Data Wrangling Market by Business Function (Marketing and Sales, Finance, Operations, HR, and Legal), Component (Tools and Services), Deployment Model, Organization Size, Industry Vertical, and Region - Global Forecast to 2023

[164 Pages Report] The data wrangling market size was valued at USD 1.09 Billion in 2017 and is expected to reach USD 3.18 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period. The base year considered for this report is 2017 and the forecast period is 20182023.

Objectives of the Study

The main objective of this report is to define, describe, and forecast the global data wrangling market by business functions, components, deployment models, organization sizes, verticals, and regions. The report analyzes the major factors influencing the market growth, such as drivers, restraints, opportunities, and challenges. It aims to strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the market. The report attempts to forecast the market size for 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. It contains key vendor profiles and comprehensively analyzes their core competencies. Moreover, the report tracks and analyzes competitive developments, including partnerships, collaborations, acquisitions, new product developments, and R&D activities in the market.

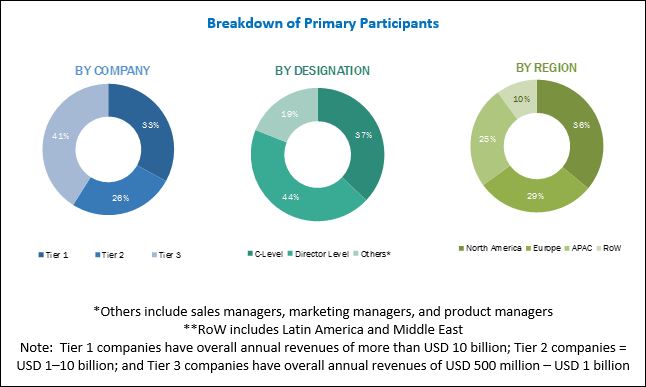

The research methodology used to estimate and forecast the data wrangling market starts with data collection through secondary research on the key vendors. The sources referred for secondary research include journals and magazines, such as D&B Hoovers, Bloomberg, EconoTimes, Factiva, and OneSource. The vendor offerings were taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of the key players in the market. Post-estimation of overall market size, the total market was divided into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with the key personnel, such as Chief Marketing Officers (CMOs), Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of primary profiles is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The key vendors of the data wrangling market are Trifacta (US), Datawatch (US), Dataiku (France), IBM (US), SAS Institute (US), Oracle (US), Talend (US), Alteryx (US), TIBCO (US), Paxata (US), Informatica (US), Hitachi Vantara (US), Teradata (US), Datameer (US), Cooladata (US), Unifi (US), Rapid Insight (US), Infogix, (US), Zaloni (US), Impetus (US), Ideata Analytics (India), Onedot (Switzerland), IRI (US), Brillio, and TMMData(US).

Key Target Audience

- Investors and venture capitalists

- Value-Added Resellers (VARs)

- Professional service providers

- Software and application developers

- Government agencies

- Small and Medium-sized Enterprises (SMEs) and large enterprises

- Third-party providers

- Consultants/consultancies/advisory firms

Study answers several questions for the stakeholders, primarily which market segments to focus in the next 25 years for prioritizing the efforts and investments.

Scope of the Data Wrangling Market Report

|

Report Metric |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Business Function, Tools, Services, Deployment Model, Organization Size, Industry Vertical, Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA) |

|

Companies covered |

Trifacta (US), Datawatch (US), Dataiku (France), IBM (US), SAS Institute (US), Oracle (US), Talend (US), Alteryx (US), TIBCO (US), Paxata (US), Informatica (US), Hitachi Vantara (US), Teradata (US), Datameer (US), Cooladata (US), Unifi (US), Rapid Insight (US), Infogix, (US), Zaloni (US), Impetus (US), Ideata Analytics (India), Onedot (Switzerland), IRI (US), Brillio, and TMMData(US) |

Data Wrangling Market By Business Function:

- Marketing and Sales

- Finance

- Operations

- HR

- Legal

By Component:

- Tools

- Services

Data Wrangling Market By Deployment Model:

- On-premises

- Cloud

By Organization Size:

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

Data Wrangling Market By Vertical:

- BFSI

- Telecom and IT

- Retail and eCommerce

- Healthcare and Life Sciences

- Travel and Hospitality

- Government

- Manufacturing

- Energy and Utilities

- Transportation and Logistics

- Others (Media and Entertainment, Education and Research, and Real Estate)

Data Wrangling Market By Region:

- North America

- Europe

- MEA

- APAC

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

Product matrix gives a detailed comparison of product portfolio for each company.

