Diagnostic Contract Manufacturing Market by Device (In Vitro Diagnostic Devices and Diagnostic Imaging Devices), Service (Device Development & Manufacturing, Quality Management, and Packaging & Assembly), Application, Region - Global Forecast to 2028

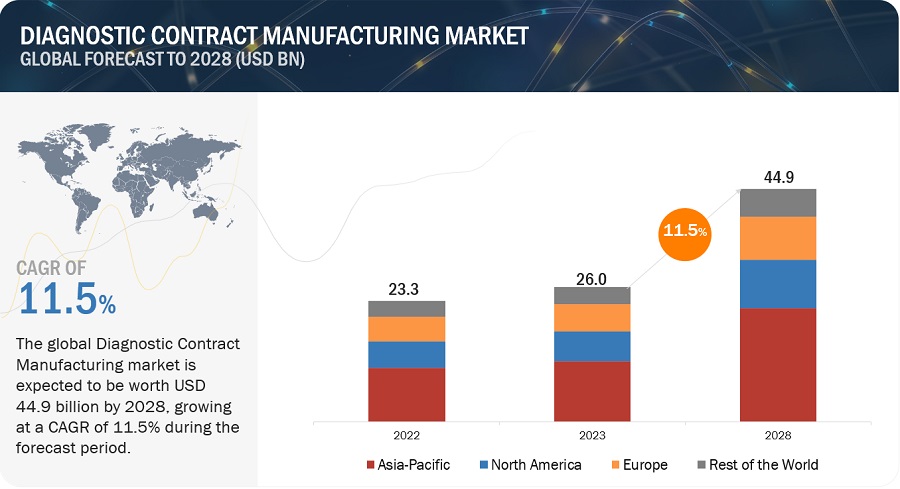

The global diagnostic contract manufacturing market, valued at US$23.3 billion in 2022, stood at US$26.0 billion in 2023 and is projected to advance at a resilient CAGR of 11.5% from 2023 to 2028, culminating in a forecasted valuation of US$44.9 billion by the end of the period. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The growth in this market is attributed to the rising number of diagnostic public-private partnerships, and government grants will increase the use of medical devices in emerging countries, leading to a boom in contract manufacturing. On the other hand, a lack of constant innovation to balance technological capabilities against cost may challenge the growth of the diagnostic contract manufacturing market.

Attractive Opportunities in the Diagnostic contract manufacturing Industry

To know about the assumptions considered for the study, Request for Free Sample Report

Global Diagnostic contract manufacturing Dynamics

DRIVER: High cost of in-house IVD manufacturing

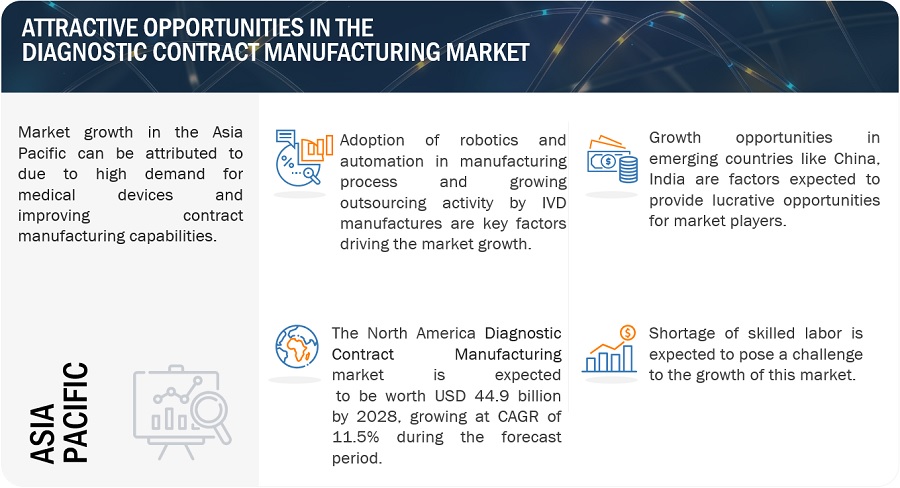

Contract manufacturing services in the IVD field have gained significant adoption as companies seek to expand their customer base by providing competitively priced products. Many CMOs are emerging in the Asia Pacific region, providing enormous opportunities for OEMs in IVD. According to a report by the Medical Device Outsourcing Association (MDOA), over 70% of medical device companies considered outsourcing in 2021. Thus, the high cost associated with the in-house manufacturing of IVD products has opened the doors to outsourcing manufacturing.

