Data Annotation and Labeling Market by Component, Data Type, Application (Dataset Management, Sentiment Analysis), Annotation Type, Vertical (BFSI, IT and ITES, Healthcare and Life Sciences) and Region - Global Forecast to 2027

Data Annotation and Labeling Market - Analysis, Industry Size & Forecast

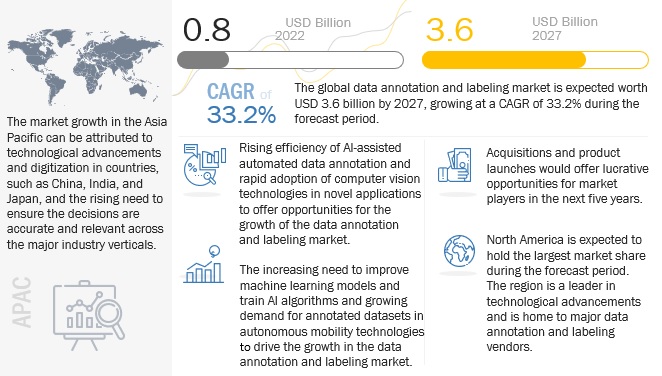

The global Data Annotation and Labeling Market size was valued at USD 0.8 billion in 2022 and is expected to grow at a CAGR of 33.2% from 2022 to 2027. The revenue forecast for 2027 is projected to reach $3.6 billion. The base year for estimation is 2021, and the historical data spans from 2022 to 2027. When creating a machine learning model, preprocessing includes data labeling and annotation. To enable the machine learning model to generate precise predictions, it is necessary to identify raw data, such as images, text files, and videos, and then to add one or more labels to that data to explain its context for the models. To organize, clean up, and label data, businesses incorporate software, procedures, and data annotators. This training data becomes the foundation for ML models. These labels give analysts the ability to isolate certain variables inside datasets, allowing them to choose the best data predictors for ML models.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Annotation and Labeling Market Dynamics

Driver: Rising popularity of labeled data in medical imaging

The deployment of Al-enabled systems for improved patient care, improved diagnostics, and accelerated drug discovery has changed the healthcare sector. Algorithms have been developed that can detect anomalies and illnesses in patients without the assistance of a human being using accurately labelled medical images. To create a database of precisely labelled operation videos, medical personnel also collaborate with expert annotation service providers. The dataset would act as the building block for the creation of autonomous surgical robots. Companies such as Labelbox supports dynamic large scale tiled imaging formats for medical practitioners to label pathological data. Another significant application area where data annotation is important is drug development. In order to help researchers detect patterns relevant to drug discovery, data annotation and labeling can assist automated systems in sorting through a massive volume of research papers, patents, clinical trial paperwork, and patient records. Such annotated datasets can be utilized to deduce novel connections between illnesses, symptoms, and potential treatments.

Restraint: Issues associated with poor quality of training data

One of the key barriers to the market expansion of data annotation and labeling solutions continues to be the lack of high-quality input data. Any attempts to train Al models with low-quality data result in errors in the predicted output, with certain algorithms degrading to the point where their complete optimization is never attained. This is because the performance of Al is strongly correlated with the quality of data input into the algorithm. Missing, irrelevant, or manipulated datasets can also cause drastic financial repercussions if there is a significant delta between ground truth and Al algorithm predictions.

Opportunity: Increasing traction of crowdsourced data annotation for improved RoI

In order to quickly annotate massive amounts of data, crowdsourced data annotation involves outsourcing the data labeling project to a number of freelance data annotators. By distributing data annotation tasks to thousands of data labelers at once, businesses attempt to speed up the time it takes to market their Al products, fueling a fervent demand for crowdsourced data annotation. The emergence of platforms for crowdsourced data labeling has boosted consumers' trust in crowdsourced data annotation. When compared to the costs associated with hiring professional data annotation experts, the data annotation can be finished for a fraction of the price.

Challenge: Dearth of skilled data annotators

The industry for data annotation and labeling has been significantly hampered by a lack of highly experienced manual data labelers and subject matter experts. Highly accurate training data that has been properly labelled is necessary for creating complex AI models for handling crucial applications, including self-driving cars and medical diagnosis solutions. This increases the demand for specialized annotators who can decipher the underlying meanings of intricate scientific or medical imagery. The lack of qualified data annotators also poses the risk of poor data quality if inexperienced data annotators have labeled them.

BFSI segment to account for largest market size during forecast period

The BFSI sector is using machine learning to enhance operations, boost revenue, and improve customer experience by utilizing the vast amount of data generated across many formats. Data annotation and labeling tools ensure that these machine learning models perform at optimum levels by offering robust data quality. Predictive analytics systems may be able to extract useful and applicable insights from unstructured data by labeling critical consumer information, such as customer loan application data, insurance claims, and KYC forms. Among the verticals, the BFSI segment is anticipated to register the largest market size during the forecast period.

Automatic segment to register to grow at the highest CAGR during forecast period

The traditional data labeling procedure was time-consuming and wholly manual. Humans have a low productivity rate and are prone to mistakes despite the high accuracy rate of their annotations. For computer vision and natural language processing activities, the demand for precise and high-quality data labelling is rising. Any unstructured customer data or content can be automatically labeled to discover segments of customers with similar combinations of attributes and treat them similarly in marketing efforts. Businesses can use automatic data labeling, which requires little to no human intervention, to significantly reduce operating costs and time. During the forecast period, automatic segment is anticipated to grow at the CAGR.

