Deep Packet Inspection and Processing Market by Component (Solutions and Services), Solution Type (Hardware and Software), Installation Type (Integrated and Standalone), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2024

Deep Packet Inspection and Processing Market Size & Trends

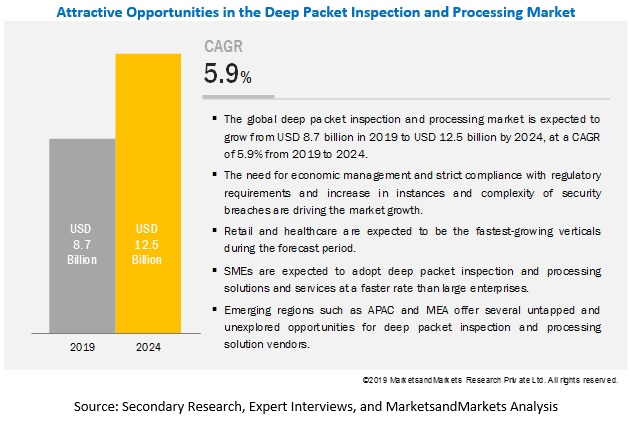

The global deep packet inspection and processing market size was valued at $8.7 billion in 2019, and is projected to reach $12.5 billion by 2024, growing at a CAGR of 5.9% from 2019 to 2024. Deep packet inspection and processing involve continuous evolution of cyberattacks and need for network performance management and optimization solutions to efficiently manage today’s complex networking environments are some of the major driving factors for the market.

Deep Packet Inspection and Processing Market Dynamics

Latest Trends

The installation type segment mainly comprises integrated and standalone solutions. deep packet inspection and processing solutions help organizations identify and reduce several risks associated with malicious data packets. Various organizations operating in different industries have been considering the implementation of integrated deep packet inspection and processing solutions to manage their IT ecosystem effectively. Moreover, integrated deep packet inspection and processing solutions minimize interfaces between systems, streamline visibility and agility, enhance productivity, minimize overall asset usage, and improve business results. They also automate, enhance, and manage the entire packet inspection process for improving transparency and measuring uncertainties that may hinder performance of organizations.

Driving Factors

The deep packet inspection and processing market is segmented on the basis of deployment modes into on-premises and cloud. Cloud-based services make information available on-demand and convenient to users due to their ease of access. The cloud environment offers unique security challenges, which include distributed denial of service (DDoS) attacks, data breaches, data losses, and insecure access points. Monitored machines are virtual in nature, and can be added and removed easily, which tend to change security requirements. Cloud-based deep packet inspection and processing solutions enable enterprises to gain more control over servers, infrastructure, and systems, which can be configured as per business requirements.

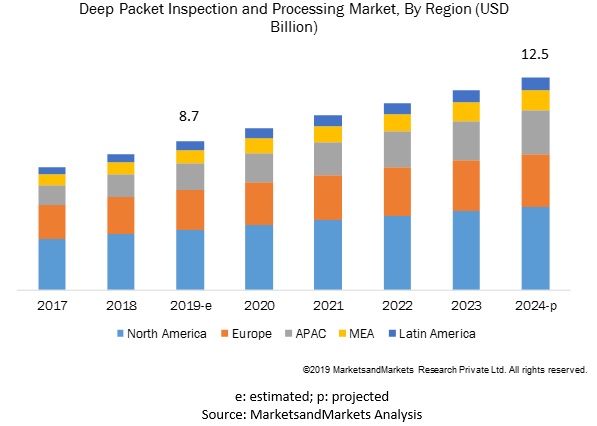

By region, North America to account for the majority of the deep packet inspection and processing market share during the forecast period

North America, being an early adopter of technologies, is often perceived as a technology leader in the world. North America leads in the adoption of deep packet inspection and processing in the world, which can be attributed to the large presence of security vendors as well as their focus toward R&D in security technologies. In the market, the majority of the key market players are based in North America, which provides a significant boost to the North American deep packet inspection and processing market. Apart from this factor, geographical presence, strategic investments, partnerships, and significant R&D activities are contributing to the large-scale deployments of deep packet inspection and processing solutions.

With all these technological advancements on one side, North America is progressing fast, but the regional vulnerability is also growing due to an increase in the number of cyberattacks. Though North America uses different technologies to protect its networks, hackers in this region develop and use even advanced technologies to plan sophisticated malware attacks. The attacks range from phishing attacks to ransomware, botnet, Distributed Denial-of-Service (DDoS), spyware, and rootkit. Such factors are expected to fuel the growth of the market in North America.

