Data Pipeline Tools Market by Component (Tools and Services), Tool Type (ETL Data Pipeline, ELT Data Pipeline, Streaming Data Pipeline, and Batch Data Pipeline), Application, Deployment Mode, Organization Size, Vertical & Region - Global Forecast to 2027

Data Pipeline Tools Market Overview, Industry Share and Forecast

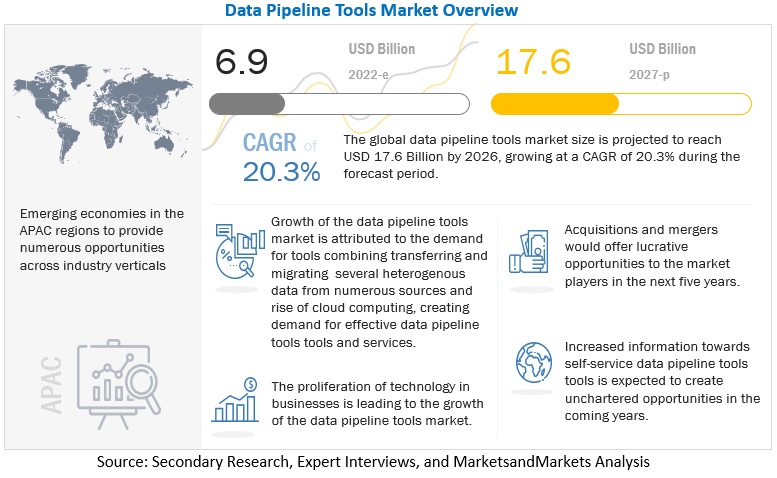

The global Data Pipeline Tools Market size was valued at USD 6.9 billion in 2022 and is expected to grow at a CAGR of 20.3% from 2022 to 2027. The revenue forecast for 2027 is projected to reach $17.6 billion. The base year for estimation is 2021, and the historical data spans from 2022 to 2027.

The major drivers of the data pipeline tool market include the demand for tools transferring data from heterogeneous sources to cloud or warehouse and rise of cloud computing creating demand for effective data pipeline and practices. The data pipeline tools market faces challenges such as lack of standardization in enterprise data pipeline and management strategy, lack of adoption of high-end ETL tools in SMEs, and need for an upgraded data pipeline framework that incorporates big data platform. The data pipeline tools market is segmented based on components, applications, type, deployment modes, organization sizes, verticals, and regions.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Pipeline Tools Market Dynamics

Driver: Need for agility to meet peaks in demand

Businesses that require data must be able to access it whenever they do. With conventional pipelines, if many organisations in a corporation need access to data at the same time, there could be shutdowns and disruptions. Instead of taking several days or weeks, the company should be able to expand its data storage and processing capabilities quickly and affordably. Legacy data pipelines frequently exhibit rigidity and slowness, are incorrect, difficult to debug, and are difficult to grow. They need a tremendous investment of time, money, and energy during both their production and administration. They also generally cannot run different procedures simultaneously, undermining the business during peak hours. At a fraction of the price of conventional systems, advanced data pipelines provide the immediate flexibility of the clouds. They ease access to shared data, offer instant, flexible provisioning when data sets and workloads expand, and allow companies to easily deploy their whole pipeline without being constrained by hardware configuration. Faster decision-making and improved data analytics can give you a competitive advantage.

Restraint: Lack of expertise among workforces

In order to collect and integrate vast volumes of data from numerous internal and external data sources and combine the information silos to obtain insightful business intelligence, organisations must implement modern data pipeline technology. The workforce's limited knowledge and weak skills prevent them from implementing data pipeline solutions. Organizations often operate in silos, therefore the necessity for a data pipeline is becoming increasingly crucial to acquire a more comprehensive understanding of many applications and sectors. Numerous reports and research claim that surveys consistently demonstrate the inadequate knowledge and abilities of the workers in firms. Organizations should prioritize and make significant investments in training and certifications to address this issue, ensuring that the workforce has the necessary understanding of big data pipeline techniques and strategies and can put those strategies into practice for effective data management.

Opportunity: Need to Reduce data latency

Data bottlenecks can occur while traveling from one system to another in a multi-cloud. As the amount of data being used grows, these may rise. The effectiveness of the message queue, stream computing, and databases used to store calculation results all affect latency. Because business intelligence applications require adequate information for decision-making, it's critical to maintain latency as low as feasible. Only a portion of the data may be transported elsewhere if only a small fraction is needed with extremely low latency. It can then be computationally more efficient to process that data and give the results, to the relevant dashboard. Analytics systems like Hadoop and Spark offer a variety of managed services in a serverless cloud environment. These systems provide organization with an opportunity to reduce data latency. These enable customers to deal with data in almost real-time, expand their systems as necessary, and, have far lower server maintenance costs. Although using managed services might be expensive and result in the usage of certain tools that aren't transferable to other cloud providers, using a cloud pipeline, can get around some of these restrictions.

Challenge: Data Downtime

Data is the driving force behind the operations and choices of data-driven businesses. However, there may be periods when their data is unreliable or unprepared (especially during events like M&A, reorganizations, infrastructure upgrades and migrations). Customer complaints and subpar analytical outcomes are only two ways that this data unavailability can have a significant impact on the businesses. Research found that a data engineer spends roughly 80% of their time updating, maintaining, and guaranteeing the integrity of the data pipeline. There is a significant marginal cost due to the lengthy operational lead time from data capture to insight. Schema modifications and migration problems are only two major causes of data downtime. Data pipelines can be difficult due to their size and complexity. Constant data outage analysis and automated ways to reduce it are crucial. Data downtime may be managed with the use of accountability and SLAs. To continually produce high-quality data pipelines that are suitable for operational and analytics, the predictive DQ can keep track of problems. Companies also suffer with unstructured information, incorrect data, duplication in data, and data transformation mistakes in addition to the problems.