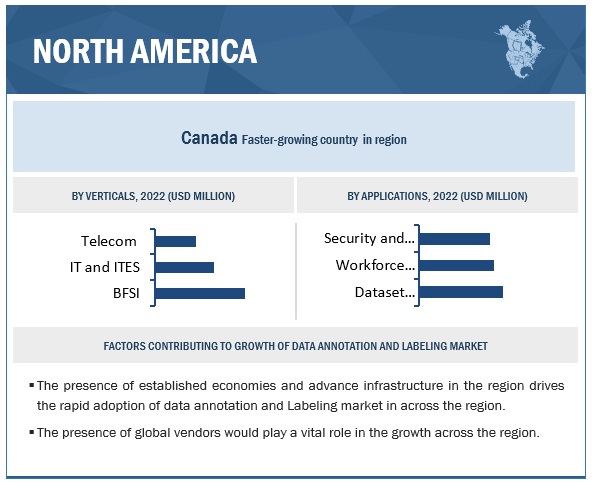

North America to account for largest market size during forecast period

By region, North America is estimated to lead the data annotation and labeling market during the forecast period. The region is one of the early adopters of data annotation and labeling solution, since the majority of large enterprises are located in this region. One of the biggest key drivers in North America is the substantial investments made by numerous businesses for outsourcing the data annotation and labelling solutions. Among the countries in these region, the United States have emerged as the main markets witnessing increased demand for affordable data annotation services and machine learning models.

To know about the assumptions considered for the study, download the pdf brochure

Data Annotation and Labeling Market - Key Players

The data annotation and labeling providers have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major players in the data annotation and labeling market include Google (US), Appen (Australia), IBM (US), Oracle (US), TELUS International (Canada), Adobe (US), AWS (US), Alegion (US), Cogito Tech (US), Anolytics (US), AI Data Innovation (US), Clickworker (Germany), CloudFactory (UK), CapeStart (US), DataPure (US), LXT (Canada), Precise BPO Solution (India), Sigma (US), Segment.ai (US), Defined.ai (US), Dataloop (Israel), Labelbox (US), V7 (UK), LightTag (Germany), SuperAnnotate (US), Scale (US), Datasur (US), Kili Technology (France), Understand.ai (Germany), Keylabs (Israel), and Label Your Data (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD (Billion) |

|

Segments covered |

Component, Data Type, Application, Deployment Type, Organization Size, Annotation Type, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Google (US), Appen (Australia), IBM (US), Oracle (US), TELUS International (Canada), Adobe (US), AWS (US), Alegion (US), Cogito Tech (US), Anolytics (US), AI Data Innovation (US), Clickworker (Germany), CloudFactory (UK), CapeStart (US), DataPure (US), LXT (Canada), Precise BPO Solution (India), Sigma (US), Segment.ai (US), Defined.ai (US), Dataloop (Israel), Labelbox (US), V7 (UK), LightTag (Germany), SuperAnnotate (US), Scale (US), Datasur (US), Kili Technology (France), Understand.ai (Germany), Keylabs (Israel), and Label Your Data (US). |

This research report categorizes the data annotation and labeling market based on component, data type, application, deployment type, organization size, annotation type, vertical, and region.

By Component

- Solution

- Services

By Data Type:

- Text

- Image

- Video

- Audio

By Deployment Type:

- On-premises

- Cloud

By Organization Size:

- Large enterprises

- SMEs

By Annotation Type:

- Manual

- Automatic

- Semi-Supervised

By Application:

- Dataset Management

- Security and Compliance

- Data Quality Control

- Workforce Management

- Content Management

- Catalogue Management

- Sentiment Analysis

- Other Applications

By Verticals:

- BFSI

- IT and ITES

- Healthcare & Lifescience

- Telecom

- Government, Defense and Public Agencies

- Retail and Consumer Goods

- Automotive

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments in Data Annotation and Labeling Market:

- In November 2022, TechSee had partnered with TELUS International to promote real-time computer vision in engagement centres. Through this partnership, TechSee's portfolio of AI-powered service automation and visual engagement technologies would be added to TELUS International's customer base.

- In October 2022, Accenture and Google Cloud today announced an expansion of their global partnership through a renewed commitment to growing their respective talent, increasing their joint capabilities, developing new solutions using data and AI, and providing enhanced support to help clients build a strong digital core and reinvent their enterprises on the cloud.

- In October 2022, Appen had collaborated with Novatics and offer shared synergies in the Latin American region to expand client offerings. This collaboration is another step in Appen's strategy to provide inclusive data for the AI lifecycle. As part of the collaboration, Novatics will be connecting Appen with key strategic clients in the Latin America region.

- In May 2022, Oracle and Informatica had partnered for data governance, enterprise cloud data connectivity, and lakehouse solutions on Oracle Cloud Infrastructure. This partnership would enable to deliver industry-leading cloud data management, integration, and governance solutions for databases, data warehouses, data lakes, data lakehouses, enterprise analytics, and data science.

- In November 2021, AWS and Goldman Sachs collaborated to create new Data Management and Analytics solutions for financial services organizations.

- In August 2021, Appen had announced that it had signed an agreement to acquire Quadrant. This acquisition of Quadrant and Appen would be well-positioned to provide high-quality data to businesses that depend on geolocation.

- In July 2021, TELUS International had announced to acquire Bangaluru based data annotation startup named Playment. With this acquisition, TELUS International can assist technology companies and large businesses in the development of AI-powered solutions, from enhancing the customer experience for current customers to opening new opportunities for the development of computer vision-powered applications across industries.