RESTRAINT: IP protection concerns and the possibility of IP theft

Diagnostic contract manufacturing includes outsourcing the production of the devices like IVD equipment, diagnostic imaging devices, and other devices to third-party manufacturers. OEM shares sensitive and proprietary information with contract manufacturers about diagnostic devices' design, technology, and manufacturing process. And with this exchange of sensitive information, data security becomes crucial.

OPPORTUNITY: Growth opportunities in emerging countries

Developing economies such as India, China, Brazil, South Korea, Turkey, Russia, and South Africa offer high growth opportunities for major players in the diagnostic contract manufacturing market. Furthermore, emerging economies offer lower manufacturing costs. For instance, outsourcing to China would reduce the overall manufacturing cost by ~30% compared to manufacturing in the US.

CHALLENGE: Adoption of refurbished diagnostic imaging systems

due to the strong demand for diagnostic imaging procedures globally, hospitals that cannot afford to invest in new imaging systems opt for refurbished ones. This is because refurbished systems are priced lower than new systems (40% to 60% of the price of new equipment). Many independent suppliers provide high-end refurbished and re-used systems at a significantly lower price.

Diagnostic Contract Manufacturing Industry Ecosystem

Prominent companies in this market include well-established, financially stable players in diagnostic contract manufacturing. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Jabil Inc. (US), Flex Ltd. (Singapore), Plexus Corp (US), Sanmina Corporation (US), TE Connectivity Ltd. (Switzerland), and Celestica Inc. (Canada).

In 2022, In Vitro Diagnostic devices to observe the highest share of the diagnostic contract manufacturing industry, by product.

