Digital Audio Workstation Market by Type (Recording, Editing, Mixing), End User (Professional/Audio Engineers and Mixers, Electronic Musicians, Music Studios), Component, Deployment Model, Operating Systems, and Region - Global Forecast to 2023

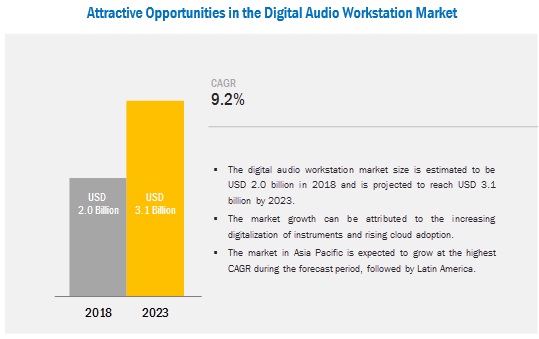

[132 Pages Report] The global digital audio workstation market expected to grow from USD 2.0 billion in 2018 to USD 3.1 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 9.2% during the forecast period. The demand for DAW is expected to grow over the next 5 years, owing to several factors, including the increasing adoption of cloud-based audio workstations and growing digitization of instruments. Increasing demand for AI-generated music, growing media & entertainment industry, and increasing adoption of Android-based operating systems are the key growth factors for the market.

Editing segment to hold the largest market size during the forecast period

The editing segment is expected to constitute the largest market size during the forecast period due to the widespread adoption of digital audio workstation software across end users in different regions. It proves to be a vital solution for musicians to easily and quickly edit the audio files more effectively. It also provide a robust feature set for audio editing. The sets include basic functionalities such as cut, copy, paste, delete, and insert as well as advanced functionalities such as silence, auto-trim, compression, and pitch shifting. The DAW enable users to reduce noises in recordings, create noise-free music pieces, and restore audio.

Android operating system segment to grow at the highest CAGR in Digital Audio Workstation Market during the forecast period

Increasing demand for Android-supported DAW solutions drives the key players to focus on developing such solutions. Android is noticed to be gaining a major share in the developing countries of Asia Pacific, specifically in China and India. The Android operating system offers better hardware support and more choices for applications at an affordable cost. It also provides easy and user-friendly interface. Hence, the Android-supported workstations are being widely used by independent music producers, hobbyists, and performers to refine their music at an effective cost.

Professional audio engineers to account for the largest market size during the forecast period

Audio engineers set up and test sound equipment before events, broadcasts, and recordings and help produce music by balancing and adjusting sound sources using equalization and audio effects mixing , reproduction, and strengthening of sound. Sound engineers are professionals who use digital audio workstations to record, edit, mix, and master music to improve sound quality and add sound effects to recordings. These workstations enable sound engineers to work with video editors and synchronize video with audio tracks. Developing regions such as Asia Pacific, Middle East & Africa, and Latin America have witnessed increased adoption of digital audio workstations by sound engineers for various applications.

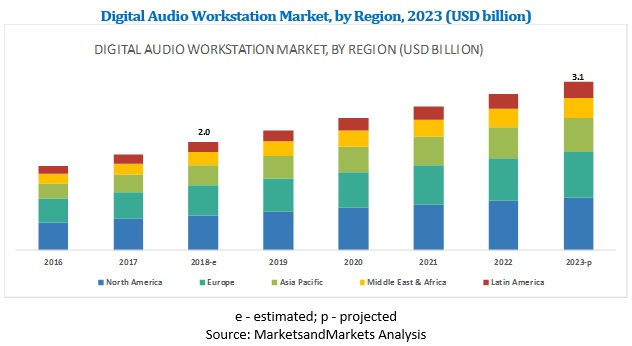

North America to account for the largest market size during the forecast period

The global digital audio workstation market by region covers five major regions: North America, Asia Pacific (APAC), Europe, Middle East and Africa (EMEA), and Latin America. North America constitutes the highest market share, owing to the early adoption of advanced technology solutions as well as initiatives taken by vendors to reach the end user base. The US and Canada are witnessing increased adoption of advanced technologies, including Android and Linux operating systems.

Key Market Players

Major vendors, such as Apple (US), Adobe (US), Avid (US), Steinberg (Germany), Ableton (Germany), MOTU (US), Acoustica (US), Native Instruments (Germany), MAGIX (Germany), Presonus (US), Cakewalk (US), Inage Line Software (Belgium), Bitwig (Germany), Renoise (Germany), and Harrison Consoles (US). The study includes in-depth competitive analysis of these key players in the global market with their company profiles, recent developments, and key market strategies.

