Data Center Linear-drive Pluggable Optics (LPO) Market - Global Forecast To 2030

Introduction to the Data Center Linear-Drive Pluggable Optics (LPO) Market

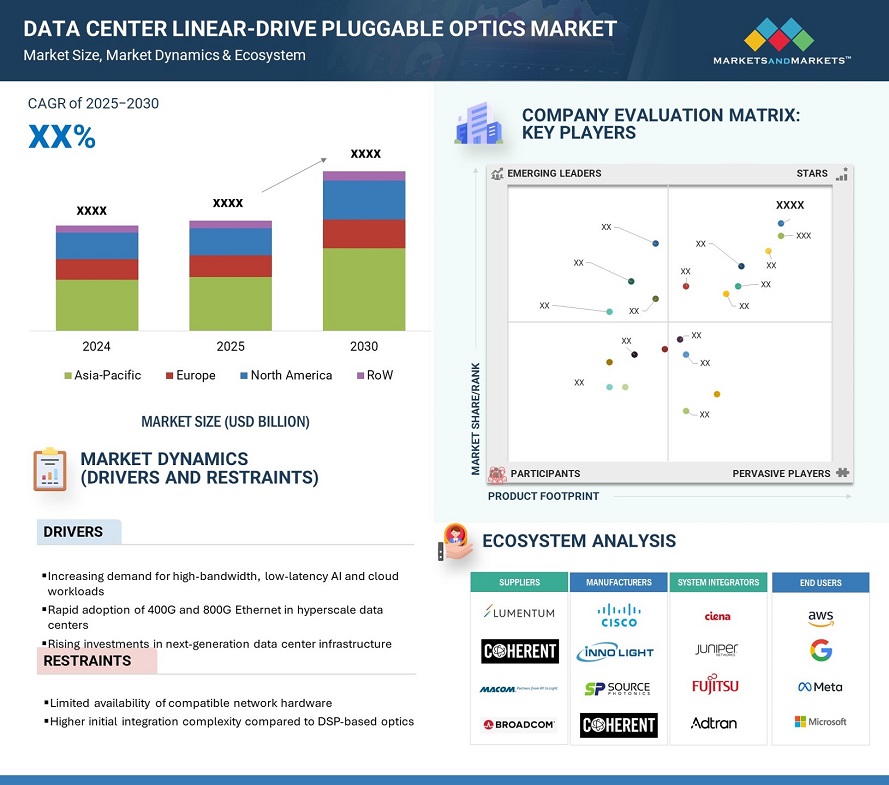

The rising demand for high-bandwidth, low-latency interconnects to support AI workloads, cloud computing, and hyperscale data center expansion is driving the data center linear-drive pluggable optics (LPO) market. Moreover, the trend toward energy-efficient solutions and cost-effective network upgrades, along with the adoption of 400G and 800G Ethernet, is accelerating the deployment of data center linear-drive pluggable optics (LPO). Need for simplified architecture and low power consumption in data centers enhances the move from DSP based optics to linear drive solutions.

Data Center Linear-drive Pluggable Optics (LPO) Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Data Center Linear-Drive Pluggable Optics (LPO) Market Dynamics

Driver: Increasing Demand for High-Bandwidth, Low-Latency AI and Cloud Workloads

The rapid growth of AI and cloud-based applications is driving demand for high-bandwidth, low-latency interconnect solutions inside data centers. AI workloads such as large language models need massive parallel processing and real-time data interchange, which exceed the limits imposed by traditional network infrastructures. Similarly, CSPs need to scale up their operations because of increasing global demand for cloud computing, video streaming, and remote work. High speed, low latency in trans data transfer: LPO brings affordable and energy-efficient connectivity; therefore, it makes good sense for AI, the cloud. The progressions towards 400G networks with a view to achieve an 800G upgrade over 100G help meet demands from data centers upgrading network infrastructures without a huge spend and with even lower power consumption. This increased demand for seamless, high-performance connectivity of hyperscale and enterprise data centers is going to be a primary propeller for the LPO market in the coming years.

