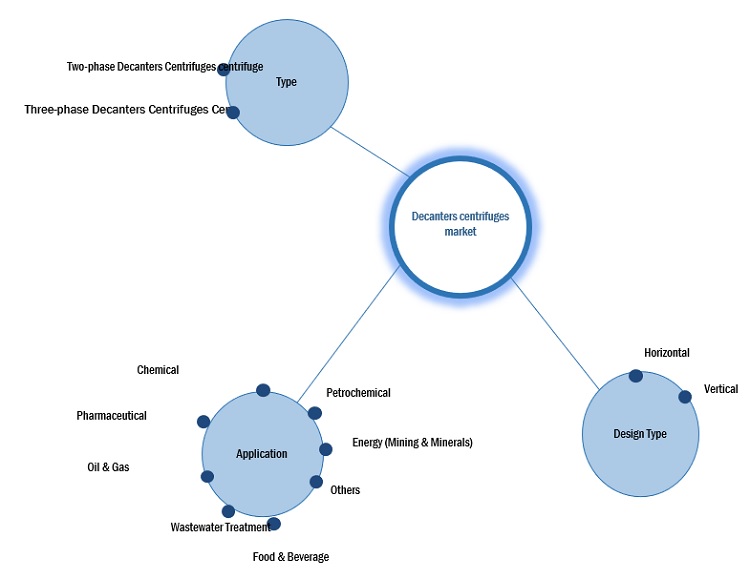

Decanters Centrifuges Market by Type (Two-Phase Centrifuge, Three-Phase Centrifuge), Application (Chemical, Oil & Gas, Energy, Petrochemical, Pharmaceutical, Wastewater Treatment, Food & Beverage), Design Type, & Region - Global Forecast 2028

Updated on : August 22, 2025

Decanters Centrifuges Market

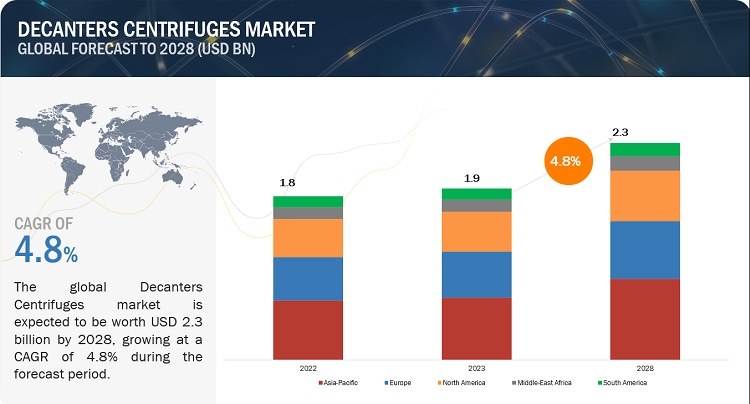

The global decanters centrifuges market was valued at USD 1.9 billion in 2023 and is projected to reach USD 2.3 billion by 2028, growing at 4.8% cagr from 2023 to 2028. The chemical is one of the major applications of the Decanters Centrifuges and offers market growth opportunities. The two-phase Decanters Centrifuges by type segment is experiencing high growth rates in emerging regions such as Asia Pacific and Europe.

Decanters Centrifuges Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Decanters Centrifuges Market

Decanters Centrifuges Market Dynamics

Driver: Increasing demand for solid-liquid separation

The increasing demand for solid-liquid separation is expected to drive the market in the Decanters Centrifuges centrifuge industry. Decanters Centrifuges centrifuges are widely used in various industries, including wastewater treatment, chemical processing, food and beverage, pharmaceuticals, and mining, for the effective separation of solids from liquids. The growing need for efficient separation processes, stringent environmental regulations, and the need to optimize industrial operations are key factors contributing to the rising demand for Decanters Centrifuges centrifuges.

Restraint: High initial investment can restrict the market

The high initial investment required for Decanters Centrifuges centrifuges can act as a restraint on market growth. Decanters Centrifuges centrifuges are sophisticated and complex machines that require substantial capital investment for procurement and installation. The high costs are primarily attributed to factors such as the advanced technology employed in Decanters Centrifuges centrifuges, the quality of materials used in their construction, and the customization required to meet specific industry needs. The significant upfront investment can pose a challenge, particularly for small and medium-sized enterprises (SMEs) with limited financial resources. SMEs may find it difficult to allocate a large portion of their budget toward acquiring Decanters Centrifuges centrifuges, which can hinder their ability to adopt this technology for solid-liquid separation.