Top Companies in Deep Packet Inspection and Processing Market:

The vendors covered in the deep packet inspection and processing market report include IBM (US), Cisco Systems (US), Extreme Networks (US), Juniper Networks (US), Symantec (US), SolarWinds (US), Viavi Solutions (US), NetScout (US), LogRhythm (US), Qosmos (France), Cubro Network Visibility (Austria), Lionic Corporation (Taiwan), Trovicor (Taiwan), Netronome (US), Sandvine (Canada), Huawei (China), Bivio Networks (US), Ipoque (Germany), ManageEngine (US), and WiseSpot (Hong Kong). These players have adopted various growth strategies, including new product launches and product enhancements, partnerships, strategic investments, and acquisitions, to expand their presence in the market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Component, Solution, Installation Type, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (US), Cisco Systems (US), Extreme Networks (US), Juniper Networks (US), Symantec (US), SolarWinds (US), Viavi Solutions (US), NetScout (US), LogRhythm (US), Qosmos (France), Cubro Network Visibility (Austria), Lionic Corporation (Taiwan), Trovicor (Taiwan), Netronome (US), Sandvine (Canada), Huawei (China), Bivio Networks (US), Ipoque (Germany), ManageEngine (US), and WiseSpot (Hong Kong). |

This research report categorizes the deep packet inspection and processing market to forecast revenue and analyze trends in each of the following submarkets:

Based on Components:

- Solutions

- Services

Based on Solutions:

- Software

- Hardware

Based on Installation Types:

- Integrated

- Standalone

Based on Deployment Modes:

- Cloud

- On-premises

Based on Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on Verticals:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

- Healthcare

- IT and Telecom

- Manufacturing

- Retail

- Others (Includes transportation; energy and utilities; and media and entertainment)

Based on Regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Australia and New Zealand (ANZ)

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2019, Extreme Networks acquired Aerohive Networks. Aerohive Networks is a California-based computer networking equipment company, which offers solutions to medium-sized and large businesses. With this acquisition, Extreme Networks can diversify cloud and on-premises wired and wireless technologies to customers and partners.

- In February 2019, Cisco completed the acquisition of Singularity Networks, a network infrastructure analytics company. This acquisition will help Cisco provide improved network performance, cost- efficiency, more visibility, and less downtime to its clients.

- In August 2018, IBM collaborated with CenturyLink to enhance customer user experience across enterprises. The collaboration would integrate IBM’s Cloud Direct Link with CenturyLink’s Cloud Connect solutions. It would help both the companies’ customers access IBM’s cloud infrastructure through CenturyLink’s Direct Link connect and Direct Link dedicated options.

- In July 2018, SolarWinds launched a new, powerful log management tool for the on-premises IT environment named SolarWinds Log Manager for Orion. The tool is designed for improved log monitoring, troubleshooting, and performance management.

- In April 2018, Symantec announced the upgradation of its powerful threat detection technology used by its own world-class research teams available to Advanced Threat Protection (ATP) customers. Symantec’s Targeted Attack Analytics (TAA) enables ATP customers to leverage advanced machine learning to automate and discover targeted attacks.

Key Questions Addressed by the Report

- What are the opportunities in the deep packet inspection and processing market?

- What is the competitive landscape of the market?

- What are the restraining factors that will impact the market?

- How have deep packet inspection and processing solutions evolved from conventional techniques to modern techniques for packet inspection?

- What are the dynamics of the deep packet inspection and processing market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 23)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 26)

2.1 Research Data

2.1.1 Breakup of Primary Profiles

2.1.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.4 Market Forecast

2.5 Competitive Leadership Mapping Research Methodology

2.5.1 Vendor Inclusion Criteria

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 39)

4.1 Attractive Opportunities in the Deep Packet Inspection and Processing Market

4.2 Market By Component, 2019

4.3 Market By Organization Size, 2019–2024

4.4 Market By Deployment Mode, 2019–2024

4.5 Market Share of Top 3 Verticals and Regions, 2019

5 Market Overview and Industry Trends (Page No. - 42)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of Regulatory and Data Protection Laws

