Date Syrup Market

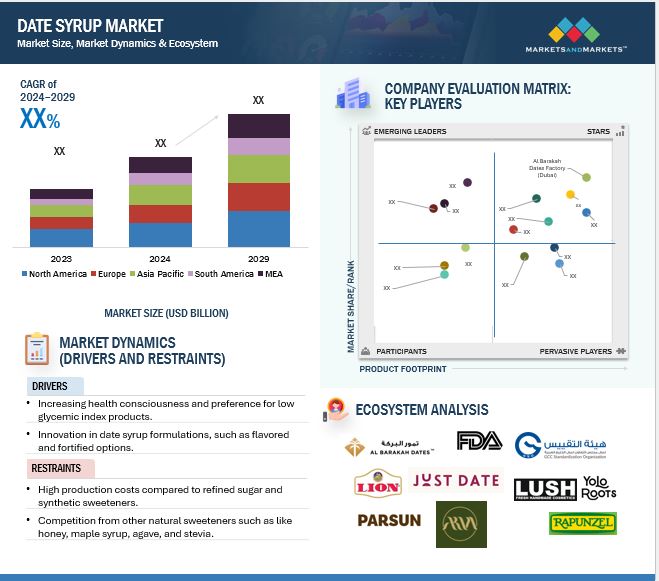

The date syrup market, estimated at USD XX billion in 2024, is projected to reach USD XX billion by 2029, growing at a CAGR of XX%. Its natural sweetness, and function as a sugar substitute—particularly for people managing blood sugar levels—are driving its popularity. With diabetes affecting 537 million adults in 2021, projected to reach 643 million by 2030 (International Diabetes Federation), date syrup presents a low glycemic index option. Although there are obstacles such as low awareness and high production costs, functional foods and beverages offer prospects for future growth.

Market Dynamics

Drivers: Growing demand for natural and organic sweeteners due to health concerns over refined sugars

The increasing demand for natural and organic sweeteners, driven by concerns over refined sugars, is boosting the date syrup market. Consumers are becoming more aware of the negative effects of refined sugars, including their links to obesity, diabetes, and heart disease. This has led to a shift toward healthier alternatives, like date syrup, which has a lower glycemic index (GI) and doesn’t cause sharp spikes in blood sugar. Date syrup is seen as a better choice due to its low GI, making it appealing to health-conscious consumers, particularly those managing conditions like diabetes.

In addition, innovation in date syrup products is fueling market growth. Manufacturers are creating flavored varieties, like vanilla and cinnamon, to appeal to a wider range of tastes and expand its use in different foods and beverages. The growing preference for clean-label products—those free from additives and artificial ingredients—also supports the demand for date syrup as a natural, organic sweetener. With increasing health awareness and a shift toward low-GI options, these factors are driving the expansion of the date syrup market. The combination of health concerns and the appeal of clean, natural alternatives is fueling this growing trend.

Restraint: Competition from other natural sweeteners

Competition from natural sweeteners like honey, maple syrup, agave, and stevia significantly restrains the growth of the date syrup market. These alternatives are already popular, more widely available, and competitively priced. Their strong consumer recognition and versatility in beverages, baking, and health foods give them an edge. The low glycemic index of agave and stevia, in particular, makes them popular with health-conscious consumers—the same group that date syrup targets. Furthermore, the competitiveness of date syrup is restricted by its high production costs. Harvesting and processing dates are labor-intensive, and the limited regions suitable for cultivating date palms drive up costs. This makes date syrup more expensive than refined sugar and synthetic sweeteners, which is a disadvantage in cost-sensitive markets.

Consumer awareness of date syrup also remains low compared to other natural sweeteners, limiting its adoption. Its thick consistency and shorter shelf life pose packaging and storage challenges, discouraging some manufacturers and retailers. Furthermore, regulatory hurdles, such as organic certification requirements and regional trade restrictions, add to the complexity of scaling the market. Despite its nutritional advantages, these factors collectively hinder date syrup’s growth, making it difficult for producers to position it as a mainstream natural sweetener in an already competitive market.

