Demulsifier Market by Type (Oil Soluble, Water Soluble) Application (Crude Oil, Petroleum Refineries, Lubircant Manufacturing, Oil Based Power Plants, Sludge Oil Treatment) & Region (APAC, North America, Europe, MEA, South America) Global Forecast to 2028

Updated on : July 28, 2025

Demulsifier Market

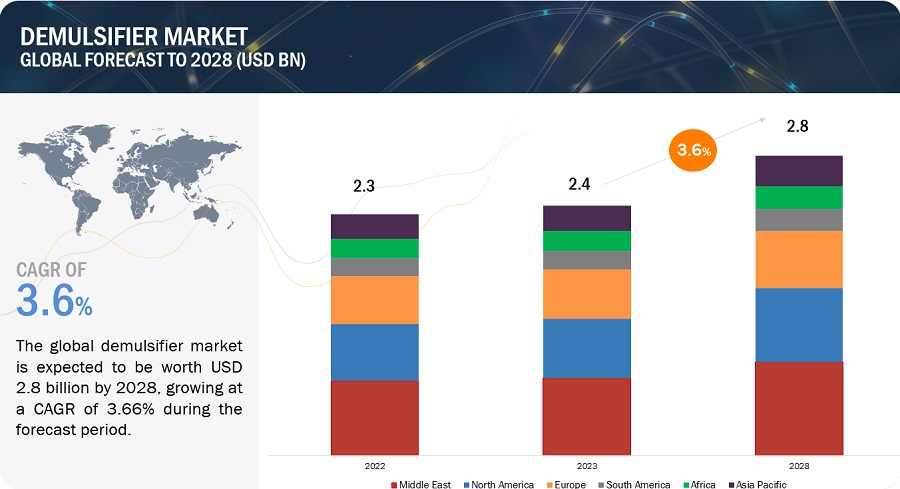

The global demulsifier market was valued at USD 2.3 billion in 2022 and is projected to reach USD 2.8 billion by 2028, growing at 3.6% cagr from 2023 to 2028. Increasing oil & gas production and expansion of offshore oil & gas exploration are the major drivers of demulsifier market. Emulsions can lead to equipment fouling and corrosion, which can result in downtime for maintenance. Effective use of demulsifier minimizes the formation of emulsions and reduces the frequency of equipment cleaning and maintenance, thereby optimizing production uptime.

Demulsifier Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Demulsifier Market Dynamics

Driver: Increasing oil & gas production

Increasing oil and gas production, demulsifier play a crucial role in the separation and processing of crude oil. Emulsions can lead to equipment fouling and corrosion, which can result in downtime for maintenance. Effective use of demulsifier minimizes the formation of emulsions and reduces the frequency of equipment cleaning and maintenance, thereby optimizing production uptime. The amount of generated water that is also produced during the extraction process rises in tandem with the growth in oil production. Produced water needs to be separated from its oil, water, and other impurities in order to be properly disposed of or treated.

Restraints : Stringent environmental regulations

Environmental regulations can indeed impact the growth and use of demulsifier in various industries, including oil and gas, petroleum, and refining. These regulations are designed to ensure responsible resource extraction, protect ecosystems, and minimize environmental impact. Demulsifier that break apart emulsions can produce waste streams that need to be properly disposed of. Environmental standards that are more severe may call for more careful processing and treatment of waste, which could raise costs and complicate operations for firms that utilise demulsifier.

Opportunities: Growing demand for bio-based demulsifier

The demand for bio-based demulsifier is growing as industries across sectors adapt more environmentally friendly and sustainable solutions. Bio-based demulsifier are manufactured from renewable sources and mostly have lower environmental impact compared to traditional chemical-based demulsifier.These demulsifier are more sustainable alternative to chemical based demulsifier, reducing the overall carbon footprint and minimizing the use of fossil resources.

Challenges: Complex emulsion characteristics

Manufacturers of demulsifier have difficulties since emulsions come in a variety of forms. To comprehend the unique characteristics of many emulsion systems and create demulsifier formulations that may successfully break them, they must engage heavily in lengthy research and development. To build demulsifier that can handle a variety of crude oil types and production settings, one needs knowledge of emulsion chemistry, surface chemistry, and fluid dynamics.