Healthcare and Life Sciences vertical to register at the highest CAGR during the forecast period

The data pipeline tools market by vertical is segmented into: energy & utility, government & defense, BFSI, manufacturing, retail & e-commerce, healthcare & life sciences, telecom, IT & ITeS, Transportation & Logistics, and other Verticals. Other Verticals includes Media & Entertainment, Travel & Hospitality and Education & Research. Among vertical, the healthcare & life sciences vertical registered to grow at a highest CAGR during the forecast period. With the deployment of ever improving technology, the healthcare sector is starting to undergo a digital transformation. To enhancing the services they offer, healthcare institutions are moving toward a more linked and collaborative healthcare environment. Because of the vast volumes of disparate healthcare data, healthcare companies must employ data-driven strategies to automate clinical operations. Healthcare data pipeline refers to the connections that move and modify medical data across systems. To provide precise diagnoses and prognoses, healthcare facilities need access to current and reliable medical data.

Tools segments register to account for the largest market size during the forecast period

The requirement for combining information from several independent sources expands quickly along with the number of data that businesses create and gather. IT giants like IBM, Microsoft, SAP, and Informatic were compelled to create and construct data pipeline software to assist IT teams in streamlining and managing the process due to the abundance of data that amounts to big data. Organizations must assess their data requirements considering the numerous data pipeline tools available before deploying the programme. When installing the data pipeline tools, businesses want scalable, cost-effective solutions that will enable them to connect their data sets and provide a single, uniform view of the data throughout the whole organisations.

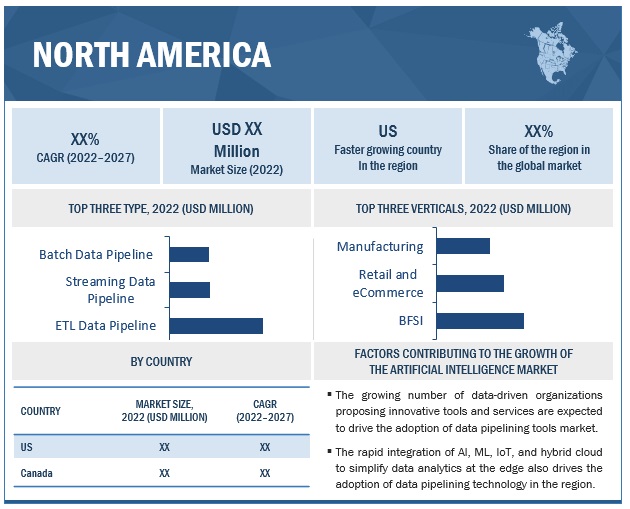

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in the data pipeline tools market. North America is one of most captivate regions in data pipelining tools market. Countries such as US and Canada are the early adopters of data pipelining technology in the North America region. This region rapidly shapes the trend of data pipelining market being home to majority of the key players that provide various tools and services for data integration and pipelining. The growing size of data silos increases data integration complexities that needs to be addressed. Data pipelining process benefits millions of enterprises with massive data silos worldwide to transform and make it ready to be analyzed to develop business insights. Various data-driven enterprises in North America are aggressively launching newer data pipelining tools and services to empower businesses to catalog, manage and analyze critical data.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The data pipeline tools vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global data pipeline tools market include Google (US), IBM (US), AWS (US), Oracle (US), Microsoft (US), SAP SE (Germany), Actian (US), Software AG (Germany), Denodo Technologies (US), Snowflake (US), Tibco (US), Adeptia (US), SnapLogic (US), K2View (US), Precisely (US), TapClicks (US), Talend (US), Rivery.io (US), Alteryx (US), Informatica (US), Qlik (US), Hitachi Vantara (US), Hevodata (US), Gathr (US), Confluent (US), Estuary Flow (US), Blendo (US), Integrate.io (US), and Fivetran (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

$6.9 billion |

|

Revenue Forecast for 2027 |

$17.6 billion |

|

Growth Rate |

20.3% CAGR |

|

Largest Market |

North America |

|

Segments covered |

Component, Deployment Mode, Type, Organization Size, Application, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Google (US), IBM (US), AWS (US), Oracle (US), Microsoft (US), SAP SE (Germany), Actian (US), Software AG (Germany), Denodo Technologies (US), Snowflake (US), Tibco (US), Adeptia (US), SnapLogic (US), K2View (US), Precisely (US), TapClicks (US), Talend (US), Rivery.io (US), Alteryx (US), Informatica (US), Qlik (US), Hitachi Vantara (US), Hevodata (US), Gathr (US), Confluent (US), Estuary Flow (US), Blendo (US), Integrate.io (US), and Fivetran (US). |

This research report categorizes the data pipeline tools market based on components, solution, type, application, deployment mode, organization size, application, vertical, and regions.

