Defect Detection Market Size, Share & Industry Growth Analysis Report by Offering (Hardware (Camera, Optics, and Processor), Software (Traditional and Deep-Learning); and Service), Application (Manufacturing, Packaging), Vertical, and Geography (2021-2026)

Updated on : October 23, 2024

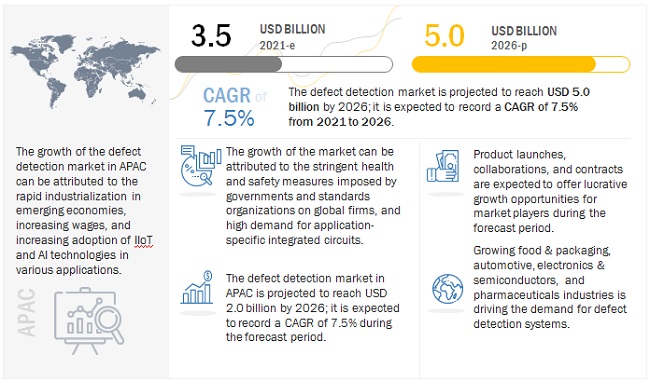

The global Defect Detection Market size is estimated to grow from USD 3.5 billion in 2021 to USD 5.0 billion by 2026, growing at a CAGR of 7.5% during the forecast period 2021 to 2026.

The growth of the defect detection market is driven by factors such as strong focus of manufacturers on automating quality control and quality assurance processes; stringent health and safety measures imposed by governments and standards organizations on global manufacturing firms; and high demand for application-specific integrated circuits (ASICs). However, dearth of skilled professionals in manufacturing factories is restraining the growth of the defect detection industry.

Impact of AI Defect Detection Market

The AI defect detection market is experiencing rapid growth, transforming industries like automotive, electronics, pharmaceuticals, and food packaging by enhancing product quality and operational efficiency. Valued at around $3.5 billion in 2021 and projected to reach $5 billion by 2026, this market benefits from technological advancements such as machine learning, deep learning, and IoT integration, which enable real-time monitoring and predictive maintenance. Companies are leveraging AI to reduce inspection times, minimize human errors, and lower operational costs, though challenges like data quality, integration complexity, and skill shortages remain. As AI models become more sophisticated and accessible, the market is expected to expand further, with significant adoption not just among major manufacturers but also among small and medium-sized enterprises seeking to improve defect detection and ensure superior quality standards.

To know about the assumptions considered for the study, Request for Free Sample Report

The defect detection market includes key companies such as Microsoft (US), IBM (US), Amazon Web Services (US), OMRON Corporation (Japan), Cognex Corporation (US), Teledyne Technologies (US), ISRA VISION (Germany), KEYENCE (Japan), Datalogic (Italy), and Matrox Electronic Systems (Canada). These companies have their manufacturing facilities and corporate offices spread across various countries across Asia Pacific, Europe, North America, and Rows. The defect detection components manufactured by these companies are purchased by several stakeholders for various verticals. COVID-19 has impacted the operations of the various defect detection manufacturers companies, along with businesses of their suppliers and distributors in short term.

Market Dynamics:

Driver: Strong focus of manufacturers on automating quality control and quality assurance processes

In manufacturing, there should be a fine balance between maximizing yield and minimizing the number of defective parts, which is possible through implementing quality control processes. This balance can be difficult to achieve and is highly dependent on the industry and the manufacturing methods applied. Therefore, manufacturing companies are witnessing intense competition, and a similar trend is expected to be observed during the forecast period. To better optimize resources, maintain high product quality, prevent quality defects, and reduce operating and maintenance costs, manufacturers are actively focusing on adopting automation technologies across manufacturing firms. Further, both process and discrete industries have increased their focus on following the best practices to reduce wastage and increase plant efficiency. As a result, defect detection systems have become an integral part of the long-term quality control and assurance and automation development processes in different industries.

Restraint: Dearth of skilled professionals in manufacturing factories

In the manufacturing industry, there is a tremendous reliance on human experience and human senses. However, recently, the shortage of skilled professionals has become a more critical issue; therefore, automation of manufacturing, assembly, product testing and inspection, and transportation processes that depend on people has become an urgent task for businesses. On account of this, companies across industries embrace industrial automation with the growing use of defect detection systems, machine vision systems, etc., to improve operational efficiency and performance, reduce waste and conserve natural resources, and reach new markets and audiences, but factories embracing machine vision technology would require more complex skill sets, and it could be difficult for lower/semi-skilled, less-educated workers to access opportunities. Machine vision systems deployed to eliminate the defects require skilled professionals capable of deciphering machine signals on a dashboard and work together with collaborative robots on which machine vision systems are mounted.

Opportunity: Growing increasing adoption of artificial intelligence (AI) technology in defect detection

Quality control is one of the most important factors in manufacturing. Inspecting each product manually is costly, in terms of time and effort, creating bottlenecks by delayed production. In many cases, defects can be easily missed by the human eye or even by industry experts, resulting in decreased quality of an individual component or a defective final product that must be scrapped. Defect rates can often increase with more complex manufacturing systems. Recently, manufacturers have been focused on adopting advanced technologies, such as AI and deep learning, on transforming production processes and faster inspection of products and prompt detection of defects. The combination of software, use of deep learning technology, the power of parallel processing, and easy-to-use tools are core parameters of this transformation. AI-based defect detection tools/systems are superior to manual inspection in tracking products on the assembly lines, delivering significantly higher precision rates, enhanced product quality, increased productivity, higher throughput, and lower production costs.

