Data Center Infrastructure Market - Global Forecast to 2029

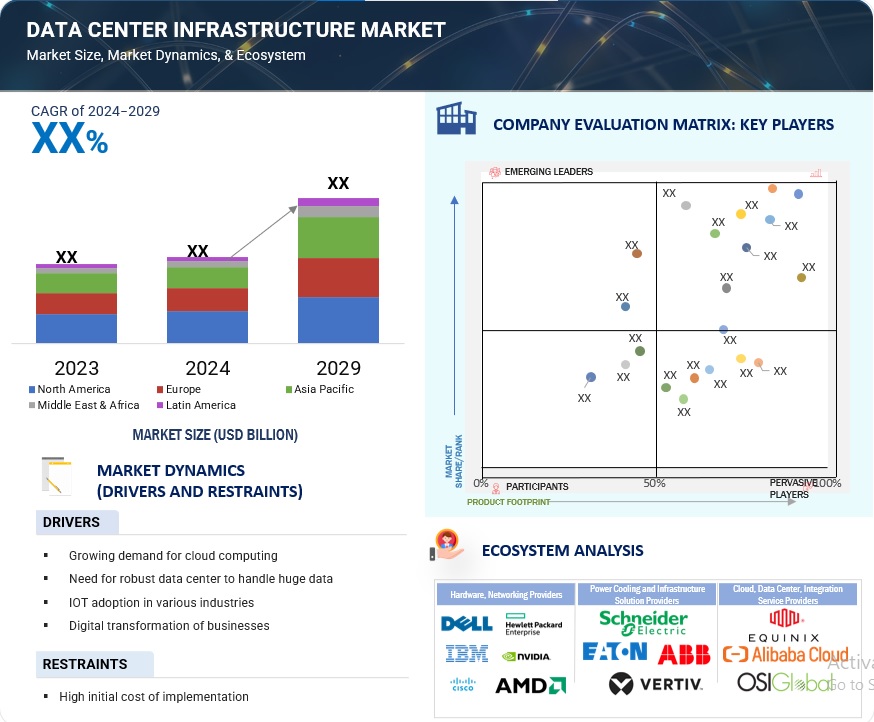

The data center infrastructure market is expected to grow from USD XX billion in 2024 to USD XX billion by 2029 at a compounded annual growth rate (CAGR) of XX% during the forecast period. Demand for advanced infrastructure in the data center is increasing with the spreading of IoT devices and the emergence of Big Data. The rapid adoption of IoT devices, including sensors, cameras, and connected machines in industrial sectors, results in exponential data growth, which further calls for real-time processing, storing, and analysis. Such data require advanced data center capabilities dealing with high-volume data, real-time analytics, and very low latency for predictive maintenance, autonomous driving, and smart city applications. Increasingly, data centers employ high-performance computing technologies, such as GPUs and FPGAs, to satisfy the needs of the applications mentioned earlier. Advanced networking capabilities are imperative for the smooth processing and distribution of data and scalable storage solutions to cater to extensive data flows.

Global Data Center Infrastructure Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