Geographic Analysis

- Further breakdown of the North American data wrangling market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed profiling and analysis of additional market players

The global data wrangling market is expected to grow from USD 1.29 Billion in 2018 to USD 3.18 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period. A rapid increase of data volumes across industry verticals is triggering organizations to incorporate advanced analytics algorithms in their systems to gain substantial insights that help them to stay competitive. The proliferation of data across verticals is one of the main growth for the market.

The report provides detailed insights into the global data wrangling market based on business functions, components, deployment models, organization sizes, verticals, and regions. Among the component, data wrangling tools are expected to have the largest market size during the forecast period. With the proliferation of data, the data wrangling tools are expected to be adopted at a rapid pace, as they are a precursor to the analytics workflows. A typical data wrangling tool encompasses functions, such as reformatting, de-duping, filtering, and cleaning data, so that proper analysis could be done. Moreover, data wrangling tools offer the self-service data preparation model that helps organizations to clean the data sets by themselves without involving data scientists. This has effectively empowered the executives to gain business insights without the intervention of IT teams.

The on-demand deployment model is expected to have a high adoption rate as compared to the on-premises deployment model. By using cloud-based deployment, organizations can avoid a large amount of cost pertaining to hardware, software, data, maintenance cost, and staff. The BFSI vertical is expected to hold the largest market size during the forecast period. Data wrangling tool leverages various capabilities specifically for banking and financial institutes, such as data discovery from numerus sources and formats, integration with existing tools, fraud detection, risk management, and higher operational productivity.

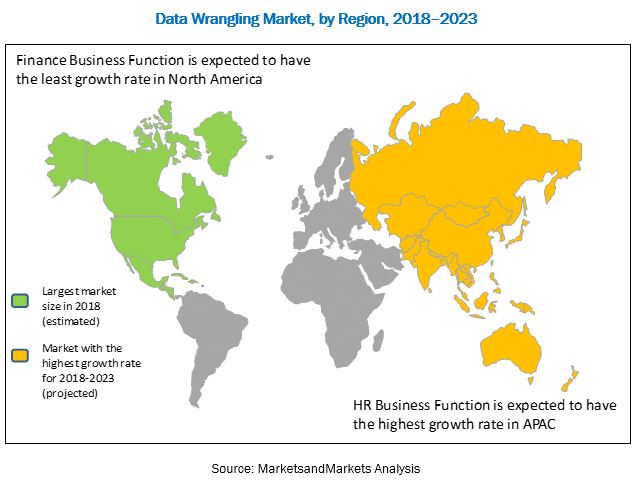

The report covers all the major aspects of the data wrangling market and provides an in-depth analysis in North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The market in North America is expected to hold the largest market share. The APAC region is projected to provide significant opportunities to vendors in the market and is expected to grow at the highest CAGR during the forecast period. APAC, being a manufacturing hub, is expected to adopt the data wrangling substantially, to remain cost efficient and export high-quality goods to other countries.

Reluctance to shift from traditional ETL tools to advanced automated tools is the major restraining factor for the growth of the market. Lack of awareness of data wrangling tools among SMEs, and concerns regarding data quality are the major challenges for the data wrangling market growth.

Most of the vendors in the data wrangling market have adopted various growth strategies, such as acquisitions, agreements, collaborations and partnerships, new product launches, product upgradations, and expansions, to expand their client base and enhance the customer experience. For instance, in March 2017, Trifacta collaborated with Google to create Google Cloud Dataprep. This solution would enable Google to help enterprises shift their data to the cloud, where in Trifacta would help them resolving their data wrangling challenges.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Data Wrangling Market

4.2 Market By Application and Region

4.3 Market Share, By Region

4.4 Life Cycle Analysis, By Region, 2018

5 Data Wrangling Market Overview (Page No. - 38)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Increasing Volume and Velocity of Data

