Diagnostic Catheter Market by Type (Angiography, OCT, Ultrasound, Electrophysiology, Pressure and Hemodynamic Monitoring), Application Area (Cardiology, Urology, Neurology, Gastroenterology), End User (Hospitals, Imaging Centers) - Global Forecast to 2021

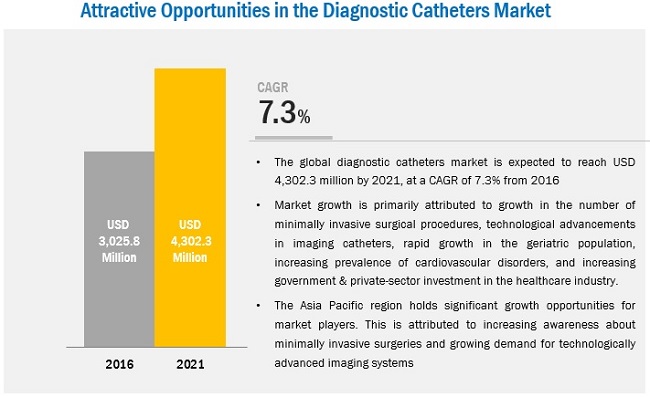

[192 Pages Report] The overall diagnostic catheters market is projected to reach USD 4,302.3 million by 2021 from USD 3,025.8 million in 2016, at a CAGR of 7.3% from 2016 to 2021. Diagnostic catheters are useful in performing various diagnostic procedures using different imaging techniques. The diagnostic catheters market is expanding with the emergence of new applications and technologies. These catheters are being used for several indications in different application areas such as cardiology, urology, gastroenterology, neurology, and others. Continuous ongoing improvements in catheter designs to simplify their use and make them safer and more effective are playing a pivotal role in growth of the market.

Market Dynamics

Drivers

- Growth in number of minimally invasive surgical procedures

- Technological advancements in imaging catheters

- Rapid growth in geriatric population and growing prevalence of CVD’s

Restraints

- Reuse of disposable diagnostic catheters

- Dearth of skilled professionals

Opportunities

- Untapped emerging markets

Challenges

- Unfavourable reimbursement scenario

- Frequent product recalls

- Extensive data requirements for launching new technologies, high product costs, and presence of substitutes

Growing preference of OCT imaging catheters in intravascular diagnostics and imaging

OCT has revolutionized the medical imaging industry and has extended its applications in disease diagnosis and imaging of various cellular and molecular processes in vivo. The successful application of OCT imaging in various diagnostic areas such as cardiology has resulted in greater adoption of OCT imaging catheters by doctors for various diagnostic indications. The resolution limits of coronary angiography, along with the need for greater precision during percutaneous interventions have resulted in increased demand for high-resolution intracoronary imaging techniques such as OCT. These varied advantages of OCT imaging have drawn a number of diagnostic catheter industry key players to launch new OCT imaging systems and catheters for diagnostic applications. In October 2013, St. Jude Medical launched an OCT-assisted system for coronary imaging in the US.

The following are the major objectives of the study.

- To define, describe, and forecast the global diagnostic catheters market based on type, application area, end user, and region

- To provide detailed information regarding the major factors influencing growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market, in four main regions—North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

- To profile key players in the global diagnostic catheters market and comprehensively analyze their core competencies2

- To track and analyze competitive developments such as product launches, acquisitions, collaborations, alliances, expansions, agreements, and R&D activities of leading players in the global market

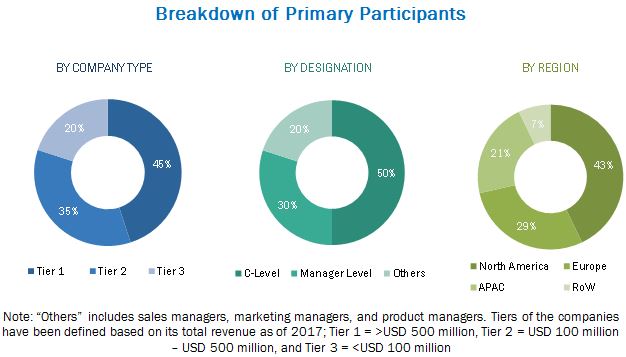

During this research study, major players operating in the diagnostic catheters market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The diagnostic catheters market comprises a network of players involved in the research and product development; raw material supply; medical device manufacturing; distribution and sale; and post-sales services. The major players in the global market are Boston Scientific Corporation (U.S.), St. Jude Medical, Inc. (U.S.), Medtronic plc. (Ireland), Johnson & Johnson (U.S.), Koninklijke Philips N.V. (The Netherlands), B. Braun Melsungen AG (Germany), Cardinal Health, Inc. (U.S.), C. R. Bard, Inc. (U.S.), Edward Lifesciences Corporation (U.S.), and Terumo Corporation (Japan).