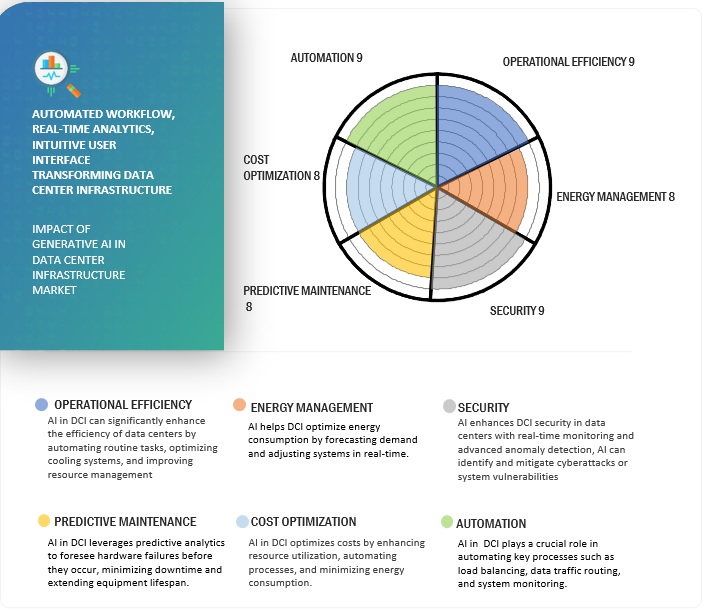

IMPACT OF AI/GEN AI ON THE DATA CENTER INFRASTRUCTURE MARKET

DATA CENTER INFRASTRUCTURE MARKET DYNAMICS

Driver: Growing demand for cloud computing

The demand for cloud computing services is rapidly seeing an emerging impact on the data center infrastructure market, with increasing numbers of organizations switching to cloud-based solutions of access scale, adaptability, and cost efficiency. Cloud providers are expected to require adequate robust and scalable data center infrastructure to support the increasing workloads, data availability, and demands from users worldwide, given that, as time progresses, more and more adoption is seen of SaaS, IaaS, and PaaS solutions across various segments such as finance, healthcare, and retail. Enterprises thus rely on advanced infrastructure mainly characterized by high-performance servers, storage, and network components to drive seamless cloud operations. In addition, edge computing and hybrid cloud models are expected to increase the need for localized and distributed data centers to minimize latency. Increasing government initiatives to promote digital transformation further speed up capital inflows into hyperscale facilities and thus represent a vital market growth component. This creates cloud computing as the most critical pillar in modernizing and future-proofing data center infrastructure.

Restraint: High initial cost of implementation

The high costs of data center infrastructure pose a significant restraint to market growth, forcing organizations to choose between building on-premises facilities and outsourcing to cloud services. Building data centers usually require capital investments in land, construction, electrical, cooling systems, high-end hardware, and many other attributes, which cannot be predicted accurately because of location and labor cost variations. For instance, in October 2024, Encor Advisors, a Canadian commercial real estate firm, points out that operating expenses range from USD 10 million to USD 25 million, including power, cooling, maintenance, staffing, and IT hardware, the most significant concern being electricity. Further, the compliance costs and continuous renewals weigh down the burden on small enterprises and startups in developing regions. The colocation and cloud-based models somewhat lighten the financial burden; however, the initial cost remains a significant hurdle, which counts during decision-making and can slow the pace of the adoption of advanced data center solutions.

Opportunity: The growing adoption of 5G

The fast adoption of 5G poses an opportunity for the data center infrastructure market, paving the way for faster, high-capacity networks to support technologies such as IoT, AI, and edge computing. The demand for more flexible and dependable solutions is increasing as businesses shell out dollars to bring data processing closer to them and reduce latency. For instance, JLL's November 2024 report reveals that India's data center capacity is expected to grow by 66% by 2026, driven by the rise of AI and the nationwide 5G expansion. This growth presents a key opportunity for providers focused on integrating energy-efficient designs and automation in their infrastructure. With 5G as a transformative driver, the data center market is poised for substantial innovation and expansion.

Challenge: Integration with other engineering systems

The data center industry faces a significant labor shortage, driven by a shift in educational focus toward software over-engineering, creating a gap in the supply of skilled workers such as mechanical and electrical engineers. Data center providers are tackling this by increasing awareness of the industry's potential, investing in reskilling programs, and offering growth opportunities, primarily through retraining military veterans and hiring trade school graduates. For instance, in June 2024, Forbes(an American business magazine) mentioned that nearly 60% of operators have difficulty finding qualified candidates, and more than half struggle to hold on to their current staff. Companies such as Aligned Data Centers also partner with universities to create specialized programs, such as Southern Methodist University's Data Center Systems Engineering program. This initiative seeks to address the talent shortage by aligning career opportunities in the industry with competitive salaries and meaningful work, ensuring long-term solutions for filling critical roles.

