Customer Self-Service Software Market by Solution (Web Self-Service, Mobile Self-Service, Intelligent Virtual Assistants, and Social Media and Community Self-Service), Service, Deployment Type, Vertical, and Region - Global Forecast to 2021

[155 Pages Report] The customer self-service software market is estimated to grow from USD 4.33 Billion in 2016 to USD 9.38 Billion by 2021, at a Compound Annual Growth Rate (CAGR) of 16.7% during the forecast period.

Request for Customization to get the global Customer Self-Service Software market forecasts to 2025

The customer self-service software report aims at estimating the market size and future growth potential of the market across different segments, such as solutions, services, deployment types, verticals, and regions. The primary objectives of the report includes providing a detailed analysis of the major factors influencing the growth of this market (drivers, restraints, opportunities, industry specific challenges, and burning issues) and analyzing the opportunities in the market for stakeholders and details of a competitive landscape for market leaders.

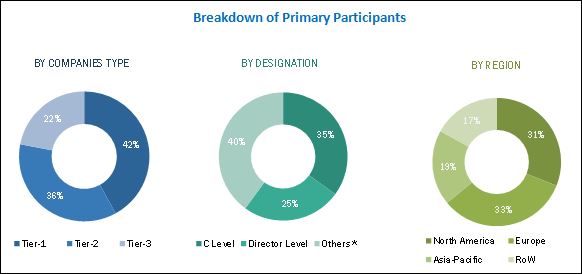

The research methodology used to estimate and forecast the customer self-service software market begins with capturing data on key vendor revenues through secondary sources such as annual reports, press releases, associations such as International Customer Service Association (ICSA), and databases such as Factiva and Bloomberg BusinessWeek, company websites, and news articles. The vendor offerings are also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global customer self-service software market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub segments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as CEOs, VPs, Directors, and Executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and sub segments. The breakdown of the profiles of primary discussion participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The customer self-service software ecosystem comprises companies such as Microsoft Corporation, Nuance Communications, Inc., Oracle Corporation, SAP SE, Salesforce.com, Inc., Aspect Software, Avaya, Inc., BMC Software, Verint Systems, Inc., and Zendesk, Inc. Further, the solutions developed by these companies are used by education, healthcare and life sciences, BFSI, retail, government and public, manufacturing, telecom and IT, transportation and logistics sectors. Please visit 360Quadrants to see the vendor listing of Customer Self-Service Software.

Key Target Audience

- Customer self-service software solution vendors

- Customer self-service software service providers

- CRM software vendors

- IT service providers

- Consulting service providers

- Managed service providers

- Telecom service providers

- Companies/organizations/enterprises using customer self-service software solutions

- Software developers

- End-users

Scope of the Report

The research report categorizes the customer self-service software market to forecast the revenues and analyze the trends in each of the following sub segments:

By Solution

- Web Self-Service

- Mobile self-service

- Intelligent virtual assistants

- Social media & community self-service

- Email management,

- IVR & ITR, and

- Others

By Service

- Professional Services

- Managed services

By Deployment Type

- Cloud

- On-premise

By Vertical

- Banking, financial Services, and Insurance (BFSI)

- Manufacturing

- Retail & e-commerce

- Education

- Media & entertainment

- It & telecommunication

- Healthcare & life sciences

- Transportation & logistics

- Utilities

- Government & public

- Others

By Region

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customization as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed information and product comparison

Geographic Analysis

- Further breakdown of the European customer self-service software market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the customer self-service software market size to grow from USD 4.33 Billion in 2016 to USD 9.38 Billion by 2021, at a Compound Annual Growth Rate (CAGR) of 16.7%. Enhancing the customer service through self-service tools empowers companies to increase customer satisfaction and loyalty, and increasing availability of various customer service touch points are the major driving factors for the growth of this market.

The customer self-service software market is broadly classified by vertical into BFSI; manufacturing; retail and e-commerce; education; media and entertainment; IT and telecommunication; healthcare and life sciences; transportation and logistics; utilities; government and public, and others. The BFSI sector commands the major market share; Healthcare and life science is expected to be the fastest-growing vertical in this market as the institutions are increasingly deploying self-service apps through which the patients can perform routine healthcare-related tasks such as scheduling appointments, filling out or updating forms, and bill payments.