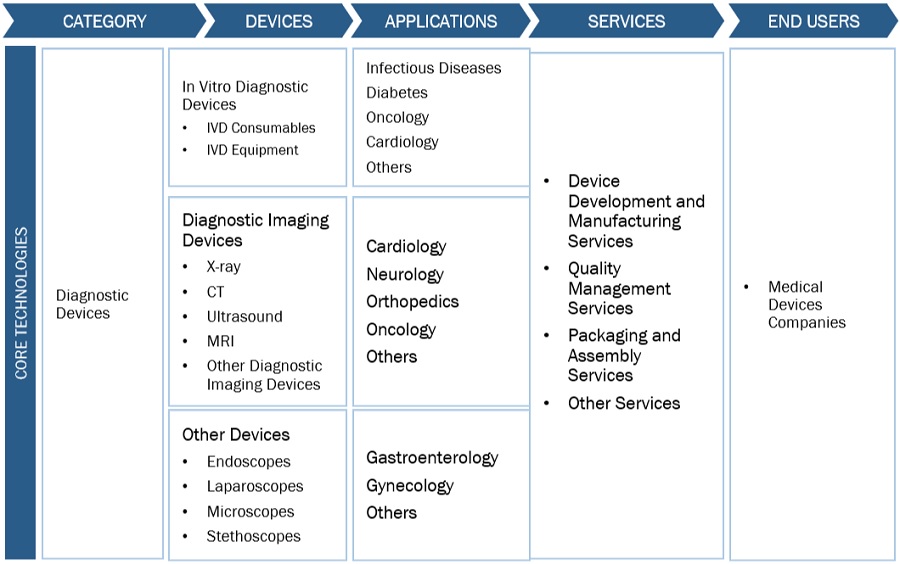

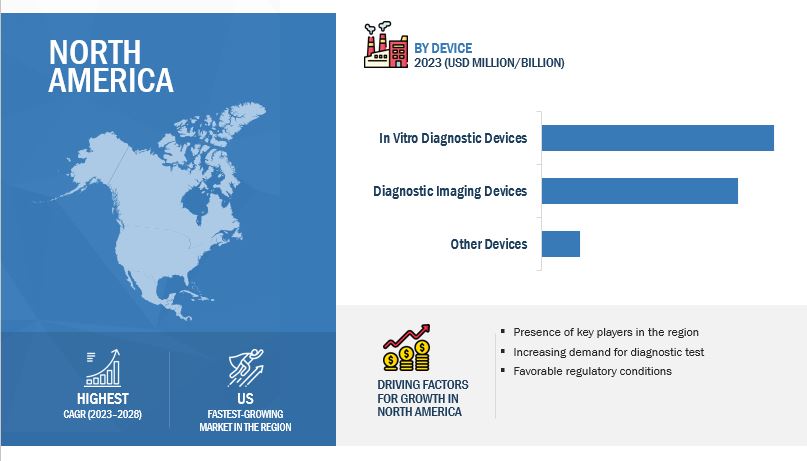

Based on the devices, the global diagnostic contract manufacturing market is broadly segmented into In vitro diagnostic devices, diagnostic imaging devices, and other devices. IVD equipment and devices are used to conduct laboratory tests to diagnose diseases and medical conditions and monitor patient status. IVD devices observe the highest market share during the forecast period. The high growth rate can be attributed to the increased adoption of automated diagnostic tools.

In 2022, device development and manufacturing services segment to dominate the diagnostic devices industry, by service.

Based on service, the diagnostic contract manufacturing market is segmented into device development and manufacturing services, quality management services, packaging and assembly services, and other services. Diagnostic device makers are currently under intense pressure to bring new devices to market faster and lower production costs. As a result, medical device manufacturing service providers continually evolve their services and find new ways to make production more efficient.

In 2022, North America to hold second largest in diagnostic contract manufacturing industry after Asia Pacific.

The global diagnostic contract manufacturing market is segmented into North America, Europe, Asia Pacific, and Rest of the World. North America is expected to observe significant growth during the forecast period, primarily due to the presence of a large number of diagnostic contract manufacturing companies in the region and improved industrial and healthcare infrastructure. The region also offers technological advancements in diagnostic devices, offering innovative solutions to their OEM partners.

To know about the assumptions considered for the study, download the pdf brochure

The diagnostic contract manufacturing market is dominated by players such as Jabil Inc. (US), Flex Ltd. (Singapore), Plexus Corp (US), Sanmina Corporation (US), TE Connectivity Ltd. (Switzerland), and Celestica Inc. (Canada).

Scope of the Diagnostics Contract Manufacturing Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$26.0 billion |

|

Projected Revenue by 2028 |

$44.9 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 11.5% |

|

Market Driver |

High cost of in-house IVD manufacturing |

|

Market Opportunity |

Growth opportunities in emerging countries |

This research report categorizes the Diagnostic contract manufacturing market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

By Product

-

In Vitro Diagnostic Devices

- IVD Consumables

- IVD Equipment

-

Diagnostic Imaging Devices

- CT

- X-ray

- Ultrasound

- MRI

- Others

- Other Devices

By Service

- Device Development and Manufacturing Services

- Quality Management Services

- Packaging and Assembly Services

- Other Services

By Application

-

In Vitro Diagnostic Devices

- Infectious Diseases

- Diabetes

- Oncology

- Cardiology

- Other Applications

-

Diagnostic Imaging Devices

- Cardiology

- Oncology

- Orthopedics

- Neurology

- Other Applications

-

Other Devices

- Gastroenterology

- Gynecology

- Other Applications

Recent Developments of Diagnostic Contract Manufacturing Industry:

- In 2022, IdentifySensors Biologics partnered with Jabil Inc. to develop processes for the reliable and robust manufacturing of portable devices that rapidly detect a wide range of infections at the molecular level with an accuracy that is superior to PCR testing.

- In 2022, Plexus Corp. expanded its manufacturing facility in Bangkok, Thailand.

- In 2021, TE Connectivity (US) acquired three companies focused on microfluidic cartridge and blister reagent package development, usability testing, and clinical research and manufacturing.

- In 2020, Sanmina Corporation achieved the Medical Device Single Audit Program (MDSAP) Certification at facilities in Malaysia, Singapore, and Sweden. The certification ensures its compliance with quality practices and audits.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global diagnostic contract manufacturing market between 2023 and 2028?

The global diagnostic contract manufacturing market is projected to grow from USD 26.0 billion in 2023 to USD 44.9 billion by 2028, at a CAGR of 11.5%. The rise is driven by increasing demand for cost-effective diagnostics and public-private partnerships in emerging economies.

What are the primary drivers of the diagnostic contract manufacturing market?

The main drivers of the diagnostic contract manufacturing market include the high cost of in-house IVD (In Vitro Diagnostics) manufacturing, the growth of diagnostic public-private partnerships, and government initiatives promoting healthcare in emerging markets.