By Component:

- Tools

- Service

By Type:

- ELT Data Pipeline

- ETL Data Pipeline

- Streaming Data Pipeline

- Batch Data Pipeline

- Change Data Capture Pipeline (CDC)

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large Enterprises

- SMEs

By Application:

- Real time Analytics

- Sales and Marketing Data

- Customer 360 & Customer Relationship Management

- Predictive Maintenance

- Customer Experience Management

- Data Migration

- Data Traffic Management

- Other Applications

By Vertical:

- BFSI

- Government and Defense

- Retail and eCommerce

- Healthcare and Life Sciences

- Energy and Utilities

- Telecom

- IT and ITeS

- Manufacturing

- Transportation and Logistics

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Thailand

- Myanmar

- Vietnam

- Rest of Asia Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments in Data Pipeline Tools Market :

- In July 2022, by acquiring Askdata, SAP has improved its capacity to support businesses in making more informed decisions by utilizing AI-driven natural language searches. To optimised business insights, users are given the freedom to browse, communicate, and contribute on real-time data.

- In June 2022, Users may see information at the table and row levels with the help of MANTA Automated Data Lineage for IBM Cloud Pak for Data, which is coupled with IBM Watson Knowledge Catalog to help consumers know where the data originates from, how it is converted, and how it will be utilized in the end. It enables direct and indirect lineage views in addition to the technical data lineage to aid users in effects associated and root cause identification.

- In May 2022, SoftServe collaborated with Google Cloud to build the services, working with it from the beginning of execution until the launch. A complete solution called Manufacturing Data Engine analyses, contextualizes, and maintains industrial data on the industry-leading data platform of Google Cloud, giving the data a structure. Manufacturing Connect is a factory edge platform that was created in collaboration with Litmus Automation. It attaches rapidly to any production equipment or industrial equipment and transmits data from it to Google Cloud.

- In March 2022, RISE with SAP will enable Microsoft to quickly implement new capacities and innovations. SAP ERP solutions will be migrated to SAP S/4HANA Cloud, Private Edition. This will complement Microsoft's substantial use of other Sap modules on Azure, such as Critical factors, SAP IBP for Supply Chain, SAP BTP, and many others.

- In January 2022, Confluent, an information streaming platform that enables individuals to set information in motion, announced recently a SCA with Amazon Web Services, Inc. (AWS). Confluent and AWS have agreed to work together on go-to-market activities for five years to help businesses embrace the cloud more quickly by providing real-time data.

Frequently Asked Questions (FAQ):

What is the projected market value of the global data pipeline tools market?

What is the estimated growth rate (CAGR) of the global data pipeline tools market for the next five years?

What are the major revenue pockets in the data pipeline tools market currently?

What does the current study of the data pipeline tools market consist of?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 1 DATA PIPELINE TOOLS: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 DATA PIPELINE TOOLS: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF DATA PIPELINE TOOLS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL DATA PIPELINE TOOLS/SERVICES

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF DATA PIPELINE TOOLS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF DATA PIPELINE TOOLS THROUGH OVERALL SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 9 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 55)

TABLE 4 DATA PIPELINE TOOLS MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y)

TABLE 5 MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y)

FIGURE 10 TOOLS TO ACCOUNT FOR LARGER MARKET IN 2022

FIGURE 11 CONSULTING SERVICES TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

FIGURE 12 REAL-TIME ANALYTICS & PREDICTIVE MAINTENANCE APPLICATIONS TO ACCOUNT FOR LARGEST MARKET IN 2022

FIGURE 13 ON-PREMISE DEPLOYMENT TO ACCOUNT FOR LARGER MARKET IN 2022

FIGURE 14 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

FIGURE 15 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO BE LARGEST VERTICAL IN 2022

FIGURE 16 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 ATTRACTIVE MARKET OPPORTUNITIES FOR DATA PIPELINE TOOLS MARKET PLAYERS

FIGURE 17 HIGH DEMAND FOR TOOLS TRANSFERRING DATA FROM PREMISES TO CLOUD TO DRIVE MARKET DURING FORECAST PERIOD

4.2 MARKET, BY VERTICAL

FIGURE 18 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO BE LARGEST VERTICAL DURING FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 19 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET BY 2027

4.4 MARKET: TOP THREE BUSINESS APPLICATIONS AND VERTICALS

FIGURE 20 REAL-TIME ANALYTICS & PREDICTIVE MAINTENANCE AND BFSI TO BE LARGEST RESPECTIVE MARKETS BY 2022

5 MARKET OVERVIEW AND TRENDS (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DATA PIPELINE TOOLS MARKET

5.2.1 DRIVERS

5.2.1.1 Need for agility to meet peaks in demand

5.2.1.2 Emergence of cloud computing technologies

5.2.2 RESTRAINTS

5.2.2.1 Lack of expertise among workforce

5.2.3 OPPORTUNITIES

5.2.3.1 Overcoming the lacunae of traditional data management tools

5.2.3.2 Necessity to reduce data latency

5.2.4 CHALLENGES

5.2.4.1 Updating data pipeline using ETL impacts data quality

5.2.4.2 Duplicate data

5.2.4.3 Data downtime

5.2.4.4 Reluctance to adopt advanced tools and technologies

5.3 DATA PIPELINE TOOLS: EVOLUTION

FIGURE 22 EVOLUTION OF DATA PIPELINE TOOLS

5.4 ECOSYSTEM

TABLE 6 DATA PIPELINE TOOLS MARKET: ECOSYSTEM

5.5 CASE STUDY ANALYSIS

5.5.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

5.5.1.1 Combined 23 disparate ERP systems into a single SAP ERP application

5.5.1.2 Big Data platform implementation on Amazon Web Services for Norway’s largest bank

5.5.2 TRANSPORTATION & LOGISTICS

5.5.2.1 Convoy builds a continuous data pipeline with the data cloud

5.5.3 RETAIL & CONSUMER GOODS

5.5.3.1 Leading eCommerce site gained improved data accessibility

5.5.4 HEALTHCARE & LIFE SCIENCES

5.5.4.1 CDPHP modernized infrastructure and improved ability to extract valuable medical data on AWS

5.5.5 MEDIA & ENTERTAINMENT

5.5.5.1 GumGum utilized AWS data pipeline to handle high data volume growth

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 23 SUPPLY CHAIN ANALYSIS

5.7 PORTER’S FIVE FORCES

FIGURE 24 DATA PIPELINE TOOLS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 PRICING ANALYSIS

TABLE 8 DATA PIPELINE TOOLS MARKET: PRICING LEVELS

FIGURE 25 AVERAGE SELLING PRICES OF KEY COMPANIES (USD)