Please visit 360Quadrants to see the vendor listing of Best Audio Editing Software Quadrant

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Operating System, Component, Deployment Model, Type, End User, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Apple (US), Adobe (US), Avid (US), Ableton (Germany), Steinberg (Germany), MOTU (US), Acoustica (US), Presonus (US), Magix (Germany), Native Instruments (Germany), Cakewalk (US), Image Line Software (Germany), Bitwig (Germany), Renoise (Germany), and Harrison Consoles (US) |

This research report categorizes the digital audio workstation market based on component, deployment model, type, end user, operating system, and region.

Based on Component, the market has been segmented as follows:

- Software

- Services

Based on Service, the market has been segmented as follows:

- Professional

- Managed

Based on Type, the market has been segmented as follows:

- Editing

- Mixing

- Recording

Based on Operating system, the market has been segmented as follows:

- Mac

- Windows

- Android

- Linux

Based on End User, the digital audio workstation market has been segmented as follows

- Professionals/Audio Engineers and Mixers

- Songwriters and Production teams

- Electronic Musicians

- Artists/Performers

- Education Institutes

- Music Studios

- Others

Based on Deployment Model, the market has been segmented as follows

- On-premises

- Cloud

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Middle East & Africa

- Asia Pacific

- Latin America

Recent Developments:

- In March 2019, Avid renewed its multiyear agreement with FotoKem, a leader in digital and film post-production. The agreement ensures optimized efficiencies from Avid to enhance FotoKem’s video and audio post-production workflows. ProTools plays an important role in improving FotoKem’s audio post-production.

- In February 2019, Steinberg released maintenance updates for all Cubase 10 versions. The updates include enhancements for chord pads, MixConsole, expression maps, etc.

Frequently Asked Questions (FAQ):

What is Digital Audio Workstation?

Digital Audio Workstation is an electronic system used to record, edit, and produce sound files. These are mostly use to acquire and save multiple audio recordings for sound mixing, equalizing, and to add audio effects for audio enhancement. The digital audio workstations are usually found to be used I television program, films, podcasts, games and also where there is need for complex manipulation of audio signals is required.What are the top companies providing Digital Audio Workstation?

Major vendors offering digital audio workstation includes Apple, Adobe, Avid, Steinberg, Ableton, MOTU, and Acoustica among others. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships and collaborations, and mergers and acquisitions to expand their offerings in the market.What is the impact for technologies such as artificial intelligence and machine learning in Digital Audio workstation?

AI is rapidly being adopted to support music creation. It also smoothens the music production workflow. Furthermore, AI infused workstations are also capable of writing melodies making it easier for fresh and new music compositions.Who are major end users of Digital Audio Workstation?

The major end users incudes Professionals/Audio Engineers and Mixers, Songwriters and Production teams, Electronic Musicians, Artists/Performers, Education Institutes, and Music Studios.To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Forecast

2.5 Research Assumptions and Limitations

2.6 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Digital Audio Workstation Market

4.2 Market Share By Region

4.3 Market By Deployment Model

4.4 Market in Europe: Top 3 Operating Systems and Countries

5 Market Overview and Industry Trends (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Digitization of Instruments

5.2.1.2 Increased Adoption of Cloud-Based Digital Audio Workstation (DAW)

5.2.2 Restraints

5.2.2.1 Availability of Free Composing Software

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Ai-Generated Music

5.2.3.2 Growing Media & Entertainment Industry

5.2.3.3 Developing DAW for the Android Operating System

5.2.4 Challenges

5.2.4.1 Playing and Recording Live Music Using DAW

5.3 Industry Trends

5.3.1 Use Cases

5.3.1.1 Use Case 1: Merging Technologies Launched A DAW to Enable Utilization of Multiple Idle Cores for A Client

5.3.1.2 Use Case 2: Shure Distribution Provided A Customized Solution to Upgrade the Teaching Infrastructure of the University of Surrey

5.3.1.3 Use Case 3: Shure Distribution Deploys A Solution for Alvik School to Overcome the Limitations of Hearing Aid Technology

6 Digital Audio Workstation Market By Component (Page No. - 39)

6.1 Introduction

6.2 Software

6.2.1 Increasing Need to Produce and Store Better Quality Music Drives the Software Segment’s Growth

6.3 Services

6.3.1 Professional Services

6.3.1.1 Implementation and Consulting

6.3.1.1.1 Increased Demand and Adoption of DAW Solutions Across the Media & Entertainment and Education Industries to Drive the Growth of Implementation and Consulting Services Segment

