DataOps Platform Market by Offering (Platform and Services), Type (Agile Development, DevOps, and Lean Manufacturing), Deployment Mode, Vertical (BFSI, Telecommunications, and Healthcare & Life Sciences) and Region - Global Forecast to 2028

DataOps Platform Market Growth

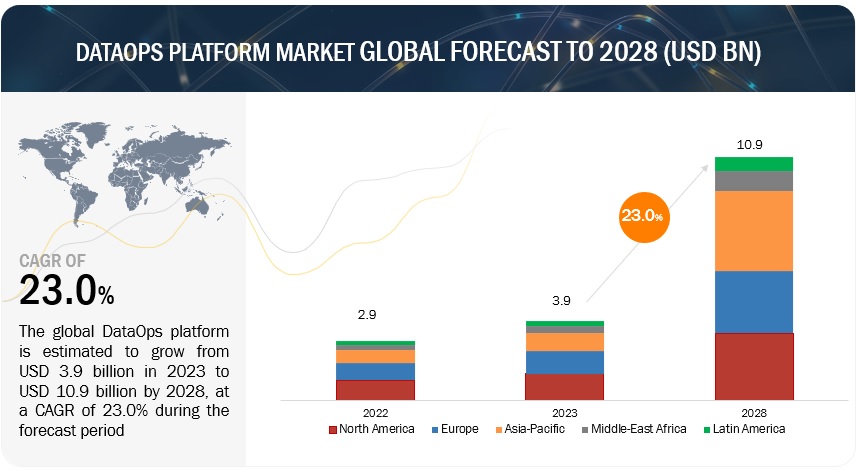

The global DataOps Platform Market size was surpassed $3.9 billion in 2023 and is poised to reach over $10.9 billion by the end of 2028, exhibiting a CAGR of 23.0% during forecast period 2023-2028.

DataOps is a holistic approach to data management that goes beyond technology and aims to combine agile methodologies, automation, and collaboration across data professionals to improve the quality, speed, and business value of data-related activities. DataOps platform is a transformational shift from traditional DevOps that aims to enhance communication, integration, and automation of data flow between data providers and data consumers.

DataOps Platform Market Technology Roadmap till 2030

DataOps platform market report covers technology roadmap till 2030, with insights around short-term, mid-term, and long-term developments.

Short-term roadmap (2023-2025)

- An increase in the adoption of DataOps platforms is expected across diverse industries and verticals.

- As more organizations migrate their data operations to the cloud, DataOps platforms are expected to incorporate cloud-native solutions.

- Automation and AI/ML will be the key focus areas for DataOps platform capabilities.

Mid-term roadmap (2026-2028)

- As organizations increasingly rely on real-time data for decision-making, DataOps platforms are expected to offer efficient real-time data processing and analytics.

- Emphasis on developing DataOps platform with automated data privacy and security management functionalities.

Long-term roadmap (2029-2030)

- As AI becomes prevalent across industries, AI governance will form a key enabler of DataOps platform adoption.

- With the rise of metaverse, the deployment of DataOps platform will enable efficient data processing and management in virtual environments.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

DataOps Platform Market Dynamics

Driver: Increased data complexity and accelerating data volumes

Organizations are dealing with ever-increasing data complexity, including large volumes of data from diverse sources, structured and unstructured data formats, and real-time data streams. Traditional data management approaches often struggle to keep up with the scale, velocity, and diversity of data, leading to inefficiencies, errors, and delays in data processing and analysis. DataOps platforms offer the necessary tools and technologies to handle this complexity and enable organizations to integrate, process, and analyse data efficiently. DataOps platforms can support batch processing as well as real-time data streaming data. These platforms are often integrated with big data technologies and cloud-based infrastructure to handle large-scale data processing. The volume of data being generated is growing exponentially, with the proliferation of digital technologies, IoT devices, social media, and other data sources. DataOps platforms provide scalable infrastructure and distributed computing capabilities that can handle massive data volumes and ensure optimal performance. Hence, organizations are turning to DataOps to gain better control over their data, improve data quality and governance, and enhance the efficiency and agility of their data operations.

Restraint: Data privacy and security concerns

Organizations are increasingly aware of the importance of protecting sensitive data and complying with data privacy regulations. DataOps platforms deal with sensitive and confidential data. Ensuring data privacy and compliance with regulations (such as GDPR or CCPA) and maintaining strong security measures can be a significant challenge. Organizations need to address these concerns and implement robust security frameworks. DataOps platforms rely on the integration of various tools and systems, which can increase the attack surface and potential vulnerabilities. Organizations may worry about the risk of data breaches and the potential impact on data privacy if the DataOps platform is not adequately secured.

Opportunity: Need to bridge gap between data engineers and data analysts

DataOps emerged also as a way to bridge the gap between data engineers and data analysts, who have different priorities and objectives. DataOps platforms foster collaboration and cross-functional alignment among different teams, including data engineers, data scientists, business analysts, and IT operations involved in data operations. DataOps platforms enable seamless collaboration, knowledge sharing, and consistent practices across teams, leading to improved productivity and outcomes by providing shared tools and workflows. Furthermore, DataOps platforms break down barriers between teams, encourage knowledge sharing, and enhance the overall effectiveness and efficiency of data operations by fostering collaboration and cross-functional alignment. This collaborative environment enables organizations to harness the collective expertise of their teams, drive innovation, and deliver high-quality data-driven insights.

Challenge: Need to mitigate the challenges of skilled talent shortage

One of the main challenges faced in the DataOps platform market is the scarcity of highly skilled professionals. DataOps platforms require individuals with extensive knowledge in data engineering, data science, software development, and operations. However, the industry is currently experiencing a significant shortage of professionals with these specific skills, resulting in a talent gap. Consequently, organizations are encountering difficulties in finding suitable candidates to build, implement, and sustain DataOps platforms. This shortage of skilled talent is further exacerbated by the rapid pace of technological advancements. Existing team members may need additional training or retraining to adapt to the DataOps approach. Additionally, the lack of skilled talent is not limited to data scientists and machine learning engineers alone. DataOps platforms also require individuals specializing in areas such as data management, data visualization, and cloud computing. It is essential for organizations to address these skill gaps through initiatives that encompass training, recruitment, and knowledge sharing. These efforts are crucial for ensuring the successful adoption and implementation of DataOps platforms.