Challenge: Lack Complexity in implementation of defect detection solutions and technologies

Increasing competition, growing instability in the business arena, and ongoing technological advancements necessitate to change the way manufacturing enterprises operate and expand their business. To achieve the aforementioned objectives, organizations need to accomplish seamless production. Defect detection systems are used in a variety of applications, including manufacturing, healthcare, and packaging. Each application has its own quirks, and technological advancements add complexity to manufacturing processes on a daily basis. Defect detection systems face the challenge of meeting the diverse and ever-changing needs of various applications. Whether it is a camera, an optics, software, or a frame grabber, versatile solutions can be quickly developed to tackle a wide range of tasks by using multipurpose components. The need of the hour is to simplify the integration process with regard to different components of defect detection systems and the production lines at application sites. With increasing efforts being put into boosting the convenience of installing and handling all technical systems, players in the defect detection market must look to address these requirements by coming up with plug-and-play solutions.

Software to register higher CAGR during the forecast period

The software segment is projected to grow at the highest CAGR during forecast period, owing to growing focus on automating quality control and assurance processes, integration of AI and deep learning technology in defect detection systems. Software type includes traditional software and deep learning software. Deep learning-based defect detection software helps minimize human intervention and provides real-time solutions by distinguishing acceptable variations in products and defects in manufacturing industries.

Manufacturing application is expected to witness higher CAGR growth during the forecast period

The defect detection market for manufacturing application is expected to grow at the highest CAGR during the forecast period, by application. The manufacturing application requires defect detection of cosmetic defects on all types of surfaces, which are difficult to inspect with conventional rule-based machine vision algorithms and human eye. Industries have realized the importance of quality assurance in manufacturing processes, resulting in the widespread acceptance of defect detection as an integral part of the long-term automation development process. The use of defect detection throughout an automated production process further helps identify complex defects in a short span of time. This, in turn, helps in reducing costs and improving response time and quality. Also, increasing adoption of defect detection system based on deep learning and AI in manufacturing to expedite the inspection of products and to facilitate prompt detection of defects is also driving the market growth.

Electronics & semiconductors segment for the defect detection market is expected to witness the highest CAGR growth during the forecast period

The defect detection market for electronics & semiconductors is expected to grow at the highest CAGR during the forecast period, by vertical. In the electronics & semiconductors vertical, apart from cosmetic defects such as scratches, dents, shade variations, smeared labels and strands of human hair, functional defects such as bent pins on ports and connectors, untightened screws, missing components, and wrong barcodes also need to be detected to produce fewer defective products and improve quality production. Increasing demand for high-speed assembly inspection where the throughput of components is rapid and growing need to comply with stringent quality standards is driving the growth of the electronics & semiconductors segment. Moreover, the industry is increasingly manufacturing semiconductor wafers with thickness in nanometers; this will increase the demand for defect detection systems in the coming years.

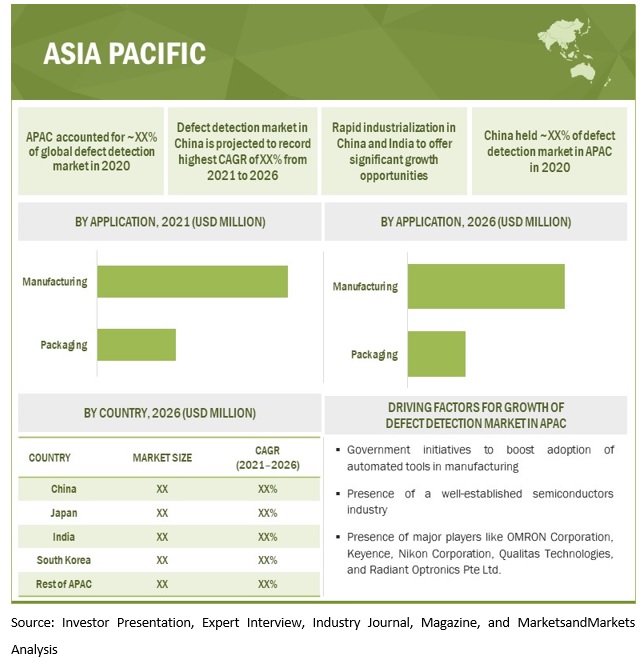

APAC is projected to register the highest CAGR growth during the forecast period

Countries in APAC, such as China, Japan, India, and South Korea, have some of the largest manufacturing facilities, wherein automation has been accorded the highest priority. Rapid industrialization, presence of well-established semiconductors, food & packaging, and automotive industries are likely to drive the defect detection market growth. Also, various government initiatives such as “Make in India” to encourage large and medium-sized enterprises are fueling the market growth in APAC. Manufacturers in this region are exceedingly investing in the R&D and implementation of Industrial Internet of Things (IIoT) and other industrial automation solutions.

