Defoaming Coating Additives Market by Type (Silicone-Based, Mineral Oil-Based, Vegetable Oil-Based, Water-Based, Polymer-Based), Application (Architectural, Automotive, Industrial, Wood & Furniture), and Geography - Global Forecasts to 2021

[150 Pages Report] The defoaming coating additives market was valued at USD 748.0 Million in 2015, and is projected to reach USD 1,034.2 Million by 2021, at a CAGR of 5.6% between 2016 and 2021.

The objectives of this study are:

- To analyze and forecast the size of the defoaming coating additives market, in terms of value and volume

- To define, describe, and forecast the defoaming coating additives market by application, defoamer type, and region

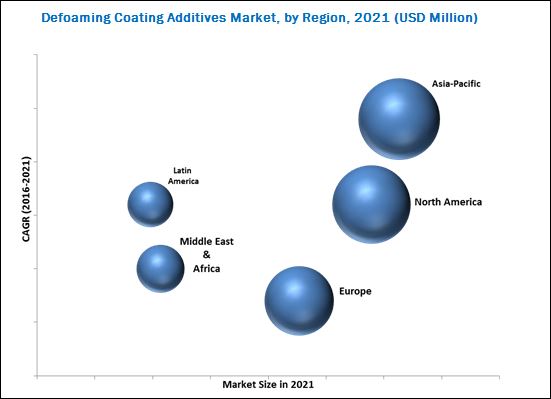

- To forecast the size of the defoaming coating additives market and its different submarkets in five regions, namely, Asia-Pacific, Europe, North America, Middle East & Africa, and South America

- To identify significant trends and factors that may drive or restrain the growth of the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze competitive developments, such as expansions, contracts & acquisitions, and new product launches in the defoaming coating additives market

- To strategically profile the key players and comprehensively analyze their growth strategies

The years considered for the study are:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period 2016 to 2021

For company profiles in the report, 2015 has been considered as the base year. Where information was unavailable for the base year, the years prior to the base year have been considered.

Research Methodology

This research study involved extensive usage of secondary sources, directories, and databases (Hoovers, Bloomberg, Businessweek, Factiva, and OneSource) to identify and collect useful information for this technical, market-oriented, and commercial report on the defoaming coating additives market. The research methodology includes:

- Analysis of the defoamer type of defoaming coating additives and their consumption across different applications

- Analysis of country-wise consumption of defoaming coating additives across regions

- Analysis of market trends in various regions/countries

- Data triangulation and market estimation procedures to determine the market size

- After arriving at the overall market size, the market was split into several segments and sub-segments

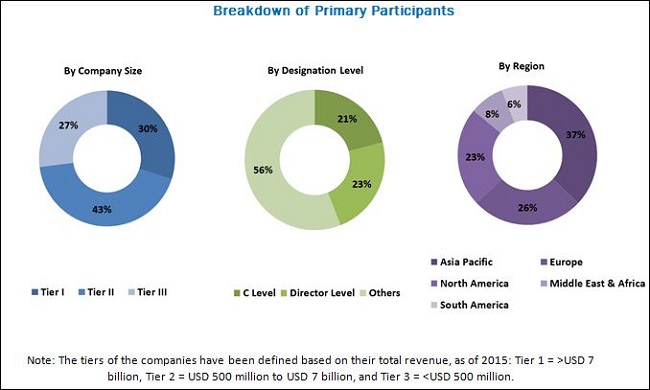

The figure below shows the breakdown of the primaries on the basis of company, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The key players in the defoaming coating additives market are Ashland Inc. (U.S.), BASF SE (Germany), BYK Additives & Instruments (Germany), Elementis Plc (U.K.), Evonik Industries AG (Germany), Momentive Performance Materials Inc. (U.S.), and Dow Corning Corporation (U.S.). They supply different types of defoaming coating additives to end users (architectural, industrial, automotive, and wood & furniture sectors). The demand of defoaming coating additives will continue to increase mainly due to the increase in demand for coatings in architecture and higher emphasis on low-VOC content in the formulation. With improving economic conditions, the demand is expected to gain further momentum.