By offering, platform segment to account for the largest market size during the forecast period

Based on offerings DataOps platform market has been segmented into platform and services. DataOps platform and services are designed to streamline data management and analysis processes, allowing organizations to make more informed decisions and improve operational efficiency period. The platform segment is estimated to account for a larger market size during the forecast period. The increasing amount of data organizations need to manage, process, and analyze offers key lucrative opportunities to the DataOps platform market.

By deployment, cloud to account for the largest market size during the forecast period

The DataOps platform market has been segmented based on deployment mode into cloud and on-premises. In the DataOps platform market, deployment mode plays a significant role in setting up the required IT infrastructure for managing the IT ecosystem. It can either be on-premises or in the cloud, depending on the specific needs of a business. The ability to have greater control over data location and accessibility across a network is driving the adoption of cloud deployment mode in the DataOps platform market.

By type, agile development segment to account for the largest market size during the forecast period

The DataOps platform market has been segmented based on type into Agile Development, DevOps, Lean Manufacturing. DataOps combines Agile development, DevOps, and lean manufacturing principles to streamline the development and operation of data analytics. Agile development is a core principle of the DataOps platform, which emphasizes the importance of flexibility and rapid response to changing business needs. The need to adapt quickly changing requirements and market conditions drives the demand for agile development in DataOps platform.

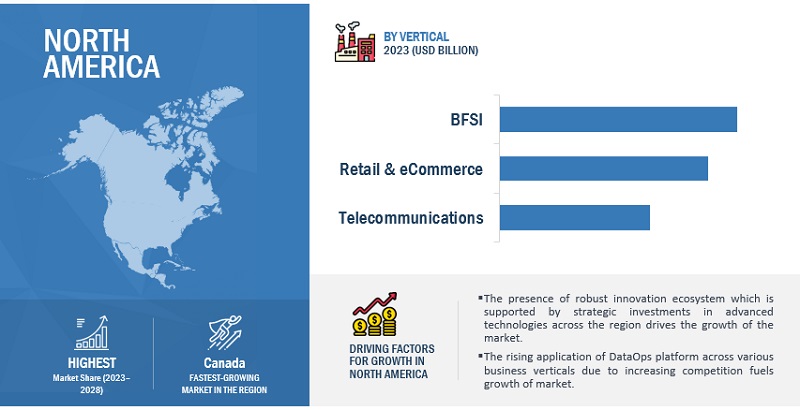

North America to account for the largest market size during the forecast period

North America has emerged as a frontrunner in adopting DataOps platforms, driven by its flourishing technology industry and a steadfast commitment to innovation and digital transformation. The region encompasses major countries such as the United States and Canada, with the United States leading the adoption of DataOps due to the presence of numerous world-renowned technology companies. The key driver behind the widespread adoption of DataOps platforms in North America lies in the region's unwavering emphasis on innovation and digital transformation. North American businesses are continuously seeking novel approaches to foster innovation and gain a competitive edge, recognizing the potent capabilities of DataOps platforms in managing and analyzing data to extract insights that drive growth and spur innovation. Additionally, the thriving technology industry in North America plays a pivotal role in propelling the adoption of DataOps platforms. With many global technology giants headquartered in the region, substantial investments are being made in data infrastructure and analytics capabilities, reinforcing the momentum of DataOps platforms, and enabling businesses to effectively harness the power of data.

Top DataOps Platform Market Companies

Key players operating in the DataOps platform market across the globe are Microsoft (US), IBM (US), Oracle (US), AWS (US), Informatica (US), Teradata (US), Wipro (India), Accenture (Ireland), SAS Institute (US), Hitachi Vantara (US), DataKitchen (US), Atlan (Singapore), Dataiku (US), Fosfor (India), Databricks (US), StreamSets (US), Talend (US), Collibra (US), Celonis (US), BMC Software (US), Saagie (France), Composable Analytics (US), Tengu.io (Belgium), Unravel Data (US), Monte Carlo Data (US), Census (US), RightData (US), Zaloni (US), Datafold (US), DataOps.live (UK), and K2view (Israel). These DataOps platform vendors have adopted various organic and inorganic strategies to sustain their positions and increase their market shares in the global market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Billion |

|

Segments covered |

Offering, Type, Deployment Mode, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), IBM (US), Oracle (US), AWS (US), Informatica (US), Teradata (US), Wipro (India), Accenture (Ireland), SAS Institute (US), Hitachi Vantara (US), DataKitchen (US), Atlan (Singapore), Dataiku (US), Fosfor (India), Databricks (US), StreamSets (US), Talend (US), Collibra (US), Celonis (US), BMC Software (US), Saagie (France), Composable Analytics (US), Tengu.io (Belgium), Unravel Data (US), Monte Carlo Data (US), Census (US), RightData (US), Zaloni (US), Datafold (US), DataOps.live (UK), K2view (Israel). |

This research report categorizes the DataOps platform market based on offering, type, deployment mode, vertical, and region.

By Component:

-

Platform

- Data Integration

- Data Quality

- Data Governance

- Master Data Management

- Data Analytics

- Automation

- Collaboration

- Data Visualization

- Others

-

Services

- Consulting Services

- Deployment & integration

- Training, support & maintenance services

By Type:

- Agile Development

- DevOps

- Lean Manufacturing

By Deployment Mode:

-

Cloud

- Public

- Private

- Hybrid

- On-premises

By Vertical:

- BFSI

- Healthcare & life sciences

- Retail & eCommerce

- Manufacturing

- Government and Defense

- Telecommunications

- Transportation, and Logistics

- IT & ITeS

- Media and Entertainment

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- ASEAN

- Australia and New Zealand

- India

- South Korea

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In April 2023, DataOps.live partnered with AWS and joined the AWS Partner Network on the Software Path and obtained the AWS Qualified Software Certification after successfully completing the AWS Foundational Technical Review.

- In March 2023, Blechwarenfabrik Limburg GmbH collaborated with Hitachi Vantara and adopted its Lumada DataOps Platform which includes Pentaho, to achieve real-time, standardized, integrated data analysis for increased sustainability and accelerated production.