5.1.1.2 Advancements in AI and Ml Technologies

5.1.2 Restraints

5.1.2.1 Reluctance to Shift From Traditional ETL Tools to Advanced Automated Tools

5.1.3 Opportunities

5.1.3.1 Increasing Regulatory Pressure

5.1.3.2 Growth of Edge Computing

5.1.4 Challenges

5.1.4.1 Lack of Awareness of Data Wrangling Tools Among SMEs

5.1.4.2 Concerns Regarding Data Quality

5.2 Data Types

5.2.1 Customer Data

5.2.2 Product Data

5.2.3 Finance Data

5.2.4 Compliance Data

5.2.5 Supplier Data

5.3 Data Wrangling: Use Cases

5.3.1 Use Case #1: Unification of Data

5.3.2 Use Case #2: Data Wrangling and Analytics to Obtain Customer Insights

5.3.3 Use Case #3: Data Integration Saved Fortune 50 Telecom Giant Millions in Call Center Interactions

5.3.4 Use Case #4: Onedot Made IT Simple for Zageno to Integrate Unstructured Data and Deliver the Best Possible Search Results

6 Data Wrangling Market By Business Function (Page No. - 46)

6.1 Introduction

6.2 Finance

6.3 Marketing and Sales

6.4 Operations

6.5 Human Resources

6.6 Legal

7 Market By Component (Page No. - 52)

7.1 Introduction

7.2 Tools

7.3 Services

7.3.1 Managed Services

7.3.2 Professional Services

7.3.2.1 Consulting Services

7.3.2.2 Support and Maintenance Services

8 Data Wrangling Market By Deployment Model (Page No. - 60)

8.1 Introduction

8.2 On-Premises

8.3 Cloud

9 Market By Organization Size (Page No. - 64)

9.1 Introduction

9.2 Large Enterprises

9.3 Small and Medium-Sized Enterprises

10 Data Wrangling Market By Industry Vertical (Page No. - 68)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Government and Public Sector

10.4 Healthcare and Life Sciences

10.5 Retail and Ecommerce

10.6 Travel and Hospitality

10.7 Automotive and Transportation

10.8 Energy and Utilities

10.9 Telecommunication and IT

10.10 Manufacturing

10.11 Others

11 Data Wrangling Market By Region (Page No. - 78)

11.1 Introduction

11.2 North America

11.2.1 By Country

11.2.1.1 United States

11.2.1.2 Canada

11.3 Europe

11.3.1 By Country

11.3.1.1 United Kingdom

11.3.1.2 Germany

11.3.1.3 France

11.3.1.4 Rest of Europe

11.4 Asia Pacific

11.4.1 By Country

11.4.1.1 China

11.4.1.2 Australia and New Zealand

11.4.1.3 Singapore

11.4.1.4 Japan

11.4.1.5 Rest of APAC

11.5 Middle East and Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Kingdom of Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 South Africa

11.5.1.5 Rest of Mea

11.6 Latin America

11.6.1 By Country

11.6.1.1 Brazil

11.6.1.2 Mexico

11.6.1.3 Rest of Latin America

12 Competitive Landscape (Page No. - 105)

12.1 Overview

12.2 Prominent Players in the Data Wrangling Market

12.3 Competitive Scenario

12.3.1 New Product Launches and Product Upgradations

12.3.2 Partnerships, Collaborations, and Agreements

12.3.3 Business Expansions

12.3.4 Acquisitions

13 Company Profiles (Page No. - 110)

(Business Overview, Solutions/Software Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 IBM

13.2 Oracle

13.3 SAS Institute

13.4 Trifacta

13.5 Datawatch

13.6 Talend

13.7 Alteryx

13.8 Dataiku

13.9 TIBCO Software

13.10 Paxata

13.11 Informatica

13.12 Hitachi Vantara

13.13 Teradata

13.14 IRI, the Cosort Company

13.15 Brillio

13.16 Onedot

13.17 TMMData

13.18 Datameer

13.19 Cooladata

13.20 Unifi Software

13.21 Rapid Insight

13.22 Infogix

13.23 Zaloni

13.24 Impetus

13.25 Ideata Analytics

*Details on Business Overview, Solutions/Software Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 155)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (78 Tables)