Major Market Developments

- In October 2015, Cardinal Health, Inc. acquired Johnson & Johnson's (U.S.) Cordis business, a global player in the cardiovascular and endovascular devices market. The acquisition enhanced Cardinal Health's portfolio of diagnostic catheters used in cardiology and endovascular applications, helping Cardinal Health to strengthen its position in the global market, specifically in the cardiovascular area.

- In February 2015, Royal Philips (U.S.), a part of Koninklijke Philips N.V., acquired Volcano Corporation (U.S.), a global leader in intravascular imaging for coronary and peripheral therapeutic devices. This acquisition has helped the company to become a leading systems integrator in the fast-growing image-guided MIS market.

- In October 2013, St. Jude Medical launched OCT-assisted system for coronary imaging in the U.S. This system uses St. Jude’s Dragonfly Duo Imaging catheter to capture near-infrared light. This launch has enhanced the company’s portfolio for advanced diagnostic catheters in the US market.

Target Audience

- Diagnostic Catheter manufacturers

- Medical device manufacturers

- Medical device distributors

- Hospitals

- Diagnostic and imaging centers

- Research institutes

- Government associations

- Research and consulting firms

- Medical devices R&D companies

Report Scope

By Type

- Diagnostic Imaging Catheters

- Angiography Catheters

-

Electrophysiology Catheters

- Conventional Electrophysiology Catheters

- Advanced Electrophysiology Catheters

- Non-Imaging Diagnostic Catheter

- Pressure and Hemodynamic Monitoring Catheters

- Temperature Monitoring Catheters

- Other Non-Imaging Diagnostic Catheter

By Application Area:

- Cardiology

- Urology

- Gastroenterology

- Neurology

- Other Application Areas

By Geography:

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

- Asia Pacific (APAC)

- Japan

- China

- India

- RoAPAC

- Rest of the World (RoW)

- Latin America

- Middle East & Africa

Critical questions which the report answers

- What are new application areas which the diagnostic catheters companies are exploring?

- Which are the key players in the market and how they are positioned in the market?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific diagnostic catheters market into South Korea, Australia, New Zealand, and others.

- Further breakdown of the Latin American diagnostic catheters market into Brazil, Argentina, and Rest of Latin America.

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The overall diagnostic catheters market is projected to reach USD 4,302.3 million by 2021 from USD 3,025.8 million in 2016, at a CAGR of 7.3% from 2016 to 2021. Advancements in medical imaging technologies, increasing number of minimally invasive procedures, launch of new technologies in terms of catheter design, and rising geriatric population (resulting in a subsequent growth in the prevalence of chronic disorders) are primarily expected to drive growth in the global market. However, factors such as dearth of skilled professionals, high cost of technologically advanced catheters, and the trend of reusing single-use diagnostic catheters are expected to restrain market growth to a certain extent.

The global market is a highly competitive market. Competitiveness is mostly based on technological differentiation of various products offered by market players. The technological aspects of products and brand loyalty are the key criteria of consideration for buyers. These factors have boosted innovation in the industry and intensified rivalry among players. Amid intense competition in the market, major market players are increasingly focusing on expanding their geographic presence into the high-growth emerging markets and strengthening their technological competitiveness in the market by acquiring smaller players that have the desired technological capabilities or geographic presence.

On the technological front, significant advancements are being made to improve the detection, sensitivity, and specificity of instruments, consequently improving spatial resolution, image contrast, and overall image quality. Efforts are also being made to develop catheters with advanced technologies and new designs to cater to the need for greater accuracy in minimally invasive diagnostic procedures. While several new and advanced technologies are being explored for clinical diagnostics and preclinical research, the market still faces stiff competition from the presence of alternative technologies such as electrocardiograms and cardiac stress tests, computed tomography (CT), magnetic resonance imaging (MRI), and positron emission tomography (PET).

Based on the type of catheter used in diagnostics, the diagnostic catheters market is segmented into imaging catheters and non-imaging catheters. Imaging catheters are further segmented into angiography catheters, ultrasound catheters, and OCT catheters. Non-imaging catheters are categorized into pressure & hemodynamic monitoring catheters, and temperature monitoring catheters. The Diagnostic Imaging catheters segment accounted for the largest share of the global market in 2015. This segment is projected grow at a higher CAGR during the forecast period.