- In February 2023, Informatica announced the launch of Cloud Data Integration-Free and PayGo, which is the only free cloud data loading, integration, and ETL/ELT service. This new service targets data practitioners and non-technical users such as in marketing, sales, and revenue operations teams to build data pipelines within minutes.

- In November 2022, Wipro had announced the launch of Data Intelligence Suite speeding up the cloud modernization and data monetization, focused on modernizing data estates, including data stores, pipelines, and visualizations, running on Amazon Web Services. It also provides a dependable and safe way to migrate from existing platforms and fragmented legacy systems to the cloud.

- In June 2022, Teradata announced the general availability and integration of the Teradata Vantage multi-cloud data and analytics platform with Amazon SageMaker. It enables organizations to widely employ advanced analytics to fully leverage their data.

Frequently Asked Questions (FAQ):

What is DataOps platform?

DataOps is a set of practices and technologies that operationalize data management and integration to ensure resiliency and agility in the face of constant change. It helps you tease order and discipline out of the chaos and solve the big challenges to turning data into business value.

DataOps platforms act as command centers for DataOps. These solutions orchestrate people, processes, and technology to deliver a trusted data pipeline to their users. DataOps platforms assemble several types of data management software into an individual and integrated environment.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Spain, and Italy in the European region.

Which are key verticals adopting DataOps platform and services?

Key verticals adopting DataOps platform and services include BFSI, retail and ecommerce, telecommunications, manufacturing, healthcare & life sciences, government & defense, IT/ITeS, transportations & logistics, media & entertainment, and other varticals.

Which are the key drivers supporting the market growth for DataOps platform?

The key drivers supporting the market growth for DataOps platform include increased data complexity and volumes, rise in need to gain real-time insights, increased demand for cloud solutions, and extensive focus on data-driven insights.

Who are the key vendors in the market for DataOps platform?

The key vendors operating in the DataOps platform market across the globe are Microsoft (US), IBM (US), Oracle (US), AWS (US), Informatica (US), Teradata (US), Wipro (India), Accenture (Ireland), SAS Institute (US), Hitachi Vantara (US), DataKitchen (US), Atlan (Singapore), Dataiku (US), Fosfor (India), Databricks (US), StreamSets (US), Talend (US), Collibra (US), Celonis (US), BMC Software (US), Saagie (France), Composable Analytics (US), Tengu.io (Belgium), Unravel Data (US), Monte Carlo Data (US), Census (US), RightData (US), Zaloni (US), Datafold (US), DataOps.live (UK), and K2view (Israel).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased data complexity and data volume- Rise in need to gain real-time insights- Increased demand for cloud solutions- Extensive focus on data-driven insightsRESTRAINTS- Data privacy and security concerns- Budget constraints due to high investmentOPPORTUNITIES- Need to bridge gap between data engineers and data analysts- Need for data teams to keep pace with rapidly changing requirementsCHALLENGES- Lack of awareness and understanding of DataOps- Shortage of skilled talent

-

5.3 CASE STUDY ANALYSISHEALTHCARE AND LIFE SCIENCES- Large pharmaceutical business selected DataKitchen to offer timely analytical insights- Roche Diagnostic used DataOps.live platform to become a more agile data-driven businessBFSI- StreamSets enabled Aon to hold its position as a leader in the financial services sector- Fannie Mae selected Hitachi Vantara to deliver game-changing value to their businessRETAIL AND ECOMMERCE- Unravel Data enabled 84.51° to enhance operational efficiencyTELECOM- DataOps.live enables OneWeb to deliver great service through complete visibility of operationsMANUFACTURING- Clarios leverages Spectra and Snowflake to create next-gen data and analytics ecosystem- Hitachi Vantara helped metals industry manufacturers reduce equipment downtimeEDUCATION- Ad Astra selected StreamSets to tackle their data ingestion challenges

- 5.4 BRIEF HISTORY OF DATAOPS PLATFORMS

-

5.5 DATAOPS PLATFORM MARKET: ECOSYSTEM

- 5.6 DATAOPS PLATFORM ARCHITECTURE

-

5.7 DATAOPS PROCESS STRUCTUREDATA ANALYTICS PIPELINESCI/CD FOR DATA OPERATIONS

- 5.8 SUPPLY CHAIN ANALYSIS

- 5.9 PRICING MODEL ANALYSIS

-

5.10 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

-

5.11 TECHNOLOGY ANALYSISRELATED TECHNOLOGY- Artificial intelligence- Machine learning- Big dataALLIED TECHNOLOGY- DevOps- IoT

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY CONFERENCES & EVENTS

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS, BY REGION- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaREGULATORY IMPLICATIONS AND INDUSTRY STANDARDS- General Data Protection Regulation- Securities and Exchange Commission Rule 17a-4- International Organization for Standardization/International Electrotechnical Commission 27001- System and Organization Controls 2 Type II Compliance- Financial Industry Regulatory Authority- Freedom of Information Act- Health Insurance Portability and Accountability Act

-

5.15 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.16 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN DATAOPS PLATFORM MARKET

- 5.17 TECHNOLOGY ROADMAP OF DATAOPS PLATFORM

-

5.18 BUSINESS MODEL OF DATAOPS PLATFORMAPI-BASEDCLOUD-BASED

- 5.19 KEY DIFFERENCES BETWEEN DATAOPS AND DEVOPS

-

5.20 FEATURES OF A DATAOPS PLATFORMDATA PIPELINE ORCHESTRATIONTESTING AND PRODUCTION QUALITYDEPLOYMENT AUTOMATIONDATA SCIENCE MODEL DEPLOYMENT/SANDBOX MANAGEMENT

-

5.21 BEST PRACTICES FOR DATAOPS PLATFORM MARKETCATALOG DATA ASSETS AND PIPELINEAPPLY DATA GOVERNANCE FRAMEWORKMONITOR, DOCUMENT, AND REMEDIATE DATA QUALITYAUTOMATE DATA SOURCE AND PIPELINE DEPLOYMENTMONITOR AND OPTIMIZE DATA SOURCE AND PIPELINE PERFORMANCE

