Cut Flowers Market by Type (Rose, Chrysanthemum, Carnation, Gerbera, Lilium), Application (Home & Commercial), Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores/Florists, Online Retail) and Region - Global Forecast to 2027

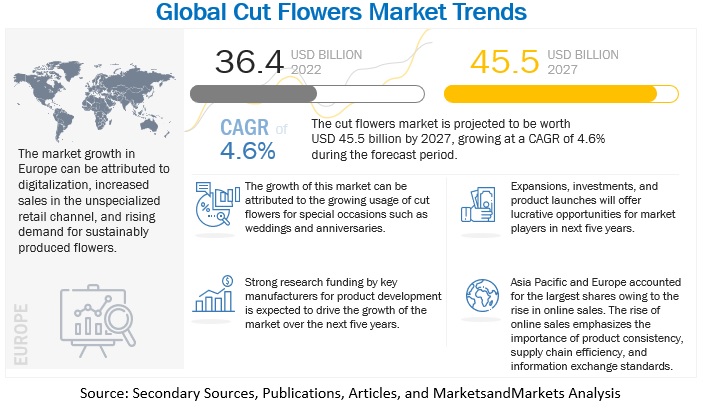

The global cut flowers market is estimated to be valued at USD 36.4 billion in 2022. It is projected to reach USD 45.5 billion by 2027, recording a CAGR of 4.6% during the forecast period. Flowers have had an important place in history, culture, and decoration since ancient times. Cut flowers are stem and bud cuttings of ornamental plants that are used for floral decorations, wreaths, packaging, bouquets, and much more. The cut flowers market involves the breeding, growing, harvesting, arranging, and selling of cut flowers as they are or as end products with definite arrangements. Cut flowers are a major business for the floriculture industry. Globally, cut flowers are recognized as the most commercially produced ornamental.

Cut flowers are mostly used for gifting on special occasions like birthdays, Valentine’s Day, weddings, anniversaries, and Mother’s Day. Show usage trends of cut flowers. Apart from gifting, cut flowers are widely used in floral and art arrangements in festivals, celebrations, mourning as well as proposals. Several commercial and home spaces use flowers for aesthetics, enhancing the décor as well as creating a positive conducive environment. Some commercial setups that regularly use cut flowers are offices, hotels, spas, and restaurants.

"The cut flowers market includes traditional and seasonal flowers and foliage, with common varieties such as roses, carnations, and lilies, and is mainly produced through contract farming and direct orders from growers to exporters and suppliers."

Some key regions that grow and export cut flowers are Ethiopia, Kenya, the Netherlands, Pakistan, and Colombia. Countries that import cut flowers in large amounts include the US, the UK, and Germany.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Increasing popularity of cut flowers and ornamentals in decorations

Fresh-cut flowers are commonly used for decorations to beautify spaces. They are an important part of celebrations like weddings and festivals, gifting to show love and care and to beautify homes and commercial spaces. They can be arranged into bouquets, corsages, and floral wreaths.

In hotels and resorts, floral arrangements and decorations can make the area more comfortable and more welcoming to visitors. Flower arrangements can introduce a personal touch to the hospitality industry. Guests appreciate flowers for the freshness they bring to the surroundings.

The production of floricultural products has grown consistently over the last 20 years, with an average yearly growth of 6% to 9%. The top ten major flower-producing countries in the world during 2018 were the Netherlands (52%), Colombia (15%), Ecuador (9%), Kenya (7%), Belgium (3%), Ethiopia (2%), Malaysia, Italy, Germany, and Israel (1%).

"The global production of floriculture products will continue to expand, especially now in countries in Asia, Africa, and Latin America, and the productivity in these countries is expected to go up further."

Traditional flower-producing countries such as the Netherlands, Japan, and the US continue to lead global production, working toward higher productivity per worker and per unit area. The trend in the production of cut flowers, which is very labor-intensive, will tend to be in areas with lower labor and other production costs.

Restraints: Less supply as opposed to rising demand for cut flowers

The demand for cut flowers in the last few years substantially increased due to rapid population growth, a higher standard of living, more hotels, restaurants, and resorts, and boosted tourism. This increased demand triggered more production; however, there is still a short supply despite its additional production. According to the FAO, the demand from the local market is so extensive that many countries, such as the Philippines, were left with no choice but to import some cut flowers, mainly chrysanthemums, and orchids, from overseas. This scenario is evident in the local situation where there are only a few commercial growers. Local retailers and florists resorted to buying cut flowers from other regions to cater to the local demand.