- In November 2020, TELUS International had announced the acquisition of Lionbridge with an intent to improve its artificial intelligence capabilities in response to the rising need for high-quality, multilingual data annotation.

Frequently Asked Questions (FAQ):

What is Data Annotation and Labeling?

Data annotation is the process of identifying raw data and adding one or more meaningful and informative labels to provide context so that a machine learning model can learn from it. For example, labels might indicate whether a photo contains a bird or car and which words were uttered in an audio recording. Data labeling is required for various use cases, including computer vision, natural language processing, and speech recognition.

Which countries are considered in the European region?

The report includes an analysis of the market in the UK, Germany, and France.

Which are the key deployment types adopting data annotation and labeling?

The key deployment types adopting data annotation and labeling are cloud and on-premises.

Which are the key drivers supporting the growth of the data annotation and labeling market?

The key drivers supporting the growth of the data annotation and labeling market include the increasing need to improve machine learning models and train AI algorithms, growing demand for annotated datasets in autonomous mobility technologies, and rising popularity of labeled data in medical imaging.

Who are the key vendors in the data annotation and labeling market?

The key players in the data annotation and labeling market include Google (US), Appen (Australia), IBM (US), Oracle (US), TELUS International (Canada), Adobe (US), AWS (US), Alegion (US), Cogito Tech (US), Anolytics (US), AI Data Innovation (US), Clickworker (Germany), CloudFactory (UK), CapeStart (US), DataPure (US), LXT (Canada), Precise BPO Solution (India), Sigma (US), Segment.ai (US), Defined.ai (US), Dataloop (Israel), Labelbox (US), V7 (UK), LightTag (Germany), SuperAnnotate (US), Scale (US), Datasur (US), Kili Technology (France), Understand.ai (Germany), Keylabs (Israel), and Label Your Data (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 DATA ANNOTATION AND LABELING: ARCHITECTURE

-

5.3 MARKET DYNAMICSDRIVERS- Increasing need to improve machine learning models and train AI algorithms- Growing demand for annotated datasets in autonomous mobility technologies- Rising popularity of labeled data in medical imagingRESTRAINTS- High costs associated with manual data annotation- Issues associated with poor quality of training data- Failure regarding data security regulations and complianceOPPORTUNITIES- Rising efficiency of AI-assisted automated data annotation- Rapid adoption of computer vision technologies in novel applications- Increasing traction of crowdsourced data annotation for improved RoICHALLENGES- Complexity in handling vast datasets leads to human bias- Dearth of skilled data annotators

- 5.4 DATA ANNOTATION AND LABELING: EVOLUTION

-

5.5 DATA ANNOTATION AND LABELING MARKET: ECOSYSTEM

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 CASE STUDY ANALYSISHEALTHCARE AND LIFE SCIENCES- iMerit to offer AI-driven remote patient monitoring capabilities to cancer centers- Mindy Support enables a US medtech firm to automate inventory keeping of all surgical equipmentRETAIL AND E-COMMERCE- CogitoTech helps US-based brick and mortar store to combat growing presence of eCommerce stores- DataLoop enables Standard AI to enable autonomous checkout at retail storesAGRICULTURE- Cropin helps 2scale to transform and create traceable rice value chain digitallyAUTOMOTIVE- Scale AI helps Toyota to create large volumes of training data for autonomous mobilityMEDIA AND ENTERTAINMENT- DataLoop assists LinkedIn in content moderationIT AND ITES- Appen helps Adobe to improve search relevance for its massive stock image library

-

5.8 TECHNOLOGY ANALYSISDATA ANNOTATION AND ARTIFICIAL INTELLIGENCEDATA ANNOTATION AND NATURAL LANGUAGE PROCESSINGDATA ANNOTATION AND CLOUD COMPUTINGDATA ANNOTATION AND INTERNET OF THINGS (IOT)

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 REGULATORY LANDSCAPEHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)GENERAL DATA PROTECTION REGULATION (GDPR)PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACTINFORMATION SECURITY TECHNOLOGY- PERSONAL INFORMATION SECURITY SPECIFICATION GB/T 35273-2017SECURE INDIA NATIONAL DIGITAL COMMUNICATIONS POLICY 2018GENERAL DATA PROTECTION LAW (LGPD)LAW NO 13 OF 2016 ON PROTECTING PERSONAL DATANIST SPECIAL PUBLICATION 800-144 - GUIDELINES ON SECURITY AND PRIVACY IN PUBLIC CLOUD COMPUTING

- 5.11 PRICING MODEL ANALYSIS

-

5.12 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

- 5.13 KEY CONFERENCES AND EVENTS, 2022–2023

-

5.14 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.15 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF DATA ANNOTATION AND LABELING MARKET

-

5.16 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONCOMPONENT: DATA ANNOTATION AND LABELING MARKET DRIVERS

-

6.2 SOLUTIONSGROWING ADOPTION OF DATA ANNOTATION AND LABELING SOLUTIONS TO ENHANCE PRODUCTIVITY

-

6.3 SERVICESRISING NEED FOR CLOUD-BASED SOLUTIONS TO DRIVE MARKET GROWTHPROFESSIONAL SERVICES- Training and Consulting- System Integration and Implementation- Support and MaintenanceMANAGED SERVICES- Need to redefine customer experience to fuel adoption of managed services