5.9 PATENT ANALYSIS

5.9.1 METHODOLOGY

5.9.2 DOCUMENT TYPE

TABLE 9 PATENTS FILED, 2018–2021

5.9.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 26 ANNUAL NUMBER OF PATENTS GRANTED, 2018–2021

5.9.3.1 Top applicants

FIGURE 27 TOP TEN PATENT APPLICANTS, 2018–2021

TABLE 10 US: TOP TEN PATENT OWNERS IN MARKET, 2018–2021

5.10 TECHNOLOGY ANALYSIS

5.10.1 ARTIFICIAL INTELLIGENCE

5.10.2 MACHINE LEARNING

5.10.3 IOT

5.10.4 CLOUD COMPUTING

5.10.5 BIG DATA

5.11 KEY CONFERENCES & EVENTS

TABLE 11 DATA PIPELINE TOOLS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.2 NORTH AMERICA: REGULATIONS

5.12.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

5.12.2.2 Gramm-Leach-Bliley (GLB) Act

5.12.2.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

5.12.2.4 Federal Information Security Management Act (FISMA)

5.12.2.5 Federal Information Processing Standards (FIPS)

5.12.2.6 California Consumer Privacy Act (CCPA)

5.12.3 EUROPE: TARIFFS AND REGULATIONS

5.12.3.1 GDPR 2016/679

5.12.3.2 General Data Protection Regulation

5.12.3.3 European Committee for Standardization (CEN)

5.12.3.4 European Technical Standards Institute (ETSI)

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

5.13.2 BUYING CRITERIA

TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 DATA PIPELINE TOOLS MARKET, BY COMPONENT (Page No. - 87)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

FIGURE 28 SERVICES TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 19 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 20 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 TOOLS

6.2.1 GREATER NEED TO ACCESS DATA FROM DATA WAREHOUSE

FIGURE 29 ETL DATA PIPELINE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 21 TOOLS: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 22 TOOLS: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 23 DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 GROWING PRODUCT ACCEPTANCE TO DRIVE ADOPTION OF DATA PIPELINE TOOLS

FIGURE 30 DEPLOYMENT & INTEGRATION SERVICES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 25 DATA PIPELINE SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 26 DATA PIPELINE SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 27 DATA PIPELINE SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 28 DATA PIPELINE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.1 Consulting

6.3.1.1.1 Scope to enable companies to lower risks and focus on business

TABLE 29 DATA PIPELINE TOOL CONSULTING SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 30 DATA PIPELINE TOOL CONSULTING SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.2 Support & maintenance

6.3.1.2.1 Increase in demand due to shifting economic situations

TABLE 31 DATA PIPELINE TOOL SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 DATA PIPELINE TOOL SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.3 Deployment & integration

6.3.1.3.1 Need to ensure minimum risks among companies to drive demand

TABLE 33 DATA PIPELINE TOOL DEPLOYMENT & INTEGRATION SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 DATA PIPELINE TOOL DEPLOYMENT & INTEGRATION SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

7 DATA PIPELINE TOOLS MARKET, BY ORGANIZATION SIZE (Page No. - 97)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 31 SMALL- & MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER CAGR DURING FORECAST PERIOD

TABLE 35 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 36 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

7.2 LARGE ENTERPRISES

7.2.1 UNSTRUCTURED DATA: MAJOR CONCERN AMONG LARGE ENTERPRISES

TABLE 37 LARGE ENTERPRISES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 LARGE ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 SMALL- & MEDIUM-SIZED ENTERPRISES

7.3.1 RISE IN NEED TO ACCESS DATA IN REAL-TIME FOR BETTER DECISIONS

TABLE 39 SMALL- & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 SMALL- & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

8 DATA PIPELINE TOOLS MARKET, BY DEPLOYMENT MODE (Page No. - 102)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

FIGURE 32 CLOUD DEPLOYMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 41 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 42 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

8.2 ON-PREMISES

8.2.1 DATA PIPELINE CONNECTS DATABASES TO CENTRALIZED INTERFACE TO EASE BUSINESS

TABLE 43 ON-PREMISE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 ON-PREMISE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 CLOUD

8.3.1 FLEXIBILITY AND SCALABILITY TO BOOST ADOPTION OF CLOUD-BASED DATA PIPELINE TOOLS

TABLE 45 CLOUD-BASED MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 CLOUD-BASED MARKET, BY REGION, 2022–2027 (USD MILLION)

9 DATA PIPELINE TOOLS MARKET, BY TYPE (Page No. - 107)

9.1 INTRODUCTION

9.1.1 TYPE: MARKET DRIVERS

FIGURE 33 ETL DATA PIPELINE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 47 DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 48 DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2 ELT DATA PIPELINE

9.2.1 USAGE OF CLOUD TO DRIVE SHIFT FROM ETL TO ELT

TABLE 49 ELT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 50 ELT MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 ETL DATA PIPELINE

