Diamond Coatings Market by Technology (CVD, PVD), Substrate (Metal, Ceramic, Composite), End-Use Industry (Electronics, Mechanical, Industrial, Medical, Automotive), and Region (Europe, North America, APAC, MEA, South America) - Global Forecast to 2022

[111 Pages Report] Diamond has a wide range of properties. It is the hardest known material which is chemically inert and wear- resistant. It has the lowest coefficient of thermal expansion, offers low friction with high thermal conductivity, and is electrically insulating. It is also optically transparent from ultra-violet (UV) to far-infrared (IR). Diamond coating is a process by which a uniform layer of diamond is deposited on material such as glass, plastics, metals, ceramics, and composites. The coating is done by using carbon feed gas, mostly methane diluted by hydrogen to approx. 1-2 mol%, which is passed into the chamber and exposed to a combination of lasers through CVD and PVD technologies. Due to the extreme temperature and pressure, the diamond particles bond to the surface of a material or substrate. Diamond coating is done to impart exceptional wear resistance, excellent hardness, and enhanced corrosion resistance to the substrates

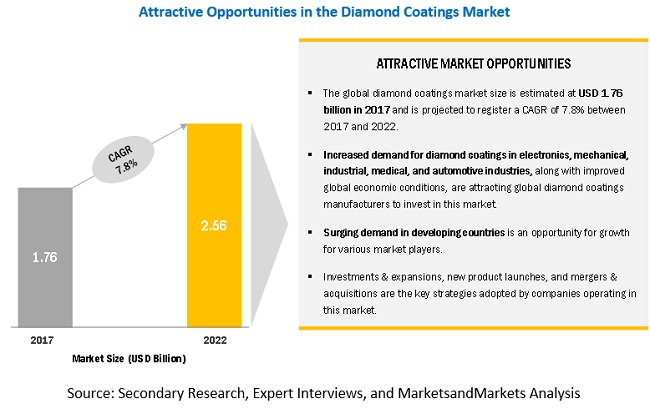

The market size for diamond coatings is estimated to be USD 1.76 billion in 2017, which is projected to reach USD 2.56 billion by 2022, at a CAGR of 7.8% during the forecast period. The growth of the diamond coatings market is primarily driven by the increasing demand for diamond coated medical devices, metal cutting tools, mechanical, and electronic equipment in the growing markets of Europe and North America. The demand for these coatings is also increasing in emerging economies such as India, China, Thailand, Indonesia, Brazil, and Argentina.

CVD To Be The Fastest-Growing Technology Between 2017 And 2022

The diamond coatings market is segmented on the basis of technology as CVD, PVD, and others. CVD diamond coatings account for the largest market size. In the CVD process, diamond is deposited from a carbon gas phase and can, therefore, coat large areas and curved surfaces. In this process, diamond deposits can grow thick enough to become free-standing parts, which can be cut and finished to the desired size and shape. The CVD process typically includes the maintenance of a plasma containing atomic hydrogen over the growth surface and requires a source of carbon such as methane (CH4). CVD process overcomes many of the limitations of high-pressure processes.

In the PVD process, the pure solid source material is gasified with the help of high power electricity or a laser beam. The gasified material then condenses on the substrate material to create the desired thin film layer. CVD and PVD technologies are witnessing high growth and are expected to continue so in the near future.

Metal substrates segment to register the highest CAGR between 2017 and 2022

The diamond coatings market is segmented on the basis of substrates as metals, ceramics, composites, and others. Diamond coating is largely dependent on the substrate chemistry. Atomic, molecular hydrogen, and carbon species cause reactions, especially with ceramics substrates, modify certain metallic substrates, and can form intermediate layers, thereby delaying the onset of diamond nucleation, growth, and coating formation.

The market for metal and ceramic substrates witnessed intense growth in the past few years. This growth is estimated to continue in the next five years. High demand for diamond coatings in the emerging economies, such as China, India, and Southeast Asian countries, are the major drivers. Certain substrates can retard or even prevent the formation of diamond coating if it is in direct contact with the diamond being formed. For example, an iron substrate can lead to massive non-diamond carbon deposition at the substrate or diamond interface

APAC to account for the fastest-growing market during the forecast period

APAC has emerged as the fastest-growing diamond coatings market owing to its growing end-use industries, increasing domestic demand and income levels. Owing to the availability of cheap labor and economical and accessible raw materials, there are significant foreign investments, which is also driving the market growth in the region. Nevertheless, the North American and European diamond coatings market are still attractive markets for high-quality products with significant brand recognition. However, manufacturers in these regions face tough competition from the APAC market as the cost is an important factor for end customers. Local manufacturers in APAC are successfully providing similar diamond coated tools and equipment at lower costs.