5.2.1.2 Increasing Number of Sophisticated Cyberattacks

5.2.2 Restraints

5.2.2.1 Limited Security Budget Among SMES

5.2.3 Opportunities

5.2.3.1 High Growth Opportunities in Virtual NGFW

5.2.3.2 High Adoption of Cloud-Based Security Technologies

5.2.4 Challenges

5.2.4.1 Lack of Skilled Security Professionals

5.3 Use Cases

5.3.1 Globally Renowned Media Company Relies on Opmanager for Broadcasting Without Disruption

5.3.2 Major European Bank Improves Application Performance With Ngeniusone

5.3.3 Barracuda’s Cloud-Ready Firewalls Utilize the Deep Packet Inspection (DPI) Engine R&S Pace 2

5.4 Regulatory Implications

5.4.1 General Data Protection Regulation

5.4.2 Payment Card Industry Data Security Standard

5.4.3 Health Insurance Portability and Accountability Act

5.4.4 Gramm–Leach–Bliley Act

5.4.5 Sarbanes-Oxley Act

5.4.6 The International Organization for Standardization 27001

6 Deep Packet Inspection and Processing Market By Component (Page No. - 50)

6.1 Introduction

6.2 Solutions

6.2.1 Solutions: Market Drivers

6.3 Services

6.3.1 Services: Market Drivers

7 Deep Packet Inspection and Processing Market By Solution (Page No. - 54)

7.1 Introduction

7.2 Hardware

7.2.1 Hardware: Market Drivers

7.3 Software

7.3.1 Software: Market Drivers

8 Deep Packet Inspection and Processing Market By Installation Type (Page No. - 58)

8.1 Introduction

8.2 Standalone

8.2.1 Standalone: Market Drivers

8.3 Integrated

8.3.1 Integrated: Market Drivers

9 Deep Packet Inspection and Processing Market By Deployment Mode (Page No. - 62)

9.1 Introduction

9.2 On-Premises

9.2.1 On-Premises: Market Drivers

9.3 Cloud

9.3.1 Cloud: Market Drivers

10 Deep Packet Inspection and Processing Market By Organization Size (Page No. - 66)

10.1 Introduction

10.2 Small and Medium-Sized Enterprises

10.2.1 Small and Medium-Sized Enterprises: Market Drivers

10.3 Large Enterprises

10.3.1 Large Enterprises: Market Drivers

11 Deep Packet Inspection and Processing Market By Vertical (Page No. - 70)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.2.1 Banking, Financial Services, and Insurance: Market Drivers

11.3 Government and Defense

11.3.1 Government and Defense: Market Drivers

11.4 Healthcare

11.4.1 Healthcare: Market Drivers

11.5 IT and Telecom

11.5.1 IT and Telecom: Market Drivers

11.6 Retail and Ecommerce

11.6.1 Retail and Ecommerce: Market Drivers

11.7 Manufacturing

11.7.1 Manufacturing: Market Drivers

11.8 Others

12 Deep Packet Inspection and Processing Market By Region (Page No. - 80)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.1.1 Presence of Several Security Vendors to Boost the Market Growth in the US

12.2.2 Canada

12.2.2.1 Canadian Market to Propel Due to Geographic Expansions of Security Vendors

12.3 Europe

12.3.1 United Kingdom

12.3.1.1 Increased Ddos Attacks on Enterprises to Boost the Market Growth

in the UK 94

12.3.2 Germany

12.3.2.1 Increasing Favorable Government Initiatives and Growing Awareness of Cyberthreats to Boost the Demand for Deep Packet Inspection and Processing Solutions in Germany

12.3.3 France

12.3.3.1 Huge Technological and Financial Advancements to Drive the Market Growth in France

12.3.4 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.1.1 Technological Advancements to Increase the Growth of Market in China

12.4.2 Japan

12.4.2.1 Increased Government Spending on Cyberattacks to Boost the Market Growth in Japan

12.4.3 Australia and New Zealand

12.4.3.1 Emergence of Mobile Technologies, Cloud Computing, and Increased Automation to Bolster the Growth of the Deep Packet Inspection and Processing Market in ANZ

12.4.4 Rest of Asia Pacific

12.5 Middle East and Africa

12.5.1 Kingdom of Saudi Arabia

12.5.1.1 Ksa Local Government to Focus on Security-Related Initiatives

12.5.2 United Arab Emirates

12.5.2.1 Need for Securing Businesses has Forced Organizations in the UAE to Adopt Deep Packet Inspection and Processing Solutions

