Dental Syringes Market by Product (Non-disposable Syringes, Disposable Syringes and Safety Syringes), Type (Aspirating & Non-aspirating), Material (Plastic and Metallic), Region (North America, Europe , Asia-Pacific, and RoW) - Global Forecast to 2021

[114 Pages Report] The dental syringes market is expected to reach USD 126.9 Million by 2021 from USD 98.5 Million in 2016, at a CAGR of 5.2% during the forecast period. Technological advancements in dental syringes, growth in geriatric population and government legislations to avoid needlestick injuries are adding to the growth prospects of this market.

Emerging markets (such as India, China, Brazil, and Mexico) offer significant growth opportunities for players operating in the dental syringes market. The growth of the market in these regions can be attributed to factors such as rising geriatric population, rising awareness among healthcare professionals related to needlestick injuries, and ongoing government initiatives to modernize & expand healthcare infrastructure.

Objectives of the Study

- To define, describe, and forecast the global market on the basis of product, type, material, and region

- To provide detailed information regarding the major factors influencing growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the global market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market with respect to four main regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To profile the key players in the global dental syringes market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches, agreements, partnerships, collaborations, geographic expansions, and mergers and acquisitions in the global market

Research Methodology

A combination of the bottom-up and top-down approaches was used to calculate the size and growth rate of the market and its subsegments. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. In this research study, all possible parameters that affect this market have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative & qualitative data. Primary interviews with key opinion leaders were also used to determine the percentage shares of each product in emerging nations. The report provides qualitative insights about growth rates and market drivers for all subsegments. It maps market sizes and growth rates for each subsegment and identifies segments poised for rapid growth in each geographic region.

Key Players

In 2015, Septodont (U.S.), 3M Company (U.S.), Dentsply International, Inc. (U.S.), Integra LifeSciences Corporation (U.S.), Vista Dental Products (U.S.), Power Dental USA, Inc. (U.S.), 4tek S.r.l (Italy), A. Titan Instrument Inc. (U.S.), and Delmaks Surgico (Pakistan) are some of the key players in the dental syringes market.

Target Audience:

- Dental syringe manufacturing companies

- Healthcare service providers (including hospitals, surgical centers, and dental clinics)

- Pharmaceutical and biotechnology companies

- Government authorities and regulatory agencies

- Independent associations and non-profit organizations

- Clinical research laboratories

- Market research & consulting firms

- R&D companies

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report

This research report categorizes the dental syringes market into the following segments:

Dental Syringes Market, by Product

- Non-disposable Syringes

- Disposable Syringes

- Safety Syringes

Dental Syringes Market, by Type

- Aspirating Syringes

- Non-aspirating Syringes

Dental Syringes Market, by Material

- Metallic Syringes

- Plastic Syringes

Dental Syringes Market, by Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- U.K.

- France

- RoE

-

Asia-Pacific

- Japan

- China

- India

- RoAPAC

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies in the dental syringes market

The global dental syringes market is projected to reach USD 126.9 Million by 2021 from USD 98.5 Million in 2016; growing at a CAGR of 5.2% during 2016-2021. The rising demand can be attributed to the growing technological advancements and growth in geriatric population.

On the basis of product, the dental syringes market is categorized into three segments, namely, non-disposable syringes, disposable syringes, and safety syringes. The non-disposable syringes segment is expected to dominate the market in 2016 mainly due to the growing number of endodontic & periodontic procedures across the globe, significant adoption of non-disposable syringes among dental professionals for administering anesthesia, and greater affordability of these products due to their reusable nature.

Based on type, the market is segmented into two segments, namely, aspirating syringes, and non-aspirating syringes. The aspirating syringes segment is expected to dominate the market during the forecast period. The prominent market position of the aspirating syringes segment can be primarily attributed to the procedural benefits offered by aspirating syringes over conventional syringes (such as easy syringe handling, minimal operational stress, and better operational control), and longer shelf life of metallic syringes (as compared to conventional plastic syringes).

On the basis of material, the market is segmented into metallic and plastic-based dental syringes. Metallic syringes are expected to dominate the market during the study period owing to their advantages (such as long shelf life, reusability, and nonreactive nature) and significant adoption of metallic syringes among dentists.