Market Dynamics

Driver: Enhanced life of cutting tools and equipment

Diamond is an ideal element because of its high hardness and strength, low friction coefficient, and chemical stability, among others. Diamond coating is done through advanced surface engineering technologies such as CVD and PVD and has been increasingly explored for cutting-tool applications. Diamond-coated tools have great potential in various machining applications. It is advantageous in the fabrication of cutting tools with complex geometry such as drills. Diamond coating enhanced the life of tools and equipment. This has increased its usages in lightweight and high-strength components, which have resulted in significant interests among end-users.

Restraint: High capacity investment

The diamond coating process requires a lot of capital investment. CVD and PVD technologies are capital intensive, and the equipment used in these coating technologies require special operating conditions, such as high temperature and controlled vacuum conditions for operation. The cost of manufacturing diamond-coated equipment is high and, since a few top global players control the market, the cost of equipment and tools for the end-use industry is high. The process of coating varies for different applications. It depends on the material to be coated and the thickness of the film layer. Different equipment is needed for different applications. The cost of diamond coating machinery is very high. Hence, it is not feasible for the end-user to set up their machines to diamond coat tools and equipment.

Opportunity: Innovation in technology through R&D

Diamond coating is done to improve the substrates properties. Depending on the thickness of the coating layer and precursor material used, the properties of the substrate materials can be improved. R&D activities are carried out in various regions by universities and independent research organizations to improve the properties of the substrate materials with different precursor materials and reduce the cost of diamond coating process to benefit the end-users. Companies involved in the diamond coating process need to invest significantly to continuously update their product portfolio to meet the newer and increasing demands from end-users. Key players in the diamond coatings market invest heavily in R&D activities every year to update and upgrade their offerings according to the end-use industry demands. Thus, innovation in technologies is expected to create a wider scope for the diamond coatings market in the coming future.

Challenge: Adhesion difficulties on various substrates

Coating delamination is a major issue in the diamond coating process. Strong adhesion between the coating and the substrate is a key factor that determines the performance of the coating. Currently, there are issues and problems related to diamond coatings such as characterization and nucleation on foreign surfaces. The introduction of diamond-coated tools for industrial machining of materials was initially hampered mainly by coating adhesion difficulties. However, this difficulty has been addressed through several R&D done by diamond coating companies. With tungsten-carbide substrates, various techniques have been developed to enhance the adhesion strength. However, diamond coating on hard metal and ceramic tools still need extensive R&D. This remains a challenge as experimental results have not been consistent in many cases. More R&D remains to be done before an accurate assessment can be made of the technological impact of the development.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2015 2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017 2022 |

|

Forecast units |

Million/Billion (USD) |

|

Segments covered |

Technology, Sustrate, End-User Industry, and Region |

|

Geographies covered |

North America, Europe, APAC, RoW (South America, Middle East, and Africa) |

|

Companies covered |

Oerlikon Balzers (Switzerland), NeoCoat SA (Switzerland), and Element Six (London), D-Coat GMBH (Germany), Crystallume Corporation (US), SP3 Diamond Technologies (US), Advanced Diamond Technologies, Inc. (US), Blue Wave Semiconductors (US), Diamond Product Solutions (Netherlands), and JCS Technologies Pte Ltd. (Singapore) |

The research report categorizes the Diamond Coatings market to forecast the revenues and analyze the trends in each of the following sub-segments:

Diamond Coatings Market, By Technology

- Chemical Vapor Deposition

- Physical Vapor Deposition

Diamond Coatings Market, By Substrate

- Metals

- Ceramics

- Composites

- Others1

Diamond Coatings Market, By Geography

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa

- South America

Key Market Players

Oerlikon Balzers (Switzerland), NeoCoat SA (Switzerland), and Element Six (London).

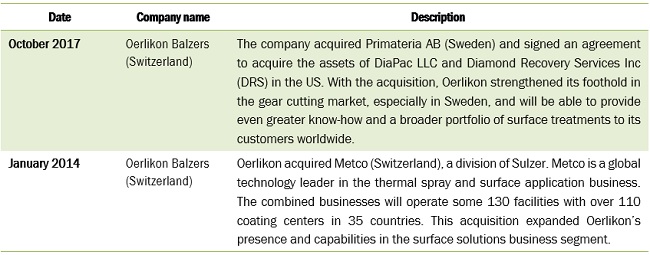

Recent Developments

Critical questions the report answers:

