Digital BSS Market by Offering (Solutions & Services), Solution (Revenue & Billing Management, Customer Management, Order Management, and Product Management), Vertical (BFSI, Telecom, and Retail & eCommerce) and Region - Global Forecast to 2028

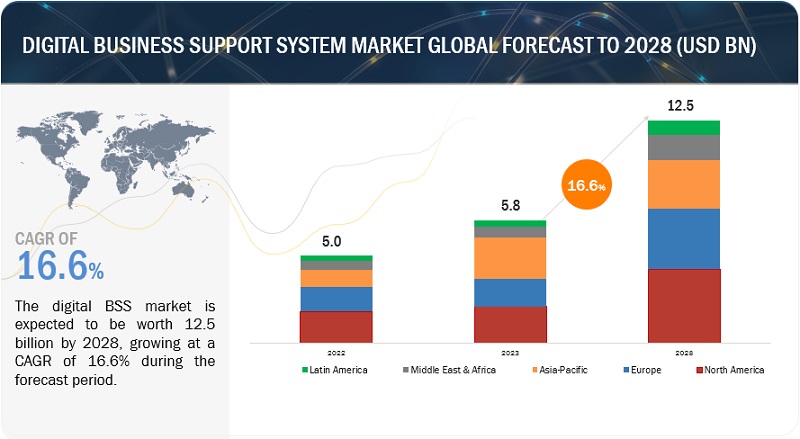

[216 Pages Report] The digital BSS market is estimated at USD 5.8 billion in 2023 to USD 12.5 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 16.6%. The increasing demand for enhanced customer experience, including personalized and seamless interactions, real-time service fulfillment, and proactive issue resolution with digital BSS, is boosting the market. The technologies, including cloud computing, AI, ML, IoT, and big data, are being used in digital BSS. These technologies are benefiting organizations in various ways, including improved customer experience, reduced operational costs, and increased revenue. As these technologies continue to develop, there will be an increase in demand for digital BSS solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Digital BSS Market Dynamics

Driver: Increasing online transactions and use of multiple mobile devices

An increasing amount of data is generated continuously due to huge investments in next-generation cloud technologies and new product launches. The increasing use of mobile internet has led to increased online transactions. Due to the huge volumes of transactions, the need to address payment authenticity and analyze security breaches in payment processes is becoming complex. These factors affect collecting, processing, analyzing, and maintaining complex databases of subscribers and severely affect the billing mechanism. Examples of the affected scenarios include complications in charging and billing for voice and data, generating invoices for customers, processing payments, and managing debt collection. As a result, the demand for BSS solutions and services to perform effective and secure transactions is becoming very important to CSPs.

Restraint: Time and cost constraints

There needs to be more motivation to adopt standardized systems. However, implementing BSS solutions, in the long run, enhances business profitability, as they are expensive and time-consuming to implement. There is a burden on smaller organizations to pay huge charges for implementing and maintaining BSS solutions and services. Telecom companies tend to shy away from BSS transformations because overhauling their existing systems can take 2–3 years. Therefore, high installation costs and excessive time consumption act as restraints for the growth of the digital BSS market.

Opportunity: Outcome and pull economies

The outcome economy focuses on pay-per-outcome, wherein customers are proposed to pay the product’s value depending on its quality, service, and delivery time. Telecom companies need to shift to more value-driven digital ecosystems to ensure competitiveness. Digital BSS solutions can enable data aggregation and facilitate collaboration across the telecom ecosystem, creating better business relationships and expertise. On the other hand, the pull economy focuses on three important aspects: continuous demand sensing, a process of leveraging new analytical techniques to create an accurate forecast of the market demand, and current certainties of the telecom ecosystem. Secondly, end-to-end automation, which focuses on connecting business processes for better business outcomes. The third aspect is resource optimization, one of the most important aspects of the telecom vertical.

Challenge: Lack of expertise in telecom companies to implement digital BSS solutions

There is an increasing demand to cater to the growing expectations of users as the pace of technological innovation is increasing. Telecom service providers need to adapt to new technology infrastructures and improve their operations and business processes due to the rapid pace of innovation. However, telecom companies need help planning, building, and deploying new infrastructures and simultaneously focusing on their core competencies in this highly competitive market. Furthermore, integrating BSS solutions needs a highly focused approach for a smooth transition while also ensuring that it does not disrupt the end-users. It is possible for the telecom service providers to focus on their core competencies and facilitate effective services to their end-users with the support of digital BSS service providers. They enable telecom companies by integrating solutions, such as revenue management, order management, product management, and the related subcomponents.