During the peak season of several occasions, such as weddings and Valentine’s Day, the demand for flowers is high. Growers, distributors, and wholesalers plan for these months in advance. Because large floriculture depends on the natural environment, any fluctuations in temperature, humidity, and rainfall disturb the entire production line, resulting in quality issues and less production. The less supply of flowers is one of the major restraints every distributor has faced time and again. A shift toward greenhouse production of flowers can help tackle and control external parameters affecting plant growth, such as temperature, by using fans, roll-up vents, heat mats, and installing wet walls. This manipulation and control of the environment inside the greenhouse will protect the quality of the flower and not hamper the flower production and supply chain.

Opportunities: Increasing use of cut flowers in accessories and decorations

Orchid flowers are widely used in Thailand, Singapore, and Malaysia to electroplate with gold and platinum to make exquisite jewelry. India has enormous potential with orchid species and hybrids like Dendrobium, Phalaenopsis, Cattleya, Oncidium, Arnada, Mokara, Vanda, and Pholidota. To diversify into such avenues to exploit the vast genetic resources and expert craftsmanship available in the country. Cut flowers are used as home accessories known as Potpourri. Potpourri is a mixture of dried, naturally fragrant plant material that provides a gentle natural scent in houses. It is usually placed in a decorative wooden bowl or tied in small bags made from sheer fabric. Dried flowers are used as a common component of potpourris. Rose petals, gomphrena, marigold petals, and lotus pods are ideal for making potpourris.

Flowers are a natural source of bioactive compounds that not only have antioxidant, anti-infammatory, and anti-aging properties but can also be used as natural dyes. Based on the current market trends, more consumers are looking for natural products, which, in their opinion, are safer and more effective. For that reason, producers are forced to look for natural replacements for synthetically derived substances to prepare products that meet the requirements of consumers.

Researchers from Poland have investigated the use of plant extracts in cosmetics, looking at active properties and the potential use of flower extracts as dyes. Studies revealed that common poppy, safflower, and blue pea could be used as effective colorants in cosmetic products. Moreover, plants do not show any cytotoxic activity. This may indicate that these plants can be used in cosmetics to slow down the aging process, such as anti-aging creams and moisturizers.

Challenges: Logistical, storage, and transportation hindrances

In the entire process and efficiency of the supply chain, maintaining the cold chain at each level of transport and storage is very important. The quality and the life of flowers decline every day. All the stakeholders in floral culture are interdependent. A broken link in the supply chain disturbs the entire operation, resulting in delayed supply and an impact on the quality and availability of flowers.

Flowers after harvesting need proper handling and post-harvest treatment. They must be cooled, pruned, graded, bunched, appropriately packed, and stored in the cold room. Most clients or markets have specific requirements for flowers and packing. Many flowers in a box or too few flowers can cause damage to the flowers during transit. Those flowers, on arrival, fail the quality check at the distributor’s warehouse and are discarded. Flowers are highly perishable. Flights are the most widely used mode of transport to reduce the farm-to-market time (thereby reducing the vase life). Distributors lose market due to lack of space, causing flowers not to be shipped. Scenarios where delivery is impacted by a delay in transportation affect the quality and life of flowers. However, this also reduces the number of flowers that can be transported as they are heavier than dry-packed flowers, so air transportation charges are higher.

Key features of Cut Flowers Market

- Diverse Product Offerings: The cut flowers market offers a wide variety of flowers, including roses, lilies, carnations, chrysanthemums, sunflowers, and more.

- Seasonal Availability: Many cut flowers have a specific growing season, leading to fluctuations in their availability and price throughout the year.

- Growing Demand: The market has seen growing demand due to an increase in gifting and special events, such as weddings and anniversaries.

- Online Sales: The rise of e-commerce has allowed consumers to easily purchase cut flowers online, leading to an increase in the market's reach and accessibility.

- Import Dependence: A significant portion of the cut flowers market is reliant on imports, particularly from countries in South America and Africa.

- Price Volatility: The cut flowers market is prone to price fluctuations due to supply chain disruptions and changes in demand.

- Sustainability Concerns: The production of cut flowers has a significant impact on the environment, and consumers are increasingly seeking sustainable and eco-friendly options.

Carnation is projected to grow in the cut flowers market because of usage in weddings

Dianthus caryophyllus, also known as carnations, is a species of Dianthus. It is native to the Mediterranean region, with characteristic fringe petals and a spicy fragrance. Carnation is a very popular cut flower and is widely used in floral arrangements, corsages, and boutonnieres. Carnations symbolically mean good luck, love, and gratitude. Cultures around the world use red and pink carnations.

In France, purple carnations are used in funerals, while in the US and Korea, carnations are an important part of proms and weddings. Carnation flowers come in several hues and offer many floral decorations. They offer great versatility and flexibility in their usage. They are widely used as a base for floral arrangements, and other blooms are added to create an aesthetic centerpiece. Europe and Western Asia are the largest growers of carnations globally. The world’s biggest carnation supplier is Colombia. Some major companies growing carnations are Flamingo, Esmeralda Farms, and Danziger.