- What are the upcoming trends for the Diamond Coatings Market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities for Players in the Diamond Coatings Market

4.2 Market Size, By Technology

4.3 Market Size, Developed vs Developing Countries

4.4 Market, By End-Use Industry and Key Countries

4.5 Market, By Substrate

4.6 Market Attractiveness

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Characteristics of Diamond Coatings

5.3 Market Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Demand for Diamond Coated Medical Devices and Equipment

5.4.1.2 Enhanced Life of Cutting Tools and Equipment

5.4.2 Restraints

5.4.2.1 High Capital Investment

5.4.2.2 Requirement of Qualified Workforce for Operation

5.4.3 Opportunities

5.4.3.1 Innovation in Technology Through R&D

5.4.3.2 Diamond Coated Tools in the Construction Industry

5.4.4 Challenges

5.4.4.1 Adhesion Difficulties on Various Substrates

5.5 Porters Five Forces Analysis

5.5.1 Threat of Substitutes

5.5.2 Bargaining Power of Buyers

5.5.3 Threat of New Entrants

5.5.4 Bargaining Power of Suppliers

5.5.5 Intensity of Competitive Rivalry

6 Diamond Coatings Market, By Technology (Page No. - 38)

6.1 Introduction

6.2 Chemical Vapor Deposition

6.2.1 LPCVD (Low Pressure CVD)

6.2.2 APCVD (Atmospheric Pressure CVD)

6.2.3 PECVD (Plasma Enhanced CVD)

6.2.4 MOCVD (Metal Organic CVD)

6.2.5 Others

6.3 Physical Vapor Deposition

6.3.1 Cathodic Arc Deposition

6.3.2 Electron Beam

6.3.3 Sputter Deposition

6.3.4 Others

7 Diamond Coatings Market, By Substrate (Page No. - 44)

7.1 Introduction

7.2 Metal

7.3 Ceramic

7.4 Composite

7.5 Others

8 Diamond Coatings Market, By End-Use Industry (Page No. - 49)

8.1 Introduction

8.2 Electronics

8.3 Mechanical

8.4 Industrial

8.5 Medical

8.6 Automotive

8.7 Others

9 Diamond Coatings Market, By Region (Page No. - 57)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.2 Taiwan

9.2.3 South Korea

9.2.4 Japan

9.2.5 India

9.2.6 Indonesia

9.2.7 Thailand

9.2.8 Rest of APAC

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 Russia

9.3.4 UK

9.3.5 Italy

9.3.6 Spain

9.3.7 Turkey

9.3.8 Rest of Europe

9.4 North America

9.4.1 US

9.4.2 Canada

9.4.3 Mexico

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.2 South Africa

9.6.3 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 83)

10.1 Introduction

10.2 Market Ranking of Key Players

10.2.1 Oerlikon Balzers (Switzerland)

10.2.2 Neocoat SA (Switzerland)

10.2.3 Element Six (UK)

10.3 Competitive Scenario

10.3.1 Acquisitions

10.3.2 Expansions

10.3.3 New Product Launches/Developments

11 Company Profiles (Page No. - 87)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Oerlikon Balzers

11.2 D-Coat GmbH

11.3 Neocoat SA

11.4 Crystallume Corporation

11.5 Element Six

11.6 SP3 Diamond Technologies

11.7 Advanced Diamond Technologies

11.8 Blue Wave Semiconductors

11.9 Diamond Product Solutions

11.10 JCS Technologies PTE Ltd.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 103)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (41 Tables)

Table 1 Diamond Coatings Market Snapshot (2017 vs 2022)

Table 2 Market Size, By Technology, 20152022 (USD Million)

Table 3 Market Size of CVD Diamond Coatings, By Region, 20152022 (USD Million)

Table 4 Market Size of PVD Diamond Coatings, By Region, 20152022 (USD Million)

Table 5 Market Size, By Substrate, 20152022 (USD Million)

Table 6 Market Size for Metal Substrate, By Region, 20152022 (USD Million)

Table 7 Market Size for Ceramic Substrate, By Region, 20152022 (USD Million)

Table 8 Market Size for Composite Substrate, By Region, 20152022 (USD Million)

Table 9 Market Size for Other Substrates, By Region, 20152022 (USD Million)

Table 10 Market Size, By End-Use Industry, 20152022 (USD Million)

Table 11 Market Size in Electronics, By Region, 20152022 (USD Million)

Table 12 Market Size in Mechanical, By Region, 20152022 (USD Million)

Table 13 Market Size in Industrial, By Region, 20152022 (USD Million)

Table 14 Market Size in Medical, By Region, 20152022 (USD Million)