Web self-service solution is expected to dominate the solution segment in the customer self-service software market as it is used as a digital support mechanism by many organizations, which enables the customers and employees in the organization to self-assist themselves by providing access to information and perform routine tasks over the internet. Social media and community self-service is expected to be the fastest-growing solution in this market, as companies are rapidly switching to the social media by forming peer-to-peer support communities and discussion forums for reducing their customer support costs.

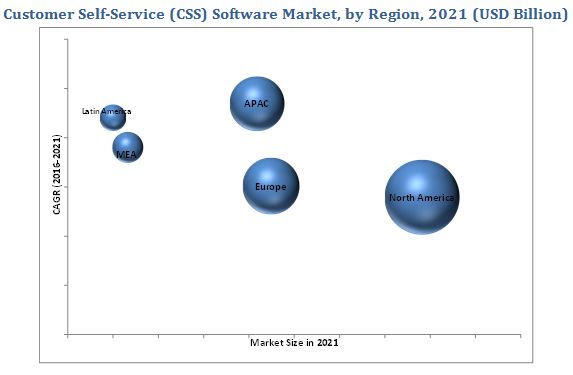

The customer self-service software market is segmented across five regions, namely, North America, Asia-Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America. North America is expected to account for the largest share of the overall CSS software market in 2016, owing to factors such as increasing penetration of mobile and web self-service solutions among customers and the presence of major CSS software vendors in the U.S.

APAC is expected to have the highest growth rate during the forecast period as organizations in this region are looking to adapt CSS solutions to meet the demand of dynamic customer base as well as SMEs are also acknowledging the importance of CSS solutions and are receptive towards considering dedicated self-care application.

Hesitation among organizations employee to adapt new self-service technologies and less awareness among customers is the major restraining factor in this market. However, integration of artificial intelligence (AI) & business Intelligence (BI), and big data with CSS technologies to understand consumer behavior is expected to provide good opportunities for the growth of the CSS software market. On a strategic front, many companies are utilizing different growth strategies, such as mergers & acquisitions, partnerships & collaborations, and product developments to increase their share in the market. Some of the major technology vendors include Nuance Communications (U.S.), SAP SE (Germany), Salesforce.com, Inc. (U.S.), Oracle Corporation (U.S.) and Microsoft Corporation (U.S.). For instance, Nuance Communications, Inc. acquired TouchCommerce, a leader in digital customer service and engagement solutions for USD 215 million. This acquisition will accelerate Nuances Enterprise business and expand its customer care solutions with new digital self-service offerings, such as live chat, customer analytics and personalization solutions. SAP partnered with Accenture to launch a multi-channel customer engagement platform for utilities by integrating the SAP S/4HANA utilities solution with SAP Hybris cloud for customer and SAP multichannel foundation. This platform will help the utility companies to enhance the experience of their customers through multi-channels, and various self-service tools.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Vendor Comparison Methodology

2.5 Research Assumptions and Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in the Customer Self-Service Software Market

4.2 Market, By Region, 2016 vs 2021

4.3 Market, By Deployment Type, 20162021

4.4 Market, By Vertical and Region, 2016

4.5 Lifecycle Analysis, By Region, 20162021

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Type

5.3.2 By Solution

5.3.3 By Service

5.3.4 By Deployment Type

5.3.5 By Vertical

5.3.6 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Enhancing the Customer Service Enables Companies to Increase Customer Satisfaction and Loyalty Levels

5.4.1.2 Increasing Availability of Various Customer Service Touch Points

5.4.1.3 Increasing Need of Companies to Gain Competitive Advantage and Decrease Customer Churn Out Rate

5.4.1.4 Increase in Productivity and Reduction of Operational Costs

5.4.2 Restraints

5.4.2.1 The Increasing Deployment of CSS Tools May Decrease the Personal Engagement and Interaction of Companies With Customers

5.4.2.2 Low Adoption of CSS Technologies Among Organizations and Less Awareness Among Customers

5.4.3 Opportunities

5.4.3.1 Integration of Artificial Intelligence, Business Intelligence, and Big Data With CSS Technologies to Understand Consumer Behavior

