Data Mining Tools Market by Component (Tools and Services), Business Function (Marketing, Finance, Supply Chain and Logistics, and Operations), Industry Vertical, Deployment Type, Organization Size, and Region - Global Forecast to 2023

[151 Pages Report] The global data mining tools market to grow from USD 519.3 Million in 2017 to USD 1,039.1 Million by 2023, at a Compound Annual Growth Rate (CAGR) of 11.9% during the forecast period. The forecast period is considered from 2018 to 2023, wherein 2017 is considered as the base year for estimating the market size.

Objectives of the Study:

The main objective of this report is to define, describe, and forecast the data mining tools market by component, service, business function, industry vertical, deployment type, organization size, and region. The report provides detailed information related to the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth. The report forecasts the market size with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report profiles the key players and comprehensively analyzes their core competencies. Moreover, this report tracks and analyzes competitive developments, such as mergers and acquisitions, partnerships and collaborations, new product developments and enhancements in the market.

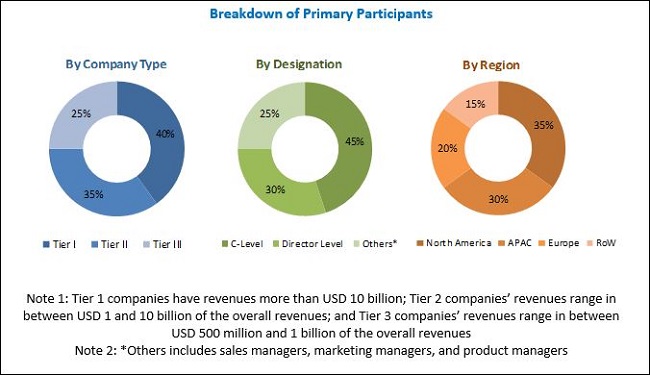

The research methodology used to estimate and forecast the data mining tools market began with the collection and analysis of data on the key vendors’ product offerings and business strategies from secondary sources. These secondary sources include IT service providers, technology providers, press releases, the investor presentations of companies, white papers, technology journals, certified publications, and articles from recognized authors, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Moreover, vendors’ offerings are taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the market from the revenues of the key data mining solution and service providers. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with the key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives.

To know about the assumptions considered for the study, download the pdf brochure

Industry Ecosystem

Major vendors in the data mining tools market include IBM (US), Microsoft (US), SAS Institute (US), Oracle (US), Intel (US), SAP SE (Germany), RapidMiner (US), KNIME (Switzerland), Teradata (US), MathWorks (US), H2O.ai (US), Alteryx (US), FICO (US), Angoss (Canada), Salford Systems (US), BlueGranite (US), Megaputer (US), Biomax Informatics (Germany), Frontline Systems (US), Dataiku (France), Wolfram (US), Reltio (US), SenticNet (Singapore), Business Insight (Belgium), and SunTec India (Delhi).

Please visit 360Quadrants to see the vendor listing of Best Data Mining Software Quadrant

Key Target Audience

- Global data mining solution providers

- Professional service providers

- Government and research organizations

- Information Technology (IT) companies

- Cloud service providers

- System integrators

- Resellers and distributors

- Investor and venture capitalists

- Associations and industrial bodies

Scope of the Report

The research report categorizes the data mining tools market to forecast the revenues and analyze the trends in each of the following submarkets:

By Component

- Tools

- Services

By Service

- Managed services

- Consulting and implementation

-

Others

- Support and Maintenance

- Training and Education

By Business Function

- Marketing

- Finance

- Supply chain and logistics

- Operations

By Industry Vertical

- Retail

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and life sciences

- Telecom and IT

- Government and defense

- Energy and Utilities

- Manufacturing

- Others (Education, and Media and Entertainment)

By Deployment Type

- On-premises

- Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Region

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific (APAC)

- Australia and New Zealand

- Japan

- China

- Rest of Asia Pacific

-

Middle East and Africa (MEA)

- Kingdom of Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American data mining tools market into countries