-

7.1 INTRODUCTIONDATA TYPE: DATA ANNOTATION AND LABELING MARKET DRIVERS

-

7.2 TEXTGROWING RELIANCE ON TEXT-BASED DATA TO DRIVE DEMAND FOR DATA ANNOTATION AND LABELING SOLUTIONS

-

7.3 IMAGEGROWING APPLICATION OF FACIAL RECOGNITION AND ROBOTIC VISION TO BOOST DEMAND FOR IMAGE ANNOTATION AND LABELING

-

7.4 VIDEOGROWING APPLICATION OF DATA ANNOTATION AND LABELING TO FUEL MARKET GROWTH

-

7.5 AUDIORISING DEMAND FOR AUDIO ANNOTATION TO ENHANCE SEARCHABILITY

-

8.1 INTRODUCTIONDEPLOYMENT TYPE: DATA ANNOTATION AND LABELING MARKET DRIVERS

-

8.2 ON-PREMISESABILITY TO PROVIDE CONTROL AND SECURITY TO BOOST DEMAND FOR ON-PREMISES DEPLOYMENT MODE

-

8.3 CLOUDEASY UPGRADEABILITY AND ACCESSIBILITY TO BOOST ADOPTION OF CLOUD-BASED SOLUTIONS

-

9.1 INTRODUCTIONORGANIZATION SIZE: DATA ANNOTATION AND LABELING MARKET DRIVERS

-

9.2 SMALL AND MEDIUM-SIZED ENTERPRISESGROWING COMPETITIVE MARKET ENVIRONMENT TO DRIVE SMES TO ADOPT GO-TO-MARKET STRATEGIES

-

9.3 LARGE ENTERPRISESRISING INCLINATION TOWARD CUTTING EDGE TECHNOLOGIES TO DRIVE DEMAND

-

10.1 INTRODUCTIONANNOTATION TYPE: DATA ANNOTATION AND LABELING MARKET DRIVERS

-

10.2 MANUALCURRENT FAST-PACED DIGITAL ENVIRONMENT TO SHIFT DEMAND FROM MANUAL LABELING TO AUTOMATIC LABELING

-

10.3 AUTOMATICABILITY TO SELF-TRAIN MACHINE LEARNING MODELS TO RECOGNIZE DEMAND FOR AUTOMATIC LABELING

-

10.4 SEMI-SUPERVISEDINTEGRATION OF AUTOMATIC AND MANUAL DATA LABELING TO ENHANCE OUTCOMES COST-EFFECTIVELY

-

11.1 INTRODUCTIONAPPLICATION: DATA ANNOTATION AND LABELING MARKET DRIVERS

-

11.2 DATASET MANAGEMENTBIG DATA HANDLING CAPABILITIES TO DELIVER LARGE VOLUMES OF DATA WITH EASE

-

11.3 SECURITY AND COMPLIANCESTRINGENT DATA PRIVACY FEATURES IN DATA ANNOTATION TOOLS TO ENSURE REGULATORY COMPLIANCE

-

11.4 DATA QUALITY CONTROLDATA QUALITY CONTROL EMBEDDED IN DATA ANNOTATION TOOLS TO DELIVER ACCURATE MACHINE LEARNING MODELS

-

11.5 WORKFORCE MANAGEMENTWORKFORCE MANAGEMENT TO ESTABLISH AND OPERATE FULLY TRANSPARENT DATA ANNOTATION WORKFLOWS

-

11.6 CONTENT MANAGEMENTCONTENT MANAGEMENT TO BRIDGE INFORMATION SILOS AND ALLOW FOR EASIER SHARING OF WEB CONTENT

-

11.7 CATALOGUE MANAGEMENTCATALOGUE MANAGEMENT APPLICATION TO ASSIST ENTERPRISES IN UNSTRUCTURED DATA MANAGEMENT

-

11.8 SENTIMENT ANALYSISSENTIMENT ANALYSIS APPLICATION TO IMPROVE BRAND REPUTATION

- 11.9 OTHER APPLICATIONS

-

12.1 INTRODUCTIONVERTICAL: DATA ANNOTATION AND LABELING MARKET DRIVERSDATA ANNOTATION AND LABELING: ENTERPRISE USE CASES

-

12.2 BFSIDATA LABELING SOLUTIONS TO DETECT FINANCIAL FRAUD AND IMPROVE CUSTOMER EXPERIENCE

-

12.3 HEALTHCARE AND LIFE SCIENCESHEALTHCARE INSTITUTIONS TO DEPLOY DATA ANNOTATION FOR AUTOMATED DIAGNOSIS AND CLINICAL RESEARCH

-

12.4 TELECOMDATA ANNOTATION SOLUTIONS TO MONITOR VALUABLE TELECOM ASSETS

-

12.5 GOVERNMENT, DEFENSE, AND PUBLIC AGENCIESRISING NEED TO CURB NATIONAL SECURITY RISKS AND BOOST PRECISION AGRICULTURE

-

12.6 IT AND ITESDATA ANNOTATION TO DEVISE PRODUCT LAUNCH STRATEGIES AND REDUCE EMPLOYEE ATTRITION

-

12.7 RETAIL AND CONSUMER GOODSRISING NEED TO IMPROVE SHELF MANAGEMENT AND REDUCE INVENTORY SHRINKAGE TO BOOST MARKET GROWTH

-

12.8 AUTOMOTIVEDATA ANNOTATION POWERED COMPUTER VISION TO IMPROVE SELF-DRIVING TECHNOLOGIES AND REDUCE DRIVER FATIGUE

- 12.9 OTHER VERTICALS

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICANORTH AMERICA: DATA ANNOTATION AND LABELING MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- US emerged as major market to witness increasing demand for affordable data annotation servicesCANADA- Canada to witness significant investments in data annotation and labeling projects