6.3.1.2 Training and Support

6.3.1.2.1 Advanced Technologies and Support Services, to Enhance the Growth of Market

6.3.2 Managed Services

6.3.2.1 Assuring Reliability and Business Continuity to Foster the Growth of Managed Services Segment

7 Digital Audio Workstation Market By Type (Page No. - 47)

7.1 Introduction

7.2 Editing

7.2.1 Ability of DAW Software to Create Noise-Free Music Pieces Leads to Their High Demand

7.3 Mixing

7.3.1 Increasing Demand of End Users to Work With Multitrack Recording Drives the Mixing Segment’s Growth

7.4 Recording

7.4.1 Increasing Demand to Record and Store Pieces of Music Generated From Different Sources Drives the Recording Segment’s Growth

8 Digital Audio Workstation Market By Operating System (Page No. - 52)

8.1 Introduction

8.2 MAC

8.2.1 Market Share of MAC Segment is Affected By the Growing Demand for Windows and Android Devices

8.3 Windows

8.3.1 Easy Availability of Technical Support and Compatibility With Various Music Production Software Influence the Growth of the Windows Segment

8.4 Android

8.4.1 Increased Demand for Android-Compatible DAW Solutions and Suites Driving the Key Players to Focus on Android

8.5 Linux

8.5.1 Increasing Need for Support for Linux and Music Product Software is Impacting the Usage for Music Production

9 Digital Audio Workstation Market By Deployment Model (Page No. - 58)

9.1 Introduction

9.2 On-Premises

9.2.1 Need for Secured Implementation and Privileged Usage to Remain the Major Factors Driving the Adoption of On-Premises Solutions

9.3 Cloud

9.3.1 Increased Demand for Easy Implementation and Affordable Solutions to Drive the Adoption of Cloud-Based DAW Solutions

10 Digital Audio Workstation Market By End User (Page No. - 62)

10.1 Introduction

10.2 Professional/Audio Engineers and Mixers

10.2.1 Easy to Use Interface and Easy Synchronization With Multiple Audio Tracks Drives the Adoption of DAW Solutions By Professional/Audio Engineers and Mixers

10.3 Songwriters and Production Teams

10.3.1 Increasing Demand for Cutting-Edge Tools Drives the Market Growth Among Songwriters and Production Teams

10.4 Electronic Musicians

10.4.1 Increasing Demand for Providing Superior Listening Experience Leads to Higher Adoption of DAW

10.5 Artists/Performers

10.5.1 Ability to Refine and Create Better Quality Music Leads to High Demand for DAW Among Artists/Performers

10.6 Educational Institutes

10.6.1 Ability to Create Shared Audio Projects is Leading to Increasing Adoption By Educational Institutes

10.7 Music Studios

10.7.1 Innovations in Digital Audio Workstation to Analyze the Recorded Signals’ Content Accurately Drives the Market Growth

