Desalting and Buffer Exchange Market Growth by Product (Kit, Cassette & Cartridge, Spin Columns), Technique (Size Exclusion Chromatography, Filtration, Dialysis), Application (Bioprocess (Pharmaceutical Companies, Research Institutes)) - Global Forecasts to 2023

The global desalting and buffer exchange market is projected to reach USD 1,094.8 million by 2023, at a CAGR of 10.0%. Growth in this market will largely be driven by increasing demand for mAbs, increasing R&D expenditure by pharmaceutical and biopharmaceutical companies, and growing focus on proteomic and genomic research.

Desalting and Buffer Exchange Market : Objectives Of The Study

- To define, describe, and segment the global market by product, technique, application, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and industry-specific challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the global market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market players

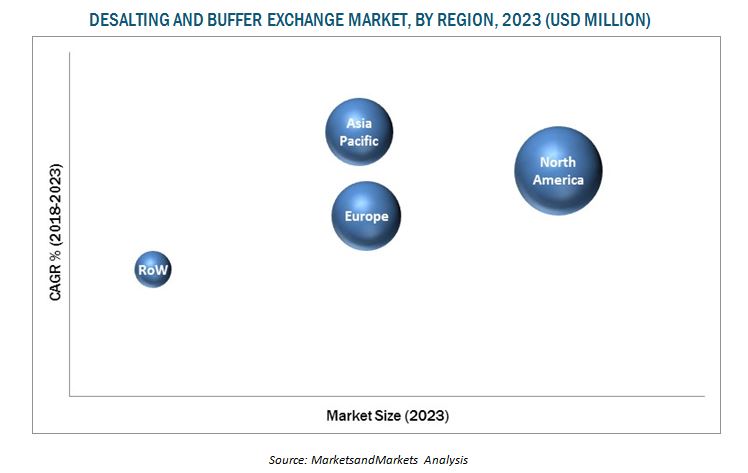

- To forecast the size of the market segments with respect to four major regional segments, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile the key players in the market and comprehensively analyze their market positions and core competencies

- To track and analyze competitive developments such as acquisitions, expansions, and agreement in the market

Research Methodology

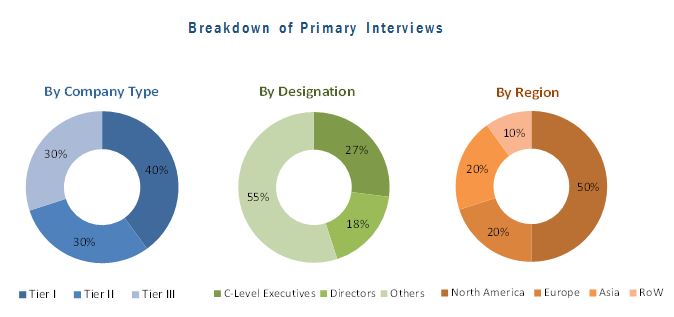

Both, top-down and bottom-up approaches were used to validate the size of the global market and estimate the size of various other dependent submarkets. Major players in the market were identified through secondary research and their market presence was studied through primary and secondary research. Secondary research included the study of the annual and financial reports of top market players, presentations, websites, and press releases of top players, news articles, journals; and paid databases ,white papers, medical journals, certified publications, articles from recognized authors, directories, and databases such as Clinical Proteomic Tumor Analysis Consortium (CPTAC), National Institutes of Health (NIH), National Center for Biotechnology Information (NCBI), US FDA, Chromatographic Society (ChromSoc), European Society for Separation Science. Whereas, primary research included extensive interviews with key opinion leaders such as CEOs, vice presidents, directors, marketing executives, and related key executives from various companies. The percentage splits, shares, and breakdowns of the segments were determined using secondary sources and verified through primary sources. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the global desalting and buffer exchange industry are Thermo Fisher Scientific (US), Merck (US), GE Healthcare (US), Danaher (US), and Sartorius (Germany).

