL CIRCULAR ECONOMY MARKET IN SUSTAINABLE BUILDING DESIGN, BY REGION, 2023–2028 (USD MILLION)

- TABLE 225 DIGITAL CIRCULAR ECONOMY MARKET IN CONSTRUCTION MATERIALS RECYCLING, BY REGION, 2018–2022 (USD MILLION)

- TABLE 226 DIGITAL CIRCULAR ECONOMY MARKET IN CONSTRUCTION MATERIALS RECYCLING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 227 DIGITAL CIRCULAR ECONOMY MARKET IN BUILDING DEMOLITION & DECONSTRUCTION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 228 DIGITAL CIRCULAR ECONOMY MARKET IN BUILDING DEMOLITION & DECONSTRUCTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 229 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER CONSTRUCTION & BUILDING APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 230 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER CONSTRUCTION & BUILDING APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 231 DIGITAL CIRCULAR ECONOMY MARKET IN HEALTHCARE & MEDICAL DEVICES, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 232 DIGITAL CIRCULAR ECONOMY MARKET IN HEALTHCARE & MEDICAL DEVICES, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 233 DIGITAL CIRCULAR ECONOMY MARKET IN MEDICAL DEVICE LIFE EXTENSION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 234 DIGITAL CIRCULAR ECONOMY MARKET IN MEDICAL DEVICE LIFE EXTENSION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 235 DIGITAL CIRCULAR ECONOMY MARKET IN HOSPITAL WASTE MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

- TABLE 236 DIGITAL CIRCULAR ECONOMY MARKET IN HOSPITAL WASTE MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

- TABLE 237 CIRCULAR HEALTHCARE EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 238 CIRCULAR HEALTHCARE EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 239 OTHER HEALTHCARE APPLICATIONS & MEDICAL DEVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 240 OTHER HEALTHCARE APPLICATIONS & MEDICAL DEVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 241 DIGITAL CIRCULAR ECONOMY MARKET IN ENERGY & UTILITY VERTICAL, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 242 DIGITAL CIRCULAR ECONOMY MARKET IN ENERGY & UTILITY VERTICAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 243 DIGITAL CIRCULAR ECONOMY MARKET IN RENEWABLE ENERGY INTEGRATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 244 DIGITAL CIRCULAR ECONOMY MARKET IN RENEWABLE ENERGY INTEGRATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 245 DIGITAL CIRCULAR ECONOMY MARKET IN EFFICIENT UTILITY OPERATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 246 DIGITAL CIRCULAR ECONOMY MARKET IN EFFICIENT UTILITY OPERATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 247 DIGITAL CIRCULAR ECONOMY MARKET IN GRID MANAGEMENT & SUSTAINABILITY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 248 DIGITAL CIRCULAR ECONOMY MARKET IN GRID MANAGEMENT & SUSTAINABILITY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 249 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER ENERGY & UTILITY APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 250 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER ENERGY & UTILITY APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 251 DIGITAL CIRCULAR ECONOMY MARKET IN CHEMICALS & MATERIALS, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 252 DIGITAL CIRCULAR ECONOMY MARKET IN CHEMICALS & MATERIALS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 253 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR CHEMICALS R&D, BY REGION, 2018–2022 (USD MILLION)

- TABLE 254 DIGITAL CIRCULAR ECONOMY MARKET IN CIRCULAR CHEMICALS R&D, BY REGION, 2023–2028 (USD MILLION)

- TABLE 255 DIGITAL CIRCULAR ECONOMY MARKET IN CHEMICAL RECYCLING, BY REGION, 2018–2022 (USD MILLION)

- TABLE 256 DIGITAL CIRCULAR ECONOMY MARKET IN CHEMICAL RECYCLING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 257 DIGITAL CIRCULAR ECONOMY MARKET IN MATERIAL REUSE & UPCYCLING, BY REGION, 2018–2022 (USD MILLION)

- TABLE 258 DIGITAL CIRCULAR ECONOMY MARKET IN MATERIAL REUSE & UPCYCLING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 259 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER CHEMICAL & MATERIAL APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 260 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER CHEMICAL & MATERIAL APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 261 DIGITAL CIRCULAR ECONOMY MARKET IN FASHION & APPAREL, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 262 DIGITAL CIRCULAR ECONOMY MARKET IN FASHION & APPAREL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 263 DIGITAL CIRCULAR ECONOMY MARKET IN SUSTAINABLE FASHION DESIGN, BY REGION, 2018–2022 (USD MILLION)

- TABLE 264 DIGITAL CIRCULAR ECONOMY MARKET IN SUSTAINABLE FASHION DESIGN, BY REGION, 2023–2028 (USD MILLION)

- TABLE 265 DIGITAL CIRCULAR ECONOMY MARKET IN CLOTHING RENTAL & RESALE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 266 DIGITAL CIRCULAR ECONOMY MARKET IN CLOTHING RENTAL & RESALE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 267 DIGITAL CIRCULAR ECONOMY MARKET IN TEXTILE RECYCLING & UPCYCLING, BY REGION, 2018–2022 (USD MILLION)

- TABLE 268 DIGITAL CIRCULAR ECONOMY MARKET IN TEXTILE RECYCLING & UPCYCLING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 269 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER FASHION & APPAREL APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 270 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER FASHION & APPAREL APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 271 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER VERTICALS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 272 DIGITAL CIRCULAR ECONOMY MARKET IN OTHER VERTICALS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 273 DIGITAL CIRCULAR ECONOMY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 274 DIGITAL CIRCULAR ECONOMY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 275 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 276 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 277 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 278 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 279 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 280 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 281 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 282 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 283 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 284 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 285 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 286 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 287 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 288 NORTH AMERICA: DIGITAL CIRCULAR ECONOMY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 289 US: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 290 US: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 291 CANADA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 292 CANADA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 293 EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 294 EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 295 EUROPE: DIGITAL CIRCULAR ECONOMY SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 296 EUROPE: DIGITAL CIRCULAR ECONOMY SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 297 EUROPE: DIGITAL CIRCULAR ECONOMY SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 298 EUROPE: DIGITAL CIRCULAR ECONOMY SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 299 EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 300 EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 301 EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 302 EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 303 EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 304 EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 305 EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 306 EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 307 UK: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 308 UK: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 309 GERMANY: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 310 GERMANY: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 311 FRANCE: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 312 FRANCE: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 313 ITALY: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 314 ITALY: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 315 SPAIN: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 316 SPAIN: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 317 NETHERLANDS: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 318 NETHERLANDS: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 319 REST OF EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 320 REST OF EUROPE: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 321 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 322 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 323 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 324 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 325 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 326 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 327 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 328 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 329 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 330 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 331 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 332 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 333 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 334 ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 335 CHINA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 336 CHINA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 337 INDIA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 338 INDIA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 339 JAPAN: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 340 JAPAN: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 341 SOUTH KOREA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 342 SOUTH KOREA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 343 SINGAPORE: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 344 SINGAPORE: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 345 AUSTRALIA & NEW ZEALAND: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 346 AUSTRALIA & NEW ZEALAND: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 347 REST OF ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 348 REST OF ASIA PACIFIC: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 349 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 350 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 351 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 352 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 353 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 354 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 355 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 356 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 357 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 358 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 359 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 360 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 361 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY MARKET, BY COUNTRY/REGION, 2018–2022 (USD MILLION)

- TABLE 362 MIDDLE EAST & AFRICA: DIGITAL CIRCULAR ECONOMY MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)