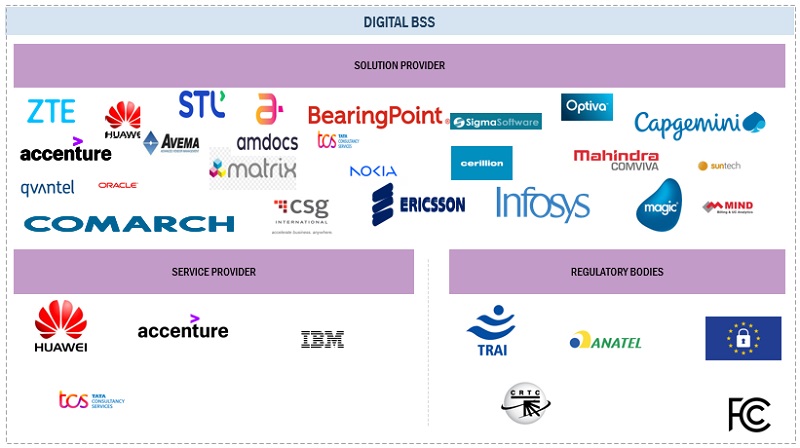

Digital BSS market Ecosystem

Prominent companies in this market include well-established, financially stable digital BSS solutions, services providers, and regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include Ericsson (Sweden), IBM (US), Huawei (China), and Accenture (Ireland).

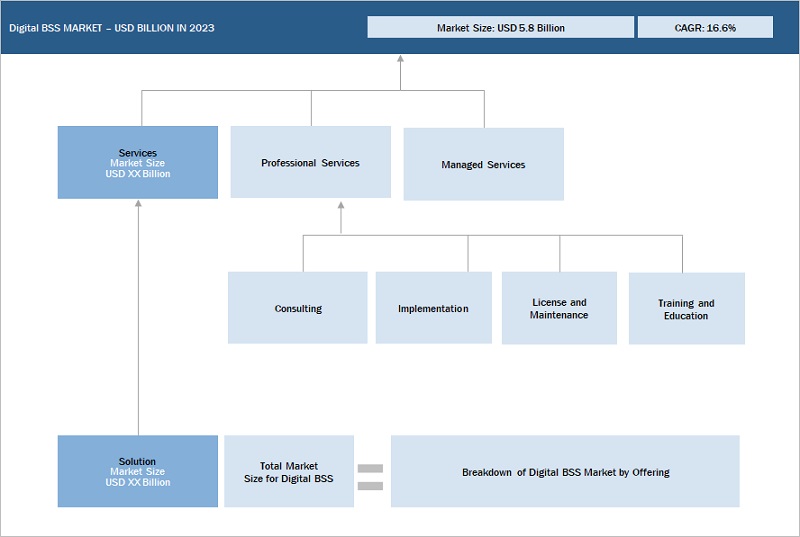

By offering, the services segment is expected to register the highest growth rate during the forecast period.

With the increasing adoption of cloud-based BSS solutions, organizations' demand for the associated services is also increasing. The digital BSS market by service has been segmented into license and support, consulting, implementation, training and education, and managed services. Most CSPs need more technical expertise in storing and managing the data in the telecom vertical, for which they avail digital BSS services from the service providers. Managed services are offered by third-party providers and help manage organizations' operational challenges. The overall services segment significantly influences the digital BSS market size. Furthermore, these services help reduce costs, increase overall revenue, and enhance business performance.

By vertical, BFSI is expected to hold the largest market size during the forecast period.

Digital BSS solutions provide robust CRM functionalities, allowing BFSI organizations to manage and analyze customer interactions, profiles, preferences, and behavior. This facilitates BFSI organizations in creating personalized customer experiences, targeted marketing campaigns, and efficient customer service. Also, digital BSS solutions streamline the billing and revenue management processes for BFSI companies. The solution enables accurate billing, invoicing, and payment collection while supporting various pricing models, fee structures, and revenue recognition methods.

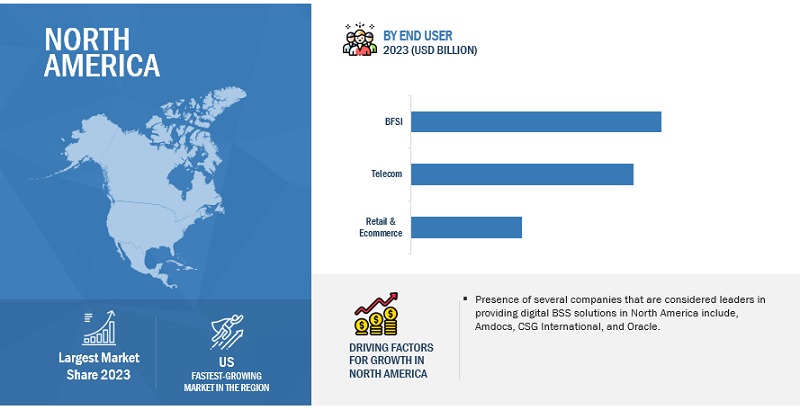

North America is expected to hold the largest market size during the forecast period.