To know about the assumptions considered for the study, download the pdf brochure

Defect Detection Market Key Market Players

The defect detection companies is dominated by a few established players such as Microsoft (US), IBM (US), Amazon Web Services (US), OMRON Corporation (Japan), Cognex Corporation (US), Teledyne Technologies (US), ISRA VISION (Germany), KEYENCE (Japan), Datalogic (Italy), and Matrox Electronic Systems (Canada). These companies have adopted both organic and inorganic growth strategies such as product launches and developments, partnerships, contracts, expansions, and acquisitions to strengthen their position in the defect detection market.

Defect Detection Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 3.5 billion in 2021 |

|

Projected Market Size |

USD 5.0 billion by 2026 |

|

Growth Rate |

CAGR of 7.5% |

|

Market size available for years |

2018–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast Unit |

Value (USD Million) |

|

Segments Covered |

Offering, Vertical, Application, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Microsoft (US), IBM (US), Amazon Web Services (US), OMRON Corporation (Japan), Cognex Corporation (US), Teledyne Technologies (US), ISRA VISION (Germany), KEYENCE (Japan), Datalogic (Italy), and Matrox Electronic Systems (Canada) |

This report categorizes the defect detection market based on component, vertical, application, and region

By Offering

- Hardware

- Software

- Services

By Application

- Manufacturing

- Packaging

By Vertical

- Automotive

- Electronics & Semiconductors

- Metals & Machinery

- Food and Packaging

- Pharmaceuticals

By Region

- North America

- Europe

- APAC

- RoW

Major Market Developments in Defect Detection Industry

- In August 2021, OMRON introduced the VT-S10 Series PCB inspection system, which uses an industry-first imaging technique and artificial intelligence to automate the high-precision inspection process for electronic substrates, removing the need for specialized skills.

- In June 2021, Amazon Web Services and Salesforce announced a significant expansion of their global strategic partnership that will make it easy for customers to use the full set of Salesforce and AWS capabilities together to quickly build and deploy powerful new business applications that accelerate digital transformation.

- In June 2021, IBM entered into a 5-year partnership with UK STFC Hartree Centre. Through this partnership, the company aims to support UK businesses and the public sector by reducing the risk of exploring and adopting innovative new digital technologies, such as artificial intelligence (AI) and quantum computing.

- In April 2021, Microsoft acquired Nuance Communication (US). This acquisition combined the solutions and expertise of both companies to deliver new cloud and AI capabilities across healthcare and other industries.

Frequently Asked Questions (FAQ):

What is the current size of the global defect detection market?

The global defect detection market is estimated to grow from USD 3.5 billion in 2021 to USD 5.0 billion by 2026 at a CAGR of 7.5% during 2021–2026. The growth of the defect detection market is driven by factors such as strong focus of manufacturers on automating quality control and quality assurance processes, stringent health and safety measures imposed by governments and standards organizations on global manufacturing firms, and high demand for application-specific integrated circuits (ASICs).

Who are the key players in the global defect detection market?

Companies such as Microsoft (US), IBM (US), Amazon Web Services (US), OMRON Corporation (Japan), and Cognex Corporation (US). These companies cater to the requirements of their customers by providing defect detection system with a presence in multiple countries.

What is the COVID-19 impact on defect detection suppliers?

The shutdown of manufacturing facilities globally combined with strict restrictions over social movement in various COVID-19 affected countries impacted the operations of defect detection hardware and related components manufacturing facilities. Additionally, COVID-19 is expected to have led to a delay in the upcoming projects and installations of defect detection system. All these factors resulted in a marginal dip of the market size of defect detection system. The supply chain disruptions have led to the procurement of raw materials or commodities from localized sources to ensure their continuous supply.

What are the opportunities for the existing players and for those who are planning to enter various stages of the defect detection system value chain?

There are various opportunities for the existing players to enter the value chain of defect detection market. Some of these include developing technologically advanced defect detection systems and offering innovative software and services with major focus on integration of technology and data management. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 DEFECT DETECTION MARKET: SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY

1.5 VOLUME UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 DEFECT DETECTION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Estimating market size by bottom-up approach (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Estimating market size by top-down approach (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 7 HARDWARE SEGMENT EXPECTED TO DOMINATE DEFECT DETECTION MARKET DURING FORECAST PERIOD

FIGURE 8 MANUFACTURING SEGMENT EXPECTED TO HOLD LARGER MARKET SHARE IN 2026

FIGURE 9 ELECTRONICS & SEMICONDUCTORS SEGMENT TO REGISTER HIGHEST CAGR IN MARKET FROM 2021 TO 2026

FIGURE 10 APAC ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 DEFECT DETECTION MARKET, 2021–2026

FIGURE 11 STRONG FOCUS OF MANUFACTURERS ON AUTOMATING QUALITY CONTROL AND QUALITY ASSURANCE PROCESSES IS DRIVING MARKET GROWTH