Data Center Infrastructure Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on the offering, the hardware segment holds the largest market share during the forecast period.

It is anticipated that the hardware segment in data center infrastructure is expected to account for the largest market share throughout the forecast period, owing to higher demand for data storage, processing, and management. This section constitutes the essential elements of data centers, such as power distribution units (PDUs), UPS systems, generators, transfer switches, cooling & thermal systems, and racks. Data centers must upgrade their hardware because of massive data and high processing speed cloud computing, big data, and IoT applications. Further, advanced hardware is expected to be in high demand due to the workloads associated with edge computing and AI. Furthermore, the fact that there is still a significant demand for efficient and scalable solutions to address data security, energy efficiency, and network reliability would also contribute to the growth of the hardware segment to be the largest market lead in the data center infrastructure market during the study period.

Based on end-user type, the cloud service providers segment is expected to grow at the highest CAGR during the forecast period based on data center type.

The cloud services provider segment is expected to grow at the highest compound annual growth rate (CAGR) during the data center infrastructure market forecast period. The heightened demand for scalable and flexible cloud solutions for virtually every business application- from virtualized desktops to analytics- propels this need. There is increasing demand from enterprises seeking increasingly cloud-first strategies and workload shift to clouds, making resilient, highly scalable data center infrastructure that can service them necessary. Increasing consumer use, such as the Internet of Things (IoT) devices, modernization initiatives, and hybrid and multi-cloud architectures, thus fuel the requirement for this extreme growth. Data centers need to be modernized in cloud operations for effective performance, security, and reliability.

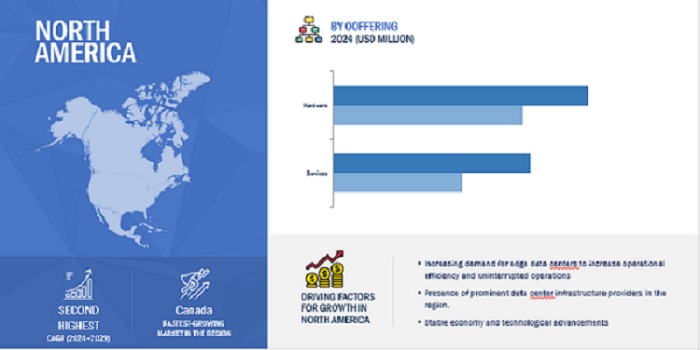

Based on the region, North America holds the largest market share during the forecast period.

North America's data center infrastructure market holds the largest market share during the forecast period. The major contributors include its advanced IT ecosystem, high adoption rates of digital transformation initiatives, and the presence of significant technology companies. The growth of the data center infrastructure in the region has also been caused majorly by huge investments made to develop cloud services, edge computing, and AI applications. The US, in particular, benefits from the economies of scale brought by established players such as Amazon Web Services, Microsoft, and Google, whose customers fill hyperscale data centers. The growth is complemented by Canada, which has initiated strategic investments, cybersecurity, data sovereignty, and a cold climate, reducing cooling costs. Increased 5G adoption, along with IoT expansion across various sectors, is also driving demand for efficient processing of data and storage, thus consolidating North America as a top global market leader in data center infrastructure.

