Data Security as a Service Market by Type (Data Encryption and Masking as a Service, Data Governance and Compliance as a Service), Organization Size, Vertical (BFSI, IT and ITeS, Healthcare, Manufacturing, Education) and Region - Global Forecast to 2027

Data Security as a Service Market Size

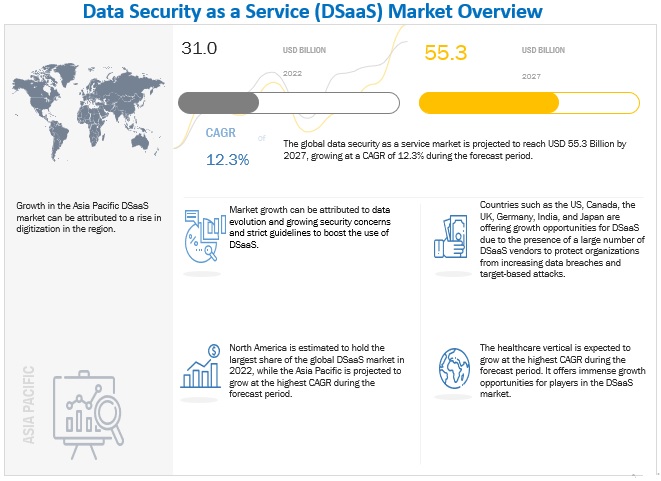

The data security as a service (DSaaS) market size is projected to grow at a CAGR of 12.3% during the forecast period to reach USD 55.3 billion by 2027 from an estimated USD 31.0 billion in 2022.

Data Security as a Service Market Growth

Factors driving market growth include the growing adoption of data security as a service (DSaaS) due to the rising amount of generated data and its associated security issues; and the prime focus on the significant data loss caused by the increasing number of data breaches and thefts. However, integration with existing infrastructure, low-security budget, and spending is expected to hinder market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Security as a Service Market Dynamics

Driver: Data evolution and growing security problems

Enterprises are becoming more concerned about enhanced data security and privacy protections because of the growing data evolution. At the same time, they do not want to expose the data to internal monitoring and breaches. In today's digitally transformed world, every endpoint gateway, sensor, and smartphone has become a potential target for hackers. Enterprises require data security services since the data needs to be safeguarded and backed up at every instance. Some businesses have constrained memory, computing power, and battery life. It indicates that traditional IT security systems sometimes cannot handle security situations due to cyberattacks. Addressing the issue would accelerate the adoption of data security services drastically.

Restraint: Low data security spending and expensive installation

High installation costs and complicated integration requirements hamper the initial adoption of data security solutions. Due to the integration of high-quality hardware, data security systems have a significant initial investment and ongoing maintenance costs. The budgets set aside to address cybersecurity issues are not keeping up with the growth of the necessary resources. Most small businesses lack the necessary resources and IT security skills to embrace improved cybersecurity solutions and services and protect their networks and IT infrastructure from various cyberattacks. For certain SMEs, a lack of capital resources can be a significant barrier to adopting a data security architecture.

Due to their limited financial resources, many businesses lack an adequate IT security infrastructure, which slows the adoption of new technologies and corporate security solutions and services. Appropriately administrating projected budget money for various operational issues and business continuity planning burdens small businesses. Organizations must recognize which program elements and information assets are more crucial to growing security threats since data security budgets will not be sufficient to meet data security needs. Due to the availability of cloud-based solutions and ongoing market advancements in data security as a service, this factor's impact will diminish during the projected period.

Opportunity: Increased adoption of cloud technology in enterprises

Multiple enterprises are willingly choosing the technologies that best correspond with their various platforms, making multi-cloud strategies the standard rather than the exception. Building robust architectures that can coexist and work with several cloud service providers is crucial.

Cloud-based data security solutions and service providers are anticipated to see increased growth prospects as SMEs focus on cloud solutions to protect their data from security breaches and vulnerabilities. Infrastructure as a service (laaS), platform as a service (PaaS), and software as service (SaaS) models are all offered by cloud service providers. These approaches are vulnerable to application vulnerabilities, malware, viruses, advanced persistent threats (APTs), distributed denial-of-service (DDoS) assaults, and access management and data security breaches. Data security measures like encryption, tokenization, DLP, and masking are effectively provided by cloud access security brokers (CASBS), who effectively protect data residing in cloud and on-premises environments.

With growing concerns about cloud data security, the demand for integrated, cloud-based data security solutions has increased, propelling the data security as a service market forward.

Challenge: Synchronizing management of unstructured to structured data

Enterprises struggle with managing unstructured information significantly, and solution suppliers work to ensure data security. The data retrieved through emails, social media posts, and client conversations is known as unstructured data. Although managing unstructured data can be challenging, it can also be a prosperous source of information for businesses. Unstructured data presents issues in quantity, quality, usability, and relevancy. Since unstructured data does not integrate well with conventional backup solutions, managing it becomes exceedingly challenging. As the data created is in terabytes, the file size is one of the most significant issues in the backup procedure. The issue is getting worse every day because of the massive growth in data. Another big problem for providers is the variety of data because it is challenging to optimize. These are some of the main obstacles preventing the market for data security as a service from expanding.