Robotic Technology to Grow Flowers is one of the Major Trends

While mechanical automation has been limited to bouquet-making machines, a trend of rapid adoption of robotic technology throughout the floral sector, particularly in the mass market segment, is seen. Companies are investing in developing one-arm robots capable of producing AIFD-quality flower creations at a rate of more than 300 units per hour.

FloraBot designs advanced technologies that enables its customers to automate the handling and assembly of fresh flower arrangements; it has been testing new robotic automation technology. The company developed robotic technology to create a typical dozen-roses arrangement in about four minutes. According to the company, with a projected labor design and cost savings of more than 75%, this new technology is projected to become widespread in the global mass-market flower industry over the next five years. The company predicts that by 2024, most floral arrangements sold by mass-market floral retailers will be manufactured by robots. This will cause a profound shift in the supply chain, how flowers are packed and boxed, which flower varieties are grown, and what arrangements look like when they hit the mass market shelves.

To know about the assumptions considered for the study, download the pdf brochure

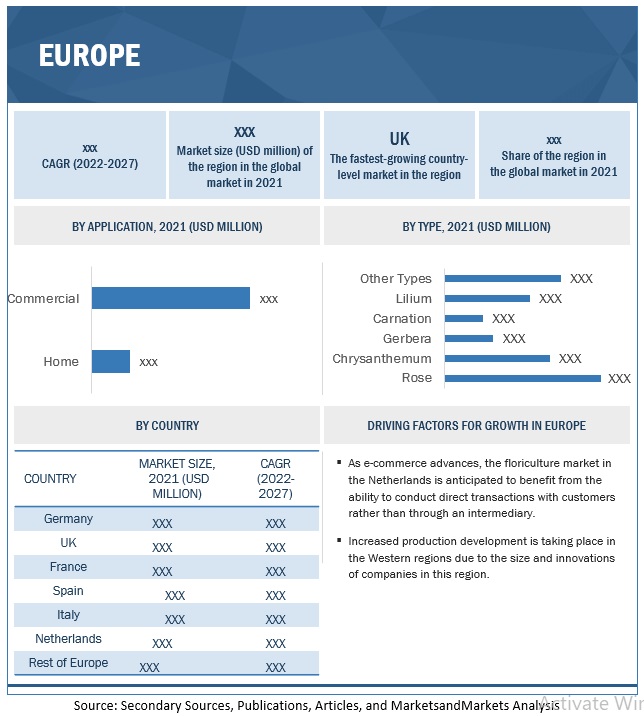

Europe dominated the cut flowers market; it is projected to grow at a CAGR of 4.1% during the forecast period

According to the Centre for the Promotion of Imports from developing countries, annually, the European Union is believed to consume over 50% of the world’s flowers and includes many countries with a high per capita consumption of cut flowers. Although some of the larger EU markets like Germany, France, and the Netherlands show signs of saturation, overall EU consumer sales of cut flowers are still increasing incessantly. Germany is the biggest consumer of flowers, followed by the UK, France, and Italy.

The most important cut flower sold in Europe is Rosa, followed by other flowers like Dendranthema (Chrysanthemum), Dianthus (Carnation), Tulipa, Lilium, and Gerbera. Growers and traders exporting cut flowers and foliage to the EU send their merchandise either to a wholesaler or to an auction. In this respect, Dutch auctions play a pivotal role in the trade of flowers destined for domestic and European markets. Products handled by agents and import wholesalers are sold directly to a wholesale buyer or submitted for auction. Export wholesalers re-export the products to other EU member countries, where flowers and foliage find their way to wholesalers and retailers.

Due to the conflict in Ukraine, which has resulted in double-digit inflation as well as crippling energy costs and rations across Europe, flower producers are switching crops, reducing production, or closing down, raising concerns about the availability of crops grown there using heat and lights in the future. Flower farms, particularly in the Netherlands — the largest producer of cut flowers in the world with USD 4.01 billion in exports in 2020, according to the Observatory of Economic Complexity — have been especially hard hit by the energy crisis. The Association of Colombian Flower Exporters, in 2022, estimates there will be a 25 to 40% reduction in production.

Key Market Players

The key players in this market include Dummen Orange (Netherlands), Danziger Group (Israel), Dos Gringos LLC. (US), Esmeralda Farms (US) and Flamingo (UK).

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 36.4 billion |

|

Market size value in 2027 |

USD 45.5 billion |

|

Market growth rate |

CAGR of 4.6% |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments covered |

By Type, Application, Distribution Channel and Region |

|

Regions covered |

North America, Asia Pacific, South America, Europe, and RoW |

|

Companies studied |

|

This research report categorizes the Cut Flowers market, based on Type, Distribution Channel, Application and Region.