Opportunities: Growing demand for water and wastewater treatment

The increasing demand for water and wastewater treatment presents a significant opportunity for the Decanters Centrifuges centrifuge market. As the global population continues to grow and urbanize, the need for effective water and wastewater management becomes paramount. Decanters Centrifuges centrifuges play a crucial role in the separation and dewatering of solids from wastewater, enabling the efficient treatment and disposal of effluent. This demand is further fueled by stringent environmental regulations that require industries to meet strict water quality standards. As governments and industries prioritize water conservation and environmental sustainability, the demand for Decanters Centrifuges centrifuges is expected to continue its upward trajectory, providing ample opportunities for market growth in the coming years.

Challenges: International trade barriers pose substantial challenges

International trade barriers pose substantial challenges for the Decanters Centrifuges centrifuge market. These barriers, including tariffs, quotas, and technical regulations, increase costs, limit market access, disrupt supply chains, create competitive disadvantages, and introduce uncertainty. Higher import costs and complex compliance requirements can impede market growth, hinder manufacturers' expansion into new markets, and disrupt global supply chains. Moreover, domestic manufacturers may face a competitive disadvantage compared to foreign counterparts with fewer trade barriers or government support. The volatile and uncertain business environment resulting from trade barriers further hampers long-term investments and planning.

Decanters Centrifuges Market Ecosystem

Manufacturers of decanters centrifuges who are well-known in the industry and have a secure financial situation. These businesses have a long history in the industry, a wide range of products, and effective international sales and marketing networks.. Prominent companies in this market include GEA (Germany), Flottweg SE (Germany), Pieralisi (Italy), Alfa Laval (Sweden), ANDRITZ (Austria), SLB (US), IHI ROTATING MACHINERY ENGINEERING CO LTD (Japan), Mitsubishi Kakoki Kaisha, Ltd (Japan), Tomoe Engineering Co Ltd (Japan), Flsmidth (Denmark).

The Horizontal segment, by design type, is expected to be the largest market during the forecast period

Based on the design type, With the horizontal type of the market, Decanters Centrifuges centrifuge manufacturers can target a larger customer base across different industries. This expands their market potential and allows them to cater to a broader range of customer needs, horizontal Decanters Centrifuges centrifuges offer flexibility in terms of processing various types of materials, including liquids with high solids content, slurries, and viscous substances. Their horizontal design allows for continuous operation and efficient separation across different applications and industries. This flexibility makes them suitable for a wide range of customer needs and contributes to a larger market size.

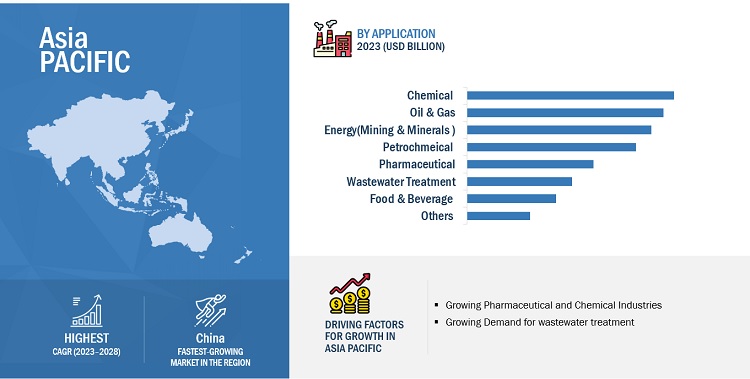

Based on application, the chemical segment accounts for the largest share of the overall market.

Based on application, The chemical industry is one of the largest manufacturing sectors globally, producing a vast array of chemicals used in various industries. The volume and variety of chemical production contribute to a significant demand for Decanters Centrifuges centrifuges. These machines are used in processes such as chemical synthesis, wastewater treatment, pigment and dye production, and the production of specialty chemicals. chemical industry often deals with hazardous or toxic materials that require careful handling and disposal. Decanters Centrifuges centrifuges provide a safe and effective means of separating and removing solid contaminants from chemical waste streams, thereby minimizing environmental impact.

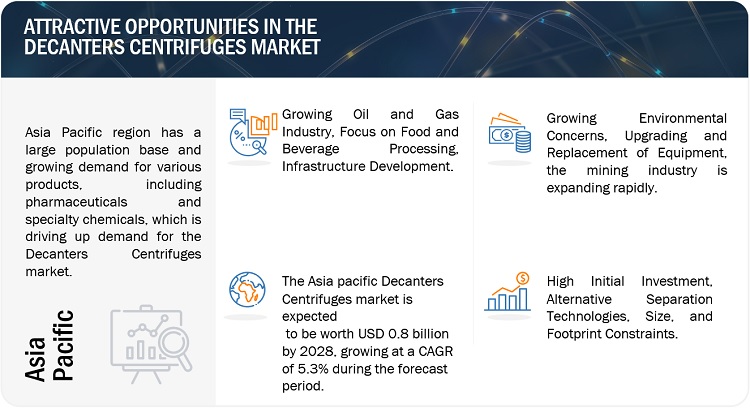

Asia Pacific is expected to account for the largest share of the global market during the forecast period.