5.4.3.2 Increasing Opportunities for CSS Via Social Media

5.4.3.3 Rapid Adoption of Automated CSS Software Across Small and Medium-Sized Enterprises

5.4.4 Challenges

5.4.4.1 Complex User Interfaces and Technological Glitches

5.4.4.2 Lack of Skilled Workforce to Handle Self-Service Portals

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Ecosystem Analysis

6.3 Innovation Spotlight

7 Customer Self-Service Software Market Analysis, By Type (Page No. - 49)

7.1 Introduction

7.2 Solutions

7.2.1 Web Self-Service

7.2.2 Mobile Self-Service

7.2.3 Intelligent Virtual Assistants

7.2.4 Social Media and Community Self-Service

7.2.5 E-Mail Management

7.2.6 Interactive Voice Response and Interactive Text Response

7.2.7 Others

7.3 Services

7.3.1 Professional Services

7.3.1.1 Consulting Services

7.3.1.2 Integration and Deployment Services

7.3.1.3 Training and Support Services

7.3.2 Managed Services

8 Customer Self-Service Software Market Analysis, By Deployment Type (Page No. - 63)

8.1 Introduction

8.2 Cloud

8.3 On-Premises

9 Customer Self-Service Software Market Analysis, By Vertical (Page No. - 67)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.3 Manufacturing

9.4 Retail and E-Commerce

9.5 Education

9.6 Media and Entertainment

9.7 IT and Telecommunication

9.8 Healthcare and Life Sciences

9.9 Transportation and Logistics

9.10 Utilities

9.11 Government and Public

9.12 Others

10 Geographic Analysis (Page No. - 78)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.4 Asia-Pacific

10.5 Middle East and Africa

10.6 Latin America

11 Competitive Landscape (Page No. - 105)

11.1 Overview

11.2 Portfolio Comparison

11.3 Competitive Situations and Trends

11.3.1 Partnerships, Agreements, and Collaborations

11.3.2 New Product Launches

11.3.3 Mergers and Acquisitions

11.4 Strategic Benchmarking

11.5 Customer Self-Service Software Market: Vendor Comparison

11.6 Vendor Inclusion Criteria

11.7 Vendors Evaluated

12 Company Profiles (Page No. - 113)

12.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.2 Microsoft Corporation

12.3 Nuance Communications, Inc.

12.4 Oracle Corporation

12.5 SAP SE

12.6 Salesforce.Com, Inc.

12.7 Aspect Software, Inc.

12.8 Avaya, Inc.

12.9 BMC Software, Inc.

12.10 Verint Systems, Inc.

12.11 Zendesk, Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

12.12 Key Innovators

12.12.1 Answerdash, Inc.

12.12.2 Aptean Corporation

12.12.3 Creative Virtual

12.12.4 Egain Corporation

12.12.5 Freshdesk, Inc.

12.12.6 Happyfox, Inc.

12.12.7 Inbenta Technologies, Inc.

12.12.8 Nanorep Technologies Ltd.

12.12.9 Recursive Labs, Inc.

12.12.10 Unblu, Inc.

13 Appendix (Page No. - 148)

13.1 Industry Excerpts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (81 Tables)

Table 1 Customer Self-Service Software Market Size and Growth Rate, 20142021 (USD Billion, Year-Over-Year (Y-O-Y) %)

Table 2 CSS Software Market: Innovation Spotlight

Table 3 Market Size, By Type, 20142021 (USD Million)

Table 4 Market Size, By Solution, 20142021 (USD Million)

Table 5 Web Self-Service: Market Size, By Region, 20142021 (USD Million)

Table 6 Mobile Self-Service: Market Size, By Region, 20142021 (USD Million)

Table 7 Intelligent Virtual Assistants: Market Size, By Region, 20142021 (USD Million)

Table 8 Social Media and Community Self-Service: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 9 E-Mail Management: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 10 Interactive Voice Response and Interactive Text Response: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 11 Others: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 12 Market Size, By Service, 20142021 (USD Million)

Table 13 Professional Services: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 14 Market Size, By Professional Service, 20142021 (USD Million)

Table 15 Consulting Services: CSS Market Size, By Region, 20142021 (USD Million)

Table 16 Integration and Deployment Services: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 17 Training and Support Services: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 18 Managed Services: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 19 Market Size, By Deployment Type, 20142021 (USD Million)