The startup culture in North America is growing at a faster pace as compared to other regions. The advent of SMEs and the increasing digitization trend in the telecom industry have aided in the growth of the North American digital BSS market. The adoption of digital BSS solutions is also being driven in the region by the increasing availability of cloud-based solutions. Cloud-based BSS solutions offer a number of advantages over traditional on-premises solutions, including reduced upfront costs, scalability, flexibility, and improved security. As a result of these factors, the adoption of digital BSS solutions in North America is expected to continue to grow in the coming years.

Market Players:

The major players in the digital BSS market are Amdocs Limited (US), Huawei Technologies Co. Ltd (China), LM Ericsson Telephone Company (Sweden), CSG Systems International, Inc. (US), Nokia Corporation (Finland), International Business Machines Corporation (US), ZTE Corporation (China), Optiva Inc. (Canada), Sigma Systems Canada LP. (US), Cerillion Technologies Limited (UK), Sterlite Technologies Limited (India), Accenture plc (Ireland), Capgemini SE (France), Infosys Limited (India), Oracle Corporation (US), Mahindra Comviva (India), Qvantel (Finland), BearingPoint (Netherlands), Formula Telecom Solutions Ltd. (US), MATRIXX Software, Inc. (US), MIND C.T.I. Ltd. (UK), and Tata Consultancy Services Limited (India). Hansen Technologies (Australia), Comarch SA (Poland), Avema Corporation (Ontario), and Suntech S.A. (Poland). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their footprint in the digital BSS market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments Covered |

Offering (Solution and Services), Solution, Vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Amdocs Limited (US), Huawei Technologies Co. Ltd (China), LM Ericsson Telephone Company (Sweden), CSG Systems International, Inc. (US), Nokia Corporation (Finland), International Business Machines Corporation (US), ZTE Corporation (China), Optiva Inc. (Canada), Sigma Systems Canada LP. (US), Cerillion Technologies Limited (UK), Sterlite Technologies Limited (India), Accenture plc (Ireland), Capgemini SE (France), Infosys Limited (India), Oracle Corporation (US), Mahindra Comviva (India), Qvantel (Finland), BearingPoint (Netherlands), Formula Telecom Solutions Ltd. (US), MATRIXX Software, Inc. (US), MIND C.T.I. Ltd. (UK), and Tata Consultancy Services Limited (India). Hansen Technologies (Australia), Comarch SA (Poland), Avema Corporation (Ontario), and Suntech S.A. (Poland). |

This research report categorizes the digital BSS market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Solution

-

Services

-

Professional Services

- Consulting

- Implementation

- License and Maintenance

- Training and Education

- Managed Services

-

Professional Services

Based on the Solution:

- Revenue and Billing Management

- Customer Management

- Order Management

- Product Management

- Other Solutions

Based on Vertical:

- BFSI

- IT and ITES

- Telecom

- Retail and E-commerce

- Media and Entertainment

- Manufacturing

- Energy and Utilities

- Other Verticals (Healthcare, Transportation and Logistics, and Government)

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- South Korea

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2023, IBM entered into a definitive agreement with Vista Equity Partners to purchase Apptio Inc. The acquisition of Apptio will accelerate the advancement of IBM's IT automation capabilities and enable enterprise leaders to deliver enhanced business value across technology investments.

- In July 2022, Ericsson acquired Vonage, which supports Ericsson’s strategy to leverage technology leadership to grow its mobile network business and expand into the enterprise.

- In April 2022, Infosys acquired oddity. The acquisition strengthens Infosys’ creative, branding, and experience design capabilities and co-creating with clients and helping them navigate their digital transformation journey.

- In October 2021, CSG International acquired the digit system. The merger combines cutting-edge solutions created to simplify the intricacies of commercializing the upcoming wave of multi-party digital offerings, fueling business expansion for communications service providers (CSPs).

Frequently Asked Questions (FAQ):

What is the definition of the digital BSS market?

Digital BSS refers to the digital transformation of the traditional BSS and helps deliver Communication Service Providers (CSPs) with more cloud-based products and services, such as product management, customer management, revenue and billing management, and order management with the help of cloud-based support systems. Doing so has significantly increased the traffic scalability, setting up new lines of business with a dedicated BSS, thereby enhancing the customer experience and cutting down on Operational Expenditure (OPEX) and Capital Expenditure (CAPEX).