Target Audience:

- Filtration and chromatography manufacturers, vendors, and distributors

- Research and consulting firms

- Pharmaceutical and biotechnology manufacturers

- Contract research organizations (CROs)

- Contract manufacturing organizations (CMOs)

- Market research and consulting firms

Desalting and Buffer Exchange Market Scope

The research report categorizes the global market into the following segments and subsegments:

By Product

- Kits

- Cassettes & cartridges

- Spin columns

- Filter plates

- Membrane filters

- Other consumables and accessories

By Technique

-

Filtration

- Ultrafiltration

- Dialysis

-

Chromatography

- Size exclusion chromatography

- Other chromatography techniques

- Precipitation

By Application

- Bioprocess application

- Diagnostic application

By Region

- North America

- US

- Canada

- Europe

- Asia Pacific

- Rest of the World (RoW)

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Product matrix that gives a detailed comparison of the product portfolios of each company

Company Information

Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Detailed analysis of market in European countries such as the UK, Germany, France, Italy, Spain, and others

- Detailed analysis of market in Asia Pacific countries such as China, Japan, India, and others

Desalting is a separation process that removes soluble low molecular weight substances, which have adverse effect on protein function or stability or interfere with downstream applications, from protein and nucleic acid samples. Size exclusion chromatography (gel filtration), ultrafiltration, and dialysis are major techniques used for desalting and buffer exchange. Growth in this market will largely be driven by increasing demand for mAbs, increasing R&D expenditure by pharmaceutical and biopharmaceutical companies, and growing focus on proteomic and genomic research.

In this report, the market has been categorized based on product, application, technique, and region.

The market is broadly segmented into kits, cassettes & cartridges, spin columns, filter plates, membrane filters, and other consumables and accessories based on product. The kits segment is projected to register the highest CAGR during the forecast period. Growth in this segment can be attributed to the increasing research and development in the field of bioprocessing and the increasing use of desalting kits for analytical sample preparation for SDS-PAGE and mass spectrometry.

Based on the application, the market is segmented into bioprocess applications and diagnostic applications. The bioprocess application segment is expected to account for the largest share of the global market in 2018. The large share of this segment is attributed to the growing demand for biopharmaceuticals and monoclonal antibodies, as well as the increasing R&D expenditure by biopharmaceutical companies.

The market is segmented into major 3 techniques: filtration, chromatography, and precipitation. In 2018, the filtration segment is expected to account for the largest share of the global market. The large share of this segment is attributed to the increased production of biologics and growth in Proteomics and Genomics research.

In 2018, in terms of value, North America is expected to account for the largest share of the global market. The large share of this regional segment is attributed to the increasing demand for biopharmaceuticals, rising R&D expenditure by biopharmaceutical companies, and growing research activities in the field of genomics and proteomics.

However, a dearth of skilled professionals is a major challenge for the growth of this market during the forecast period.

Key players in the global change market are Thermo Fisher Scientific (US), Merck (US), GE Healthcare (US), Danaher (US), and Sartorius (Germany). These players focus on inorganic and organic strategies such as expansions, acquisitions and agreements to sustain their growth in the market.

Frequently Asked Questions (FAQs):

What is the size of Desalting and Buffer Exchange Market?

The global desalting and buffer exchange market is projected to reach USD 1,094.8 million by 2023, at a CAGR of 10.0%.

What are the major growth factors of Desalting and Buffer Exchange Market?

Growth in this market will largely be driven by increasing demand for mAbs, increasing R&D expenditure by pharmaceutical and biopharmaceutical companies, and growing focus on proteomic and genomic research.

Who all are the prominent players of Desalting and Buffer Exchange Market?