Target Audience

- Government and Research Organizations

- Associations and Industrial Bodies

- Raw Material Suppliers and Distributors

- Defoaming Coating Additives Manufacturers

- Defoaming Coating Additives Traders/Suppliers

- Manufacturers of Resins, Additives, Pigments, and Other Feedstock Chemicals Manufacturers

- End-user Industries, such as Automotive, Architectural, Industrial, and Wood & Furniture

The study answers several questions for the stakeholders, primarily which market segments to focus on, in the next two-to-five years for prioritizing efforts and investments and competitive landscape of the market.

Scope of the Report: This research report categorizes the defoaming coating additives market on the basis of application, technology type, and region, and forecasts the market size, in terms of value. The report has also analyzed the market based on the following subsegments:

On the basis of Technology Type:

- Silicone-based Defoamer

- Mineral Oil-based Defoamer

- Vegetable Oil-based Defoamer

- Water-based Defoamer

- Polymer-based Defoamer

- Others

On the basis of Application:

- Architectural

- Industrial

- Automotive

- Wood & Furniture

- Others

On the basis of Region:

- Asia-Pacific

- North America

- Europe

- Middle East & Africa

- South America

The following customization options are available for the report:

- Further breakdown of Rest of Asia-Pacific, Rest of Europe, and Rest of Middle East & Africa

- Detailed analysis and profiling of the additional market players (up to five)

- Porters Five Forces Analysis

- Product Matrix

The defoaming coating additives market was valued at USD 748.0 Million in 2015, and is projected to reach USD 1,034.2 Million by 2021, at a CAGR of 5.6% between 2016 and 2021. The growing automotive and construction industries are boosting the growth of defoaming coating additives market, globally.

The growth in application markets such as automotive, industrial, and architectural where coating additives are extensively used owing to their ability to visually and chemically improve the performance of the coatings also acts as a driving factor for the defoaming coating additives market. Architecture is the major application for defoaming coating additives. The growing commercial and residential construction in Asia-Pacific is driving the demand for coating additives owing to the need of better protection of buildings.

Water-based defoamer is the fastest-growing type segment of the defoaming coating additive market. Water-based defoamers typically contain around 75-90% water. These defoamers are preferred by various end-user industries in comparison to oil-based defoamers (which mainly include mineral oil and vegetable oil) as they are free from hydrocarbon oils. Globally, silicone-based defoamers account for the highest consumption in the defoaming coating additives market as silicones have low surface and interfacial tensions which enables them to flow easily over the film.

The growing demand and policies encouraging emission control and development of environment-friendly products have led to innovation and developments in the industry, making Asia-Pacific region a strong chemical hub. Extensive growth and innovation, along with the industry consolidations, are expected to ensure a bright future for the defoaming coating additives industry in the Asia-Pacific region.

The rising demand for cleaner and greener formulations for coating and decorative needs is driving the growth of defoaming coating additives market. However, stringent environmental regulations and high loading levels of defoaming agents in industrial processes are some of the factors restraining the growth for the market.

Some of the major players in the defoaming coating additives market include Ashland Inc. (U.S.), BASF SE (Germany), BYK Additives & Instruments (Germany), Elementis Plc (U.K.), Evonik Industries AG (Germany), Momentive Performance Materials Inc. (U.S.), and Dow Corning Corporation (U.S.), among others. These companies have been focusing on new product launches to cater to the diverse needs of customers. Companies are also adopting acquisition as a growth strategy to increase their geographic presence and achieve growth in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Regional Scope

1.3.2 Markets Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.3.1.1 Key Industry Insights

2.3.2 Assumptions

3 Executive Summary (Page No. - 25)

3.1 Introduction

3.2 Historical Backdrop

3.3 Current Scenario

4 Premium Insights (Page No. - 30)

4.1 Significant Opportunities for Defoaming Coating Additives Market (2016 & 2021)

4.2 Defoaming Coating Additives Market in Asia-Pacific, By Application and Country

4.3 Defoaming Coating Additives Market Attractiveness, 2016-2021

4.4 Defoaming Coating Additives Market, By Defoamer Type

4.5 Defoaming Coating Additives Market: By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Economic Development in Asia-Pacific