What challenges does the diagnostic contract manufacturing market face?

Key challenges in the diagnostic contract manufacturing market include concerns over intellectual property (IP) protection and the risk of IP theft, especially when sensitive information is shared with third-party manufacturers.

Which services are most dominant in the diagnostic contract manufacturing industry?

The device development and manufacturing services segment is expected to dominate the diagnostic contract manufacturing industry, driven by the need for faster product launches and lower production costs.

How are emerging countries contributing to the growth of the diagnostic contract manufacturing market?

Emerging countries such as India, China, Brazil, and South Africa offer high growth potential due to lower manufacturing costs and the increasing demand for diagnostic devices in these regions.

What impact does the adoption of refurbished diagnostic imaging systems have on the market?

The growing demand for refurbished diagnostic imaging systems, which cost 40-60% less than new systems, poses a challenge to the growth of new diagnostic imaging devices in the market.

Which region holds the largest share in the diagnostic contract manufacturing market?

In 2022, the Asia Pacific region is expected to hold the largest share in the diagnostic contract manufacturing market due to the presence of numerous CMOs and lower production costs, followed by North America.

What role do IVD devices play in the diagnostic contract manufacturing market?

IVD (In Vitro Diagnostic) devices hold the largest share of the diagnostic contract manufacturing market, driven by the increasing use of automated diagnostic tools and the growing need for faster and accurate disease diagnosis.

What recent developments have occurred in the diagnostic contract manufacturing market?

Recent developments include IdentifySensors Biologics partnering with Jabil Inc. to develop processes for manufacturing portable molecular diagnostic devices, and TE Connectivity acquiring three companies focused on microfluidic cartridge and blister reagent package development.

How are OEMs benefiting from diagnostic contract manufacturing?

OEMs benefit from diagnostic contract manufacturing by reducing costs, accelerating product development timelines, and leveraging the advanced capabilities and expertise of contract manufacturers, particularly in regions like the Asia Pacific.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for early diagnosis and widening scope of clinical applications- Adoption of robotics and automation in manufacturing processes- Growing outsourcing activity by IVD manufacturers- High cost of in-house IVD manufacturingRESTRAINTS- IP protection concerns and possibility of IP theftOPPORTUNITIES- Growth opportunities in emerging economiesCHALLENGES- Increasing adoption of refurbished diagnostic imaging systems- Lack of constant innovation to balance technological capabilities against costs- Shortage of skilled labor

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.5 ECOSYSTEM ANALYSISROLE IN ECOSYSTEM

-

5.6 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- Japan- China- India

- 5.7 KEY CONFERENCES AND EVENTS IN 2022–2023

- 5.8 TECHNOLOGY ANALYSIS

- 6.1 INTRODUCTION

-

6.2 IN VITRO DIAGNOSTIC DEVICESIVD CONSUMABLES- Consumables segment to dominate IVD contract manufacturing marketIVD EQUIPMENT- Automation, advancements, and emphasis on efficient diagnostics to drive growth

-

6.3 DIAGNOSTIC IMAGING DEVICESCT- Rising adoption of CT scanners for detection of tumors to support growthULTRASOUND- Minimally invasive nature of ultrasound to boost demandX-RAY- Low cost of X-ray imaging compared to other modalities to drive growthMRI- Innovation and advancement in MRI applications to drive demandOTHER DIAGNOSTIC IMAGING DEVICES

- 6.4 OTHER DEVICES

- 7.1 INTRODUCTION

-

7.2 DEVICE DEVELOPMENT AND MANUFACTURING SERVICESDEVICE MANUFACTURING SERVICES TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

-

7.3 QUALITY MANAGEMENT SERVICESSTRINGENT REGULATIONS AND INCREASING PRODUCT SAFETY CONCERNS TO DRIVE DEMAND FOR QUALITY MANAGEMENT SERVICES

-

7.4 PACKAGING AND ASSEMBLY SERVICESINCREASING PRODUCT SAFETY CONCERNS FOR MEDICAL DEVICES TO SUPPORT GROWTH

- 7.5 OTHER SERVICES

- 8.1 INTRODUCTION

-

8.2 IN VITRO DIAGNOSTIC DEVICE APPLICATIONSINFECTIOUS DISEASES- Increasing incidence of infectious diseases to drive adoption of IVD devicesDIABETES- Rising prevalence of diabetes to drive adoption of glucose monitoring devicesONCOLOGY- Rising initiatives for early detection of cancer to drive growthCARDIOLOGY- Increasing use of immunoassays in detection of CVD to drive growthOTHER APPLICATIONS (IVD DEVICES)