-

13.3 EUROPEEUROPE: DATA ANNOTATION AND LABELING MARKET DRIVERSEUROPE: RECESSION IMPACTUK- European policymakers encourage governments to increase data captureGERMANY- Germany to improve both business results and competitiveness by democratizing access to data annotationFRANCE- Significant potential for AI and data management startups to boost market growthREST OF EUROPE- Growing need to gather important information from unstructured data to boost demand

-

13.4 ASIA PACIFICASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET DRIVERSASIA PACIFIC: IMPACT OF RECESSIONINDIA- Rapid adoption of technologies to accelerate India's current transformation into a prominent global powerhouse for innovationJAPAN- Growing use of cutting-edge technologies to drive growth of data annotation and labeling marketCHINA- Rapid adoption of innovative technologies across verticals to drive market demandREST OF ASIA PACIFIC- Development of infrastructure and technological capabilities to drive growth

-

13.5 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: DATA ANNOTATION AND MARKET DRIVERSMIDDLE EAST AND AFRICA: IMPACT OF RECESSIONSAUDI ARABIA- Government spending on innovative technology to drive market demandUAE- Growing ability to embrace emerging technologies across several verticalsSOUTH AFRICA- Untapped market opportunities to drive adoption of advanced technologiesREST OF MIDDLE EAST AND AFRICA- Presence of various startups and initiatives by government boost market growth

-

13.6 LATIN AMERICALATIN AMERICA: DATA ANNOTATION AND LABELING MARKET DRIVERSLATIN AMERICA: IMPACT OF RECESSIONBRAZIL- Investment by startups and rapid adoption of technologies to fuel demandMEXICO- Growing support to implement emerging technologies and drive adoption rateREST OF LATIN AMERICA- Growing investment and rapid adoption of technologies to make region attractive for entrepreneurs

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES

-

14.3 REVENUE ANALYSISHISTORICAL REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS

-

14.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

14.6 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSSTARTUPS/SMES COMPETITIVE BENCHMARKING

-

14.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

- 15.1 INTRODUCTION

-

15.2 MAJOR PLAYERSGOOGLE- Business overview- Products/Solutions/Services offered- Recent Developments- MNM viewAPPEN- Business overview- Products/Solutions/Services offered- Recent Developments- MNM viewIBM- Business overview- Products/Solutions/Services offered- Recent Developments- MNM viewORACLE- Business overview- Products/Solutions/Services offered- Recent Developments- MNM viewTELUS INTERNATIONAL- Business overview- Products/Solutions/Services offered- Recent Developments- MNM viewADOBE- Business overview- Products/Solutions/Services offered- Recent Developments- MNM viewAWS- Business overview- Products/Solutions/Services offered- Recent DevelopmentsALEGION- Business overview- Products/Solutions/Services offered- Recent DevelopmentsCOGITO TECH- Business overview- Products/Solutions/Services offered- Recent DevelopmentsANOLYTICS- Business overview- Products/Solutions/Services offered

-

15.3 OTHER KEY PLAYERSAI DATA INNOVATIONCLICKWORKERCLOUDFACTORYCAPESTARTDATAPURELXTPRECISE BPO SOLUTIONSIGMASEGMENTS.AIDEFINED AI

-

15.4 SMES AND STARTUPSDATALOOPLABEL BOXV7LIGHTTAGSUPERANNOTATESCALE AIDATASAURKILI TECHNOLOGYUNDERSTAND.AIKEYLABSLABEL YOUR DATA

- 16.1 INTRODUCTION

-

16.2 NLP MARKET - GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEW- NLP market, by component- NLP market, by type- NLP market, by deployment mode- NLP market, by organization size- NLP market, by application- NLP market, by technology- NLP market, by vertical- NLP market, by region

-

16.3 ARTIFICIAL INTELLIGENCE MARKET - GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEW- Artificial Intelligence market, by offering- Artificial Intelligence market, by technology- Artificial Intelligence market, by deployment mode- Artificial Intelligence market, by organization size- Artificial intelligence market, by business function- Artificial intelligence market, by vertical- Artificial intelligence market, by region

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

- TABLE 1 PRIMARY INTERVIEWS

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 GLOBAL DATA ANNOTATION AND LABELING MARKET SIZE AND GROWTH RATE, 2019–2021 (USD MILLION, Y-O-Y %)

- TABLE 4 GLOBAL DATA ANNOTATION AND LABELING MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

- TABLE 5 DATA ANNOTATION AND LABELING MARKET: ECOSYSTEM

- TABLE 6 DATA ANNOTATION AND LABELING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 AVERAGE SELLING PRICING ANALYSIS, 2022

- TABLE 8 PATENTS FILED, 2013–2022

- TABLE 9 TOP 10 PATENT OWNERS (US) IN DATA ANNOTATION AND LABELING MARKET, 2013–2022

- TABLE 10 DATA ANNOTATION AND LABELING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 18 DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 19 DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 20 SOLUTIONS: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 21 SOLUTIONS: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 22 DATA ANNOTATION AND LABELING MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 23 DATA ANNOTATION AND LABELING MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 24 SERVICES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 25 SERVICES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 26 DATA ANNOTATION AND LABELING MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 27 DATA ANNOTATION AND LABELING MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 28 PROFESSIONAL SERVICES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 29 PROFESSIONAL SERVICES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 30 TRAINING AND CONSULTING: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 31 TRAINING AND CONSULTING: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 32 SYSTEM INTEGRATION AND IMPLEMENTATION: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 33 SYSTEM INTEGRATION AND IMPLEMENTATION: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 34 SUPPORT AND MAINTENANCE: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 35 SUPPORT AND MAINTENANCE: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 36 MANAGED SERVICES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 37 MANAGED SERVICES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 38 DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2019–2021 (USD MILLION)