- Further breakdown of the European market into countries

- Further breakdown of the APAC market into countries

- Further breakdown of the MEA market into countries

- Further breakdown of the Latin American market into countries

Company Information

- Detailed analysis and profiling of additional market players

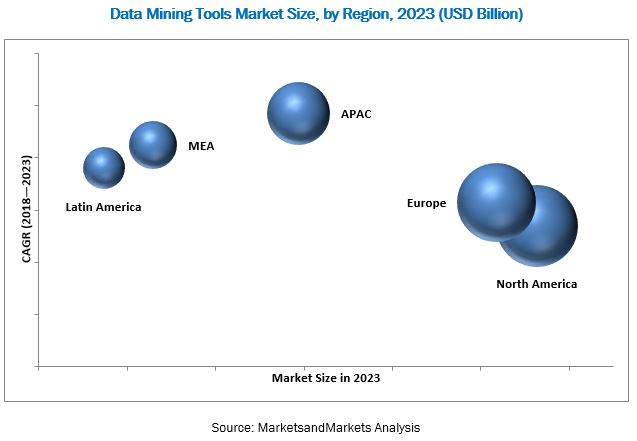

The data mining tools market is expected to grow from USD 591.2 Million in 2018 to USD 1,039.1 Million by 2023, at a Compound Annual Growth Rate (CAGR) of 11.9% during the forecast period, owing to the significant increase in data volume and increased awareness among enterprises to leverage the benefits of available data assets.

The Banking, Financial Services, and Insurance (BFSI) industry vertical includes commercial banks, insurance companies, non-banking financial companies, stock brokerage firms, and payment gateway providers. BFSI companies deal with critical credit management, collection management, and fraud detection management in their day to day financial operations. Additionally, the BFSI industry vertical deals with large volumes of customer and transactional data from various sources. BFSI organizations are looking forward to provide customer friendly digital solutions and software platforms, so that they can serve their customers in a better way. The BFSI industry vertical is a major contributor, in terms of revenue, in the data mining tools market.

Data mining tools empower enterprises to extract usable data from a large set of raw data and analyze hidden data patterns to categorize these patterns into useful information. Data mining managed services would be used extensively by enterprises to gain traction in the global data mining tools market. Managed services enable organizations to focus on their core business competencies while managed service providers mine data for them and provide insights from hidden data patterns. These services further help organizations in focusing on customer-centric aspects and adding value to business operations.

The marketing segment is expected to have the largest market share during the forecast period. The marketing business function enables enterprises to understand the historical transaction patterns of customers, thus helping them plan and manage new marketing campaigns. Furthermore, data mining provides insights into customer-buying patterns and helps organizations in managing the demand and supply match while offering customized offerings to their clients.

North America is estimated to account for the largest market size in 2018 and is expected to dominate the data mining tools market from 2018 to 2023. This region houses industry verticals such as BFSI, retail and consumer goods, healthcare, and Telecom and IT, which largely contribute to the market. However, the Asia Pacific (APAC) region would provide opportunities for data mining tools service providers. These growth opportunities can be attributed to the increasing commercial investments by several companies in the APAC region. However, government rules and regulations pertaining to data usage are expected to restrain the growth of the market.

Major service providers in the global data mining tools market include IBM (US), Microsoft (US), SAS Institute (US), Oracle (US), Intel (US), SAP SE (Germany), RapidMiner (US), KNIME (Switzerland), Teradata (US), MathWorks (US), H2O.ai (US), Alteryx (US), FICO (US), Angoss (Canada), Salford Systems (US), BlueGranite (US), Megaputer (US), Biomax Informatics (Germany), Frontline Systems (US), Dataiku (France), Wolfram (US), Reltio (US), SenticNet (Singapore), Business Insight (Belgium), and SunTec India (Delhi).

Frequently Asked Questions (FAQ):

How big is the Data Mining Tools Market?

What is growth rate of the Data Mining Tools Market?

What are the top trends in Data Mining Tools Market?

Who are the key players in Data Mining Tools Market?

Who will be the leading hub for Data Mining Tools Market?

What is scope of the Data Mining Tools Market report?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Data Mining Tools Market

4.2 Market By Deployment Type

4.3 Market By Component

4.4 Market By Organization Size

4.5 Market Top 3 Industry Verticals and Regions

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Significant Increase in Data Volume