Table 1 Data Wrangling Market Size, 20162023 (USD Million)

Table 2 Market Size By Business Function, 20162023 (USD Million)

Table 3 Finance: Market Size By Region, 20162023 (USD Million)

Table 4 Marketing and Sales: Market Size By Region, 20162023 (USD Million)

Table 5 Operations: Market Size By Region, 20162023 (USD Million)

Table 6 Human Resources: Market Size By Region, 20162023 (USD Million)

Table 7 Legal: Market Size By Region, 20162023 (USD Million)

Table 8 Data Wrangling Market Size, By Component, 20162023 (USD Million)

Table 9 Tools: Market Size By Region, 20162023 (USD Million)

Table 10 Services: Market Size By Region, 20162023 (USD Million)

Table 11 Services: Market Size By Type, 20162023 (USD Million)

Table 12 Managed Services Market Size, By Region, 20162023 (USD Million)

Table 13 Professional Services Market Size, By Region, 20162023 (USD Million)

Table 14 Professional Services Market Size, By Type, 20162023 (USD Million)

Table 15 Consulting Services Market Size, By Region, 20162023 (USD Million)

Table 16 Support and Maintenance Services Market Size, By Region, 20162023 (USD Million)

Table 17 Data Wrangling Market Size, By Deployment Model, 20162023 (USD Million)

Table 18 On-Premises: Market Size By Region, 20162023 (USD Million)

Table 19 Cloud: Market Size By Region, 20162023 (USD Million)

Table 20 Market Size By Organization Size, 20162023 (USD Million)

Table 21 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 22 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 23 Data Wrangling Market Size, By Industry Vertical, 20162023 (USD Million)

Table 24 Banking, Financial Services, and Insurance: Market Size By Region, 20162023 (USD Million)

Table 25 Government and Public Sector: Market Size By Region, 20162023 (USD Million)

Table 26 Healthcare and Life Sciences: Market Size By Region, 20162023 (USD Million)

Table 27 Retail and Ecommerce: Market Size By Region, 20162023 (USD Million)

Table 28 Travel and Hospitality: Market Size By Region, 20162023 (USD Million)

Table 29 Automotive and Transportation: Market Size By Region, 20162023 (USD Million)

Table 30 Energy and Utilities: Market Size By Region, 20162023 (USD Million)

Table 31 Telecommunication and IT: Market Size By Region, 20162023 (USD Million)

Table 32 Manufacturing: Market Size By Region, 20162023 (USD Million)

Table 33 Others: Market Size By Region, 20162023 (USD Million)

Table 34 Data Wrangling Market Size By Region, 20162023 (USD Million)

Table 35 North America: Market Size By Component, 20162023 (USD Million)

Table 36 North America: Market Size By Service, 20162023 (USD Million)

Table 37 North America: Market Size By Professional Service, 20162023 (USD Million)

Table 38 North America: Market Size By Business Function, 20162023 (USD Million)

Table 39 North America: Market Size By Deployment Model, 20162023 (USD Million)

Table 40 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 41 North America: Market Size By Industry Vertical, 20162023 (USD Million)

Table 42 North America: Market Size By Country, 20162023 (USD Million)

Table 43 Europe: Data Wrangling Market Size, By Component, 20162023 (USD Million)

Table 44 Europe: Market Size By Service, 20162023 (USD Million)

Table 45 Europe: Market Size By Professional Service, 20162023 (USD Million)

Table 46 Europe: Market Size By Business Function, 20162023 (USD Million)

Table 47 Europe: Market Size By Deployment Model, 20162023 (USD Million)

Table 48 Europe: Market Size By Organization Size, 20162023 (USD Million)

Table 49 Europe: Market Size By Industry Vertical, 20162023 (USD Million)

Table 50 Europe: Market Size By Country, 20162023 (USD Million)

Table 51 Asia Pacific: Data Wrangling Market Size, By Component, 20162023 (USD Million)

Table 52 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 53 Asia Pacific: Market Size By Professional Service, 20162023 (USD Million)

Table 54 Asia Pacific: Market Size By Business Function, 20162023 (USD Million)

Table 55 Asia Pacific: Market Size By Deployment Model, 20162023 (USD Million)