Based on the region, the Asia Pacific region is experiencing the largest market share in the Decanters Centrifuges market due to the region has been witnessing significant economic growth and industrial development in countries such as China, India, Japan, South Korea, and Singapore. Asia Pacific region is home to a large number of pharmaceutical, chemical, and petrochemical companies, which are major consumers of Decanters Centrifuges systems.

To know about the assumptions considered for the study, download the pdf brochure

Decanters Centrifuges Market Players

The Decanters Centrifuges market is dominated by a few major players that have a wide regional presence. The key players in the Decanters Centrifuges industry are GEA (Germany), Flottweg SE (Germany), Pieralisi (Italy), Alfa Laval (Sweden), ANDRITZ (Austria), SLB (US), IHI ROTATING MACHINERY ENGINEERING CO LTD (Japan), Mitsubishi Kakoki Kaisha, Ltd (Japan), Tomoe Engineering Co Ltd (Japan), Flsmidth (Denmark). In the last few years, the companies have adopted growth strategies such as acquisitions, new product launches, partnerships, contracts, and agreements to capture a larger share of the Decanters Centrifuges market.

Read More: Decanters Centrifuges Companies

Decanters Centrifuges Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 1.9 billion |

|

Revenue Forecast in 2028 |

USD 2.3 billion |

|

CAGR |

4.8% |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments |

Type, Design type, Application, and Region. |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

GEA (Germany), Flottweg SE (Germany), Pieralisi (Italy), Alfa Laval (Sweden), ANDRITZ (Austria), SLB (US), IHI ROTATING MACHINERY ENGINEERING CO LTD (Japan), Mitsubishi Kakoki Kaisha, Ltd (Japan), Tomoe Engineering Co Ltd (Japan), Flsmidth (Denmark). |

This report categorizes the global decanters centrifuges market based on type, design type, application, and region.

Based on By Type, the decanters centrifuges market has been segmented as follows:

- Two-phase centrifuge

- Three-phase centrifuge

Based on By Design type, the decanters centrifuges market industry has been segmented as follows:

- Horizontal

- Vertical

Based on Application, the decanters centrifuges market has been segmented as follows:

- Chemical

- Oil & Gas

- Energy (Mining & Minerals)

- Petrochemical

- Pharmaceutical

- Wastewater Treatment

- Food & Beverage

- Others

Based on the Region, the decanters centrifuges market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- Oct 2021 DealITC Paperboards and Specialty Papers Division in Bhadrachalam, India, receives two GEA CF 8000 Decanters Centrifuges. The GEA Decanters Centrifuges will aid in the modernization and expansion of ITC.

- Oct 2021 Deal MEGGLE has received two new Flottweg Decanters Centrifuges centrifuges for casein production from Flottweg. MEGGLE has already used Flottweg separation technology for a variety of uses, including lactose extraction.

- August 2022 Partnership SPX FLOW, Inc., a leading provider of process solutions for the industrial, nutrition, and healthcare markets, has announced a new collaboration with Flottweg. Collaboration between SPX FLOW and Flottweg Decanters Centrifuges brings together expertise and innovation.

- Nov 2022 Deal Wien Energie is one of the main regional energy suppliers in Austria. Flottweg supplied Wien Energie with 12 Xelletor Decanters Centrifuges centrifuges for dewatering sewage sludge from the adjacent main sewage treatment plant.

- September 2022 Deal To dewater sludge, Flottweg Peru has a high-performance Z92 Decanters Centrifuges installed in Mining company Andalucita.

- April 2023 Partnership Flottweg, is a German company, is widely regarded as a world leader in separation technology. Rhames Ltd will be the UK's agent for all Flottweg's industry-leading equipment, comprising new machines and spare parts.

Frequently Asked Questions (FAQ):

What is the current size of the Decanters Centrifuges market?

The current market size of the global Decanters Centrifuges market is 1.9 Billion in 2023.

What are the major drivers for the Decanters Centrifuges market?

Increasing Demand for Solid-Liquid Separation, Expansion of Water Treatment Facilities.

Which is the fastest-growing region during the forecasted period in the Decanters Centrifuges market?

Europe is expected to be the fastest-growing region for the global Decanters Centrifuges market between 2023–2028. Europe also has a well-established regulatory framework that supports innovation and the adoption of new technologies in the pharmaceutical and chemical industries.

Which is the fastest-growing segment, by type during the forecasted period in the Decanters Centrifuges market?

By type, the Decanters Centrifuges market has been segmented into the two-phase Decanters Centrifuges centrifuge segment and is anticipated to be the fastest-growing Decanters Centrifuges market segment by type during the forecast period.

Which is the fastest growing segment by design type method during the forecasted period in the Decanters Centrifuges market?