Restraint: Higher Initial Integration Complexity Compared to DSP-Based Optics

Higher initial integration complexity compared to traditional DSP-based optics is the most significant restraint in the market. LPO modules depend on the host system for crucial functions like FEC and signal processing, which puts additional responsibility on network architects and also demands more advanced host-side capabilities. All these factors will affect the adoption, especially by small enterprises or those with legacy infrastructures. The perceived complexity at the integration stage and thus the challenge to achieve greater penetration in the short term outweighs the long-term benefits of reduced power consumption and cost savings.

Opportunity: Growing Interest from CSPs and Enterprise Data Centers

The increasing adoption of cloud services and AI applications provides huge growth opportunities for linear drive pluggable optics (LPO) in both CSPs and enterprise data centers. CSPs are expanding their networks to support growing demand for cloud-based services such as SaaS, IaaS, and AI-driven solutions requiring high-speed, cost-effective optical interconnects. Enterprises are also investing in private and hybrid cloud environments to support digital transformation. It makes the need for scalable low-latency networking solutions drive. LPO is an attractive choice for both CSPs and enterprises who want to reduce infrastructure cost without sacrificing performance.

Challenge: Balancing Cost and Performance in Large-Scale Deployments

Balancing cost and performance is a big challenge for large-scale deployments of linear drive pluggable optics (LPO) in data centers. Although LPO solutions promise long-term savings through reduced power consumption and simplified architectures, the costs of integrating LPO modules into existing infrastructures can be substantial. Organizations need to weigh up the trade-offs between immediate capital expenditures and the operational savings that LPO can offer over time. In addition, maintaining consistency of performance in high-density environments is technically challenging, especially in hyperscale data centers where even minor performance inefficiencies can have a large cumulative impact.

Ecosystem Analysis

GPU-to-GPU interconnect segment to account for largest market share during forecast period

The data center linear-drive pluggable optics (LPO) market is expected to be led by the GPU-to-GPU interconnect segment due to the ever-growing deployment of AI and machine learning workloads. HPC environments and AI training models have the need for ultra-fast, low-latency data transfer between GPUs, which generates a demand for high-bandwidth optical interconnects. High-speed connections between GPUs that make LPO energy-efficient will put this technology at the forefront of hyperscale data centers and AI clusters, making this segment to experience huge growth during the forecast period.