- TABLE 39 DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2022–2027 (USD MILLION)

- TABLE 40 TEXT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 41 TEXT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 42 IMAGE: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 43 IMAGE: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 44 VIDEO: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 45 VIDEO: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 46 AUDIO: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 47 AUDIO: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 48 DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT TYPE, 2019–2021 (USD MILLION)

- TABLE 49 DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 50 ON-PREMISES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 51 ON-PREMISES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 52 CLOUD: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 53 CLOUD: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 54 DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

- TABLE 55 DATA ANNOTATION AND LABELING MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 56 SMALL AND MEDIUM-SIZED ENTERPRISES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 57 SMALL AND MEDIUM-SIZED ENTERPRISES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 58 LARGE ENTERPRISES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 59 LARGE ENTERPRISES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 60 DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2019–2021 (USD MILLION)

- TABLE 61 DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2022–2027 (USD MILLION)

- TABLE 62 MANUAL: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 63 MANUAL: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 64 AUTOMATIC: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 65 AUTOMATIC: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 66 SEMI-SUPERVISED: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 67 SEMI-SUPERVISED: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 68 DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 69 DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 70 DATASET MANAGEMENT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 71 DATASET MANAGEMENT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 72 SECURITY AND COMPLIANCE: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 73 SECURITY AND COMPLIANCE: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 74 DATA QUALITY CONTROL: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 75 DATA QUALITY CONTROL: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 76 WORKFORCE MANAGEMENT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 77 WORKFORCE MANAGEMENT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 78 CONTENT MANAGEMENT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 79 CONTENT MANAGEMENT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 80 CATALOGUE MANAGEMENT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 81 CATALOGUE MANAGEMENT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 82 SENTIMENT ANALYSIS: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 83 SENTIMENT ANALYSIS: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 84 OTHER APPLICATIONS: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 85 OTHER APPLICATIONS: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 86 DATA ANNOTATION AND LABELING MARKET BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 87 DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 88 BFSI: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 89 BFSI: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 90 HEALTHCARE AND LIFE SCIENCES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 91 HEALTHCARE AND LIFE SCIENCES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 92 TELECOM:DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 93 TELECOM: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 94 GOVERNMENT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 95 GOVERNMENT: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 96 IT AND ITES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 97 IT AND ITES: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 98 RETAIL AND CONSUMER GOODS: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 99 RETAIL AND CONSUMER GOODS: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 100 AUTOMOTIVE: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 101 AUTOMOTIVE: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 102 OTHER VERTICALS: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 103 OTHER VERTICALS: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 104 DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 105 DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 106 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 107 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 108 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 109 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 110 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 111 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 112 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2019–2021 (USD MILLION)

- TABLE 113 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2022–2027 (USD MILLION)

- TABLE 114 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2019–2021 (USD MILLION)

- TABLE 115 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2022–2027 (USD MILLION)

- TABLE 116 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

- TABLE 117 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 118 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

- TABLE 119 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 120 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 121 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 122 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 123 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 124 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 125 NORTH AMERICA: DATA ANNOTATION AND LABELING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 126 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 127 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 128 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 129 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 130 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 131 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 132 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2019–2021 (USD MILLION)

- TABLE 133 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2022–2027 (USD MILLION)

- TABLE 134 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2019–2021 (USD MILLION)

- TABLE 135 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2022–2027 (USD MILLION)

- TABLE 136 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

- TABLE 137 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 138 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

- TABLE 139 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 140 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 141 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 142 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 143 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 144 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 145 EUROPE: DATA ANNOTATION AND LABELING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 146 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 147 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 148 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 149 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 150 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 151 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 152 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2019–2021 (USD MILLION)

- TABLE 153 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2022–2027 (USD MILLION)

- TABLE 154 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2019–2021 (USD MILLION)

- TABLE 155 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2022–2027 (USD MILLION)

- TABLE 156 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

- TABLE 157 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 158 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

- TABLE 159 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 160 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 161 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 162 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 163 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 164 ASIA PACIFIC: DATA ANNOTATION AND LABELING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 165 ASIA PACIFIC: DATA ANNOTATION AND LABELING, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 166 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 167 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 168 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 169 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 170 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 171 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 172 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2019–2021 (USD MILLION)

- TABLE 173 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2022–2027 (USD MILLION)

- TABLE 174 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2019–2021 (USD MILLION)

- TABLE 175 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2022–2027 (USD MILLION)

- TABLE 176 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 178 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

- TABLE 179 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT MODE,2022–2027 (USD MILLION)

- TABLE 180 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION, 2019–2021 (USD MILLION)

- TABLE 181 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 182 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 183 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 184 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 185 MIDDLE EAST AND AFRICA: DATA ANNOTATION AND LABELING, BY REGION, 2022–2027 (USD MILLION)

- TABLE 186 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 187 LATIN AMERICA: DATA ANNOTATION AND LABELING, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 188 LATIN AMERICA: DATA ANNOTATION AND LABELING, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 189 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 190 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 191 LATIN AMERICA: DATA ANNOTATION AND LABELING, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 192 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2019–2021 (USD MILLION)

- TABLE 193 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2022–2027 (USD MILLION)