5.3.1.2 Rising Demand From Construction Industry

5.3.1.3 Increasing Demand for Environment-Friendly Coatings and Decorative Products

5.3.2 Restraint

5.3.2.1 Stringent Enviornmental Regulations

5.3.2.2 High Loading Levels of Defoaming Agent in the Industrial Process

5.3.3 Opportunities

5.3.3.1 Booming Construction Industry

5.3.3.2 Technological Advancements

5.4 Value Chain Analysis

5.4.1 Raw Material

5.4.2 Defoaming Agent Formulation

5.4.3 Manufacturers

5.4.4 Distribution

5.4.5 End-Use Industry

6 Defoaming Coating Additives Market, By Defoamer Type (Page No. - 42)

6.1 Introduction

6.2 Market Size and Projection

6.3 Silicone-Based Defoamer

6.4 Mineral Oil-Based Defoamer

6.5 Water-Based Defoamer

6.6 Polymer-Based Defoamer

6.7 Vegetable Oil-Based Defoamer

6.8 Other Defoamer Types

7 Defoaming Coating Additives Market, By Application (Page No. - 55)

7.1 Introduction

7.2 Architectural

7.3 Industrial

7.4 Wood & Furniture

7.5 Automotive

7.6 Others

8 Defoaming Coating Additives Market, By Region (Page No. - 66)

8.1 Introduction

8.2 Asia-Pacific

8.2.1 China

8.2.2 Japan

8.2.3 South Korea

8.2.4 India

8.2.5 Rest of Asia-Pacific

8.3 North America

8.3.1 U.S.

8.3.2 Canada

8.3.3 Mexico

8.4 Europe

8.4.1 Germany

8.4.2 U.K.

8.4.3 France

8.4.4 Italy

8.4.5 Rest of Europe

8.5 South America

8.5.1 Brazil

8.5.2 Argentina

8.5.3 Rest of South America

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.2 UAE

8.6.3 South Africa

8.6.4 Rest of Middle East & Africa

9 Competitive Landscape (Page No. - 114)

9.1 Overview

9.2 Market Share of Key Players

9.3 Competitive Situation and Trends

9.3.1 New Product Launches

9.3.2 Acquisitions

10 Company Profiles (Page No. - 118)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Revenue Mix of Market Players

10.2 BASF SE

10.3 Elementis PLC

10.4 Mόnzing Chemie GmbH

10.5 DOW Corning Corporation

10.6 Momentive Performance Materials Inc.

10.7 BYK-Chemie GmbH (Altana)

10.8 Arkema S.A.

10.9 Ashland Inc.

10.10 Evonik Industries AG

10.11 Allnex SA/NV

10.12 Other Market Players

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 143)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing RT: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

List of Tables (105 Tables)

Table 1 Global Defoaming Coating Additives Market Snapshot

Table 2 Market, By Defoamer Type

Table 3 Market, By Application

Table 4 Market, By Defoamer Type, 20142021 (USD Million)

Table 5 Market, By Defoamer Type, 20142021 (Kilotons)

Table 6 Market for Silicone-Based Defoamer, By Region, 20142021 (USD Million)

Table 7 Market for Silicone-Based Defoamer, , By Region, 20142021 (Kilotons)

Table 8 Market for Mineral Oil-Based Defoamer, By Region, 20142021 (USD Million)

Table 9 Market for Mineral Oil-Based Defoamer, By Region, 20142021 (Kilotons)

Table 10 Market for Water-Based Defoamer, By Region, 20142021 (USD Million)

Table 11 Market for Water-Based Defoamer, By Region, 20142021 (Kilotons)

Table 12 Market for Polymer-Based Defoamer, By Region, 20142021 (USD Million)

Table 13 Market for Polymer-Based Defoamer, By Region, 20142021 (Kilotons)

Table 14 Market for Vegetable Oil-Based Defoamer, By Region, 20142021 (USD Million)

Table 15 Market for Vegetable Oil-Based Defoamer, By Region, 20142021 (Kilotons)

Table 16 Market for Other Defoamer Types, By Region, 20142021 (USD Million)

Table 17 Market for Other Defoamer Types, By Region, 20142021 (Kilotons)

Table 18 Global Market, By Application, 2014-2021 (USD Million)

Table 19 Global Market, By Application, 2014-2021 (Kilotons)

Table 20 Defoaming Coating Additives Market in Architectural, By Region, 20142021 (USD Million)

Table 21 Market in Architectural, By Region, 2014-2021 (Kilotons)

Table 22 Market in Industrial, By Region, 20142021 (USD Million)

Table 23 Market in Industrial, By Region, 2014-2021 (Kilotons)

Table 24 Market in Wood & Furniture, By Region, 20142021 (USD Million)

Table 25 Market in Wood & Furniture, By Region, 2014-2021 (Kilotons)