-

6.1 INTRODUCTIONOFFERING: DATAOPS PLATFORM MARKET DRIVERS

-

6.2 PLATFORMDATA INTEGRATION- Ability to offer unified view of data and extract meaningful insights to drive demandDATA QUALITY- Data quality features that help streamline data management processes to drive growthDATA GOVERNANCE- Implementation of data governance to maintain data quality and security to spur adoptionMASTER DATA MANAGEMENT- Incorporation of master data management capabilities to ensure data accuracy and enhance data agility to boost growthDATA ANALYTICS- Implementation of data analytics to make more strategically guided decisions to propel demandAUTOMATION- Automation of repetitive and time-consuming tasks to reduce risk of errors to boost demandCOLLABORATION- Use of collaboration features to optimize DataOps processes to spur demandDATA VISUALIZATION- Ability to drill down into specific data points and offer more detailed view of data to fuel adoptionOTHERS- Extensive use in gaining complete view of journey of data from source to destination to propel demand

-

6.3 SERVICESPROFESSIONAL SERVICES- Consulting services- Deployment & integration- Training, support, & maintenanceMANAGED SERVICES- Ability to ensure system availability and minimize downtime to propel demand

-

7.1 INTRODUCTIONTYPE: DATAOPS PLATFORM MARKET DRIVERS

-

7.2 AGILE DEVELOPMENTNEED TO OFFER EFFICIENT WORKFLOWS AND FASTER TIME-TO-MARKET FOR DATA ANALYTICS TO DRIVE GROWTH

-

7.3 DEVOPSUSE IN EFFICIENT DATAOPS PLATFORM DEVELOPMENT AND DELIVERY TO DRIVE DEMAND

-

7.4 LEAN MANUFACTURINGABILITY TO ELIMINATE INEFFICIENCIES AND STREAMLINE DATA WORKFLOWS TO BOOST ADOPTION

-

8.1 INTRODUCTIONDEPLOYMENT MODE: DATAOPS PLATFORM MARKET DRIVERS

-

8.2 CLOUDPUBLIC CLOUD- Ability to eliminate expensive resources to drive demandPRIVATE CLOUD- Ability to ensure compliance with data privacy regulations to support demandHYBRID CLOUD- Ability to maintain control over critical data to propel demand

-

8.3 ON-PREMISESBENEFITS SUCH AS HIGH PERFORMANCE AND GREATER CONTROL TO BOOST ADOPTION

-

9.1 INTRODUCTIONVERTICAL: DATAOPS PLATFORM MARKET DRIVERS

-

9.2 BFSIFINANCIAL DATA OPTIMIZATION- Increased need to optimize data management and analytics capabilities to drive demandFRAUDULENT TRANSACTIONS IDENTIFICATION- Rise in volume of financial transactions to spur adoptionCREDIT SCORING- Increased demand for fast and accurate credit decisions to boost demandINVESTMENT ANALYSIS- Ability to offer wide range of tools and services to analyze large volume of data to drive demandOTHER BFSI APPLICATIONS- Need to comply with regulations to protect financial stability of organizations to drive demand

-

9.3 HEALTHCARE & LIFE SCIENCESCLINICAL TRIAL MANAGEMENT- Efficient clinical trial management to propel adoptionELECTRONIC HEALTH RECORD- Ability to gain insights from patient data to drive demandPRECISION MEDICINE- Ability to process large-scale data sets to drive adoptionDRUG DISCOVERY- Accelerated drug discovery through use of advanced technologies to fuel demandOTHER HEALTHCARE & LIFE SCIENCES APPLICATIONS- Analyzing large volumes of data from patient populations to identify patterns in patient health to propel demand

-

9.4 RETAIL & ECOMMERCEPRICING OPTIMIZATION- Use in identifying anomalies and irregularities to optimize pricing to drive adoptionPERSONALIZED PRODUCT RECOMMENDATION- Ability to process data from various sources in real-time for personalized product recommendations to propel demandINVENTORY MANAGEMENT- Ability to offer real-time visibility into inventory levels to fuel adoptionDEMAND FORECASTING- Use in analyzing historical sales data and external factors to accurately forecast demand to drive demandOTHER RETAIL & ECOMMERCE APPLICATIONS- Ability to proactively address return-related challenges and optimize operations to drive demand

-

9.5 MANUFACTURINGPREDICTIVE MAINTENANCE- Use in identifying potential issues to avoid equipment downtime to spur adoptionSUPPLY CHAIN OPTIMIZATION- Need to adopt data-driven strategies to effectively manage supply chains to propel demandPRODUCT QUALITY CONTROL- Ability to gain real-time insights into manufacturing processes to identify quality issues to fuel adoptionPRODUCT PLANNING AND SCHEDULING- Leveraging advanced analytics and automation to optimize production schedules to drive demandOTHER MANUFACTURING APPLICATIONS- Wide range of capabilities to enhance asset tracking and supplier management to boost adoption

-

9.6 GOVERNMENT & DEFENSEPUBLIC SAFETY- Efficiently identifying and responding to potential threats to drive demandINTELLIGENCE GATHERING AND ANALYSIS- Increased demand to share intelligence data across multiple agencies to propel demandEMERGENCY RESPONSE- Ability to offer quick decision-making during emergencies to spur demandGEOSPATIAL ANALYSIS- Use of advance analytics tools to efficiently analyze large volumes to propel adoptionOTHER GOVERNMENT & DEFENSE APPLICATIONS- Implementation in processing large volumes of data in real-time to respond to security breaches to drive demand

-

9.7 TELECOMMUNICATIONSNETWORK SECURITY- Enhancing network security by providing real-time monitoring and management of network resources to drive demandNETWORK PERFORMANCE- Automation of routine tasks to manage network performance to boost adoptionREAL-TIME ANALYTICS- Use of real-time analytics for quick response to network outages to propel adoptionNETWORK CAPACITY PLANNING- Collecting real-time data to make informed decisions to manage network capacity to boost adoptionOTHER TELECOMMUNICATIONS APPLICATIONS- Optimization of service delivery and call delivery to enhance customer satisfaction to fuel adoption