The diagnostic catheter market in APAC is expected to grow at the highest CAGR during the forecast period. The growing patient population, increasing awareness about healthcare, growing per capita healthcare expenditure, government initiatives, and growing investments to modernize the healthcare infrastructure in these regions is expected to drive market growth in developing economies. Moreover, regulatory policies in the Asia-Pacific region, being more adaptive and business-friendly than those in developed markets, have led to a surge in the region’s healthcare industry, which is positively affecting the market.

Diagnostic catheters applications in Neurology and cardiology is expected to boost the growth of Diagnostic Catheter market in the near future

Cardiology

Cardiology is one of those applications where diagnostic catheters are extensively used for diagnosis of various disorders. With cardiology catheters, heart diseases such as coronary artery disease, heart valve problem, decreased heart function, congenital heart disease, elevated blood pressure, abnormal cardiac output, heart muscle inflammation, infection, or transplant rejection can be diagnosed. The demand for cardiac catheters is fueled by the increasing incidence of cardiovascular and pulmonary disorders across the globe. Moreover, increasing technological improvements, primarily in the form of wireless technology and software, are expected to enable faster and more convenient diagnosis in the near future.

Neurology

Catheters are also increasingly used for diagnostic applications in neurology. Diagnosis of disorders and diseases such as aneurysms and atherosclerosis (plaque), along with the guidance of X-ray imaging, is done using cerebral angiography. The use of catheters makes it possible to combine diagnosis and treatment in a single procedure, eliminating the need for open surgery.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming technological advancements in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Reuse of disposable diagnostic catheters is a major factor restraining the growth of the market. Over the years, the number of cases for various cardiovascular, gastroenterological, and urological disorders has increased, leading to increase in interventions for their diagnosis. This has led to increased use of various disposable diagnostic and imaging catheters, propelling the consequent economic load demand. However, a number of hospitals and clinics are now reusing these disposable catheters. In contrast to the use of many other disposable devices, a number of imaging catheters are increasingly being reused by hospitals in an attempt to cut costs, due to the high price of these devices. In addition, the current regulatory stance of the U.S. FDA pertaining to the reuse of medical devices is quite limited, which restricts the regulatory pressure on hospitals regarding reuse of diagnostic catheters. Thus, the reuse of disposable catheters, specifically in emerging markets is expected to restrain growth of the market in the coming years.

The diagnostic catheters market mainly includes catheter manufacturers, diagnostic catheter vendors, and diagnostic kits manufacturers. As this is an emerging market, the focus of players is currently on enhancing and upgrading their product offerings. Moreover, to strengthen their market positions, a majority of players operating in this market are focusing on acquisitions to cater to a larger consumer base. The leading players in this market include Medtronic plc. (Ireland), St. Jude Medical, Inc. (U.S.), Johnson & Johnson (U.S.), Boston Scientific Corporation (U.S.), and Koninklijke Philips N.V. (The Netherlands).