Key Market Players

The data center infrastructure market is dominated by a few globally established players such as DELL (US), HPE (US), Cisco (US), IBM (US), ABB (Switzerland), Equinix (US), NVIDIA (US), AMD (US), Intel (US), Huawei (China), Schneider Electric (France), Pure Storage (US), VERTIV (US), Eaton (Brazil), Mitsubishi Electric (Japan), Legrand (France), Delta Electronics (New Zealand), Seagate Technology (US), Alibaba Cloud (China), Lenovo (China), OSI Global (US), Aspen Systems (US), Cyber Power Systems (US), Riello UPS (UK), and Broadcom (US) among others, are the key vendors that secured data center infrastructure market in last few years. Customers are conducting experiments in the data center infrastructure market because of their increased standard of living, ease of access to information, and quick adoption of technical items.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2019-2029 |

|

Base year considered |

2024 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Offering, Data Center Size, Tier Type, End User, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

DELL (US), HPE (US), Cisco (US), IBM (US), ABB (Switzerland), Equinix (US), NVIDIA (US), AMD (US), Intel (US), Huawei (China), Schneider Electric (France), Pure Storage (US), VERTIV (US), Eaton (Brazil), Mitsubishi Electric (Japan), Legrand (France), Delta Electronics (New Zealand), Seagate Technology (US), Lenovo (China), OSI Global (US), Aspen Systems (US), Cyber Power Systems (US), Riello UPS (UK), and Broadcom (US). |

Recent Developments:

- In December 2024, Marvell Technology expanded its collaboration with AWS through a five-year agreement focusing on AI and data center semiconductors. The partnership includes using AWS's cloud for electronic design automation (EDA) to accelerate silicon design and deliver efficient, scalable cloud and AI infrastructure solutions.

- In October 2024, Vertiv announced the opening of a 215,000-square-foot facility in Pelzer, South Carolina, adding 300 jobs to produce modular data center infrastructure. This expansion supports global growth in prefabricated solutions amid rising AI demand, with further capacity doubling planned through 2025.

- In October 2024, Equinix, CPP Investments, and GIC launched a USD 15 billion joint venture to develop US data centers. CPP and GIC hold 37.5% equity, and Equinix owns 25%. The venture is expected to fund xScale facilities exceeding 100MW, supporting AI workloads and expanding digital infrastructure.

- In March 2024, Schneider Electric announced a collaboration with NVIDIA to deliver AI-focused data center reference designs. These designs optimize scalability, energy efficiency, and performance for high-density AI workloads, with plans to unveil further developments during Schneider's Innovation Summit.

Frequently Asked Questions (FAQ):

What is data center infrastructure?

Data center infrastructure refers to the physical and virtual components that work to operate and manage data centers. This includes servers, storage systems, networking equipment, power supplies, cooling systems, and security provisions. Such infrastructures are essential to storing, processing, and transmitting all data and provide reliability, availability, security, and scalability. Critical infrastructural items such as racks, cabling, fire suppression systems, and backup power are integrated for continuous operation. All modern data centers rely on virtualization technologies and highly depend on cloud computing to provide flexibility.

What initiatives have tech giants implemented to enhance the development of Data Center infrastructure?

Tech giants are advancing data center infrastructure with renewable energy, AI-driven automation, and energy-efficient hardware to enhance scalability and sustainability. They focus on hyperscale and edge computing, advanced cooling, and eco-friendly practices to meet growing digital demands.

Which are the key vendors exploring data center infrastructure?

Some of the significant vendors offering data center infrastructure worldwide include DELL (US), HPE (US), Cisco (US), IBM (US), ABB (Switzerland), Equinix (US), NVIDIA (US), AMD (US), Intel (US) and Huawei (China).

What is the total CAGR recorded for the data center infrastructure market from 2024 to 2029?

The data center infrastructure market is expected to achieve a CAGR of XX% from 2024 to 2029.

Who are vital clients adopting data center infrastructure?

Key clients adopting the data center infrastructure include: -

- Cloud Service Providers (CSPs)

- Colocation Providers

- Telecom Companies

- Large Enterprises (e.g., tech companies, financial institutions, healthcare organizations)

- Government Agencies

- Managed Service Providers (MSPs)

- Hyperscale Operators

- E-commerce Companies

- Internet Service Providers (ISPs)

- Academic and Research Institutions

- Data Analytics and AI Companies

- Media and Entertainment

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Data Center Infrastructure Market