- TABLE 194 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2019–2021 (USD MILLION)

- TABLE 195 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2022–2027 (USD MILLION)

- TABLE 196 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 197 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 198 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

- TABLE 199 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 200 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

- TABLE 201 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 202 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

- TABLE 203 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 204 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 205 LATIN AMERICA: DATA ANNOTATION AND LABELING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 206 OVERVIEW OF STRATEGIES ADOPTED BY KEY DATA ANNOTATION AND LABELING VENDORS

- TABLE 207 DATA ANNOTATION AND LABELING MARKET: DEGREE OF COMPETITION

- TABLE 208 DATA ANNOTATION AND LABELING MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- TABLE 209 DATA ANNOTATION AND LABELING MARKET: PRODUCT FOOTPRINT ANALYSIS OF OTHER KEY PLAYERS, 2022

- TABLE 210 DATA ANNOTATION AND LABELING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 211 DATA ANNOTATION AND LABELING MARKET: PRODUCT FOOTPRINT ANALYSIS OF STARTUPS/ SMES PLAYERS, 2022

- TABLE 212 SERVICE/PRODUCT LAUNCHES, 2019–2022

- TABLE 213 DEALS, 2019–2022

- TABLE 214 GOOGLE: BUSINESS OVERVIEW

- TABLE 215 GOOGLE: PRODUCTS OFFERED

- TABLE 216 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 217 GOOGLE: DEALS

- TABLE 218 APPEN: BUSINESS OVERVIEW

- TABLE 219 APPEN: PRODUCTS OFFERED

- TABLE 220 APPEN: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 221 APPEN: DEALS

- TABLE 222 IBM: BUSINESS OVERVIEW

- TABLE 223 IBM: PRODUCTS OFFERED

- TABLE 224 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 225 IBM: DEALS

- TABLE 226 ORACLE: BUSINESS OVERVIEW

- TABLE 227 ORACLE: PRODUCTS OFFERED

- TABLE 228 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 229 ORACLE: DEALS

- TABLE 230 TELUS INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 231 TELUS INTERNATIONAL: PRODUCTS OFFERED

- TABLE 232 TELUS INTERNATIONAL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 233 TELUS INTERNATIONAL: DEALS

- TABLE 234 TELUS INTERNATIONAL: OTHERS

- TABLE 235 ADOBE: BUSINESS OVERVIEW

- TABLE 236 ADOBE: PRODUCTS OFFERED

- TABLE 237 ADOBE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 238 ADOBE: DEALS

- TABLE 239 AWS: BUSINESS OVERVIEW

- TABLE 240 AWS: PRODUCTS OFFERED

- TABLE 241 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 242 AWS: DEALS

- TABLE 243 ALEGION: BUSINESS OVERVIEW

- TABLE 244 ALEGION: PRODUCTS OFFERED

- TABLE 245 ALEGION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 246 ALEGION: DEALS

- TABLE 247 ALEGION: OTHERS

- TABLE 248 COGITO TECH: BUSINESS OVERVIEW

- TABLE 249 COGITO TECH: PRODUCTS OFFERED

- TABLE 250 COGITO TECH: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 251 ANOLYTICS: BUSINESS OVERVIEW

- TABLE 252 ANOLYTICS: PRODUCTS OFFERED

- TABLE 253 NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 254 NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 255 NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 256 NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 257 NATURAL LANGUAGE PROCESSING MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 258 NATURAL LANGUAGE PROCESSING MARKET, BY DEPLOYMENT MODE, 2022–2027USD MILLION)

- TABLE 259 NATURAL LANGUAGE PROCESSING MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 260 NATURAL LANGUAGE PROCESSING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 261 NATURAL LANGUAGE PROCESSING MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 262 NATURAL LANGUAGE PROCESSING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 263 NATURAL LANGUAGE PROCESSING MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

- TABLE 264 NATURAL LANGUAGE PROCESSING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 265 NATURAL LANGUAGE PROCESSING MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 266 NATURAL LANGUAGE PROCESSING MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 267 NATURAL LANGUAGE PROCESSING MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 268 NATURAL LANGUAGE PROCESSING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 269 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2016–2021 (USD BILLION)

- TABLE 270 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2022–2027 (USD BILLION)

- TABLE 271 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2016–2021 (USD BILLION)

- TABLE 272 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2022–2027 (USD BILLION)

- TABLE 273 ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD BILLION)

- TABLE 274 ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD BILLION)

- TABLE 275 ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION, 2016–2021 (USD BILLION)

- TABLE 276 ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION, 2022–2027 (USD BILLION)

- TABLE 277 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD BILLION)

- TABLE 278 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD BILLION)

- TABLE 279 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2016–2021 (USD BILLION)

- TABLE 280 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 281 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2016–2021 (USD BILLION)

- TABLE 282 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2022–2027 (USD BILLION)

- FIGURE 1 DATA ANNOTATION AND LABELING MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 DATA ANNOTATION AND LABELING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF DATA ANNOTATION AND LABELING MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES OF DATA ANNOTATION AND LABELING MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES OF DATA ANNOTATION AND LABELING MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF DATA ANNOTATION AND LABELING THROUGH OVERALL DATA ANNOTATION AND LABELING SPENDING