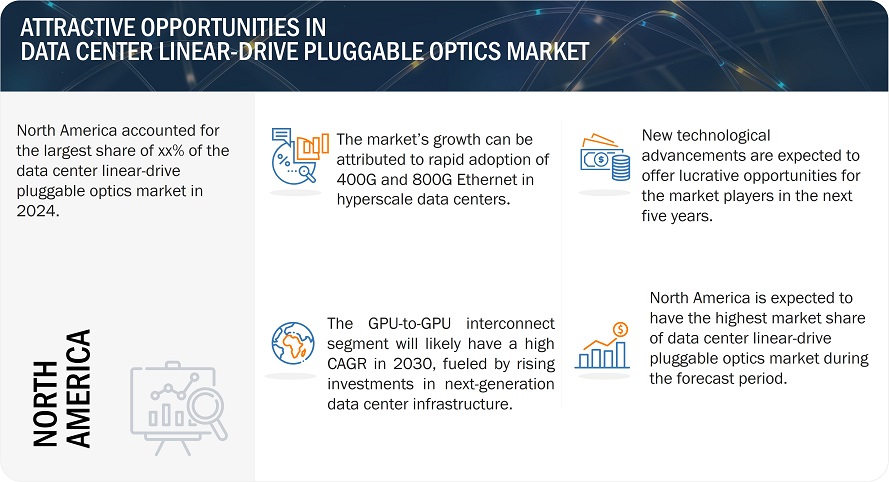

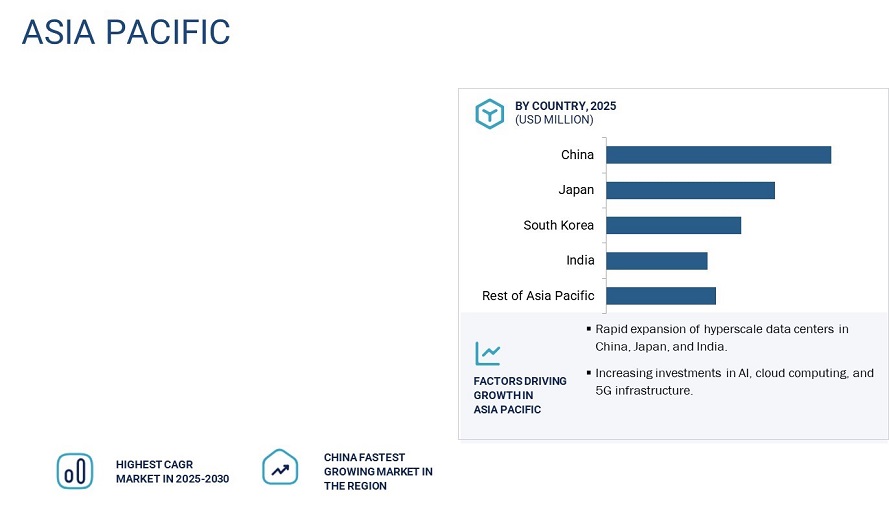

Asia Pacific region to register highest CAGR in data center linear-drive pluggable optics (LPO) market during forecast period

The Asia Pacific region is expected to exhibit the highest CAGR in the market for linear-drive pluggable optics, led by the need for rapid digital transformation and hyperscale data center expansion in countries like China, Japan, and India. Increasing investments in AI, cloud computing, and 5G infrastructure are fueling demand for high-speed and energy-efficient optical interconnects. Not just that, but the use of advanced networking technologies both by CSPs and in Asian Pacific enterprises is also something that is further accelerating deployment because the region is a fast growth driver in the LPO market.

Data Center Linear-drive Pluggable Optics (LPO) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Leading players operating in the data center linear-drive pluggable optics (LPO) market are

- Eoptolink Technology Inc., Ltd. (China),

- Cisco Systems, Inc. (US),

- Coherent Corp. (US),

- MACOM (US),

- Lumentum (US),

- CIG Tech (US),

- Linktel Technologies Co., Ltd. (China),

- Semtech (US),

- Hisense Broadband (China),

- Molex (US), among others.

Recent Developments

- In March 2024, Semtech (US) announced the demonstration of 100Gbps/lane linear pluggable optical links featuring Semtech’s PAM4 PMDs from its FiberEdge product line and from its new DirectEdge brand, focused specifically on LPO (Linear Pluggable Optics) applications.

- In March 2024, Infinera (US) launched ICE-D, a new line of high-speed intra-data center optics based on monolithic indium phosphide (InP) photonic integrated circuit (PIC) technology. ICE-D optics are designed to dramatically lower cost and power per bit while providing intra-data center connectivity at speeds of 1.6 terabits per second (Tb/s) and greater. This technology enables data center operators to cost-effectively keep pace with relentless growth in bandwidth.

- In March 2024, Eoptolink Technology Inc., Ltd. (China), a leading provider of optical transceiver solutions and services, announced today the launch of 800G Linear-drive Pluggable Optics (LPO).

Frequently Asked Questions (FAQ):

What are the major driving factors for the data center linear-drive pluggable optics (LPO) market?

Increasing demand for high-bandwidth, low-latency AI and cloud workloads, rapid adoption of 400G and 800G Ethernet in hyperscale data centers, growing need for energy-efficient, cost-effective network solutions, and simplified architecture reducing complexity and power consumption are some of the major driving factors in the market

What are the major opportunities for the data center linear-drive pluggable optics (LPO) market?

? Expanding demand for AI-driven data center upgrades, Increasing deployments in emerging 5G and edge data centers, and Growing interest from CSPs and enterprise data centers are some of the major opportunities in the market

Which region is expected to hold the largest market share?

North America holds the largest share of the data center linear-drive pluggable optics (LPO) market. Rising government investments and the presence of major market players in the region are driving the demand for data center linear-drive pluggable optics (LPO) in North America

Who are the leading players in the global data center linear-drive pluggable optics (LPO) market?

Leading players operating in the data center linear-drive pluggable optics (LPO) market are Eoptolink Technology Inc., Ltd. (China), Cisco Systems, Inc. (US), Coherent Corp. (US), MACOM (US), and Lumentum (US).

What are some of the technological advancements in the market?

Integration of Photonic Integrated Circuits (PICs), Energy-Efficient Designs, Smaller Form Factors are major technological advancements in the market.

Growth opportunities and latent adjacency in Data Center Linear-drive Pluggable Optics (LPO) Market