-

9.8 TRANSPORTATION & LOGISTICSROUTE OPTIMIZATION- Gathering real-time data on traffic conditions to create more accurate routes to boost adoptionREAL-TIME TRACKING- Ability to respond quickly to traffic congestion to drive adoptionFLEET MANAGEMENT- Increased need to optimize fleet management operations to enhance customer satisfaction to drive adoptionOTHER TRANSPORTATION & LOGISTICS APPLICATIONS- Ability to improve overall safety for both drivers and the public to spur demand

-

9.9 IT/ITESSOFTWARE DEVELOPMENT- Need to boost development process while ensuring higher accuracy and quality of code to drive adoptionIT INFRASTRUCTURE MANAGEMENT- Need for real-time visibility into the performance of IT systems to optimize IT resources to boost adoptionAPPLICATION PERFORMANCE MANAGEMENT- Ability to optimize the performance of applications to propel demandINCIDENT MANAGEMENT- Increased need to respond quickly and effectively to incidents to drive demandOTHER IT/ITES APPLICATIONS- Ability to streamline DevOps processes and enhance security posture to fuel adoption

-

9.10 MEDIA & ENTERTAINMENTCONTENT RECOMMENDATION- Rise in demand for analyzing user data to predict viewer preferences and recommend content to boost adoptionAD TARGETING- Use in analyzing massive volumes of data in real-time to adjust ad targeting strategies to propel demandCONTENT OPTIMIZATION- Leveraging power of data to optimize content for specific channels to drive demandAUDIENCE SEGMENTATION- Use in processing large amounts of data to personalize content to fuel adoptionOTHER MEDIA & ENTERTAINMENT APPLICATIONS- Use in analyzing data on audience engagement to optimize content distribution strategies to drive demand

-

9.11 OTHER VERTICALSLEVERAGING THE POWER OF DATA AND ANALYTICS TO STREAMLINE OPERATIONS AND IMPROVE SERVICES TO SPUR DEMAND

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: DATAOPS PLATFORM MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Increased emphasis on data-driven decision-making to fuel growth of marketCANADA- Rise in need to gain valuable insights to enhance operational efficiency to propel market growth

-

10.3 EUROPEEUROPE: DATAOPS PLATFORM MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Rise in volume of data generated in companies across several verticals to spur market growthGERMANY- Increased need to manage data effectively to fuel market growthFRANCE- Increased application across several business verticals to drive market growthITALY- Presence of supportive business ecosystem to drive market growthSPAIN- Rise in investments in technology and favorable government policies to propel market growthREST OF EUROPE- Rise in need to analyze large volumes of data generated to spur market growth

-

10.4 ASIA PACIFICASIA PACIFIC: DATAOPS PLATFORM MARKET DRIVERSASIA PACIFIC: IMPACT OF RECESSIONINDIA- Rise in adoption of advanced technologies for automated approach to data management to fuel market growthJAPAN- Increased demand to improve efficiency and agility of data operations to propel market growthCHINA- Increased willingness to foster technological developments and provide policy support to propel market growthAUSTRALIA AND NEW ZEALAND- Rise in need to gain competitive advantage through data-driven insights to propel market growthSOUTH KOREA- Increased focus on innovation and adoption of advanced technologies to drive market growthASEAN- Increased use in automating data analytics processes to speed up decision-making process to propel market growthREST OF ASIA PACIFIC- Rise in competition from global players to drive market growth

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET DRIVERSMIDDLE EAST & AFRICA: IMPACT OF RECESSIONSAUDI ARABIA- Initiatives taken by government to support digital technologies to propel market growthUAE- Rise in awareness of advanced data analytics capabilities to drive adoptionSOUTH AFRICA- Rise in demand for data assets to gain competitive advantage to boost adoptionISRAEL- Extracting valuable insights from extensive data sets to drive adoptionREST OF MIDDLE EAST & AFRICA- Increased investments in infrastructure to support digital transformation and support market growth

-

10.6 LATIN AMERICALATIN AMERICA: DATAOPS PLATFORM MARKET DRIVERSLATIN AMERICA: IMPACT OF RECESSIONBRAZIL- Rise in need for effective data management and analysis to drive marketMEXICO- Increased demand for real-time insights and streamlined workflows to fuel market growthARGENTINA- Rise in need for businesses to manage and analyze data effectively to boost market growthREST OF LATIN AMERICA- Increased adoption of cutting-edge technologies to stay competitive in market to boost demand

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.3 REVENUE ANALYSISHISTORICAL REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

11.6 STARTUPS/SMES EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSSTARTUPS/SMES COMPETITIVE BENCHMARKING

- 11.7 DATAOPS PLATFORM PRODUCT LANDSCAPE

-

11.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

- 11.9 VALUATION AND FINANCIAL METRICS OF KEY DATAOPS PLATFORM VENDORS

- 11.10 YEAR TO-DATE (YTD) PRICE TOTAL RETURN AND STOCK BETA OF KEY DATAOPS PLATFORM VENDORS

- 12.1 INTRODUCTION

-

12.2 MAJOR PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINFORMATICA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTERADATA- Business overview- Products/Solutions/Services offered- Recent developmentsWIPRO- Business overview- Products/Solutions/Services offered- Recent developmentsACCENTURE- Business overview- Products/Solutions/Services offered- Recent developmentsSAS INSTITUTE- Business overview- Products/Solutions/Services offered- Recent developmentsHITACHI VANTARA- Business overview- Products/Solutions/Services offered- Recent developmentsDATAKITCHEN- Business overview- Products/Solutions/Services Offered- Recent developmentsATLAN- Business overview- Products/Solutions/Services offered- Recent developmentsDATAIKU- Business overview- Products/Solutions/Services offered- Recent developmentsFOSFOR- Business overview- Products/Solutions/Services offered- Recent developmentsDATABRICKS- Business overview- Products/Solutions/Services offered- Recent developments

-

12.3 OTHER PLAYERSBMC SOFTWARE- Business overview- Products/Solutions/Services offered- Recent developmentsSTREAMSETS- Business overview- Products/Solutions/Services offered- Recent developmentsTALEND- Business overview- Products/Solutions/Services offered- Recent developmentsCOLLIBRA- Business overview- Products/Solutions/Services offered- Recent developmentsCELONISSAAGIECOMPOSABLE ANALYTICSTENGU.IOUNRAVEL DATAMONTE CARLO DATACENSUSRIGHTDATAZALONIDATAFOLDDATAOPS.LIVEK2VIEW