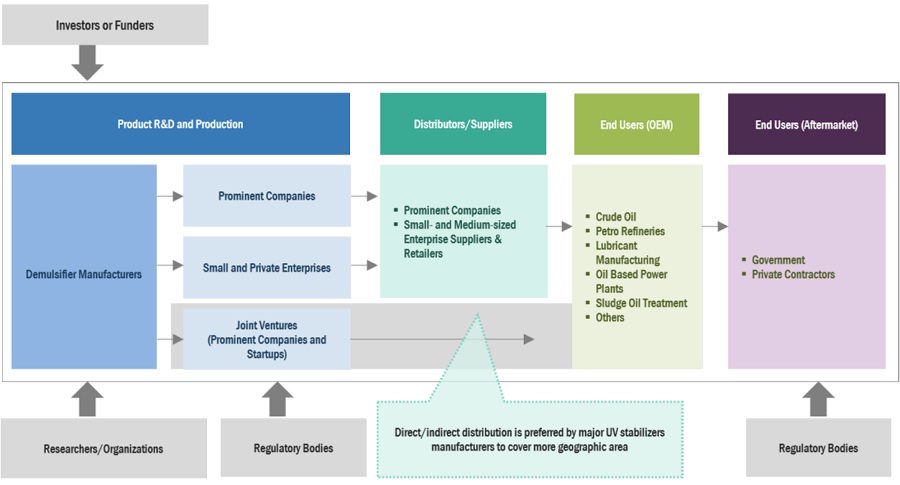

Demulsifier Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of demulsifier. These companies have been in business for a while and have a broad range of products, cutting-edge technologies, and robust international sales and marketing networks. Prominent companies in this market include Baker Hughes (US), Clariant AG (Switzerland), Ecolab Inc. (US), Hallinburton Company (US), Schlumberger Limited (US), Nouryon (Netherlands), BASF SE (Gemany), Dow Inc. (US), Arkema S.A. (France), and Momentive Performance Materials Inc. (US).

Based on type, oil soluble was the largest segment for demulsifier market, in terms of value, in 2022.

The demand for effective processing of crude oil, increased production yields, and high-quality oil output are the driving forces behind oil-soluble demulsifier. This demand is significantly shaped by the global energy landscape, technological developments, market dynamics, and environmental concerns. Responsible resource extraction includes minimizing the environmental impact of production activities. Effective emulsion breaking using demulsifier can help reduce the volume of waste materials that need to be treated, disposed of, or reinjected into reservoirs.

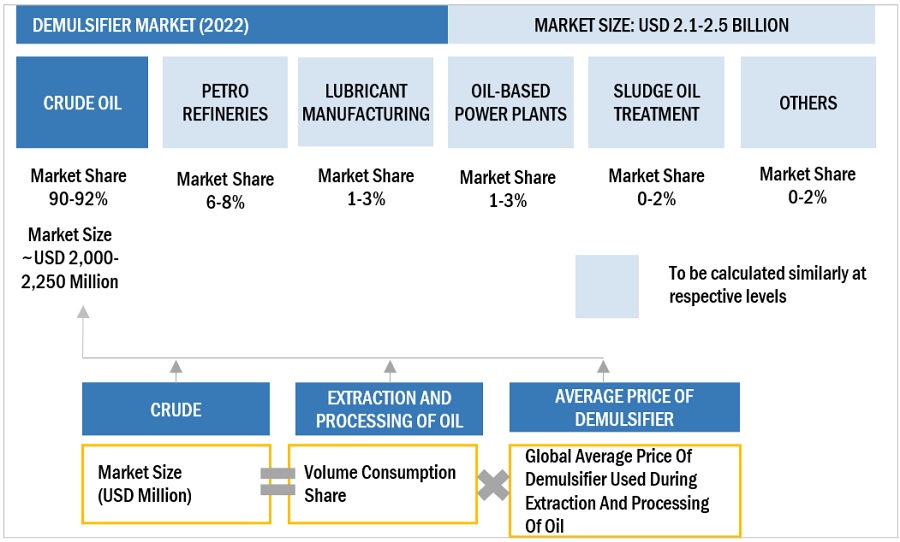

Based on application, crude oil was the largest segment for demulsifier market, in terms of value, in 2022.

The need to extract additional crude oil from reservoirs is becoming increasingly urgent as the world's energy needs keep expanding. Increased production leads to higher volumes of crude oil-water emulsions that require effective demulsification for efficient processing. Also, ongoing research and development efforts lead to the creation of more advanced and effective demulsifier. These innovations can increase the demand for demulsification solutions that offer improved performance and efficiency.

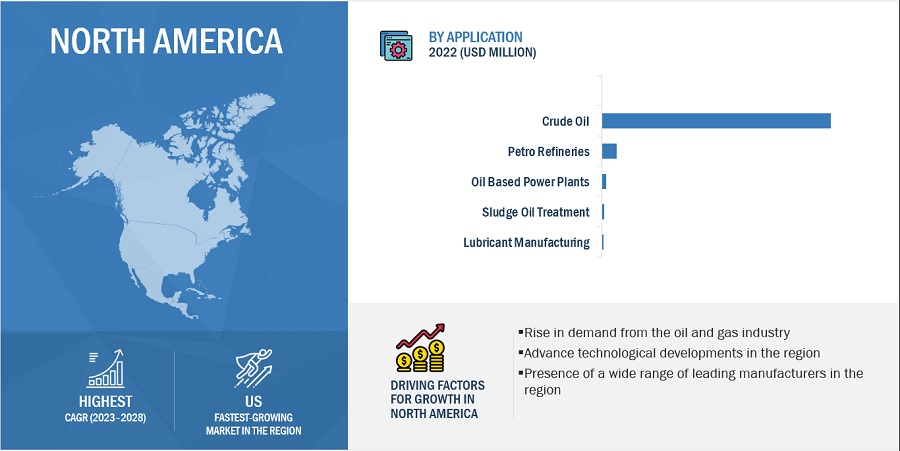

“North America is projected to register highest CAGR in terms of value, during the forecast period”