Opportunity: Expanding applications of date syrup in bakery, confectionery, and beverage industries drive date syrup demand

The expanding applications of date syrup in the bakery, confectionery, and beverage industries represent a major opportunity in the date syrup market. Date syrup’s natural sweetness, combined with its rich nutritional profile, makes it increasingly popular in these sectors, particularly as consumers seek healthier alternatives to refined sugars. In bakeries, it functions as both a sweetener and binder, enhancing texture and adding a natural flavor. In confectionery, date syrup provides a cleaner, more nutritious option, catering to the growing demand for clean-label ingredients. In beverages, it enhances taste without being overpowering, making it perfect for soft drinks, iced teas, and smoothies.

A major driver of this trend is the rising demand for organic and sustainably sourced ingredients, leading manufacturers to choose date syrup over synthetic sweeteners. Its applications are further expanded by innovations like GLOBAL FOODS' Clear Date Syrup. This transparent version is perfect for clear beverages, dairy products, and baked goods as it preserves all the advantages of traditional date syrup without changing the final product's appearance. Clear Date Syrup is revolutionary in the food manufacturing industry as it provides a subtle sweetness without sacrificing the product's appearance.

Challenge: Supply shortages, certification issues, and production disruptions impact the date syrup market

Supply shortages, certification issues, and production disruptions are significant challenges for the date syrup market. In 2023, stricter EU regulations caused many date farms in North Africa, especially in Tunisia and Algeria, to lose their organic certification. Farmers cannot regain this status until 2026, leading to a significant shortage of organic dates. This shortage has disrupted the production of date-based ingredients, such as date syrup, which are commonly used in food manufacturing. Additionally, while the 2023/24 harvest was abundant in high-quality dates, industrial-grade dates were in short supply, creating a bottleneck for food producers who rely on date paste and syrup.

The supply chain is further strained by rising prices for limited stocks, forcing manufacturers to either pay inflated costs or use non-organic dates, which can hurt their reputation for organic products. Another obstacle is limited consumer awareness of date syrup’s health benefits, which hampers market growth. Despite its nutritional advantages, date syrup is less well-known than other sweeteners, affecting consumer demand. These combined issues create a volatile market, making it difficult for companies to maintain consistent production and meet customer needs.

Market Ecosystem

Food & beverages segment dominated the end-use segment within date syrup market in 2023.

The food & beverage sector leads the date syrup market due to its wide use in various products and the growing demand for natural sweeteners. Packed with nutrients like potassium, iron, and antioxidants, date syrup fits well with the trend of health-conscious eating. It is commonly used as a healthier alternative to refined sugar in items like baked goods, energy bars, breakfast cereals, and beverages, appealing to clean-label consumers.

The increasing preference for plant-based and vegan ingredients further drives its adoption in dairy alternatives and desserts. Date syrup’s natural sweetness, combined with its compatibility with organic and non-GMO certifications, makes it a sought-after ingredient for premium food products. Additionally, its glycemic index, which is lower than many traditional sweeteners, appeals to consumers managing blood sugar levels.

Interest in Middle Eastern and Mediterranean cuisines, where date syrup is a staple, is also helping drive market demand globally. Food & beverage manufacturers are innovating by incorporating date syrup into health-focused products like immunity-boosting drinks and functional snacks. Its health benefits, clean-label appeal, and culinary flexibility have made the food & beverage industry the main driver of the date syrup market.