By design type, the Horizontal segment is anticipated to be the fastest growing in the Decanters Centrifuges market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for solid-liquid separation- Growing demand for high-quality olive oil- Growth of food & beverage industryRESTRAINTS- High initial investments- Alternative separation technologies- Requirement for significant floor spaceOPPORTUNITIES- Growth of renewable energy sources- Advancements in automation and digitalization- Rising demand for water & wastewater treatmentCHALLENGES- Use of decanter centrifuge for barite recovery in oil & gas industry- Minimizing waste generation and maximizing resource recovery

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSDECANTER MANUFACTURERSDISTRIBUTORSEND USER

-

6.3 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

-

6.4 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.5 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

-

6.6 PATENT ANALYSISINTRODUCTIONMETHODOLOGY- Document type- Patent publication trendsINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTSLIST OF MAJOR PATENTS

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFTS & REVENUE POCKETS FOR DECANTER MARKET

-

6.8 ECOSYSTEM/MARKET MAP

-

6.9 TECHNOLOGY ANALYSISVFD TECHNOLOGYADVANCED CONTROL TECHNOLOGY

-

6.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.11 CASE STUDYMUNICIPALITY UPGRADES TO DECANTER CENTRIFUGE WITH GREASED BEARINGS

- 7.1 INTRODUCTION

-

7.2 HORIZONTAL DECANTERHORIZONTAL DECANTERS WIDELY USED DUE TO THEIR HIGH CAPACITY AND VERSATILITY

-

7.3 VERTICAL DECANTERVERTICAL DECANTERS MOSTLY USED FOR SPECIALISED APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 TWO-PHASE DECANTERTWO-PHASE SEGMENT TO ACCOUNT FOR DOMINANT SHARE IN OVERALL MARKET

-

8.3 THREE-PHASE DECANTERENABLES RECOVERY OF VALUABLE MATERIALS FROM COMPLICATED MIXES, OFFERS HIGH PROCESSING CAPACITY

- 9.1 INTRODUCTION

-

9.2 CHEMICALCHEMICAL APPLICATION TO BE LARGEST END USER OF DECANTERS

-

9.3 OIL & GASDECANTERS WIDELY USED IN DRILLING OPERATIONS IN OIL & GAS SECTOR

-

9.4 ENERGY (MINING & MINERALS)DECANTERS USED FOR COMPLEX SOLID-LIQUID SEPARATION PROCESSES IN MINING

-

9.5 PETROCHEMICALDECANTERS USED IN PETROCHEMICAL SECTOR TO MAXIMIZE RESOURCE RECOVERY AND REDUCE WASTE GENERATION

-

9.6 PHARMACEUTICALNEED FOR EFFICIENT SEPARATION, CLARIFYING, AND PURIFICATION PROCEDURES TO DRIVE DEMAND

-

9.7 WASTEWATER TREATMENTDECANTER CENTRIFUGES WIDELY USED IN WASTEWATER TREATMENT FOR OIL-WATER SEPARATION

-

9.8 FOOD & BEVERAGEDEMAND FOR HIGH-QUALITY PROCESSING OF FOOD & BEVERAGE TO DRIVE MARKET

-

9.9 OTHERSPULP & PAPER INDUSTRY- Decanters used for effective sludge dewatering in pulp & paper industry- Automotive

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

-

10.3 RECESSION IMPACTCHINA- Large population to fuel demand for wastewater treatmentJAPAN- Demand for high-quality products to support marketINDIA- Chemical application to be largest end user of decanter centrifugesSOUTH KOREA- Growing demand from various end-use industries to drive marketVIETNAM- Growing food and aquaculture industry to drive marketREST OF ASIA PACIFIC

- 10.4 EUROPE

-

10.5 RECESSION IMPACTGERMANY- Decanter centrifuges widely used to promote sustainable practicesITALY- Production of olive oil to fuel demand for decanter centrifugesFRANCE- Strong commitment to environmental sustainability to create favorable marketUK- Rise in demand for renewable energy to create opportunitiesSPAIN- Thriving oil and food industries to support market growthRUSSIA- Oil & gas sector to drive marketREST OF EUROPE

-

10.6 NORTH AMERICARECESSION IMPACTUS- US to dominate market in North AmericaCANADA- Developments in chemical and pharmaceutical sectors to drive marketMEXICO- Growing awareness of sustainability to drive demand

-

10.7 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Saudi Arabia to account for largest market share in Middle East & AfricaSOUTH AFRICA- Two-phase decanter to be larger and faster-growing segmentREST OF MIDDLE EAST & AFRICA

-

10.8 SOUTH AMERICARECESSION IMPACTBRAZIL- Rising investment in oil production and energy industry to drive demandARGENTINA- Rising awareness to drive marketREST OF SOUTH AMERICA

- 11.1 OVERVIEW

-

11.2 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERSMARKET SHARE OF KEY PLAYERS- Gea Group Aktiengesellschaft- Flottweg SE- Alfa Laval- Andritz- Mitsubishi Kakoki Kaisha, Ltd.