North America is projected to be the fastest growing region, in terms of value, during the forecast period. The development of shale oil and gas resources, particularly in the US, has led to increased production. Shale formations often have complex reservoir conditions that can lead to emulsions, making demulsifier crucial for effective processing. Crude oil is refined and petrochemically processed into a variety of goods in North America. Demulsifier are used to prepare crude oil and feedstock for refinement, increasing the processing units' efficiency. Major companies in North America are investing in sustainability and reducing their environmental footprint. Efficient demulsification can contribute to waste reduction and support sustainable practices.

To know about the assumptions considered for the study, download the pdf brochure

Demulsifier Market Players

The key players profiled in the report include Baker Hughes (US), Clariant AG (Switzerland), Ecolab Inc. (US), Hallinburton Company (US), Schlumberger Limited (US), Nouryon (Netherlands), BASF SE (Gemany), Dow Inc. (US), Arkema S.A. (France), and Momentive Performance Materials Inc. (US) among others, these are the key manufacturers that secured major market share in the last few years.

Demulsifier Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Unit) and Value (USD Thousand/ Million) |

|

Segments covered |

Type, Application, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East, Africa, and South America |

|

Companies profiled |

The key players profiled in the report include Baker Hughes (US), Clariant AG (Switzerland), Ecolab Inc. (US), Hallinburton Company (US), Schlumberger Limited (US), Nouryon (Netherlands), BASF SE (Gemany), Dow Inc. (US), Arkema S.A. (France), and Momentive Performance Materials Inc. (US) among others. |

This report categorizes the global demulsifier market based on type, application, and region.

On the basis of type, the demulsifier market has been segmented as follows:

- Oil soluble

- Water soluble

On the basis of application, the demulsifier market has been segmented as follows:

- Crude oil

- Petroleum refineries

- Lubricant Manufacturing

- Oil Based Power Plants

- Sludge Oil Treatment

- Others

On the basis of region, the demulsifer market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East

- South America

- Africa

Recent Developments

- In October 2022, Clariant AG announced its expansion by launching a state-of-the-art technical center in the UAE. This center will serve customers in Europe, the Middle East, and Africa (EMEA).

- In September 2022, Clariant AG launched the D3 PROGRAM to introduce more sustainable solutions to the oil and gas industry.

- In November 2021, Clariant AG increased its presence in Africa, Southeast Asia, the Commonwealth of Independent States, Europe, the North Sea, and the Middle East by setting up a new commercial hub and a state-of-the-art Oil Services facility—the Eastern Hemisphere Technical Center (EHTC), in Dubai.

Frequently Asked Questions (FAQ):

Which are the major players in demulsifier market?

The key players profiled in the report include Baker Hughes (US), Clariant AG (Switzerland), Ecolab Inc. (US), Hallinburton Company (US), Schlumberger Limited (US), Nouryon (Netherlands), BASF SE (Gemany), Dow Inc. (US), Arkema S.A. (France), and Momentive Performance Materials Inc. (US).

What are the drivers and opportunities for the demulsifier market?

The increasing oil and gas production is a major driver for demulsifier market. Also, the rising demand for bio-based demulsifier is expected to create new opportunity for the market.

What are the various strategies key players are focusing within demulsifier market?

New product launches, expansion and partnership are some of the strategies atoped by key players to expand their global presence.

What is the CAGR of the Demulsifier Market?

The market is projected to grow at a CAGR of 3.6%, in terms of value, during the forecast period.

What are the major factors restraining demulsifier market growth during the forecast period?

Volaity in crude oil prices and stringent government regulations are some of the restricting f factors for demulsifier market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing oil & gas production- Expansion of offshore oil & gas explorationRESTRAINTS- Stringent environmental regulations- Volatility in crude oil pricesOPPORTUNITIES- Growing demand for bio-based demulsifiers- Rising focus on sustainable and eco-friendly solutionsCHALLENGES- Complex emulsion characteristics- Technological advancements and innovations

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALSMANUFACTURERSDISTRIBUTORS

- 6.2 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

6.3 ECOSYSTEM

-

6.4 CASE STUDY ANALYSISEFFECTIVE DEMULSIFIERS IMPROVE CRUDE QUALITY AND REDUCE BACKPRESSUREIMPROVED WATER QUALITY AND REDUCED DOSAGE WITH DEMUL SIFIER IN NORTH SEATRETOLITE CLEAR REDUCES OIL IN INJECTION WATER AND INCREASES ANNUAL REVENUE