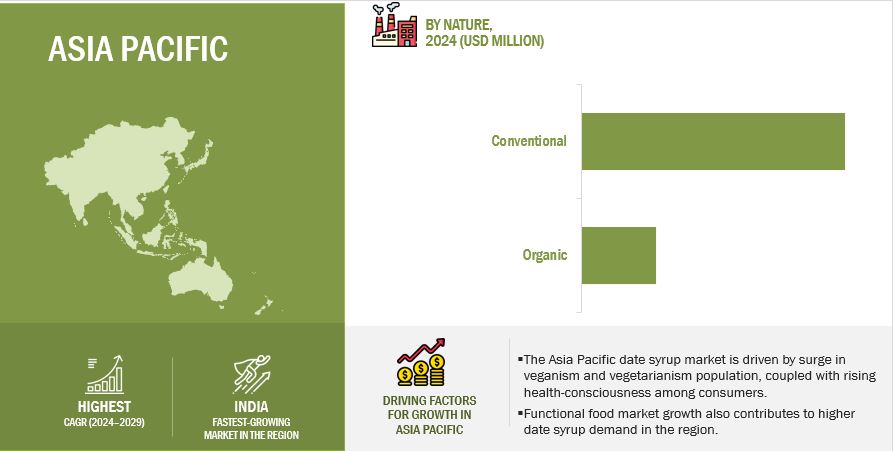

Based on nature, the organic segment is projected to be growing at a significant rate within date syrup market in the forecast period through 2029.

The organic segment of the date syrup market is growing rapidly, driven by the rising global demand for organic products, especially among health-conscious consumers and those concerned about the environment. As people become more aware of the health benefits of organic foods—such as reduced exposure to pesticides and chemicals—organic date syrup is gaining popularity as a natural and healthy alternative to traditional sweeteners. This trend is part of a broader shift in the food industry, where organic products are seen as healthier and more sustainable.

The US organic food market is a key example of this change, with sales growing from around USD 26.9 billion in 2010 to USD 52.0 billion in 2021, according to the Nutrition Business Journal (NBJ, 2022). This increase reflects both a rise in consumer awareness and a broader societal preference for eco-friendly, sustainable production methods. Organic products in the date syrup market are considered premium, which increases their appeal to consumers who are concerned about their health and the environment. In response to this desire for healthier, more environmentally friendly options, organic date syrup is expanding far more quickly than its conventional counterparts.

The Asia Pacific region is anticipated to experience the significant growth between 2024 and 2029.

The Asia Pacific region is experiencing significant growth in date syrup market, driven by combination of rising health awareness, high diabetes prevalence, and shifting consumer preferences toward natural sweeteners. In Southeast Asia and Western Pacific, diabetes rates are alarmingly high. The International Diabetes Federation reported that in 2021, about 90 million adults in Southeast Asia and 206 million in Western Pacific were living with diabetes. By 2030, these numbers are expected to rise to 113 million in Southeast Asia and 238 million in Western Pacific, with projections reaching 151 million and 260 million by 2045. This surge is further underscored by the staggering number of diabetes-related deaths, with 747,000 deaths in Southeast Asia and 2.3 million deaths in the Western Pacific in 2021.

As people become more and more health-conscious and look for alternatives to refined sugar, date syrup is gaining popularity due to its natural sweetness, rich nutrients, and lower glycemic index. The region's rapidly growing date syrup market is largely driven by the growing demand for sugar substitutes which promote better blood sugar control. This growth is anticipated to be sustained by the growing health and wellness trend, as consumers look for natural options that complement their dietary and lifestyle choices.

Key Market Players

- Al Barakah Dates Factory (UAE)

- Ariafoods (Iran)

- PARSUN DAY SYMBOL CO. (Iran)

- Rapunzel Naturkost (Germany)

- Al Foah (UAE)

- Lion Dates (India)

- RatinKhosh (Iran)

- Bateel International (UAE)

- Bombus Energy (Czech Republic)

- D’vash Organics (US)

- EZEEBEE OVERSEAS PVT LTD. (India)

- Arat Company Pjs (Iran)

- Minoo Industrial Group (Iran)

- Histon Sweet Spreads Limited (UK)

- Al Fakhra Date Company Ltd (Saudi Arabia)

- BIONA (UK)

- Noshid (Iran)

- Just Date (US)

- Date Lady (US)

- Nakheel Alya Dates Factory (Saudi Arabia)

- Sama Al Dar (UAE)

- Saanjh Dates Factory (India)

- Groovy Food Company Ltd (UK)

- GLOBAL FOODS (Spain)

- Crystal Dates Company (Iran)

These market players are focusing on increasing their presence through innovative product launches and partnerships. Most of these companies have a strong presence in Middle East region and are expanding to other growing regions such as North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In November 2024, Global Foods introduced Clear Date Syrup, a transparent, natural sweetener suitable for a wide range of industries, including beverages, breakfast foods, dairy, baked goods, and condiments. The syrup preserves the nutritional benefits of dates while offering a mild, balanced sweetness without altering product appearance. Its high solubility and neutral flavor enhance food manufacturing efficiency.