12.5.3 South Africa

12.5.3.1 Organizations to Deploy Deep Packet Inspection and Processing Solutions to Address Dynamic Business Models in South Africa

12.5.4 Rest of Middle East and Africa

12.6 Latin America

12.6.1 Brazil

12.6.1.1 Brazilian Market to Grow Due to the Growing Awareness of Mitigating Cyber Threats

12.6.2 Mexico

12.6.2.1 Adoption of Deep Packet Inspection and Processing Solutions to Grow in the Banking, Financial Services, and Insurance Vertical in Mexico

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 143)

13.1 Competitive Leadership Mapping

13.1.1 Visionary Leaders

13.1.2 Innovators

13.1.3 Dynamic Differentiators

13.1.4 Emerging Companies

14 Company Profiles (Page No. - 145)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 Introduction

14.2 IBM

14.3 Cisco Networks

14.4 Extreme Networks

14.5 Juniper Networks

14.6 Symantec

14.7 SolarWinds

14.8 Viavi Solutions

14.9 NetScout

14.10 LogRhythm

14.11 Qosmos

14.12 Cubro Network Visibility

14.13 Lionic Corporation

14.14 Trovicor

14.15 Netronome

14.16 Sandvine

14.17 Huawei

14.18 Bivio Networks

14.19 Ipoque

14.20 ManageEngine

14.21 WiseSpot

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 175)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (164 Tables)

Table 1 Factor Analysis

Table 2 Evaluation Criteria

Table 3 Deep Packet Inspection and Processing Market Size and Growth, 2017–2024 (USD Million, Y-O-Y%)

Table 4 Market Size By Component, 2017–2024 (USD Million)

Table 5 Solutions: Market Size By Region, 2017–2024 (USD Million)

Table 6 Services: Market Size By Region, 2017–2024 (USD Million)

Table 7 Market Size By Solution, 2017–2024 (USD Million)

Table 8 Hardware: Market Size By Region, 2017–2024 (USD Million)

Table 9 Software: Market Size By Region, 2017–2024 (USD Million)

Table 10 Market Size, By Installation Type, 2017–2024 (USD Million)

Table 11 Standalone: Market Size By Region, 2017–2024 (USD Million)

Table 12 Integrated: Market Size By Region, 2017–2024 (USD Million)

Table 13 Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 14 On-Premises: Market Size By Region, 2017–2024 (USD Million)

Table 15 Cloud: Market Size By Region, 2017–2024 (USD Million)

Table 16 Market Size By Organization Size, 2017–2024 (USD Million)

Table 17 Small and Medium-Sized Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 18 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 19 Market Size, By Vertical, 2017–2024 (USD Million)

Table 20 Banking, Financial Services, and Insurance: Market Size By Region, 2017–2024 (USD Million)

Table 21 Government and Defense: Market Size By Region, 2017–2024 (USD Million)

Table 22 Healthcare: Market Size By Region, 2017–2024 (USD Million)

Table 23 IT and Telecom: Market Size By Region, 2017–2024 (USD Million)

Table 24 Retail and Ecommerce: Market Size By Region, 2017–2024 (USD Million)

Table 25 Manufacturing: Market Size By Region, 2017–2024 (USD Million)

Table 26 Others: Market Size By Region, 2017–2024 (USD Million)

Table 27 Deep Packet Inspection and Processing Market Size, By Region, 2017–2024 (USD Million)

Table 28 North America: Market Size, By Component, 2017–2024 (USD Million)

Table 29 North America: Market Size By Solution, 2017–2024 (USD Million)

Table 30 North America: Market Size By Installation Type, 2017–2024 (USD Million)

Table 31 North America: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 32 North America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 33 North America: Market Size By Vertical, 2017–2024 (USD Million)

Table 34 North America: Market Size By Country, 2017–2024 (USD Million)

Table 35 United States: Market Size, By Component, 2017–2024 (USD Million)

Table 36 United States: Market Size By Solution, 2017–2024 (USD Million)

Table 37 United States: Market Size By Installation Type, 2017–2024 (USD Million)

Table 38 United States: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 39 United States: Market Size By Organization Size, 2017–2024 (USD Million)

Table 40 United States: Market Size By Vertical, 2017–2024 (USD Million)

Table 41 Canada: Deep Packet Inspection and Processing Market Size, By Component, 2017–2024 (USD Million)