Key players in the global desalting and buffer exchange industry are Thermo Fisher Scientific (US), Merck (US), GE Healthcare (US), Danaher (US), and Sartorius (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.1.2.1 Key Industry Insights

2.2 Market Size Estimation

2.3 Data Triangulation Method

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Desalting and Buffer Exchange: Market Overview

4.2 Geographic Analysis: Market, By Technique (2018)

4.3 Market, By Product, 2018 vs 2023

4.4 Market, By Application, 2016–2023

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for MABS

5.2.1.2 Extensive Proteomic and Genomic Research

5.2.1.3 Increasing Biopharmaceutical R&D Expenditure

5.2.2 Opportunities

5.2.2.1 Patent Expiry of Blockbuster Drugs

5.2.2.2 Growth Opportunities in Emerging Markets

5.2.3 Challenges

5.2.3.1 Lack of Skilled Professionals

6 Desalting and Buffer Exchange Market, By Product (Page No. - 36)

6.1 Introduction

6.2 Kits

6.3 Cassettes & Cartridges

6.4 Filter Plates

6.5 Spin Columns

6.6 Membrane Filters

6.7 Other Consumables and Accessories

7 Desalting and Buffer Exchange Market, By Technique (Page No. - 45)

7.1 Introduction

7.2 Filtration

7.2.1 Ultrafiltration

7.2.2 Dialysis

7.3 Chromatography

7.3.1 Size-Exclusion Chromatography

7.3.2 Other Chromatography Techniques

7.4 Precipitation

8 Desalting and Buffer Exchange Market, By Application (Page No. - 55)

8.1 Introduction

8.2 Bioprocess Applications

8.3 Pharmaceutical and Biotechnology Companies

8.4 Cmos & Cros

8.5 Academic & Research Institutes

8.6 Diagnostic Applications

9 Desalting and Buffer Exchange Market, By Region (Page No. - 63)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.4 Asia Pacific

9.5 Rest of the World

10 Competitive Landscape (Page No. - 85)

10.1 Market Overview

10.2 Market Ranking Analysis, 2017

10.3 Competitive Situation and Trends

10.3.1 Acquisitions

10.3.2 Agreements

10.3.3 Expansions

11 Company Profiles (Page No. - 88)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 Thermo Fisher Scientific

11.2 Merck KGaA

11.3 Ge Healthcare

11.4 Danaher Corporation

11.5 Sartorius AG

11.6 Bio-Rad Laboratories

11.7 Agilent Technologies

11.8 Repligen Corporation

11.9 Bio-Works Technologies Ab

11.10 Avantor

11.11 Norgen Biotek Corp.

11.12 Phynexus, Inc

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 111)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (86 Tables)

Table 1 Recently Approved Monoclonal Antibodies in the US and EU

Table 2 Bestselling Biologics Expected to Go Off-Patent

Table 3 Market, By Product, 2016–2023 (USD Million)

Table 4 Desalting and Buffer Exchange Kits Market, By Region, 2016–2023 (USD Million)

Table 5 North America: Desalting and Buffer Exchange Kits Market, By Country, 2016–2023 (USD Million)

Table 6 Desalting and Buffer Exchange Cassettes and Cartridges Market, By Region, 2016–2023 (USD Million)

Table 7 North America: Desalting and Buffer Exchange Cassettes and Cartridges Market, By Country, 2016–2023 (USD Million)

Table 8 Desalting and Buffer Exchange Filter Plates Market, By Region, 2016–2023 (USD Million)

Table 9 North America: Desalting and Buffer Exchange Filter Plates Market, By Country, 2016–2023 (USD Million)

Table 10 Desalting and Buffer Exchange Spin Columns Market, By Region, 2016–2023 (USD Million)

Table 11 North America: Desalting and Buffer Exchange Spin Columns Market, By Country, 2016–2023 (USD Million)

Table 12 Desalting and Buffer Exchange Membrane Filters Market, By Region, 2016–2023 (USD Million)

Table 13 North America: Desalting and Buffer Exchange Membrane Filters Market, By Country, 2016–2023 (USD Million)

Table 14 Desalting and Buffer Exchange Market for Other Consumables and Accessories, By Region, 2016–2023 (USD Million)