4.2 MARKET, BY OFFERING

FIGURE 12 SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY VERTICAL

FIGURE 13 ELECTRONICS & SEMICONDUCTORS SEGMENT PROJECTED TO CAPTURE HIGHEST CAGR DURING FORECAST PERIOD

4.4 DEFECT DETECTION MARKET, BY APPLICATION

FIGURE 14 MANUFACTURING SEGMENT PROJECTED TO RECORD HIGHER CAGR DURING FORECAST PERIOD

4.5 DEFECT DETECION MARKET IN APAC, BY APPLICATION & COUNTRY, 2020

FIGURE 15 CHINA ACCOUNTED FOR LARGEST SHARE OF APAC MARKET IN 2020

4.6 DEFECT DETECTION MARKET, BY REGION

FIGURE 16 APAC ESTIMATD TO HOLD LARGEST SHARE OF MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 IMPACT OF DRIVERS AND OPPORTUNITIES ON MARKET

FIGURE 18 IMPACT OF CHALLENGES AND RESTRAINTS ON DEFECT DETECTION MARKET

5.2.1 DRIVERS

5.2.1.1 Strong focus of manufacturers on automating quality control and quality assurance processes

5.2.1.2 Stringent health and safety measures imposed by governments and standards organizations on global manufacturing firms

5.2.1.3 High demand for application-specific integrated circuits (ASICs)

5.2.2 RESTRAINTS

5.2.2.1 Dearth of skilled professionals in manufacturing factories

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of artificial intelligence (AI) technology in defect detection

5.2.3.2 Rapid industrialization in emerging economies, along with government initiatives to facilitate adoption of automated tools in manufacturing plants

5.2.4 CHALLENGES

5.2.4.1 Complexity in implementation of defect detection solutions and technologies

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED BY COMPONENT AND SYSTEM MANUFACTURERS, FOLLOWED BY SYSTEM INTEGRATORS

5.3.1 RESEARCH & DEVELOPMENT ENGINEERS AND RAW MATERIAL SUPPLIERS

5.3.2 COMPONENT AND SYSTEM MANUFACTURERS

5.3.3 SYSTEM INTEGRATORS

5.3.4 SUPPLIERS AND DISTRIBUTORS

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 IMPACT OF EACH FORCE ON DEFECT DETECTION MARKET

5.5 AVERAGE SELLING PRICE ANALYSIS

TABLE 3 AVERAGE SELLING PRICE OF SMART CAMERAS AND INSPECTION SYSTEMS

TABLE 4 PRICING ANALYSIS OF CAMERAS AND MODULES USED FOR DEFECT DETECTION 57

5.6 TRADE ANALYSIS

5.6.1 IMPORT SCENARIO OF PRODUCTS UNDER HS CODE 852580

TABLE 5 IMPORT DATA FOR PRODUCTS UNDER HS CODE 852580, BY COUNTRY, 2016–2020 (USD MILLION)

5.6.2 EXPORT SCENARIO OF PRODUCTS UNDER HS CODE 852580

TABLE 6 EXPORT DATA FOR PRODUCTS UNDER HS CODE 852580, BY COUNTRY, 2016–2020 (USD MILLION)

5.7 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

FIGURE 20 REVENUE SHIFT IN DEFECT DETECTION MARKET

5.8 DEFECT DETECTION ECOSYSTEM

5.8.1 ROLE OF COMPANIES IN ECOSYSTEM/VALUE CHAIN

5.9 CASE STUDY ANALYSIS

5.9.1 COGNEX CORPORATION: AVTEX (CANADA)

TABLE 7 COGNEX CORPORATION: COGNEX VISIONPRO SOFTWARE

5.9.2 MICROSOFT: AIRBUS (GERMANY)

TABLE 8 MICROSOFT: AZURE COGNITIVE SERVICES

5.9.3 DATALOGIC: NEWBAZE IRELAND NUTRITION (IRELAND)

TABLE 9 DATALOGIC: MX-E PROCESSOR

5.10 PATENT ANALYSIS

5.10.1 PATENT REGISTRATIONS, 2018–2021

TABLE 10 SOME PATENT REGISTRATIONS, 2018–2021

5.10.2 DEFECT DETECTION: PATENT ANALYSIS

5.10.2.1 Methodology

5.10.2.2 Document type

TABLE 11 PATENTS FILED

FIGURE 21 PATENTS FILED BETWEEN 2018 AND 2020

FIGURE 22 GRANTED PATENT TRENDS, 2015–2020

5.10.2.3 Insight

5.11 TECHNOLOGY TRENDS

5.11.1 AI IN DEFECT DETECTION

5.11.2 DEEP LEARNING

5.11.3 LIQUID LENSES

5.11.4 ROBOTIC VISION

5.11.5 INDUSTRIAL INTERNET OF THINGS AND AI

5.12 TARIFFS AND REGULATIONS

5.12.1 NEGATIVE IMPACT OF TARIFFS ON MACHINE VISION MARKET

5.12.2 POSITIVE IMPACT OF TARIFFS ON MACHINE VISION MARKET

5.12.3 REGULATIONS

5.12.3.1 CAMERA

5.12.3.1.1 EMVA 1288

5.12.3.1.2 ASTM E57

5.12.3.2 Lens

6 DEFECT DETECTION MARKET, BY OFFERING (Page No. - 69)

6.1 INTRODUCTION

FIGURE 23 MARKET FOR SOFTWARE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 12 MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 13 MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 HARDWARE