Data Security as a Service (DSaaS) Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By type, Data Governance & Compliance as a Service segment to grow at the highest CAGR during the forecast period

Data governance is a process that helps organizations manage and secure both structured and unstructured data in their enterprise workstations and cloud environments. As unstructured data accounts for a large portion of enterprise data and is expected to grow rapidly, managing it can be difficult. Data governance solutions provide an automated, scalable, and interoperable platform to address these challenges, making it easier to govern access to this large amount of data. With a data governance solution, organizations can identify where data resides and determine who is responsible for it and who has access to it, making it a critical tool for managing and securing data.

By vertical, the Healthcare segment is to grow at the highest CAGR during the forecast period

The healthcare segment includes various entities such as hospitals, clinics, pharmaceuticals, and life sciences. Data security is critical in this vertical as it deals with sensitive personal health information and critical patient data. There is a growing need to protect internal healthcare data within organizations, as many organizations prioritize protecting customer data but neglect internal data protection.

Data security as a service (DSaaS) solutions ensure that the organization's data is available in different silos and remain integrated, confidential, and available. Some of the significant data measures adopted by the healthcare vertical are encryption, tokenization, and masking. Encryption solutions help healthcare professionals secure personal health information on their mobile devices, such as laptops and smartphones. Further, the encryption of data, files, and folders helps healthcare professionals ensure the security and privacy of confidential data, financial transactions, and medical records related to the patient.

Implementing regulatory compliances, such as HIPAA, helps secure sensitive data, protect identities by providing a digital signature, and protect network gateways and databases. With the increasing instances of medical record thefts and awareness of regulatory compliances, the adoption rate of DSaaS solutions is expected to rise in the coming years.

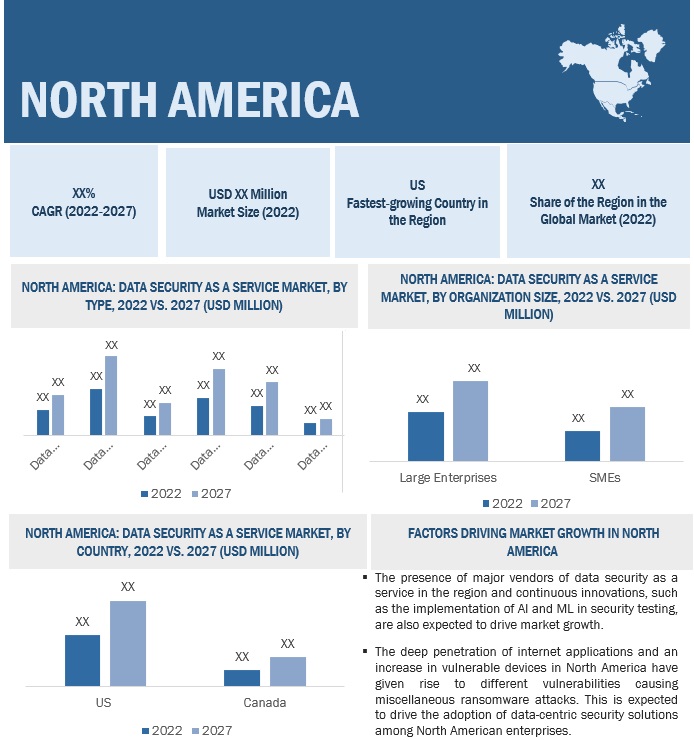

By region, North America to hold largest highest market size during the forecast period

North America is the most affected region regarding data security breaches and, as a result, has the most significant number of DSaaS providers. Hence, the global data security as a service (DSaaS) market is expected to be dominated by North America. It is the most advanced region adopting data protection solutions with relevant infrastructure. Data security is recognized as the most serious economic and national security challenge by regional organizations and governments. The growing concern about the security of critical infrastructure and sensitive data has increased the government's intervention in data security in recent years. Specific budget allocations, support from the government, and mandated data protection policies are expected to make North America the most profitable region for the growth of data protection providers.