- 11.3 COMPANY FOOTPRINT ANALYSIS

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.5 COMPETITIVE BENCHMARKING

-

11.6 STARTUP/SME EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

-

11.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSGEA GROUP AKTIENGECOMSELLSCHAFT- Business overview- Products/Services/Solutions offered- MnM viewFLOTTWEG SE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewPIERALISI MAIP SPA- Business overview- Products/services/solutions offered- MnM viewALFA LAVAL- Business overview- Products/Services/Solutions offered- MnM viewANDRITZ- Business overview- Products/Services/Solutions offered- MnM viewSLB- Business overview- Products/Services/Solutions offered- MnM viewIHI ROTATING MACHINERY ENGINEERING CO., LTD.- Business overview- Products/Services/Solutions offered- Products/Services/Solutions offered- MnM viewMITSUBISHI KAKOKI KAISHA, LTD.- Business overview- Products/Services/Solutions offered- MnM viewTOMOE ENGINEERING CO. LTD.- Business overview- Products/services/solutions offered- MnM viewFLSMIDTH- Business overview- Products/services/solutions offered- MnM view

-

12.2 OTHER PLAYERSTHE WEIR GROUP PLCELGIN POWER AND SEPARATION SOLUTIONSSIEBTECHNIK TEMA GMBHPOLAT MAKINA SAN A.S.JIANGSU HUADA CENTRIFUGE CO., LTD.HILLER SEPARATION & PROCESSTHOMAS BROADBENT & SONS LTD.CENTRISYSROUSSELET ROBATELNOXON ABGN SOLIDS CONTROLZK SEPARATIONPENNWALT LTD.HUADING SEPARATORVITONE ECO S.R.L

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 DECANTER MARKET: SNAPSHOT

- TABLE 2 DECANTER MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EXPORTS OF DECANTER CENTRIFUGES, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 6 IMPORT OF DECANTER CENTRIFUGES, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 7 GRANTED PATENTS ACCOUNT FOR 36.5% OF TOTAL COUNT IN LAST 10 YEARS

- TABLE 8 LIST OF MAJOR PATENTS FOR DECANTER CENTRIFUGES

- TABLE 9 MAJOR PATENTS FOR DECANTER CENTRIFUGES

- TABLE 10 DECANTER MARKET: ECOSYSTEM

- TABLE 11 ADVANTAGES OF VFD TECHNOLOGY

- TABLE 12 ADVANTAGES OF ADVANCED CONTROL TECHNOLOGY

- TABLE 13 INFLUENCE OF BUYERS IN BUYING PROCESS FOR TOP SEVEN APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR END USERS

- TABLE 15 DECANTER MARKET, BY DESIGN TYPE, 2019–2022 (USD MILLION)

- TABLE 16 DECANTER MARKET, BY DESIGN TYPE, 2023–2028 (USD MILLION)

- TABLE 17 DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 18 DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 19 DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 20 DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 21 DECANTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 DECANTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 ASIA PACIFIC: DECANTER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 24 ASIA PACIFIC: DECANTER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 ASIA PACIFIC: DECANTER MARKET BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 ASIA PACIFIC: DECANTER MARKET BY APPLICATION 2019–2022 (USD MILLION)

- TABLE 28 ASIA PACIFIC: DECANTER MARKET, BY APPLICATION 2023–2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: DECANTER MARKET, BY DESIGN TYPE, 2019–2022 (USD MILLION)

- TABLE 30 ASIA PACIFIC: DECANTER MARKET, BY DESIGN TYPE, 2023–2028 (USD MILLION)

- TABLE 31 CHINA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 32 CHINA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 33 CHINA: DECANTER MARKET, BY APPLICATION 2019–2022 (USD MILLION)

- TABLE 34 CHINA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 35 JAPAN: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 36 JAPAN: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 JAPAN: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 38 JAPAN: DECANTER MARKET, BY APPLICATION 2023–2028 (USD MILLION)

- TABLE 39 INDIA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 40 INDIA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 41 INDIA: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 42 INDIA: DECANTER MARKET, BY APPLICATION 2023–2028 (USD MILLION)

- TABLE 43 SOUTH KOREA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 44 SOUTH KOREA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 SOUTH KOREA: DECANTER MARKET, BY APPLICATION, 2019–2022(USD MILLION)

- TABLE 46 SOUTH KOREA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 VIETNAM: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 48 VIETNAM: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 49 VIETNAM: DECANTER MARKET, BY APPLICATION 2019–2022 (USD MILLION)

- TABLE 50 VIETNAM: DECANTER MARKET, BY APPLICATION 2023–2028 (USD MILLION)