-

6.5 TECHNOLOGY ANALYSISCLARIANT OIL SERVICES INTRODUCES PHASETREAT WET FOR ENHANCED DEMULSIFICATION EFFICIENCY

-

6.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.7 PRICING ANALYSISAVERAGE SELLING PRICE, BY APPLICATIONAVERAGE SELLING PRICE, BY REGION

-

6.8 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

6.9 REGULATORY LANDSCAPEREGULATIONS RELATED TO DEMULSIFIER MARKETREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 KEY CONFERENCES AND EVENTS, 2023–2024

-

6.11 PATENT ANALYSISAPPROACHDOCUMENT TYPESJURISDICTION ANALYSIS

- 7.1 INTRODUCTION

- 7.2 COMPARISON BETWEEN OIL-SOLUBLE AND WATER-SOLUBLE DEMULSIFIER

-

7.3 OIL-SOLUBLE DEMULSIFIERWIDE USE OF ORGANIC LIQUID FORMULATIONS TO DRIVE MARKET

-

7.4 WATER-SOLUBLE DEMULSIFIERSOLUBLE IN CRUDE OIL AND ORGANIC SOLVENTS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 DEMULSIFIER, BY TYPE OF SURFACTANTANIONIC DEMULSIFIERNONIONIC DEMULSIFIERAMPHOTERIC DEMULSIFIERCATIONIC DEMULSIFIER

-

8.3 DEMULSIFIER FORMULATIONSOXYALKYLATED PHENOLIC RESINSPOLYMERIZED POLYOLSPOLYALKYLENE GLYCOLSPOLYOLS ESTERSRESIN ESTERSSULFONATESEO/PO BLOCK POLYMERSPOLYAMINESPOLYMERIC ELASTOMERS

- 9.1 INTRODUCTION

-

9.2 CRUDE OILINCREASING CRUDE OIL PRODUCTION TO DRIVE MARKET

-

9.3 PETROLEUM REFINERIESINCREASING OIL REFINERY CAPACITIES TO DRIVE DEMAND

-

9.4 LUBRICANT MANUFACTURINGOPPORTUNITIES IN INDUSTRIAL SECTOR TO DRIVE MARKET

-

9.5 OIL-BASED POWER PLANTSINCREASE IN ENERGY DEMAND TO DRIVE MARKET

-

9.6 SLUDGE OIL TREATMENTINCREASING NEED OF SLUDGE OIL DISPOSAL TO DRIVE MARKET

- 9.7 OTHERS

- 10.1 INTRODUCTION

-

10.2 MIDDLE EASTIMPACT OF RECESSIONMIDDLE EAST & AFRICA DEMULSIFIER MARKET, BY APPLICATIONMIDDLE EAST & AFRICA DEMULSIFIER MARKET, BY COUNTRY- Saudi Arabia- Iran- Iraq- UAE- Kuwait

-

10.3 NORTH AMERICAIMPACT OF RECESSIONNORTH AMERICA DEMULSIFIER MARKET, BY APPLICATIONNORTH AMERICA DEMULSIFIER MARKET, BY COUNTRY- US- Canada- Mexico

-

10.4 EUROPEIMPACT OF RECESSIONEUROPE DEMULSIFIER MARKET, BY APPLICATIONEUROPE DEMULSIFIER MARKET, BY COUNTRY- Russia- Kazakhstan- Norway- UK

-

10.5 ASIA PACIFICIMPACT OF RECESSIONASIA PACIFIC DEMULSIFIER MARKET, BY APPLICATIONASIA PACIFIC DEMULSIFIER MARKET, BY COUNTRY- China- India- Indonesia

-

10.6 AFRICAIMPACT OF RECESSIONAFRICA DEMULSIFIER MARKET, BY APPLICATIONAFRICA DEMULSIFIER MARKET, BY COUNTRY- Nigeria- Angola- Algeria

-

10.7 SOUTH AMERICAIMPACT OF RECESSIONSOUTH AMERICA DEMULSIFIER MARKET, BY APPLICATIONSOUTH AMERICA DEMULSIFIER MARKET, BY COUNTRY- Brazil- Venezuela

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 RANKING OF KEY MARKET PLAYERS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 HISTORICAL REVENUE ANALYSIS OF KEY COMPANIES

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.7 COMPANY EVALUATION MATRIX (TIER 1)STARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 11.8 COMPETITIVE BENCHMARKING

-

11.9 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

11.10 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 MAJOR PLAYERSBAKER HUGHES COMPANY- Business overview- Products offered- MnM viewCLARIANT AG- Business overview- Products offered- Recent developments- MnM viewECOLAB INC.- Business overview- Products offered- MnM viewHALLIBURTON COMPANY- Business overview- Products offered- MnM viewSCHLUMBERGER LIMITED- Business overview- Products offered- MnM viewNOURYON- Business overview- Products offered- MnM viewBASF SE- Business overview- Products offered- MnM viewDOW INC.- Business overview- Products offered- MnM viewARKEMA S.A.- Business overview- Products offered- MnM viewMOMENTIVE PERFORMANCE MATERIALS INC.- Business overview- Products offered- MnM view