10.8 Others

11 Digital Audio Workstation Market By Region (Page No. - 71)

11.1 Introduction

11.2 North America

11.2.1 North America, By Component

11.2.2 North America, By Service

11.2.3 North America, By Professional Service

11.2.4 North America, By Deployment Model

11.2.5 North America, By Type

11.2.6 North America, By Operating System

11.2.7 North America, By End User

11.2.8 North America, By Country

11.2.8.1 US

11.2.8.1.1 Availability of Cost-Effective Solutions and Increased Digitalization Drive the Market Growth

11.2.8.2 Canada

11.2.8.2.1 Presence of Large End User Base to Drive the Market Growth in Canada

11.3 Europe

11.3.1 Europe, By Component

11.3.2 Europe, By Service

11.3.3 Europe, By Professional Service

11.3.4 Europe, By Deployment Model

11.3.5 Europe, By Type

11.3.6 Europe, By Operating System

11.3.7 Europe, By End User

11.3.8 Europe, By Country

11.3.8.1 UK

11.3.8.1.1 Increasing Demand for Customized Solutions to Drive the Adoption of DAW

11.3.8.2 France

11.3.8.2.1 High Internet Penetration to Assist the Market Growth in France

11.3.8.3 Germany

11.3.8.3.1 Increased Digitalization and High Investment in Music Production to Create Growth Opportunities in Germany

11.3.8.4 Rest of Europe

11.4 Asia Pacific

11.4.1 Asia Pacific, By Component

11.4.2 Asia Pacific, By Service

11.4.3 Asia Pacific, By Professional Service

11.4.4 Asia Pacific, By Deployment Model

11.4.5 Asia Pacific, By Type

11.4.6 Asia Pacific, By Operating System

11.4.7 Asia Pacific, By End User

11.4.8 Asia Pacific, By Country

11.4.8.1 China

11.4.8.1.1 Rapid Digitization and Growing Internet User Base to Boost Adoption in China

11.4.8.2 Japan

11.4.8.2.1 Increasing Need to Target the Right Audience to Fuel the DAW Solutions Adoption in Japan

11.4.8.3 India

11.4.8.3.1 Increasing Adoption By Artists and Individual Performers and Increased Focus on Cloud-Based Solutions to Drive the Market Growth

11.4.8.4 Rest of Asia Pacific

11.5 Middle East & Africa

11.5.1 Middle East & Africa, By Component

11.5.2 Middle East & Africa, By Service

11.5.3 Middle East & Africa, By Professional Service

11.5.4 Middle East & Africa, By Deployment Model

11.5.5 Middle East & Africa, By Type

11.5.6 Middle East & Africa, By Operating System

11.5.7 Middle East & Africa, By End User

11.5.8 Middle East & Africa, By Region

11.5.8.1 Middle East

11.5.8.1.1 Emergence of Music Streaming Services and Mobility of DAW to Drive the Market Growth

11.5.8.2 Africa

11.5.8.2.1 Automated Processing and Increasing Adoption of Digital Technologies to Drive the Market Growth

11.6 Latin America

11.6.1 Latin America, By Component

11.6.2 Latin America, By Service

11.6.3 Latin America, By Professional Service

11.6.4 Latin America, By Deployment Model

11.6.5 Latin America, By Type

11.6.6 Latin America, By Operating System

11.6.7 Latin America, By End User

11.6.8 Latin America, By Country

11.6.8.1 Brazil

11.6.8.1.1 Wide Adoption of Digitalization and Strong Vendor Presence to Drive the Market Growth

11.6.8.2 Mexico

11.6.8.2.1 Increasing Adoption of Digital Technologies to Drive the Market Growth

11.6.8.3 Rest of Latin America

12 Competitive Landscape (Page No. - 97)

12.1 Micro-Quadrant Overview

12.1.1 Visionary Leaders

12.1.2 Innovators

12.1.3 Dynamic Differentiators

12.1.4 Emerging Companies

12.2 Strength of Product Portfolio

12.3 Business Strategy Excellence

13 Company Profiles (Page No. - 102)

(Business Overview, Products and Solutions Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 Apple

13.2 Adobe

13.3 AVID

13.4 Steinberg

13.5 Ableton

13.6 Motu

13.7 Acoustica

13.8 Native Instruments

13.9 Magix

13.10 Presonus

13.11 Cakewalk

13.12 Image-Line

13.13 Bitwig

13.14 Renoise

13.15 Harrison Consoles

*Details on Business Overview, Products and Solutions Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 125)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: MarketsandMarkets’ Subscription Portal

14.4 Available Customization

14.5 Related Reports

14.6 Author Details

List of Tables (73 Tables)

Table 1 United States Dollar Exchange Rate, 2014–2017

Table 2 Factor Analysis

Table 3 Digital Audio Workstation Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 4 Market Size By Component, 2016–2023 (USD Million)

Table 5 Software: Market Size By Region, 2016–2023 (USD Million)

Table 6 Market Size, By Service, 2016–2023 (USD Million)

Table 7 Services: Market Size By Region, 2016–2023 (USD Million)

Table 8 Professional Services: Market Size By Type, 2016–2023 (USD Million)

Table 9 Professional Services: Market Size By Region, 2016–2023 (USD Million)

Table 10 Implementation and Consulting Services: Market Size By Region, 2016–2023 (USD Million)

Table 11 Training and Support: Market Size By Region, 2016–2023 (USD Million)

Table 12 Managed Services: Market Size By Region, 2016–2023 (USD Million)

Table 13 Digital Audio Workstation Market Size, By Type, 2016–2023 (USD Million)

Table 14 Editing: Market Size By Region, 2016–2023 (USD Million)

Table 15 Mixing: Market Size By Region, 2016–2023 (USD Million)

Table 16 Recording: Market Size By Region, 2016–2023 (USD Million)