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Approach

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Ranking Analysis

2.5 Assumption for the Study

3 Executive Summary (Page No. - 28)

3.1 Introduction

3.2 Conclusion

4 Premium Insights (Page No. - 35)

4.1 Market Overview

4.2 Asia-Pacific: Diagnostic Imaging Catheters Market, By Type

4.3 Geographic Growth Opportunities

4.4 Geographic Mix

4.5 Market Share, By Type (2016 vs 2021)

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.3 Key Market Drivers

5.3.1 Growth in the Number of Minimally Invasive Surgical Procedures

5.3.2 Technological Advancements in Imaging Catheters

5.3.3 Rapid Growth in Geriatric Population and Growing Prevalence of Cardiovascular Disorders

5.4 Key Market Restraints

5.4.1 Dearth of Skilled Professionals

5.4.2 Reuse of Disposable Diagnostic Catheter

5.5 Key Market Opportunities

5.5.1 Untapped Emerging Markets

5.6 Key Challenges

5.6.1 Unfavorable Reimbursement Scenario

5.6.2 Frequent Product Recalls

5.6.3 Extensive Data Requirements for Launching New Technologies, High Product Costs, and Presence of Substitutes

6 Industry Insights (Page No. - 48)

6.1 Industry Trends

6.1.1 Growing Preference for Oct Imaging Catheters in Intravascular Diagnostics and Imaging

6.1.2 Increasing Acquisitions Driving Consolidation in the Catheters Market

6.2 Regulatory Analysis

6.2.1 North America

6.2.1.1 U.S.

6.2.1.2 Canada

6.2.2 Europe

6.2.3 APAC

6.2.3.1 Japan

6.2.3.2 China

6.2.3.3 India

6.3 Vendor Benchmarking

6.3.1 Product Portfolio Analysis: Diagnostic Catheter Market

7 Diagnostic Catheter Market, By Type (Page No. - 58)

7.1 Introduction

7.2 Diagnostic Imaging Catheters

7.2.1 Angiography Catheters

7.2.2 Electrophysiology Catheters

7.2.2.1 Conventional Electrophysiology Catheters

7.2.2.2 Advanced Electrophysiology Catheters

7.2.3 Ultrasound Catheters

7.2.4 Oct Catheters

7.2.5 Other Diagnostic Imaging Catheters

7.3 Non-Imaging Diagnostic Catheter

7.3.1 Pressure and Hemodymanic Monitoring Catheters

7.3.2 Temperature Monitoring Catheters

7.3.3 Other Non-Imaging Diagnostic Catheter

8 Diagnostic Catheter Market, By Application Area (Page No. - 76)

8.1 Introduction

8.2 Cardiology

8.3 Urology

8.4 Gastroenterology

8.5 Neurology

8.6 Other Application Areas

9 Global Diagnostic Catheter Market, By End User (Page No. - 84)

9.1 Introduction

9.2 Hospitals

9.3 Diagnostic & Imaging Centers

10 Diagnostic Catheter Market, By Region (Page No. - 89)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe (RoE)

10.4 Asia-Pacific

10.4.1 Japan

10.4.2 China

10.4.3 India

10.4.4 Rest of Asia-Pacific (RoAPAC)

10.5 Rest of the World

10.5.1 Latin America

10.5.2 Middle East and Africa

11 Competitive Landscape (Page No. - 150)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Strategic Benchmarking

11.4 Competitive Situation and Trends

11.4.1 Acquisitions

11.4.2 Product Launches

11.4.3 Agreements, Partnerships, and Collaborations

11.4.4 Expansions

11.4.5 Regulatory Approvals

12 Company Profiles (Page No. - 159)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Boston Scientific Corporation

12.3 St. Jude Medical, Inc.

12.4 Johnson & Johnson

12.5 Medtronic PLC

12.6 Koninklijke Philips N.V.

12.7 B. Braun Melsungen AG

12.8 C. R. Bard, Inc.

12.9 Cardinal Health, Inc.

12.10 Terumo Corporation

12.11 Edwards Lifesciences Corporation

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 181)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (135 Tables)

Table 1 Key Market Drivers: Impact Analysis

Table 2 Key Market Restraints: Impact Analysis

Table 3 Key Market Opportunities: Impact Analysis

Table 4 Key Market Challenges: Impact Analysis

Table 5 Global Diagnostic Catheter Market Size, By Type, 2014–2021 (USD Million)

Table 6 Global Diagnostic Imaging Catheters Market Size, By Type, 2014–2021 (USD Million)

Table 7 Global Diagnostic Imaging Catheters Market Size, By Country/Region, 2014–2021 (USD Million)

Table 8 Global Angiographycatheters Market Size, By Country/Region, 2014–2021 (USD Million)

Table 9 Global Electrophysiology Catheters Market Size, By Type, 2014–2021 (USD Million)

Table 10 Global Electrophysiology Catheters Market Size, By Country/Region, 2014–2021 (USD Million)

Table 11 Global Conventional Electrophysiology Catheters Market Size, By Country/Region, 2014–2021 (USD Million)

Table 12 Global Advanced Electrophysiology Catheters Market Size, By Country/Region, 2014–2021 (USD Million)

Table 13 Global Ultrasound Catheters Market Size, By Country/Region, 2014–2021 (USD Million)

Table 14 Global Oct Catheters Market Size, By Country/Region, 2014–2021 (USD Million)

Table 15 Global Other Diagnostic Imaging Catheters Market Size, By Country/Region, 2014–2021 (USD Million)

Table 16 Global Non-Imaging Market Size, By Type, 2014–2021 (USD Million)

Table 17 Global Non-Imaging Market Size, By Country/Region, 2014–2021 (USD Million)

Table 18 Global Pressure and Hemodynamic Monitoring Catheters Market Size, By Country/Region, 2014–2021 (USD Million)