Table 26 Market in Automotive, By Region, 2014-2021 (USD Million)

Table 27 Market in Automotive, By Region, 2014-2021 (Kilotons)

Table 28 Market in Other Applications, By Region, 2014-2021 (USD Million)

Table 29 Market in Other Applications, By Region, 2014-2021 (Kilotons)

Table 30 Market, By Geography, 2014-2021 (USD Million)

Table 31 Market, By Geography, 2014-2021 (Kilotons)

Table 32 Asia-Pacific Defoaming Coating Additives Market, By Country, 2014-2021 (USD Million)

Table 33 Asia-Pacific Market, By Country, 2014-2021 (Kilotons)

Table 34 Asia-Pacific Market, By Defoamer Application, 2014-2021 (USD Million)

Table 35 Asia-Pacific Market, By Defoamer Application, 2014-2021 (Kilotons)

Table 36 Asia-Pacific Market, By Application, 2014-2021 (USD Million)

Table 37 Asia-Pacific Market, By Application, 2014-2021 (Kilotons)

Table 38 Asia-Pacific Market, By Defoamer Type, 2014-2021 (USD Million)

Table 39 Asia-Pacific Market, By Defoamer Type, 2014-2021 (Kilotons)

Table 40 China Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 41 China Market, By Application, 20142021 (Kilotons)

Table 42 Japan Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 43 Japan Market, By Application, 20142021 (Kilotons)

Table 44 South Korea Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 45 South Korea Market, By Application, 20142021 (Kilotons)

Table 46 India Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 47 India Market, By Application, 20142021 (Kilotons)

Table 48 Rest of Asia-Pacific Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 49 Rest of Asia-Pacific Market, By Application, 20142021 (Kilotons)

Table 50 North America Defoaming Coating Additives Market, By Country, 20142021 (USD Million)

Table 51 North America Market, By Country, 20142021 (Kilotons)

Table 52 North America Market, By Application, 20142021 (USD Million)

Table 53 North America Market, By Application, 20142021 (Kilotons)

Table 54 North America Market, By Defoamer Type, 2014-2021 (USD Million)

Table 55 North America Market, By Defoamer Type, 2014-2021 (Kilotons)

Table 56 U.S. Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 57 U.S. Market, By Application, 20142021 (Kilotons)

Table 58 Canada Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 59 Canada Market, By Application, 20142021 (Kilotons)

Table 60 Mexico Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 61 Mexico Market, By Application, 20142021 (Kilotons)

Table 62 Europe Defoaming Coating Additives Market, By Country, 20142021 (USD Million)

Table 63 Europe Market, By Country, 2014-2021 (Kilotons)

Table 64 Europe Market, By Application, 20142021 (USD Million)

Table 65 Europe Market, By Application, 2014-2021 (Kilotons)

Table 66 Europe Market, By Defoamer Type, 2014-2021 (USD Million)

Table 67 Europe Market, By Defoamer Type, 2014-2021 (Kilotons)

Table 68 Germany Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 69 Germany Market, By Application, 20142021 (Kilotons)

Table 70 U.K. Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 71 U.K. Market, By Application, 20142021 (Kilotons)

Table 72 France Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 73 France Market, By Application, 20142021 (Kilotons)

Table 74 Italy Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 75 Italy Market, By Application, 20142021 (Kilotons)

Table 76 Rest of Europe Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 77 Rest of Europe Market, By Application, 20142021 (Kilotons)

Table 78 South America Defoaming Coating Additives Market, By Country, 2014-2021 (USD Million)

Table 79 South America Market, By Country, 2014-2021 (Kilotons)

Table 80 South America Market, By Application, 2014-2021 (USD Million)

Table 81 South America Market, By Application, 2014-2021 (Kilotons)

Table 82 South America Market, By Defoamer Type, 2014-2021 (USD Million)

Table 83 South America Market, By Defoamer Type, 2014-2021 (Kilotons)

Table 84 Brazil Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 85 Brazil Market, By Application, 20142021 (Kilotons)

Table 86 Argentina Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 87 Argentina Market, By Application, 20142021 (Kilotons)

Table 88 Rest of South America Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 89 Rest of South America Market, By Application, 20142021 (Kilotons)

Table 90 Middle East & Africa Defoaming Coating Additives Market, By Country, 2014-2021 (USD Million)

Table 91 Middle East & Africa Market, By Country, 2014-2021 (Kilotons)