5.2.1.2 Increased Awareness Among Enterprises to Leverage the Available Data Assets

5.2.2 Restraints

5.2.2.1 Government Rules and Regulations

5.2.3 Opportunities

5.2.3.1 Increasing Need to Create Insights From Raw Data

5.2.3.2 Need for Embedded Intelligence to Gain Competitive Advantage

5.2.4 Challenges

5.2.4.1 Data Privacy, Security, and Reliability

5.2.4.2 Advent of Bi and Ai Raising Concerns for Data Mining Vendors

6 Data Mining Tools Market, By Component (Page No. - 38)

6.1 Introduction

6.2 Tools

6.3 Services

7 Market By Service (Page No. - 42)

7.1 Introduction

7.2 Managed Services

7.3 Consulting and Implementation

7.4 Others

8 Market By Business Function (Page No. - 47)

8.1 Introduction

8.2 Marketing

8.3 Finance

8.4 Supply Chain and Logistics

8.5 Operations

9 Market, By Industry Vertical (Page No. - 53)

9.1 Introduction

9.2 Retail

9.3 Banking, Financial Services, and Insurance

9.4 Healthcare and Life Sciences

9.5 Telecom and IT

9.6 Government and Defense

9.7 Energy and Utilities

9.8 Manufacturing

9.9 Others

10 Market, By Deployment Type (Page No. - 62)

10.1 Introduction

10.2 On-Premises

10.3 Cloud

11 Market By Organization Size (Page No. - 66)

11.1 Introduction

11.2 Large Enterprises

11.3 Small and Medium-Sized Enterprises

12 Data Mining Tools Market, By Region (Page No. - 70)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.2 Canada

12.3 Europe

12.3.1 United Kingdom

12.3.2 Germany

12.3.3 France

12.3.4 Rest of Europe

12.4 Asia Pacific

12.4.1 Australia and New Zealand

12.4.2 Japan

12.4.3 China

12.4.4 Rest of Asia Pacific

12.5 Middle East and Africa

12.5.1 Kingdom of Saudi Arabia

12.5.2 United Arab Emirates

12.5.3 South Africa

12.5.4 Rest of Middle East and Africa

12.6 Latin America

12.6.1 Brazil

12.6.2 Mexico

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 94)

13.1 Overview

13.2 Market Ranking

13.3 Competitive Scenario

13.3.1 New Product/Service Launches and Product Upgradations

13.3.2 Business Expansions

13.3.3 Acquisitions

13.3.4 Partnerships, Agreements, and Collaborations

14 Company Profiles (Page No. - 100)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.1 IBM

14.2 SAS Institute

14.3 Oracle

14.4 Microsoft

14.5 Teradata

14.6 MathWorks

14.7 H2O.ai

14.8 Intel

14.9 Alteryx

14.10 SAP

14.11 Rapidminer

14.12 Knime

14.13 FICO

14.14 Salford Systems

14.15 BlueGranite

14.16 Angoss Software

14.17 Megaputer Intelligence

14.18 Biomax Informatics

14.19 Frontline Systems

14.20 Suntec India

14.21 Dataiku

14.22 Wolfram Research

14.23 Reltio

14.24 SenticNet

14.25 Business Insight

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 142)

15.1 Key Industry Insights

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (70 Tables)

Table 1 United States Dollar Exchange Rate, 2014–2017

Table 2 Data Mining Tools Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 3 Market Size, By Component, 2016–2023 (USD Million)

Table 4 Tools: Market Size By Region, 2016–2023 (USD Million)

Table 5 Services: Market Size By Region, 2016–2023 (USD Million)

Table 6 Market Size, By Service, 2016–2023 (USD Million)

Table 7 Managed Services: Market Size By Region 2016–2023 (USD Million)

Table 8 Consulting and Implementation: Market Size By Region, 2016–2023 (USD Million)

Table 9 Others: Market Size By Region, 2016–2023 (USD Million)

Table 10 Market, By Business Function, 2016–2023 (USD Million)

Table 11 Marketing: Market Size By Region, 2016–2023 (USD Million)

Table 12 Finance: Market Size By Region, 2016–2023 (USD Million)

Table 13 Supply Chain and Logistics: Market Size By Region, 2016–2023 (USD Million)

Table 14 Operations: Market Size By Region, 2016–2023 (USD Million)

Table 15 Data Mining Tools Market Size, By Industry Vertical, 2016–2023 (USD Million)

Table 16 Retail: Market Size By Region, 2016–2023 (USD Million)

Table 17 Banking, Financial Services, and Insurance: Market Size By Region, 2016–2023 (USD Million)

Table 18 Healthcare and Life Sciences: Market Size By Region, 2016–2023 (USD Million)

Table 19 Telecom and IT: Market Size By Region, 2016–2023 (USD Million)

Table 20 Government and Defense: Market Size By Region, 2016–2023 (USD Million)

Table 21 Energy and Utilities: Market Size By Region, 2016–2023 (USD Million)

Table 22 Manufacturing: Market Size By Region, 2016–2023 (USD Million)

Table 23 Others: Market Size By Region, 2016–2023 (USD Million)

Table 24 Market Size, By Deployment Type, 2016–2023 (USD Million)

Table 25 On-Premises: Market Size By Region, 2016–2023 (USD Million)