What is the market size of the digital BSS market?

The digital BSS market is estimated at USD 5.8 billion in 2023 to USD 12.5 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 16.6%.

What are the major drivers in the digital BSS market?

The major drivers in the digital BSS market are the advent of tailored BSS solutions and new commercial models, reduced operational costs, increasing online transactions, and the use of multiple mobile devices.

Who are the key players operating in the digital BSS market?

The major companies profiled in the digital BSS market are Amdocs Limited (US), Huawei Technologies Co. Ltd (China), LM Ericsson Telephone Company (Sweden), CSG Systems International, Inc. (US), Nokia Corporation (Finland), International Business Machines Corporation (US), ZTE Corporation (China), Optiva Inc. (Canada), Sigma Systems Canada LP. (US), Cerillion Technologies Limited (UK), Sterlite Technologies Limited (India), Accenture plc (Ireland), Capgemini SE (France), Infosys Limited (India), Oracle Corporation (US), Mahindra Comviva (India), Qvantel (Finland), BearingPoint (Netherlands), Formula Telecom Solutions Ltd. (US), MATRIXX Software, Inc. (US), MIND C.T.I. Ltd. (UK), and Tata Consultancy Services Limited (India). Hansen Technologies (Australia), Comarch SA (Poland), Avema Corporation (Ontario), and Suntech S.A. (Poland).

Which are the key technology trends prevailing in the digital BSS market?

Cloud computing, AI, ML, IoT, and big data are the key technology trends for the digital BSS market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Advent of tailored BSS solutions and commercial models- Need for reduced operational costs- Increase in online transactions and use of multiple mobile devicesRESTRAINTS- Expensive and time-consuming implementation of digital BSS solutionsOPPORTUNITIES- Growing emphasis on outcome and pull economies- Development and optimization of telecom operators’ businessesCHALLENGES- Increasing complexities in network transactions and integration of digital BSS solutions with legacy systems- Lack of expertise in telecom companies

-

5.3 INDUSTRY TRENDSCASE STUDY ANALYSIS- Case Study 1: MVNO adopted Optiva’s BSS Platform in SaaS model to improve customer satisfaction- Case Study 2: Optiva’s BSS Suite enabled rapid MVNO onboarding and enhanced customer experience for leading Mexican telecom provider- Case Study 3: Cerillion’s Convergent CRM & Billing Solution revolutionized BTC’s service offerings and customer experience- Case Study 4: Cerillion provided SWAN with solutions comprising various modules from its Enterprise BSS/OSS SuiteECOSYSTEM ANALYSIS- Communication service providers- System integrators- Technology partners- Solution providersVALUE CHAIN ANALYSISREGULATORY LANDSCAPE- Regulatory bodies, government agencies, and other organizations- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaAVERAGE SELLING PRICE ANALYSIS- Average selling price analysis for key players- Pricing modelsPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryTECHNOLOGY ANALYSIS- Cloud Computing- Artificial Intelligence- Machine Learning- Big Data AnalyticsPATENT ANALYSIS- Methodology- Document types- Innovation and patent applicationsTRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTSKEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaKEY CONFERENCES & EVENTS

-

6.1 INTRODUCTIONOFFERINGS: DIGITAL BSS MARKET DRIVERS

-

6.2 SOLUTIONSREVENUE & BILLING MANAGEMENT- Need for increased converged billing across various channels to drive demandCUSTOMER MANAGEMENT- Demand for better customer experience management to spur growthORDER MANAGEMENT- Growing use of advanced analytics to simplify order management process to boost growthPRODUCT MANAGEMENT- Need for optimizing product portfolio and life cycle management to boost demandOTHER SOLUTIONS

-

6.3 SERVICESPROFESSIONAL SERVICES- Consulting- Implementation- License & Maintenance- Training & EducationMANAGED SERVICES- Demand for support and maintenance services by third-party service providers to boost market

-

7.1 INTRODUCTIONVERTICALS: DIGITAL BSS MARKET DRIVERS

-

7.2 BFSIAIM OF BUSINESSES TO ENHANCE OPERATIONAL EFFICIENCY AND UNLOCK REVENUE OPPORTUNITIES TO DRIVE ADOPTION OF DIGITAL BSS SOLUTIONS

-

7.3 IT & ITESGROWING NEED TO STREAMLINE SERVICE DELIVERY PROCESSES AND AUTOMATE TASKS TO BOOST ADOPTION OF DIGITAL BSS SERVICES