- 13.1 INTRODUCTION

-

13.2 ADVANCED ANALYTICS MARKET—GLOBAL FORECAST TO 2026MARKET DEFINITIONMARKET OVERVIEWADVANCED ANALYTICS MARKET, BY COMPONENTADVANCED ANALYTICS MARKET, BY BUSINESS FUNCTIONADVANCED ANALYTICS MARKET, BY TYPEADVANCED ANALYTICS MARKET, BY DEPLOYMENT MODEADVANCED ANALYTICS MARKET, BY ORGANIZATION SIZEADVANCED ANALYTICS MARKET, BY VERTICALADVANCED ANALYTICS MARKET, BY REGION

-

13.3 DATA CATALOG MARKET—GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEWDATA CATALOG MARKET, BY COMPONENTDATA CATALOG MARKET, BY SERVICEDATA CATALOG MARKET, BY DEPLOYMENT MODEDATA CATALOG MARKET, BY DATA CONSUMERDATA CATALOG MARKET, BY METADATA TYPEDATA CATALOG MARKET, BY ORGANIZATION SIZEDATA CATALOG MARKET, BY VERTICALDATA CATALOG MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATIONS OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2022

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 IMPACT OF RECESSION ON THE GLOBAL DATAOPS PLATFORM MARKET

- TABLE 5 GLOBAL DATAOPS PLATFORM MARKET SIZE AND GROWTH RATE, 2019–2022 (USD MILLION, Y-O-Y %)

- TABLE 6 GLOBAL DATAOPS PLATFORM MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 7 DATAOPS PLATFORM MARKET: CLOUD PROVIDERS

- TABLE 8 DATAOPS PLATFORM MARKET: PLATFORM PROVIDERS

- TABLE 9 DATAOPS PLATFORM MARKET: SERVICE PROVIDERS

- TABLE 10 DATAOPS PLATFORM MARKET: REGULATORY BODIES

- TABLE 11 AVERAGE SELLING PRICE ANALYSIS, 2023

- TABLE 12 PATENTS FILED, 2013–2023

- TABLE 13 TOP 12 PATENT OWNERS IN THE DATAOPS PLATFORM MARKET, 2013–2023

- TABLE 14 LIST OF PATENTS IN DATAOPS PLATFORM MARKET, 2021–2023

- TABLE 15 PORTER’S FIVE FORCES ANALYSIS

- TABLE 16 DATAOPS PLATFORM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 23 SHORT-TERM ROADMAP, 2023–2025

- TABLE 24 MID-TERM ROADMAP, 2026–2028

- TABLE 25 LONG-TERM ROADMAP, 2029–2030

- TABLE 26 DATAOPS PLATFORM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 27 DATAOPS PLATFORM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 28 PLATFORM: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 PLATFORM: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 SERVICES: DATAOPS PLATFORM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 31 SERVICES: DATAOPS PLATFORM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 32 SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 PROFESSIONAL SERVICES: DATAOPS PLATFORM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 35 PROFESSIONAL SERVICES: DATAOPS PLATFORM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 36 PROFESSIONAL SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 PROFESSIONAL SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 CONSULTING SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 CONSULTING SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 DEPLOYMENT & INTEGRATION: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 DEPLOYMENT & INTEGRATION: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 TRAINING, SUPPORT, & MAINTENANCE: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 TRAINING, SUPPORT, & MAINTENANCE: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 MANAGED SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 MANAGED SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 DATAOPS PLATFORM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 47 DATAOPS PLATFORM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 48 AGILE DEVELOPMENT: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 AGILE DEVELOPMENT: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 DEVOPS: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 DEVOPS: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 LEAN MANUFACTURING DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 LEAN MANUFACTURING: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 55 DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 56 CLOUD: DATAOPS PLATFORM MARKET, BY TYPE 2019–2022 (USD MILLION)

- TABLE 57 CLOUD: DATAOPS PLATFORM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 58 CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 PUBLIC CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 PUBLIC CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 PRIVATE CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 PRIVATE CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 HYBRID CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 HYBRID CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 ON-PREMISES: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 ON-PREMISES: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 DATAOPS PLATFORM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 69 DATAOPS PLATFORM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 70 BFSI: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 BFSI: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 HEALTHCARE & LIFE SCIENCES: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 HEALTHCARE & LIFE SCIENCES: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 RETAIL & ECOMMERCE: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 RETAIL & ECOMMERCE: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 MANUFACTURING: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 MANUFACTURING: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 GOVERNMENT & DEFENSE: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 GOVERNMENT & DEFENSE: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 TELECOMMUNICATIONS: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 TELECOMMUNICATIONS: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 TRANSPORTATION & LOGISTICS: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 TRANSPORTATION &LOGISTICS: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 IT/ITES: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 IT/ITES: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 MEDIA & ENTERTAINMENT: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 MEDIA & ENTERTAINMENT: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 OTHER VERTICALS: DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 OTHER VERTICALS: DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 DATAOPS PLATFORM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 91 DATAOPS PLATFORM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2019–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2019–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2019–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2023–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 108 EUROPE: DATAOPS PLATFORM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 109 EUROPE: DATAOPS PLATFORM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: DATAOPS PLATFORM MARKET, BY SERVICES, 2019–2022 (USD MILLION)

- TABLE 111 EUROPE: DATAOPS PLATFORM MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 112 EUROPE: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2019–2022 (USD MILLION)

- TABLE 113 EUROPE: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 114 EUROPE: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 115 EUROPE: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 116 EUROPE: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2019–2022 (USD MILLION)

- TABLE 117 EUROPE: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2023–2028 (USD MILLION)

- TABLE 118 EUROPE: DATAOPS PLATFORM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 119 EUROPE: DATAOPS PLATFORM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 120 EUROPE: DATAOPS PLATFORM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 121 EUROPE: DATAOPS PLATFORM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 122 EUROPE: DATAOPS PLATFORM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 123 EUROPE: DATAOPS PLATFORM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY SERVICES, 2019–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2019–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2019–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2019–2022 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2019–2022 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2019–2022 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2023–2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 156 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 157 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2019–2022 (USD MILLION)