- TABLE 51 REST OF ASIA PACIFIC: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 52 REST OF ASIA PACIFIC: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 53 REST OF ASIA PACIFIC: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 54 REST OF ASIA PACIFIC: DECANTER, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 EUROPE: DECANTER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 56 EUROPE: DECANTER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 57 EUROPE: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 58 EUROPE: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 EUROPE: DECANTER MARKET, BY APPLICATION 2019–2022 (USD MILLION)

- TABLE 60 EUROPE: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 EUROPE: DECANTER MARKET, BY DESIGN TYPE, 2019–2022 (USD MILLION)

- TABLE 62 EUROPE: DECANTER MARKET, BY DESIGN TYPE, 2023–2028 (USD MILLION)

- TABLE 63 GERMANY: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 64 GERMANY: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 65 GERMANY: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 66 GERMANY: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 ITALY: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 68 ITALY: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 69 ITALY: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 70 ITALY: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 FRANCE: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 72 FRANCE: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 FRANCE: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 74 FRANCE: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 UK: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 76 UK: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 77 UK: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 78 UK: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 SPAIN: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 80 SPAIN: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 81 SPAIN: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 82 SPAIN: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 RUSSIA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 84 RUSSIA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 85 RUSSIA: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 RUSSIA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 REST OF EUROPE: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 88 REST OF EUROPE: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 REST OF EUROPE: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: DECANTER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: DECANTER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: DECANTER MARKET, BY DESIGN TYPE, 2019–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: DECANTER MARKET, BY DESIGN TYPE, 2023–2028 (USD MILLION)

- TABLE 99 US: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 100 US: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 101 US: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 102 US: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 CANADA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 104 CANADA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 105 CANADA: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 CANADA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 MEXICO: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 108 MEXICO: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 MEXICO: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 MEXICO: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: DECANTER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: DECANTER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: DECANTER MARKET, BY DESIGN TYPE, 2019–2022 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: DECANTER MARKET, BY DESIGN TYPE, 2023–2028 (USD MILLION)

- TABLE 119 SAUDI ARABIA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 120 SAUDI ARABIA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 121 SAUDI ARABIA: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 122 SAUDI ARABIA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 SOUTH AFRICA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 124 SOUTH AFRICA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 125 SOUTH AFRICA: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 126 SOUTH AFRICA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 REST OF MIDDLE EAST & AFRICA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 128 REST OF MIDDLE EAST & AFRICA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 129 REST OF MIDDLE EAST & AFRICA: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST & AFRICA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 SOUTH AMERICA: DECANTER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 132 SOUTH AMERICA: DECANTER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 133 SOUTH AMERICA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 134 SOUTH AMERICA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 135 SOUTH AMERICA: DECANTER MARKET, BY DESIGN TYPE, 2019–2022 (USD MILLION)

- TABLE 136 SOUTH AMERICA: DECANTER MARKET, BY DESIGN TYPE, 2023–2028 (USD MILLION)

- TABLE 137 SOUTH AMERICA: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 138 SOUTH AMERICA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 BRAZIL: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 140 BRAZIL: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 141 BRAZIL: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 142 BRAZIL: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 143 ARGENTINA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 144 ARGENTINA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 ARGENTINA: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 146 ARGENTINA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 147 REST OF SOUTH AMERICA: DECANTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 148 REST OF SOUTH AMERICA: DECANTER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 149 REST OF SOUTH AMERICA: DECANTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 150 REST OF SOUTH AMERICA: DECANTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 152 DECANTER MARKET: DEGREE OF COMPETITION

- TABLE 153 DECANTER MARKET: COMPANY APPLICATION FOOTPRINT

- TABLE 154 DECANTER MARKET: COMPANY TYPE FOOTPRINT

- TABLE 155 DECANTER MARKET: COMPANY DESIGN TYPE FOOTPRINT

- TABLE 156 DECANTER MARKET: COMPANY REGION FOOTPRINT

- TABLE 157 DECANTER MARKET: KEY STARTUPS/SMES

- TABLE 158 DECANTER MARKET: SMES/STARTUPS APPLICATION FOOTPRINT

- TABLE 159 DECANTER MARKET: SMES/STARTUPS TYPE FOOTPRINT

- TABLE 160 DECANTER MARKET: SMES/STARTUPS DESIGN TYPE FOOTPRINT

- TABLE 161 DECANTER MARKET: SMES/STARTUPS REGION FOOTPRINT

- TABLE 162 DECANTER MARKET: PRODUCT LAUNCHES (2019–2022)

- TABLE 163 DECANTER MARKET: DEALS (2019–2023)

- TABLE 164 DECANTER MARKET: OTHER DEVELOPMENTS (2019–2023)

- TABLE 165 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 166 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 167 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 168 GEA GROUP AKTIENGESELLSCHAFT: DEALS