-

8.3 DIAGNOSTIC IMAGING DEVICE APPLICATIONSCARDIOLOGY- High prevalence of CVD to drive growthONCOLOGY- Wide adoption of nuclear imaging systems to distinguish between benign and malignant tumors to drive growthORTHOPEDICS- Effective diagnosis and prognosis of musculoskeletal disorders by imaging devices to drive growthNEUROLOGY- Innovations in 3D MRI technology to drive growthOTHER APPLICATIONS (DIAGNOSTIC IMAGING DEVICES)

-

8.4 OTHER DEVICE APPLICATIONSGASTROENTEROLOGY- Surging demand for early diagnosis to propel growthGYNECOLOGY- Rising cases of cancer among women to drive growthOTHER APPLICATIONS (OTHER DEVICES)

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICASIA PACIFIC: IMPACT OF ECONOMIC RECESSIONCHINA- Low labor costs and rapidly changing healthcare infrastructure to drive growthJAPAN- Need for advanced medical diagnostic tools to fuel growthINDIA- Rising contract manufacturing capabilities to support growthREST OF ASIA PACIFIC

-

9.3 NORTH AMERICANORTH AMERICA: IMPACT OF ECONOMIC RECESSIONUS- Rising in-house manufacturing costs to drive shift toward contract manufacturingCANADA- Strong presence of key manufacturing companies to augment market

-

9.4 EUROPEEUROPE: IMPACT OF ECONOMIC RECESSIONGERMANY- Germany to hold largest market share in EuropeFRANCE- Strong focus on research and innovation of diagnostic devices to drive growthUK- Increasing accessibility of IVD devices to drive growthITALY- Lack of supporting infrastructure to restrain growthSPAIN- Increasing demand for diagnostic equipment to boost demand for contract manufacturingREST OF EUROPE

-

9.5 REST OF THE WORLDLATIN AMERICA: IMPACT OF ECONOMIC RECESSIONMIDDLE EAST & AFRICA: IMPACT OF ECONOMIC RECESSION

- 10.1 OVERVIEW

-

10.2 STRATEGIES OF KEY PLAYERS/RIGHT TO WINOVERVIEW OF STRATEGIES ADOPTED BY KEY DIAGNOSTIC CONTRACT MANUFACTURERS

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.6 FOOTPRINT ANALYSIS OF COMPANIES

- 10.7 COMPETITIVE BENCHMARKING

-

10.8 COMPETITIVE SCENARIOPRODUCT/SERVICE LAUNCHES AND APPROVALSDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSJABIL INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewFLEX LTD.- Business overview- Products/Services/Solutions offered- MnM viewPLEXUS CORP.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSANMINA CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTE CONNECTIVITY LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCELESTICA INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewINTEGER HOLDINGS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsNIPRO CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsTHERMO FISHER SCIENTIFIC- Business overview- Products/Services/Solutions offered- Recent developmentsWEST PHARMACEUTICAL SERVICES, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsBENCHMARK ELECTRONICS INC.- Business overview- Products/Services/Solutions offered- Recent developmentsKIMBALL ELECTRONICS INC.- Business overview- Products/Services/Solutions offered- Recent developmentsKMC SYSTEMS- Business overview- Products/Services/Solutions offered- Recent developmentsSAVYON DIAGNOSTICS- Business overview- Products/Services/Solutions offeredNOVA BIOMEDICAL- Business overview- Products/Services/Solutions offered- Recent developments

-

11.2 OTHER PLAYERSCENOGENICS CORPORATIONCONE BIOPRODUCTSAVIOQ, INC.PHILLIPS-MEDISIZE CORPORATIONINVETECHMERIDIAN BIOSCIENCE, INC.- Recent developmentsNOLATO AB- Recent developmentsFUJIREBIO- Recent developmentsSEKISUIPRESTIGE DIAGNOSTICSBIOKIT