Table 15 Market Size in Automotive, By Region, 20152022 (USD Million)

Table 16 Market Size in Other End-Use Industries, By Region, 20152022 (USD Million)

Table 17 Market Size, By Region, 20152022 (USD Million)

Table 18 APAC: Diamond Coatings Market Size, By Country, 20152022 (USD Million)

Table 19 APAC: Market Size, By Technology, 20152022 (USD Million)

Table 20 APAC: Market Size, By Substrate, 20152022 (USD Million)

Table 21 APAC: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 22 Europe: Diamond Coatings Market Size, By Country, 20152022 (USD Million)

Table 23 Europe: Market Size, By Technology, 20152022 (USD Million)

Table 24 Europe: Market Size, By Substrate, 20152022 (USD Million)

Table 25 Europe: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 26 North America: Diamond Coatings Market Size, By Country, 20152022 (USD Million)

Table 27 North America: Market Size, By Technology, 20152022 (USD Million)

Table 28 North America: Market Size, By Substrate, 20152022 (USD Million)

Table 29 North America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 30 South America: Diamond Coatings Market Size, By Country, 20152022 (USD Million)

Table 31 South America: Market Size, By Technology, 20152022 (USD Million)

Table 32 South America: Market Size, By Substrate, 20172022 (USD Million)

Table 33 South America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 34 Middle East & Africa: Diamond Coatings Market Size, By Country, 20152022 (USD Million)

Table 35 Middle East & Africa: Market Size, By Technology, 20152022 (USD Million)

Table 36 Middle East & Africa: Market Size, By Substrate, 20152022 (USD Million)

Table 37 Middle East & Africa: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 38 Market Ranking of Key Players, 2016

Table 39 Acquisitions, 20132017

Table 40 Expansions, 20132017

Table 41 New Product Launches/Developments, 20132017

List of Figures (32 Figures)

Figure 1 Diamond Coatings: Market Segmentation

Figure 2 Diamond Coatings Market: Research Design

Figure 3 Diamond Coatings Market Size Estimation: Bottom-Up Approach

Figure 4 Diamond Coatings Market Size Estimation: Top-Down Approach

Figure 5 Diamond Coatings: Data Triangulation

Figure 6 CVD to Be the Fastest-Growing Technology Between 2017 and 2022

Figure 7 Metal Substrates Segment to Register the Highest CAGR Between 2017 and 2022

Figure 8 Medical to Be the Key End-Use Industry of Diamond Coatings Market Between 2017 and 2022

Figure 9 APAC to Be the Fastest-Growing Market for Diamond Coatings Market Between 2017 and 2022

Figure 10 Emerging Economies to Offer Lucrative Growth Opportunities for Diamond Coatings Market Players Between 2017 and 2022

Figure 11 CVD Diamond Coatings Market Segment to Have the Largest Market Size During Forecast Period

Figure 12 Demand for Diamond Coatings Market to Be High in Developing Countries

Figure 13 Electronics to Account for Largest Share in the Market in 2017

Figure 14 Diamond Coatings Market on Metal Substrate to Register the Highest Growth During Forecast Period

Figure 15 China to Register the Highest CAGR in Market of Diamond Coatings Market Between 2017 and 2022

Figure 16 Factors Governing the Market of Diamond Coatings

Figure 17 CVD Diamond Coating to Dominate the Market

Figure 18 APAC to Be the Fastest-Growing Market of Diamond Coatings Between 2017 and 2022

Figure 19 Market Size, By Substrate and Region, 2017 (USD Million)

Figure 20 High Growth of Major End-Use Industries to Drive the Market of Diamond Coatings

Figure 21 Diamond Coatings Market O Register the Highest Growth Rate in Medical Industry Between 2017 and 2022

Figure 22 Indonesia: an Emerging Market for Diamond Coatings

Figure 23 APAC Emerging as High-Growth Market for CVD and PVD Diamond Coating Technologies

Figure 24 APAC to Lead the Market of Diamond Coatings in All Major End-Use Industries

Figure 25 APAC: Market Snapshot

Figure 26 Electronics Sector to Drive the Market in Europe

Figure 27 Turkey to Be the Fastest-Growing Market in Europe

Figure 28 North American Market Snapshot

Figure 29 Market of Diamond Coatings in South America to Witness Slow Growth

Figure 30 Middle East & Africa Market Snapshot

Figure 31 Companies Adopted New Product Launch as the Key Growth Strategy Between 2013 and 2017

Figure 32 Oerlikon Balzers: Company Snapshot

Growth opportunities and latent adjacency in Diamond Coatings Market