Table 17 Market Size, By Operating System, 2016–2023 (USD Million)

Table 18 MAC: Market Size By Region, 2016–2023 (USD Million)

Table 19 Windows: Market Size By Region, 2016–2023 (USD Million)

Table 20 Android: Market Size By Region, 2016–2023 (USD Million)

Table 21 Linux: Market Size By Region, 2016–2023 (USD Million)

Table 22 Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 23 On-Premises: Market Size By Region, 2016–2023 (USD Million)

Table 24 Cloud: Market Size By Region, 2016–2023 (USD Million)

Table 25 Digital Audio Workstation Market Size, By End User, 2016–2023 (USD Million)

Table 26 Professional/Audio Engineers and Mixers: Market Size By Region, 2016–2023 (USD Million)

Table 27 Songwriters and Production Teams: Market Size By Region, 2016–2023 (USD Million)

Table 28 Electronic Musicians: Market Size By Region, 2016–2023 (USD Million)

Table 29 Artists/Performers: Market Size By Region, 2016–2023 (USD Million)

Table 30 Educational Institutes: Market Size By Region, 2016–2023 (USD Million)

Table 31 Music Studios: Market Size By Region, 2016–2023 (USD Million)

Table 32 Others: Market Size By Region, 2016–2023 (USD Million)

Table 33 Digital Audio Workstation Market Size, By Region, 2016–2023 (USD Million)

Table 34 North America: Market Size By Component, 2016–2023 (USD Million)

Table 35 North America: Market Size By Service, 2016–2023 (USD Million)

Table 36 North America: Market Size By Professional Service, 2016–2023 (USD Million)

Table 37 North America: Market Size By Deployment Model, 2016–2023 (USD Million)

Table 38 North America: Market Size By Type, 2016–2023 (USD Million)

Table 39 North America: Market Size By Operating System, 2016–2023 (USD Million)

Table 40 North America: Market Size By End User, 2016–2023 (USD Million)

Table 41 North America: Market Size By Country, 2016–2023 (USD Million)

Table 42 Europe: Digital Audio Workstation Market Size, By Component, 2016–2023 (USD Million)

Table 43 Europe: Market Size By Service, 2016–2023 (USD Million)

Table 44 Europe: Market Size By Professional Service, 2016–2023 (USD Million)

Table 45 Europe: Market Size By Deployment Model, 2016–2023 (USD Million)

Table 46 Europe: Market Size By Type, 2016–2023 (USD Million)

Table 47 Europe: Market Size By Operating System, 2016–2023 (USD Million)

Table 48 Europe: Market Size By End User, 2016–2023 (USD Million)

Table 49 Europe: Market Size By Country, 2016–2023 (USD Million)

Table 50 Asia Pacific: Digital Audio Workstation Market Size, By Component, 2016–2023 (USD Million)

Table 51 Asia Pacific: Market Size By Service, 2016–2023 (USD Million)

Table 52 Asia Pacific: Market Size By Professional Service, 2016–2023 (USD Million)

Table 53 Asia Pacific: Market Size By Deployment Model, 2016–2023 (USD Million)

Table 54 Asia Pacific: Market Size By Type, 2016–2023 (USD Million)

Table 55 Asia Pacific: Market Size By Operating System, 2016–2023 (USD Million)

Table 56 Asia Pacific: Market Size By End User, 2016–2023 (USD Million)

Table 57 Asia Pacific: Market Size By Country, 2016–2023 (USD Million)

Table 58 Middle East & Africa: Digital Audio Workstation Market Size, By Component, 2016–2023 (USD Million)

Table 59 Middle East & Africa: Market Size By Service, 2016–2023 (USD Million)

Table 60 Middle East & Africa: Market Size By Professional Service, 2016–2023 (USD Million)

Table 61 Middle East & Africa: Market Size By Deployment Model, 2016–2023 (USD Million)

Table 62 Middle East & Africa: Market Size By Type, 2016–2023 (USD Million)

Table 63 Middle East & Africa: Market Size By Operating System, 2016–2023 (USD Million)

Table 64 Middle East & Africa: Market Size By End User, 2016–2023 (USD Million)

Table 65 Middle East & Africa: Market Size By Region, 2016–2023 (USD Million)

Table 66 Latin America: Digital Audio Workstation Market Size, By Component, 2016–2023 (USD Million)

Table 67 Latin America: Market Size By Service, 2016–2023 (USD Million)