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 RISK ASSESSMENT: DIAGNOSTIC CONTRACT MANUFACTURING MARKET

- TABLE 3 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING DIAGNOSTIC CONTRACT MANUFACTURING

- TABLE 4 US: CLASSIFICATION OF MEDICAL EQUIPMENT

- TABLE 5 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 6 JAPAN: CLASSIFICATION OF IVD REAGENTS

- TABLE 7 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 8 DIAGNOSTIC CONTRACT MANUFACTURING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS IN 2022–2023

- TABLE 9 DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 10 IN VITRO DIAGNOSTIC DEVICES: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 11 IN VITRO DIAGNOSTIC DEVICES: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 12 IVD CONSUMABLES: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 13 IVD EQUIPMENT: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 DIAGNOSTIC IMAGING DEVICES: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 15 DIAGNOSTIC IMAGING DEVICES: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 16 CT: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 ULTRASOUND: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 X-RAY: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 MRI: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 OTHER DIAGNOSTIC IMAGING DEVICES: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 OTHER DEVICES: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 23 DEVICE DEVELOPMENT AND MANUFACTURING SERVICES: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 QUALITY MANAGEMENT SERVICES: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 PACKAGING AND ASSEMBLY SERVICES: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 OTHER SERVICES: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 28 INFECTIOUS DISEASES: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 DIABETES: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 ONCOLOGY: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 CARDIOLOGY: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 OTHER APPLICATIONS: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 34 CARDIOLOGY: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 ONCOLOGY: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 ORTHOPEDICS: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 NEUROLOGY: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 OTHER APPLICATIONS: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 40 ESTIMATED NEW GI CANCER CASES AND DEATHS IN US, 2021

- TABLE 41 GASTROENTEROLOGY: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 GYNECOLOGY: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 OTHER APPLICATIONS: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 44 DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 52 ASIA PACIFIC: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 53 CHINA: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 54 CHINA: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 55 CHINA: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 56 CHINA: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 57 CHINA: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 CHINA: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 59 CHINA: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 60 JAPAN: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 61 JAPAN: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 JAPAN: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 63 JAPAN: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 64 JAPAN: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 65 JAPAN: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 66 JAPAN: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 67 INDIA: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 68 INDIA: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 INDIA: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 INDIA: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 71 INDIA: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 72 INDIA: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 73 INDIA: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 79 REST OF ASIA PACIFIC: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 80 REST OF ASIA PACIFIC: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 US: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 90 US: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 US: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 92 US: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 93 US: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 US: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 95 US: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 96 CANADA: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 97 CANADA: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 CANADA: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 CANADA: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 100 CANADA: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 101 CANADA: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 102 CANADA: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 103 EUROPE: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 EUROPE: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 EUROPE: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 108 EUROPE: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 109 EUROPE: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 110 EUROPE: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 GERMANY: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 112 GERMANY: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 GERMANY: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 GERMANY: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 115 GERMANY: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 116 GERMANY: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 117 GERMANY: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 118 FRANCE: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 119 FRANCE: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 FRANCE: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 FRANCE: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 122 FRANCE: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 123 FRANCE: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 124 FRANCE: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 125 UK: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 126 UK: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 127 UK: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 128 UK: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 129 UK: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 130 UK: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 131 UK: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 132 ITALY: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 133 ITALY: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 ITALY: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 ITALY: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 136 ITALY: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 137 ITALY: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 138 ITALY: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 139 SPAIN: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 140 SPAIN: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 SPAIN: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 142 SPAIN: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 143 SPAIN: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 144 SPAIN: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 145 SPAIN: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 146 REST OF EUROPE: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 147 REST OF EUROPE: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 REST OF EUROPE: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 REST OF EUROPE: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 150 REST OF EUROPE: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 151 REST OF EUROPE: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 152 REST OF EUROPE: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 153 REST OF THE WORLD: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 154 REST OF THE WORLD: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 REST OF THE WORLD: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 REST OF THE WORLD: DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021–2028 (USD MILLION)

- TABLE 157 REST OF THE WORLD: IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 158 REST OF THE WORLD: DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 159 REST OF THE WORLD: OTHER DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 160 OVERALL FOOTPRINT OF COMPANIES