- TABLE 159 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2019–2022 (USD MILLION)

- TABLE 161 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 163 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 164 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2019–2022 (USD MILLION)

- TABLE 165 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2023–2028 (USD MILLION)

- TABLE 166 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 167 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 168 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 169 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 170 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 171 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 172 OVERVIEW OF STRATEGIES ADOPTED BY KEY DATAOPS PLATFORM VENDORS

- TABLE 173 DATAOPS PLATFORM MARKET: DEGREE OF COMPETITION

- TABLE 174 DATAOPS PLATFORM MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- TABLE 175 DATAOPS PLATFORM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 176 DATAOPS PLATFORM MARKET: PRODUCT FOOTPRINT ANALYSIS OF STARTUPS/SMES, 2023

- TABLE 177 COMPARATIVE ANALYSIS OF DATA INTEGRATION PRODUCTS

- TABLE 178 COMPARATIVE ANALYSIS OF DATA PREPARATION PRODUCTS

- TABLE 179 COMPARATIVE ANALYSIS OF DATA CATALOG PRODUCTS

- TABLE 180 SERVICE/PRODUCT LAUNCHES AND ENHANCEMENTS, 2019–2023

- TABLE 181 DEALS, 2019–2023

- TABLE 182 IBM: BUSINESS OVERVIEW

- TABLE 183 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 185 IBM: DEALS

- TABLE 186 MICROSOFT: BUSINESS OVERVIEW

- TABLE 187 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 189 MICROSOFT: DEALS

- TABLE 190 ORACLE: BUSINESS OVERVIEW

- TABLE 191 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 ORACLE: DEALS

- TABLE 193 AWS: BUSINESS OVERVIEW

- TABLE 194 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 196 AWS: DEALS

- TABLE 197 INFORMATICA: BUSINESS OVERVIEW

- TABLE 198 INFORMATICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 INFORMATICA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 200 INFORMATICA: DEALS

- TABLE 201 INFORMATICA: OTHERS

- TABLE 202 TERADATA: BUSINESS OVERVIEW

- TABLE 203 TERADATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 TERADATA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 205 TERADATA: DEALS

- TABLE 206 TERADATA: OTHERS

- TABLE 207 WIPRO: BUSINESS OVERVIEW

- TABLE 208 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 WIPRO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 210 WIPRO: DEALS

- TABLE 211 ACCENTURE: BUSINESS OVERVIEW

- TABLE 212 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 ACCENTURE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 214 ACCENTURE: DEALS

- TABLE 215 SAS INSTITUTE: BUSINESS OVERVIEW

- TABLE 216 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 SAS INSTITUTE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 218 SAS INSTITUTE: DEALS

- TABLE 219 HITACHI VANTARA: BUSINESS OVERVIEW

- TABLE 220 HITACHI VANTARA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 HITACHI VANTARA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 222 HITACHI VANTARA: DEALS

- TABLE 223 DATAKITCHEN: BUSINESS OVERVIEW

- TABLE 224 DATAKITCHEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 DATAKITCHEN: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 226 ATLAN: BUSINESS OVERVIEW

- TABLE 227 ATLAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 ATLAN: DEALS

- TABLE 229 DATAIKU: BUSINESS OVERVIEW

- TABLE 230 DATAIKU: PRODUCTS/SOLUTION/SERVICES OFFERED

- TABLE 231 DATAIKU: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 232 DATAIKU: DEALS

- TABLE 233 DATAIKU: OTHERS

- TABLE 234 FOSFOR: BUSINESS OVERVIEW

- TABLE 235 FOSFOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 FOSFOR: DEALS

- TABLE 237 DATABRICKS: BUSINESS OVERVIEW

- TABLE 238 DATABRICKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 DATABRICKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 240 DATABRICKS: DEALS

- TABLE 241 DATABRICKS: OTHERS

- TABLE 242 BMC SOFTWARE: BUSINESS OVERVIEW

- TABLE 243 BMC SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 BMC SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 245 BMC SOFTWARE: DEALS

- TABLE 246 STREAMSETS: BUSINESS OVERVIEW

- TABLE 247 STREAMSETS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 STREAMSETS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 249 STREAMSETS: DEALS

- TABLE 250 TALEND: BUSINESS OVERVIEW

- TABLE 251 TALEND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 TALEND: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 253 TALEND: DEALS

- TABLE 254 COLLIBRA: BUSINESS OVERVIEW

- TABLE 255 COLLIBRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 COLLIBRA: PRODUCT LAUNCHES

- TABLE 257 COLLIBRA: DEALS

- TABLE 258 COLLIBRA: OTHERS

- TABLE 259 ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

- TABLE 260 ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 261 ADVANCED ANALYTICS MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

- TABLE 262 ADVANCED ANALYTICS MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

- TABLE 263 ADVANCED ANALYTICS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 264 ADVANCED ANALYTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 265 ADVANCED ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

- TABLE 266 ADVANCED ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 267 ADVANCED ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

- TABLE 268 ADVANCED ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 269 ADVANCED ANALYTICS MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

- TABLE 270 ADVANCED ANALYTICS MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 271 ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 272 ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

- TABLE 273 DATA CATALOG MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 274 DATA CATALOG MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 275 SERVICES: DATA CATALOG MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 276 SERVICES: DATA CATALOG MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 277 DATA CATALOG MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

- TABLE 278 DATA CATALOG MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 279 DATA CATALOG MARKET, BY DATA CONSUMER, 2017–2021 (USD MILLION)

- TABLE 280 DATA CATALOG MARKET, BY DATA CONSUMER, 2022–2027 (USD MILLION)

- TABLE 281 DATA CATALOG MARKET, BY METADATA TYPE, 2017–2021 (USD MILLION)

- TABLE 282 DATA CATALOG MARKET, BY METADATA TYPE, 2022–2027 (USD MILLION)

- TABLE 283 DATA CATALOG MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 284 DATA CATALOG MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 285 DATA CATALOG MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 286 DATA CATALOG MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 287 DATA CATALOG MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 288 DATA CATALOG MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 DATAOPS PLATFORM MARKET: RESEARCH DESIGN