-

7.4 TELECOMNEED TO OFFER PERSONALIZED EXPERIENCE TO TELECOM CUSTOMERS TO ENCOURAGE MARKET GROWTH

-

7.5 RETAIL & ECOMMERCEDEMAND FOR SEAMLESS SHOPPING SOLUTIONS FROM CUSTOMERS TO ENCOURAGE ADOPTION OF DIGITAL BSS SOLUTIONS

-

7.6 MEDIA & ENTERTAINMENTFOCUS ON LEVERAGING EFFECTIVE CONTENT CONSUMPTION STRATEGIES TO DRIVE MARKET

-

7.7 MANUFACTURINGINCREASING DIGITALIZATION AND AUTOMATION IN MANUFACTURING SECTOR TO ENCOURAGE MARKET EXPANSION

-

7.8 ENERGY & UTILITIESGROWING DEMAND FOR ENERGY MANAGEMENT AND SMART METERING SOLUTIONS TO SPUR GROWTH

-

7.9 HEALTHCAREDIGITALIZATION IN PATIENT CARE AND AUTOMATION IN MANUAL HEALTHCARE OPERATIONAL PROCESSES TO BOOST GROWTH

- 7.10 OTHER VERTICALS

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: DIGITAL BSS MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Adoption of cloud-native and cloud-ready solutions in telecom industry to drive growthCANADA- Increasing number of mergers and acquisitions in country’s telecom sector to drive adoption of OSS/BSS solutions

-

8.3 EUROPEEUROPE: DIGITAL BSS MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Need to transform and modernize telecom operations to drive growthGERMANY- Adoption of cloud computing services to boost marketFRANCE- Presence of major players providing digital BSS solutions to propel growthSPAIN- Demand for personalized customer experience to drive market expansionITALY- Emergence of advanced technologies to encourage adoption of BSS solutions and servicesREST OF EUROPE

-

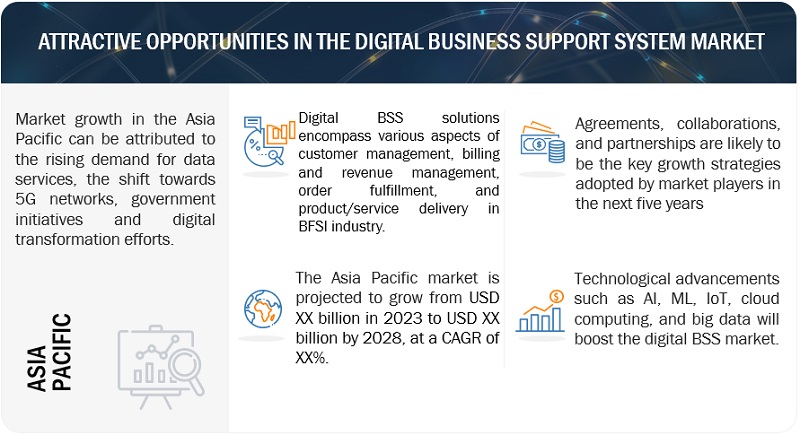

8.4 ASIA PACIFICASIA PACIFIC: DIGITAL BSS MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Increasing trend of technological adoption to boost marketINDIA- Advancements in 5G and IoT technologies to drive opportunities for digital BSS marketJAPAN- Presence of highly efficient and competitive digital BSS players across sectors to propel growthAUSTRALIA & NEW ZEALAND- Use of advanced IoT technologies to drive digital BSS marketSOUTH KOREA- Increasing popularity of mobile devices and growth of e-commerce to spur growthREST OF ASIA PACIFIC

-

8.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: DIGITAL BSS MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST- Business expansions to increase adoption of digital BSS solutionsAFRICA- Convergence of telecom and IT industries to drive growth

-

8.6 LATIN AMERICALATIN AMERICA: DIGITAL BSS MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Rapid implementation of various projects and initiatives to boost adoption of digital BSS solutionsMEXICO- Steady growth of industries and economy to drive market expansionREST OF LATIN AMERICA

- 9.1 INTRODUCTION

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- 9.4 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- 9.5 COMPETITIVE BENCHMARKING

-

9.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

9.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

10.1 MAJOR PLAYERSAMDOCS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHUAWEI- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewERICSSON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCSG INTERNATIONAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNETCRACKER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developmentsCAPGEMINI- Business overview- Products/Solutions/Services offered- Recent developmentsNOKIA- Business overview- Products/Solutions/Services offered- Recent developmentsZTE- Business overview- Products/Solutions/Services offered- Recent developmentsINFOSYS- Business overview- Products/Solutions/Services offered- Recent developmentsTCS- Business overview- Products/Solutions/Services offered- Recent developmentsIBM- Business overview- Products/Solutions/Services offered- Recent developmentsACCENTURE- Business overview- Products/Solutions/Services offered- Recent developmentsHANSEN TECHNOLOGIESSTERLITE TECHNOLOGIESCOMARCHBEARINGPOINTMAHINDRA COMVIVASIGMA SOFTWARE