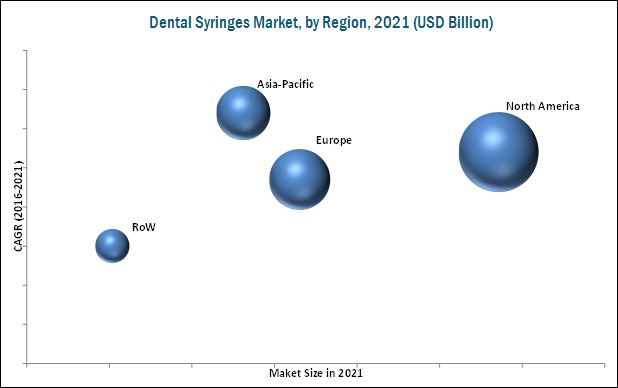

On the basis of region, the market is segmented into four regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World. The Asia-Pacific market is expected to grow at the highest CAGR during the forecast period. The growth opportunities in the Asia-Pacific region can be attributed to the presence of a large patient population for target diseases (coupled with rapidly growing geriatric population, especially in Japan and China), rising awareness among healthcare professionals related to needlestick injuries, ongoing government initiatives to modernize & expand healthcare infrastructure, and continuous reduction in product prices.

During 2013-2017, mergers and acquisitions, product launches, and collaborations were the primary growth strategies adopted by major players to expand their product portfolio in the global dental syringes market. Several market players also adopted strategies such as expansions to expand their presence and increase their visibility in the market. In 2015, 3M Company (U.S.), Septodont (U.S.), Vista Dental Products (U.S.), Power Dental USA, Inc. (U.S.), 4tek S.r.l (Italy), A. Titan Instrument Inc. (U.S.), Delmaks Surgico (Pakistan), Integra LifeSciences Corporation (U.S.), and Dentsply International, Inc. (U.S.) were some of the key players operating in the global market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Opportunity Indicators

2.2.1 Introduction

2.2.1.1 Global Burden of Dental Disorders

2.2.1.2 Rapid Growth in Geriatric Population

2.2.1.3 Healthcare Expenditure Patterns

2.3 Market Estimation Methodology

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

2.5.1 Assumptions

3 Executive Summary (Page No. - 29)

3.1 Introduction

3.2 Conclusion

4 Premium Insights (Page No. - 33)

4.1 Market Overview

4.2 Geographic Analysis: Dental Syringes Market, By Product (2016)

4.3 Global Dental Syringes Market, By Type, 2016 vs 2021

4.4 Global Dental Syringes Market Size, By Material, 2016 vs 2021 (USD Million)

4.5 Geographic Snapshot of the Global Market (2016–2021)

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Major Market Drivers

5.2.1.1 Growth in Geriatric Population

5.2.1.2 Government Legislations to Avoid Needlestick Injuries

5.2.1.3 Technological Advancements

5.2.2 Major Market Restraint

5.2.2.1 Dearth of Skilled Dental Surgeons

5.2.3 Major Market Opportunity

5.2.3.1 Growing Market Preference for Prefilled Dental Syringes

6 Industry Insights (Page No. - 42)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Industry Trends

6.4 Porter’s Five Forces Analysis

6.5 Pricing Trends

6.5.1 North America

6.5.2 Europe

6.5.3 Asia-Pacific

6.5.4 Rest of the World

7 Global Dental Syringes Market, By Product (Page No. - 46)

7.1 Introduction

7.2 Nondisposable Dental Syringes

7.3 Disposable Dental Syringes

7.4 Safety Dental Syringes

8 Global Dental Syringes Market, By Type (Page No. - 54)

8.1 Introduction

8.2 Aspirating Dental Syringes

8.3 Non-Aspirating Dental Syringes

9 Global Dental Syringes Market, By Material (Page No. - 58)

9.1 Introduction

9.2 Metallic Dental Syringes

9.3 Plastic Dental Syringes

10 Dental Syringes Market, By Region (Page No. - 62)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 U.K.

10.3.3 France

10.3.4 Rest of Europe (RoE)

10.4 Asia-Pacific

10.4.1 Japan

10.4.2 China

10.4.3 India

10.4.4 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 86)