Key Market Players

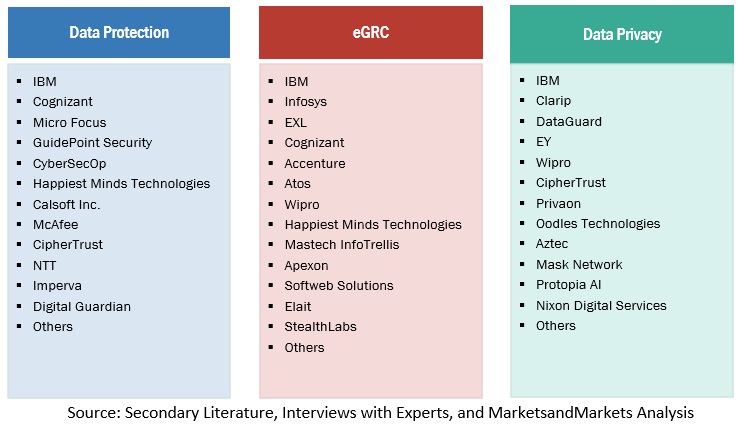

Key players in the global data security as a service (DSaaS) market include Cisco (US), AWS (US), Thales (France), IBM (US), Cognizant (US), Micro Focus (UK), Microsoft (US), Varonis Systems (US), Imperva (US), Commvault (US), HPE (US), Acronis (Switzerland), Veritas Technologies (US), Asigra (Canada), NetApp (US), GuidePoint Security (US), Informatica (US), Carbonite (US), TrustArc(US), Cloudian(US), NetWrix (US), Alation (US), Infrascale (US), Securiti (US), DataGuard (Germany), Cobalt Iron (US), Storagepipe (Canada), Polar Security (Israel), Clarip (US) and SEQRITE (India).

Scope of the Report

|

Report Metrics |

Details |

|

Market value in 2027 |

USD 55.3 Billion |

|

Market value in 2022 |

USD 31.0 Billion |

|

Market Growth Rate |

12.3% CAGR |

|

Largest Market |

North America |

|

Market size available for years |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Segments Covered |

|

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Major companies covered |

Cisco (US), AWS (US), Thales (France), IBM (US), Cognizant (US), Micro Focus (UK), Microsoft (US), Varonis Systems (US), Imperva (US), Commvault (US), HPE (US), Acronis (Switzerland), Veritas Technologies (US), Asigra (Canada), and NetApp (US). |

Market Segmentation

Recent Developments

- In October 2022, Imperva collaborated with Oracle. Oracle Cloud Infrastructure (OCI) is now supported by Imperva's award-winning hybrid data security technology, making migration easier for users and providing automated compliance monitoring of cloud data instances.

- In July 2022, Oracle and Commvault partnered to provide metallic data management. Critical data assets will be safeguarded in the cloud or on-premises by preserving flexibility between customer-controlled storage or a SaaS-delivered data protection service, including managed cloud storage, using Oracle cloud infrastructure storage for air-gapped ransomware protection.

- In November 2021, NetApp announced the acquisition of CloudCheckr. It is a cloud optimization platform that provides visibility and insights to lower costs, maintain security and Compliance, and optimize cloud resources.

Frequently Asked Questions (FAQ):

What is the definition of Data Security as a Service?

MarketsandMarkets defines data security as a service (DSaaS) as data security as a service that enables organizations to mitigate risks, protect data from hackers, and remove compliance burdens with the help of cloud-native services. Effective data security entails a set of controls, applications, and techniques that evaluate the importance of various datasets and apply the best security measures.

What is the projected value of the global data security as a service market?

The global data security as a service (DSaaS) market is expected to grow from an estimated USD 31.03 billion in 2022 to 55.33 billion USD by 2027, at a Compound Annual Growth Rate (CAGR) of 12.3% from 2022 to 2027.

Which are the key companies influencing the growth of the data security as a service market?

Cisco (US), AWS (US), Thales (France), IBM (US), Cognizant (US), Micro Focus (UK), and Microsoft (US). Some key companies in the data security as a service (DSaaS) market are recognized as star players. These companies account for a significant share of the data security as a service (DSaaS) market. They offer comprehensive solutions related to DSaaS services. These vendors offer customized solutions as per user requirements and adopt growth strategies to consistently achieve the desired growth and mark their presence in the market.

Which vertical segment is expected to grow at the highest CAGR during the forecast period?

The healthcare vertical is expected to grow at the highest CAGR during the forecast period.

Which country in the Asia Pacific region is expected to hold the largest market size during the forecast period?

China is expected to hold the largest market size during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Data evolution and growing security problems- Strict guidelines to boost use of data security as a service- Increased issues concerning significant data loss in on-premises environmentRESTRAINTS- Traditional and on-premises applications’ compatibility limitations in cloud environment- Low data security spending and expensive installationOPPORTUNITIES- Increased adoption of cloud technology in enterprises- Widespread use of data security as a service in highly regulated industry sectors- Future of data backup and recovery with blockchain technologyCHALLENGES- Synchronizing management of unstructured to structured data- Lack of technical and operational knowledge among workers