Table 92 Middle East & Africa Market, By Application, 2014-2021 (USD Million)

Table 93 Middle East & Africa Market, By Application, 2014-2021 (Kilotons)

Table 94 Middle East & Africa Market, By Defoamer Type, 2014-2021 (USD Million)

Table 95 Middle East & Africa Market, By Defoamer Type, 2014-2021 (Kilotons)

Table 96 Saudi Arabia Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 97 Saudi Arabia Market, By Application, 20142021 (Kilotons)

Table 98 UAE Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 99 UAE Market, By Application, 20142021 (Kilotons)

Table 100 South Africa Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 101 South Africa Market, By Application, 20142021 (Kilotons)

Table 102 Rest of Middle East & Africa Defoaming Coating Additives Market, By Application, 20142021 (USD Million)

Table 103 Rest of Middle East & Africa Market, By Application, 20142021 (Kilotons)

Table 104 New Product Launches, 20122016

Table 105 Acquisitions, 2013

List of Figures (48 Figures)

Figure 1 Defoaming Coating Additives: Market Segmentation

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Defoaming Coating Additives Market: Data Triangulation

Figure 6 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 7 Water-Based Defoamer Segment to Register the Highest Growth Between 2016 and 2021

Figure 8 Automotive Application to Register the Highest Growth Between 2016 and 2021

Figure 9 Asia-Pacific to Be the Dominating Market Between 2016 and 2021

Figure 10 Attractive Opportunities for Market Players in Emerging Economies of Asia-Pacific Region

Figure 11 Architectural Application Accounted for the Largest Share in Asia-Pacific in 2015

Figure 12 Rapid Industrialization Across Different Regions to Drive the Demand for Defoaming Coating Additives Between 2016 and 2021

Figure 13 Silicone-Based Defoamer Segment Accounted for the Largest Market Share in 2015

Figure 14 Asia-Pacific Projected to Grow at the Highest Rate Between 2016 and 2021

Figure 15 Defoaming Coating Additives Market, By Region

Figure 16 Overview of the Forces Governing the Defoaming Coating Additives Market

Figure 17 Value Chain of Defoaming Coating Additives Market

Figure 18 Selection Criteria for Defoamer

Figure 19 Market for Silicone-Based Defoamer, By Region , 2016 & 2021

Figure 20 Market for Mineral Oil-Based Defoamer, By Region, 2016 & 2021

Figure 21 Market for Water-Based Defoamer, By Region, 2016 & 2021

Figure 22 Market for Polymer-Based Defoamer, By Region, 2016 & 2021

Figure 23 Market for Vegetable Oil-Based Defoamer, By Region, 2016 & 2021

Figure 24 Market for Other Defoamer Types, By Region, 2016 & 2021

Figure 25 Global Market, By Application, 2016 & 2021

Figure 26 Market in Architectural, By Region, 2016 & 2021

Figure 27 Market in Industrial, By Region, 2016 & 2021

Figure 28 Market in Wood & Furniture, By Region, 2016 & 2021

Figure 29 Market in Automotive, By Region, 2016 & 2021

Figure 30 Market in Other Applications, By Region, 2016 & 2021

Figure 31 Regional Snapshot: Rapidly Growing Markets are Emerging as Strategic Destinations

Figure 32 Asia-Pacific Market Snapshot

Figure 33 North America Market Snapshot

Figure 34 Europe Market Snapshot

Figure 35 South America Market Snapshot

Figure 36 Middle East & Africa Market Snapshot

Figure 37 Companies Adopted New Product Launch as the Key Growth Strategy Between 2011-2016

Figure 38 New Product Launch has Been the Key Strategy Adopted By the Companies

Figure 39 BYK-Chemie GmbH is the Leading Player in the Coating Additives Market

Figure 40 Regional Revenue Mix of Major Market Players

Figure 41 BASF SE: Company Snapshot

Figure 42 Elementis PLC.: Company Snapshot

Figure 43 DOW Corning Corporation: Company Snapshot

Figure 44 Momentive Performance Materials Inc.: Company Snapshot

Figure 45 BYK-Chemie GmbH: Company Snapshot

Figure 46 Arkema S.A.: Company Snapshot

Figure 47 Ashland Inc.: Company Snapshot

Figure 48 Evonik Industries AG: Company Snapshot

Growth opportunities and latent adjacency in Defoaming Coating Additives Market