FIGURE 24 CAMERAS SEGMENT TO GROW AT HIGHEST CAGR IN MARKET FOR HARDWARE DURING FORECAST PERIOD

TABLE 14 DEFECT DETECTION MARKET FOR HARDWARE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 15 MARKET FOR HARDWARE, BY TYPE, 2021–2026 (USD MILLION)

6.2.1 CAMERAS

6.2.1.1 Cameras, by format

6.2.1.1.1 Area scan cameras

6.2.1.1.1.1 Area scan cameras are used for stationary test objects

6.2.1.1.2 Line scan cameras

6.2.1.1.2.1 Line scan cameras provide cost advantage and can offer higher resolution than area scan cameras

6.2.1.2 Cameras, by frame rate

6.2.1.2.1 Frame rates of less than 25 fps are used for applications involving large objects

6.2.1.3 Sensors

6.2.1.3.1 CCD sensor

6.2.1.3.1.1 CCD sensors offer higher sensitivity with lower noise than CMOS sensors

6.2.1.3.2 CMOS sensor

6.2.1.3.2.1 CMOS offers benefits such as low power consumption and high-speed performance

6.2.2 FRAME GRABBERS

6.2.2.1 Frame grabbers are used to capture high-resolution digital still images from analog signal or digital video systems

6.2.3 OPTICS

6.2.3.1 Optics deliver captured images through image sensors present in cameras to end users

6.2.4 PROCESSORS

6.2.4.1 FPGAs are most preferred processors in defect detection market

6.3 SOFTWARE

FIGURE 25 MARKET FOR DEEP LEARNING SOFTWARE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 16 MARKET FOR SOFTWARE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 17 MARKET FOR SOFTWARE, BY TYPE, 2021–2026 (USD MILLION)

6.3.1 TRADITIONAL SOFTWARE

6.3.1.1 Traditional software held largest share of market in 2020

6.3.2 DEEP LEARNING SOFTWARE

6.3.2.1 Deep learning software automates and scales defect detection

6.4 SERVICES

6.4.1 GROWING ADOPTION OF AI AND DEEP LEARNING TECHNOLOGIES TO BOOST DEMAND FOR SERVICES

7 DEFECT DETECTION MARKET, BY APPLICATION (Page No. - 81)

7.1 INTRODUCTION

FIGURE 26 MANUFACTURING APPLICATION EXPECTED TO REGISTER HIGHER CAGR IN MARKET DURING FORECAST PERIOD

TABLE 18 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 19 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 MANUFACTURING

TABLE 20 MARKET FOR MANUFACTURING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 21 MARKET FOR MANUFACTURING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 22 MARKET FOR MANUFACTURING, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 23 MARKET FOR MANUFACTURING, BY VERTICAL, 2021–2026 (USD MILLION)

FIGURE 27 APAC EXPECTED TO REGISTER HIGHEST CAGR IN MARKET FOR MANUFACTURING APPLICATION FROM 2021 TO 2026

TABLE 24 DEFECT DETECTION MARKET FOR MANUFACTURING, BY REGION, 2018–2020 (USD MILLION)

TABLE 25 MARKET FOR MANUFACTURING, BY REGION, 2021–2026 (USD MILLION)

7.2.1 ASSEMBLY VERIFICATION

TABLE 26 USE CASE: COGNEX IN-SIGHT ENSURES QUALITY CONTROL OF GUANGDONG TYCO PRODUCTS

7.2.1.1 Presence/Absence checks

7.2.1.1.1 Defect detection systems ensure completeness of final product and detect missing items before they are distributed 87

TABLE 27 USE CASE: COGNEX’S VISION SYSTEM ENABLES FAST AND INEXPENSIVE UPGRADE OF TABLET PRINTING SYSTEMS

7.2.1.2 Feature location

7.2.1.2.1 Deep learning-based defect detection systems identify complex defects

7.2.1.3 Visual Inspection

7.2.1.3.1 Defect detection system helps in detecting defects related to quantity in vials and dimension in tablets/pills

7.2.2 FLAW DETECTION

7.2.2.1 Measurement (Size outside tolerances)

7.2.2.1.1 Defect detection systems find defects related to measurement in production processes

7.2.2.2 Surface anomalies

7.2.2.2.1 Technologically advanced defect detection systems ensure consistent quality through anomaly detection

TABLE 28 USE CASE: COGNEX’S VIDI MACHINE VISION SYSTEM HELPED IN ENHANCING PART IDENTIFICATION ACCURACY

7.2.3 FABRICATION INSPECTION

7.2.3.1 Welding inspection

7.2.3.1.1 Defect detection systems are capable of identifying complex weld defects

7.2.3.2 Semiconductor device fabrication

7.2.3.2.1 Defect detection systems inspect silicon wafer defects at fabrication stage to avoid errors at later stages

TABLE 29 USE CASE: OMRON CORPORATION: FH SERIES VISION SYSTEM FOR HDI PCB MANUFACTURER

7.3 PACKAGING

TABLE 30 USE CASE: NOVIO PACKAGING REACHED NEW LEVELS OF QUALITY WITH OMRON MACHINE VISION SYSTEM

TABLE 31 DEFECT DETECTION MARKET FOR PACKAGING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 32 MARKET FOR PACKAGING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

FIGURE 28 FOOD & PACKAGING VERTICAL EXPECTED TO REGISTER HIGHEST CAGR IN MARKET FOR PACKAGING APPLICATION DURING FORECAST PERIOD