Table 56 Asia Pacific: Market Size By Organization Size, 20162023 (USD Million)

Table 57 Asia Pacific: Market Size By Industry Vertical, 20162023 (USD Million)

Table 58 Asia Pacific: Market Size By Country, 20162023 (USD Million)

Table 59 Middle East and Africa: Data Wrangling Market Size, By Component, 20162023 (USD Million)

Table 60 Middle East and Africa: Market Size By Service, 20162023 (USD Million)

Table 61 Middle East and Africa: Market Size By Professional Service, 20162023 (USD Million)

Table 62 Middle East and Africa: Market Size By Business Function, 20162023 (USD Million)

Table 63 Middle East and Africa: Market Size By Deployment Model, 20162023 (USD Million)

Table 64 Middle East and Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 65 Middle East and Africa: Market Size By Industry Vertical, 20162023 (USD Million)

Table 66 Middle East and Africa: Market Size By Country, 20162023 (USD Million)

Table 67 Latin America: Data Wrangling Market Size, By Component, 20162023 (USD Million)

Table 68 Latin America: Market Size By Service, 20162023 (USD Million)

Table 69 Latin America: Market Size By Professional Service, 20162023 (USD Million)

Table 70 Latin America: Market Size By Business Function, 20162023 (USD Million)

Table 71 Latin America: Market Size By Deployment Model, 20162023 (USD Million)

Table 72 Latin America: Market Size By Organization Size, 20162023 (USD Million)

Table 73 Latin America: Market Size By Industry Vertical, 20162023 (USD Million)

Table 74 Latin America: Market Size By Country, 20162023 (USD Million)

Table 75 New Product Launches and Product Upgradations, 20142018

Table 76 Partnerships, Collaborations, and Agreements, 20142018

Table 77 Business Expansions, 20142018

Table 78 Acquisitions, 2012018

List of Figures (43 Figures)

Figure 1 Data Wrangling Market Segmentation

Figure 2 Market By Region and Country

Figure 3 Market Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Wrangling Market: Assumptions

Figure 9 Global Market is Expected to Witness Significant Growth During the Forecast Period

Figure 10 Market Snapshot By Component (2018 vs 2023)

Figure 11 Market Snapshot By Service (2018 vs 2023)

Figure 12 Market Snapshot By Business Function (2018 vs 2023)

Figure 13 Data Wrangling Market Snapshot By Deployment Model (2018 vs 2023)

Figure 14 Market Snapshot By Industry Vertical (2018 vs 2023)

Figure 15 Market Growth is Driven By Rapid Growth in Data Volumes and Stringent Regulatory and Compliance Mandates

Figure 16 Finance, and North America are Estimated to Have the Largest Market Shares in 2018

Figure 17 North America is Estimated to Have the Largest Market Share in 2018

Figure 18 Asia Pacific is Expected to Witness Significant Growth During the Forecast Period

Figure 19 Data Wrangling Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Operations Business Function is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 22 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 23 Consulting Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 24 Cloud Deployment Model is Expected to Register A Higher CAGR During the Forecast Period

Figure 25 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 26 Healthcare and Life Sciences Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 Asia Pacific is Expected to Have the Highest CAGR During the Forecast Period

Figure 28 Asia Pacific is Expected to Register the Highest Growth Rate in the Data Wrangling Market During the Forecast Period

Figure 29 North America: Market Snapshot

Figure 30 Asia Pacific: Market Snapshot

Figure 31 Key Developments By the Leading Players in the Data Wrangling Market, 20142018

Figure 32 IBM: Company Snapshot

Figure 33 IBM: SWOT Analysis

Figure 34 Oracle: Company Snapshot

Figure 35 Oracle: SWOT Analysis

Figure 36 SAS Institute: Company Snapshot

Figure 37 SAS Institute: SWOT Analysis

Figure 38 Trifacta: SWOT Analysis

Figure 39 Datawatch: Company Snapshot

Figure 40 Datawatch: SWOT Analysis

Figure 41 Talend: Company Snapshot

Figure 42 Alteryx: Company Snapshot

Figure 43 Teradata: Company Snapshot

Growth opportunities and latent adjacency in Data Wrangling Market