Table 42 Canada: Market Size By Solution, 2017–2024 (USD Million)

Table 43 Canada: Market Size By Installation Type, 2017–2024 (USD Million)

Table 44 Canada: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 45 Canada: Market Size By Organization Size, 2017–2024 (USD Million)

Table 46 Canada: Market Size By Vertical, 2017–2024 (USD Million)

Table 47 Europe: Market Size, By Component, 2017–2024 (USD Million)

Table 48 Europe: Market Size By Solution, 2017–2024 (USD Million)

Table 49 Europe: Market Size By Installation Type, 2017–2024 (USD Million)

Table 50 Europe: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 51 Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 52 Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 53 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 54 United Kingdom: Deep Packet Inspection and Processing Market Size, By Component, 2017–2024 (USD Million)

Table 55 United Kingdom: Market Size By Solution, 2017–2024 (USD Million)

Table 56 United Kingdom: Market Size By Installation Type, 2017–2024 (USD Million)

Table 57 United Kingdom: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 58 United Kingdom: Market Size By Organization Size, 2017–2024 (USD Million)

Table 59 United Kingdom: Market Size By Vertical, 2017–2024 (USD Million)

Table 60 Germany: Market Size, By Component, 2017–2024 (USD Million)

Table 61 Germany: Market Size By Solution, 2017–2024 (USD Million)

Table 62 Germany: Market Size By Installation Type, 2017–2024 (USD Million)

Table 63 Germany: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 64 Germany: Market Size By Organization Size, 2017–2024 (USD Million)

Table 65 Germany: Market Size By Vertical, 2017–2024 (USD Million)

Table 66 France: Deep Packet Inspection and Processing Market Size, By Component, 2017–2024 (USD Million)

Table 67 France: Market Size By Solution, 2017–2024 (USD Million)

Table 68 France: Market Size By Installation Type, 2017–2024 (USD Million)

Table 69 France: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 70 France: Market Size By Organization Size, 2017–2024 (USD Million)

Table 71 France: Market Size By Vertical, 2017–2024 (USD Million)

Table 72 Rest of Europe: Market Size, By Component, 2017–2024 (USD Million)

Table 73 Rest of Europe: Market Size By Solution, 2017–2024 (USD Million)

Table 74 Rest of Europe: Market Size By Installation Type, 2017–2024 (USD Million)

Table 75 Rest of Europe: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 76 Rest of Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 77 Rest of Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 78 Asia Pacific: Deep Packet Inspection and Processing Market Size, By Component, 2017–2024 (USD Million)

Table 79 Asia Pacific: Market Size By Solution, 2017–2024 (USD Million)

Table 80 Asia Pacific: Market Size By Installation Type, 2017–2024 (USD Million)

Table 81 Asia Pacific: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 82 Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 83 Asia Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 84 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 85 China: Market Size, By Component, 2017–2024 (USD Million)

Table 86 China: Market Size By Solution, 2017–2024 (USD Million)

Table 87 China: Market Size By Installation Type, 2017–2024 (USD Million)

Table 88 China: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 89 China: Market Size By Organization Size, 2017–2024 (USD Million)

Table 90 China: Market Size By Vertical, 2017–2024 (USD Million)

Table 91 Japan: Deep Packet Inspection and Processing Market Size, By Component, 2017–2024 (USD Million)

Table 92 Japan: Market Size By Solution, 2017–2024 (USD Million)

Table 93 Japan: Market Size By Installation Type, 2017–2024 (USD Million)

Table 94 Japan: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 95 Japan: Market Size By Organization Size, 2017–2024 (USD Million)

Table 96 Japan: Market Size By Vertical, 2017–2024 (USD Million)

Table 97 Australia and New Zealand: Market Size, By Component, 2017–2024 (USD Million)

Table 98 Australia and New Zealand: Market Size By Solution, 2017–2024 (USD Million)

Table 99 Australia and New Zealand: Market Size By Installation Type, 2017–2024 (USD Million)

Table 100 Australia and New Zealand: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 101 Australia and New Zealand: Market Size By Organization Size, 2017–2024 (USD Million)

Table 102 Australia and New Zealand: Market Size By Vertical, 2017–2024 (USD Million)

Table 103 Rest of Asia Pacific: Deep Packet Inspection and Processing Market Size, By Component, 2017–2024 (USD Million)