-

5.3 ECOSYSTEM ANALYSIS

-

5.4 TECHNOLOGY ANALYSISAI/MLBIG DATA AND ANALYTICSIOTCLOUD COMPUTING

-

5.5 REGULATORY IMPLICATIONSPAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI–DSS)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)FEDERAL INFORMATION SECURITY MANAGEMENT ACT (FISMA)GRAMM-LEACH-BLILEY ACT (GLBA)SARBANES-OXLEY ACT (SOX)INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) STANDARD 27001EUROPEAN UNION GENERAL DATA PROTECTION REGULATION (EU GDPR)CALIFORNIA’S PRIVACY RIGHTS ACT (CPRA)REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.6 PATENT ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 USE CASESUSE CASE 1: MICRO FOCUS HELPED SWISSCOM AG TO PROTECT SENSITIVE CUSTOMER DATA IN COMPLEX ENVIRONMENTUSE CASE 2: IMPERVA HELPED DISCOVERY INC. TO TACKLE DATA COMPLIANCE IN PUBLIC CLOUDUSE CASE 3: VERITAS HELPED QCON WITH DATA SECURITY FEATURES TO ENSURE DATA SECURITY OF APPLICATIONSUSE CASE 4: COHESITY HELPED TXT E-SOLUTIONS TO MINIMIZE DOWNTIME ISSUES RESULTING FROM SEVERAL MERGERS AND ACQUISITIONS

- 5.10 PRICING ANALYSIS

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

-

6.1 INTRODUCTIONTYPE: DATA SECURITY AS A SERVICE MARKET DRIVERS

-

6.2 DATA BACKUP AND RECOVERY AS A SERVICEMITIGATES RISK OF CYBER DISASTERS

-

6.3 DATA ENCRYPTION AND MASKING AS A SERVICESAFEGUARDS ENCRYPTION OF CRITICAL DATA

-

6.4 DATA ACCESS CONTROL AS A SERVICENEED FOR SECURE DATA ACCESS RESULTED IN WIDESPREAD ADOPTION OF DATA ACCESS CONTROL SERVICES

-

6.5 DATA DISCOVERY AND CLASSIFICATION AS A SERVICERAPID PRODUCTION OF DATA SUPPORTS NEED FOR DSAAS

-

6.6 DATA GOVERNANCE AND COMPLIANCE AS A SERVICENEED FOR STRUCTURED DATA TO PROPEL ADOPTION OF DSAAS

-

6.7 DATA AUDITING AND MONITORING AS A SERVICECROSS-EXAMINATION OF CRITICAL DATA TO DRIVE ADOPTION OF DATA AUDITING AND MONITORING SERVICE

-

7.1 INTRODUCTIONORGANIZATION SIZE: DATA SECURITY AS A SERVICE MARKET DRIVERS

-

7.2 LARGE ENTERPRISESRISE IN USAGE OF PERSONAL DEVICES TO BOOST ADOPTION OF DATA SECURITY AS A SERVICE

-

7.3 SMALL AND MEDIUM-SIZED ENTERPRISESINCREASE IN CYBERATTACKS TO DRIVE ADOPTION OF DATA SECURITY AS A SERVICE AMONG SMES

-

8.1 INTRODUCTIONVERTICAL: DATA SECURITY AS A SERVICE MARKET DRIVERS

-

8.2 BANKING, FINANCIAL SERVICES, AND INSURANCETECHNOLOGICAL ADVANCEMENTS TO SUPPORT MARKET GROWTH

-

8.3 HEALTHCAREINCREASING INSTANCES OF MEDICAL RECORD THEFTS TO DRIVE ADOPTION OF DATA SECURITY AS A SERVICE

-

8.4 MANUFACTURINGAUTOMATION OF MANUFACTURING PROCESSES TO PROPEL ADOPTION OF DATA SECURITY AS A SERVICE

-

8.5 RETAIL AND ECOMMERCEADVANCEMENTS IN MOBILE TECHNOLOGY TO BOOST ADOPTION OF DATA SECURITY AS A SERVICE

-

8.6 EDUCATIONEDUCATIONAL INSTITUTES VULNERABLE TO EXPLOITATION BY CYBERCRIMINALS

-

8.7 MEDIA AND ENTERTAINMENTINTRODUCTION OF STORAGE SOLUTIONS TO BOOST ADOPTION OF DATA SECURITY AS A SERVICE

-

8.8 TELECOMMUNICATIONSDEVELOPMENT OF INNOVATIVE TECHNOLOGIES TO DRIVE MARKET

-

8.9 IT AND ITESDATA SECURITY AS A SERVICE TO SAFEGUARD ORGANIZATIONS’ DATABASES, ENSURING NO IMPACT ON REMOTE OPERATIONS

- 8.10 OTHER VERTICALS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: REGULATORY LANDSCAPEUNITED STATES- Technological and infrastructural advancements to drive adoption of data security as a serviceCANADA- Technological advancements and government initiatives to support market growth

-

9.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: REGULATORY LANDSCAPEUNITED KINGDOM- Highly targeted country in terms of data and identity breachesGERMANY- Increased investments in data security landscape to propel adoption of servicesFRANCE- Government initiatives to strengthen adoption of data security as a serviceREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: REGULATORY LANDSCAPECHINA- Intensive usage of Internet strengthens market for data security as a serviceJAPAN- Rise in adoption of cloud-based data security as a service to propel marketINDIA- Rising adoption of DSaaS for securing confidential informationREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Digitalization boosting DSaaS adoption by businessesAFRICA- Internet penetration to boost adoption of DSaaS