- TABLE 169 GEA GROUP AKTIENGESELLSCHAFT: OTHER DEVELOPMENTS

- TABLE 170 FLOTTWEG SE: COMPANY OVERVIEW

- TABLE 171 FLOTTWEG SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 172 FLOTTWEG SE: PRODUCT LAUNCHES

- TABLE 173 FLOTTWEG SE: DEALS

- TABLE 174 FLOTTWEG SE: OTHER DEVELOPMENTS

- TABLE 175 PIERALISI MAIP SPA: COMPANY OVERVIEW

- TABLE 176 PIERALISI MAIP SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 PIERALISI MAIP SPA: DEALS

- TABLE 178 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 179 ALFA LAVAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 180 ALFA LAVAL: PRODUCT LAUNCHES

- TABLE 181 ALFA LAVAL: DEALS

- TABLE 182 ALFA LAVAL: OTHER DEVELOPMENTS

- TABLE 183 ANDRITZ: COMPANY OVERVIEW

- TABLE 184 ANDRITZ: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 185 ANDRITZ: PRODUCT LAUNCHES

- TABLE 186 SLB: COMPANY OVERVIEW

- TABLE 187 SLB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 188 SLB: OTHER DEVELOPMENTS

- TABLE 189 IHI ROTATING MACHINERY ENGINEERING CO., LTD.: COMPANY OVERVIEW

- TABLE 190 IHI ROTATING MACHINERY ENGINEERING CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 191 MITSUBISHI KAKOKI KAISHA, LTD.: COMPANY OVERVIEW

- TABLE 192 MITSUBISHI KAKOKI KAISHA, LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 193 MITSUBISHI KAKOKI KAISHA, LTD.: OTHER DEVELOPMENTS

- TABLE 194 TOMOE ENGINEERING CO., LTD.: COMPANY OVERVIEW

- TABLE 195 TOMOE ENGINEERING CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 196 TOMOE ENGINEERING CO., LTD.: DEALS

- TABLE 197 FLSMIDTH: COMPANY OVERVIEW

- TABLE 198 FLSMIDTH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 199 FLSMIDTH: OTHER DEVELOPMENTS

- TABLE 200 FLSMIDTH: DEALS

- TABLE 201 THE WEIR GROUP PLC: COMPANY OVERVIEW

- TABLE 202 ELGIN POWER AND SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 203 SIEBTECHNIK TEMA GMBH: COMPANY OVERVIEW

- TABLE 204 POLAT MAKINA SAN A.S.: COMPANY OVERVIEW

- TABLE 205 JIANGSU HUADA CENTRIFUGE CO., LTD.: COMPANY OVERVIEW

- TABLE 206 HILLER SEPARATION & PROCESS: COMPANY OVERVIEW

- TABLE 207 THOMAS BROADBENT & SONS LTD.: COMPANY OVERVIEW

- TABLE 208 CENTRISYS: COMPANY OVERVIEW

- TABLE 209 ROUSSELET ROBATEL: COMPANY OVERVIEW

- TABLE 210 NOXON AB: COMPANY OVERVIEW

- TABLE 211 GN SOLIDS CONTROL: COMPANY OVERVIEW

- TABLE 212 ZK SEPARATION: COMPANY OVERVIEW

- TABLE 213 PENNWALT LTD.: COMPANY OVERVIEW

- TABLE 214 HUADING SEPARATOR: COMPANY OVERVIEW

- TABLE 215 VITONE ECO S.R.L: COMPANY OVERVIEW

- FIGURE 1 DECANTER MARKET: RESEARCH DESIGN

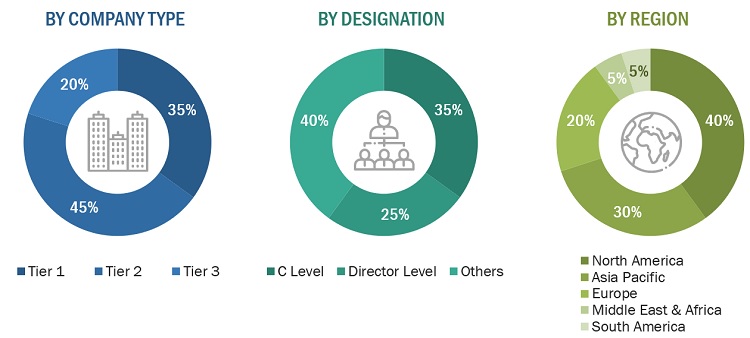

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION: DECANTER MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION BASED ON DEMAND SIDE

- FIGURE 7 METRICS CONSIDERED FOR ASSESSING DEMAND FOR DECANTERS

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 TWO-PHASE DECANTER SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 10 CHEMICAL APPLICATION SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 11 HORIZONTAL DESIGN SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 12 INCREASING AWARENESS REGARDING SUSTAINABLE TECHNOLOGY TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 TWO-PHASE DECANTER SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2028