Table 104 Rest of Asia Pacific: Market Size By Solution, 2017–2024 (USD Million)

Table 105 Rest of Asia Pacific: Market Size By Installation Type, 2017–2024 (USD Million)

Table 106 Rest of Asia Pacific: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 107 Rest of Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 108 Rest of Asia Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 109 Middle East and Africa: Market Size, By Component, 2017–2024 (USD Million)

Table 110 Middle East and Africa: Market Size By Solution, 2017–2024 (USD Million)

Table 111 Middle East and Africa: Market Size By Installation Type, 2017–2024 (USD Million)

Table 112 Middle East and Africa: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 113 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 114 Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 115 Middle East and Africa: Market Size By Country, 2017–2024 (USD Million)

Table 116 Kingdom of Saudi Arabia: Deep Packet Inspection and Processing Market Size, By Component, 2017–2024 (USD Million)

Table 117 Kingdom of Saudi Arabia: Market Size By Solution, 2017–2024 (USD Million)

Table 118 Kingdom of Saudi Arabia: Market Size By Installation Type, 2017–2024 (USD Million)

Table 119 Kingdom of Saudi Arabia: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 120 Kingdom of Saudi Arabia: Market Size By Organization Size, 2017–2024 (USD Million)

Table 121 Kingdom of Saudi Arabia: Market Size By Vertical, 2017–2024 (USD Million)

Table 122 United Arab Emirates: Market Size, By Component, 2017–2024 (USD Million)

Table 123 United Arab Emirates: Market Size By Solution, 2017–2024 (USD Million)

Table 124 United Arab Emirates: Market Size By Installation Type, 2017–2024 (USD Million)

Table 125 United Arab Emirates: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 126 United Arab Emirates: Market Size By Organization Size, 2017–2024 (USD Million)

Table 127 United Arab Emirates: Market Size By Vertical, 2017–2024 (USD Million)

Table 128 South Africa: Deep Packet Inspection and Processing Market Size, By Component, 2017–2024 (USD Million)

Table 129 South Africa: Market Size By Solution, 2017–2024 (USD Million)

Table 130 South Africa: Market Size By Installation Type, 2017–2024 (USD Million)

Table 131 South Africa: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 132 South Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 133 South Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 134 Rest of Middle East and Africa: Market Size, By Component, 2017–2024 (USD Million)

Table 135 Rest of Middle East and Africa: Market Size By Solution, 2017–2024 (USD Million)

Table 136 Rest of Middle East and Africa: Market Size By Installation Type, 2017–2024 (USD Million)

Table 137 Rest of Middle East and Africa: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 138 Rest of Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 139 Rest of Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 140 Latin America: Deep Packet Inspection and Processing Market Size, By Component, 2017–2024 (USD Million)

Table 141 Latin America: Market Size By Solution, 2017–2024 (USD Million)

Table 142 Latin America: Market Size By Installation Type, 2017–2024 (USD Million)

Table 143 Latin America: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 144 Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 145 Latin America: Market Size By Vertical, 2017–2024 (USD Million)

Table 146 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 147 Brazil: Market Size, By Component, 2017–2024 (USD Million)

Table 148 Brazil: Market Size By Solution, 2017–2024 (USD Million)

Table 149 Brazil: Market Size By Installation Type, 2017–2024 (USD Million)

Table 150 Brazil: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 151 Brazil: Market Size By Organization Size, 2017–2024 (USD Million)

Table 152 Brazil: Market Size By Vertical, 2017–2024 (USD Million)

Table 153 Mexico: Deep Packet Inspection and Processing Market Size, By Component, 2017–2024 (USD Million)

Table 154 Mexico: Market Size By Solution, 2017–2024 (USD Million)

Table 155 Mexico: Market Size By Installation Type, 2017–2024 (USD Million)

Table 156 Mexico: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 157 Mexico: Market Size By Organization Size, 2017–2024 (USD Million)

Table 158 Mexico: Market Size By Vertical, 2017–2024 (USD Million)

Table 159 Rest of Latin America: Deep Packet Inspection and Processing Market Size, By Component, 2017–2024 (USD Million)

Table 160 Rest of Latin America: Market Size By Solution, 2017–2024 (USD Million)

Table 161 Rest of Latin America: Market Size By Installation Type, 2017–2024 (USD Million)

Table 162 Rest of Latin America: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 163 Rest of Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 164 Rest of Latin America: Market Size By Vertical, 2017–2024 (USD Million)

