Dental Contouring Market by Instrument Type (Sanding Discs, Diamond Burs, Dental Drills), Site (central incisors, lateral incisors, canines) , Application (irregular edges, chips and cracks), - Global Forecast to 2027

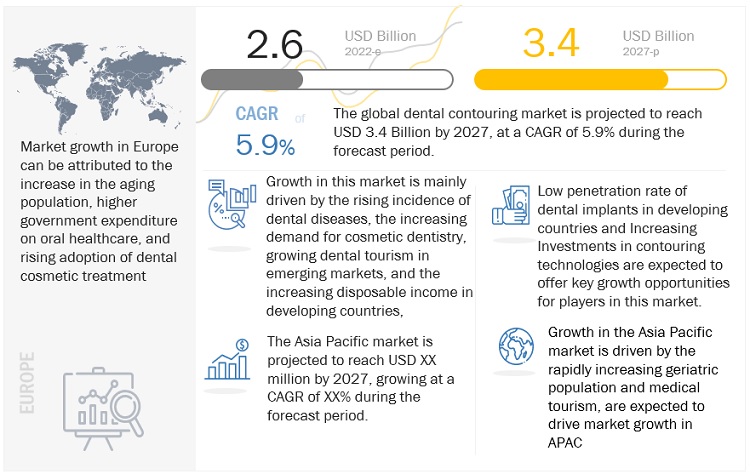

The dental contouring market is projected to reach USD 3.4 billion by 2027 from USD 2.6 billion in 2022, at a CAGR of 5.9% during the forecast period. Growth in the dental contouring market is primarily due to the development of technologically advanced solutions, changing lifestyles and unhealthy food habits, and growing consumer awareness and rising focus on aesthetics. The dental industry has evolved over the years with the development of new dental materials. Patient compliance has concurrently increased, with a sharp rise in the demand for minimally invasive procedures

To know about the assumptions considered for the study, Request for Free Sample Report

The competitive landscape includes the analysis of the key growth strategies adopted by major players between January 2019 and September 2022. Players in the global dental contouring market have employed various strategies to expand their global footprint and increase their market shares such as agreements, divestitures, expansions, and acquisitions.

In given report, the dental contouring market is segmented on the Type, Contouring Site, Contouring Application, and region.

Key Market Players :

The prominent players in the global dental contouring market are Mount Sinai Family Dental, Mayo Clinic Dentistry, Newton Dental Group, Cleveland Clinic, All Smiles Dental, Highfield Dental & Facial Clinic, Elleven Dental, Abano Healthcare Group, Apollo White Dental, Axiss Dental, and others.

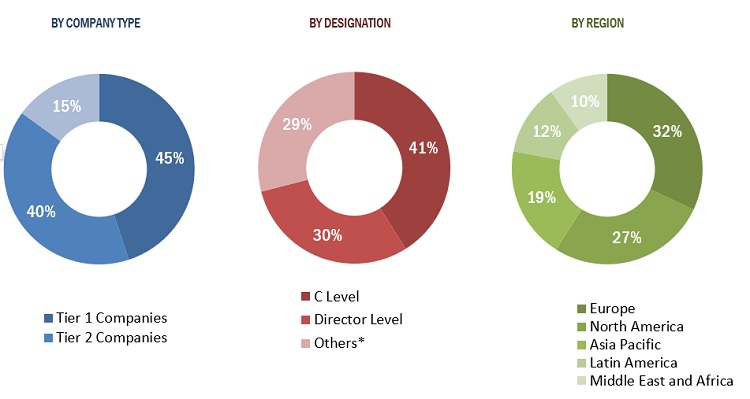

A breakdown of the primary participants (supply-side) for the dental contouring market referred to for this report is provided below:

- By Company Type: Tier 146%, Tier 2–19%, and Tier 3–36%

- By Designation: C-level–41%, Director Level–35%, and Others–24%

- By Region: North America–56%, Europe–14%, Asia Pacific–26%, Latin America- 3%, and Middle East and Africa– 2%

To know about the assumptions considered for the study, download the pdf brochure

Research Coverage:

The market study covers the dental contouring market across various segments. It aims at estimating the market size and the growth potential of this market across different segments type, contouring site, contouring application, and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