- TABLE 161 DEVICE TYPE FOOTPRINT OF COMPANIES

- TABLE 162 REGIONAL FOOTPRINT OF COMPANIES

- TABLE 163 DIAGNOSTIC CONTRACT MANUFACTURING MARKET: LIST OF KEY START-UP/SME PLAYERS

- TABLE 164 DIAGNOSTIC CONTRACT MANUFACTURING MARKET: PRODUCT/SERVICE LAUNCHES AND APPROVALS, 2020–2023

- TABLE 165 DIAGNOSTIC CONTRACT MANUFACTURING MARKET: DEALS, 2020–2023

- TABLE 166 DIAGNOSTIC CONTRACT MANUFACTURING MARKET: OTHER DEVELOPMENTS, 2020–2023

- TABLE 167 JABIL INC.: COMPANY OVERVIEW

- TABLE 168 FLEX LTD.: COMPANY OVERVIEW

- TABLE 169 PLEXUS CORP.: COMPANY OVERVIEW

- TABLE 170 SANMINA CORPORATION: COMPANY OVERVIEW

- TABLE 171 TE CONNECTIVITY LTD.: COMPANY OVERVIEW

- TABLE 172 CELESTICA INC.: COMPANY OVERVIEW

- TABLE 173 INTEGER HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 174 NIPRO CORPORATION: COMPANY OVERVIEW

- TABLE 175 THERMO FISHER SCIENTIFIC: COMPANY OVERVIEW

- TABLE 176 WEST PHARMACEUTICAL SERVICES, INC.: COMPANY OVERVIEW

- TABLE 177 BENCHMARK ELECTRONICS INC.: COMPANY OVERVIEW

- TABLE 178 KIMBALL ELECTRONICS INC.: COMPANY OVERVIEW

- TABLE 179 KMC SYSTEMS: COMPANY OVERVIEW

- TABLE 180 SAVYON DIAGNOSTICS: COMPANY OVERVIEW

- TABLE 181 NOVA BIOMEDICAL: COMPANY OVERVIEW

- FIGURE 1 DIAGNOSTIC CONTRACT MANUFACTURING MARKET SEGMENTATION

- FIGURE 2 DIAGNOSTIC CONTRACT MANUFACTURING MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 6 DEMAND-SIDE ESTIMATION FOR DIAGNOSTIC CONTRACT MANUFACTURING MARKET

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DIAGNOSTIC CONTRACT MANUFACTURING MARKET: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 DIAGNOSTIC CONTRACT MANUFACTURING MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 HIGH COST OF IN-HOUSE MANUFACTURING TO DRIVE DEMAND FOR DIAGNOSTIC CONTRACT MANUFACTURING

- FIGURE 15 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 IVD DEVICES SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC DIAGNOSTIC CONTRACT MANUFACTURING MARKET IN 2022

- FIGURE 17 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 DIAGNOSTIC CONTRACT MANUFACTURING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 DIAGNOSTIC CONTRACT MANUFACTURING: SUPPLY CHAIN

- FIGURE 20 DIAGNOSTIC CONTRACT MANUFACTURING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 KEY PLAYERS IN DIAGNOSTIC CONTRACT MANUFACTURING MARKET ECOSYSTEM

- FIGURE 22 ASIA PACIFIC: DIAGNOSTIC CONTRACT MANUFACTURING MARKET SNAPSHOT

- FIGURE 23 NORTH AMERICA: DIAGNOSTIC CONTRACT MANUFACTURING MARKET SNAPSHOT

- FIGURE 24 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 25 IN VITRO DIAGNOSTIC DEVICES CONTRACT MANUFACTURING MARKET: DEGREE OF COMPETITION

- FIGURE 26 DIAGNOSTIC IMAGING DEVICES CONTRACT MANUFACTURING MARKET: DEGREE OF COMPETITION

- FIGURE 27 DIAGNOSTIC CONTRACT MANUFACTURING MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 28 JABIL INC.: COMPANY SNAPSHOT (2022)

- FIGURE 29 FLEX LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 30 PLEXUS CORP.: COMPANY SNAPSHOT (2022)

- FIGURE 31 SANMINA CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 32 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 33 CELESTICA INC.: COMPANY SNAPSHOT (2022)

- FIGURE 34 INTEGER HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 35 NIPRO CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 36 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2022)

- FIGURE 37 WEST PHARMACEUTICAL SERVICES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 38 BENCHMARK ELECTRONICS INC.: COMPANY SNAPSHOT (2022)

- FIGURE 39 KIMBALL ELECTRONICS INC.: COMPANY SNAPSHOT (2022)