9.3.1 CENTRALIZING AND STANDARDIZING DATA TO ENABLE EASY ACCESS TO EXPERTS AND DECISION-MAKERS

TABLE 51 ETL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 ETL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 STREAMING DATA PIPELINE

9.4.1 REAL-TIME DATA MORE CRUCIAL IN STREAMING DATA PIPELINE

TABLE 53 STREAMING DATA PIPELINE DATA PIPELINE TOOLS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 STREAMING MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 BATCH DATA PIPELINE

9.5.1 FLEXIBILITY AND SCALABILITY TO BOOST ADOPTION OF CLOUD-BASED DATA PIPELINE TOOLS SOFTWARE

TABLE 55 BATCH MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 BATCH MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 CHANGE DATA CAPTURE PIPELINE (CDC)

9.6.1 CHANGE DATA CAPTURE ESSENTIAL TO PREVENT LOSS AND DESTRUCTION OF DATA

TABLE 57 CHANGE DATA CAPTURE PIPELINE TOOLS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 CHANGE DATA CAPTURE PIPELINE TOOLS MARKET, BY REGION, 2022–2027 (USD MILLION)

10 DATA PIPELINE TOOLS MARKET, BY APPLICATION (Page No. - 115)

10.1 INTRODUCTION

10.1.1 APPLICATION: MARKET DRIVERS

FIGURE 34 CUSTOMER EXPERIENCE MANAGEMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 59 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 60 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 REAL-TIME ANALYTICS & PREDICTIVE MAINTENANCE

10.2.1 ELIMINATE DATA PIPELINE DOWNTIME AND PROVIDE REAL-TIME DATA ANALYSIS

TABLE 61 REAL-TIME ANALYTICS & PREDICTIVE MAINTENANCE APPLICATIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 62 REAL-TIME ANALYTICS & PREDICTIVE MAINTENANCE APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 SALES & MARKETING DATA

10.3.1 NEED TO REDUCE DATA GATHERING TIME FROM VARIOUS SOURCES AND STORE DATA AT SINGLE LOCATION

TABLE 63 SALES & MARKETING DATA APPLICATIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 64 SALES & MARKETING DATA APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 CUSTOMER 360 & CUSTOMER RELATIONSHIP MANAGEMENT

10.4.1 NEED TO ANALYZE CUSTOMER BEHAVIOR AND REDUCE CUSTOMER CHURN

TABLE 65 CUSTOMER 360 & CUSTOMER RELATIONSHIP MANAGEMENT APPLICATIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 66 CUSTOMER 360 & CUSTOMER RELATIONSHIP MANAGEMENT APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 CUSTOMER EXPERIENCE MANAGEMENT

10.5.1 UNIFIED CUSTOMER VIEWS ACROSS CUSTOMER ECOSYSTEM TO ENHANCE CUSTOMER EXPERIENCE

TABLE 67 CUSTOMER EXPERIENCE MANAGEMENT APPLICATIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 68 CUSTOMER EXPERIENCE MANAGEMENT APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 DATA MIGRATION

10.6.1 DEMAND TO SIMPLIFY DATA MIGRATION PROCESS BY CREATING BATCH AND STREAMING DATA PIPELINE

TABLE 69 DATA MIGRATION APPLICATIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 70 DATA MIGRATION APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 OTHER APPLICATIONS

TABLE 71 OTHER APPLICATIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 72 OTHER APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

11 DATA PIPELINE TOOLS MARKET, BY VERTICAL (Page No. - 125)

11.1 INTRODUCTION

11.1.1 VERTICAL: MARKET DRIVERS

FIGURE 35 HEALTHCARE & LIFE SCIENCES VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 73 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 74 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

11.2.1 NEED TO ENHANCE QUALITY OF SERVICES AND MAKE REAL-TIME SMART DECISIONS TO DRIVE GROWTH

TABLE 75 BFSI VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 76 BFSI VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 RETAIL & ECOMMERCE

11.3.1 CONTINUOUS DATA PIPELINE FLOW TO HELP ANALYZE CONSUMER BEHAVIOR IN REAL-TIME

TABLE 77 RETAIL & ECOMMERCE VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 78 RETAIL & ECOMMERCE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 GOVERNMENT & DEFENSE

11.4.1 EFFECTIVE TRANSFORMATION OF DATA WITHOUT LOSING PACKETS TO HELP IN FASTER DECISION-MAKING

TABLE 79 GOVERNMENT & DEFENSE VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 80 GOVERNMENT & DEFENSE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 HEALTHCARE & LIFE SCIENCES

11.5.1 PRESSURE FROM INSURERS AND IMPACT OF PHYSICIANS TO DRIVE ADOPTION OF ROBUST DATA PIPELINES

TABLE 81 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 82 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 IT & ITES

11.6.1 RISING COMPLEXITY AND FAST INNOVATION TO DRIVE NEED FOR STREAMLINED DATA PIPELINES

TABLE 83 IT & ITES VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 84 IT & ITES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 ENERGY & UTILITIES

11.7.1 ADVANCED DATA PIPELINE TOOLS TO HELP BUILD ACCOUNTABLE, TRANSPARENT, FAIR, AND SECURE SYSTEMS

TABLE 85 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 86 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.8 TELECOMMUNICATION

11.8.1 DEPLOYMENT OF DATA PIPELINE TOOLS TO REDUCE NETWORK ANOMALIES BY MAINTAINING CONTINUOUS DATA FLOW

TABLE 87 TELECOMMUNICATION VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 88 TELECOMMUNICATION VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.9 MANUFACTURING