-

10.2 STARTUPS/SMESOPTIVACERILLION TECHNOLOGIESQVANTELMIND CTIMATRIXX SOFTWAREMAGIC SOFTWARE GROUPAVEMA CORPORATIONMYCOM OSISUNTECH SA

- 11.1 INTRODUCTION

-

11.2 CLOUD OSS BSS MARKETMARKET DEFINITIONMARKET OVERVIEWCLOUD OSS BSS MARKET, BY COMPONENTCLOUD OSS BSS MARKET, BY SOLUTIONCLOUD OSS BSS MARKET, BY SERVICECLOUD OSS BSS MARKET, BY CLOUD TYPECLOUD OSS BSS MARKET, BY OPERATOR TYPECLOUD OSS BSS MARKET, BY REGION

-

11.3 SUBSCRIPTION & BILLING MANAGEMENT MARKETMARKET DEFINITIONMARKET OVERVIEWSUBSCRIPTION & BILLING MANAGEMENT MARKET, BY COMPONENTSUBSCRIPTION & BILLING MANAGEMENT MARKET, BY DEPLOYMENT TYPESUBSCRIPTION & BILLING MANAGEMENT MARKET, BY VERTICALSUBSCRIPTION & BILLING MANAGEMENT MARKET, BY REGION

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 AVERAGE SELLING PRICE ANALYSIS FOR KEY PLAYERS

- TABLE 9 IMPACT OF PORTER’S FORCES ON DIGITAL BSS MARKET

- TABLE 10 PATENTS FILED, 2021–2023

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 14 DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 15 DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 16 SOLUTIONS: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 17 SOLUTIONS: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 19 DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 20 REVENUE & BILLING MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 21 REVENUE & BILLING MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 CUSTOMER MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 23 CUSTOMER MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 ORDER MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 25 ORDER MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 PRODUCT MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 27 PRODUCT MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 OTHER SOLUTIONS: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 29 OTHER SOLUTIONS: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 31 DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 32 SERVICES: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 SERVICES: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 PROFESSIONAL SERVICES: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 PROFESSIONAL SERVICES: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 37 DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 38 CONSULTING: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 CONSULTING: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 IMPLEMENTATION: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 IMPLEMENTATION: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 LICENSE & MAINTENANCE: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 LICENSE & MAINTENANCE: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 TRAINING & EDUCATION: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 TRAINING & EDUCATION: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 MANAGED SERVICES: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 MANAGED SERVICES: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 49 DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 50 BFSI: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 BFSI: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 IT & ITES: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 53 IT & ITES: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 TELECOM: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 55 TELECOM: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 RETAIL & ECOMMERCE: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 RETAIL & ECOMMERCE: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 MEDIA & ENTERTAINMENT: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 MEDIA & ENTERTAINMENT: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 MANUFACTURING: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 61 MANUFACTURING: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 ENERGY & UTILITIES: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 63 ENERGY & UTILITIES: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 HEALTHCARE: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 65 HEALTHCARE: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 OTHER VERTICALS: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 67 OTHER VERTICALS: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 69 DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: DIGITAL BSS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: DIGITAL BSS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 82 US: DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 83 US: DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 84 US: DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 85 US: DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 86 US: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 87 US: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 88 US: DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 89 US: DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 90 US: DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 91 US: DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 92 CANADA: DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 93 CANADA: DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 94 CANADA: DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 95 CANADA: DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 96 CANADA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 97 CANADA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 98 CANADA: DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 99 CANADA: DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 100 CANADA: DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 101 CANADA: DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 103 EUROPE: DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 105 EUROPE: DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 107 EUROPE: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 108 EUROPE: DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 109 EUROPE: DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 111 EUROPE: DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 112 EUROPE: DIGITAL BSS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 113 EUROPE: DIGITAL BSS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 UK: DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 115 UK: DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 116 UK: DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 117 UK: DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 118 UK: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 119 UK: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 120 UK: DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 121 UK: DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 122 UK: DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 123 UK: DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: DIGITAL BSS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DIGITAL BSS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 136 CHINA: DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 137 CHINA: DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 138 CHINA: DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 139 CHINA: DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 140 CHINA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 141 CHINA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 142 CHINA: DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 143 CHINA: DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 144 CHINA: DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 145 CHINA: DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST: DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 159 MIDDLE EAST: DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST: DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST: DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 163 MIDDLE EAST: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 164 MIDDLE EAST: DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 165 MIDDLE EAST: DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 166 MIDDLE EAST: DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 167 MIDDLE EAST: DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 168 LATIN AMERICA: DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 169 LATIN AMERICA: DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 170 LATIN AMERICA: DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 171 LATIN AMERICA: DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 172 LATIN AMERICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 173 LATIN AMERICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 177 LATIN AMERICA: DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: DIGITAL BSS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 179 LATIN AMERICA: DIGITAL BSS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 180 BRAZIL: DIGITAL BSS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 181 BRAZIL: DIGITAL BSS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 182 BRAZIL: DIGITAL BSS MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 183 BRAZIL: DIGITAL BSS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 184 BRAZIL: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 185 BRAZIL: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 186 BRAZIL: DIGITAL BSS MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 187 BRAZIL: DIGITAL BSS MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 188 BRAZIL: DIGITAL BSS MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 189 BRAZIL: DIGITAL BSS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 190 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 191 DIGITAL BSS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 192 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 193 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 194 PRODUCT LAUNCHES, 2023