TABLE 33 MARKET FOR PACKAGING, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 34 MARKET FOR PACKAGING, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 35 MARKET FOR PACKAGING, BY REGION, 2018–2020 (USD MILLION)

TABLE 36 DEFECT DETECTION MARKET FOR PACKAGING, BY REGION, 2021–2026 (USD MILLION)

7.3.1 GRADING

7.3.1.1 Defect detection systems are used for grading based on size, color, and other parameters

7.3.1.2 Organic grading

TABLE 37 USE CASE: NKL CONTACTLENZEN IMPROVED QUALITY AND TRACEABILITY WITH COGNEX’S IN-SIGHT VISION SYSTEMS

7.3.2 LABEL VALIDATION

TABLE 38 USE CASE: COGNEX’S VISION SENSORS VERIFY LABELING LANGUAGE FOR RECONCILE ENGINEERING

7.3.2.1 Product information

7.3.2.1.1 Defect detection systems are used to detect product information defects

7.3.2.2 Barcodes

7.3.2.2.1 Defect detection systems are used to detect barcode defects such as poorly printed code, low-contrast, scratched, or hard-to-read codes

7.3.3 CONTAINER/PACKAGING INSPECTION

TABLE 39 USE CASE: COGNEX CORPORATION: COGNEX IN-SIGHT VISION SYSTEMS USED BY PACKAGING TECHNOLOGIES & INSPECTION (US)

7.3.3.1 Packaging integrity

7.3.3.1.1 Defect detection system caters to detect defects in package assembly and wrapping

TABLE 40 USE CASE: VARTA USES VISIONPRO 3D TO ACHIEVE PRODUCTION SPEED AND PRODUCT QUALITY

8 DEFECT DETECTION MARKET, BY VERTICAL (Page No. - 100)

8.1 INTRODUCTION

FIGURE 29 ELECTRONICS & SEMICONDUCTORS TO REGISTER HIGHEST CAGR BETWEEN 2021 AND 2026

TABLE 41 MARKET, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 42 MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

8.2 AUTOMOTIVE

8.2.1 DEFECT DETECTION OFFERS IMPROVED ACCURACY IN CRITICAL ACTIVITIES IN AUTOMOTIVE SECTOR

TABLE 43 AUTOMOTIVE: DEFECT DETECTION MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 44 AUTOMOTIVE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 45 AUTOMOTIVE MANUFACTURING: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 46 AUTOMOTIVE MANUFACTURING: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 47 AUTOMOTIVE PACKAGING: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 48 AUTOMOTIVE PACKAGING: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.3 ELECTRONICS & SEMICONDUCTOR

8.3.1 IDENTIFICATION OF MACRO AND MICROSCOPIC DEFECTS BOOST VERTICAL

FIGURE 30 MANUFACTURING OF ELECTRONICS & SEMICONDUCTORS TO GROW AT HIGHEST CAGR (2021–2026)

TABLE 49 ELECTRONICS & SEMICONDUCTOR: DEFECT DETECTION MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 50 ELECTRONICS & SEMICONDUCTOR: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 51 ELECTRONICS & SEMICONDUCTOR MANUFACTURING: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 52 ELECTRONICS & SEMICONDUCTOR MANUFACTURING: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 53 ELECTRONICS & SEMICONDUCTOR PACKAGING: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 54 ELECTRONICS & SEMICONDUCTOR PACKAGING: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.4 METALS & MACHINERY

8.4.1 COST-EFFECTIVENESS, EFFICIENCY, AND ACCURACY FUEL GROWTH IN VERTICAL

TABLE 55 METALS & MACHINERY: DEFECT DETECTION MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 56 METALS & MACHINERY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 57 METALS & MACHINERY MANUFACTURING: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 58 METALS & MACHINERY MANUFACTURING: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 59 METALS & MACHINERY PACKAGING: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 60 METALS & MACHINERY PACKAGING: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.5 FOOD & PACKAGING

8.5.1 DEFECT DETECTION SYSTEMS INSPECT PACKAGING PROCESSES AND REDUCE ERRORS

FIGURE 31 FOOD PACKAGING TO DOMINATE DEFECT DETECTION MARKET FROM 2021 TO 2026

TABLE 61 FOOD & PACKAGING: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 62 FOOD & PACKAGING: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 63 FOOD & PACKAGING MANUFACTURING: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 64 FOOD & PACKAGING MANUFACTURING: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 65 FOOD PACKAGING: DEFECT DETECTION MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 66 FOOD PACKAGING: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.6 PHARMACEUTICALS

8.6.1 DEMAND DRIVEN BY NEED FOR STRICT QUALITY ASSURANCE IN PHARMACEUTICAL VERTICAL

TABLE 67 PHARMACEUTICALS: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 68 PHARMACEUTICALS: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 69 PHARMACEUTICALS MANUFACTURING: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 70 PHARMACEUTICALS MANUFACTURING: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 71 PHARMACEUTICALS PACKAGING: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 72 PHARMACEUTICALS PACKAGING: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 114)