Table 19 Global Temperature Monitoring Catheters Market Size, By Country/Region, 2014–2021 (USD Million)

Table 20 Global Other Non-Imaging Market Size, By Country/Region, 2014–2021 (USD Million)

Table 21 Global Market Size, By Application Area, 2014–2021 (USD Million)

Table 22 Global Cardiology Market Size, By Country, 2014–2021 (USD Million)

Table 23 Global Urology Market Size, By Country, 2014–2021 (USD Million)

Table 24 Global Gastroenterology Market Size, By Country, 2014–2021 (USD Million)

Table 25 Global Neurology Market Size, By Country, 2014–2021 (USD Million)

Table 26 Global Market Size for Other Application Areas, By Country, 2014–2021 (USD Million)

Table 27 Global Market Size, By End User, 2014–2021 (USD Million)

Table 28 Global Market Size for Hospitals, By Region, 2014–2021 (USD Million)

Table 29 Global Market Size for Diagnostic & Imaging Centers, By Region, 2014–2021 (USD Million)

Table 30 Global Market Size, By Region, 2014–2021 (USD Million)

Table 31 North America: Market Size, By Country, 2014-2021 (USD Million)

Table 32 North America: Market Size, By Type, 2014-2021 (USD Million)

Table 33 North America: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 34 North America: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 35 North America: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 36 North America: Market Size, By Application Area, 2014-2021 (USD Million)

Table 37 North America: Market Size, By End User, 2014-2021 (USD Million)

Table 38 U.S.: Market Size, By Type, 2014-2021 (USD Million)

Table 39 U.S.: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 40 U.S.: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 41 U.S.: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 42 U.S.: Market Size, By Application Area, 2014-2021 (USD Million)

Table 43 Canada: Market Size, By Type, 2014-2021 (USD Million)

Table 44 Canada: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 45 Canada: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 46 Canada: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 47 Canada: Market Size, By Application Area, 2014-2021 (USD Million)

Table 48 Europe: Market Size, By Country, 2014-2021 (USD Million)

Table 49 Europe: Market Size, By Type, 2014-2021 (USD Million)

Table 50 Europe: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 51 Europe: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 52 Europe: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 53 Europe: Diagnostic Catheter Market Size, By Application Area, 2014-2021 (USD Million)

Table 54 Europe: Diagnostic Catheter Market Size, By End User, 2014-2021 (USD Million)

Table 55 Germany: Market Size, By Type, 2014-2021 (USD Million)

Table 56 Germany: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 57 Germany: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 58 Germany: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 59 Germany: Market Size, By Application Area, 2014-2021 (USD Million)

Table 60 France: Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 61 France: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 62 France: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 63 France: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 64 France: Market Size, By Application Area, 2014-2021 (USD Million)

Table 65 U.K.: Market Size, By Type, 2014-2021 (USD Million)

Table 66 U.K.: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 67 U.K.: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 68 U.K.: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 69 U.K.: Diagnostic Catheter Market Size, By Application Area, 2014-2021 (USD Million)

Table 70 Italy: Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 71 Italy: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 72 Italy: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 73 Italy: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 74 Italy: Market Size, By Application Area, 2014-2021 (USD Million)

Table 75 Spain: Market Size, By Type, 2014-2021 (USD Million)

Table 76 Spain: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 77 Spain: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 78 Spain: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 79 Spain: Market Size, By Application Area, 2014-2021 (USD Million)

Table 80 RoE: Market Size, By Type, 2014-2021 (USD Million)

Table 81 RoE: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 82 RoE: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 83 RoE: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 84 RoE: Diagnostic Catheter Market Size, By Application Area, 2014-2021 (USD Million)

Table 85 APAC: Diagnostic Catheter Market Size, By Country, 2014-2021 (USD Million)

Table 86 APAC: Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 87 APAC: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 88 APAC: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 89 APAC: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 90 APAC: Market Size, By Application Area, 2014-2021 (USD Million)

Table 91 APAC: Market Size, By End User, 2014-2021 (USD Million)

Table 92 Japan: Market Size, By Type, 2014-2021 (USD Million)

Table 93 Japan: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 94 Japan: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 95 Japan: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 96 Japan: Diagnostic Catheter Market Size, By Application Area, 2014-2021 (USD Million)

Table 97 China: Market Size, By Type, 2014-2021 (USD Million)

Table 98 China: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 99 China: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 100 China: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 101 China: Diagnostic Catheter Market Size, By Application Area, 2014-2021 (USD Million)

Table 102 India: Market Size, By Type, 2014-2021 (USD Million)