Table 20 Cloud: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 21 On-Premises: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 22 Size, By Vertical, 20142021 (USD Million)

Table 23 Banking, Financial Services, and Insurance: Customer Self-Service Software Market Size, By Region, 20142021 (USD Million)

Table 24 Manufacturing: Market Size, By Region, 20142021 (USD Million)

Table 25 Retail and E-Commerce: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 26 Education: Market Size, By Region, 20142021 (USD Million)

Table 27 Media and Entertainment: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 28 IT and Telecommunication: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 29 Healthcare and Life Sciences: Customer Self-Service Software Market Size, By Region, 20142021 (USD Million)

Table 30 Transportation and Logistics: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 31 Utilities: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 32 Government and Public: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 33 Others: CSS Software Market Size, By Region, 20142021 (USD Million)

Table 34 Market Size, By Region, 20142021 (USD Million)

Table 35 North America: Customer Self-Service Software Market Size, By Type, 20142021 (USD Million)

Table 36 North America: Market Size, By Solution, 20142021 (USD Million)

Table 37 North America: Market Size, By Service, 20142021 (USD Million)

Table 38 North America: Market Size, By Professional Service, 20142021 (USD Million)

Table 39 North America: Market Size, By Deployment Type, 20142021 (USD Million)

Table 40 North America: Market Size, By Vertical, 20142021 (USD Million)

Table 41 North America: Market Size, By Country, 20142021 (USD Million)

Table 42 U.S.: Customer Self-Service Software Market Size, By Type, 20142021 (USD Million)

Table 43 U.S.: Market Size, By Solution, 20142021 (USD Million)

Table 44 U.S.: Market Size, By Service, 20142021 (USD Million)

Table 45 U.S.: Market Size, By Professional Service, 20142021 (USD Million)

Table 46 U.S.: Market Size, By Deployment Type, 20142021 (USD Million)

Table 47 U.S.: Market Size, By Vertical, 20142021 (USD Million)

Table 48 Canada: Market Size, By Type, 20142021 (USD Million)

Table 49 Canada: Market Size, By Solution, 20142021 (USD Million)

Table 50 Canada: Market Size, By Service, 20142021 (USD Million)

Table 51 Canada: Market Size, By Professional Service, 20142021 (USD Million)

Table 52 Canada: Market Size, By Deployment Type, 20142021 (USD Million)

Table 53 Canada: Market Size, By Vertical, 20142021 (USD Million)

Table 54 Europe: Customer Self-Service Software Market Size, By Type, 20142021 (USD Million)

Table 55 Europe: Market Size, By Solution, 20142021 (USD Million)

Table 56 Europe: Market Size, By Service, 20142021 (USD Million)

Table 57 Europe: Market Size, By Professional Service, 20142021 (USD Million)

Table 58 Europe: Market Size, By Deployment Type, 20142021 (USD Million)

Table 59 Europe: Market Size, By Vertical, 20142021 (USD Million)

Table 60 Asia-Pacific: Market Size, By Type, 20142021 (USD Million)

Table 61 Asia-Pacific: Market Size, By Solution, 20142021 (USD Million)

Table 62 Asia-Pacific: Market Size, By Service, 20142021 (USD Million)

Table 63 Asia-Pacific: Market Size, By Professional Service, 20142021 (USD Million)

Table 64 Asia-Pacific: CSS Software Size, By Deployment Type, 20142021 (USD Million)

Table 65 Asia-Pacific: Market Size, By Vertical, 20142021 (USD Million)

Table 66 Middle East and Africa: Customer Self-Service Software Market Size, By Type, 20142021 (USD Million)

Table 67 Middle East and Africa: Market Size, By Solution, 20142021 (USD Million)

Table 68 Middle East and Africa: Market Size, By Service, 20142021 (USD Million)

Table 69 Middle East and Africa: Market Size, By Professional Service, 20142021 (USD Million)

Table 70 Middle East and Africa: Market Size, By Deployment Type, 20142021 (USD Million)

Table 71 Middle East and Africa: Market Size, By Vertical, 20142021 (USD Million)

Table 72 Latin America: Market Size, By Type, 20142021 (USD Million)