9.1 INTRODUCTION

FIGURE 32 GEOGRAPHIC SNAPSHOT OF DEFECT DETECTION MARKET, 2021–2026

TABLE 73 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 74 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 33 SNAPSHOT: MARKET IN NORTH AMERICA

TABLE 75 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 76 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 77 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 78 DEFECT DETECTION MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Presence of prominent players to drive market growth in US

TABLE 79 MARKET IN US, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 80 MARKET IN US, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growing food industry to accelerate demand for defect detection systems for quality assurance in Canada

TABLE 81 MARKET IN CANADA, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 82 MARKET IN CANADA, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Expanding manufacturing sector to create opportunities for defect detection market in Mexico

TABLE 83 MARKET IN MEXICO, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 84 MARKET IN MEXICO, BY APPLICATION, 2021–2026 (USD MILLION)

9.3 EUROPE

FIGURE 34 SNAPSHOT: DEFECT DETECTION MARKET IN EUROPE

TABLE 85 MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 86 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 87 MARKET IN EUROPE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 88 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany accounted for largest share of defect detection market in Europe in 2020

TABLE 89 MARKET IN GERMANY, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 90 MARKET IN GERMANY, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 Growing investment in AI to accelerate adoption of industrial automation in UK

TABLE 91 MARKET IN UK, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 92 MARKET IN UK, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 France likely to be fastest-growing defect detection market in Europe from 2021 to 2026

TABLE 93 MARKET IN FRANCE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 94 MARKET IN FRANCE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.4 REST OF EUROPE

TABLE 95 MARKET IN REST OF EUROPE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 96 DEFECT DETECTION MARKET IN REST OF EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

9.4 APAC

FIGURE 35 SNAPSHOT: MARKET IN ASIA PACIFIC

TABLE 97 MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 98 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 99 MARKET IN APAC, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 100 DEFECT DETECTION MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Government initiatives to support industrialization and adoption of advanced technologies are driving growth of market in China

TABLE 101 MARKET IN CHINA, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 102 MARKET IN CHINA, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Surge in adoption of industrial automation to boost demand for defect detection systems in Japan

TABLE 103 MARKET IN JAPAN, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 104 MARKET IN JAPAN, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.3 SOUTH KOREA

9.4.3.1 Presence of leading electronics and semiconductor manufacturers boost demand for defect detection systems in South Korea

TABLE 105 DEFECT DETECTION MARKET IN SOUTH KOREA, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 106 MARKET IN SOUTH KOREA, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.4 INDIA

9.4.4.1 Government initiatives to encourage automation in manufacturing to fuel growth of market in India

TABLE 107 MARKET IN INDIA, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 108 MARKET IN INDIA, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.5 REST OF APAC

TABLE 109 MARKET IN REST OF APAC, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 110 MARKET IN REST OF APAC, BY APPLICATION, 2021–2026 (USD MILLION)

9.5 ROW

TABLE 111 DEFECT DETECTION MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 112 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 113 MARKET IN ROW, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 114 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 South America has significant potential to use defect detection systems

TABLE 115 DEFECT DETECTION MARKET IN SOUTH AMERICA, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 116 MARKET IN SOUTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Rising automation in various industries to strengthen market growth in Middle East & Africa

TABLE 117 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 118 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 138)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

TABLE 119 OVERVIEW OF STRATEGIES ADOPTED BY KEY DEFECT DETECTION SYSTEM PROVIDERS

10.2.1 PRODUCT PORTFOLIO

10.2.2 REGIONAL FOCUS

10.2.3 MANUFACTURING FOOTPRINT

10.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

10.3 MARKET SHARE ANALYSIS, 2020

TABLE 120 DEFECT DETECTION MARKET: DEGREE OF COMPETITION

10.4 REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 36 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 PERVASIVE

10.5.3 EMERGING LEADER

10.5.4 PARTICIPANT

FIGURE 37 DEFECT DETECTION MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

10.6 START-UP/SME EVALUATION QUADRANT

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 38 DEFECT DETECTION MARKET (GLOBAL), START-UP/SME EVALUATION QUADRANT, 2020

10.7 COMPANY PRODUCT FOOTPRINT

TABLE 121 COMPANY PRODUCT FOOTPRINT (20 COMPANIES)

TABLE 122 FOOTPRINT OF DEFECT DETECTION OFFERINGS BY DIFFERENT COMPANIES

TABLE 123 FOOTPRINT OF APPLICATIONS BY DIFFERENT COMPANIES

TABLE 124 REGION FOOTPRINT OF DIFFERENT COMPANIES

10.8 COMPETITIVE SITUATIONS & TRENDS

10.8.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 125 MARKET: PRODUCT LAUNCHES, JANUARY 2017–AUGUST 2021