-

12.2 OTHER PLAYERSRIMPRO INDIACARGILL INC.DORF KETALNOVA STAR LPINNOSPEC INC.REDA OILFIELDROEMEX LIMITEDCOCHRAN CHEMICAL COMPANY INC.SI GROUP INC.MCC CHEMICALS INCOIL TECHNICS HOLDINGS LTD.CHEMIPHASE LTDNATIONAL CHEMICAL & PETROLEUM INDUSTRIES CO. W.L.L. (NCPI)EGYPTIAN MUD ENGINEERING AND CHEMICALS COMPANY (EMEC)IMPERIAL OILFIELD CHEMICALS PVT.LTD.

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 SPECIALTY OILFIELD CHEMICALS MARKETMARKET DEFINITIONMARKET OVERVIEWSPECIALTY OILFIELD CHEMICALS MARKET BY REGION- North America- Middle East & Africa- Europe- Asia Pacific- South America

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 DEMULSIFIER MARKET: RISK ASSESSMENT

- TABLE 2 DEMULSIFIER MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2021–2028 (USD BILLION)

- TABLE 4 DEMULSIFIER MARKET: ECOSYSTEM

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 7 AVERAGE SELLING PRICES BY KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

- TABLE 8 AVERAGE SELLING PRICES OF DEMULSIFIERS, BY REGION, 2021–2028 (USD/KG)

- TABLE 9 DEMULSIFIERS IMPORTS, BY REGION, 2013–2022 (USD MILLION)

- TABLE 10 DEMULSIFIERS EXPORTS, BY REGION, 2013–2022 (USD MILLION)

- TABLE 11 DEMULSIFIER MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 12 DEMULSIFIER MARKET: GLOBAL PATENTS

- TABLE 13 DEMULSIFIER MARKET, BY TYPE, 2018–2021 (TON)

- TABLE 14 DEMULSIFIER MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 15 DEMULSIFIER MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 16 DEMULSIFIER MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 17 FORMULATION TYPES OF DEMULSIFIER

- TABLE 18 DEMULSIFIER USED IN OILFIELD

- TABLE 19 DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 20 DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 21 DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 22 DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 23 DEMULSIFIER MARKET IN CRUDE OIL, BY REGION, 2018–2021 (TON)

- TABLE 24 DEMULSIFIER MARKET IN CRUDE OIL, BY REGION, 2022–2028 (TON)

- TABLE 25 DEMULSIFIER MARKET IN CRUDE OIL, BY REGION, 2018–2021 (USD MILLION)

- TABLE 26 DEMULSIFIER MARKET IN CRUDE OIL, BY REGION, 2022–2028 (USD MILLION)

- TABLE 27 DEMULSIFIER MARKET IN PETROLEUM REFINERIES, BY REGION, 2018–2021 (TON)

- TABLE 28 DEMULSIFIER MARKET IN PETROLEUM REFINERIES, BY REGION, 2022–2028 (TON)

- TABLE 29 DEMULSIFIER MARKET IN PETROLEUM REFINERIES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 30 DEMULSIFIER MARKET IN PETROLEUM REFINERIES, BY REGION, 2022–2028 (USD MILLION)

- TABLE 31 DEMULSIFIER MARKET IN LUBRICANT MANUFACTURING, BY REGION, 2018–2021 (TON)

- TABLE 32 DEMULSIFIER MARKET IN LUBRICANT MANUFACTURING, BY REGION, 2022–2028 (TON)

- TABLE 33 DEMULSIFIER MARKET IN LUBRICANT MANUFACTURING, BY REGION, 2018–2021 (USD MILLION)

- TABLE 34 DEMULSIFIER MARKET IN LUBRICANT MANUFACTURING, BY REGION, 2022–2028 (USD MILLION)

- TABLE 35 DEMULSIFIER MARKET IN OIL-BASED POWER PLANTS, BY REGION, 2018–2021 (TON)

- TABLE 36 DEMULSIFIER MARKET IN OIL-BASED POWER PLANTS, BY REGION, 2022–2028 (TON)

- TABLE 37 DEMULSIFIER MARKET IN OIL-BASED POWER PLANTS, BY REGION, 2018–2021 (USD MILLION)

- TABLE 38 DEMULSIFIER MARKET IN OIL-BASED POWER PLANTS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 39 DEMULSIFIER MARKET IN SLUDGE OIL TREATMENT, BY REGION, 2018–2021 (TON)

- TABLE 40 DEMULSIFIER MARKET IN SLUDGE OIL TREATMENT, BY REGION, 2022–2028 (TON)

- TABLE 41 DEMULSIFIER MARKET IN SLUDGE OIL TREATMENT, BY REGION, 2018–2021 (USD MILLION)