- In September 2021, The Groovy Food Company unveiled their new Organic Date Syrup, a natural, vegan, and low-fat sweetener made entirely of dates. It provides a more healthful option than syrups and refined sugars. With its low glycemic index and high fiber content, it appeals to health-conscious consumers. The launch expands the company’s plant-based offerings and strengthens its position in the growing natural sweetener market, catering to the rising demand for healthy alternatives like date syrup.

- In March 2021, D’vash Organics, a California-based vegan date syrup maker, signed a historic partnership with Al Barakah Dates Factory, the world’s largest date manufacturer, to create the first date-based super brand. This collaboration will enable the production of a wide range of products, from syrups to snacks.

- In March 2021, Al Barakah Dates Factory revealed plans to expand its Dubai Industrial City facility by building a 600,000 square foot solar-powered factory. The new facility will double its current capacity by processing more than 100,000 tonnes of dates annually. With 420,000 square feet dedicated to cold storage and processing, the expansion intends to meet the growing demand for date-based products and increase the company's market share in the global market for health ingredients, which includes the date syrup industry.

- In February 2021, Jomara, an FMCG brand owned by Bateel International, teamed up with Skyne to introduce a new date syrup (Dhibs) packaging design in the UAE and KSA markets. The launch introduced three new flavors—Vanilla, Passion Fruit, and Cardamom. The packaging, featuring a luxurious gold color and cultural patterns, aligns with Jomara’s premium image. This partnership has helped Jomara strengthen its brand identity and expand its presence in the growing date syrup market, appealing to both local and international consumers.

Frequently Asked Questions (FAQ):

What is the current size of the date syrup market?

The date syrup market is estimated at USD XX billion in 2024 and is projected to reach USD XX billion by 2029, at a CAGR of XX% from 2024 to 2029.

Which are the key players in the date syrup market, and how intense is the competition?

Key players in the date syrup market include Al Barakah Dates Factory (UAE), Ariafoods (Iran), PARSUN DAY SYMBOL CO. (Iran), Rapunzel Naturkost (Germany), Al Foah (UAE), Lion Dates (India), RatinKhosh (Iran), Bateel International (UAE), Bombus Energy (Czech Republic), and D’vash Organics (US). The competition in this market is highly intense, driven by ongoing investments in research and development (R&D), innovations in product formulations, partnerships, and advancements in sustainable production technologies.

Which region is expected to dominate the date syrup market?

The North America region is anticipated to hold the significant share of the date syrup market, primarily due to its growing demand for natural sweeteners driven by increasing health consciousness among consumers, along with strong retail infrastructure and a preference for clean-label, organic, and plant-based alternatives to traditional sugars.

What are the key factors driving the growth of the date syrup market?

The growth of the date syrup market is driven by several factors, including the increasing health consciousness and preference for low glycemic index products, growing demand for natural and organic sweeteners, and innovation in date syrup formulations, such as flavored and fortified options.

What kind of information is included in the company profiles section?

The company profiles section provides detailed insights into market-leading companies, including their business overviews, financial performance, product offerings, geographic presence, strategic initiatives, and recent innovations. This information helps in understanding the companies' strategies and competitive positioning in the market.

What role does sustainability play in the date syrup market?

Sustainability in the date syrup market focuses on environmentally responsible farming practices, such as water-efficient irrigation and organic farming, to reduce carbon footprints and improve soil health, while ensuring ethical labor practices and supporting fair trade initiatives in regions like the Middle East and North Africa, where date production is concentrated.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Date Syrup Market