11.1 Overview

11.2 Market Ranking

11.3 Competitive Scenario

11.4 Recent Developments

11.4.1 Mergers and Acquisitions

11.4.2 Product Launches

11.4.3 Expansions

11.4.4 Collaborations

12 Company Profiles (Page No. - 91)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

12.1 Introduction

12.2 3M Company

12.3 Dentsply International Inc.

12.4 Septodont

12.5 Integra Lifesciences Corporation

12.6 Acteon

12.7 Vista Dental Products

12.8 Power Dental Usa, Inc.

12.9 4TEK S.R.L

12.10 A. Titan Instrument Inc.

12.11 Delmaks Surgico

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 105)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (71 Tables)

Table 1 Global Dental Syringes Market Size, By Product, 2014-2021 (USD Million)

Table 2 Global Dental Syringes Market Size, By Region, 2014-2021 (USD Million)

Table 3 Nondisposable Dental Syringes Market Size, By Region, 2014-2021 (USD Million)

Table 4 North America Non-Disposable Syringes Market, By Country 2014-2021 (USD Million)

Table 5 Europe Non Disposable Syringes Market, By Country 2014-2021 (USD Million)

Table 6 Asia-Pacific Non-Disposable Syringes Market, By Country 2014-2021 (USD Million)

Table 7 Disposable Dental Syringes Market Size, By Region, 2014-2021 (USD Million)

Table 8 North America Disposable Syringes Market, By Country 2014-2021 (USD Million)

Table 9 Europe Disposable Syringes Market, By Country 2014-2021 (USD Million)

Table 10 Asia-Pacific Disposable Syringes Market, By Country 2014-2021 (USD Million)

Table 11 Safety Dental Syringes Market Size, By Region, 2014-2021 (USD Million)

Table 12 North America Safety Syringes Market, By Country 2014-2021 (USD Million)

Table 13 Europe Safety Syringes Market, By Country 2014-2021 (USD Million)

Table 14 Asia-Pacific Safety Syringes Market, By Country 2014-2021 (USD Million)

Table 15 Global Dental Syringes Market Size, By Type, 2014–2021 (USD Million)

Table 16 Aspirating Dental Syringes Market Size, By Region, 2014–2021 (USD Million)

Table 17 Non-Aspirating Dental Syringes Market Size, By Region, 2014–2021 (USD Million)

Table 18 Global Dental Syringes Market Size, By Material, 2014-2021 (USD Million)

Table 19 Metallic Syringes Market Size, By Region, 2014-2021 (USD Million)

Table 20 Plastic Syringes Market Size, By Region, 2014-2021 (USD Million)

Table 21 Dental Syringes Market Size, By Region, 2014-2021 (USD Million)

Table 22 North America: Market Size, By Country, 2014-2021 (USD Million)

Table 23 North America: Market Size, By Product, 2014-2021 (USD Million)

Table 24 North America: Market Size, By Type, 2014-2021 (USD Million)

Table 25 North America: Market Size, By Material, 2014-2021 (USD Million)

Table 26 U.S.: Market Size, By Product, 2014-2021 (USD Million)

Table 27 U.S.: Market Size, By Type, 2014-2021 (USD Million)

Table 28 U.S.: Market Size, By Material, 2014-2021 (USD Million)

Table 29 Canada: Market Size, By Product, 2014-2021 (USD Million)

Table 30 Canada: Market Size, By Type, 2014-2021 (USD Million)

Table 31 Canada: Market Size, By Material, 2014-2021 (USD Million)

Table 32 Europe: Market Size, By Country, 2014-2021 (USD Million)

Table 33 Europe: Market Size, By Product, 2014-2021 (USD Million)

Table 34 Europe: Market Size, By Type, 2014-2021 (USD Million)

Table 35 Europe: Market Size, By Material, 2014-2021 (USD Million)

Table 36 Germany: Market Size, By Product, 2014-2021 (USD Million)

Table 37 Germany: Market Size, By Type, 2014-2021 (USD Million)

Table 38 Germany: Market Size, By Material, 2014-2021 (USD Million)

Table 39 U.K.: Market Size, By Product, 2014-2021 (USD Million)

Table 40 U.K.: Market Size, By Type, 2014-2021 (USD Million)

Table 41 U.K.: Market Size, By Material, 2014-2021 (USD Million)

Table 42 France: Market Size, By Product, 2014-2021 (USD Million)

Table 43 France: Market Size, By Type, 2014-2021 (USD Million)

Table 44 France: Market Size, By Material, 2014-2021 (USD Million)

Table 45 RoE: Market Size, By Product, 2014-2021 (USD Million)

Table 46 RoE: Market Size, By Type, 2014-2021 (USD Million)