Table 68 Latin America: Market Size By Professional Service, 2016–2023 (USD Million)

Table 69 Latin America: Market Size By Deployment Model, 2016–2023 (USD Million)

Table 70 Latin America: Market Size By Type, 2016–2023 (USD Million)

Table 71 Latin America: Market Size By Operating System, 2016–2023 (USD Million)

Table 72 Latin America: Market Size By End User, 2016–2023 (USD Million)

Table 73 Latin America: Market Size By Country, 2016–2023 (USD Million)

List of Figures (31 Figures)

Figure 1 Digital Audio Workstation Market: Research Design

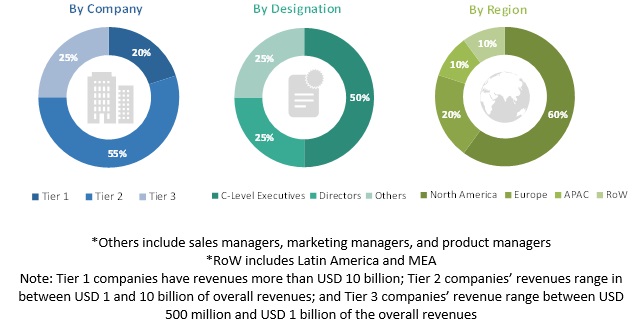

Figure 2 Breakup of Primary Participants’ Profiles: By Company Type, Designation, and Region

Figure 3 Market Bottom-Up Approach

Figure 4 Market Top-Down Approach

Figure 5 Market Snapshot By Region, 2018 vs 2023

Figure 6 Digital Audio Workstation Market Snapshot By Component, 2018 vs 2023

Figure 7 Market Snapshot By Service, 2018 vs 2023

Figure 8 Market Snapshot By Professional Service, 2018 vs 2023

Figure 9 Market Snapshot, By Type, 2018 vs 2023

Figure 10 Market Snapshot, By Deployment Model, 2018 vs 2023

Figure 11 Market Snapshot By Operating System, 2018 vs 2023

Figure 12 Market Snapshot By End User, 2018–2023

Figure 13 Growing Digitization of Instruments to Drive the Digital Audio Workstation Market

Figure 14 North America to Account for the Largest Market Share in 2018

Figure 15 Cloud Deployment Model to Dominate the Market in 2018

Figure 16 Windows Operating System and UK to Hold the Highest Market Shares in 2018

Figure 17 Drivers, Restraints, Opportunities, and Challenges

Figure 18 Software Segment to Account for the Largest Market Size During the Forecast Period

Figure 19 Professional Services Segment to Account for A Larger Market Size as Compared to Managed Services Segment During the Forecast Period

Figure 20 Editing Segment to Have the Largest Market Size During the Forecast Period

Figure 21 Windows Segment to Account for the Largest Market Size During the Forecast Period

Figure 22 Cloud Segment to Have A Larger Market Size as Compared to the On-Premises Segment During the Forecast Period

Figure 23 Professionals/Audio Engineers and Mixers Segment to Have the Largest Market Size During the Forecast Period

Figure 24 North America to Account for the Largest Market Size During the Forecast Period

Figure 25 North America: Market Snapshot

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Digital Audio Workstation (Global) Competitive Leadership Mapping, 2018

Figure 28 Ranking of Key Players in the Digital Audio Workstation Market, 2018

Figure 29 Apple: Company Snapshot

Figure 30 Adobe: Company Snapshot

Figure 31 AVID: Company Snapshot

The study involved 4 major activities to estimate the current market size of the digital audio workstation market. An exhaustive secondary research was done to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides of the digital audio workstation market ecosystem were interviewed to obtain qualitative and quantitative information for this study. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors who provide the digital audio workstation software, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Digital Audio Workstation Market Size Estimation

For making market estimates and forecasting the market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies’ revenues and their offerings in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined with the help of primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation of data through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the digital audio workstation market by type, operating system, deployment model, component, end user, and region

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape of the market

- To forecast the revenue of the market’s segments with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their recent developments and positioning in the market

- To analyze competitive developments, such as acquisitions; new product launches and upgrades; partnerships, agreements, and collaborations; and business expansions, in the market

Key Questions addressed by the report:

- What are the opportunities in the market?

- What is the competitive landscape in the market?

- What are the key trends in the digital audio workstation market?

- How are mergers and acquisitions influencing the market?

- What are the dynamics of the market?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Digital Audio Workstation Market