11.9.1 RISE IN USE OF ROBUST DATA PIPELINE TOOLS TO PREDICT MACHINE DOWNTIME AND MAINTENANCE

TABLE 89 MANUFACTURING VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 90 MANUFACTURING VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.10 TRANSPORTATION & LOGISTICS

11.10.1 GROWING NEED FOR SEAMLESS INTEGRATED DATA PIPELINE ACROSS MULTI-MODEL TRANSPORTATION NETWORK

TABLE 91 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 92 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.11 OTHER VERTICALS

TABLE 93 OTHER VERTICALS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 94 OTHER VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

2 DATA PIPELINE TOOLS MARKET, BY REGION (Page No. - 139)

12.1 INTRODUCTION

FIGURE 36 THAILAND TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 37 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

TABLE 95 DATA PIPELINE MARKET TOOLS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 96 DATA PIPELINE MARKET TOOLS MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

TABLE 97 NORTH AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: DATA PIPELINE SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: DATA PIPELINE SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 101 NORTH AMERICA: DATA PIPELINE TOOLS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 105 NORTH AMERICA: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 106 NORTH AMERICA: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.2 US

12.2.2.1 Presence of several global players to increase demand for data pipelines

12.2.3 CANADA

12.2.3.1 Rapid adoption of flexible and intuitive data pipeline tools and services

12.3 EUROPE

12.3.1 EUROPE: DATA PIPELINE TOOLS MARKET DRIVERS

TABLE 113 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 115 EUROPE: DATA PIPELINE SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 116 EUROPE: DATA PIPELINE SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 121 EUROPE: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 122 EUROPE: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 123 EUROPE: DATA PIPELINE TOOLS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 127 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.2 UK

12.3.2.1 Focus on research & development of advanced technologies to drive growth

12.3.3 GERMANY

12.3.3.1 Rapid adoption of modern technologies across various verticals to fuel expansion

12.3.4 FRANCE

12.3.4.1 Government investments in infrastructure and modern technologies to fuel growth

12.3.5 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: DATA PIPELINE TOOLS MARKET DRIVERS

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 129 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 131 ASIA PACIFIC: DATA PIPELINE SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 132 ASIA PACIFIC: DATA PIPELINE SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: DATA PIPELINE TOOLS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Rapid adoption of advanced technologies across various verticals to increase demand

12.4.3 THAILAND

12.4.3.1 Rise in government and foreign investment to boost demand

12.4.4 MYANMAR

12.4.4.1 Advancement and expansion of technologies to drive growth

12.4.5 VIETNAM

12.4.5.1 Adoption of modern technologies to fuel growth

12.4.6 JAPAN

12.4.6.1 Growth in innovation and initiatives to propel market

12.4.7 INDIA

12.4.7.1 Foreign investment in Indian firms to drive growth

12.4.8 REST OF ASIA PACIFIC

12.5 MIDDLE EAST & AFRICA

12.5.1 MIDDLE EAST & AFRICA: DATA PIPELINE TOOLS MARKET DRIVERS

TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: DATA PIPELINE SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: DATA PIPELINE SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: DATA PIPELINE TOOLS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY SUBREGION, 2016–2021 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: MARKET, BY SUBREGION, 2022–2027 (USD MILLION)

12.5.2 MIDDLE EAST

12.5.2.1 Higher expenditure on emerging technologies to offer opportunities to drive growth

12.5.3 AFRICA

12.5.3.1 Widespread adoption of technologies to improve business applications

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: DATA PIPELINE TOOLS MARKET DRIVERS

TABLE 161 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 163 LATIN AMERICA: DATA PIPELINE SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 164 LATIN AMERICA: DATA PIPELINE SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 169 LATIN AMERICA: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 170 LATIN AMERICA: DATA PIPELINE TOOLS SUBSEGMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 171 LATIN AMERICA: DATA PIPELINE TOOLS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.2 BRAZIL

12.6.2.1 Need to integrate and validate data collected from sources to drive demand

12.6.3 MEXICO

12.6.3.1 Rapid adoption of modern technology and initiatives by government to drive demand

12.6.4 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 177)

13.1 OVERVIEW

13.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 177 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN DATA PIPELINE TOOLS MARKET

13.3 REVENUE ANALYSIS

FIGURE 40 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST FIVE YEARS (USD MILLION)

13.4 MARKET SHARE ANALYSIS

FIGURE 41 MARKET SHARE ANALYSIS FOR KEY PLAYERS IN 2022

TABLE 178 MARKET: DEGREE OF COMPETITION

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

FIGURE 42 KEY DATA PIPELINE TOOLS MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

13.6 STARTUP/SME EVALUATION MATRIX

13.6.1 PROGRESSIVE COMPANIES

13.6.2 RESPONSIVE COMPANIES

13.6.3 DYNAMIC COMPANIES

13.6.4 STARTING BLOCKS

FIGURE 43 DATA PIPELINE TOOL STARTUPS/SMES, COMPANY EVALUATION MATRIX, 2022

13.7 COMPETITIVE BENCHMARKING

TABLE 179 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 180 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

13.8 COMPETITIVE SCENARIO

13.8.1 PRODUCT LAUNCHES

TABLE 181 PRODUCT LAUNCHES, 2018–2022

13.8.2 DEALS

TABLE 182 DEALS, 2018–2022

13.8.3 OTHERS

TABLE 183 OTHERS, 2018–2022

14 COMPANY PROFILES (Page No. - 189)

(Business Overview, Solutions offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 KEY PLAYERS