- FIGURE 2 DATAOPS PLATFORM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 3 APPROACH 1 (SUPPLY SIDE): REVENUE FROM OFFERINGS OF DATAOPS PLATFORM MARKET

- FIGURE 4 APPROACH 2—BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM OFFERINGS OF DATAOPS PLATFORM PLAYERS

- FIGURE 5 APPROACH 3—BOTTOM-UP (SUPPLY SIDE): REVENUE AND SUBSEQUENT MARKET ESTIMATION FROM OFFERINGS OF DATAOPS PLATFORMS

- FIGURE 6 APPROACH 4—BOTTOM-UP (DEMAND SIDE): SHARE OF DATAOPS PLATFORM OFFERINGS THROUGH OVERALL DATAOPS PLATFORM SPENDING

- FIGURE 7 PLATFORM SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 8 PROFESSIONAL SERVICES TO BE LARGEST SERVICES SEGMENT IN 2023

- FIGURE 9 CONSULTING SERVICES TO BE LARGEST PROFESSIONAL SERVICES SEGMENT IN MARKET IN 2023

- FIGURE 10 CLOUD SEGMENT TO DOMINATE DATAOPS PLATFORM MARKET IN 2023

- FIGURE 11 PUBLIC CLOUD ESTIMATED TO BE LARGEST SEGMENT IN 2023

- FIGURE 12 AGILE DEVELOPMENT ESTIMATED TO BE LARGEST TYPE SEGMENT IN 2023

- FIGURE 13 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 RISING NEED TO GAIN REAL-TIME INSIGHTS FROM DATA TO DRIVE MARKET GROWTH

- FIGURE 16 AGILE DEVELOPMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 PLATFORM SEGMENT AND BFSI SEGMENT TO HOLD LARGEST MARKET SHARES IN NORTH AMERICA IN 2023

- FIGURE 18 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2023

- FIGURE 19 DATAOPS PLATFORM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 DATAOPS PLATFORM ECOSYSTEM

- FIGURE 21 DATAOPS PLATFORM ARCHITECTURE

- FIGURE 22 DATAOPS PROCESS STRUCTURE

- FIGURE 23 SUPPLY CHAIN ANALYSIS: DATAOPS PLATFORM MARKET

- FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 25 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS, 2013–2023

- FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013–2023

- FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 30 DATAOPS PLATFORM MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 31 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 TRAINING, SUPPORT, & MAINTENANCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 AGILE DEVELOPMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 HEALTHCARE & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 40 HISTORICAL REVENUE ANALYSIS OF TOP PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 41 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2022

- FIGURE 42 KEY DATAOPS PLATFORM MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- FIGURE 43 STARTUPS/SMES DATAOPS PLATFORM PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- FIGURE 44 VALUATION AND FINANCIAL METRICS OF KEY DATAOPS PLATFORM VENDORS

- FIGURE 45 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY DATAOPS PLATFORM VENDORS

- FIGURE 46 IBM: COMPANY SNAPSHOT

- FIGURE 47 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 48 ORACLE: COMPANY SNAPSHOT

- FIGURE 49 AWS: COMPANY SNAPSHOT

- FIGURE 50 INFORMATICA: COMPANY SNAPSHOT

- FIGURE 51 TERADATA: COMPANY SNAPSHOT

- FIGURE 52 WIPRO: COMPANY SNAPSHOT

- FIGURE 53 ACCENTURE: COMPANY SNAPSHOT

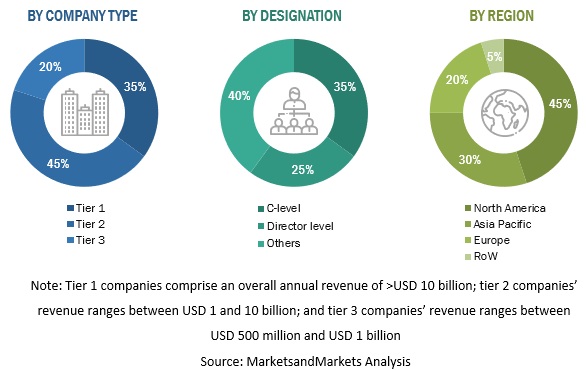

The research study for the DataOps platform market involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject matter experts, high-level executives of multiple companies offering the DataOps platform, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to, to identify and collect information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies, and white papers, certified publications, and articles from recognized associations and government publishing sources. The secondary research was mainly used to obtain the key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the DataOps platform market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing DataOps platform offerings, associated service provider, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used for conducting market estimation and forecasting the DataOps platform market and the other dependent submarkets. The bottom-up procedure was used to arrive at the overall market size of the global DataOps platform market, using the revenue of the key companies from their offerings in the market. With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

In the top-down approach, an exhaustive list of all the vendors offering DataOps platform was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. The offerings of each of these vendors were evaluated based on the breadth of solution and service offerings, cloud type, organization size, and verticals. The aggregate of all the revenues of the companies was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of the DataOps platform and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of DataOps platform and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on DataOps platform based on some of the key use cases. These factors for the DataOps platform industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

DataOps platforms act as command centers for DataOps. These solutions orchestrate people, processes, and technology to deliver a trusted data pipeline to their users. DataOps platforms assemble several types of data management software into an individual and integrated environment.

According to StreamSets, DataOps is a set of practices and technologies that operationalize data management and integration to ensure resiliency and agility in the face of constant change. It helps you tease order and discipline out of the chaos and solve the big challenges to turning data into business value.

Key Stakeholders

- DataOps service providers

- Managed service providers

- Support and maintenance service providers

- System integrators (SIs)/Migration service providers

- Value-added resellers (VARs) and distributors

- Independent software vendors (ISVs)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and predict the DataOps platform market, by offering (platform and services), type, deployment mode, organization size, vertical, and region

- To provide detailed information related to major factors, such as drivers, restraints, opportunities, and industry-specific challenges influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the market

- To analyze the impact of recession on the DataOps platform market across all the regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for DataOps platform market

- Further breakup of the European market for market

- Further breakup of the Asia Pacific market for market

- Further breakup of the Latin American market for market

- Further breakup of the Middle East & Africa market for DataOps platform market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in DataOps Platform Market