Table 15 North America: Market for Other Consumables and Accessories, By Country, 2016–2023 (USD Million)

Table 16 Market, By Technique, 2016–2023 (USD Million)

Table 17 Market for Filtration, By Region, 2016–2023 (USD Million)

Table 18 North America: Market for Filtration, By Country, 2016–2023 (USD Million)

Table 19 Market for Filtration, By Type, 2016–2023 (USD Million)

Table 20 Market for Ultrafiltration, By Region, 2016–2023 (USD Million)

Table 21 North America: Market for Ultrafiltration, By Country, 2016–2023 (USD Million)

Table 22 Market for Dialysis, By Region, 2016–2023 (USD Million)

Table 23 North America: Market for Dialysis, By Country, 2016–2023 (USD Million)

Table 24 Market for Chromatography, By Region, 2016–2023 (USD Million)

Table 25 North America: Market for Chromatography, By Country, 2016–2023 (USD Million)

Table 26 Market for Chromatography, By Type, 2016–2023 (USD Million)

Table 27 Market for Size-Exclusion Chromatography, By Region, 2016–2023 (USD Million)

Table 28 North America: Market for Size-Exclusion Chromatography, By Country, 2016–2023 (USD Million)

Table 29 Market for Other Chromatography Techniques, By Region, 2016–2023 (USD Million)

Table 30 North America: Market for Other Chromatography Techniques, By Country, 2016–2023 (USD Million)

Table 31 Market for Precipitation, By Region, 2016–2023 (USD Million)

Table 32 North America: Market for Precipitation, By Country, 2016–2023 (USD Million)

Table 33 Market, By Application, 2016–2023 (USD Million)

Table 34 Market for Bioprocess Applications, By Region, 2016–2023 (USD Million)

Table 35 North America: Market for Bioprocess Applications, By Country, 2016–2023 (USD Million)

Table 36 Market for Bioprocess Applications, By End User, 2016–2023 (USD Million)

Table 37 Market for Pharmaceutical and Biotechnology Companies, By Region, 2016–2023 (USD Million)

Table 38 North America: Market for Pharmaceutical and Biotechnology Companies, By Country, 2016–2023 (USD Million)

Table 39 Market for Cmos & Cros, By Region, 2016–2023 (USD Million)

Table 40 North America: Market for Cmos & Cros, By Country, 2016–2023 (USD Million)

Table 41 Market for Academic & Research Institutes, By Region, 2016–2023 (USD Million)

Table 42 North America: Market for Academic & Research Institutes, By Country, 2016–2023 (USD Million)

Table 43 Market for Diagnostic Applications, By Region, 2016–2023 (USD Million)

Table 44 North America: Market for Diagnostic Applications, By Country, 2016–2023 (USD Million)

Table 45 Market, By Region, 2016–2023 (USD Million)

Table 46 North America: Market, By Country, 2016–2023 (USD Million)

Table 47 North America: Market, By Product, 2016–2023 (USD Million)

Table 48 North America: Market, By Technique, 2016–2023 (USD Million)

Table 49 North America: Desalting and Buffer Exchange Market for Filtration, By Type, 2016–2023 (USD Million)

Table 50 North America: Market for Chromatography, By Type, 2016–2023 (USD Million)

Table 51 North America: Market, By Application, 2016–2023 (USD Million)

Table 52 North America: Market for Bioprocess Applications, By End User, 2016–2023 (USD Million)

Table 53 US: Market, By Product, 2016–2023 (USD Million)

Table 54 US: Market, By Technique, 2016–2023 (USD Million)

Table 55 US: Market for Filtration, By Type, 2016–2023 (USD Million)

Table 56 US: Market for Chromatography, By Type, 2016–2023 (USD Million)

Table 57 US: Market, By Application, 2016–2023 (USD Million)

Table 58 US: Market for Bioprocess Applications, By End User, 2016–2023 (USD Million)

Table 59 Canada: Market, By Product, 2016–2023 (USD Million)