14.1.1 GOOGLE

TABLE 184 GOOGLE: BUSINESS OVERVIEW

FIGURE 44 GOOGLE: COMPANY SNAPSHOT

TABLE 185 GOOGLE: SOLUTIONS OFFERED

TABLE 186 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 187 GOOGLE: DEALS

14.1.2 IBM

TABLE 188 IBM: BUSINESS OVERVIEW

FIGURE 45 IBM: COMPANY SNAPSHOT

TABLE 189 IBM: SOLUTIONS OFFERED

TABLE 190 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 191 IBM: DEALS

TABLE 192 IBM: OTHERS

14.1.3 MICROSOFT

TABLE 193 MICROSOFT: BUSINESS OVERVIEW

FIGURE 46 MICROSOFT: COMPANY SNAPSHOT

TABLE 194 MICROSOFT: SOLUTIONS OFFERED

TABLE 195 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 196 MICROSOFT: DEALS

TABLE 197 MICROSOFT: OTHERS

14.1.4 AWS

TABLE 198 AWS: BUSINESS OVERVIEW

FIGURE 47 AWS: COMPANY SNAPSHOT

TABLE 199 AWS: SOLUTIONS OFFERED

TABLE 200 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 201 AWS: DEALS

TABLE 202 AWS: OTHERS

14.1.5 SAP

TABLE 203 SAP: BUSINESS OVERVIEW

FIGURE 48 SAP: COMPANY SNAPSHOT

TABLE 204 SAP: SOLUTIONS OFFERED

TABLE 205 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 206 SAP: DEALS

14.1.6 ORACLE

TABLE 207 ORACLE: BUSINESS OVERVIEW

FIGURE 49 ORACLE: COMPANY SNAPSHOT

TABLE 208 ORACLE: SOLUTIONS OFFERED

TABLE 209 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 210 ORACLE: DEALS

14.1.7 ALTERYX

TABLE 211 ALTERYX: BUSINESS OVERVIEW

FIGURE 50 ALTERYX: COMPANY SNAPSHOT

TABLE 212 ALTERYX: SOLUTIONS OFFERED

TABLE 213 ALTERYX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 214 ALTERYX: DEALS

14.1.8 INFORMATICA

TABLE 215 INFORMATICA: BUSINESS OVERVIEW

TABLE 216 INFORMATICA: SOLUTIONS OFFERED

TABLE 217 INFORMATICA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 218 INFORMATICA: DEALS

TABLE 219 INFORMATICA: OTHERS

14.1.9 ACTIAN

TABLE 220 ACTIAN: BUSINESS OVERVIEW

TABLE 221 ACTIAN: SOLUTIONS OFFERED

TABLE 222 ACTIAN: PRODUCT LAUNCHES AND ENHANCEMENTS

14.1.10 TALEND

TABLE 223 TALEND: BUSINESS OVERVIEW

FIGURE 51 TALEND: COMPANY SNAPSHOT

TABLE 224 TALEND: SOLUTIONS OFFERED

TABLE 225 TALEND: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 226 TALEND: DEALS

TABLE 227 TALEND: OTHERS

14.1.11 DENODO TECHNOLOGIES

TABLE 228 DENODO TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 229 DENODO TECHNOLOGIES: SOLUTIONS OFFERED

TABLE 230 DENODO TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 231 DENODO TECHNOLOGIES: DEALS

14.1.12 SNOWFLAKE

TABLE 232 SNOWFLAKE: BUSINESS OVERVIEW

TABLE 233 SNOWFLAKE: SOLUTIONS OFFERED

TABLE 234 SNOWFLAKE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 235 SNOWFLAKE: DEALS

14.1.13 SOFTWARE AG

TABLE 236 SOFTWARE AG: BUSINESS OVERVIEW

TABLE 237 SOFTWARE AG: SOLUTIONS OFFERED

TABLE 238 SOFTWARE AG: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 239 SOFTWARE AG: DEALS

14.1.14 HITACHI VANTARA

TABLE 240 HITACHI VANTARA: BUSINESS OVERVIEW

TABLE 241 HITACHI: SOLUTIONS OFFERED

TABLE 242 HITACHI VANTARA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 243 HITACHI VANTARA: DEALS

14.1.15 QLIK

TABLE 244 QLIK: BUSINESS OVERVIEW

TABLE 245 QLIK: SOLUTIONS OFFERED

TABLE 246 QLIK: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 247 QLIK: DEALS

14.1.16 TIBCO

TABLE 248 TIBCO: BUSINESS OVERVIEW

TABLE 249 TIBCO: SOLUTIONS OFFERED

TABLE 250 TIBCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 251 TIBCO: DEALS

14.1.17 HEVO DATA

TABLE 252 HEVO DATA: BUSINESS OVERVIEW

TABLE 253 HEVO DATA: SOLUTIONS OFFERED

TABLE 254 HEVO DATA: DEALS

14.1.18 ADEPTIA

14.1.19 SNAPLOGIC

14.1.20 K2VIEW

14.1.21 PRECISELY

14.1.22 TAPCLICKS

14.1.23 RIVERY.IO

14.2 STARTUP/SME PLAYERS

14.2.1 GATHR

14.2.2 CONFLUENT

14.2.3 ESTUARY FLOW

14.2.4 BLENDO

14.2.5 INTEGRATE.IO

14.2.6 FIVETRAN

*Details on Business Overview, Solutions offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 269)

15.1 INTRODUCTION

15.2 DATA INTEGRATION MARKET—GLOBAL FORECAST TO 2026

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

15.2.3 DATA INTEGRATION MARKET, BY COMPONENT

TABLE 255 DATA INTEGRATION MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 256 DATA INTEGRATION MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