-

9.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Adoption of DSaaS to revolutionize fight against cybercrimesMEXICO- Rising incidence of cybercrimes to propel adoption of DSaaSREST OF LATIN AMERICA

- 10.1 OVERVIEW

- 10.2 MARKET EVALUATION FRAMEWORK

- 10.3 REVENUE ANALYSIS OF LEADING PLAYERS

- 10.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- 10.5 HISTORICAL REVENUE ANALYSIS

- 10.6 RANKING OF KEY PLAYERS IN DATA SECURITY AS A SERVICE MARKET

-

10.7 COMPANY EVALUATION QUADRANT OF KEY COMPANIESSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.8 COMPETITIVE BENCHMARKINGEVALUATION CRITERIA OF KEY COMPANIESEVALUATION CRITERIA OF SMES/STARTUP COMPANIES

-

10.9 COMPANY EVALUATION QUADRANT OF SMES/STARTUPSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.10 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

-

11.1 KEY PLAYERSCISCO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHALES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewCOGNIZANT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICRO FOCUS- Business overview- Products/Solutions/Services offered- Recent developmentsMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developmentsVARONIS SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsIMPERVA- Business overview- Products/Solutions/Services offered- Recent developmentsCOMMVAULT- Business overview- Products/Solutions/Services offered- Recent developmentsHPE- Business overview- Products/Solutions/Services offered- Recent developmentsACRONIS- Business overview- Products/Solutions/Services offered- Recent developmentsVERITAS TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsASIGRA- Business overview- Products/Solutions/Services offeredNETAPP- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER PLAYERSGUIDEPOINT SECURITYINFORMATICACARBONITETRUSTARCCLOUDIANNETWRIXALATIONINFRASCALESECURITIDATAGUARDCOBALT IRONSTORAGEPIPEPOLAR SECURITYCLARIPSEQRITE

-

12.1 LIMITATIONSDATA-CENTRIC SECURITY MARKETBIG DATA SECURITY MARKETDATA PROTECTION MARKET

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 DATA SECURITY AS A SERVICE MARKET SIZE AND GROWTH RATE, 2022–2027

- TABLE 4 DATA SECURITY AS A SERVICE MARKET: ROLE IN ECOSYSTEM

- TABLE 5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 DATA SECURITY AS A SERVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 8 DATA SECURITY AS A SERVICE MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 9 DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 10 DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 11 DATA BACKUP AND RECOVERY AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 12 DATA BACKUP AND RECOVERY AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 13 DATA ENCRYPTION AND MASKING AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 14 DATA ENCRYPTION AND MASKING AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 15 DATA ACCESS CONTROL AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 16 DATA ACCESS CONTROL AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 17 DATA DISCOVERY AND CLASSIFICATION AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 18 DATA DISCOVERY AND CLASSIFICATION AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 19 DATA GOVERNANCE AND COMPLIANCE AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 20 DATA GOVERNANCE AND COMPLIANCE AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 21 DATA AUDITING AND MONITORING AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 22 DATA AUDITING AND MONITORING AS A SERVICE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 24 DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 25 LARGE ENTERPRISES: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 26 LARGE ENTERPRISES: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 SMALL AND MEDIUM-SIZED ENTERPRISES: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 28 SMALL AND MEDIUM-SIZED ENTERPRISES: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 30 DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 31 BFSI: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 32 BFSI: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 HEALTHCARE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 34 HEALTHCARE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 MANUFACTURING: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 36 MANUFACTURING: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 RETAIL AND ECOMMERCE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 38 RETAIL AND ECOMMERCE: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 EDUCATION: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 40 EDUCATION: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 41 MEDIA AND ENTERTAINMENT: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 42 MEDIA AND ENTERTAINMENT: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 TELECOMMUNICATIONS: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 44 TELECOMMUNICATIONS: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 IT AND ITES: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 46 IT AND ITES: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 OTHER VERTICALS: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 48 OTHER VERTICALS: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 50 DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 52 NORTH AMERICA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: DATA SECURITY AS A SERVICE MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: DATA SECURITY AS A SERVICE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 59 US: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 60 US: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 61 US: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 62 US: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 63 US: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 64 US: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 65 CANADA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 66 CANADA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 67 CANADA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 68 CANADA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 69 CANADA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 70 CANADA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 71 EUROPE: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 72 EUROPE: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 73 EUROPE: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 74 EUROPE: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 75 EUROPE: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 76 EUROPE: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 77 EUROPE: DATA SECURITY AS A SERVICE MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 78 EUROPE: DATA SECURITY AS A SERVICE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 79 UNITED KINGDOM: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 80 UNITED KINGDOM: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 81 UNITED KINGDOM: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 82 UNITED KINGDOM: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 83 UNITED KINGDOM: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 84 UNITED KINGDOM: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 85 GERMANY: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 86 GERMANY: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 87 GERMANY: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 88 GERMANY: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 89 GERMANY: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 90 GERMANY: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 91 FRANCE: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 92 FRANCE: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 93 FRANCE: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 94 FRANCE: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 95 FRANCE: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 96 FRANCE: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 97 REST OF EUROPE: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 98 REST OF EUROPE: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 99 REST OF EUROPE: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 100 REST OF EUROPE: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 101 REST OF EUROPE: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 102 REST OF EUROPE: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 103 ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 104 ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 105 ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 106 ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 111 CHINA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 112 CHINA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 113 CHINA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 114 CHINA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 115 CHINA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 116 CHINA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 117 JAPAN: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 118 JAPAN: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 119 JAPAN: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 120 JAPAN: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 121 JAPAN: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 122 JAPAN: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 123 INDIA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 124 INDIA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 125 INDIA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 126 INDIA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 127 INDIA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 128 INDIA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: DATA SECURITY AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 143 MIDDLE EAST: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 144 MIDDLE EAST: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 145 MIDDLE EAST: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 146 MIDDLE EAST: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 147 MIDDLE EAST: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 148 MIDDLE EAST: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 149 AFRICA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 150 AFRICA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 151 AFRICA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 152 AFRICA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 153 AFRICA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 154 AFRICA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 155 LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 156 LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 157 LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 158 LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 159 LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 160 LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 161 LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 162 LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 163 BRAZIL: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 164 BRAZIL: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 165 BRAZIL: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 166 BRAZIL: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 167 BRAZIL: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 168 BRAZIL: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 169 MEXICO: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 170 MEXICO: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 171 MEXICO: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 172 MEXICO: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 173 MEXICO: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 174 MEXICO: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 175 REST OF LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 176 REST OF LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 177 REST OF LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 178 REST OF LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 179 REST OF LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 180 REST OF LATIN AMERICA: DATA SECURITY AS A SERVICE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 181 DATA SECURITY AS A SERVICE MARKET: DEGREE OF COMPETITION