Table 26 Cloud: Market Size By Region, 2016–2023 (USD Million)

Table 27 Market Size By Organization Size, 2016–2023 (USD Million)

Table 28 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 29 Small and Medium-Sized Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 30 Data Mining Tools Market Size, By Region, 2016–2023 (USD Million)

Table 31 North America: Market Size By Country, 2016–2023 (USD Million)

Table 32 North America: Market Size By Component, 2016–2023 (USD Million)

Table 33 North America: Market Size By Service, 2016–2023 (USD Million)

Table 34 North America: Market Size By Business Function, 2016–2023 (USD Million)

Table 35 North America: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 36 North America: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 37 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 38 Europe: Data Mining Tools Market Size, By Country, 2016–2023 (USD Million)

Table 39 Europe: Market Size By Component, 2016–2023 (USD Million)

Table 40 Europe: Market Size By Service, 2016–2023 (USD Million)

Table 41 Europe: Market Size By Business Function, 2016–2023 (USD Million)

Table 42 Europe: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 43 Europe: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 44 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 45 Asia Pacific: Data Mining Tools Market Size, By Country, 2016–2023 (USD Million)

Table 46 Asia Pacific: Market Size By Component, 2016–2023 (USD Million)

Table 47 Asia Pacific: Market Size By Service, 2016–2023 (USD Million)

Table 48 Asia Pacific: Market Size By Business Function, 2016–2023 (USD Million)

Table 49 Asia Pacific: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 50 Asia Pacific: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 51 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 52 Middle East and Africa: Data Mining Tools Market Size, By Country, 2016–2023 (USD Million)

Table 53 Middle East and Africa: Market Size By Component, 2016–2023 (USD Million)

Table 54 Middle East and Africa: Market Size By Service, 2016–2023 (USD Million)

Table 55 Middle East and Africa: Market Size By Business Function, 2016–2023 (USD Million)

Table 56 Middle East and Africa: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 57 Middle East and Africa: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 58 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 59 Latin America: Data Mining Tools Market Size, By Country, 2016–2023 (USD Million)

Table 60 Latin America: Market Size By Component, 2016–2023 (USD Million)

Table 61 Latin America: Market Size By Service, 2016–2023 (USD Million)

Table 62 Latin America: Market Size By Business Function, 2016–2023 (USD Million)

Table 63 Latin America: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 64 Latin America: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 65 Latin America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 66 Market Ranking for the Data Mining Tools Market, 2018

Table 67 New Product/Service Launches and Product Upgradations

Table 68 Business Expansions

Table 69 Acquisitions

Table 70 Partnerships, Agreements, and Collaborations

List of Figures (44 Figures)

Figure 1 Data Mining Tools Market Segmentation

Figure 2 Regional Scope

Figure 3 Market: Research Design

Figure 4 Breakdown of Primaries: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Mining Tools Market: Assumptions

Figure 9 Market Top 3 Segments in 2018

Figure 10 Market By Component

Figure 11 Market By Business Function

Figure 12 Market By Region

Figure 13 Increased Awareness Among Enterprises to Leverage the Available Data Assets is Likely to Drive the Market Growth During the Forecast Period

Figure 14 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 15 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 16 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 17 Retail Industry Vertical and North American Region are Estimated to Dominate the Market in 2018

Figure 18 Data Mining Tools Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Managed Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Supply Chain and Logistics Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Banking, Financial Services, and Insurance Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 24 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 North America is Expected to Hold the Largest Market Share During the Forecast Period

Figure 26 Asia Pacific is Expected to Register the Highest Growth Rate During the Forecast Period

Figure 27 North America: Market Snapshot

Figure 28 Asia Pacific: Market Snapshot

Figure 29 Key Developments of the Leading Players in the Data Mining Tools Market, 2015–2018

Figure 30 Market Evaluation Framework

Figure 31 IBM: Company Snapshot

Figure 32 IBM: SWOT Analysis

Figure 33 SAS Institute: Company Snapshot

Figure 34 SAS Institute: SWOT Analysis

Figure 35 Oracle: Company Snapshot

Figure 36 Oracle: SWOT Analysis

Figure 37 Microsoft: Company Snapshot

Figure 38 Microsoft: SWOT Analysis

Figure 39 Teradata: Company Snapshot

Figure 40 Teradata: SWOT Analysis

Figure 41 Intel: Company Snapshot

Figure 42 Alteryx: Company Snapshot

Figure 43 SAP: Company Snapshot

Figure 44 FICO: Company Snapshot

Growth opportunities and latent adjacency in Data Mining Tools Market