- TABLE 42 DEMULSIFIER MARKET IN SLUDGE OIL TREATMENT, BY REGION, 2022–2028 (USD MILLION)

- TABLE 43 DEMULSIFIER MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2021 (TON)

- TABLE 44 DEMULSIFIER MARKET IN OTHER APPLICATIONS, BY REGION, 2022–2028 (TON)

- TABLE 45 DEMULSIFIER MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

- TABLE 46 DEMULSIFIER MARKET IN OTHER APPLICATIONS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 47 DEMULSIFIER MARKET, BY REGION, 2018–2021 (TON)

- TABLE 48 DEMULSIFIER MARKET, BY REGION, 2022–2028 (TON)

- TABLE 49 DEMULSIFIER MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 50 DEMULSIFIER MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 51 MIDDLE EAST: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 52 MIDDLE EAST: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 53 MIDDLE EAST: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 54 MIDDLE EAST: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 55 MIDDLE EAST: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (TON)

- TABLE 56 MIDDLE EAST: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 57 MIDDLE EAST: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 58 MIDDLE EAST: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 59 SAUDI ARABIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 60 SAUDI ARABIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 61 SAUDI ARABIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 62 SAUDI ARABIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 63 IRAN: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 64 IRAN: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 65 IRAN: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 66 IRAN: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 67 IRAQ: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 68 IRAQ: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 69 IRAQ: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 70 IRAQ: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 71 UAE: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 72 UAE: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 73 UAE: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 74 UAE: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 75 KUWAIT: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 76 KUWAIT: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 77 KUWAIT: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 78 KUWAIT: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 79 NORTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 80 NORTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 81 NORTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (TON)

- TABLE 84 NORTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 85 NORTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 87 US: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 88 US: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 89 US: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 90 US: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 91 CANADA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 92 CANADA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 93 CANADA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 94 CANADA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 95 MEXICO: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 96 MEXICO: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 97 MEXICO: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 98 MEXICO: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 99 EUROPE: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 100 EUROPE: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 101 EUROPE: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 102 EUROPE: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 103 EUROPE: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (TON)

- TABLE 104 EUROPE: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 105 EUROPE: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 106 EUROPE: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 107 RUSSIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 108 RUSSIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 109 RUSSIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 110 RUSSIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 111 KAZAKHSTAN: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 112 KAZAKHSTAN: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 113 KAZAKHSTAN: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 114 KAZAKHSTAN: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 115 NORWAY: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 116 NORWAY: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 117 NORWAY: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 118 NORWAY: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 119 UK: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 120 UK: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 121 UK: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 122 UK: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 123 ASIA PACIFIC: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 124 ASIA PACIFIC: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 125 ASIA PACIFIC: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (TON)

- TABLE 128 ASIA PACIFIC: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 129 ASIA PACIFIC: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 131 CHINA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 132 CHINA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 133 CHINA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 134 CHINA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 135 INDIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 136 INDIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 137 INDIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 138 INDIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 139 INDONESIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 140 INDONESIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 141 INDONESIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 142 INDONESIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 143 AFRICA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 144 AFRICA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 145 AFRICA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 146 AFRICA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 147 AFRICA: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (TON)

- TABLE 148 AFRICA: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 149 AFRICA: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 150 AFRICA: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 151 NIGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 152 NIGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 153 NIGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 154 NIGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 155 ANGOLA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 156 ANGOLA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 157 ANGOLA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 158 ANGOLA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 159 ALGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 160 ALGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 161 ALGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 162 ALGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 163 SOUTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 164 SOUTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 165 SOUTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 166 SOUTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 167 SOUTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (TON)

- TABLE 168 SOUTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 169 SOUTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

- TABLE 170 SOUTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 171 BRAZIL: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 172 BRAZIL: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 173 BRAZIL: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 174 BRAZIL: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 175 VENEZUELA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (TON)

- TABLE 176 VENEZUELA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 177 VENEZUELA: DEMULSIFIER MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 178 VENEZUELA: DEMULSIFIER MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 179 OVERVIEW OF STRATEGIES ADOPTED BY KEY DEMULSIFIERS MANUFACTURERS

- TABLE 180 DEMULSIFIER MARKET: DEGREE OF COMPETITION

- TABLE 181 DEMULSIFIER MARKET: TYPE FOOTPRINT

- TABLE 182 DEMULSIFIER MARKET: APPLICATION FOOTPRINT

- TABLE 183 DEMULSIFIER MARKET: REGION FOOTPRINT

- TABLE 184 DEMULSIFIERS: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 185 DEMULSIFIER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 DEMULSIFIER MARKET: PRODUCT LAUNCHES (2020–2022)

- TABLE 187 DEMULSIFIER MARKET: DEALS (2020–2022)

- TABLE 188 DEMULSIFIER MARKET: OTHER DEVELOPMENTS (2020–2022)