List of Figures (34 Figures)

Figure 1 Global Deep Packet Inspection and Processing Market: Research Design

Figure 2 Research Methodology

Figure 3 Market Size Estimation Methodology: Bottom-Up and Top-Down Approaches

Figure 4 Deep Packet Inspection and Processing Market to Witness Significant Growth During the Forecast Period

Figure 5 Integrated Segment to Grow at a Higher CAGR During the Forecast Period

Figure 6 North America to Hold the Highest Market Share in 2019

Figure 7 Fastest-Growing Segments of the Market

Figure 8 Growing Adoption of Regulatory and Data Protection Laws and Increasing Number of Cyberattacks to Drive the Growth of Market

Figure 9 Solutions Segment to Hold a Higher Market Share During the Forecast Period

Figure 10 Large Enterprises Segment to Have a Higher Market Share During the Forecast Period

Figure 11 On-Premises Segment to Hold a Higher Market Share During the Forecast Period

Figure 12 Banking, Financial Services, and Insurance Vertical and North America to Have the Highest Market Shares in 2019

Figure 13 Drivers, Restraints, Opportunities, and Challenges: Deep Packet Inspection and Processing Market

Figure 14 Solutions Segment to Hold a Larger Market Size During the Forecast Period

Figure 15 Software Segment to Grow at a Higher CAGR During the Forecast Period

Figure 16 Integrated Segment to Dominate the Market During the Forecast Period

Figure 17 Cloud Segment to Dominate the Market During the Forecast Period

Figure 18 Large Enterprises Segment to Dominate the Market During the Forecast Period

Figure 19 Banking, Financial Services, and Insurance Vertical to Dominate the Market During the Forecast Period

Figure 20 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 21 North America: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Deep Packet Inspection and Processing Market (Global), Competitive Leadership Mapping, 2019

Figure 24 IBM: Company Snapshot

Figure 25 IBM: SWOT Analysis

Figure 26 Cisco: Company Snapshot

Figure 27 Cisco Systems: SWOT Analysis

Figure 28 Extreme Networks: Company Snapshot

Figure 29 Extreme Networks: SWOT Analysis

Figure 30 Juniper Networks: Company Snapshot

Figure 31 Juniper Networks: SWOT Analysis

Figure 32 Symantec: Company Snapshot

Figure 33 Symantec: SWOT Analysis

Figure 34 SolarWinds: Company Snapshot

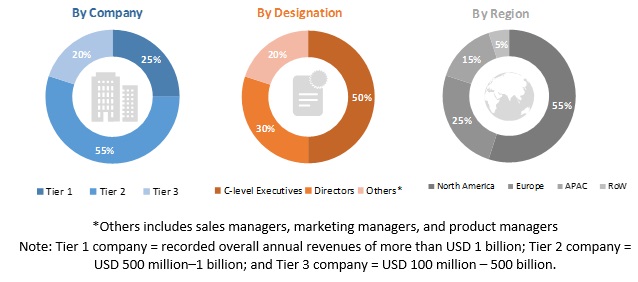

The study involved four major activities in estimating the current size of the deep packet inspection and processing market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of the segments and subsegments of the deep packet inspection and processing market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The deep packet inspection and processing market comprises several stakeholders, such as deep packet inspection and processing software vendors, deep packet inspection and processing service providers, system integrators, value-added resellers, deep packet inspection and processing system investors, cloud vendors, and consultants/advisory firms. The demand side of the market consists of financial institutions, investors, and insurance companies. The supply side includes deep packet inspection and processing solutions providers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the deep packet inspection and processing market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall deep packet inspection and processing market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global deep packet inspection and processing market by component, solution, installation type, deployment mode, organization size, vertical, and region from 2019 to 2024, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to 5 main regions, namely, North America; Europe; Asia Pacific (APAC); Middle East and Africa (MEA); and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the European deep packet inspection and processing market includes Spain, the Netherlands, and Italy.

- Further breakdown of the APAC market includes South Korea, India, Malaysia, and Singapore.

- Further breakdown of the Latin American market includes Chile, Peru, and Argentina.

- Further breakdown of the MEA market includes Oman, Israel, Egypt, and Algeria.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Deep Packet Inspection and Processing Market

Report has in-depth qualitative and quantitative insights

Well structured report with detailed information by segments

In-depth quantitative insights with multiple cross tables across all segments