- TABLE 182 REGIONAL FOOTPRINT OF KEY COMPANIES

- TABLE 183 LIST OF STARTUPS/SMES

- TABLE 184 REGIONAL FOOTPRINT OF SMES/STARTUP COMPANIES

- TABLE 185 DATA SECURITY AS A SERVICE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020–2022

- TABLE 186 DATA SECURITY AS A SERVICE MARKET: DEALS, 2020–2022

- TABLE 187 CISCO: BUSINESS OVERVIEW

- TABLE 188 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 CISCO: PRODUCT LAUNCHES

- TABLE 190 CISCO: DEALS

- TABLE 191 AWS: BUSINESS OVERVIEW

- TABLE 192 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 AWS: PRODUCT LAUNCHES

- TABLE 194 AWS: DEALS

- TABLE 195 THALES: BUSINESS OVERVIEW

- TABLE 196 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 THALES: PRODUCT LAUNCHES

- TABLE 198 THALES: DEALS

- TABLE 199 IBM: BUSINESS OVERVIEW

- TABLE 200 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 IBM: PRODUCT LAUNCHES

- TABLE 202 IBM: DEALS

- TABLE 203 COGNIZANT: BUSINESS OVERVIEW

- TABLE 204 COGNIZANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 COGNIZANT: DEALS

- TABLE 206 MICRO FOCUS: BUSINESS OVERVIEW

- TABLE 207 MICRO FOCUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 MICRO FOCUS: DEALS

- TABLE 209 MICROSOFT: BUSINESS OVERVIEW

- TABLE 210 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 MICROSOFT: PRODUCT LAUNCHES

- TABLE 212 MICROSOFT: DEALS

- TABLE 213 VARONIS SYSTEMS: BUSINESS OVERVIEW

- TABLE 214 VARONIS SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 VARONIS SYSTEMS: PRODUCT LAUNCHES

- TABLE 216 VARONIS SYSTEMS: DEALS

- TABLE 217 IMPERVA: BUSINESS OVERVIEW

- TABLE 218 IMPERVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 IMPERVA: PRODUCT LAUNCHES

- TABLE 220 IMPERVA: DEALS

- TABLE 221 COMMVAULT: BUSINESS OVERVIEW

- TABLE 222 COMMVAULT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 COMMVAULT: PRODUCT LAUNCHES

- TABLE 224 COMMVAULT: DEALS

- TABLE 225 HPE: BUSINESS OVERVIEW

- TABLE 226 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 HPE: PRODUCT LAUNCHES

- TABLE 228 HPE: DEALS

- TABLE 229 ACRONIS: BUSINESS OVERVIEW

- TABLE 230 ACRONIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 ACRONIS: PRODUCT LAUNCHES