- TABLE 189 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 190 CLARIANT AG: COMPANY OVERVIEW

- TABLE 191 CLARIANT AG: PRODUCT LAUNCHES

- TABLE 192 CLARIANT AG: OTHER DEVELOPMENTS

- TABLE 193 ECOLAB INC.: COMPANY OVERVIEW

- TABLE 194 HALLIBURTON COMPANY: COMPANY OVERVIEW

- TABLE 195 SCHLUMBERGER LIMITED: COMPANY OVERVIEW

- TABLE 196 NOURYON: COMPANY OVERVIEW

- TABLE 197 BASF SE: COMPANY OVERVIEW

- TABLE 198 DOW INC.: COMPANY OVERVIEW

- TABLE 199 ARKEMA S.A.: COMPANY OVERVIEW

- TABLE 200 MOMENTIVE PERFORMANCE MATERIALS INC.: COMPANY OVERVIEW

- TABLE 201 RIMPRO INDIA: COMPANY OVERVIEW

- TABLE 202 CARGILL INC.: COMPANY OVERVIEW

- TABLE 203 DORF KETAL: COMPANY OVERVIEW

- TABLE 204 NOVA STAR LP: COMPANY OVERVIEW

- TABLE 205 INNOSPEC INC: COMPANY OVERVIEW

- TABLE 206 REDA OILFIELD: COMPANY OVERVIEW

- TABLE 207 ROEMEX LIMITED: COMPANY OVERVIEW

- TABLE 208 COCHRAN CHEMICAL COMPANY INC.: COMPANY OVERVIEW

- TABLE 209 SI GROUP INC.: COMPANY OVERVIEW

- TABLE 210 MCC CHEMICALS INC.: COMPANY OVERVIEW

- TABLE 211 OIL TECHNICS HOLDINGS LTD: COMPANY OVERVIEW

- TABLE 212 CHEMIPHASE LTD.: COMPANY OVERVIEW

- TABLE 213 NATIONAL CHEMICAL & PETROLEUM INDUSTRIES CO. W.L.L. (NCPI): COMPANY OVERVIEW

- TABLE 214 EGYPTIAN MUD ENGINEERING AND CHEMICALS COMPANY (EMEC): COMPANY OVERVIEW

- TABLE 215 IMPERIAL OILFIELD CHEMICALS PVT. LTD.: COMPANY OVERVIEW

- TABLE 216 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 217 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 218 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 219 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION 2021–2027 (KILOTON)

- TABLE 220 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 221 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 222 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 223 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021–2027 (KILOTONS)

- TABLE 224 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 227 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 228 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 229 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 230 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 231 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 232 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 233 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 234 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 235 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 236 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 237 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 238 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 239 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- FIGURE 1 DEMULSIFIER MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL TYPES OF DEMULSIFIER

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 – TOP DOWN

- FIGURE 6 DEMULSIFIER MARKET: DATA TRIANGULATION

- FIGURE 7 SUPPLY-SIDE MARKET CAGR PROJECTIONS

- FIGURE 8 DEMAND-SIDE MARKET GROWTH PROJECTIONS: DRIVERS AND OPPORTUNITIES

- FIGURE 9 OIL-SOLUBLE DEMULSIFIERS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 CRUDE OIL TO BE FASTEST-GROWING APPLICATION OF DEMULSIFIER MARKET DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO BE FASTEST-GROWING MARKET FOR DEMULSIFIER DURING FORECAST PERIOD

- FIGURE 12 MIDDLE EAST TO LEAD DEMULSIFIER MARKET DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 CRUDE OIL SEGMENT AND SAUDI ARABIA ACCOUNTED FOR LARGEST SHARES IN 2022

- FIGURE 15 CRUDE OIL DOMINATED DEMULSIFIER MARKET ACROSS REGIONS

- FIGURE 16 IRAQ TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS: DEMULSIFIER MARKET

- FIGURE 19 DEMULSIFIER MARKET: SUPPLY CHAIN

- FIGURE 20 REVENUE SHIFT & NEW REVENUE POCKETS FOR DEMULSIFIER MARKET

- FIGURE 21 DEMULSIFIER MARKET: ECOSYSTEM

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 24 AVERAGE SELLING PRICES BY KEY PLAYERS FOR TOP THREE APPLICATIONS

- FIGURE 25 AVERAGE SELLING PRICE OF DEMULSIFIERS, BY REGION, 2021–2028

- FIGURE 26 DEMULSIFIERS IMPORTS, BY KEY COUNTRY, 2013–2022

- FIGURE 27 DEMULSIFIERS EXPORTS, BY KEY COUNTRY, 2013–2022

- FIGURE 28 PATENTS REGISTERED IN DEMULSIFIER MARKET, 2013–2023

- FIGURE 29 PATENT PUBLICATION TRENDS, 2013–2022

- FIGURE 30 LEGAL STATUS OF PATENTS FILED IN DEMULSIFIER MARKET

- FIGURE 31 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- FIGURE 32 OIL SOLUBLE SEGMENT TO DOMINATE DEMULSIFIER MARKET DURING FORECAST PERIOD