- TABLE 195 DEALS, 2021–2023

- TABLE 196 AMDOCS: BUSINESS OVERVIEW

- TABLE 197 AMDOCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 AMDOCS: DEALS

- TABLE 199 HUAWEI: BUSINESS OVERVIEW

- TABLE 200 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 HUAWEI: DEALS

- TABLE 202 ERICSSON: BUSINESS OVERVIEW

- TABLE 203 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 ERICSSON: DEALS

- TABLE 205 CSG INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 206 CSG INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 CSG INTERNATIONAL: DEALS

- TABLE 208 NETCRACKER: BUSINESS OVERVIEW

- TABLE 209 NETCRACKER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 NETCRACKER: PRODUCT LAUNCHES

- TABLE 211 NETCRACKER: DEALS

- TABLE 212 ORACLE: BUSINESS OVERVIEW

- TABLE 213 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 ORACLE: DEALS

- TABLE 215 CAPGEMINI: BUSINESS OVERVIEW

- TABLE 216 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 CAPGEMINI: DEALS

- TABLE 218 NOKIA: BUSINESS OVERVIEW

- TABLE 219 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 NOKIA: DEALS

- TABLE 221 ZTE: BUSINESS OVERVIEW

- TABLE 222 ZTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 ZTE: DEALS

- TABLE 224 INFOSYS: BUSINESS OVERVIEW

- TABLE 225 INFOSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 INFOSYS: DEALS

- TABLE 227 TCS: BUSINESS OVERVIEW

- TABLE 228 TCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 TCS: DEALS

- TABLE 230 IBM: BUSINESS OVERVIEW

- TABLE 231 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 IBM: DEALS

- TABLE 233 ACCENTURE: BUSINESS OVERVIEW

- TABLE 234 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 ACCENTURE: DEALS

- TABLE 236 CLOUD OSS BSS MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 237 CLOUD OSS BSS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 238 CLOUD OSS BSS MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 239 CLOUD OSS BSS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 240 CLOUD OSS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 241 CLOUD OSS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 242 CLOUD BSS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 243 CLOUD BSS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 244 CLOUD OSS BSS MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 245 CLOUD OSS BSS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 246 PROFESSIONAL SERVICES: CLOUD OSS BSS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 247 PROFESSIONAL SERVICES: CLOUD OSS BSS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 248 CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2017–2021 (USD MILLION)

- TABLE 249 CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2022–2027 (USD MILLION)

- TABLE 250 CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2017–2021 (USD MILLION)

- TABLE 251 CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2022–2027 (USD MILLION)

- TABLE 252 CLOUD OSS BSS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 253 CLOUD OSS BSS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 254 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 255 SERVICES: SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

- TABLE 256 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2018–2025 (USD MILLION)

- TABLE 257 CLOUD: SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

- TABLE 258 ON-PREMISES: SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

- TABLE 259 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

- TABLE 260 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY REGION, 2018–2025 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION APPROACHES

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1: SUPPLY-SIDE ANALYSIS OF REVENUE FROM VENDORS OF DIGITAL BSS SOLUTIONS AND SERVICES

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF DIGITAL BSS VENDORS

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 IMPACT OF RECESSION ON DIGITAL BSS MARKET

- FIGURE 10 DIGITAL BSS MARKET, 2021–2028 (USD MILLION)

- FIGURE 11 DIGITAL BSS MARKET, BY REGION, 2023

- FIGURE 12 INCREASING SERVICE OPTIONS AND COMPLEX IT INFRASTRUCTURE TO DRIVE MARKET EXPANSION

- FIGURE 13 SERVICES, REVENUE AND BILLING MANAGEMENT, AND BFSI SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 14 SERVICES SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 15 REVENUE & BILLING MANAGEMENT SEGMENT TO LEAD MARKET IN 2023