Target Audience:

- Cut Flowers suppliers

- Cut Flowers growers

- Intermediate suppliers, such as traders and distributors of cut flowers

- Manufacturers of floral decorations, raw material suppliers and distributors

- Government and research organizations

- Associations, regulatory bodies, and other industry-related bodies:

- Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES)

- Kenya Plant Health inspectorate Service (KEPHIS)

- United States Department of Agriculture (USDA)

- Kenya Flower Council (KFC)

- National Horticulture Board (NHB)

- Department of Agriculture, Fisheries and Forestry (DAFF)

- Ministry of Agriculture, Forestry and Fisheries (MAFF)

- ICAR-Directorate of Floricultural Research (DFR)

- NARO Institute of Floricultural Science (NIFS)

- Flower Promotion Organization (FPO)

- LIDA Plant Research

- Indian Council of Agricultural Research (ICAR)

Report Scope:

Cut Flowers Market:

By Type

- Rose

- Chrysanthemum

- Carnation

- Gerbera

- Lilium

- Others

By Application

- Home

- Commercial

By Distribution Channel

- Supermarkets & hypermarkets

- Specialty stores/florists

- Online retail

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In 2022, Selecta One (Germany) announced a strategic partnership with Moraglia Breeding (Italy). This will help the company get logistical support from Moraglia and utilize its existing genetic improvement to create new varieties of carnations.

- In 2021, Selecta One (Germany) and Armada (Netherlands) entered a strategic alliance where the Colombian and Kenyan chrysanthemum markets of Armada

- In 2018, Danziger Group expanded its North American Rooted Cutting Station network. The company added four more companies to the partnership. These include Devan Greenhouses, Ltd., Wenke/Sunbelt Young Plants Division, Plantpeddler, and Headstart. North American Rooted Cutting Station network.

- In 2022, Marginpar BV completed the setup of its new headquarters in the Netherlands and will be relocating by the end of 2022 to ‘Aalsmeer-Oost.’ This location will help the company develop a new product street in the area and use the logistical advantage of Royal FloraHolland.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the cut flowers market?

Europe dominated the cut flower market, with a value of USD 13.1 billion in 2022; it is projected to reach USD 16.1 billion by 2027, at a CAGR of 4.1% during the forecast period. Major players present in the European cut flowers market are Dummen Orange (Netherlands), Marginpar BV (Netherlands), and Flamingo (UK).

What is the current size of the global cut flowers market?

The global cut flowers market is estimated to be valued at USD 36.4 billion in 2022. It is projected to reach USD 45.5 billion by 2027, recording a CAGR of 4.6% during the forecast period.

Which are the key players in the market?

Key players operating in this market include Dummen Orange (Netherlands), Danziger Group (Israel), Dos Gringos LLC. (US), Esmeralda Farms (US), Flamingo (UK), Florance Flora (India), Karen Roses Company (Kenya), Marginpar BV (Netherlands), Multiflora (US), Rosebud Limited (Uganda), Selecta One (Germany), Washington Bulb Co., Inc. (US), Soex Flora (India), and Florius Flowers (UAE). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

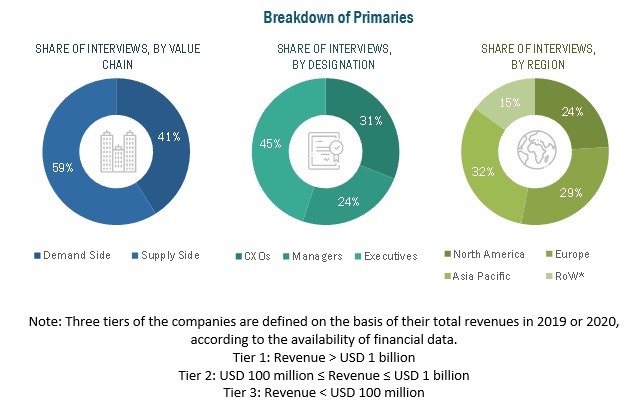

This research study involved the extensive use of secondary sources—directories and databases such as the Food and Agriculture Organization and World Health Organization—to identify and collect information useful for a technical, market-oriented, and commercial study of the cut flowers market. In-depth interviews were conducted with various primary respondents such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure depicts the research design applied in drafting this report on the cut flowers market.

Secondary Research

In the secondary research process, various sources such as website information, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the cut flowers market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the cut flowers market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- All macroeconomic and microeconomic factors affecting the growth of the cut flowers market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for cut flowers on the basis of flower type, application, distribution channel and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the cut flowers market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe for cut flowers market includes the Sweden, Belgium, Greece, Switzerland, and other EU & Non-EU Countries

- Further breakdown of the Rest of South America for cut flowers market includes Peru, Uruguay, and Venezuela.

- Further breakdown of the Rest of Asia Pacific for cut flowers market includes Thailand, Indonesia, South Korea, Malaysia, Singapore, the Philippines, and Vietnam.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cut Flowers Market