2020–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

By Type, Contouring Site, Contouring Application, And Region |

|

Countries Covered |

|

|

Companies covered |

The prominent players in the global dental contouring market are Mount Sinai Family Dental, Mayo Clinic Dentistry, Newton Dental Group, Cleveland Clinic, All Smiles Dental, Highfield Dental & Facial Clinic, Elleven Dental, Abano Healthcare Group, Apollo White Dental, Axiss Dental, and others. |

The research report categorizes closed system transfer device market into the following segments and sub-segments:

By Instrument Type

- Sanding Discs

- Diamond Burs

- Dental Drills

By Contouring Site

- Central Incisors

- Lateral Incisors

- Canines

By Application

- Irregular Edges

- Chips And Cracks

- Minor Crowding

- Tooth Overlapping

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 CATEGORY-WISE INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 KEY DATA FROM PRIMARY SOURCES

2.1.2.2 KEY INDUSTRY INSIGHTS

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 MARKET SHARE ESTIMATION

2.5 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 INDUSTRY TRENDS

5.4 REGULATORY ANALYSIS

5.5 ECOSYSTEM ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.7 TRADE ANALYSIS

5.8 VALUE CHAIN ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

5.10 PATENT ANALYSIS

5.11 SUPPLY CHAIN ANALYSIS

5.12 PRICING ANALYSIS

5.13 KEY CONFERENCES AND EVENTS (2022-2023)

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

6 DENTAL CONTOURING MARKET, BY INSTRUMENT TYPE, 2020-2027 (USD MILLION)

6.1 INTRODUCTION

6.2 SANDING DISCS

6.3 DIAMOND BURS

6.4 DENTAL DRILLS

7 DENTAL CONTOURING MARKET, BY CONTOURING SITE, 2020-2027 (USD MILLION)

7.1 INTRODUCTION

7.2 CENTRAL INCISORS

7.3 LATERAL INCISORS

7.4 CANINES

8 DENTAL CONTOURING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

8.1 INTRODUCTION

8.2 IRREGULAR EDGES

8.3 CHIPS AND CRACKS

8.4 MINOR CROWDING

8.5 TOOTH OVERLAPPING

9 DENTAL CONTOURING MARKET, BY COUNTRY/REGION, 2020-2027 (USD MILLION)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA

9.3 EUROPE

9.3.1 GERMANY

9.3.2 UK

9.3.3 FRANCE

9.3.4 SPAIN

9.3.5 ITALY

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.5 REST OF THE WORLD

10 COMPETITIVE LANDSCAPE

10.1 INTRODUCTION

10.2 REVENUE SHARE ANALYSIS

10.3 MARKET SHARE ANALYSIS OF KEY PLAYERS IN DENTAL CONTOURING MARKET

10.4 COMETITIVE BENCHMARKING

10.5 COMPANY GEOGRAPHIC FOOTPRINT

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STARS

10.6.2 PERVASIVE PLAYERS

10.6.3 EMERGING LEADERS

10.6.4 PARTICIPANTS

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT/SERVICE LAUNCHES & APPROVALS

10.7.2 DEALS

11 COMPANY PROFILES

(Business Overview, Financials, Recent Developments, MnM View & SWOT Analysis)

11.1.1 MOUNT SINAI FAMILY DENTAL

11.1.2 MAYO CLINIC DENTISTRY

11.1.3 NEWTON DENTAL GROUP

11.1.4 CLEVELAND CLINIC

11.1.5 ALL SMILES DENTAL

11.1.6 HIGHFIELD DENTAL & FACIAL CLINIC

11.1.7 ELLEVEN DENTAL

11.1.8 ABANO HEALTHCARE GROUP

11.1.9 APOLLO WHITE DENTAL

11.1.10 AXISS DENTAL

11.2 OTHER PLAYERS

11.2.1 COAST DENTAL

11.2.2 DENTAL SERVICES GROUP

11.2.3 GENTLE DENTISTRY

11.2.4 GREAT EXPRESSIONS DENTAL CENTERS

11.2.5 PACIFIC DENTAL SERVICES

11.2.6 SMILES 360

11.2.7 Q &M DENTAL GROUP

11.2.8 3M COMPANY

11.2.9 DENTSPLY SIRONA

11.2.10 HENRY SCHEIN

11.2.11 KURARAY CO. LTD.

11.2.12 PLANMECA GROUP

11.2.13 ROLAND DG

11.2.14 ZIMMER BIOMET HOLDINGS, INC.

11.2.15 STRAUMANN HOLDINGS AG

12 APPENDIX

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

*The segmentation of the study can be updated during the course of the study based on primary insights and secondary research

*The list of companies mentioned above is indicative only and might change during the course of the study.