Table 47 RoE: Market Size, By Material, 2014-2021 (USD Million)

Table 48 Asia-Pacific: Market Size, By Country, 2014-2021 (USD Million)

Table 49 Asia-Pacific: Market Size, By Product, 2014-2021 (USD Million)

Table 50 Asia-Pacific: Market Size, By Type, 2014-2021 (USD Million)

Table 51 Asia-Pacific: Market Size, By Material, 2014-2021 (USD Million)

Table 52 Japan: Market Size, By Product, 2014-2021 (USD Million)

Table 53 Japan: Market Size, By Type, 2014-2021 (USD Million)

Table 54 Japan: Market Size, By Material, 2014-2021 (USD Million)

Table 55 China: Market Size, By Product, 2014-2021 (USD Million)

Table 56 China: Market Size, By Type, 2014-2021 (USD Million)

Table 57 China: Market Size, By Material, 2014-2021 (USD Million)

Table 58 India: Market Size, By Product, 2014-2021 (USD Million)

Table 59 India: Market Size, By Type, 2014-2021 (USD Million)

Table 60 India: Market Size, By Material, 2014-2021 (USD Million)

Table 61 RoAPAC: Market Size, By Product, 2014-2021 (USD Million)

Table 62 RoAPAC: Market Size, By Type, 2014-2021 (USD Million)

Table 63 RoAPAC: Market Size, By Material, 2014-2021 (USD Million)

Table 64 RoW: Market Size, By Product, 2014-2021 (USD Million)

Table 65 RoW: Market Size, By Type, 2014-2021 (USD Million)

Table 66 RoW: Market Size, By Material, 2014-2021 (USD Million)

Table 67 Global Dental Syringes Market Ranking, Key Player (2015)

Table 68 Mergers and Acquisitions (2013–2016)

Table 69 Product Launches (2013–2016)

Table 70 Expansions (2013–2016)

Table 71 Collaborations (2013–2016)

List of Figures (34 Figures)

Figure 1 Research Design

Figure 2 Increase in Aging Population, By Country (2010 vs 2015)

Figure 3 Percentage Increase in Aging Population, By Region (1980–2010 vs 2010–2040)

Figure 4 Healthcare Spending Matrix, By Country (2015)

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 Non-Disposable Dental Syringes Dominated the Global Dental Syringes Market in 2016

Figure 10 Aspirating Dental Syringes to Register the Highest CAGR During the Forecast Period

Figure 11 Metallic Dental Syringes Will Continue to Dominate the Dental Syringes Market in 2021

Figure 12 North America Accounted for the Largest Share of the Dental Syringes Market in 2016

Figure 13 APAC Dental Syringes Market to Register the Highest Growth Rate in the Forecast Period

Figure 14 Non-Disposable Dental Syringes Accounted for the Largest Market Share in 2016

Figure 15 Aspirating Dental Syringes Will Continue to Dominate the Global Market in 2021

Figure 16 Metallic Dental Syringes Segment Accounted for the Largest Share of the GlobalMarket in 2016

Figure 17 Asia-Pacific—Fastest-Growing Region in the Global Market

Figure 18 Market Drivers, Restraints, & Opportunities

Figure 19 Number of Dentists vs Total Population (As in 2014)

Figure 20 Market Supply Chain Analysis

Figure 21 Porter’s Five Forces Analysis

Figure 22 Safety Syringes to Register Highest Growth During the Forecast Period

Figure 23 Global Market Size, By Type, 2016 vs 2021 (USD Million)

Figure 24 Global Market Size, By Material, 2014-2021 (USD Million)

Figure 25 North America: Market Snapshot

Figure 26 Europe: Market Snapshot

Figure 27 Asia-Pacific: Market Snapshot

Figure 28 Product Launches, Expansions, Mergers & Acquisitions, and Collaborations: Key Growth Strategies Adopted By Market Players From 2013 to 2016

Figure 29 Mergers & Acquisitions Was the Key Growth Strategy Pursued By Market Players Between 2013 & 2016

Figure 30 Geographic Revenue Mix of the Market Players (2015)

Figure 31 3M Company: Company Snapshot (2015)

Figure 32 Dentsply International, Inc.: Company Snapshot (2015)

Figure 33 Integra Lifesciences Corporation: Company Snapshot (2015)

Figure 34 Acteon: Company Snapshot (2015)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dental Syringes Market