Table 103 India: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 104 India: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 105 India: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 106 India: Market Size, By Application Area, 2014-2021 (USD Million)

Table 107 RoAPAC: Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 108 RoAPAC: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 109 RoAPAC: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 110 RoAPAC: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 111 RoAPAC: Diagnostic Catheter Market Size, By Application Area, 2014-2021 (USD Million)

Table 112 RoW: Market Size, By Country, 2014-2021 (USD Million)

Table 113 RoW: Market Size, By Type, 2014-2021 (USD Million)

Table 114 RoW: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 115 RoW: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 116 RoW: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 117 RoW: Diagnostic Catheter Market Size, By Application Area, 2014-2021 (USD Million)

Table 118 RoW: Market Size, By End User, 2014-2021 (USD Million)

Table 119 Latin America: Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 120 Latin America: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 121 Latin America: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 122 Latin America: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 123 Latin America: Market Size, By Application Area, 2014-2021 (USD Million)

Table 124 Middle East and Africa: Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 125 Middle East and Africa: Diagnostic Imaging Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 126 Middle East and Africa: Electrophysiology Catheters Market Size, By Type, 2014-2021 (USD Million)

Table 127 Middle East and Africa: Non-Imaging Diagnostic Catheter Market Size, By Type, 2014-2021 (USD Million)

Table 128 Middle East and Africa: Diagnostic Catheter Market Size, By Application Area, 2014-2021 (USD Million)

Table 129 Growth Strategy Matrix (2013–2016)

Table 130 Global Electrophysiology Diagnostic Catheter Market Ranking, By Key Player, 2015

Table 131 Acquisitions, 2013–2016

Table 132 Product Launches, 2013–2016

Table 133 Agreements, Partnerships, and Collaborations, 2013–2016

Table 134 Expansions, 2013–2016

Table 135 Others, 2013–2016

List of Figures (38 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Diagnostic Catheters Market, By Type, 2016 vs 2021

Figure 7 Diagnostic Imaging Catheters Market, By Type, 2016 vs 2021

Figure 8 Cardiology Segment to Dominate the Market, By Application Area (2016)

Figure 9 Diagnostic Catheters Market, By End User, 2016 vs 2021

Figure 10 Geographic Snapshot

Figure 11 Growing Use of Imaging Catheters in Various Diagnostic Procedures is A Key Factor Driving the Market Growth

Figure 12 Angiography Catheters Accounted for the Largest Share of the Asia-Pacific Diagnostic Catheters Market in 2015

Figure 13 The U.S. Dominated the Global Market in 2015

Figure 14 North America to Dominate the Market During the Forecast Period

Figure 15 Angiography Catheters Will Continue to Dominate the Diagnostic Imaging Catheters Market in 2021

Figure 16 Market Drivers, Restraints, Opportunities, and Challenges

Figure 17 Angiography Catheters to Dominate the Diagnostic Imaging Catheters Market in 2016

Figure 18 Advanced Electrophysiology Catheters Segment to Register the Higher Growth Rate During the Forecast Period

Figure 19 Pressure and Hemodynamic Monitoring Catheters Segment to Dominate the Global Non-Imaging Diagnostic Catheters Market in 2016

Figure 20 Cardiology Segment to Dominate the Market During the Forecast Period

Figure 21 Geographical Snapshot (2016):

Figure 22 North America: Market Snapshot

Figure 23 Europe: Market Snapshot

Figure 24 Asia-Pacific: Market Snapshot

Figure 25 Acquisition—Key Growth Strategy Adopted By Market Players From 2013 to 2016

Figure 26 Key Acquisitions: Market (2013–2016)

Figure 27 Battle for Market Share: Acquisitions Accounted for the Largest Share During 2013 to 2016

Figure 28 Geographic Revenue Mix of the Prominent Players in the Market

Figure 29 Company Snapshot: Boston Scientific Corporation

Figure 30 Company Snapshot: St. Jude Medical, Inc.

Figure 31 Company Snapshot: Johnson & Johnson

Figure 32 Company Snapshot: Medtronic PLC

Figure 33 Company Snapshot: Koninklijke Philips N.V.

Figure 34 Company Snapshot: B. Braun Melsungen AG

Figure 35 Company Snapshot: C.R. Bard, Inc.

Figure 36 Company Snapshot: Cardinal Health, Inc.

Figure 37 Company Snapshot: Terumo Corporation

Figure 38 Company Snapshot: Edwards Lifesciences Corporation

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Diagnostic Catheter Market