15.2.4 DATA INTEGRATION MARKET, BY APPLICATION

TABLE 257 DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2015–2020 (USD MILLION)

TABLE 258 DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2021–2026 (USD MILLION)

15.2.5 DATA INTEGRATION MARKET, BY DEPLOYMENT MODEL

TABLE 259 DATA INTEGRATION MARKET, BY DEPLOYMENT MODEL, 2015–2020 (USD MILLION)

TABLE 260 DATA INTEGRATION MARKET, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

15.2.6 DATA INTEGRATION MARKET, BY ORGANIZATION SIZE

TABLE 261 DATA INTEGRATION MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 262 DATA INTEGRATION MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

15.2.7 DATA INTEGRATION MARKET, BY VERTICAL

TABLE 263 DATA INTEGRATION MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 264 DATA INTEGRATION MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

15.2.8 DATA INTEGRATION MARKET, BY REGION

TABLE 265 DATA INTEGRATION MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 266 DATA INTEGRATION MARKET, BY REGION, 2021–2026 (USD MILLION)

15.3 BIG DATA MARKET—GLOBAL FORECAST TO 2026

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 267 BIG DATA MARKET SIZE AND GROWTH RATE, 2016–2020 (USD MILLION, Y-O-Y)

TABLE 268 BIG DATA MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y)

15.3.3 BIG DATA MARKET, BY COMPONENT

TABLE 269 BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 270 BIG DATA MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

15.3.4 BIG DATA MARKET, BY BUSINESS FUNCTION

TABLE 271 BIG DATA MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 272 BIG DATA MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

15.3.5 BIG DATA MARKET, BY ORGANIZATION SIZE

TABLE 273 BIG DATA MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 274 BIG DATA MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

15.3.6 BIG DATA MARKET, BY DEPLOYMENT MODE

TABLE 275 BIG DATA MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 276 BIG DATA MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

15.3.7 BIG DATA MARKET, BY VERTICAL

TABLE 277 BIG DATA MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 278 BIG DATA MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

15.3.8 BIG DATA MARKET, BY REGION

TABLE 279 BIG DATA MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 280 BIG DATA MARKET, BY REGION, 2021–2026 (USD MILLION)

16 APPENDIX (Page No. - 280)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The research study for the data pipeline tools involved the use of extensive secondary sources, directories, and several magazines and journals, including International Research Journal of Engineering and Technology (IRJET), Journal of Big Data, Journal of Pipeline Science and Engineering - KeAi Publishing, and Active intelligence Magazine, and publications, such as IEEE Conference Publication and design to omni-channel logistics: A literature review and research agenda, Annals of Mathematics and Multichannel Order Management. 0.778 Impact Factor 2019, and International Journal of Information Systems and Supply Chain Management (IJISSCM), to identify and collect information useful for this comprehensive market research study. Primary sources were mainly industry experts from the core and related industries, preferred data pipeline tools providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering data pipeline tools solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as Omni-channel management in the new retailing era: A systematic review and future research agenda Journals and magazines, and Journal/Forums for Machine Learning (ML), AI India magazine, Customer Experience magazine, and other magazines. The data pipeline tools spending of various countries was extracted from respective sources. Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify key players based on solutions; services; market classification, and segmentation according to offerings of major players; industry trends related to solutions, services, deployment modes, applications, verticals, and regions; and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, product development/innovation teams; related key executives from data pipeline tools solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using data pipeline tools solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of data pipeline tools solutions and services, which would impact the overall data pipeline tools.

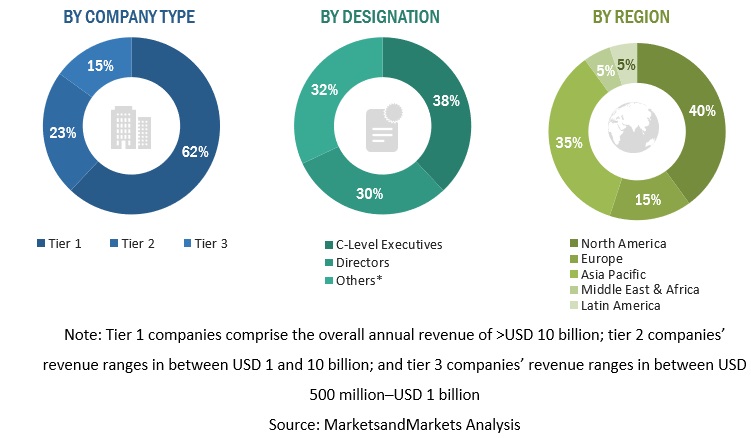

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Data Pipeline Tools Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global data pipeline tools market and various other dependent subsegments. In the top-down approach, an exhaustive list of all the vendors offering tools and services in the data pipeline tools was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on breadth of solutions and services, deployment modes, applications, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation. In the bottom-up approach, the adoption rate of data pipeline tools solutions among different end users in key countries with respect to their regions that contribute the most to the market share was identified. For cross-validation, the adoption of data pipeline tools solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on data pipeline tools solutions based on some of the key use cases. These factors for the data pipeline tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the data pipeline tools by component (software and services), application, deployment mode, organization size, vertical, and region.

- To provide detailed information about major factors (drivers, restraints, opportunities, and challenges) influencing the data pipeline tools market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders.

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the data pipeline tools

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American data pipeline tools market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin American market

- Further breakup of the Middle East & Africa market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Pipeline Tools Market