*Details on key financials might not be captured in case of unlisted companies.

* SWOT Analysis will be provided for Top-5 companies only.

This study involved four major approaches in estimating the current dental contouring market size. Extensive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the value market. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources; directories; databases such as Hoovers, Bloomberg Business, Factiva, and Avention; white papers; and annual reports, company house documents, and SEC filings of companies. Secondary research was used to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the global dental contouring market. It was also used to obtain important information about top players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments related to market and technological perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the dental contouring market. Primary sources from the demand side include personnel from hospitals, clinics, pharma companies, and research labs. Primary research was conducted to identify segmentation types; industry trends; technology trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, and key player strategies.

Market Size Estimation

The total size of the dental contouring market was arrived at after data triangulation from four different approaches, as mentioned below.

Bottom-up Approach: Revenues of individual companies were gathered from public sources and databases. Shares of the dental contouring businesses of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the business unit was ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, selling price, and geographic reach and strength. Individual shares or revenue estimates were validated through expert interviews.

Country level Analysis: The size of the dental contouring market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of dental contouring products in the overall dental contouring market was obtained from secondary data and validated by primary participants to arrive at the total dental contouring market. Primary participants further validated the numbers.

rimary Interviews: As a part of the primary research process, individual respondent insights on the market size and growth were taken during the interview (regional and global, as applicable). All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall dental contouring market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

After complete market engineering with calculations for market statistics, market size estimations, market forecasting, market breakdown, and data triangulation, extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and further quantitative analysis was also done from all the numbers arrived at in the complete market engineering process to list key information throughout the report.

Breakdown of Primary Interviews (Supply Side): By Company Type, Designation, and Region

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue. As of 2020, Tier 1 = >USD 1 billion, Tier 2 = ~USD 505 million, and Tier 3 = >USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

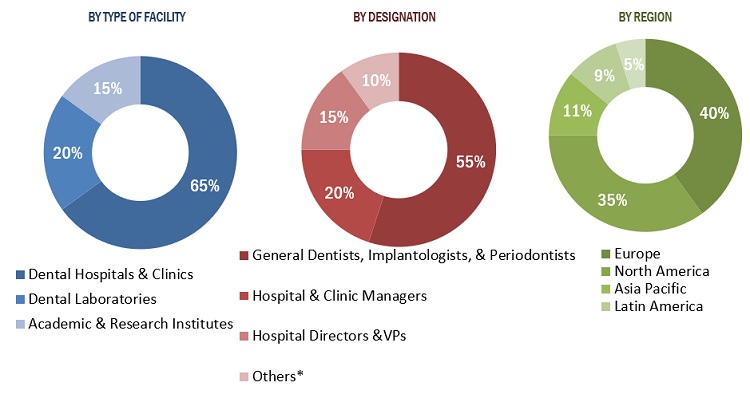

Breakdown of Primary Interviews (Demand Side): By End User Type, Designation, and Region

Note 1: Other end users segment includes research institutes.

Note 2: Other designation includes type-c executives of hospitals and clinics.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Approach to derive the market size and estimate market growth

The market rankings for leading players were ascertained after a detailed assessment of their revenues from the dental contouring business using secondary data available through paid and unpaid sources. Owing to data limitations, in certain cases, the revenue share was arrived at after a detailed assessment of the product portfolios of major companies and their respective sales performance. At each point, this data was validated through primary interviews with industry experts.

Objectives of the Study

- To define, describe, segment, and forecast the dental contouring market by Type, Contouring Site, Contouring Application, and region

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall Dental Contouring market

- To analyze market opportunities for stakeholders and provide details of the market’s competitive landscape

- To forecast the size of the Dental Contouring market in five main regions, namely,

North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa, along with their respective key countries - To profile key players in the market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments, such as acquisitions; new product launches; expansions; collaborations, agreements, and partnerships; and R&D activities of the leading market players

- To benchmark players in the market using the "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Further segmentation of individual product segments by application

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific dental contouring market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe dental contouring market into Belgium, Russia, the Netherlands, Switzerland, and others

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Dental Contouring Market