10.8.2 DEALS

TABLE 126 DEFECT DETECTION MARKET: DEALS, JANUARY 2017–AUGUST 2021

11 COMPANY PROFILES (Page No. - 159)

11.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View)*

11.1.1 MICROSOFT

TABLE 127 MICROSOFT: BUSINESS OVERVIEW

FIGURE 39 MICROSOFT: COMPANY SNAPSHOT

11.1.2 IBM

TABLE 128 IBM: BUSINESS OVERVIEW

FIGURE 40 IBM: COMPANY SNAPSHOT

11.1.3 AMAZON WEB SERVICES (AWS)

TABLE 129 AMAZON WEB SERVICES: BUSINESS OVERVIEW

FIGURE 41 AMAZON.COM: COMPANY SNAPSHOT

11.1.4 OMRON CORPORATION

TABLE 130 OMRON CORPORATION: BUSINESS OVERVIEW

FIGURE 42 OMRON CORPORATION: COMPANY SNAPSHOT

11.1.5 COGNEX CORPORATION

TABLE 131 COGNEX CORORATION: BUSINESS OVERVIEW

FIGURE 43 COGNEX CORPORATION: COMPANY SNAPSHOT

11.1.6 TELEDYNE TECHNOLOGIES

TABLE 132 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 44 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

11.1.7 ISRA VISION

TABLE 133 ISRA VISION: BUSINESS OVERVIEW

FIGURE 45 ISRA VISION: COMPANY SNAPSHOT

TABLE 134 ISRA VISION: PRODUCT LAUNCHES

11.1.8 MATROX ELECTRONIC SYSTEMS

TABLE 135 MATROX ELECTRONIC SYSTEMS: BUSINESS OVERVIEW

11.1.9 KEYENCE

TABLE 136 KEYENCE: BUSINESS OVERVIEW

FIGURE 46 KEYENCE: COMPANY SNAPSHOT

11.1.10 DATALOGIC

TABLE 137 DATALOGIC: BUSINESS OVERVIEW

FIGURE 47 DATALOGIC: COMPANY SNAPSHOT

* Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 NIKON CORPORATION

11.2.2 ALLIED VISION TECHNOLOGIES

11.2.3 QUALITAS TECHNOLOGIES

11.2.4 BEYONDMINDS

11.2.5 ELUNIC AG

11.2.6 CHOOCH INTELLIGENCE TECHNOLOGIES

11.2.7 KILI TECHNOLOGY

11.2.8 MOBIDEV

11.2.9 DWFRITZ AUTOMATION

11.2.10 RADIANT OPTRONICS PTE LTD

11.2.11 VISIONIFY

12 APPENDIX (Page No. - 224)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

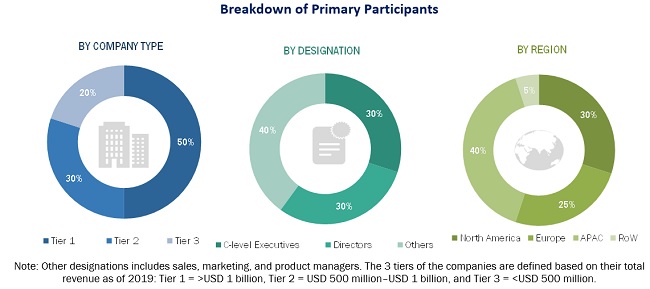

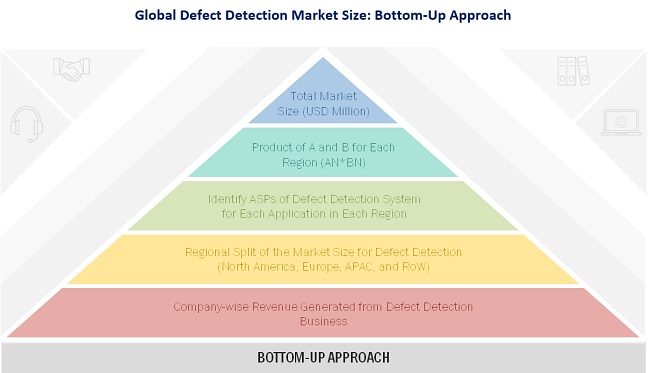

The study involved four major activities for estimating the size of the defect detection market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its child market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the defect detection market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the defect detection market began with the acquisition of data related to the revenues of key vendor in the market through secondary research. The secondary research referred to for this research study involves Semiconductor Industry Association (SIA), European Machine Vision Association (EMVA), UK Industrial Vision Association, and International Society of Automation (ISA). Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the defect detection market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of defect detection market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, North America, Europe, APAC, and Middle East and Africa (MEA), and South America. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to arrive at the overall size of the defect detection market from the revenues of key players in the defect detection market. The research methodology used to estimate the market size includes the following:

- Conducting multiple discussion sessions with the key opinion leaders to understand different defect detection products and their deployment in multiple applications; analyzing the break-up of the work carried out by each key company

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then finally with the domain experts at MarketsandMarkets

- Tracking the ongoing and upcoming developments in the defect detection market that include investments, R&D, product launches and developments, collaborations, and partnerships as well as forecasting the market size based on these developments and other critical parameters

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases, for the company- and region-specific developments undertaken in the defect detection market

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the defect detection market, in terms of value, on the basis of offering, application, vertical, and region

- To describe and forecast the market size for various segments for four primary regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding major factors including drivers, restraints, opportunities, and challenges that influence the growth of the defect detection market

- To provide a detailed overview of the value chain pertaining to the defect detection market ecosystem

- To analyze various policies and regulations pertaining to the use of machine vision in North America, Europe, and APAC

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of revenue and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as collaborations, agreements, partnerships, and product launches in the defect detection market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of defect detection market

- Estimation of the market size of the segments of the defect detection market based on different subsegments

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Defect Detection Market