Table 60 Canada: Market, By Technique, 2016–2023 (USD Million)

Table 61 Canada: Market for Filtration, By Type, 2016–2023 (USD Million)

Table 62 Canada: Market for Chromatography, By Type, 2016–2023 (USD Million)

Table 63 Canada: Market, By Application, 2016–2023 (USD Million)

Table 64 Canada: Market for Bioprocess Applications, By End User, 2016–2023 (USD Million)

Table 65 Europe: Market, By Product, 2016–2023 (USD Million)

Table 66 Europe: Market, By Technique, 2016–2023 (USD Million)

Table 67 Europe: Market for Filtration, By Type, 2016–2023 (USD Million)

Table 68 Europe: Market for Chromatography, By Type, 2016–2023 (USD Million)

Table 69 Europe: Market, By Application, 2016–2023 (USD Million)

Table 70 Europe: Desalting and Buffer Exchange Market for Bioprocess Applications, By End User, 2016–2023 (USD Million)

Table 71 Asia Pacific: Market, By Product, 2016–2023 (USD Million)

Table 72 Asia Pacific: Market, By Technique, 2016–2023 (USD Million)

Table 73 Asia Pacific: Market for Filtration, By Type, 2016–2023 (USD Million)

Table 74 Asia Pacific: Market for Chromatography, By Type, 2016–2023 (USD Million)

Table 75 Asia Pacific: Market, By Application, 2016–2023 (USD Million)

Table 76 Asia Pacific: Market for Bioprocess Applications, By End User, 2016–2023 (USD Million)

Table 77 RoW: Market, By Product, 2016–2023 (USD Million)

Table 78 RoW: Market, By Technique, 2016–2023 (USD Million)

Table 79 RoW: Market for Filtration, By Type, 2016–2023 (USD Million)

Table 80 RoW: Market for Chromatography, By Type, 2016–2023 (USD Million)

Table 81 RoW: Market, By Application, 2016–2023 (USD Million)

Table 82 RoW: Market for Bioprocess Applications, By End User, 2016–2023 (USD Million)

Table 83 Market Ranking, By Key Player (2017)

Table 84 Acquisitions , 2015-2017

Table 85 Agreements, 2015 & 2018

Table 86 Expansions, 2016 to 2017

List of Figures (26 Figures)

Figure 1 Research Design: Desalting and Buffer Exchange Market

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market: Bottom-Up Approach

Figure 4 Market: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Market, By Product, 2018 vs 2023 (USD Million)

Figure 7 Market, By Technique, 2018 vs 2023 (USD Million)

Figure 8 Market, By Application, 2018 vs 2023 (USD Million)

Figure 9 Geographical Snapshot of the Market

Figure 10 Increasing Demand for Monoclonal Antibodies to Drive the Market

Figure 11 Filtration Segment to Account for the Largest Market Share in 2018

Figure 12 Desalting and Buffer Exchange Kits Will Continue to Dominate the Market in 2023

Figure 13 Bioprocess Applications to Account for the Largest Share of the Market in 2018

Figure 14 Market: Drivers, Restraints. and Opportunities

Figure 15 Market: Geographic Snapshot (2018)

Figure 16 North America: Market Snapshot

Figure 17 Asia Pacific: Market Snapshot

Figure 18 Thermo Fisher Scientific: Company Snapshot (2017)

Figure 19 Merck KGaA: Company Snapshot (2017)

Figure 20 GE Healthcare: Company Snapshot (2017)

Figure 21 Danaher Corporation: Company Snapshot (2017)

Figure 22 Sartorius AG: Company Snapshot (2017)

Figure 23 Bio-Rad Laboratories: Company Snapshot (2017)

Figure 24 Agilent Technologies: Company Snapshot (2017)

Figure 25 Repligen Corporation: Company Snapshot (2017)

Figure 26 Bio-Works Technologies AB: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Desalting and Buffer Exchange Market