- TABLE 232 ACRONIS: DEALS

- TABLE 233 VERITAS TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 234 VERITAS TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 VERITAS TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 236 VERITAS TECHNOLOGIES: DEALS

- TABLE 237 ASIGRA: BUSINESS OVERVIEW

- TABLE 238 ASIGRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 ASIGRA: PRODUCT LAUNCHES

- TABLE 240 NETAPP: BUSINESS OVERVIEW

- TABLE 241 NETAPP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 NETAPP: PRODUCT LAUNCHES

- TABLE 243 NETAPP: DEALS

- TABLE 244 ADJACENT MARKETS AND FORECASTS

- TABLE 245 DATA-CENTRIC SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 246 DATA-CENTRIC SECURITY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 247 DATA-CENTRIC SECURITY MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 248 DATA-CENTRIC SECURITY MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 249 DATA-CENTRIC SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 250 DATA-CENTRIC SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 251 DATA-CENTRIC SECURITY MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 252 DATA-CENTRIC SECURITY MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 253 DATA-CENTRIC SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 254 DATA-CENTRIC SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 255 BIG DATA SECURITY MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

- TABLE 256 BIG DATA SECURITY MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

- TABLE 257 BIG DATA SECURITY MARKET, BY SOFTWARE, 2014–2019 (USD MILLION)

- TABLE 258 BIG DATA SECURITY MARKET, BY SOFTWARE, 2019–2026 (USD MILLION)

- TABLE 259 BIG DATA SECURITY MARKET, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

- TABLE 260 BIG DATA SECURITY MARKET, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

- TABLE 261 BIG DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

- TABLE 262 BIG DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

- TABLE 263 BIG DATA SECURITY MARKET, BY VERTICAL, 2014–2019 (USD MILLION)

- TABLE 264 BIG DATA SECURITY MARKET, BY VERTICAL, 2019–2026 (USD MILLION)

- TABLE 265 BIG DATA SECURITY MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 266 BIG DATA SECURITY MARKET, BY REGION, 2019–2026 (USD MILLION)

- TABLE 267 DATA PROTECTION MARKET, BY COMPONENT, 2015–2022 (USD BILLION)

- TABLE 268 DATA PROTECTION MARKET, BY DEPLOYMENT MODE, 2015–2022 (USD BILLION)

- TABLE 269 DATA PROTECTION MARKET, BY ORGANIZATION SIZE, 2015–2022 (USD BILLION)

- TABLE 270 DATA PROTECTION MARKET, BY INDUSTRY VERTICAL, 2015–2022 (USD BILLION)

- TABLE 271 DATA PROTECTION MARKET, BY REGION, 2015–2022 (USD BILLION)

- FIGURE 1 DATA SECURITY AS A SERVICE MARKET: RESEARCH DESIGN

- FIGURE 2 DATA SECURITY AS A SERVICE MARKET: RESEARCH FLOW

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1, SUPPLY-SIDE ANALYSIS: REVENUE OF SOLUTIONS AS A SERVICE IN DATA SECURITY AS A SERVICE MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1, SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AS A SERVICE IN DATA SECURITY AS A SERVICE MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, BOTTOM-UP (DEMAND SIDE)

- FIGURE 7 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- FIGURE 8 STARTUP EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- FIGURE 9 GLOBAL DATA SECURITY AS A SERVICE MARKET SIZE AND Y-O-Y GROWTH RATE, 2016–2027

- FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 DATA EVOLUTION AND GROWING SECURITY CONCERNS TO DRIVE MARKET

- FIGURE 12 DATA ENCRYPTION AND MASKING AS A SERVICE SEGMENT TO DOMINATE MARKET IN 2022

- FIGURE 13 BFSI SEGMENT TO DOMINATE MARKET IN 2027

- FIGURE 14 NORTH AMERICA TO DOMINATE MARKET IN FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 16 DATA SECURITY AS A SERVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 DATA SECURITY AS A SERVICE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 18 DATA SECURITY AS A SERVICE MARKET: PATENT ANALYSIS

- FIGURE 19 DATA SECURITY AS A SERVICE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 DATA SECURITY AS A SERVICE MARKET: PORTER’S FIVE FORCE ANALYSIS

- FIGURE 21 DATA SECURITY AS A SERVICE MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 23 DATA GOVERNANCE AND COMPLIANCE AS A SERVICE SEGMENT TO REGISTER HIGHEST GROWTH IN FORECAST PERIOD

- FIGURE 24 LARGE ENTERPRISES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 25 BFSI SEGMENT TO DOMINATE MARKET IN 2022

- FIGURE 26 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 27 NORTH AMERICA: DATA SECURITY AS A SERVICE MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: DATA SECURITY AS A SERVICE MARKET SNAPSHOT

- FIGURE 29 DATA SECURITY AS A SERVICE: MARKET EVALUATION FRAMEWORK

- FIGURE 30 DATA SECURITY AS A SERVICE MARKET: REVENUE ANALYSIS

- FIGURE 31 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF KEY PUBLIC SECTOR DATA SECURITY AS A SERVICE PROVIDERS