- FIGURE 15 CHEMICAL SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2028

- FIGURE 16 HORIZONTAL SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2028

- FIGURE 17 CHINA ACCOUNTS FOR LARGEST MARKET SHARE IN 2023

- FIGURE 18 DECANTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 PORTER’S FIVE FORCES ANALYSIS: DECANTER MARKET

- FIGURE 20 VALUE CHAIN OF DECANTER MARKET

- FIGURE 21 NUMBER OF PATENTS GRANTED FROM 2013 TO 2023

- FIGURE 22 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DECANTERS, 2023

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 24 REVENUE SHIFTS FOR DECANTER PROVIDERS

- FIGURE 25 DECANTER MARKET: ECOSYSTEM MAPPING

- FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP SEVEN APPLICATIONS

- FIGURE 27 KEY BUYING CRITERIA FOR END USERS

- FIGURE 28 HORIZONTAL DECANTER SEGMENT TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 29 TWO-PHASE DECANTERS TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 30 CHEMICAL APPLICATION TO LEAD OVERALL DECANTER MARKET DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC: DECANTER MARKET SNAPSHOT

- FIGURE 32 EUROPE: DECANTERS MARKET SNAPSHOT

- FIGURE 33 NORTH AMERICA: DECANTER MARKET SNAPSHOT

- FIGURE 34 MIDDLE EAST & AFRICA: DECANTER MARKET SNAPSHOT

- FIGURE 35 SOUTH AMERICA: DECANTER MARKET SNAPSHOT

- FIGURE 36 RANKING OF TOP FIVE PLAYERS IN DECANTER MARKET, 2022

- FIGURE 37 DEGREE OF COMPETITION IN DECANTER MARKET

- FIGURE 38 COMPANY EVALUATION MATRIX, 2022

- FIGURE 39 STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 40 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 41 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 42 ANDRITZ: COMPANY SNAPSHOT

- FIGURE 43 SLB: COMPANY SNAPSHOT

- FIGURE 44 IHI ROTATING MACHINERY ENGINEERING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 45 MITSUBISHI KAKOKI KAISHA, LTD.: COMPANY SNAPSHOT

- FIGURE 46 TOMOE ENGINEERING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 47 FLSMIDTH: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the Decanters Centrifuges market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The Decanters Centrifuges market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the Decanters Centrifuges industry have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the Decanters Centrifuges industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to Decanters Centrifuges by type, design type, applications, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Decanters Centrifuges and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

GEA (Germany) |

Regional Head |

|

Flottweg SE (Germany) |

Sales Manager |

|

Pieralisi (Italy) |

Director |

|

Alfa Laval (Sweden) |

Marketing Manager |

|

ANDRITZ (Austria), |

R&D Manager |

Market Size Estimation

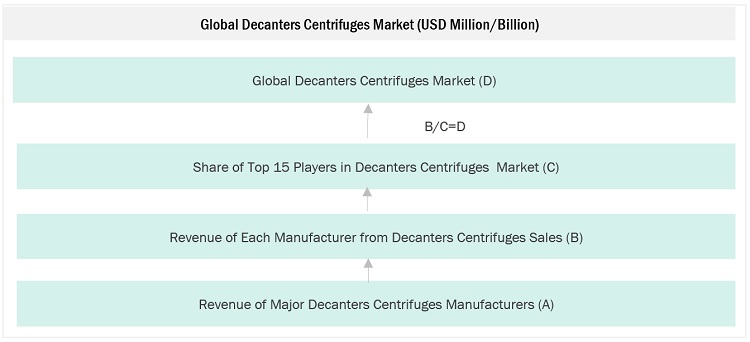

The top-down and bottom-up approaches have been used to estimate and validate the size of the Decanters Centrifuges market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Decanters Centrifuges Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Decanters Centrifuges Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The Decanters Centrifuges market refers to the global industry that encompasses the manufacturing, distribution, and sale of Decanters Centrifuges centrifuge equipment used for the efficient separation of solid particles from liquid streams in various industries such as wastewater treatment, chemical processing, food and beverage, pharmaceuticals, mining, and oil and gas. It is segmented into by type, design type, application, and region.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define and describe the Decanters Centrifuges market based on type, design type, and application, in terms of value.

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To estimate the market size in terms of value.

- To strategically analyze micromarkets1 with respect to individual growth trends, future expansions, and their contributions to the overall Decanters Centrifuges market.

- To provide post-pandemic estimation for the Decanters Centrifuges market and analyze the impact of the pandemic on market growth.

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders.

- To forecast the growth of the Decanters Centrifuges market with respect to five key regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their key countries.

- To strategically profile the key players and comprehensively analyze their core competencies2.

- To analyze competitive developments, such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the Decanters Centrifuges market

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Decanters Centrifuges Market