Table 73 Latin America: Market Size, By Solution, 20142021 (USD Million)

Table 74 Latin America: Market Size, By Service, 20142021 (USD Million)

Table 75 Latin America: Market Size, By Professional Service, 20142021 (USD Million)

Table 76 Latin America: Market Size, By Deployment Type, 20142021 (USD Million)

Table 77 Latin America: Market Size, By Vertical, 20142021 (USD Million)

Table 78 Partnerships, Agreements, and Collaborations, 2016

Table 79 New Product Launches, 2016

Table 80 Mergers and Acquisitions, 20152016

Table 81 Evaluation Criteria

List of Figures (53 Figures)

Figure 1 Global Customer Self-Service Software Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Vendor Comparison: Criteria Weightage

Figure 6 Increasing Need Among the Companies to Enhance Their Overall Customer Experience is Driving the Growth of the Customer Self-Service Software Market

Figure 7 The Top Three Segments for the CSS Software Market During the Forecast Period

Figure 8 North America is Expected to Hold the Largest Market Share in 2016

Figure 9 Growth Trends of CSS Market

Figure 10 Asia-Pacific is Expected to Witness the Highest Growth During the Forecast Period

Figure 11 Cloud Deployment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Banking, Financial Services, and Insurance Vertical is Expected to Hold the Largest Market Share in 2016

Figure 13 Regional Lifecycle: Asia-Pacific is Expected to Exhibit the Highest Growth Potential During the Forecast Period

Figure 14 Customer Self-Service Software Market: Market Investment Scenario

Figure 15 Evolution of CSS Software Market

Figure 16 Market Segmentation: By Type

Figure 17 Market Segmentation By Solution

Figure 18 Market Segmentation By Service

Figure 19 Market Segmentation By Deployment Type

Figure 20 Market Segmentation By Vertical

Figure 21 Market Segmentation By Region

Figure 22 Customer Self-Service Software Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 CSS Software Market: Ecosystem

Figure 24 Web Self-Service is Expected to Lead the Customer Self-Service Software Solutions Market in Terms of Market Size During the Forecast Period

Figure 25 Professional Services is Expected to Hold the Largest Market Size During the Forecast Period

Figure 26 Cloud Deployment is Expected to Dominate the Market During the Forecast Period

Figure 27 Banking, Financial Services, and Insurance Vertical is Expected to Dominate the Market During the Forecast Period

Figure 28 Asia-Pacific: an Attractive Destination for the CSS Software Market, 20162021

Figure 29 Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Regional Snapshot: Asia-Pacific, Latin America, and MEA as Hotspots During 20162021

Figure 31 North America Market Snapshot

Figure 32 Asia-Pacific Market Snapshot

Figure 33 Companies Adopted Partnerships, Agreements, and Collaborations and New Product Launches as the Key Growth Strategies From 2014 to 2016

Figure 34 Customer Self-Service Software Market: Portfolio Comparison

Figure 35 Market Evaluation Framework

Figure 36 Battle for Market Share: New Product Launches and Partnerships, Agreements, and Collaborations Were the Key Strategies Adopted By Companies in the Customer Self-Service Software Market From 2014 to 2016

Figure 37 Companies Adopted Partnerships and Collaborations to Gain A Competitive Advantage in the Market

Figure 38 Evaluation Overview Table: Product Offerings

Figure 39 Evaluation Overview Table: Business Strategies

Figure 40 Geographic Revenue Mix of the Top Five Market Players

Figure 41 Microsoft Corporation: Company Snapshot

Figure 42 Microsoft Corporation: SWOT Analysis

Figure 43 Nuance Communications, Inc.: Company Snapshot

Figure 44 Nuance Communications, Inc.: SWOT Analysis

Figure 45 Oracle Corporation: Company Snapshot

Figure 46 Oracle Corporation: SWOT Analysis

Figure 47 SAP SE: Company Snapshot

Figure 48 SAP SE: SWOT Analysis

Figure 49 Salesforce.Com, Inc.: Company Snapshot

Figure 50 Salesforce.Com, Inc.: SWOT Analysis

Figure 51 Avaya, Inc.: Company Snapshot

Figure 52 Verint Systems, Inc.: Company Snapshot

Figure 53 Zendesk, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Customer Self-Service Software Market