- FIGURE 32 RANKING OF KEY PLAYERS

- FIGURE 33 DATA SECURITY AS A SERVICE MARKET: COMPANY EVALUATION QUADRANT OF KEY PLAYERS, 2022

- FIGURE 34 DATA SECURITY AS A SERVICE MARKET: COMPANY EVALUATION QUADRANT OF SMES/STARTUPS, 2022

- FIGURE 35 CISCO: COMPANY SNAPSHOT

- FIGURE 36 AWS: COMPANY SNAPSHOT

- FIGURE 37 THALES: COMPANY SNAPSHOT

- FIGURE 38 IBM: COMPANY SNAPSHOT

- FIGURE 39 COGNIZANT: COMPANY SNAPSHOT

- FIGURE 40 MICRO FOCUS: COMPANY SNAPSHOT

- FIGURE 41 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 42 VARONIS SYSTEMS: COMPANY SNAPSHOT

- FIGURE 43 COMMVAULT: COMPANY SNAPSHOT

- FIGURE 44 HPE: COMPANY SNAPSHOT

- FIGURE 45 NETAPP: COMPANY SNAPSHOT

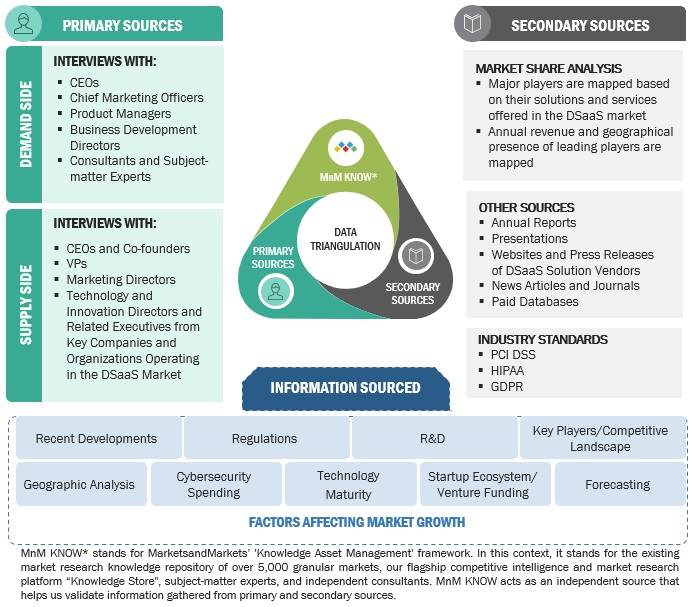

This study involved multiple steps in estimating the current size of the data security as a service (DSaaS) market. Exhaustive secondary research was carried out to collect information on the data security as a service (DSaaS) industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. The top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the data security as a service (DSaaS) market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of data security as a service (DSaaS) vendors, forums, certified publications, and whitepapers. This research was used to obtain key information related to the industry's value chain, the total pool of key players, market classification, and segmentation from the market- and technology-oriented perspectives.

Factors Considered to Estimate Regional-Level Market Size:

- Gross Domestic Product (GDP) Growth

- Information and Communication Technology (ICT) Security Spending

- Recent Market Developments

- Market Ranking Analysis of Major DSaaS Providers

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. These sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the data security as a service (DSaaS) market.

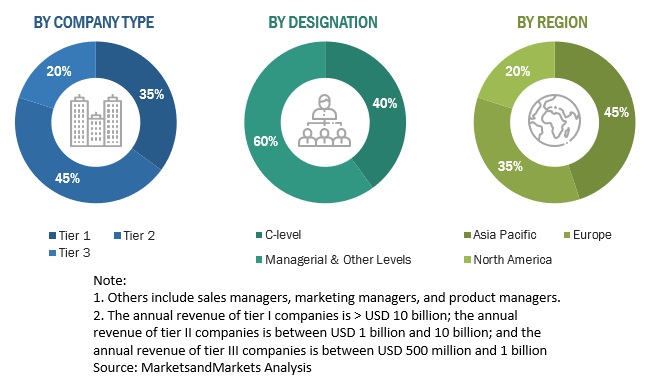

Following is the breakup of the primary interviews:

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

To know about the assumptions considered for the study, Request for Free Sample Report

Report Objectives

- To define, describe, and forecast the data security as a service (DSaaS) market based on type, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the data security as a service (DSaaS) market

- To forecast the data security as a service (DSaaS) market size across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the data security as a Service (DSaaS) market and comprehensively analyze their market size and core competencies

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To map the companies to get competitive intelligence based on company profiles, key player strategies, and game-changing developments such as product launches, collaborations, and acquisitions

- To track and analyze competitive developments such as product launches and enhancements, acquisitions, partnerships, and collaborations in the DSaaS market

Available Customization

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Security as a Service Market