- FIGURE 8 SOLUTIONS SEGMENT DOMINATED IN 2022

- FIGURE 9 PROFESSIONAL SERVICES HELD LARGER MARKET SHARE IN 2022

- FIGURE 10 TRAINING AND CONSULTING DOMINATED MARKET IN 2022

- FIGURE 11 TEXT DATA TYPE SEGMENT LED MARKET IN 2022

- FIGURE 12 DATASET MANAGEMENT SEGMENT HELD LARGEST MARKET SHARE IN 2022

- FIGURE 13 MANUAL ANNOTATION TYPE HELD LARGEST SEGMENT IN 2022

- FIGURE 14 LARGE ENTERPRISES DOMINATED DATA ANNOTATION AND LABELING MARKET IN 2022

- FIGURE 15 CLOUD SEGMENT HELD LARGER MARKET IN 2022

- FIGURE 16 HEALTHCARE AND LIFE SCIENCES SEGMENT GREW AT HIGHEST CAGR IN 2022

- FIGURE 17 NORTH AMERICA HELD LARGEST MARKET SHARE AND ASIA PACIFIC GREW AT HIGHEST CAGR IN 2022

- FIGURE 18 INCREASING NEED TO IMPROVE MACHINE LEARNING MODELS TO DRIVE MARKET GROWTH

- FIGURE 19 CATALOGUE MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 SOLUTIONS SEGMENT AND BFSI SEGMENT HELD LARGEST MARKET SHARES IN 2022

- FIGURE 21 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2022

- FIGURE 22 ARCHITECTURE: DATA ANNOTATION AND LABELING MARKET

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DATA ANNOTATION AND LABELING MARKET

- FIGURE 24 PERCENTAGE OF TIME ALLOCATED TO MACHINE LEARNING PROJECT TASKS

- FIGURE 25 AUTONOMOUS DRIVING DISCLOSED DEALS AND EQUITY FUNDING

- FIGURE 26 AI IN DRUG DISCOVERY PAPERS PUBLISHED PER YEAR

- FIGURE 27 EVOLUTION: DATA ANNOTATION AND LABELING MARKET

- FIGURE 28 SUPPLY CHAIN ANALYSIS: DATA ANNOTATION AND LABELING MARKET

- FIGURE 29 DATA ANNOTATION AND LABELING: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 30 TOTAL NUMBER OF PATENTS GRANTED, 2013–2022

- FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS, 2013–2022

- FIGURE 32 DATA ANNOTATION AND LABELING MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 35 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 SYSTEM INTEGRATION AND IMPLEMENTATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 TEXT SEGMENT TO REGISTER LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 39 ON-PREMISES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 MANUAL ANNOTATION TYPE TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 42 CATALOGUE MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 HEALTHCARE AND LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 48 HISTORICAL REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019–2021 (USD MILLION)

- FIGURE 49 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2022

- FIGURE 50 KEY DATA ANNOTATION AND LABELING MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- FIGURE 51 STARTUPS/SMES DATA ANNOTATION AND LABELING PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- FIGURE 52 GOOGLE: COMPANY SNAPSHOT

- FIGURE 53 APPEN: COMPANY SNAPSHOT

- FIGURE 54 IBM: COMPANY SNAPSHOT

- FIGURE 55 ORACLE: COMPANY SNAPSHOT

- FIGURE 56 TELUS INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 57 ADOBE: COMPANY SNAPSHOT

- FIGURE 58 AWS: COMPANY SNAPSHOT

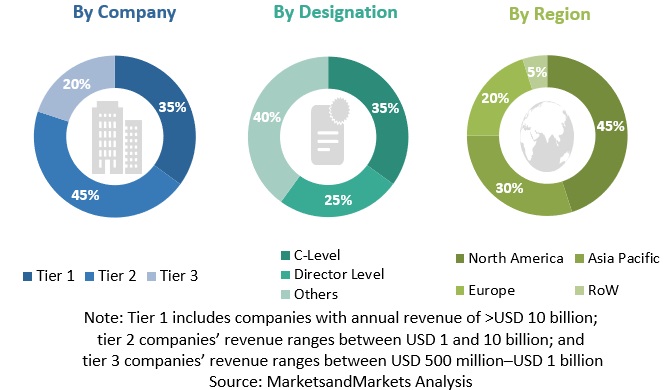

The research study for the Data annotation and labeling market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were industry experts from the core and related industries, preferred data annotation and labeling providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

The market size of companies offering data annotation and labeling, and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing major companies' product portfolios and rating them based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, Data annotation and labeling spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, functionality, applications, verticals, and regions, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and Data annotation and labeling expertise; related key executives from Data annotation and labeling solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using data annotation and labeling solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of data annotation and labeling solutions and services, which would impact the overall data annotation and labeling market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Data Annotation and Labeling Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the data annotation and labeling market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This research methodology included the study of annual and financial presentations of the top market players and interviews with experts for key insights (quantitative and qualitative).

The percentage share splits, and breakdowns were determined using secondary sources and verified through primary research. All possible parameters that affect the data annotation and labeling market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

- The pricing trend is assumed to vary over time.

- All the forecasts were made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates were used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website was used.

- All the forecasts were made under the standard assumption that the globally accepted currency USD will remain constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services were factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

- Demand/end-user analysis: End users operating in verticals across regions were analyzed in terms of market spending on data annotation and labeling based on some of the key use cases. These factors for the data annotation and labeling industry per region were separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor was derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the data annotation and labeling market by component (solutions and services), deployment mode, data type, applications, annotation type, organization size, verticals, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the data annotation and labeling market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the data annotation and labeling market

- To analyze the impact of recession across all the regions across the data annotation and labeling market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American data annotation and labeling market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin American market

- Further breakup of the Middle Eastern and African market

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Annotation and Labeling Market