- FIGURE 16 BFSI SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 17 US AND BFSI SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 18 DIGITAL BSS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 ECOSYSTEM MAP

- FIGURE 20 VALUE CHAIN ANALYSIS

- FIGURE 21 NUMBER OF PATENTS GRANTED ANNUALLY, 2021–2023

- FIGURE 22 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2021–2023

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 25 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 26 PRODUCT MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 HEALTHCARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 31 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 32 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 33 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 34 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 35 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 36 AMDOCS: COMPANY SNAPSHOT

- FIGURE 37 HUAWEI: COMPANY SNAPSHOT

- FIGURE 38 ERICSSON: COMPANY SNAPSHOT

- FIGURE 39 CSG INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 40 ORACLE: COMPANY SNAPSHOT

- FIGURE 41 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 42 NOKIA: COMPANY SNAPSHOT

- FIGURE 43 ZTE: COMPANY SNAPSHOT

- FIGURE 44 INFOSYS: COMPANY SNAPSHOT

- FIGURE 45 TCS: COMPANY SNAPSHOT

- FIGURE 46 IBM: COMPANY SNAPSHOT

- FIGURE 47 ACCENTURE: COMPANY SNAPSHOT

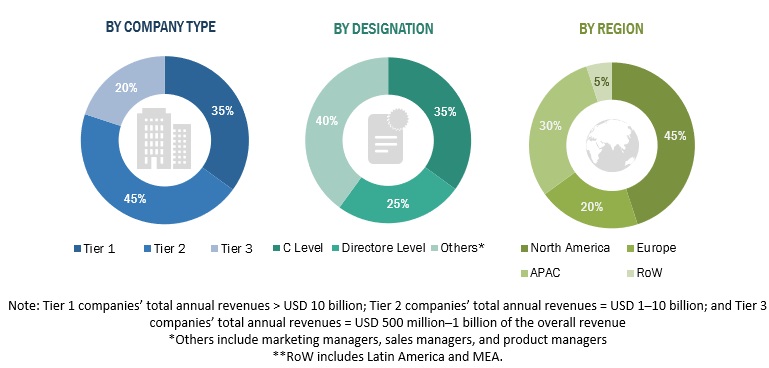

This research study used extensive secondary sources, directories, and databases, such as Factiva, D&B Hoovers, and Bloomberg, to identify and collect information useful for this comprehensive market research study on the digital BSS market. The primary sources were mainly industry experts from the core and related industries, preferred digital BSS software and service providers, third-party service providers, consulting providers, end-users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information as well as assess the prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included companies’ annual reports, press releases, investor presentations, white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing digital BSS software and associated services. The primary sources from the demand side included the end-users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

After the complete market engineering (including calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types; industry trends; key players; the competitive landscape of different market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

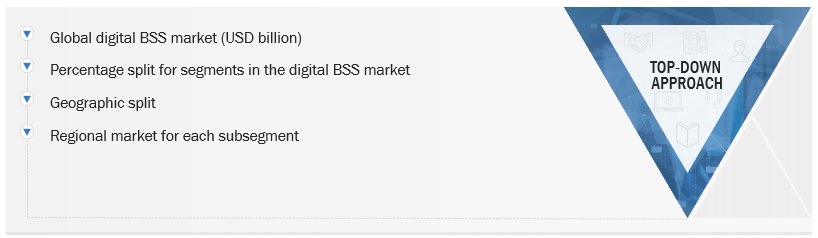

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the market size of the global digital BSS market and the market size of the various dependent submarkets. The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Digital BSS Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Digital BSS Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the digital BSS market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Digital BSS refers to the digital transformation of the traditional BSS and helps deliver Communication Service Providers (CSPs) with more cloud-based products and services, such as product management, customer management, revenue and billing management, and order management with the help of cloud-based support systems. Doing so has significantly increased the traffic scalability, setting up new lines of business with a dedicated BSS, thereby enhancing the customer experience and cutting down on Operational Expenditure (OPEX) and Capital Expenditure (CAPEX).

Key Stakeholders

- Digital BSS solution providers

- Digital BSS service providers

- System integrators

- CSPs

- Consultancy/advisory firms

- Mobile Virtual Network Enablers (MVNEs)

- Technology providers

- Cloud service providers

Report Objectives

- To determine and forecast the global digital BSS market by offering, end-user, and region from 2017 to 2023 and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa, and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall digital BSS market

- To provide detailed information regarding the major factors influencing the growth of the digital BSS market (drivers, restraints, opportunities, and challenges)

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market.

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities in the digital BSS market

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Digital BSS Market