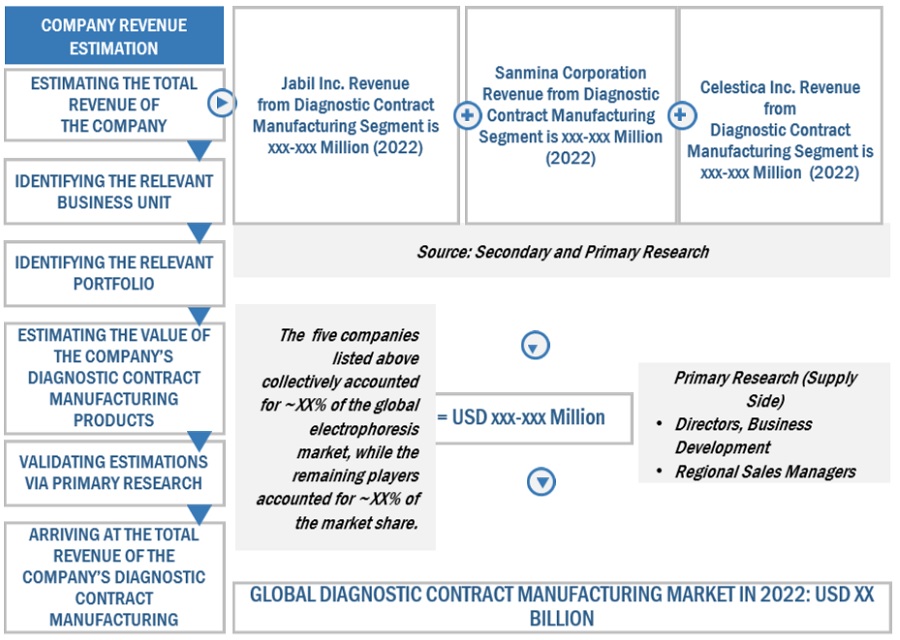

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as acquisitions, product/service launches, expansions, collaborations, agreements, and partnerships of the leading players, the competitive landscape of the diagnostic contract manufacturing market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the diagnostic contract manufacturing market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the diagnostic contract manufacturing market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as clinical laboratories, hospitals, and academic & research institutes) and supply side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing, and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

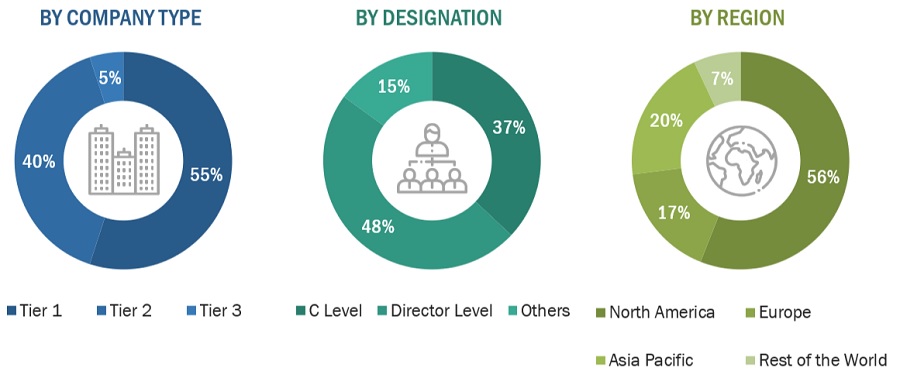

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All major product manufacturers offering various sleep apnea were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value diagnostic contract manufacturing market was also split into various segments and subsegments at the regional and country level based on the following:

- Product mapping of various manufacturers for each type of diagnostic contract manufacturing market at the regional and country-level

- Relative adoption pattern of each diagnostic contract manufacturing market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Global Diagnostic contract manufacturing Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Diagnostic contract manufacturing market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Diagnostic contract manufacturing industry.

Market Definition

Diagnostic contract manufacturing is a process wherein a manufacturing company makes diagnostic devices or the components of devices that can be sold later by other companies. Diagnostic device contract manufacturers specialize in a certain process or task and offer expertise due to their frequent practice of manufacturing.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the global diagnostic contract manufacturing market by device type, service, application, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall diagnostic contract manufacturing market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to four regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product excellence

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Additional country-level analysis of the Diagnostic contract manufacturing market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Diagnostic contract manufacturing Market

Growth opportunities and latent adjacency in Diagnostic Contract Manufacturing Market