- FIGURE 33 CRUDE OIL SEGMENT TO DOMINATE DEMULSIFIER MARKET DURING FORECAST PERIOD

- FIGURE 34 MIDDLE EAST TO LEAD DEMULSIFIER MARKET DURING FORECAST PERIOD

- FIGURE 35 MIDDLE EAST: DEMULSIFIER MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: DEMULSIFIER MARKET SNAPSHOT

- FIGURE 37 EUROPE: DEMULSIFIER MARKET SNAPSHOT

- FIGURE 38 RANKING OF TOP FIVE PLAYERS IN DEMULSIFIER MARKET, 2022

- FIGURE 39 BAKER HUGHES COMPANY LED DEMULSIFIER MARKET IN 2022

- FIGURE 40 REVENUE ANALYSIS OF KEY COMPANIES DURING PAST FIVE YEARS

- FIGURE 41 DEMULSIFIER MARKET: COMPANY FOOTPRINT

- FIGURE 42 COMPANY EVALUATION MATRIX FOR DEMULSIFIER MARKET

- FIGURE 43 STARTUP/SME EVALUATION MATRIX FOR DEMULSIFIER MARKET

- FIGURE 44 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- FIGURE 45 CLARIANT AG: COMPANY SNAPSHOT

- FIGURE 46 ECOLAB INC: COMPANY SNAPSHOT

- FIGURE 47 HALLIBURTON: COMPANY SNAPSHOT

- FIGURE 48 SCHLUMBERGER LIMITED: COMPANY SNAPSHOT

- FIGURE 49 BASF SE: COMPANY SNAPSHOT

- FIGURE 50 DOW INC.: COMPANY SNAPSHOT

- FIGURE 51 ARKEMA S.A.: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size for demulsifier. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

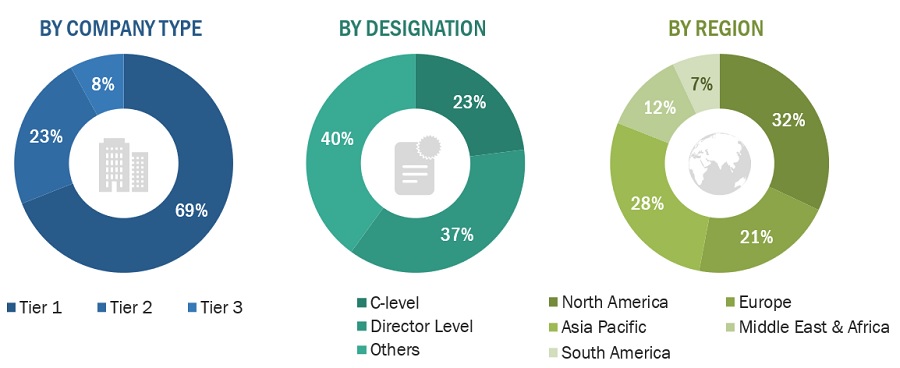

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The demulsifier market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the crude oil production, petroleum refineries, lubricant manufacturing, oil based power plants, sludge oil treatment, and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Baker Hughes |

Senior Manager |

|

Clariant AG |

Innovation Manager |

|

Ecolab Inc. |

Sales Manager |

|

Hallinburton Company |

Production Supervisor |

|

Nouryon |

Vice-President |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the demulsifier market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Demulsifier Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Demulsifier Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the demulsifier industry.

Market Definition

Demulsifier function by causing emulsions to lose their stability, which leads to the scattered droplets coalescing and separating from the continuous phase. For example, a demulsifier can destabilize oil-water emulsions, causing the oil droplets to congregate and rise to the surface, allowing the water and oil to be separated. These chemicals are used in various industries, such as petroleum production, where crude oil often contains water and needs to be separated into its oil and water components for refining.

Key Stakeholders

- Demulsifier manufacturers

- Demulsifier suppliers

- Raw material suppliers

- Service providers

- End users, such as crude oil, petr refineries, and others

- Government bodies

Report Objectives

- To define, describe, and forecast the demulsifier market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by type, application, and region

- To forecast the size of the market for five main regions: Europe, North America, Asia Pacific, South America, and the Middle East, Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To analyze the impact of COVID-19 on the market and end-use industries

- To strategically profile key players and comprehensively analyze their growth strategies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Demulsifier Market

Demulsifier for fuels

Detailed cuntry specific information for Oil Field Chemicals market

General information on Demulsifiers Market

Interested in Demulsifier Market by Type (Oil Soluble and Water Soluble), Application (Crude Oil, Petro Refineries, Lubricant Manufacturing, Oil-based Power Plants, Sludge Oil Treatment), and Region

Supply chain analysis regarding the demulsifier market in Asia (primarily China and SEA).

Interested in Demulsifier market

Demulsifier Market